Basic-Fit Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Basic-Fit Bundle

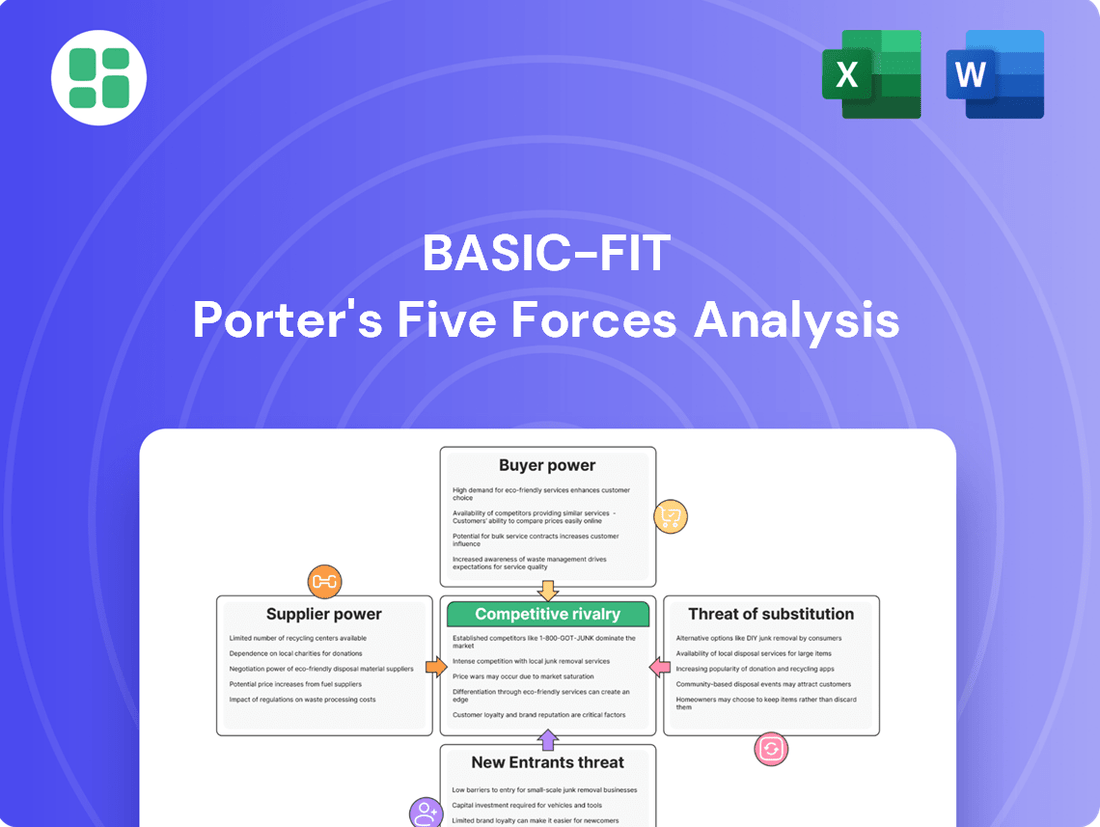

Basic-Fit's competitive landscape is shaped by intense rivalry, moderate buyer power, and the looming threat of substitutes. Understanding these forces is crucial for navigating the budget gym market.

The full Porter's Five Forces Analysis dives deep into each of these pressures, revealing the underlying dynamics that impact Basic-Fit's profitability and strategic options. Unlock actionable insights for your own business or investment decisions.

Suppliers Bargaining Power

Basic-Fit's substantial size, evidenced by its 1,575 clubs across Europe by the close of 2024, typically grants it considerable leverage when negotiating with suppliers of common fitness equipment and routine services. This scale often translates into more favorable pricing and contract terms due to the sheer volume of its purchases.

However, the bargaining power dynamic shifts when dealing with providers of specialized or premium fitness technology, such as Matrix or Technogym. For these suppliers, their unique offerings and brand reputation can afford them moderate bargaining power, even with a large client like Basic-Fit.

