Bath & Body Works, LLC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works, LLC Bundle

Bath & Body Works, LLC navigates a competitive landscape shaped by moderate buyer power and the constant threat of new entrants, particularly in the beauty and personal care sector. While brand loyalty offers some defense, the accessibility of similar products from both large retailers and independent sellers presents a continuous challenge.

The full analysis reveals the real forces shaping Bath & Body Works, LLC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bath & Body Works faces a significant bargaining power from its fragrance ingredient suppliers due to a highly concentrated market. Approximately 87% of its fragrance ingredients come from just three global giants: Givaudan SA, International Flavors & Fragrances (IFF), and Firmenich. This reliance on a small number of key players means these suppliers hold considerable sway over pricing and availability.

The dominance of these few suppliers allows them to exert substantial influence on Bath & Body Works' cost of goods sold. Their control over specialized fragrance components can lead to increased input costs, directly impacting the company's profitability. Furthermore, these suppliers' ability to innovate and control unique scent profiles can affect Bath & Body Works' product differentiation strategy in a competitive market.

The personal care ingredient supply chain is quite concentrated, meaning a few big players have a lot of control. For instance, the top five suppliers actually manage 72% of the specialty fragrance ingredients market. This concentration, along with how complicated these special ingredients are to make, really boosts the bargaining power of these suppliers.

Bath & Body Works, in particular, needs specific and high-quality scent profiles for its products. This means they have to maintain strong relationships with these particular suppliers who can consistently deliver on quality. When a company relies on a small group of specialized suppliers, those suppliers naturally have more leverage.

Bath & Body Works strategically employs long-term supplier contracts, often spanning three to five years, to manage supplier power. These agreements frequently include pre-negotiated pricing structures, offering a predictable cost environment for key raw materials and finished goods. This approach helps to stabilize the company's supply chain and mitigate immediate price fluctuations.

While these contracts provide stability, they also represent a commitment that can reduce Bath & Body Works' agility. Locking into specific suppliers for extended durations might limit the company's ability to quickly adapt to shifts in market dynamics or to capitalize on potentially more advantageous terms from new or innovative suppliers that emerge during the contract period.

Predominantly U.S.-Based Supply Chain Agility

Bath & Body Works benefits significantly from its predominantly U.S.-based supply chain, featuring a concentrated supplier base in Beauty Park, Ohio. This geographical advantage allows for quicker adaptation to evolving consumer preferences and bolsters supply chain dependability.

The domestic focus streamlines logistics and mitigates certain international trade challenges, though exposure to global commodity price swings remains a factor. For instance, in 2024, the company continued to leverage this domestic network to ensure product availability.

- Domestic Supplier Concentration: Key suppliers are located near Bath & Body Works' headquarters, enabling rapid response to market shifts.

- Agility and Reliability: Proximity enhances the ability to adjust production and maintain consistent product flow.

- Risk Mitigation: Reduced reliance on international shipping can lessen disruptions from global events.

Potential for Increased Production Costs from Tariffs

The bargaining power of suppliers for Bath & Body Works is influenced by potential cost increases due to tariffs. While the company primarily operates in the U.S., its supply chain for key materials like essential oils, glass containers, and packaging can be impacted by international trade policies. For instance, duties on imported components from countries such as France and India are anticipated to raise production expenses for domestic home fragrance brands.

These anticipated cost escalations could directly affect Bath & Body Works' profit margins. Effective management of these increased costs, whether through operational efficiencies or strategic pricing adjustments to pass them onto consumers, will be crucial for maintaining profitability.

- Tariff Impact: Duties on imported components can directly increase production costs.

- Key Materials Affected: Essential oils, glass containers, and packaging materials are susceptible to tariff-related price hikes.

- Geographic Exposure: While U.S.-based, reliance on international suppliers for certain components exposes the company to global trade risks.

- Margin Pressure: Increased supplier costs may squeeze profit margins if not effectively mitigated.

Bath & Body Works faces significant supplier bargaining power due to the concentration in the fragrance ingredient market, with major suppliers like Givaudan, IFF, and Firmenich holding substantial sway. This reliance on a few key players means they can influence pricing and product innovation, directly impacting Bath & Body Works' cost of goods sold and its ability to differentiate its offerings.

