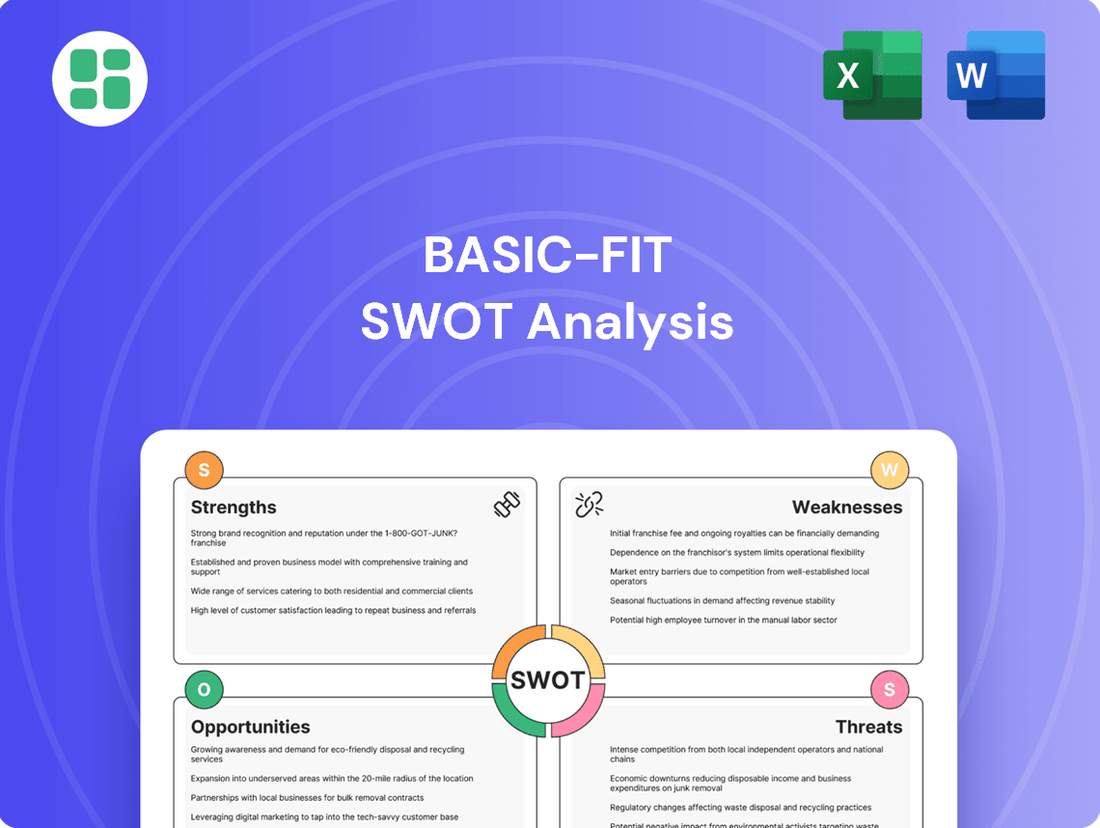

Basic-Fit SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Basic-Fit Bundle

Basic-Fit's strengths lie in its accessible pricing and widespread European presence, but it faces intense competition and potential economic downturns. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Basic-Fit's market position, competitive advantages, and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your business strategy and investment decisions.

Strengths

Basic-Fit's core strategy revolves around its Affordable, High-Value, Low-Price (HVLP) model. This approach makes fitness accessible to a wide range of people, fueling significant membership increases across Europe. For instance, in 2023, Basic-Fit reported a substantial rise in its member base, a direct consequence of its competitive pricing strategy.

Basic-Fit boasts an impressive and growing club network, a significant strength. As of the first quarter of 2025, the company operates more than 1,600 clubs throughout Europe, solidifying its position as the continent's largest fitness operator. This extensive reach is a key advantage, offering members unparalleled accessibility.

The company's commitment to expansion is evident in its strategic plans. Basic-Fit intends to open around 100 new clubs annually in both 2025 and 2026, further strengthening its pan-European footprint. This consistent growth ensures that members can find a Basic-Fit facility conveniently located, enhancing member retention and attraction.

