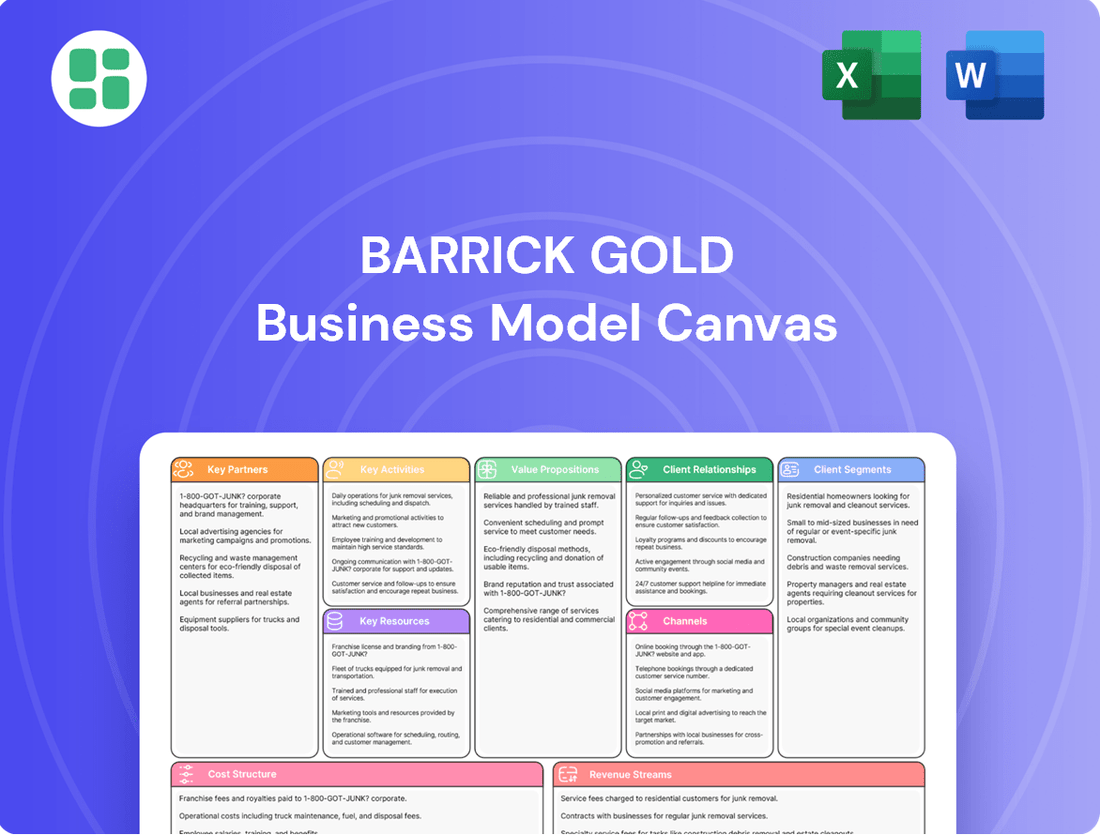

Barrick Gold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barrick Gold Bundle

Unlock the strategic blueprint behind Barrick Gold's immense success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they effectively manage key resources, cultivate vital partnerships, and deliver unique value propositions in the global mining sector. Gain critical insights into their revenue streams and cost structure to understand their competitive advantage.

Ready to dissect a titan of the mining industry? Our full Business Model Canvas for Barrick Gold provides a clear, actionable roadmap of their operations, from customer relationships to key activities. Download this professionally crafted document to accelerate your strategic planning and competitive analysis.

Partnerships

Barrick Gold cultivates vital relationships with government agencies and regulators across its global operating footprint. These partnerships are fundamental for obtaining and retaining mining permits, meeting stringent environmental regulations, and ensuring full legal compliance. In 2024, Barrick continued to navigate complex regulatory landscapes, with significant engagement surrounding the Reko Diq project in Pakistan, aiming to secure necessary approvals for its development.