Switching costs for Basic-Fit regarding standard gym equipment are generally low. The market for treadmills, weights, and resistance machines has numerous manufacturers, allowing Basic-Fit to source components or finished goods from various suppliers without significant disruption. This competitive landscape limits the bargaining power of suppliers for these basic items.

However, the situation changes for more specialized or integrated systems. For instance, Basic-Fit's membership management software and virtual training platforms represent higher switching costs. If a supplier provides a proprietary system that is deeply integrated, changing providers could involve substantial costs for new software, data migration, and employee retraining, thereby increasing supplier bargaining power in these specific areas.

Basic-Fit's strategic focus on equipment longevity, exemplified by its 'Smart Refurbishing' program and supplier agreements for preventative maintenance, also influences supplier relationships. By extending the useful life of existing equipment through regular inspections and upkeep, Basic-Fit reduces the frequency of new equipment purchases. This can shift some negotiation leverage towards Basic-Fit, as suppliers may be more willing to offer favorable terms to secure ongoing service contracts or future bulk orders.

While much gym equipment is similar, suppliers providing unique technology for virtual classes, app features, or AI coaching can hold more sway. This uniqueness can differentiate Basic-Fit's offerings and create a stronger dependence on these specialized providers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into operating gym chains like Basic-Fit is generally low. Their primary focus remains on manufacturing and selling fitness equipment or technology, not managing the complex operations of a large-scale fitness provider.

However, certain technology suppliers might introduce direct-to-consumer fitness platforms. While these don't directly compete with Basic-Fit's physical club model, they could offer alternative digital fitness solutions that indirectly challenge Basic-Fit's online service components.

- Low Direct Threat: Fitness equipment manufacturers typically lack the expertise and capital to replicate Basic-Fit's extensive network of physical clubs.

- Indirect Digital Competition: Some tech firms may launch app-based or online fitness programs, creating a competitive edge in digital offerings.

- Focus on Core Business: Suppliers' main objective is to sell products to gym operators, not to become gym operators themselves.

Supplier's Importance to Basic-Fit's Cost Structure

Suppliers of real estate, fitness equipment, and energy are critical to Basic-Fit's cost structure, particularly given its vast network of over 1,400 clubs as of early 2024. Favorable leasing terms for its locations are paramount, as rent represents a significant fixed cost. Similarly, the acquisition and maintenance of fitness equipment are substantial expenditures.

Basic-Fit actively manages these supplier relationships to mitigate cost pressures. For instance, the company focuses on securing long-term energy contracts to stabilize utility expenses, a key operational cost. Furthermore, optimizing operational efficiencies across its club network helps to absorb potential price increases from equipment suppliers.

- Real Estate: Rent is a major fixed cost, making negotiation of lease agreements vital.

- Fitness Equipment: The cost of acquiring and maintaining modern equipment significantly impacts capital expenditure and ongoing operational costs.

- Energy: As a large operator, energy consumption is substantial, necessitating strategic procurement to manage utility expenses.

Basic-Fit's considerable scale, operating 1,575 clubs across Europe by the end of 2024, generally gives it strong bargaining power with suppliers of standard fitness equipment and routine services. This purchasing volume allows for more advantageous pricing and contract terms.

However, suppliers of specialized or premium fitness technology, such as advanced cardio machines or integrated software solutions, can retain moderate bargaining power due to their unique offerings and brand reputation, even with a large customer like Basic-Fit.

The bargaining power of suppliers is generally low for common fitness equipment due to numerous manufacturers and low switching costs for Basic-Fit. Conversely, suppliers of proprietary, integrated systems like membership software can exert more influence due to higher switching costs for Basic-Fit.