The company's strategy of using long-term contracts, typically three to five years, helps to stabilize costs and supply chains by pre-negotiating pricing. However, this can also limit flexibility to adopt new suppliers or react to market changes. For instance, in 2024, Bath & Body Works continued to leverage its U.S.-based supply chain, particularly in Ohio, to ensure product availability and responsiveness to consumer trends.

Potential tariffs on imported components, such as essential oils and packaging, pose a risk to Bath & Body Works by increasing production expenses. This exposure to global trade policies can affect profit margins if not managed through efficiencies or price adjustments. For example, duties on materials from countries like France and India are expected to raise costs for domestic brands.

| Supplier Characteristic | Impact on Bath & Body Works | 2024 Relevance |

|---|---|---|

| Fragrance Ingredient Market Concentration | High reliance on few major suppliers (Givaudan, IFF, Firmenich) | Continued dependence on these key players for unique scent profiles. |

| Long-Term Contracts (3-5 years) | Cost stabilization and supply chain predictability | Limits agility to switch suppliers or capitalize on new market opportunities. |

| U.S.-Based Supply Chain Focus | Enhanced responsiveness and reduced international shipping risks | Enabled quicker adaptation to consumer preferences and maintained product availability throughout 2024. |

| Tariff Exposure on Imported Components | Potential for increased production costs for oils, glass, and packaging | Anticipated cost escalations from duties on materials from countries like France and India in 2024. |

What is included in the product

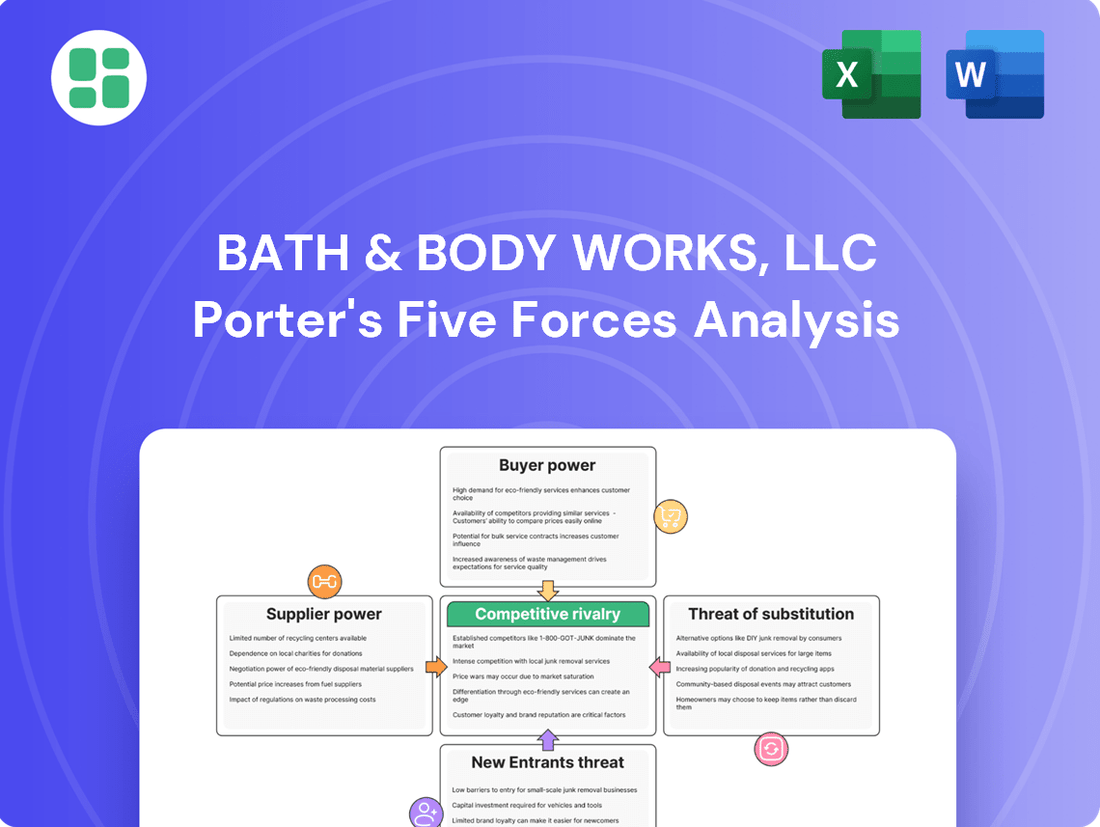

This analysis delves into the competitive forces impacting Bath & Body Works, LLC, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Instantly visualize the competitive landscape and identify key threats to Bath & Body Works' market position with a dynamic Porter's Five Forces analysis.