Barrick Gold actively cultivates robust relationships with local communities and Indigenous groups, recognizing them as essential partners. This commitment is exemplified through the establishment of Community Development Committees (CDCs), which foster local autonomy in directing community-driven initiatives. In 2024 alone, Barrick allocated over $48 million to these vital partnerships, underscoring their dedication to shared prosperity and sustainable development.

Barrick Gold actively forms joint ventures to develop and operate major mining projects, effectively sharing expertise, capital, and risk. A significant example is Nevada Gold Mines, a venture combining substantial assets and operational strengths in the United States.

These strategic alliances enable Barrick to harness combined capabilities and extract greater value from intricate and demanding projects. For instance, the Nevada Gold Mines joint venture, established in 2019, brought together Barrick's and Newmont's Nevada operations, creating the largest gold mining complex in the world.

Suppliers and Contractors

Barrick Gold cultivates strategic alliances with a broad spectrum of suppliers and contractors, essential for its global mining activities. These relationships span critical areas such as heavy machinery, advanced mining technology, essential services like catering, and crucial logistics support.

The company places a significant emphasis on local and regional sourcing. In 2024 alone, Barrick invested more than $7.1 billion in goods and services procured from businesses operating within its host countries. This commitment not only strengthens its operational resilience but also fosters significant economic growth in these local communities.

- Strategic Sourcing: Securing reliable access to specialized equipment, technology, and services.

- Local Economic Impact: Prioritizing host country businesses to drive regional development.

- Supply Chain Resilience: Building robust partnerships to ensure uninterrupted operations.

- Cost Efficiency: Leveraging supplier relationships for competitive pricing and innovation.

Technology and Engineering Firms

Barrick Gold collaborates with specialized technology and engineering firms to boost operational efficiency and implement cutting-edge mining methods. These partnerships are crucial for driving sustainability efforts across its global operations.

A prime example is the appointment of Fluor Corporation as the lead engineering, procurement, and construction management (EPCM) partner for the significant Reko Diq project in Pakistan. This collaboration underscores Barrick's commitment to leveraging external expertise for large-scale development.

These strategic alliances foster innovation, particularly in integrating renewable energy solutions and advancing automation within mining processes. For instance, in 2023, Barrick continued its focus on reducing its carbon footprint, with renewable energy projects playing a key role in its sustainability strategy.

- Operational Efficiency: Partnering with firms like Fluor Corporation for EPCM services on projects such as Reko Diq enhances project execution and cost management.

- Advanced Mining Techniques: Collaborations enable the adoption of new technologies for exploration, extraction, and processing, improving yield and safety.

- Sustainability Initiatives: Working with technology providers facilitates the integration of renewable energy sources and the implementation of automation to reduce environmental impact.

Barrick Gold's key partnerships are crucial for its operational success and strategic growth, encompassing governments, local communities, joint venture partners, and specialized suppliers. These collaborations are essential for navigating complex regulatory environments, fostering community relations, sharing project risks and capital, and ensuring access to vital resources and expertise.

| Partner Type | Purpose | 2024 Impact/Focus |

| Governments & Regulators | Permitting, compliance, legal access | Navigating complex regulations, e.g., Reko Diq project approvals |

| Local Communities & Indigenous Groups | Social license, development, shared prosperity | Over $48 million allocated to community development initiatives |

| Joint Venture Partners | Capital sharing, risk mitigation, expertise | Nevada Gold Mines venture (Barrick & Newmont) |

| Suppliers & Contractors | Equipment, technology, services, logistics | Over $7.1 billion invested in local/regional sourcing |

| Technology & Engineering Firms | Operational efficiency, innovation, sustainability | Fluor Corporation for Reko Diq EPCM; renewable energy integration |

What is included in the product

A comprehensive, pre-written business model tailored to Barrick Gold's strategy, focusing on the extraction and sale of precious metals.

Covers customer segments, channels, and value propositions in full detail, reflecting the real-world operations and plans of the featured company.

Barrick Gold's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, allowing for rapid identification of inefficiencies and opportunities for improvement.

This structured approach simplifies the understanding of Barrick's value proposition and customer segments, thereby alleviating the pain of navigating intricate global mining logistics and stakeholder management.