Suppliers of real estate, fitness equipment, and energy are crucial to Basic-Fit's cost structure. Negotiating favorable lease terms for its over 1,400 clubs as of early 2024 is vital, as is managing the significant costs associated with acquiring and maintaining fitness equipment.

| Supplier Category | Basic-Fit's Bargaining Power | Factors Influencing Power |

|---|---|---|

| Standard Fitness Equipment | High | Numerous suppliers, low switching costs, high volume purchases |

| Specialized Fitness Technology | Moderate | Unique offerings, brand reputation, potential integration complexity |

| Real Estate (Leasing) | Moderate to High | Dependence on location, negotiation skill, lease term length |

| Energy | Moderate | Commodity nature, potential for long-term contracts, market volatility |

What is included in the product

This analysis unpacks the competitive forces impacting Basic-Fit, from the threat of new entrants and substitutes to the bargaining power of buyers and suppliers, offering a strategic view of its market position.

Instantly identify and address competitive threats with a clear, actionable breakdown of Basic-Fit's market landscape.

Customers Bargaining Power

Basic-Fit's core strategy revolves around providing accessible and affordable fitness, meaning customers are highly attuned to pricing. This price sensitivity is a key driver of their purchasing decisions, making them likely to switch providers if costs rise. For instance, in 2024, the European fitness market saw continued competition, with many budget-friendly chains like Basic-Fit focusing on value propositions to attract and retain members.

Customers looking at Basic-Fit have a wealth of other fitness options. They can choose from other budget gyms, mid-tier and high-end fitness centers, or even specialized studios. This means Basic-Fit members can easily switch if they find a better deal or a more suitable facility elsewhere.

The availability of alternatives extends beyond traditional gyms. Many consumers opt for home workouts using online apps or equipment, or engage in outdoor activities like running or cycling, which are often free. In 2023, the global online fitness market was valued at over $15 billion, highlighting the significant competition from digital solutions.

Switching costs for Basic-Fit customers are notably low. Memberships are typically structured around contracts that can be canceled with relative ease, often with options for weekly payments, making it simple to move to a competitor. For instance, in 2024, many gym memberships across Europe, including those similar to Basic-Fit's model, allow for monthly cancellations after an initial commitment period, meaning a customer could switch gyms with minimal financial penalty.

Customer Information and Transparency

Customers in the fitness sector now have unprecedented access to information. Online platforms, review sites, and social media allow consumers to readily compare pricing, facilities, and class schedules across numerous gyms. This heightened transparency, especially with Basic-Fit’s straightforward pricing, makes it simple for customers to weigh their options.

Basic-Fit's commitment to transparency is further solidified by its mobile application. This app serves as a central hub for members, offering detailed insights into their membership, class bookings, and facility information. In 2024, Basic-Fit reported over 3.5 million members across Europe, indicating a large user base that benefits from this readily available data.

- Information Access: Customers can easily compare Basic-Fit with competitors using online resources and reviews.

- Price Transparency: Basic-Fit's clear pricing model facilitates straightforward comparisons.

- App Utility: The Basic-Fit app provides members with extensive, transparent information.

- Member Base: With over 3.5 million members in 2024, Basic-Fit's customer base is significant and informed.

Customer Base Size and Concentration

Basic-Fit benefits from a substantial and expanding customer base, reaching 4.25 million members by the close of 2024. This broad reach across various European markets dilutes the influence of any single customer. While individual members may have high bargaining power due to low switching costs and a focus on price, the sheer scale of the membership base mitigates the impact of individual churn.

The dispersed nature of Basic-Fit's customers means that no single customer or small group possesses significant leverage to negotiate terms. This collective size, rather than individual clout, is the defining characteristic of their customer base. Consequently, the bargaining power of customers, while present at an individual level, is considerably weakened by the company's extensive and diversified membership.

- Customer Volume: 4.25 million members by end of 2024.

- Geographic Reach: Operations across multiple European countries.

- Individual vs. Collective Power: Low switching costs empower individuals, but large numbers dilute this.

- Concentration: No single customer or small group holds significant individual bargaining power.

The bargaining power of Basic-Fit's customers is significant, primarily driven by the availability of numerous alternatives and low switching costs. Customers can easily compare pricing and services across various fitness providers, from budget gyms to home workout solutions, which saw the online fitness market valued at over $15 billion in 2023. Basic-Fit's transparent pricing and user-friendly app, which supported over 3.5 million members in 2024, further empower consumers to make informed choices and switch providers with minimal hassle.

