Barrick Gold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barrick Gold Bundle

The global gold market is a complex web of political, economic, social, technological, legal, and environmental factors that significantly influence Barrick Gold's operations. From fluctuating commodity prices and geopolitical stability to evolving ESG expectations and technological advancements in mining, understanding these external forces is crucial for strategic planning. Gain a competitive edge by delving into the comprehensive PESTLE analysis of Barrick Gold, meticulously crafted to provide actionable intelligence. Download the full version now to unlock a deeper understanding of the landscape shaping this industry giant and fortify your own market strategy.

Political factors

Barrick Gold's operations are significantly influenced by government stability and evolving resource nationalism policies across its global mining sites. Jurisdictions like Mali have seen increased government intervention, as demonstrated by the country's move in 2023 to increase royalty rates and demand greater state equity in mining projects, directly impacting Barrick's Loulo-Gounkoto complex. This trend can create substantial operational hurdles and financial uncertainties.

Changes in mining regulations, tax policies, and environmental laws in Barrick's operating countries directly impact its profitability and operational structure. For example, Mali's 2023 mining code reforms, which raised royalty rates and required greater government equity, have introduced a challenging regulatory landscape. Barrick's capacity to successfully navigate and adjust to these shifting legal frameworks is vital for its continued operations and financial stability.

Geopolitical tensions, including ongoing conflicts in Ukraine and the Middle East, continue to bolster gold's appeal as a safe-haven asset, potentially boosting Barrick Gold's revenue streams. For instance, gold prices saw significant upward movement in early 2024, partly driven by these global uncertainties.

However, these same geopolitical factors introduce considerable risks to Barrick's supply chains and operational continuity in affected areas. While Barrick strategically diversifies its reserves across politically stable regions, operational challenges, such as past disputes in Mali, underscore the inherent difficulties of global mining operations.

Trade Agreements and Investment Protection

Barrick Gold's global operations are significantly shaped by trade agreements and investment protection treaties. The presence of these frameworks allows for smoother cross-border transactions and provides recourse in case of disputes. For instance, Barrick's experience in Mali, where it faced operational challenges and initiated international arbitration, highlights the critical need for robust legal protections for foreign investments.

The company actively engages in negotiations to resolve such issues, demonstrating a dual approach of diplomacy and preparedness for legal action. This strategy is essential for navigating the complexities of international investment landscapes.

- Impact of Trade Agreements: Facilitate market access and reduce tariffs on gold exports, directly influencing Barrick's profitability.

- Investment Protection Treaties: Offer legal recourse and security against expropriation or unfair treatment, crucial for long-term asset management.

- Mali Dispute: Underscores the importance of clear legal frameworks; Barrick sought arbitration in 2023, indicating reliance on these protections.

Bribery and Corruption Policies

Barrick Gold enforces a strict zero-tolerance policy on bribery and corruption, underscored by comprehensive employee training on its Code of Conduct. This dedication to ethical business practices is crucial for securing its social license to operate and mitigating legal risks across its global mining sites.

In 2023, Barrick Gold reported zero significant bribery or corruption incidents, reflecting the effectiveness of its compliance programs. This adherence to anti-corruption regulations is essential for fostering trust with governments and local communities, which is paramount for long-term operational stability.

The company's commitment to integrity helps prevent substantial financial penalties and reputational damage. For instance, in 2024, several multinational corporations faced fines upwards of $50 million for violations of anti-bribery laws, highlighting the severe consequences of non-compliance.

Barrick Gold's proactive approach to combating corruption includes robust due diligence on third-party partners and regular audits. These measures ensure that all business dealings align with international standards and local regulations, safeguarding the company's operations and stakeholder relationships.

Political stability remains a key concern for Barrick Gold, with resource nationalism trends influencing operations in countries like Mali. In 2023, Mali's government increased royalty rates and sought greater state equity, impacting Barrick's Loulo-Gounkoto complex and highlighting the need for adaptable strategies in evolving regulatory environments.

Changes in mining laws and tax policies directly affect Barrick's financial performance and operational structure. The 2023 mining code reforms in Mali, for instance, introduced higher royalties and demanded more government ownership, creating a complex legal landscape that Barrick must navigate to ensure stability.

Geopolitical events, such as conflicts in Ukraine and the Middle East, have bolstered gold's status as a safe-haven asset, potentially increasing demand and prices for Barrick's products. This trend was evident in early 2024, with gold prices experiencing upward momentum due to global uncertainties.