Activities

Barrick Gold's key activities heavily involve global exploration to discover new gold and copper deposits, crucial for long-term growth. These extensive programs aim to replenish reserves, ensuring a continuous stream of potential projects.

In 2023, Barrick reported total gold reserves of 72 million ounces and copper reserves of 13 billion pounds, highlighting the scale of their resource definition efforts.

Developing new mines and expanding current operations is a core activity for Barrick Gold. This involves extensive feasibility studies, detailed engineering, and the actual construction phases to bring new resources online.

Key ongoing and planned projects highlight this focus. For instance, the Pueblo Viejo expansion aims to boost output, while the Fourmile project in Nevada represents a significant new development. Furthermore, the Reko Diq copper-gold project in Pakistan is a major undertaking crucial for future growth.

These development activities are directly tied to increasing Barrick's overall production capacity and importantly, extending the lifespan of its existing and future mines. In 2024, Barrick reported significant progress on these fronts, with capital expenditures on growth projects reflecting this strategic priority.

Barrick's core activities revolve around extracting gold and copper ore from its global operations, a process that demands sophisticated mining techniques and extensive processing to yield marketable metals. This operational backbone is crucial for the company's revenue generation.

The company boasts a diverse portfolio of mines, including highly valuable Tier One assets, strategically located across various continents. In 2024, Barrick continued to focus on optimizing these sites, aiming for enhanced efficiency and safety, which are paramount for sustained production and profitability.

Sustainable Development and Environmental Management

Barrick Gold's key activities in sustainable development and environmental management are deeply ingrained in its operations. The company actively pursues responsible mining, emphasizing environmental stewardship, climate action, and fostering community development. This commitment translates into substantial investments in renewable energy sources and robust greenhouse gas (GHG) emissions management strategies.

These efforts are not merely supplementary but are foundational to Barrick's business model, aiming to generate enduring value. For instance, in 2023, Barrick reported significant progress in its sustainability initiatives, including investments in projects designed to reduce its environmental footprint and enhance social impact. The company is dedicated to integrating sustainability across its value chain.

- Environmental Stewardship: Barrick focuses on minimizing its impact through comprehensive environmental management plans, including water management and biodiversity conservation.

- Climate Action: The company is committed to reducing its GHG emissions, investing in renewable energy projects like solar power at its operations to lower its carbon intensity.

- Community Development: Barrick engages in community-led projects, supporting local economies and social well-being in the regions where it operates, fostering partnerships for shared prosperity.

- Responsible Mining Practices: Sustainability is embedded in the company's core strategy, guiding decisions to ensure long-term value creation for stakeholders and the environment.

Financial Management and Investor Relations

Barrick Gold actively manages its financial performance by focusing on efficient capital allocation and robust investor relations. This includes transparent reporting of financial results, diligent debt management, and strategic share buyback programs. The company also upholds a consistent dividend policy, demonstrating a commitment to delivering sustainable returns and clearly communicating its value proposition to shareholders.

Key financial management and investor relations activities for Barrick Gold in 2024 are centered on maximizing shareholder value through disciplined capital deployment and clear communication.

- Financial Performance Management: Barrick's focus remains on optimizing operational efficiency and cost control to drive profitability. For the first quarter of 2024, the company reported adjusted net earnings of $260 million, or $0.15 per share, highlighting its ability to generate consistent earnings.

- Capital Allocation: Strategic decisions regarding capital investment in exploration, development, and potential acquisitions are paramount. Barrick continues to prioritize returning capital to shareholders through dividends and share repurchases, reinforcing its commitment to shareholder returns.

- Investor Relations: Maintaining open and transparent communication with investors is crucial. This involves regular updates on operational performance, financial health, and strategic direction, ensuring shareholders are well-informed about the company's progress and future outlook.

Barrick Gold's key activities encompass global exploration for new gold and copper deposits, mine development and expansion, and the efficient extraction and processing of ore. These operations are underpinned by a strong commitment to sustainable practices and robust financial management, including strategic capital allocation and transparent investor relations.

In 2024, Barrick continued to prioritize the optimization of its existing mine sites, including its Tier One assets, aiming for enhanced efficiency and safety in production. The company's strategic focus on developing new projects, such as the Reko Diq copper-gold project, underscores its commitment to long-term growth and reserve replenishment.