Despite the high individual bargaining power due to price sensitivity and easy switching, Basic-Fit's extensive customer base of 4.25 million members by the end of 2024 across Europe dilutes the collective influence of any single customer or small group. This vast, dispersed membership means no individual customer can significantly dictate terms, thereby moderating the overall bargaining power of the customer segment.

| Factor | Impact on Basic-Fit | Supporting Data (2023-2024) |

| Availability of Alternatives | High | Online fitness market valued at >$15 billion (2023) |

| Switching Costs | Low | Flexible monthly cancellations common in 2024 gym memberships |

| Information Access | High | Basic-Fit app supports >3.5 million members (2024) |

| Customer Concentration | Low | 4.25 million members by end of 2024; dispersed across Europe |

Full Version Awaits

Basic-Fit Porter's Five Forces Analysis

This preview showcases the complete Basic-Fit Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the fitness industry. The document you see is the exact, professionally formatted report you will receive immediately upon purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The European fitness landscape is intensely competitive, with a wide array of businesses vying for members. Basic-Fit, while a leader in Europe with over 3.5 million members as of early 2024, contends with formidable rivals. These include other large budget operators like PureGym, which has a significant presence across several European countries, and RSG Group, which owns brands such as McFit and Gold's Gym, further intensifying the rivalry.

Beyond the major budget chains, Basic-Fit also faces competition from mid-market gyms that offer a broader range of amenities and services, as well as premium health clubs catering to a more affluent clientele. The rise of specialized boutique studios, focusing on niche fitness experiences like yoga, CrossFit, or cycling, also fragments the market and presents a different kind of competitive pressure, drawing in specific customer segments.

The European fitness market is booming, with a projected 71.6 million members in 2024 and revenues hitting €36 billion. This robust expansion fuels intense competition as companies vie for market share by rapidly opening new locations.

Basic-Fit is a prime example of this aggressive expansion, having added 173 clubs in 2024 alone. The company plans to continue this growth trajectory, aiming for approximately 100 new clubs annually in both 2025 and 2026, further intensifying the competitive landscape.

Basic-Fit’s competitive rivalry is shaped by its high-value, low-price strategy, focusing on accessibility and a standardized gym experience. While this model offers a broad appeal, it means differentiation isn't its primary strength compared to niche or premium fitness providers.

The company aims to boost member satisfaction by improving club quality and digital offerings, but its core equipment and virtual classes are largely similar to many competitors. In 2023, Basic-Fit reported a revenue of €1.2 billion, highlighting its scale in a competitive market.

Switching Costs for Customers

Customer switching costs in the budget gym sector are generally quite low, meaning members can easily move between different fitness providers. This ease of switching fuels intense competition, as gyms can readily lure customers away from rivals through attractive pricing or special offers. For instance, in 2024, many budget gyms continued to offer introductory discounts of up to 50% off the first few months, directly targeting competitor customer bases.

Basic-Fit counters this by concentrating on consistently enhancing its services and the overall member experience. The aim is to cultivate a stronger sense of loyalty among its existing customers, making them less inclined to switch. This strategy is crucial in a market where, according to industry reports from early 2025, over 30% of gym members surveyed indicated they had switched providers in the past two years due to price incentives.

- Low Switching Costs: Customers can easily move between budget gyms, often with minimal notice periods or exit fees.

- Price Sensitivity: This low barrier encourages price-based competition, with gyms frequently using promotions to attract new members.

- Basic-Fit's Strategy: The company focuses on improving its value proposition and member experience to build loyalty and reduce churn.

- Market Trend: A significant percentage of gym-goers switch providers annually, highlighting the impact of low switching costs on rivalry.

Exit Barriers

Exit barriers in the fitness industry, such as Basic-Fit's, are substantial. These include long-term lease agreements for prime club locations and significant capital tied up in specialized fitness equipment. These fixed costs make it challenging for companies to leave the market swiftly without incurring considerable financial losses.