Gain actionable insights into customer bargaining power and the threat of substitutes, enabling strategic adjustments to enhance profitability and customer loyalty.

Customers Bargaining Power

Bath & Body Works boasts an impressive 87% consumer recognition rate, a testament to its powerful brand presence. This widespread awareness, coupled with a brand value estimated at $4.2 billion, cultivates a deep sense of customer loyalty, making price alone a less significant factor in purchasing decisions.

The emotional connection customers form with their favorite Bath & Body Works scents plays a crucial role in driving repeat business. This loyalty significantly reduces the bargaining power of customers, as they are less likely to switch to competitors for minor price differences.

Bath & Body Works' loyalty program is a significant lever in mitigating customer bargaining power. As of Q4 2024, the program boasted approximately 39 million active members, a substantial base that drives roughly 80% of the company's U.S. sales.

These engaged loyalty members exhibit a clear pattern of increased spending, more frequent store visits, and a propensity for cross-channel purchases, all contributing to higher retention rates. This deepens customer commitment and makes them less likely to seek alternatives based on price or product alone.

By offering exclusive benefits and fostering a sense of belonging, the loyalty program effectively reduces the bargaining power of individual customers. It creates a sticky customer base that is more invested in the brand's ecosystem, thereby limiting their ability to negotiate better terms or switch to competitors easily.

Bath & Body Works customers benefit from a variety of purchasing options, with 68% of sales historically coming from physical retail stores and a substantial 27% from their e-commerce platform. This dual approach offers significant convenience, allowing shoppers to buy products whether they prefer browsing in person or shopping online.

The convenience of multiple channels, from brick-and-mortar locations to a robust online presence, empowers customers. They can readily compare prices and product offerings across these diverse platforms, which inherently gives them some leverage when making purchasing decisions.

Consumer Price Sensitivity and Economic Pressures

Consumers, even those loyal to brands like Bath & Body Works, are increasingly mindful of prices, particularly with ongoing economic pressures and inflation impacting household budgets. This price sensitivity directly affects purchasing decisions for non-essential items such as personal care and home fragrance products, which are core to Bath & Body Works' offerings.

For instance, in 2024, reports indicated that consumer spending on discretionary goods saw a noticeable moderation as inflation persisted, even if at a slower pace than the previous year. This trend underscores the need for companies to carefully consider their pricing strategies.

- Price Sensitivity: Despite strong brand recognition, Bath & Body Works customers are not immune to price increases, especially when economic conditions tighten.

- Discretionary Spending: Personal care and home fragrance items are often among the first categories consumers cut back on during periods of economic uncertainty.

- Value Proposition: Bath & Body Works needs to continually demonstrate value through product quality, promotions, and loyalty programs to offset price sensitivity and retain its customer base.

Demand for Product Innovation and Newness

Customers' appetite for novelty is a significant driver of demand. Bath & Body Works actively caters to this by frequently refreshing its product lines and introducing seasonal collections. For instance, their collaborations, like the popular Disney collections, generate considerable buzz and encourage repeat purchases.

This strategy of constant newness can actually mitigate the bargaining power of customers. By offering limited-edition items and frequent product drops, the company creates a sense of urgency and excitement, making customers less likely to negotiate prices or seek alternatives. In 2023, Bath & Body Works reported net sales of $7.56 billion, reflecting strong consumer engagement with their product innovation cycle.

- Demand for Innovation: Consumers consistently seek fresh and innovative products, including seasonal and collaborative releases.

- Company Strategy: Bath & Body Works employs frequent floor set changes and new product launches to meet this demand.

- Impact on Customer Power: This focus on novelty can decrease customer bargaining power by fostering excitement and a desire for limited-edition items.

While Bath & Body Works enjoys strong brand recognition and a robust loyalty program, customer bargaining power remains a factor, particularly concerning price sensitivity. With 2024 data showing continued consumer focus on discretionary spending due to economic pressures, customers are more likely to compare prices across channels, which include both their 68% of sales from physical stores and 27% from e-commerce.

The company's strategy of frequent product refreshes and limited-edition releases, which drove $7.56 billion in net sales in 2023, aims to counter this by fostering demand for newness. However, this constant cycle of newness also presents opportunities for customers to seek out deals or wait for sales on previous collections, thereby exerting some influence on pricing and purchase timing.