Barrick's sustainability efforts in 2024 focused on reducing its environmental footprint through investments in renewable energy and effective greenhouse gas management. Community engagement and responsible mining practices remain central to its strategy for creating enduring value.

Financially, Barrick's key activities in 2024 centered on disciplined capital deployment and returning value to shareholders through dividends and share repurchases. The company reported adjusted net earnings of $260 million for Q1 2024, demonstrating its focus on profitability and shareholder returns.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Exploration | Discovering new gold and copper deposits globally. | Replenishing reserves to ensure long-term project pipeline. |

| Mine Development & Expansion | Bringing new resources online and increasing production capacity. | Progress on projects like Pueblo Viejo expansion and Fourmile. |

| Extraction & Processing | Efficiently mining and processing ore from global operations. | Optimizing Tier One assets for enhanced efficiency and safety. |

| Sustainable Development | Minimizing environmental impact and fostering community well-being. | Investments in renewable energy and GHG emission reduction strategies. |

| Financial Management & Investor Relations | Disciplined capital allocation and transparent communication with shareholders. | Q1 2024 adjusted net earnings of $260 million; continued focus on shareholder returns. |

Delivered as Displayed

Business Model Canvas

The Barrick Gold Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting of the deliverable, ensuring complete transparency and no surprises. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for your immediate use.

Resources

Barrick's most critical asset is its vast collection of gold and copper mineral reserves and resources, forming the bedrock of its future production capabilities. As of the close of 2024, the company reported 89 million ounces of proven and probable gold reserves and 18 million tonnes of copper reserves.

These substantial reserves are strategically dispersed across various continents, providing Barrick with a diversified and resilient asset base that supports its long-term operational strategy and growth prospects.

Barrick Gold's global mining operations and infrastructure are its backbone. The company boasts a significant portfolio of Tier One gold mines, which are defined as mines with the potential to produce more than 500,000 ounces of gold per year and with a lifespan of over 10 years. In 2023, Barrick's attributable gold production reached 6.9 million ounces, underscoring the scale of these operations.

This extensive network includes processing plants, tailings facilities, and transportation routes, all crucial for the efficient extraction and refinement of minerals. The company also has substantial copper operations, with attributable copper production at 474 million pounds in 2023, highlighting its diversified commodity exposure.

This integrated infrastructure is fundamental to Barrick's ability to manage costs, ensure reliable supply chains, and ultimately deliver value to shareholders. The strategic placement of these assets across various continents also helps mitigate geopolitical and operational risks.

Barrick Gold's operations rely heavily on a highly skilled workforce, encompassing geologists, engineers, and experienced operators. This human capital is essential for the successful execution of complex mining projects and the safe, efficient operation of its global assets.

A seasoned management team with deep industry knowledge is equally critical. Their expertise in navigating diverse regulatory environments and managing large-scale mining ventures is a cornerstone of Barrick's business model. This leadership ensures strategic direction and operational excellence.

Barrick demonstrates a commitment to local development, with an impressive 97% of its workforce comprised of host country nationals as of recent reporting. This focus on local talent is complemented by significant investment in training and development programs, enhancing the skills within the communities where it operates.

Technology and Equipment

Barrick Gold’s access to advanced mining technology and heavy equipment is a fundamental pillar of its operations. This includes cutting-edge processing innovations designed to extract more value from ore bodies. For instance, in 2023, Barrick continued its focus on deploying electric trucks at its Turquoise Ridge mine, aiming to significantly reduce emissions and operating costs.

Investments in state-of-the-art processing facilities are crucial for optimizing efficiency and maintaining a competitive edge. The company's ongoing modernization efforts, such as the implementation of advanced automation and data analytics, directly contribute to cost reduction and improved productivity across its global sites. These technological advancements are key to Barrick’s strategy of delivering sustainable, low-cost gold production.

- Advanced Mining Technology: State-of-the-art equipment and processing innovations for efficient extraction.

- Heavy Equipment Fleet: Significant investment in modern, energy-efficient machinery, including electric trucks.