The high fixed costs associated with maintaining a large network of fitness clubs, as Basic-Fit operates, can trap companies in the market. This situation intensifies competitive rivalry because struggling entities are compelled to remain operational, even if unprofitable, to avoid substantial exit penalties or asset write-downs.

- Significant Capital Investment: Fitness equipment alone represents a major sunk cost for companies like Basic-Fit, with specialized machines often costing tens of thousands of euros.

- Lease Commitments: Long-term leases for strategically located fitness centers create ongoing financial obligations that are difficult to escape without penalties.

- Brand and Network Value: The established brand presence and extensive network of clubs represent intangible assets that are hard to liquidate quickly, further increasing exit barriers.

Competitive rivalry within the European fitness sector is fierce, driven by a large number of players and a growing market. Basic-Fit, with over 3.5 million members in early 2024, faces strong competition from budget rivals like PureGym and RSG Group, as well as mid-market and premium clubs. The market's expansion, projected to reach 71.6 million members in 2024, fuels aggressive growth strategies, with companies like Basic-Fit adding numerous clubs annually.

The low switching costs for consumers in the budget segment mean that gyms must constantly innovate and offer compelling value to retain members. Many competitors utilize aggressive pricing strategies, such as significant introductory discounts, to attract customers. Basic-Fit's strategy of enhancing member experience and club quality aims to build loyalty in this price-sensitive environment, where industry data from early 2025 suggests over 30% of members switched providers in the prior two years.

| Competitor Type | Examples | Key Competitive Factor |

| Budget Chains | PureGym, RSG Group (McFit, Gold's Gym) | Price, accessibility, standardized offerings |

| Mid-Market Gyms | Various national and regional chains | Broader amenities, slightly higher price point |

| Premium Health Clubs | High-end fitness centers | Exclusive facilities, personalized services, higher price point |

| Boutique Studios | Yoga, CrossFit, cycling studios | Niche experiences, specialized training, community focus |

SSubstitutes Threaten

The threat of substitutes for traditional gym memberships like Basic-Fit is significant. Consumers can opt for home workout equipment, with the global home fitness equipment market projected to reach over $14 billion by 2026, or leverage free online fitness videos and apps, a trend that surged during the pandemic and continues to be popular.

The threat of substitutes for Basic-Fit is significant, largely due to the cost-effectiveness of alternatives. Many people can access free online workout videos or engage in outdoor activities like running or cycling, which require no membership fees. These options present a compelling zero-cost alternative compared to even Basic-Fit's budget-friendly gym memberships.

While Basic-Fit's low-cost model, with memberships often starting around €19.99 per month in 2024, is designed to mitigate this price sensitivity, the appeal of completely free activities remains strong. For individuals prioritizing savings above all else, these no-cost substitutes can be a powerful draw, limiting Basic-Fit's ability to capture the most price-sensitive segment of the market.

The threat of substitutes for Basic-Fit is moderate, as the quality and effectiveness of alternatives are increasing. While a traditional gym offers a complete fitness environment, sophisticated home gym equipment and a surge in online fitness platforms, including personalized coaching, present viable alternatives for consumers. For example, by mid-2024, the global online fitness market was projected to reach over $20 billion, highlighting the growing appeal of these substitutes.

Ease of Switching to Substitutes

For consumers, switching to alternative fitness options is remarkably straightforward. There's often no significant financial outlay or complex logistical planning required to shift from a gym membership. For instance, many individuals can transition to outdoor activities like running or cycling with minimal initial investment, or even utilize free fitness apps and online workout videos. This ease of transition makes substitutes highly appealing.

The low barrier to entry for substitute activities directly impacts the competitive landscape for gym chains like Basic-Fit. When it costs virtually nothing to start a home workout routine or join a free community fitness group, the perceived value of a paid gym membership diminishes. This is a critical factor in understanding the threat of substitutes.

Consider the proliferation of digital fitness solutions. In 2024, the global digital fitness market was valued at over $20 billion, with projections indicating continued robust growth. This vast and accessible market offers a direct alternative to traditional gym attendance, further highlighting the ease with which consumers can switch.

