Basic-Fit Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Basic-Fit Bundle

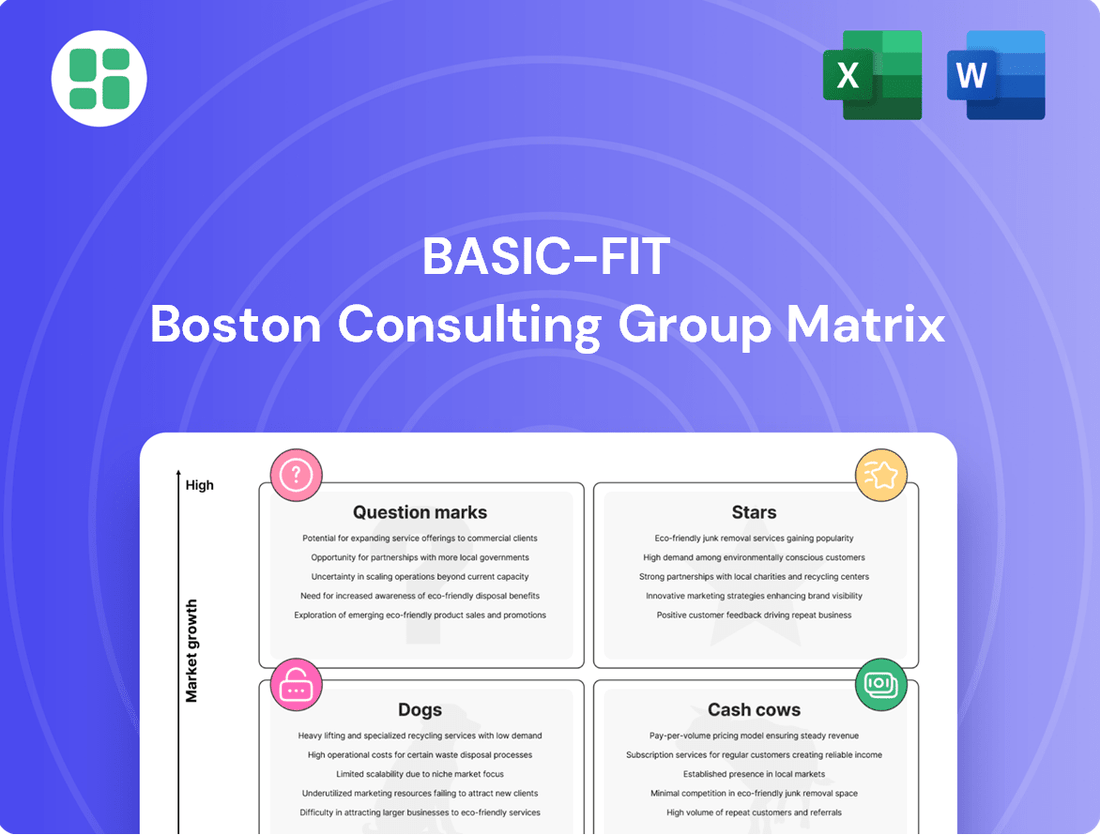

Curious about Basic-Fit's strategic positioning? This glimpse into their BCG Matrix reveals how their various offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understanding these dynamics is crucial for any business aiming for sustainable growth and efficient resource allocation.

To truly unlock the strategic advantage, dive into the complete Basic-Fit BCG Matrix. You'll gain a comprehensive breakdown of each product's market share and growth rate, equipping you with the insights needed to make informed decisions about investment and divestment. Purchase the full report for a clear roadmap to optimizing Basic-Fit's portfolio.

Stars

Basic-Fit's aggressive expansion in France, Spain, and Germany is a key indicator of its strong performance in these growth markets. The company opened 77 new clubs in France and 70 in Spain during 2024, demonstrating a clear commitment to increasing its footprint. This rapid growth is reflected in substantial membership increases observed in both countries during the first half of 2025.