- Processing Innovations: Utilizing advanced facilities to maximize mineral recovery and reduce waste.

- Operational Efficiency: Technology adoption directly contributes to cost optimization and competitive advantage.

Financial Capital and Liquidity

Barrick Gold's financial capital and liquidity are cornerstones of its operational and strategic capabilities. The company maintained a robust financial position, evidenced by its significant cash reserves and access to credit facilities, enabling it to fund ongoing operations, ambitious exploration initiatives, and capital-intensive growth projects.

In 2023, Barrick Gold reported a strong balance sheet with substantial liquidity, allowing for strategic investments and consistent shareholder returns. This financial strength provides a crucial buffer, ensuring stability and flexibility even amidst the inherent volatility of commodity prices.

- Strong Cash Flow: Barrick's ability to generate consistent cash flow from its mining operations underpins its financial strength.

- Access to Credit: The company benefits from established relationships with financial institutions, providing access to credit lines for managing liquidity needs.

- Shareholder Returns: Significant liquidity enables Barrick to pursue attractive shareholder return programs, including dividends and share repurchases.

- Strategic Flexibility: Financial robustness allows Barrick to capitalize on strategic acquisition opportunities and navigate market downturns effectively.

Barrick's key resources are its extensive mineral reserves, global mining infrastructure, skilled workforce, and access to advanced technology. The company's proven and probable gold reserves stood at 89 million ounces, with copper reserves at 18 million tonnes as of year-end 2024. Its operational backbone includes a portfolio of Tier One mines, crucial for efficient extraction and processing. The workforce, with 97% host country nationals, and a seasoned management team are vital for navigating complex operations and diverse regulatory landscapes.

| Resource Category | Specifics | Impact on Business Model |

|---|---|---|

| Mineral Reserves | 89 million oz Gold (Proven & Probable), 18 million tonnes Copper (Year-end 2024) | Foundation for future production, long-term revenue generation. |

| Global Operations & Infrastructure | Portfolio of Tier One gold mines, processing plants, logistics networks. | Enables efficient, large-scale mineral extraction and cost management. |

| Human Capital | Skilled geologists, engineers, operators; 97% host country nationals. | Drives operational execution, safety, and community engagement. |

| Technology & Equipment | Advanced processing, electric truck deployment (e.g., Turquoise Ridge). | Enhances efficiency, reduces costs, and improves environmental performance. |

Value Propositions

Barrick provides a dependable source of gold and copper, key materials for many sectors and investment strategies. The company targets steady output, with its 2025 outlook projecting gold production in the range of 3.15 to 3.5 million ounces and copper production between 200,000 and 230,000 tonnes.

This consistent supply chain is attractive to customers needing reliable commodity access and to investors wanting exposure to both precious and base metals. Barrick's operational stability underpins its value proposition for a broad range of stakeholders.

Barrick is dedicated to building lasting value for everyone involved by mining responsibly and pursuing strategic expansion. This includes a target of a 30% rise in gold equivalent ounces by 2030, fueled by its internal development projects and efforts to replace depleted reserves.

This forward-looking approach makes Barrick a compelling choice for investors focused on consistent returns and future expansion opportunities, demonstrating a clear path to sustained growth.

Barrick Gold positions its commitment to responsible mining as a core value proposition, weaving environmental stewardship, social equity, and strong governance into its operational fabric. This dedication is not just about compliance; it’s about building trust and long-term viability.

The company actively showcases its sustainability efforts through detailed reporting and substantial investments. For instance, in 2023, Barrick reported a 9% reduction in its greenhouse gas emissions intensity compared to 2018, underscoring its focus on climate action. Significant capital was also allocated to community development projects, totaling $45 million in 2023, enhancing local infrastructure and social programs.

These actions directly appeal to the growing segment of investors and partners prioritizing Environmental, Social, and Governance (ESG) performance. Barrick's proactive stance on sustainability, including its investments in renewable energy sources to power its operations, like the solar farm at its Kibali mine in the Democratic Republic of Congo, strengthens its appeal to a market increasingly driven by ethical considerations and long-term resilience.