Basic-Fit is experiencing impressive growth, with both its revenue and membership numbers climbing steadily. In the first quarter of 2025, the company saw its revenue jump by a significant 17% compared to the previous year, reaching €332 million. This financial strength is mirrored in its expanding customer base, which added 213,000 members by February 2025, bringing the total to 4.47 million.

Technological Integration and Digital Offerings

Basic-Fit's commitment to technological integration is a significant strength, enhancing member experience through its comprehensive mobile app. This app allows users to manage memberships, book classes, and track workouts, fostering greater convenience and engagement.

The company has also embraced digital innovations like virtual group classes and AI-driven personal training solutions. These offerings cater to evolving fitness preferences and broaden the accessibility of their services, contributing to increased member interaction.

For example, Basic-Fit reported a substantial increase in digital engagement following the rollout of its new mobile app and AI features in late 2023 and early 2024, with a reported 25% uplift in app usage for booking classes.

- Mobile App Functionality: Seamless management of memberships, class bookings, and workout tracking.

- Virtual Offerings: Virtual group classes and AI-powered personal training expand service reach.

- Digital Engagement Growth: Investments in digital platforms have demonstrably increased member interaction.

- Accessibility Extension: Digital solutions make fitness services more accessible to a wider audience.

Operational Efficiency and Cost Management

Basic-Fit's commitment to operational efficiency is a cornerstone of its strategy, directly supporting its low-cost model. By focusing on optimizing every aspect of its operations, the company effectively manages its expenses. This meticulous approach allows them to offer competitive pricing while maintaining profitability.

A prime example of this focus is their 'Smart Refurbishing' program. This initiative is designed to extend the lifespan of their gym equipment, with a target of up to 12 years. This significantly reduces the capital expenditure and depreciation costs associated with frequent equipment replacement, a key factor in their cost management.

Furthermore, Basic-Fit is actively investing in energy-efficient upgrades across its network of clubs. These upgrades are projected to yield substantial energy savings, directly impacting operating expenses. This not only lowers their utility bills but also enhances their operating leverage, meaning that as revenue grows, profits increase at a faster rate due to the reduced proportion of fixed costs.

- Smart Refurbishing: Equipment lifespan extended to 12 years, reducing depreciation.

- Energy Efficiency: Implementation of upgrades to lower energy consumption and costs.

- Operating Leverage: Improved efficiency contributes to better profitability as the business scales.

- Cost Structure: Direct impact on maintaining a competitive low-cost offering in the fitness market.

Basic-Fit's extensive network, exceeding 1,600 clubs by Q1 2025, positions it as Europe's largest fitness operator. The company's commitment to growth is underscored by its plan to open approximately 100 new clubs annually in 2025 and 2026, ensuring broad member accessibility. This expansive footprint is a significant competitive advantage.

The company's financial performance demonstrates robust growth, with revenue climbing 17% year-over-year to €332 million in Q1 2025. Membership also saw a substantial increase, adding 213,000 members by February 2025, reaching a total of 4.47 million. This indicates strong market demand and successful execution of its business model.

Basic-Fit's technological integration, particularly its mobile app, enhances member experience through seamless management of memberships and class bookings. The adoption of virtual group classes and AI-driven personal training further broadens service accessibility and engagement, with app usage seeing a 25% uplift after recent feature rollouts.

Operational efficiency, exemplified by the 'Smart Refurbishing' program extending equipment life to 12 years and investments in energy-efficient upgrades, directly supports Basic-Fit's low-cost strategy. These measures reduce capital expenditure and operating costs, bolstering profitability and enabling competitive pricing.

| Metric | Q1 2025 Value | Year-over-Year Change |

|---|---|---|

| Number of Clubs | >1,600 | N/A (Ongoing Expansion) |

| Total Members | 4.47 million (as of Feb 2025) | Growth of 213,000 members by Feb 2025 |

| Revenue | €332 million | +17% |

| New Clubs Planned (2025) | ~100 | N/A (Annual Target) |

| Equipment Lifespan Target | 12 years | N/A (Strategic Initiative) |

What is included in the product

Delivers a strategic overview of Basic-Fit’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable SWOT analysis of Basic-Fit's competitive landscape, highlighting key strengths and weaknesses to inform strategic decisions.