Full Version Awaits

Bath & Body Works, LLC Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Bath & Body Works' competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry within the industry. Understanding these forces is crucial for strategic decision-making in the retail sector.

Rivalry Among Competitors

Bath & Body Works operates within a fiercely contested retail landscape for personal care and home fragrances. The market is crowded with a multitude of established brands, alongside a steady influx of new entrants, all vying for consumer attention and market share. This intense rivalry demands continuous product innovation and distinct strategic positioning to remain competitive.

Bath & Body Works thrives on differentiating its products through exclusive fragrance creations, eye-catching packaging, and a reputation for quality that remains affordable. This strategy is evident in their constant stream of new items, with product rotations occurring every four to six weeks, keeping customers engaged and ahead of rivals.

Bath & Body Works enjoys a powerful brand that acts as a significant intangible asset, cementing its market leadership in key categories like bath and shower products, as well as candles and air fresheners. This strong brand recognition, evidenced by over 80% awareness among women aged 18-59, creates a substantial competitive moat. The company's agility in adapting to evolving consumer preferences further reinforces its dominant market position, making it difficult for rivals to gain traction.

Impact of E-commerce and Digital Competition

The digital marketplace has dramatically reshaped competition, turning local skirmishes into global battles. Brands that once only worried about nearby stores now face online retailers from across the world. This shift means that even smaller, niche brands can gain significant traction by reaching a wider audience online, directly challenging established players like Bath & Body Works.

Bath & Body Works has recognized this shift and is actively bolstering its digital presence. Their expansion into e-commerce, including strategic moves like launching on TikTok Shop in 2024, is a direct response to the intensified rivalry in the online space. This allows them to connect with a new generation of consumers and maintain relevance in an increasingly digital-first retail environment.

- E-commerce Growth: Global e-commerce sales were projected to reach over $6.3 trillion in 2024, highlighting the scale of online competition.

- Platform Expansion: Bath & Body Works' presence on platforms like TikTok Shop taps into a rapidly growing social commerce segment, estimated to be worth billions.

- Direct-to-Consumer (DTC) Impact: The rise of DTC brands online further fragments the market, forcing traditional retailers to innovate their digital strategies.

Diverse Competitor Landscape

Bath & Body Works operates within a highly competitive sector, facing rivals from specialty beauty retailers such as The Body Shop and Lush, alongside broader offerings from department stores, drugstores, and agile online-only brands. This varied competitive set means customers have access to a wide spectrum of price points, product assortments, and brand identities, compelling Bath & Body Works to remain dynamic in its approach to stay ahead.

The intensity of this rivalry is underscored by the fact that in 2024, the global beauty and personal care market was valued at over $500 billion, with a significant portion driven by direct-to-consumer and specialty retail segments. Competitors often differentiate through unique ingredient sourcing, ethical branding, or aggressive digital marketing strategies. For instance, The Body Shop emphasizes its commitment to natural ingredients and ethical sourcing, while Lush is known for its handmade products and strong stance on animal welfare, both appealing to consumer segments that value these attributes.

- Specialty Retailers: Brands like The Body Shop and Lush offer curated product lines with strong ethical or natural positioning.

- Broad-line Retailers: Department stores and drugstores provide convenience and a wider product selection across multiple categories.

- Online-Only Brands: E-commerce players leverage digital marketing and direct customer relationships for agility and targeted appeal.

- Price and Product Differentiation: Competitors vary significantly in their pricing strategies and the breadth of their product offerings, from focused artisanal goods to mass-market accessibility.

Bath & Body Works faces intense competition from specialty retailers, broad-line stores, and online-only brands, all vying for consumer loyalty in the vast personal care market. This rivalry is fueled by diverse strategies, including ethical sourcing, unique product formulations, and aggressive digital marketing. For example, while Bath & Body Works focuses on seasonal fragrances and accessible luxury, competitors like The Body Shop emphasize natural ingredients and ethical practices, appealing to different consumer segments.