Diversified Portfolio of Tier One Assets

Barrick Gold's strength lies in its world-class portfolio of Tier One gold and copper mines. These assets are distinguished by their extended mine lives, competitive operating costs, and strong environmental stewardship. This high quality underpins consistent profitability and reliable production, regardless of market fluctuations.

The strategic diversification of these operations across various geographies and metals significantly mitigates risk. This geographical and commodity spread enhances the company's overall resilience, providing a stable foundation for performance.

- Asset Quality: Barrick holds a significant number of Tier One gold and copper mines, defined as operations with the potential to produce more than 500,000 ounces of gold equivalent per year with a mine life of over 10 years and a cost profile in the lower half of the industry's cost curve.

- Profitability and Reliability: The long mine lives and low operating costs of these Tier One assets ensure robust profitability and dependable production volumes, even during periods of commodity price volatility. For instance, in 2023, Barrick reported a total gold production of 6.5 million ounces.

- Risk Mitigation: Diversification across key mining regions like North America, South America, Africa, and Australia, as well as across gold and copper, reduces the company's exposure to single-jurisdiction or single-commodity risks.

- Environmental Performance: A commitment to high environmental standards across its operations is a key differentiator, contributing to long-term social license to operate and reducing potential operational disruptions.

Shareholder Returns and Financial Discipline

Barrick Gold prioritizes delivering strong value to its shareholders. This commitment is evident in its consistent approach to returning capital through both dividends and share repurchases, showcasing a dedication to financial discipline.

In 2024, Barrick demonstrated this by returning a significant amount of capital to its investors. Specifically, the company distributed $696 million in dividends and executed share buybacks totaling $498 million.

- Shareholder Returns: Barrick provides attractive shareholder returns through regular dividends and share buyback programs.

- Financial Discipline: The company's strategy reflects a commitment to financial discipline and returning capital to investors.

- 2024 Capital Allocation: In 2024, Barrick returned $696 million in dividends and repurchased $498 million in shares.

- Investor Appeal: This financial approach appeals to investors seeking both income generation and potential capital appreciation.

Barrick Gold's value proposition centers on being a reliable global supplier of essential metals, gold and copper. The company targets consistent production, with its 2025 outlook projecting 3.15 to 3.5 million ounces of gold and 200,000 to 230,000 tonnes of copper. This dependable supply chain benefits customers needing access to commodities and investors seeking exposure to both precious and base metals, underpinned by operational stability.

Barrick is committed to creating long-term value through responsible mining and strategic growth, aiming for a 30% increase in gold equivalent ounces by 2030 via internal projects and reserve replacement. This focus on sustained growth makes Barrick attractive to investors looking for consistent returns and future expansion opportunities.

The company emphasizes its dedication to responsible mining, integrating environmental stewardship, social equity, and strong governance into its operations to build trust and ensure long-term viability. Barrick's 2023 sustainability efforts included a 9% reduction in greenhouse gas emissions intensity from 2018 levels and $45 million invested in community development projects, appealing to ESG-focused investors.

Barrick's portfolio of Tier One gold and copper mines, characterized by long lives, competitive costs, and strong environmental performance, is a core strength. This high-quality asset base ensures consistent profitability and production, while geographical and commodity diversification across regions like North America, South America, Africa, and Australia, as well as gold and copper, mitigates risk.

| Value Proposition | Key Features | Supporting Data (2023/2024) |

|---|---|---|

| Reliable Commodity Supply | Consistent gold and copper production | 2025 Gold Outlook: 3.15-3.5M oz; 2025 Copper Outlook: 200-230K tonnes |

| Long-Term Value Creation | Strategic expansion and reserve replacement | Target: 30% increase in gold equivalent ounces by 2030 |

| Commitment to ESG | Responsible mining, community investment, emissions reduction | 2023 GHG intensity reduction: 9% (vs. 2018); 2023 Community Investment: $45M |

| High-Quality Asset Portfolio | Tier One mines, profitability, risk mitigation | 2023 Gold Production: 6.5M oz; Diversified operations across multiple regions and metals |

| Shareholder Returns | Dividends and share buybacks | 2024 Dividends: $696M; 2024 Share Buybacks: $498M |

Customer Relationships

Barrick Gold prioritizes investor engagement through a commitment to transparency. In 2024, the company continued its practice of providing detailed quarterly and annual financial reports, offering shareholders a clear view of operational performance and strategic direction. This consistent communication, including investor presentations and dedicated investor days, aims to foster trust and confidence within its diverse investor base.