However, these geopolitical factors also pose risks to Barrick's supply chains and operational continuity in affected regions. While the company diversifies its assets across stable areas, past disputes, like those in Mali, underscore the inherent challenges of international mining.

What is included in the product

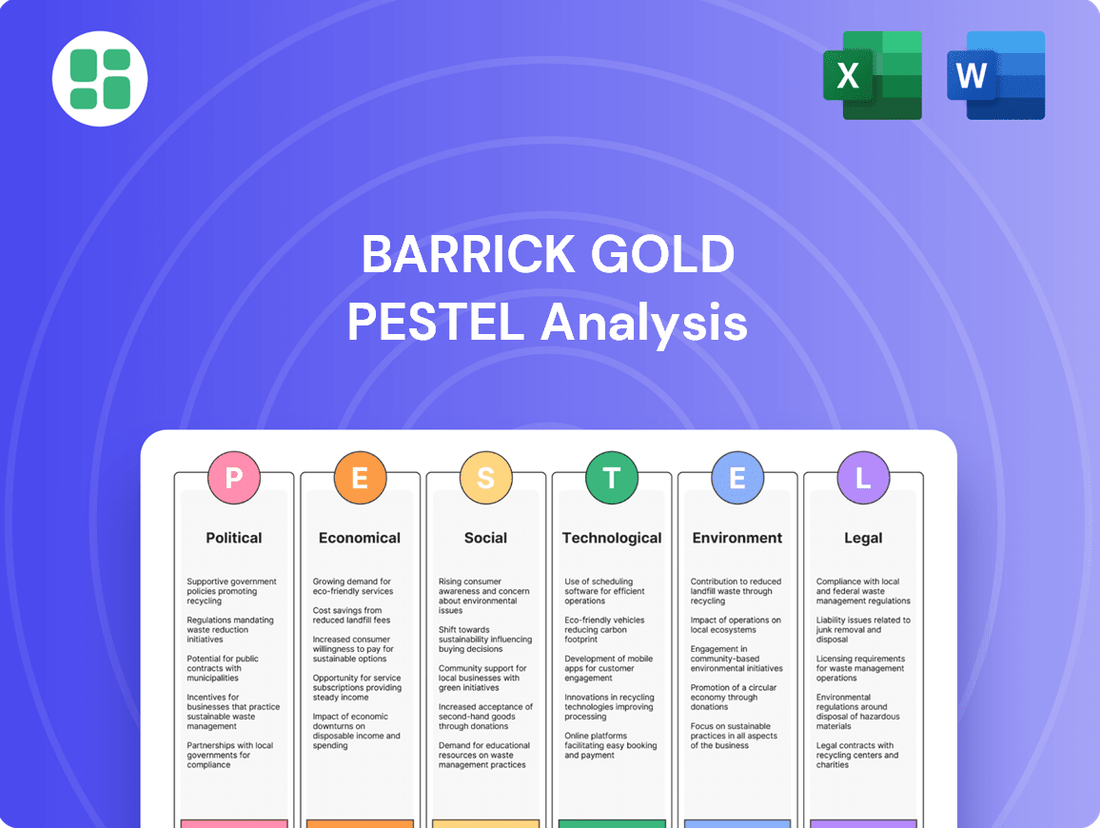

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Barrick Gold, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these global trends create both opportunities and threats for Barrick Gold's strategic planning and operational decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of Barrick Gold's external operating environment.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal factors impacting Barrick Gold.

Economic factors

The prices of gold and copper are directly tied to Barrick Gold's bottom line. A notable increase in gold prices, fueled by global uncertainties and inflation concerns, has significantly boosted Barrick's profitability, helping it absorb escalating production expenses. For instance, gold prices averaged around $2,030 per ounce in early 2024, a substantial increase from previous years, which directly benefits companies like Barrick.

Barrick's financial health is highly sensitive to the fluctuations in these commodity markets. When gold and copper prices rise, the company typically sees stronger profit margins and healthier free cash flow. Copper prices also saw a rebound in late 2023 and early 2024, trading in the range of $3.50 to $4.00 per pound, which further supports Barrick's diversified revenue streams.

Inflation directly affects Barrick Gold's operational expenses, with rising costs for labor, consumables, and energy impacting profitability. For instance, the US Consumer Price Index (CPI) saw a significant increase, reaching 3.4% year-over-year in April 2024, indicating persistent cost pressures for mining operations.