Weaknesses

Basic-Fit's high-volume, low-price strategy, while a strength, can also be a weakness. Clubs may become overcrowded during peak times, leading to queues for equipment and a less comfortable workout environment. This saturation can detract from the overall member experience and potentially lower the perceived quality of the facilities, a common hurdle for budget fitness providers.

Basic-Fit's current ratio, a key measure of its ability to meet short-term obligations, suggests a tight liquidity position. This means the company has less readily available cash to cover its immediate debts.

The company experienced a net loss in the first half of 2025 and generated negative free cash flow. This was largely driven by substantial investments in opening new clubs and upgrading existing facilities, including noise reduction measures.

While management is optimistic about a future improvement in cash flow, these significant capital expenditures create short-term financial strain. This pressure could impact the company's flexibility in managing its finances until the new investments begin to generate returns.

Basic-Fit's strategy hinges on attracting and retaining a massive number of members to make its low-cost model viable. This means that if membership growth stalls or more people leave than expected, the company's profits can take a serious hit.

For instance, in 2023, Basic-Fit reported a total of 3.7 million members across Europe. A substantial dip in this number, even by a few hundred thousand, could significantly impact their revenue projections, given the average monthly membership fee is around €25.

Limited Scope for Personalized Training and Premium Services

Basic-Fit's value-oriented approach, while a strength, inherently limits the depth of personalized training and premium services compared to higher-priced competitors. This means members looking for extensive one-on-one coaching or highly specialized, niche fitness programs might find the current offerings less comprehensive.

While Basic-Fit offers virtual classes, the core model prioritizes accessibility and affordability over the in-depth, tailored experiences sought by a segment of the fitness market. This can be a disadvantage for individuals who consider personalized guidance and specialized training essential to their fitness journey.

- Limited One-on-One Coaching: The emphasis is on self-directed fitness, with fewer dedicated personal trainers available compared to premium gyms.

- Niche Program Gaps: Highly specialized classes or advanced training methodologies may not be a primary focus, potentially alienating enthusiasts seeking such options.

- Value Proposition vs. Customization: Basic-Fit's affordable model prioritizes broad accessibility, which naturally restricts the resources available for extensive personalization.

Sensitivity to Economic Fluctuations and Consumer Discretionary Spending

Basic-Fit's reliance on fitness as a discretionary expense makes it vulnerable to economic downturns. When budgets tighten, gym memberships are often among the first expenses consumers cut. This was clearly demonstrated during the COVID-19 pandemic, where widespread closures and economic uncertainty led to significant membership disruptions across the fitness industry.

Inflation and rising cost of living further exacerbate this weakness. Even with Basic-Fit's affordable pricing, members may be forced to cancel subscriptions or reduce spending on additional services. For instance, in early 2024, persistent inflation in many European markets continued to pressure household disposable incomes, directly impacting discretionary spending categories like fitness memberships.

- Discretionary Spending Vulnerability: Fitness remains a non-essential expense for many consumers.

- Economic Downturn Impact: Recessions or significant economic slowdowns can lead to subscription cancellations.

- Inflationary Pressures: Rising living costs can force members to prioritize essential spending over gym memberships.

- Past Industry Performance: The fitness sector has historically shown sensitivity to economic crises, such as the impact of the COVID-19 pandemic on membership retention.

Basic-Fit's high-volume, low-price strategy can lead to overcrowding during peak hours, diminishing the member experience. The company's current ratio indicates a tight liquidity position, with a net loss and negative free cash flow reported in the first half of 2025 due to significant investments in new club openings and upgrades. This financial strain could limit flexibility, and the business model's reliance on a large member base makes it susceptible to revenue drops if membership growth falters.

What You See Is What You Get

Basic-Fit SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Basic-Fit SWOT analysis, ensuring transparency and quality. Once purchased, you'll get the complete, in-depth report.