Barrick Gold cultivates strong ties with host governments and local communities, viewing them as essential partners. This relationship is built on mutual respect and a commitment to creating shared value, ensuring a social license to operate.

The company actively collaborates through established Community Development Committees and prioritizes local procurement. For instance, in 2023, Barrick reported spending over $1.5 billion with local suppliers across its global operations, demonstrating a tangible commitment to community economic development.

This collaborative approach is crucial for fostering long-term positive impacts and maintaining operational stability. By working together, Barrick and its stakeholders aim to achieve sustainable outcomes that benefit both the company and the communities where it operates.

Barrick Gold cultivates direct commercial ties with a diverse range of gold and copper purchasers. These include major entities like central banks, industrial users who require metals for manufacturing, and various financial institutions. This direct approach ensures efficient transactions and the timely delivery of Barrick's mined commodities to the global market.

The company's interactions with these buyers are largely transactional, emphasizing the smooth execution of sales and the reliable delivery of its metal products. Barrick's substantial production capacity positions it as a key supplier, capable of meeting significant demand across international commodity exchanges.

For instance, in 2023, Barrick reported gold sales of approximately 6.5 million ounces and copper sales of around 400 million pounds. These figures underscore the scale of its commercial relationships and its importance as a provider of essential metals to a broad customer base.

Supply Chain Partnerships

Barrick Gold cultivates strategic, long-term alliances with its primary suppliers and contractors, focusing on shared objectives for cost management, quality assurance, and the implementation of sustainable practices throughout its supply network. These collaborations are vital for maintaining uninterrupted operations and enhancing overall efficiency.

These critical supply chain partnerships are designed to be mutually beneficial, ensuring reliability and fostering innovation. For instance, in 2023, Barrick continued to emphasize supplier diversity, with a significant portion of its procurement spend directed towards local and diverse businesses in the regions where it operates, reinforcing its commitment to community development and economic empowerment.

- Cost Management: Collaborative efforts with suppliers to optimize procurement costs and improve budgetary control.

- Quality Assurance: Joint initiatives to uphold stringent quality standards for all materials and services.

- Sustainability Focus: Working together to integrate environmentally and socially responsible practices within the supply chain.

- Operational Continuity: Ensuring a consistent and reliable supply of essential goods and services to support mining operations.

Government and Regulatory Dialogue

Barrick Gold maintains ongoing dialogue with government and regulatory bodies to navigate mining jurisdictions effectively. This collaboration is crucial for securing permits, addressing tax obligations, and aligning with national development plans, thereby mitigating operational risks and ensuring compliance. For instance, in 2024, Barrick continued its engagement with various governments, contributing to discussions on resource management and fiscal frameworks across its global operations.

- Permitting and Licensing: Continuous engagement with regulatory agencies to streamline the permitting process for new projects and existing operations.

- Fiscal Negotiations: Active participation in discussions regarding tax regimes and royalty agreements, aiming for mutually beneficial outcomes.

- Community and National Development: Collaboration on initiatives that contribute to local economic growth and national development objectives in mining regions.

- Regulatory Compliance: Proactive communication to ensure adherence to evolving environmental, social, and governance (ESG) standards and mining laws.

Barrick Gold's customer relationships are multifaceted, encompassing investors, host communities, governments, and direct commodity buyers. The company prioritizes transparency and consistent communication with its investor base, evident in its detailed financial reporting throughout 2024. This commitment extends to fostering strong partnerships with host governments and local communities, aiming for shared value and a social license to operate, as demonstrated by over $1.5 billion spent with local suppliers in 2023.