Conversely, gold's traditional role as an inflation hedge can boost Barrick's revenue. As inflation remains a concern, investor interest in gold as a store of value often increases, potentially driving higher demand and prices for the commodity Barrick produces.

Interest rates play a crucial role in Barrick's financial health. Higher interest rates, such as the Federal Reserve's target range of 5.25%-5.50% as of May 2024, increase the cost of borrowing for capital-intensive mining projects and can dampen overall economic activity, which indirectly affects demand for metals.

Currency exchange rates play a crucial role for Barrick Gold. Since gold is typically priced in U.S. dollars, a weaker dollar makes gold more attractive to international buyers, potentially increasing demand. For Barrick, this means that when their operating currencies weaken against the dollar, their production costs decrease when translated back, directly boosting their profitability.

For instance, in early 2024, the U.S. dollar experienced some volatility. A sustained period of dollar weakness could translate into higher gold prices and reduced local currency operating expenses for Barrick, enhancing their margins. Conversely, a strong dollar could have the opposite effect, making gold more expensive globally and increasing their dollar-denominated costs relative to local currency earnings.

Production Costs and Operational Efficiency

Barrick's all-in sustaining costs (AISC) are a key determinant of its profitability, encompassing direct mining expenses, labor, materials, energy, taxes, royalties, and necessary capital expenditures. For instance, in the first quarter of 2024, Barrick reported an AISC of $1,374 per ounce for gold, a slight increase from the previous year, highlighting the ongoing pressure on production expenses.

Maintaining operational efficiency and effectively managing these production costs are paramount for Barrick to fully leverage current favorable gold and copper prices. The company's strategic focus remains on optimizing its operations to keep its cost structure among the lowest in the industry, even amidst inflationary pressures. In 2023, Barrick's full-year AISC for gold was $1,345 per ounce, demonstrating a commitment to cost control.

- All-in Sustaining Costs (AISC) for Gold (Q1 2024): $1,374 per ounce.

- Full-Year AISC for Gold (2023): $1,345 per ounce.

- Strategic Goal: Maintain one of the lowest cost structures among gold mining peers.

Investment Demand and Central Bank Buying

Investment demand, encompassing gold-backed Exchange Traded Funds (ETFs) and physical gold bars, alongside significant central bank purchases, are crucial components supporting gold prices. Central banks have notably increased their gold holdings, reaching near-record levels in recent years, providing a stable floor for gold's appreciation. This heightened institutional and investor interest creates a supportive backdrop for Barrick Gold's expansion and financial performance.

Central bank gold buying reached an estimated 1,037 metric tons in 2023, marking the second-highest annual total on record according to the World Gold Council. This sustained demand from official sector institutions, driven by diversification and de-dollarization trends, directly bolsters the market for gold producers like Barrick. The increasing appetite for gold as a safe-haven asset and a store of value, evident in both institutional and individual investment flows, contributes to a favorable pricing environment.

- Record Central Bank Purchases: Central banks added approximately 1,037 tonnes of gold in 2023, underscoring their commitment to diversifying reserves.

- ETF Inflows: While fluctuating, gold-backed ETFs historically attract significant investment, especially during periods of economic uncertainty.

- Physical Gold Demand: Retail demand for gold bars and coins remains a consistent driver, particularly in emerging markets.

- Price Support Mechanism: This combined investment and central bank demand acts as a vital support for gold prices, benefiting mining companies.

Global economic factors significantly influence Barrick Gold's performance. Favorable commodity prices, like gold averaging around $2,030 per ounce in early 2024 and copper trading between $3.50-$4.00 per pound in late 2023/early 2024, directly boost revenue. However, inflation, with the US CPI at 3.4% year-over-year in April 2024, increases operational costs for labor and materials.