Basic-Fit's 24/7 staffed club operations are a clear Star in their BCG Matrix. The company successfully rolled out and expanded these clubs, especially in key markets like France, Spain, and Germany, catering to the growing demand for flexible fitness options.

This strategic move has demonstrably boosted membership numbers. A successful pilot in France in 2024 paved the way for a significant expansion, with 333 24/7 clubs operating in France by early 2025. Similar expansions are underway in Spain and Germany, underscoring the strong market reception and growth potential.

Basic-Fit's tiered membership structure, particularly the Premium and Ultimate options, is a key driver for increasing average revenue per member. These higher tiers provide compelling benefits such as the ability to bring a friend, unlimited access to massage chairs, and complimentary Yanga Sportswater, all contributing to a more valuable member experience.

The company strategically introduced this new membership framework in late December 2024. The objective is to fine-tune revenue generation by achieving a favorable balance between the yield generated from each member and the overall membership count. Early indicators from the beginning of 2025 suggest this approach is yielding positive results.

Digital Offerings and Basic-Fit App

Basic-Fit's digital offerings, spearheaded by the Basic-Fit App, represent a significant and expanding area for the company. This app provides members with access to virtual training programs and a vast library of workouts, significantly enhancing the overall membership value.

While specific market share data for Basic-Fit within the broader digital fitness sector isn't publicly detailed, the consistent growth in digital engagement and the app's crucial role in member retention point towards its potential as a Star in the BCG matrix. This digital platform is key to meeting contemporary fitness demands and improving the member experience.

- Digital Engagement Growth: Basic-Fit has seen a notable increase in user interaction with its digital platforms, indicating strong adoption and usage of its app features.

- App as a Value Driver: The Basic-Fit App is central to the company's strategy for enhancing member satisfaction and encouraging long-term loyalty.

- Virtual Training Expansion: The continuous development and offering of virtual training programs within the app cater to evolving consumer preferences for flexible and accessible fitness solutions.

Strategic Franchising Initiative

Basic-Fit's Strategic Franchising Initiative is positioned as a nascent Star within its BCG Matrix, reflecting its potential for high growth with uncertain future market share. The planned launch of a franchise platform in 2025 is designed to significantly accelerate European expansion and enter new, untapped countries. This approach minimizes capital expenditure for Basic-Fit by relying on local partners.

This franchising strategy allows Basic-Fit to tap into the expertise and capital of experienced franchisee partners, potentially unlocking substantial new markets. Discussions with these potential partners are already in progress, indicating active development of this growth avenue. By leveraging this model, Basic-Fit aims for rapid market penetration without the direct, heavy investment typically associated with company-owned expansion.

- Franchise Platform Launch: Planned for 2025 to drive European growth.

- Capital Expenditure Reduction: Aims to expand into new countries with limited upfront investment.

- Leveraging Local Partners: Utilizes the expertise and capital of franchisees.

- Market Expansion Potential: Positions Basic-Fit for high growth in new territories.

Basic-Fit's 24/7 staffed clubs are a clear Star, demonstrating strong growth and market leadership. The company's expansion into key markets like France and Spain, with 77 and 70 new clubs opened in 2024 respectively, highlights this success. By early 2025, France alone boasted 333 of these 24/7 locations, indicating a robust and well-received operational model.

The company's tiered membership structure, particularly Premium and Ultimate options introduced in late 2024, is also a Star. This strategy aims to optimize revenue per member by offering enhanced benefits like guest access and massage chair usage, showing early positive results in 2025.

Basic-Fit's digital offerings, centered around its app, represent another Star. The app provides virtual training and a workout library, enhancing member value and retention. While specific market share in the digital fitness sector is not detailed, the app's growing engagement signifies its importance.