The global beauty and personal care market, valued at over $500 billion in 2024, highlights the scale of this competition. Brands differentiate through price, product breadth, and brand narrative, forcing Bath & Body Works to continuously innovate its offerings and marketing. Their strategic expansion into platforms like TikTok Shop in 2024 demonstrates an effort to capture new demographics and maintain relevance in an evolving retail landscape, where global e-commerce sales are projected to exceed $6.3 trillion.

| Competitor Type | Differentiation Strategy | Example |

|---|---|---|

| Specialty Retailers | Ethical sourcing, natural ingredients, handmade products | The Body Shop, Lush |

| Broad-line Retailers | Convenience, wide product selection, accessibility | Department stores, Drugstores |

| Online-Only Brands | Agility, targeted digital marketing, direct customer relationships | Various DTC beauty brands |

SSubstitutes Threaten

Bath & Body Works faces a growing threat from alternative personal care products, especially body sprays and mists. This segment is seeing significant expansion as consumers seek lighter fragrance options.

The global body spray market is a prime example, with projections indicating a compound annual growth rate of 5.7% through 2030. This trend suggests a clear shift in consumer preference towards these more accessible and often less expensive alternatives that can satisfy similar personal fragrance desires.

Scented candles and diffusers are strong substitutes for Bath & Body Works' core product offerings in the home fragrance segment. The global scented candle market alone was valued at $5.9 billion in 2022 and is expected to expand at a compound annual growth rate of 5.6% through 2028, indicating robust consumer demand for these alternatives. Many consumers opt for these items not just for their scent but also for their decorative appeal, presenting a direct challenge to traditional air fresheners and liquid fragrancessold by Bath & Body Works.

The growing consumer demand for natural, organic, and cruelty-free personal care items has significantly boosted the DIY fragrance movement. This trend allows individuals to craft their own scents, offering a direct alternative to mass-produced perfumes and body sprays. For instance, the global essential oils market, a key component in DIY fragrances, was valued at approximately $10.5 billion in 2023 and is projected to grow, indicating a tangible shift in consumer preferences.

Cross-Category Substitution for Mood and Wellness

The perception of fragrance is evolving beyond mere scent to encompass mood enhancement, self-expression, and self-care. This evolution fuels cross-category substitution, where consumers may choose alternatives to traditional home fragrance products.

For instance, essential oils, aromatherapy diffusers, and even certain scented cleaning products can fulfill the desire for a pleasant ambiance and contribute to a desired mood. This trend is intrinsically linked to broader wellness movements.

- Consumer spending on wellness products, including aromatherapy, saw significant growth, with the global aromatherapy market projected to reach over $2.6 billion by 2024.

- The home fragrance market itself is substantial, with the U.S. market alone estimated at over $4.5 billion in 2023, indicating the scale of potential substitution.

- A 2023 survey indicated that 65% of consumers use scented products for relaxation or stress relief, highlighting the wellness connection.

Availability of Multi-functional Products

The personal care sector is witnessing an increase in multi-functional products. These items often combine several benefits, potentially diminishing the consumer's need for separate, single-purpose products.

For instance, a competitor offering a highly scented body lotion might lessen the perceived necessity for a distinct fine fragrance mist. This shift encourages consumers to seek consolidated solutions, thereby influencing the demand for Bath & Body Works' specialized fragrance items.

- Market Trend: Rise of multi-functional personal care products.

- Consumer Behavior: Preference for consolidated solutions over single-purpose items.

- Competitive Impact: Competitors' enhanced lotions may reduce demand for separate fragrance mists.

- Industry Data: The global personal care market was valued at approximately $511 billion in 2023 and is projected to reach over $716 billion by 2028, indicating significant innovation and product diversification.

Bath & Body Works faces a significant threat from substitutes, particularly in the personal care and home fragrance segments. Body sprays and mists offer lighter, often more affordable alternatives, with the global body spray market projected to grow at a 5.7% CAGR through 2030. Scented candles and diffusers are also strong contenders, with the U.S. home fragrance market alone valued at over $4.5 billion in 2023, appealing to consumers for both scent and decor. Furthermore, the DIY fragrance movement, fueled by the essential oils market (valued at approximately $10.5 billion in 2023), allows consumers to create personalized scents, directly competing with mass-produced items.

| Substitute Category | Market Data Point | Implication for Bath & Body Works |

| Body Sprays & Mists | Global market CAGR of 5.7% through 2030 | Offers lighter, often less expensive fragrance alternatives. |

| Scented Candles & Diffusers | U.S. home fragrance market > $4.5 billion (2023) | Competes on ambiance and decorative appeal, not just scent. |

| DIY Fragrances (Essential Oils) | Global essential oils market ~$10.5 billion (2023) | Directly challenges mass-produced products with personalization. |

| Multi-functional Personal Care | Global personal care market ~$511 billion (2023) | May reduce demand for specialized fragrance items like mists. |

Entrants Threaten

Bath & Body Works benefits from robust brand recognition and a deeply loyal customer base, creating a formidable barrier for any new competitors. This established trust and affinity in the personal care and home fragrance market is not easily replicated.