Interest rates, with the Federal Reserve's target range at 5.25%-5.50% as of May 2024, impact borrowing costs for capital-intensive projects. Currency exchange rates also matter; a weaker dollar generally benefits Barrick by making gold cheaper for international buyers and reducing dollar-denominated costs relative to local earnings.

| Economic Factor | Impact on Barrick Gold | Relevant Data (Early/Mid 2024) |

|---|---|---|

| Gold Price | Directly impacts revenue and profitability. | Averaged ~$2,030/oz |

| Copper Price | Supports diversified revenue streams. | Traded $3.50-$4.00/lb |

| Inflation (US CPI) | Increases operational costs (labor, energy, materials). | 3.4% YoY (April 2024) |

| Interest Rates (Fed Funds Rate) | Affects borrowing costs and economic activity. | 5.25%-5.50% target range (May 2024) |

| USD Exchange Rate | Weak dollar generally benefits revenue and cost translation. | Experienced volatility. |

Same Document Delivered

Barrick Gold PESTLE Analysis

The preview shown here is the exact Barrick Gold PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Barrick Gold. You'll gain valuable insights into the external forces shaping the company's operations and strategic decisions.

Sociological factors

Barrick Gold prioritizes robust community relations, viewing them as fundamental to its sustainability and its social license to operate. This commitment is evident in their investment in community-led projects managed by dedicated committees, targeting essential services like schools, clinics, and water infrastructure to foster local development.

In 2023, Barrick reported investing $57 million in community development initiatives across its global operations, underscoring its dedication to shared value creation. This proactive engagement is vital for effectively managing environmental and social impacts, thereby securing long-term operational success and community acceptance.

Barrick Gold prioritizes responsible labor practices, fostering a safe, respectful, and inclusive environment for its employees. This commitment is underscored by mandatory anti-harassment training across its operations. In 2023, Barrick reported that approximately 90% of its workforce comprised host country nationals, with a significant portion holding senior management positions at its sites, reflecting a deep integration with local communities.

Attracting and retaining skilled talent at all levels—local, national, and corporate—is crucial for Barrick's sustainable operational success. This focus on human capital is intrinsically linked to its broader sustainability strategy, recognizing that a motivated and capable workforce is fundamental to achieving long-term business objectives and maintaining social license to operate.

Barrick Gold places a strong emphasis on health and safety, integrating comprehensive policies into its sustainability framework. This commitment is overseen by both site-level leadership and group management, ensuring adherence to global best practices in mining operations.

In 2023, Barrick reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.54 per 200,000 hours worked, demonstrating a continued focus on reducing workplace incidents. This dedication to employee well-being is paramount, particularly given the inherent risks associated with the mining sector.

By prioritizing safety, Barrick not only aims to prevent operational disruptions but also actively cultivates a reputation as a responsible mining entity. This proactive approach to health and safety is a key component of its social license to operate.

Indigenous Rights and Cultural Heritage

Barrick Gold's operations are increasingly scrutinized for their impact on indigenous rights and cultural heritage. In 2024, the company continued its engagement with local communities, aiming to align mining plans with cultural preservation. This includes initiatives to protect sacred sites and ensure traditional practices are respected, reflecting a growing global demand for ethical resource extraction.

The company's approach involves:

- Consultation: Engaging with indigenous groups to understand their concerns and incorporate feedback into operational planning.

- Cultural Impact Assessments: Conducting studies to identify and mitigate potential negative effects on cultural heritage.

- Benefit Sharing: Exploring agreements that provide tangible economic and social benefits to local communities.

- Land Rights: Respecting customary land rights and working collaboratively on land use agreements.

Public Perception and Corporate Reputation

Barrick Gold's public perception and corporate reputation are heavily influenced by its demonstrated commitment to sustainable development and ethical operations. These factors are crucial for maintaining trust with stakeholders, including local communities, governments, and investors, which in turn can facilitate smoother project approvals and reduce operational risks. For example, in 2023, Barrick reported investing approximately $3.5 billion in host country economies through local procurement and employment, a significant figure that underpins its social license to operate.

A strong reputation acts as a valuable asset, enabling Barrick to attract investment capital and navigate complex regulatory landscapes more effectively. Conversely, any perceived missteps, such as environmental incidents or labor disputes, can quickly erode this goodwill. For instance, while Barrick has made strides in community engagement, past operational challenges at sites like the North Mara mine in Tanzania have, at times, led to public scrutiny and required substantial efforts to rebuild trust and ensure responsible practices moving forward.

- Sustainable Development Investments: In 2023, Barrick Gold's sustainability initiatives included a focus on water management and biodiversity conservation, with specific projects aimed at improving water quality in areas surrounding its operations.

- Economic Contributions: The company's significant economic contributions, totaling billions in taxes, royalties, and local spending in 2023, directly impact its standing in host nations.