The strategic franchising initiative, set to launch in 2025, is an emerging Star. This plan aims to accelerate European expansion into new countries by leveraging franchisee capital and expertise, thereby minimizing Basic-Fit's own capital expenditure.

| Category | BCG Status | Key Growth Driver | 2024/2025 Data Point |

| 24/7 Staffed Clubs | Star | Flexible fitness access, market expansion | 77 new clubs in France (2024); 333 24/7 clubs in France (early 2025) |

| Tiered Membership Structure | Star | Increased ARPM through premium benefits | New structure introduced late 2024; early positive results in 2025 |

| Digital Offerings (App) | Star | Enhanced member value, virtual training | Growing digital engagement and app usage |

| Strategic Franchising | Emerging Star | Accelerated expansion, reduced capex | Platform launch planned for 2025 |

What is included in the product

The Basic-Fit BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investment, divestment, and resource allocation for each segment.

A clear Basic-Fit BCG Matrix overview to quickly identify underperforming and high-potential business units.

An easily digestible BCG Matrix visual to pinpoint strategic focus and resource allocation needs.

Cash Cows

Basic-Fit's foundational low-cost membership model in mature markets such as the Netherlands and Belgium truly exemplifies a Cash Cow. These regions represent the company's bedrock, consistently delivering robust and predictable cash flows.

The sustained high market share in these established territories, coupled with efficient operational management, allows Basic-Fit to maintain low per-member costs. This translates directly into strong profitability for the company.

For instance, in 2024, Basic-Fit reported continued stability in its membership base within these core countries, underscoring the enduring appeal and financial resilience of its core offering. This segment remains the primary engine for generating substantial and reliable earnings.

Basic-Fit's established club network in the Benelux region, particularly in the Netherlands and Belgium, functions as a classic Cash Cow. These clubs, typically operating for over two years, have achieved high membership levels and demand minimal additional marketing spend. This maturity translates into consistent and reliable revenue generation for the company.

As of June 2025, Basic-Fit boasted an impressive 1,219 mature clubs across its network. These well-established locations are performing strongly, with each club averaging approximately 3,074 active memberships. This substantial membership base within mature markets underscores their role as significant cash generators.

Yanga Sportswater and massage chair add-ons at Basic-Fit are prime examples of Cash Cows. Their consistent revenue streams, especially for Comfort and Ultimate members, highlight their profitability. These services boast high profit margins and demand minimal extra operational input, solidifying their role as steady contributors to the company's fitness revenue.

The financial performance of these add-ons is robust. Basic-Fit's overall fitness revenue saw a significant 15% surge in the first half of 2025, reaching €650 million. This growth is partly fueled by the reliable income generated from these high-margin, low-effort services, demonstrating their value within the company's portfolio.

Optimized Operational Leverage

Basic-Fit's strategic emphasis on optimizing its operational leverage, particularly through headquarters efficiencies, firmly places it in the Cash Cow quadrant of the BCG Matrix. This focus directly translates to a reduction in overhead and marketing expenses as a proportion of overall revenue, bolstering profitability from its established, market-leading positions.

The company's disciplined approach to cost management is a key driver of its robust profit margins. For instance, in the first half of 2025, overhead and marketing costs were successfully managed down to 11.0% of revenue, a figure that surpassed their internal projections.

- Reduced Overhead and Marketing Costs: Decreased to 11.0% of revenue in H1 2025, outperforming targets.

- High Profit Margins: Achieved through efficient operations and disciplined cost control.

- Market Leadership: Leverages existing high market share for consistent revenue generation.

- Operational Leverage: Headquarters efficiencies contribute to a stronger financial performance.

Strong Brand Recognition and Member Retention

Strong brand recognition and consistent member retention in its established markets solidify Basic-Fit's position as a Cash Cow. This loyalty translates into a reliable revenue stream, allowing the company to generate substantial profits from its existing customer base.

Basic-Fit's commitment to member satisfaction is evident in its improving Google ratings, such as those in France, which reached an average of 4.3 stars by early 2024. This focus fosters sustained profitability by nurturing long-term member relationships, effectively allowing the company to 'milk' these valuable connections.

- Stable Revenue: High member retention ensures a predictable income.

- Brand Strength: Well-recognized brand in core European markets.