- Minimal Financial Commitment: Many substitutes, like outdoor exercise or free apps, require little to no upfront cost.

- Low Logistical Hurdles: Transitioning to alternative fitness forms usually involves no complex sign-up processes or travel arrangements.

- Accessibility of Digital Alternatives: The widespread availability of free or low-cost fitness apps and online content provides readily available substitutes.

- Consumer Preference Shifts: Growing interest in home-based workouts and outdoor activities can further empower consumers to switch away from traditional gym facilities.

Trend Towards Hybrid Fitness Models

The fitness industry is seeing a significant shift towards hybrid models. This means consumers are increasingly blending traditional gym memberships with at-home digital fitness platforms or personal training sessions. For instance, by mid-2024, many fitness tech companies reported substantial growth in subscription numbers for their online classes and apps, indicating a broader consumer adoption of these flexible solutions.

This trend directly impacts the threat of substitutes for traditional gyms like Basic-Fit. Substitutes are no longer just other brick-and-mortar gyms but also a wide array of digital offerings. A 2024 survey found that over 30% of fitness enthusiasts regularly use a combination of gym visits and online fitness resources, suggesting that the perceived necessity of a single, exclusive gym membership is diminishing.

- Hybrid fitness models combine gym access with digital solutions.

- Substitutes now include online classes and home workout equipment.

- Consumer adoption of digital fitness grew significantly in 2024.

- This can reduce the perceived value of traditional gym memberships.

The threat of substitutes for Basic-Fit is significant due to the accessibility and low cost of alternatives. Consumers can easily opt for home workouts using readily available equipment or leverage the vast array of free online fitness content. By mid-2024, the global online fitness market was projected to exceed $20 billion, demonstrating the substantial appeal and reach of these substitute options.

The ease with which consumers can switch to these alternatives further amplifies the threat. Transitioning to outdoor activities or using fitness apps often involves minimal financial commitment and no complex logistical planning, making them highly attractive compared to even budget-friendly gym memberships. This low barrier to entry directly challenges the perceived value of traditional gym services.

| Substitute Type | Estimated Market Value (Mid-2024) | Key Advantages |

|---|---|---|

| Online Fitness Market | >$20 Billion | Accessibility, Variety, Convenience |

| Home Fitness Equipment | >$14 Billion (Projected by 2026) | Personalization, Privacy, No Commute |

| Outdoor Activities/Free Apps | N/A (Cost-Neutral) | Zero Cost, Health Benefits, Flexibility |

Entrants Threaten

Establishing a fitness chain akin to Basic-Fit necessitates considerable capital for prime locations, state-of-the-art equipment, and initial operating expenses. For instance, in 2024, the average cost to open a new fitness facility can range from $50,000 to over $1 million, depending on size and amenities.

While Basic-Fit's strategy focuses on affordability, building a widespread presence and strong brand across international markets demands significant financial resources. This can create a substantial barrier for potential new competitors seeking to replicate their scale and market penetration.

Basic-Fit leverages substantial economies of scale in purchasing fitness equipment and executing marketing campaigns, creating a cost advantage new entrants find difficult to overcome. For instance, in 2023, Basic-Fit reported a revenue of €1,293.5 million, demonstrating the scale of its operations.

New competitors would need massive upfront investment to achieve similar purchasing power and brand recognition, making it challenging to compete on price with Basic-Fit's established low-cost model.

Furthermore, Basic-Fit's extensive experience in optimizing operations for the budget fitness market provides an ingrained efficiency that newcomers would take years to replicate, impacting their ability to offer competitive pricing and service.

While individual customer switching costs are generally low for gym memberships, Basic-Fit has cultivated significant brand loyalty. Their extensive network of over 1,400 clubs across Europe, coupled with a consistent, no-frills value proposition, makes them a default choice for many. In 2023, Basic-Fit reported a revenue of €1.25 billion, underscoring their established market position.