- Stakeholder Engagement: Barrick actively engages with over 100 stakeholder groups globally, aiming to address concerns and foster collaborative relationships to enhance its corporate reputation.

- Reputational Risk Management: The company allocates resources to manage reputational risks, recognizing that negative publicity from operational issues or ethical lapses can lead to financial penalties and hinder future growth opportunities.

Barrick Gold's commitment to community development is a cornerstone of its operations, with significant investments made in local infrastructure and social programs. In 2023, the company invested $57 million globally in community initiatives, demonstrating a tangible dedication to shared value creation and fostering positive relationships.

The company's workforce composition is a key sociological factor, with 90% of its employees in 2023 being host country nationals, many in senior management roles, highlighting deep local integration and a commitment to local employment.

Barrick Gold actively addresses the impact of its operations on indigenous rights and cultural heritage, engaging in consultations and conducting cultural impact assessments to ensure alignment with local customs and the protection of sacred sites in 2024.

Barrick's reputation is significantly shaped by its social performance, with approximately $3.5 billion invested in host country economies in 2023 through local procurement and employment, reinforcing its social license to operate.

| Sociological Factor | 2023/2024 Data Point | Impact on Barrick Gold |

|---|---|---|

| Community Investment | $57 million invested in community development globally (2023) | Enhances social license to operate, fosters local goodwill. |

| Local Employment | 90% of workforce comprised host country nationals (2023) | Strengthens community ties, reduces operational risks. |

| Indigenous Rights Engagement | Continued engagement and cultural impact assessments (2024) | Mitigates potential conflicts, ensures ethical operations. |

| Economic Contribution to Host Nations | ~$3.5 billion in host country economies (2023) | Builds trust with governments and communities, aids regulatory navigation. |

Technological factors

Barrick Gold is actively investing in advanced technologies, particularly automation, to boost efficiency and safety across its mining operations. This strategic focus on digital transformation is evident in projects like the Kibali gold mine in the Democratic Republic of Congo, recognized as one of Africa's most automated mines.

These technological advancements are designed to streamline processes, reduce human exposure to hazardous environments, and ultimately lower operational costs while simultaneously improving overall productivity. By embracing automation, Barrick aims to solidify its position as a leader in operational excellence within the gold mining sector.

Advanced exploration technologies and sophisticated resource modeling are fundamental to Barrick Gold's strategy for discovering new gold deposits and prolonging the economic viability of its current operations. These tools enable more precise identification of potential ore bodies, reducing exploration risk and cost.

Barrick's 2024 drilling results at the Fourmile project in Nevada serve as a prime example of these technologies in action. This program successfully expanded the project's mineral resources, demonstrating the direct impact of technological advancements on strengthening the company's reserve base and paving the way for future growth.

Barrick Gold is actively investing in sustainable mining technologies to significantly lower its environmental impact. A key part of this strategy involves substantial solar and hydroelectric power projects in Pakistan, Argentina, and the Democratic Republic of Congo. These initiatives are crucial for meeting Barrick's ambitious Net Zero by 2050 commitment.

These investments in renewable energy sources directly improve energy efficiency at its operations. By reducing dependence on fossil fuels, Barrick not only advances its environmental stewardship but also stands to achieve considerable operational cost savings. For example, in 2023, Barrick reported a 10% reduction in greenhouse gas emissions intensity compared to 2018, partly driven by these technological integrations.

Data Analytics and Operational Optimization

Data analytics is a cornerstone of Barrick Gold's strategy for optimizing its mining operations. This technology allows for the detailed analysis of data collected from exploration through to the final processing stages, pinpointing inefficiencies and opportunities for enhancement.

By leveraging data analytics, Barrick can refine its operational strategies, aiming to boost mineral recovery rates and instill rigorous cost-discipline across its global mining sites. This analytical approach underpins a commitment to ongoing improvement and efficiency gains.

- Data-driven exploration: Identifying new mineral deposits with greater precision.

- Process optimization: Enhancing gold recovery rates, for example, aiming for incremental percentage point improvements in specific operations.

- Cost management: Analyzing energy consumption and equipment utilization to reduce operational expenses.

- Predictive maintenance: Using data to forecast equipment failures, minimizing downtime and associated costs.