- Customer Loyalty: Efforts to improve member satisfaction, like rising Google ratings, bolster retention.

- Profitability: Ability to generate consistent profits from existing members.

Basic-Fit's mature clubs in the Netherlands and Belgium are quintessential Cash Cows, demonstrating high market share and consistent profitability. These established locations, often operating for over two years, require minimal new investment and generate substantial, predictable cash flows.

The company's focus on operational efficiency and cost management, particularly at the headquarters level, further strengthens these Cash Cow characteristics. By keeping overhead and marketing costs low as a percentage of revenue, Basic-Fit maximizes the earnings from these mature segments.

In the first half of 2025, Basic-Fit reported a 15% surge in fitness revenue to €650 million, with a notable reduction in overhead and marketing costs to 11.0% of revenue, outperforming targets. This financial discipline highlights the robust cash-generating ability of its established operations.

| Metric | Value (H1 2025) | Significance |

|---|---|---|

| Fitness Revenue | €650 million | Demonstrates strong top-line growth from core operations. |

| Overhead & Marketing Costs | 11.0% of Revenue | Indicates efficient cost management, boosting profitability. |

| Mature Clubs | 1,219 (as of June 2025) | Represents a significant base of established, cash-generating assets. |

| Average Members per Club | 3,074 | Highlights high penetration and utilization in mature markets. |

What You’re Viewing Is Included

Basic-Fit BCG Matrix

The Basic-Fit BCG Matrix document you are previewing is precisely the same comprehensive report you will receive immediately after completing your purchase. This means you'll get the fully formatted, analysis-ready content without any alterations or added watermarks, enabling you to directly implement its strategic insights. The preview accurately represents the final product, ensuring you know exactly what you are acquiring for your business planning needs. This is the genuine, professionally crafted BCG Matrix report, ready for immediate download and application to optimize Basic-Fit's strategic decisions.

Dogs

Underperforming legacy clubs represent a challenge within Basic-Fit's portfolio. These might be older facilities in less desirable locations, facing stagnant local demand and struggling to attract new members. In 2024, such clubs could be characterized by low membership growth rates, potentially below the company's overall average, and a higher cost-to-member ratio compared to newer, more efficient locations.

Outdated or underutilized ancillary services at Basic-Fit could be classified as Dogs in the BCG Matrix. These are offerings that don't fit the company's core strategy of high value at a low price and see minimal member engagement. For instance, niche group classes with very low attendance or older equipment that's rarely used might fall into this category.

Such services often represent a drain on resources, requiring maintenance or space without generating significant revenue or member satisfaction. Basic-Fit's success hinges on broadly appealing, high-demand services, making these low-utilization ancillaries potential candidates for divestment or significant overhaul. In 2024, companies across the fitness industry are increasingly scrutinizing ancillary service profitability, with many aiming to streamline offerings to focus on core revenue drivers.

Clubs acquired through portfolio deals, like the RSG Spain acquisition, that were later identified as a poor strategic fit and subsequently sold off, represent the Dogs category in Basic-Fit's BCG Matrix. These were clubs with limited strategic value or market share that Basic-Fit moved to divest to prevent them from becoming financial burdens.

An example of this strategy in action is the divestment of five clubs from the RSG Spain acquisition shortly after the deal's completion in 2024. This move allowed Basic-Fit to streamline its portfolio and focus resources on more promising growth areas, aligning with the principle of shedding underperforming or non-strategic assets.

Highly Competitive, Saturated Micro-Markets

Basic-Fit might find itself in highly competitive, saturated micro-markets, particularly within established European countries. Think of densely populated urban areas where numerous gym chains and independent studios vie for members. In these micro-markets, even if the overall fitness market is mature, intense rivalry can mean Basic-Fit struggles to capture a substantial share. This often translates into price wars, making it harder to achieve healthy profit margins.