Opportunities

Basic-Fit has a substantial opportunity to grow by entering European markets where gym membership is less common. Countries like Germany, Italy, Spain, and those in Eastern Europe show significant untapped potential for affordable fitness options.

The company is strategically targeting growth areas such as France, Spain, and Germany, recognizing the high demand for accessible fitness solutions in these regions. For instance, in 2024, Spain's fitness market showed robust growth, with budget-friendly gym chains like Basic-Fit poised to capture a larger share.

Basic-Fit is set to introduce a franchise model in 2025, which will serve as a cost-effective strategy for expanding into new international markets and reaching a wider customer base. This move is expected to accelerate their global footprint without requiring significant upfront capital investment from the company itself.

Furthermore, Basic-Fit is focusing on growing revenue from ancillary services. These include offerings like round-the-clock club access, day passes for non-members, and revenue generated from vending machines and advertising within their clubs. These additional income streams are crucial for enhancing overall profitability and diversifying revenue beyond traditional membership fees.

The global health and wellness sector has seen a remarkable surge in interest following the pandemic. This trend is directly translating into increased demand for fitness services, with many consumers prioritizing their physical and mental well-being. For instance, a 2024 report indicated that over 60% of individuals increased their focus on personal health compared to pre-pandemic levels.

This heightened awareness creates a significant opportunity for Basic-Fit to capture new members. The company's value proposition of affordable and accessible fitness solutions aligns perfectly with the growing desire for convenient ways to maintain a healthy lifestyle. Basic-Fit's expansion into new markets and its focus on digital offerings can further capitalize on this sustained consumer engagement with fitness.

Further Leveraging Technology for Enhanced Member Engagement

Basic-Fit can further enhance member engagement by investing in advanced technologies. This includes AI-powered personalized fitness plans and improved analytics from wearable devices, offering a more tailored experience. Such advancements are crucial for retaining existing members and attracting new, tech-oriented individuals, ultimately boosting workout efficiency.

The company's focus on digital innovation is evident in its continuous app development and the integration of smart equipment. For instance, in 2023, Basic-Fit reported a significant increase in digital service usage, with over 70% of members actively using their app for class bookings and progress tracking. This digital-first approach is key to optimizing member journeys and fostering a stronger sense of community.

- AI-driven personalized workout recommendations

- Enhanced data analytics for wearable device integration

- Interactive online platforms for virtual classes and challenges

- Gamification features to boost motivation and retention

Strengthening Sustainability and ESG Initiatives

Basic-Fit's dedication to sustainability, including its aim to reduce energy consumption by 15% by 2025 and increase renewable energy use, resonates with a market increasingly prioritizing environmental, social, and governance (ESG) factors. This commitment not only appeals to environmentally aware consumers but also attracts investors focused on long-term, responsible growth. By showcasing these initiatives, Basic-Fit can bolster its brand image and foster stronger relationships with stakeholders who value corporate responsibility.

The company's focus on ESG is a strategic advantage. For instance, in 2023, Basic-Fit reported a 5% reduction in energy usage per member compared to the previous year, demonstrating tangible progress. This proactive approach to environmental stewardship positions Basic-Fit favorably in a competitive landscape where sustainability is becoming a key differentiator.

Further strengthening these initiatives presents a significant opportunity. Basic-Fit could explore partnerships for green energy sourcing or implement more water-saving technologies across its facilities.

- Enhanced Brand Reputation: Aligning with consumer values around sustainability can improve brand perception.

- Investor Attraction: Strong ESG performance can attract socially responsible investment funds.

- Operational Efficiency: Reducing energy and resource consumption can lead to cost savings.

- Competitive Differentiation: Standing out as an environmentally conscious fitness provider.

Basic-Fit has a substantial opportunity to grow by entering European markets where gym membership is less common, with countries like Germany, Italy, Spain, and Eastern Europe showing significant untapped potential for affordable fitness options.

The company is strategically targeting growth areas such as France, Spain, and Germany, recognizing the high demand for accessible fitness solutions in these regions. For instance, in 2024, Spain's fitness market showed robust growth, with budget-friendly gym chains like Basic-Fit poised to capture a larger share.