Waste Management and Processing Innovations

Barrick Gold is actively investing in waste management and mineral processing innovations to boost gold recovery and lessen its environmental footprint. For instance, their work at the Pueblo Viejo mine in the Dominican Republic showcases a dedication to process optimization, which is designed to yield better operational outcomes and improve how resources are used. This focus on efficiency not only enhances recovery but also plays a role in reducing the overall volume of waste materials generated.

Technological advancements in mineral processing are critical for unlocking more value from ore bodies and managing the byproducts of mining. Barrick's strategic approach involves adopting new technologies that can improve the efficiency of extracting gold and other valuable minerals. This directly impacts the company's bottom line by increasing the amount of saleable product from each ton of ore processed.

- Enhanced Recovery Rates: Innovations in flotation, leaching, and gravity separation are key to maximizing gold extraction, especially from complex ore types.

- Tailings Management: Technologies like filtered dry stacking and paste backfill are being employed to reduce the volume and improve the stability of tailings, minimizing environmental risks and land use.

- Process Optimization: Digitalization and advanced analytics are being used to monitor and fine-tune processing parameters in real-time, leading to more consistent and efficient operations.

- Water Management: Innovations in water recycling and treatment are crucial for reducing freshwater consumption and ensuring that discharged water meets stringent environmental standards.

Barrick Gold is significantly investing in automation and digital technologies to enhance operational efficiency and safety. For example, the Kibali mine in the Democratic Republic of Congo is a prime example of their commitment to automation, recognized as one of Africa's most advanced mines.

The company leverages data analytics to optimize mining processes, aiming to boost gold recovery rates and maintain cost discipline across its global sites. Predictive maintenance, powered by data, is also a key focus to minimize equipment downtime.

Barrick's exploration efforts are increasingly reliant on advanced technologies and sophisticated resource modeling to identify new deposits and extend the life of existing mines. Their 2024 drilling results at the Fourmile project in Nevada demonstrate how these technologies directly contribute to expanding mineral resources.

Investments in sustainable technologies, including solar and hydroelectric power projects in Pakistan, Argentina, and the Democratic Republic of Congo, are crucial for Barrick's Net Zero by 2050 commitment and improving energy efficiency, contributing to a reported 10% reduction in greenhouse gas emissions intensity by 2023 compared to 2018.

| Technology Area | Barrick's Focus | Impact/Example |

|---|---|---|

| Automation & Robotics | Increasing use in mining operations | Kibali mine (DRC) recognized as highly automated; aims to boost efficiency and safety. |

| Data Analytics & AI | Process optimization, predictive maintenance | Enhancing gold recovery rates; reducing equipment downtime. 2023 saw a 10% reduction in GHG emissions intensity. |

| Exploration Technology | Advanced modeling, data-driven discovery | Fourmile project (Nevada) 2024 drilling results expanded mineral resources. |

| Sustainable Technologies | Renewable energy, waste management | Solar/hydro projects in Pakistan, Argentina, DRC; aiming for Net Zero by 2050. |

Legal factors

Barrick Gold navigates a complex web of mining laws and regulations across its global operations, dictating everything from exploration permits and licensing to environmental standards and royalty payments. For instance, in 2023, Mali enacted reforms to its mining code, significantly increasing state ownership stakes and altering tax frameworks, a move that directly impacts Barrick's operations in the country and highlights the evolving legal landscape.

Adherence to these diverse legal requirements is critical for maintaining operational continuity and avoiding costly legal entanglements. Barrick's proactive engagement with regulatory bodies and commitment to compliance are essential for sustainable business practices and mitigating risks associated with legal and political shifts.

Barrick Gold operates under increasingly stringent environmental legislation globally, necessitating rigorous permitting for all its mining activities. This legal framework directly influences project timelines and operational costs, demanding substantial investment in environmental compliance and mitigation strategies.

The Reko Diq project in Pakistan exemplifies this, with its Environmental and Social Impact Assessment (ESIA) requiring approval, anticipated in Q1 2025. This process is crucial for securing the necessary legal authorizations to proceed with development, underscoring the critical link between environmental law and operational viability.

Failure to comply with these environmental statutes can lead to significant penalties, project delays, or even the revocation of operating licenses, making legal adherence a cornerstone of Barrick's strategic planning and risk management.

Barrick Gold navigates a complex web of labor laws across its global operations, impacting everything from minimum wages to workplace safety standards and employee protections. For instance, in 2024, compliance with varying national labor regulations is paramount to avoid penalties and maintain operational continuity.