For instance, in major cities like Amsterdam or Berlin, the density of fitness facilities is exceptionally high. Data from 2024 indicates that in some of these hyper-competitive urban pockets, the market share for any single gym brand can be quite fragmented. Basic-Fit, despite its scale, might only hold a small percentage in these specific micro-markets, facing challenges from both large international competitors and strong, locally recognized brands.

- Intense Competition: Micro-markets in mature countries often feature a high concentration of fitness providers.

- Price Sensitivity: Fierce competition can lead to aggressive pricing strategies, impacting profitability.

- Limited Market Share: Basic-Fit may struggle to gain significant traction in these saturated areas due to established incumbents.

- Operational Challenges: Sustaining efficient growth and profitability becomes difficult in environments with intense rivalry.

Services with Declining Relevance

Any fitness service or product that is experiencing a significant decline in overall market relevance or popularity could become a Dog for Basic-Fit. For instance, if a particular class format, like step aerobics, sees a sharp drop in participation, it might be categorized as a Dog. In 2023, while the overall fitness industry continued to grow, certain niche or older fitness trends have indeed seen reduced engagement.

If Basic-Fit continues to offer such services without adapting, they would yield low returns and consume resources that could be better allocated elsewhere. Imagine a gym still heavily promoting a specific type of cardio machine that has been largely superseded by newer, more engaging alternatives. This would mean wasted space and maintenance costs for minimal member use.

This category would depend on evolving fitness trends and consumer preferences. For example, a 2024 survey indicated a rise in demand for functional training and HIIT, suggesting that traditional, less dynamic group fitness classes might be on the decline. Basic-Fit needs to monitor these shifts closely.

- Declining Participation: Services with consistently low attendance numbers, indicating a loss of member interest.

- Outdated Equipment/Classes: Fitness offerings that have been surpassed by newer, more effective, or popular alternatives.

- High Maintenance, Low Return: Services that require significant upkeep or space but generate minimal revenue or member engagement.

- Shifting Consumer Preferences: Acknowledging trends like the growing popularity of digital fitness or specialized training modalities that may render older services obsolete.

Basic-Fit's "Dogs" in the BCG Matrix represent offerings with low market share and low growth potential, often requiring divestment or significant overhaul. These can include underperforming legacy clubs, outdated ancillary services, or acquired businesses that proved to be a poor strategic fit. For instance, Basic-Fit divested five clubs from its 2024 RSG Spain acquisition, identifying them as non-strategic assets.

These underperforming units or services drain resources without contributing significantly to revenue or member engagement. In highly competitive, saturated micro-markets, even established brands like Basic-Fit can find their market share fragmented, leading to price sensitivity and operational challenges. The company must actively monitor evolving fitness trends, like the rise of functional training, to avoid investing in declining service formats.

Question Marks

Basic-Fit's strategy of opening new clubs in untapped markets, like emerging regions within Germany or potential new franchise territories, positions these locations as potential Stars or Question Marks in the BCG matrix. These ventures demand substantial upfront capital for establishment and member acquisition, reflecting their high growth potential but also their nascent stage of development. For instance, Basic-Fit reported a significant increase in new openings in 2023, with a focus on expanding its footprint in countries like Germany, where it aims to capture a larger market share.

Introducing advanced digital features or premium app content for Basic-Fit could position them as Stars within the BCG matrix, given the booming digital fitness market. However, these ventures demand significant upfront investment to capture user interest and compete with existing digital platforms. Their ultimate success hinges on effective market penetration and sustained user engagement.

Basic-Fit's exploration of franchise expansion into new countries positions them squarely in the Question Mark quadrant of the BCG Matrix. This strategic move, while promising capital-efficient growth, carries inherent risks due to the complexities of entering unfamiliar markets. Initial market share in these new territories is expected to be low, but the potential for high growth exists, making the long-term success uncertain.

Entering new national markets requires significant investment in understanding diverse regulatory frameworks, adapting to local competitive pressures, and catering to varied consumer preferences. For instance, a successful entry into a market like India, with its burgeoning middle class and distinct fitness trends, would necessitate a tailored approach compared to established European markets. The success of these ventures hinges on effective market entry strategies and the ability to build brand awareness rapidly in a landscape where their presence is nascent.