New entrants face a substantial hurdle in replicating this widespread accessibility and brand recognition. To lure members away from Basic-Fit, they would likely need to invest heavily in marketing campaigns and offer a demonstrably superior or distinctly different value proposition. For instance, a new competitor might need to offer premium amenities or specialized training programs to justify the effort of switching for the average consumer.

Access to Distribution Channels (Locations)

Securing prime, high-traffic locations presents a significant hurdle for new entrants aiming to establish a gym presence, particularly in densely populated urban centers. Basic-Fit leverages its established network and existing relationships with property owners, often positioning itself as a favored tenant, which inherently complicates the acquisition of desirable sites for emerging competitors.

This reality creates a tangible barrier, as new gyms struggle to secure the visibility and accessibility that Basic-Fit already commands. For instance, in 2024, the commercial real estate market continued to see high demand for retail and fitness spaces in prime urban locations, driving up rental costs and further intensifying the challenge for newcomers to find suitable, affordable premises.

- Limited Availability of Prime Real Estate: High-traffic areas are often already occupied by established players, making it difficult for new entrants to find suitable locations.

- Landlord Preferences: Established chains like Basic-Fit, with a proven track record and financial stability, are often preferred by landlords over new, unproven businesses.

- Cost of Acquisition: The premium for desirable locations can be prohibitively high for new entrants, impacting their initial capital outlay and overall cost structure.

Regulatory and Legal Barriers

The fitness industry faces significant regulatory hurdles that can deter new competitors. In 2024, for instance, adherence to evolving health and safety standards, particularly post-pandemic, requires substantial investment and expertise. Building codes and operational licensing, which differ across European countries, add layers of complexity and cost for any aspiring fitness operator looking to enter markets like those served by Basic-Fit.

These varied regulatory landscapes present a substantial barrier. For example, obtaining the necessary permits and certifications in Germany might involve different processes and timelines compared to France or the Netherlands, demanding localized knowledge and resources. This complexity can significantly increase the upfront capital expenditure and the time-to-market for new entrants, effectively raising the barrier to entry.

- Health and Safety Regulations: Compliance with updated health and safety protocols, crucial for gym operations, adds operational costs and complexity.

- Building Codes and Zoning: Strict building regulations and zoning laws in various European municipalities can limit site selection and increase construction costs for new facilities.

- Operational Licensing: Obtaining and maintaining various operational licenses, which differ by country and region, requires navigating diverse legal frameworks and can be time-consuming.

- Data Protection Laws: Adherence to GDPR and similar data privacy regulations necessitates robust IT infrastructure and compliance procedures, an added cost for new businesses.

The threat of new entrants for Basic-Fit is moderate. While the fitness industry has relatively low switching costs for individual consumers, new players face significant capital requirements for prime locations and equipment. Basic-Fit's established economies of scale in purchasing and marketing, coupled with strong brand recognition across Europe, create substantial barriers. For instance, Basic-Fit reported revenues of €1,293.5 million in 2023, highlighting its operational scale.

Newcomers must overcome the challenge of replicating Basic-Fit's extensive network and cost advantages. Securing desirable real estate is also a hurdle, as established brands often have preferred tenant status. In 2024, prime urban locations remained in high demand, increasing rental costs for new entrants.

Regulatory complexities across different European countries, including health and safety standards and licensing, further increase the cost and time-to-market for new fitness businesses. These factors collectively moderate the threat of new entrants by demanding significant investment and operational expertise to compete effectively.

| Factor | Impact on New Entrants | Relevance to Basic-Fit |

| Capital Requirements | High (locations, equipment) | Basic-Fit has significant scale advantage |

| Brand Recognition & Loyalty | Low for new entrants | Basic-Fit has strong brand presence (1,400+ clubs) |

| Economies of Scale | Difficult to match | Basic-Fit leverages scale for purchasing and marketing |

| Real Estate Access | Challenging in prime locations | Basic-Fit has established network and landlord relationships |

| Regulatory Hurdles | Complex and costly across Europe | Basic-Fit has navigated these complexities |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Basic-Fit is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and competitor press releases. This blend of data allows for a comprehensive understanding of the fitness industry's competitive landscape.