The company's proactive stance on fostering a safe and respectful environment, including mandatory anti-harassment training, demonstrates a commitment to not only meeting but often surpassing legal requirements for its workforce. This focus is crucial for employee morale and legal defense.

Instances like the detention of employees in Mali highlight the severe legal and reputational risks associated with non-compliance or perceived violations of labor rights. Such events can trigger international scrutiny and substantial financial repercussions, impacting Barrick's global standing.

International Arbitration and Dispute Resolution

Barrick Gold frequently navigates international disputes, leaning on international arbitration to safeguard its investments. This approach is crucial when disagreements arise with host governments, providing a structured legal framework for resolution.

A prime example is Barrick's ongoing arbitration against Mali at the World Bank's International Centre for Settlement of Investment Disputes (ICSID). This case, initiated in response to actions Barrick deemed unlawful, highlights the company's commitment to using legal avenues to protect its operational interests and challenge government decisions.

The outcomes of these international arbitration cases are significant. They not only determine the resolution for the specific dispute but also have the potential to establish critical precedents that influence future international mining investments and the legal landscape for resource-rich nations.

- ICSID Arbitration: Barrick's reliance on ICSID underscores the importance of established international legal mechanisms for resolving disputes with sovereign states.

- Precedent Setting: Favorable rulings in cases like the one against Mali can strengthen investor confidence and clarify legal protections for mining operations globally.

- Risk Mitigation: International arbitration provides Barrick with a predictable and impartial forum to address potential expropriation or unfair treatment by governments, thereby mitigating political and legal risks.

Corporate Governance and Compliance

Barrick Gold places significant emphasis on corporate governance and compliance, maintaining a robust framework to guide its global operations. This commitment is demonstrated through practices like regular risk register updates and a comprehensive Code of Conduct. In 2023, Barrick reported a 100% completion rate for its employee refresher training on the Code of Conduct, underscoring a dedication to ethical standards and legal adherence across all levels of the organization.

This strong governance structure is crucial for navigating the complex legal landscapes in the countries where Barrick operates. It ensures that the company not only meets but often exceeds regulatory requirements, fostering trust with stakeholders and mitigating potential legal risks.

- Robust Governance Framework: Barrick Gold maintains a strong corporate governance structure, including regular updates to its risk register.

- Code of Conduct Adherence: The company achieved 100% employee completion rates for its Code of Conduct refresher training in 2023.

- Global Compliance: This commitment ensures compliance with diverse legal and ethical standards across its international mining operations.

- Accountability and Transparency: Strong governance reinforces accountability and transparency, vital for stakeholder confidence and operational integrity.

Barrick Gold's operations are heavily influenced by evolving mining legislation and tax regimes worldwide. For instance, changes in royalty structures or national ownership requirements, as seen in Mali's 2023 mining code reforms, directly impact profitability and operational strategy.

The company must also navigate stringent environmental laws, requiring extensive permitting processes that can affect project timelines and costs. The Reko Diq project's Environmental and Social Impact Assessment (ESIA) approval, anticipated in Q1 2025, exemplifies this critical legal dependency for development.

International arbitration remains a key legal tool for Barrick, particularly in disputes with host governments. The ongoing ICSID arbitration against Mali highlights the company's proactive approach to safeguarding investments and challenging government actions deemed unlawful.

| Legal Factor | Impact on Barrick Gold | Example/Data Point |

| Mining Codes & Taxation | Dictates operational terms, ownership, and financial obligations. | Mali's 2023 mining code reforms increased state ownership and altered tax frameworks. |

| Environmental Legislation | Mandates rigorous permitting and compliance, influencing project costs and timelines. | Reko Diq ESIA approval anticipated Q1 2025 is crucial for legal authorization. |

| International Arbitration | Provides a framework for resolving disputes with governments. | Barrick's ongoing ICSID arbitration against Mali regarding alleged unlawful actions. |

| Labor Laws | Governs employment standards, safety, and employee protections. | Compliance with varying national labor regulations in 2024 is paramount. |

Environmental factors

Barrick Gold is actively pursuing a robust strategy to reduce its greenhouse gas (GHG) emissions, recalibrating its roadmap to accommodate an expanding production base with a clear objective of achieving Net Zero by 2050. This commitment translates into substantial investments in renewable energy sources, including solar and hydroelectric power, integrated across its global operations. For instance, in 2023, Barrick continued to advance its renewable energy projects, aiming to significantly offset its carbon footprint from mining activities.