Basic-Fit is set to introduce a franchise model in 2025, which will serve as a cost-effective strategy for expanding into new international markets and reaching a wider customer base. This move is expected to accelerate their global footprint without requiring significant upfront capital investment from the company itself.

Furthermore, Basic-Fit is focusing on growing revenue from ancillary services. These include offerings like round-the-clock club access, day passes for non-members, and revenue generated from vending machines and advertising within their clubs. These additional income streams are crucial for enhancing overall profitability and diversifying revenue beyond traditional membership fees.

The global health and wellness sector has seen a remarkable surge in interest following the pandemic, with many consumers prioritizing their physical and mental well-being. For instance, a 2024 report indicated that over 60% of individuals increased their focus on personal health compared to pre-pandemic levels.

This heightened awareness creates a significant opportunity for Basic-Fit to capture new members. The company's value proposition of affordable and accessible fitness solutions aligns perfectly with the growing desire for convenient ways to maintain a healthy lifestyle. Basic-Fit's expansion into new markets and its focus on digital offerings can further capitalize on this sustained consumer engagement with fitness.

Basic-Fit can further enhance member engagement by investing in advanced technologies. This includes AI-powered personalized fitness plans and improved analytics from wearable devices, offering a more tailored experience. Such advancements are crucial for retaining existing members and attracting new, tech-oriented individuals, ultimately boosting workout efficiency.

The company's focus on digital innovation is evident in its continuous app development and the integration of smart equipment. For instance, in 2023, Basic-Fit reported a significant increase in digital service usage, with over 70% of members actively using their app for class bookings and progress tracking. This digital-first approach is key to optimizing member journeys and fostering a stronger sense of community.

Basic-Fit's dedication to sustainability, including its aim to reduce energy consumption by 15% by 2025 and increase renewable energy use, resonates with a market increasingly prioritizing environmental, social, and governance (ESG) factors. This commitment not only appeals to environmentally aware consumers but also attracts investors focused on long-term, responsible growth. By showcasing these initiatives, Basic-Fit can bolster its brand image and foster stronger relationships with stakeholders who value corporate responsibility.

The company's focus on ESG is a strategic advantage. For instance, in 2023, Basic-Fit reported a 5% reduction in energy usage per member compared to the previous year, demonstrating tangible progress. This proactive approach to environmental stewardship positions Basic-Fit favorably in a competitive landscape where sustainability is becoming a key differentiator.

Further strengthening these initiatives presents a significant opportunity. Basic-Fit could explore partnerships for green energy sourcing or implement more water-saving technologies across its facilities.

Basic-Fit's strategic expansion into new European markets, particularly in countries with lower gym penetration, presents a significant growth avenue. The introduction of a franchise model in 2025 is expected to accelerate this expansion efficiently. Additionally, leveraging the growing consumer focus on health and wellness, amplified by post-pandemic trends, and enhancing digital offerings and member engagement through AI and data analytics are key opportunities for increased revenue and member retention.

Threats

The high-value, low-price fitness segment is experiencing a surge in competition, with major players like PureGym and Planet Fitness aggressively expanding their European footprints. This heightened rivalry presents a significant threat to Basic-Fit, potentially triggering price wars and escalating marketing expenditures. For instance, PureGym announced plans to open 50 new clubs in Germany by the end of 2024, directly challenging Basic-Fit's established presence.

Ongoing economic uncertainties, including inflation and higher interest rates, pose a significant threat by potentially increasing Basic-Fit's operational costs. Expenses like energy, rent, and personnel are particularly vulnerable to these macroeconomic shifts.

Furthermore, the possibility of Value Added Tax (VAT) increases in crucial markets, such as the Netherlands, could directly affect Basic-Fit's pricing strategies and, consequently, consumer affordability. For instance, if VAT were to increase by 2% in the Netherlands, it could necessitate price adjustments that might deter some customers.

While gym attendance is bouncing back, the lasting appeal of home workouts, specialized boutique studios, and online fitness platforms presents a significant challenge. These alternatives can draw away potential members who are looking for different fitness experiences or prioritize the convenience of exercising from their own space, impacting traditional gym attendance.