Introduction of Higher-Tiered, More Expensive Offerings

Introducing higher-tiered, more expensive offerings, like premium personal training packages or exclusive access to specialized equipment, could position Basic-Fit's new ventures as Question Marks within the BCG matrix. This strategy aims to boost average revenue per member by targeting a more affluent customer base.

Basic-Fit's established identity as a low-cost provider means these premium services would likely begin with a low market share. Success would hinge on significant, strategic investment to build awareness and perceived value in a growing but competitive premium fitness market.

For instance, if Basic-Fit were to launch a new tier at €49.99 per month, compared to its current average membership fee, it would represent a significant price increase. The success of such a move would depend on market adoption, with initial sales figures likely being modest against the backdrop of its existing millions of members.

- Targeting Affluent Segment: Focus on attracting members willing to pay more for enhanced services.

- Low Initial Market Share: New premium offerings are expected to start with a small percentage of the total membership.

- Strategic Investment Needed: Significant marketing and operational investment required to establish these higher-tiered services.

- Potential for Increased ARPM: Successful premium tiers can substantially increase the average revenue per member.

Investments in Advanced Technology (e.g., AI-driven training)

Basic-Fit's investment in advanced technologies like AI-driven personalized training would likely position it as a Question Mark in the BCG matrix. The market for these innovations is experiencing rapid growth, with projections indicating a significant expansion in the digital fitness sector. For instance, the global AI in fitness market was valued at approximately $1.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years, reaching several billion dollars by 2030.

While this high-growth market presents an opportunity, Basic-Fit would initially hold a low market share in this specific niche. This necessitates substantial investment in research and development (R&D) and marketing to establish a foothold and demonstrate the value proposition. The capital expenditure for such technologies, including software development, hardware integration, and ongoing operational costs, could be considerable. For example, developing a robust AI training platform can cost anywhere from hundreds of thousands to millions of dollars, depending on the complexity and features.

- High Market Growth: The digital fitness and AI-powered training market is expanding rapidly, driven by consumer demand for personalized and data-driven fitness experiences.

- Low Market Share: Basic-Fit would enter this segment as a new player, requiring significant effort to build brand recognition and customer adoption compared to established tech-focused fitness companies.

- High Investment Needs: Substantial R&D and marketing budgets are crucial to develop, launch, and promote these advanced technologies, with a clear need to prove return on investment (ROI) through user engagement and subscription models.

- Strategic Importance: Investing in these areas could be vital for Basic-Fit's long-term competitive positioning, potentially attracting a new demographic and enhancing member retention through innovative offerings.

Question Marks represent ventures with low market share in high-growth industries, demanding significant investment to determine their future potential. Basic-Fit's expansion into new countries, like its recent focus on Germany and potential ventures into markets such as India, exemplifies this. These initiatives require substantial capital for market entry, adapting to local regulations, and building brand awareness, with uncertain outcomes regarding market penetration and profitability.

Similarly, the introduction of premium service tiers or advanced AI-driven training platforms positions Basic-Fit as a Question Mark. While these areas promise high growth, they necessitate considerable investment in R&D, marketing, and operational adjustments. The success of these ventures hinges on their ability to attract a new customer segment and establish a competitive advantage in a rapidly evolving fitness landscape.

Basic-Fit's strategic moves into new national markets and the development of innovative digital fitness solutions are classic examples of Question Marks. These ventures operate in high-growth potential sectors but currently hold a low market share. Significant investment is required to understand diverse consumer preferences, navigate regulatory complexities, and build brand recognition, making their long-term success a key strategic question.

The company's reported expansion efforts in 2023, particularly in Germany, highlight this strategy. While the German market offers growth, establishing a strong foothold requires considerable investment to compete with existing players and adapt to local market dynamics. The ultimate success of these new market entries remains a critical question for Basic-Fit's future growth trajectory.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.