Effective water management is a cornerstone of Barrick Gold's environmental strategy, particularly in regions facing water scarcity. The company's commitment to conservation is evident in its 2024 operational data, where it achieved an impressive 85% water reuse and recycling rate.

This high percentage highlights Barrick's focus on efficient resource utilization and minimizing its environmental footprint. Such sustainable water practices are fundamental to its broader environmental stewardship and social license to operate.

Barrick Gold's sustainability framework prioritizes biodiversity conservation and land rehabilitation, with a specific policy aimed at minimizing its ecological footprint. This commitment translates into integrating biodiversity considerations directly into mine management practices and actively pursuing rehabilitation initiatives once operations conclude.

Specialist mine teams, including dedicated environmental officers, are crucial in managing and mitigating the company's impacts on local ecosystems. For instance, in 2023, Barrick reported on its progressive rehabilitation efforts at various sites, aiming to restore disturbed land to a state that supports native flora and fauna, contributing to the broader goal of ecological restoration.

Waste and Tailings Management

Barrick Gold places significant emphasis on the responsible management of mining waste, especially tailings, recognizing it as a critical environmental concern. The company's commitment is reflected in its robust policies designed to ensure the safe and stable storage of these materials, aiming to prevent environmental contamination and protect surrounding communities.

Innovations in processing technologies are central to Barrick's strategy for mitigating its environmental footprint. These advancements are geared towards reducing the overall volume of waste generated and enhancing resource recovery rates, thereby lessening the long-term environmental impact associated with its mining operations.

- Tailings Management Facilities: Barrick operates numerous tailings storage facilities globally, adhering to stringent international standards for design, construction, and monitoring.

- Waste Reduction Initiatives: In 2023, Barrick reported progress in its waste reduction efforts, with a focus on dry stacking and paste thickening technologies at several key sites to minimize water usage and improve stability.

- Resource Efficiency: The company's ongoing investment in advanced processing aims to extract more value from ore bodies, inherently decreasing the amount of material classified as waste and increasing overall operational efficiency.

Environmental and Social Impact Assessments (ESIAs)

Barrick Gold prioritizes thorough Environmental and Social Impact Assessments (ESIAs) for all new ventures and expansions. These assessments are crucial for identifying and proactively addressing potential environmental and social risks associated with their operations.

The ESIA for the Reko Diq project, finalized in December 2024, serves as a prime example of this dedication. This comprehensive assessment underscored Barrick's commitment to robust community engagement and ensured that local concerns were thoroughly considered throughout the evaluation process.

- Reko Diq ESIA Completion: December 2024

- Focus Areas: Identifying and mitigating environmental and social risks

- Key Practice: Extensive community engagement throughout the assessment

Barrick Gold is committed to reducing its environmental impact, focusing on greenhouse gas emissions and water management. The company aims for Net Zero by 2050, investing in renewable energy like solar and hydro. In 2023, Barrick continued advancing these projects to lower its carbon footprint from mining activities.

Effective water management is key, especially in water-scarce areas. Barrick achieved an 85% water reuse and recycling rate in 2024, demonstrating efficient resource use and a commitment to minimizing its environmental footprint.

Biodiversity conservation and land rehabilitation are also priorities, with policies integrated into mine management. Specialist teams work on mitigating ecosystem impacts, and in 2023, Barrick reported on progressive rehabilitation efforts to restore disturbed land.

Responsible waste management, particularly for tailings, is critical. Barrick employs robust policies for safe storage and uses innovations like dry stacking and paste thickening to reduce waste and water usage, as seen in its 2023 progress reports.

| Environmental Focus | 2023/2024 Data | Key Initiatives |

| Greenhouse Gas Emissions | Net Zero by 2050 target | Investment in solar and hydroelectric power |

| Water Management | 85% water reuse and recycling rate (2024) | Conservation in water-scarce regions |

| Biodiversity & Land | Progressive rehabilitation efforts (2023) | Integrating biodiversity into mine management |

| Waste Management | Dry stacking and paste thickening | Minimizing tailings volume and water usage |

PESTLE Analysis Data Sources

Our Barrick Gold PESTLE Analysis is informed by a comprehensive blend of sources, including official government reports on mining regulations and economic policies, data from international financial institutions, and industry-specific market research from leading consultancies. This ensures a robust understanding of the external factors impacting the company's operations.