For instance, the global online/virtual fitness market was valued at approximately $15 billion in 2023 and is projected to grow substantially. This trend indicates a strong consumer shift towards flexible and accessible fitness solutions, directly competing with the membership models of larger, physical gym chains.

Regulatory Changes and Increased Labor Costs

Evolving labor legislation in key European markets like France and Spain presents a notable threat. For instance, potential mandates for increased staffing to support 24/7 club operations could directly escalate personnel expenses, impacting Basic-Fit's operational costs.

Furthermore, the need to comply with new or updated health and safety regulations, or other operational requirements, could introduce additional costs. These could range from investments in new equipment to revised operational procedures, all contributing to a higher cost base for the company.

These regulatory shifts and potential labor cost increases are particularly relevant in 2024 and 2025, as European countries continue to review and adapt their labor laws. For example, minimum wage increases in several EU nations during this period will naturally put upward pressure on staffing costs.

- Increased Personnel Expenses: Higher staffing mandates in countries like France and Spain could raise labor costs significantly for 24/7 operations.

- Compliance Costs: Adhering to new health, safety, or operational regulations may require additional investment, increasing the overall cost base.

- Minimum Wage Hikes: General increases in minimum wages across the EU in 2024-2025 will directly impact staffing budgets.

Brand Image and Reputation Risks

Basic-Fit's high-volume, accessible model inherently carries risks to its brand image and reputation. Maintaining consistent service quality and cleanliness across its vast network of gyms is a significant challenge. For instance, a widespread issue reported in late 2024 regarding equipment breakdowns in several Spanish locations led to considerable social media backlash, highlighting the vulnerability of their large-scale operations.

Negative publicity, whether stemming from overcrowding during peak hours, equipment maintenance lapses, or hygiene concerns, can rapidly erode trust and deter new members. A particular incident in November 2024 involving reports of unsanitary conditions at a flagship German facility quickly escalated, impacting online reviews and search trends for the brand.

- Service Consistency: Maintaining uniform quality across over 1,400 locations (as of Q3 2024) presents a constant operational hurdle.

- Hygiene Perception: Public perception of cleanliness directly impacts membership decisions, especially in fitness facilities.

- Equipment Reliability: Frequent equipment failures can lead to member dissatisfaction and negative word-of-mouth.

- Overcrowding Management: Popular times can lead to overcrowding, negatively affecting the member experience and potentially leading to safety concerns.

Intensifying competition from budget rivals like PureGym, which plans 50 new German clubs by year-end 2024, threatens Basic-Fit's market share and could trigger price wars. Economic headwinds, including inflation and rising interest rates, may increase operational costs for energy, rent, and personnel. Potential VAT hikes in key markets, such as a hypothetical 2% increase in the Netherlands, could impact affordability and necessitate price adjustments.

| Threat Category | Specific Threat | Impact on Basic-Fit | Relevant Data/Example |

| Competitive Landscape | Aggressive Expansion by Rivals | Market share erosion, price pressure | PureGym targeting 50 new German clubs by end of 2024. |

| Economic Factors | Inflation and Interest Rate Hikes | Increased operational costs (energy, rent, personnel) | General upward pressure on operating expenses across the sector. |

| Regulatory Environment | Potential VAT Increases | Reduced consumer affordability, pricing strategy challenges | Hypothetical 2% VAT increase in the Netherlands could necessitate price adjustments. |

| Consumer Behavior | Rise of Home & Boutique Fitness | Member acquisition and retention challenges | Global online fitness market valued at ~$15 billion in 2023, indicating strong alternative growth. |

| Labor & Compliance | Evolving Labor Laws & Minimum Wage | Increased personnel expenses, compliance costs | Minimum wage increases in several EU nations during 2024-2025 directly impact staffing budgets. |

| Brand & Reputation | Service Consistency and Hygiene | Negative publicity, member dissatisfaction | Reports of equipment breakdowns in Spain (late 2024) and unsanitary conditions in Germany (Nov 2024) caused social media backlash. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Basic-Fit's official financial reports, comprehensive market research on the fitness industry, and insights from industry experts and customer feedback to ensure a well-rounded perspective.