New entrants would need to invest heavily in marketing, product innovation, and customer relationship building over an extended period to even approach Bath & Body Works' market position. For instance, in 2023, Bath & Body Works reported net sales of $4.0 billion, a testament to its enduring customer appeal and market penetration.

Bath & Body Works' vast network of over 1,895 company-operated stores across the U.S. and Canada is a significant barrier to entry. This extensive physical footprint represents a substantial capital investment, making it difficult for new competitors to replicate on a similar scale.

The fragrance industry presents a significant hurdle for new entrants due to the exclusivity and complexity of sourcing key ingredients. A handful of major global players, including Givaudan, International Flavors & Fragrances (IFF), Firmenich, and Symrise, dominate the supply chain for high-quality fragrance compounds. For instance, Givaudan reported net sales of CHF 7.0 billion in 2023, highlighting the scale of these established suppliers.

Developing unique and appealing scents requires specialized knowledge and established, often long-term, relationships with these ingredient suppliers. This intricate process, coupled with the substantial investment needed to secure consistent and high-quality raw materials, creates a formidable barrier to entry for smaller or emerging brands aiming to differentiate themselves in the market.

Lower Barriers for Online-Only Entrants

While establishing a brick-and-mortar presence for fragrance sales involves significant capital for real estate and inventory, the digital landscape presents a different story. The proliferation of e-commerce platforms, such as Shopify and Etsy, has dramatically reduced the initial investment required for new entrants aiming to sell fragrances online.

These platforms offer user-friendly interfaces and scalable solutions, enabling entrepreneurs to launch online stores with minimal technical expertise and comparatively low startup costs. This accessibility fosters a more dynamic market, allowing smaller, niche brands to emerge and compete directly with established players in the digital realm.

For instance, the global e-commerce market for beauty and personal care products, which includes fragrances, was projected to reach over $700 billion by 2024. This growth signifies a fertile ground for new online-only businesses to capture market share, even with limited initial resources.

- Lowered Capital Requirements: Online-only entrants can bypass the substantial costs associated with physical retail, such as rent, store build-outs, and extensive staffing.

- Ease of Platform Adoption: User-friendly e-commerce builders and marketplaces allow for quick and cost-effective online store setup.

- Direct-to-Consumer (DTC) Model: Many new entrants leverage a DTC model, reducing overhead and allowing for more direct customer engagement and brand building online.

Agile Business Model and Innovation Capability

Bath & Body Works' agile business model, bolstered by its largely U.S.-based supply chain, allows for swift product innovation and adaptation to evolving consumer preferences. This inherent ability to quickly launch new fragrances and product ranges, including collaborations and seasonal offerings, presents a dynamic challenge for potential competitors. They must continuously innovate and adjust to keep pace, making it difficult to establish a foothold.

While Bath & Body Works enjoys significant brand loyalty and an extensive physical retail presence, the threat of new entrants is somewhat amplified by the digital landscape. The ease of launching online-only fragrance businesses through accessible e-commerce platforms lowers initial capital requirements. However, securing high-quality fragrance ingredients remains a substantial barrier, as a few major global suppliers dominate this niche market, demanding significant investment and established relationships.

| Factor | Impact on New Entrants | Bath & Body Works' Advantage |

|---|---|---|

| Brand Recognition & Loyalty | High Barrier | Established trust and affinity, difficult to replicate. |

| Physical Retail Footprint | High Barrier | Over 1,895 stores in North America, representing significant capital investment. |

| Fragrance Ingredient Sourcing | High Barrier | Dependence on a few dominant global suppliers (e.g., Givaudan, IFF) requires established relationships and investment. |

| E-commerce Accessibility | Lowered Barrier | Platforms like Shopify and Etsy enable lower startup costs for online-only businesses. |

| Supply Chain Agility | Moderate Barrier | Bath & Body Works' ability to innovate quickly challenges new entrants to keep pace. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bath & Body Works, LLC leverages data from company annual reports, SEC filings, and industry-specific market research from firms like IBISWorld and Statista to understand competitive dynamics.