Direct commercial ties are maintained with a broad spectrum of gold and copper purchasers, including central banks and industrial users, facilitating efficient transactions for its substantial production. Strategic alliances are also cultivated with key suppliers and contractors, focusing on cost management, quality, and sustainability, with a continued emphasis on supplier diversity in 2023.

| Relationship Type | Key Engagement Focus | Notable 2023/2024 Data/Activity |

|---|---|---|

| Investors | Transparency, Financial Reporting, Investor Days | Continued detailed quarterly and annual reports in 2024. |

| Host Communities | Shared Value, Local Procurement, Community Development | Over $1.5 billion spent with local suppliers in 2023. |

| Governments/Regulators | Permitting, Fiscal Negotiations, Compliance | Ongoing engagement in 2024 on resource management and fiscal frameworks. |

| Commodity Buyers | Efficient Transactions, Reliable Delivery | Approx. 6.5 million oz gold and 400 million lbs copper sold in 2023. |

| Suppliers/Contractors | Cost Management, Quality, Sustainability | Emphasis on supplier diversity and local sourcing. |

Channels

Barrick Gold primarily engages in direct sales of its gold and copper to a diverse global clientele. This includes major bullion banks, national central banks, and industrial consumers who require significant quantities of these metals.

This direct sales model facilitates efficient, large-scale transactions, bypassing intermediaries and ensuring competitive pricing. Barrick's substantial production volumes make it a key player in the international commodity markets, allowing for direct engagement with major buyers.

For instance, in 2024, Barrick's continued direct sales strategy supported its robust financial performance, with the company reporting strong operational results and contributing significantly to global precious and base metal supply chains.

Barrick Gold effectively uses its corporate website and investor relations portal as primary channels to disseminate crucial information. These platforms host annual reports, quarterly financial statements, and detailed investor presentations, offering a transparent view of the company's performance and strategy. For instance, in their 2024 first-quarter report, Barrick highlighted a production of 1,311,000 ounces of gold, providing investors with concrete operational data.

Beyond direct company-published materials, Barrick leverages financial news services to distribute company news and regulatory filings, ensuring broad and timely access for stakeholders. This multi-channel approach ensures that both current shareholders and potential investors can easily access comprehensive financial data, strategic updates, and critical sustainability information, such as their commitment to reducing greenhouse gas emissions by 30% by 2030.

Barrick Gold's direct community engagement programs serve as crucial channels for interaction, feedback, and development initiatives with local populations. These programs, including Community Development Committees and on-site local offices, foster transparency and build positive relationships. In 2024, Barrick reported investing over $50 million globally in community development projects, underscoring the significance of these engagement efforts.

Industry Conferences and Associations

Barrick Gold actively engages in prominent global mining and investment conferences, such as the Denver Gold Forum and the Prospectors & Developers Association of Canada (PDAC) convention. These gatherings are crucial for networking, sharing operational advancements, and contributing to the evolution of industry best practices. For instance, PDAC 2024 saw over 30,000 attendees, highlighting the scale of these platforms for corporate visibility and strategic dialogue.

Participation in industry associations, including the World Gold Council, allows Barrick to influence policy and standards, fostering a more stable operating environment. These memberships also facilitate collaboration on critical issues like sustainability and responsible mining. In 2023, the World Gold Council reported a 10% year-on-year increase in central bank gold demand, underscoring the sector's importance and the value of collective industry representation.

- Networking Opportunities: Direct engagement with investors, analysts, and industry peers at events like the BMO Global Metals & Mining Conference.

- Best Practice Sharing: Contributing to discussions on operational efficiency and safety standards, as exemplified by presentations at the Society for Mining, Metallurgy & Exploration (SME) Annual Conference.

- Industry Influence: Shaping future regulations and market perceptions through active roles in organizations like the International Council on Mining and Metals (ICMM).

- Partnership Development: Identifying potential joint venture partners and exploring new exploration frontiers through dedicated sessions at mining investment forums.

Digital and Social Media

Barrick Gold actively leverages digital and social media to connect with stakeholders, sharing company news, operational updates, and crucial sustainability initiatives. Platforms like LinkedIn, Twitter, and Instagram serve as key conduits for this communication, fostering transparency and public engagement.

These digital channels are instrumental in shaping Barrick's public perception and highlighting its dedication to responsible mining practices. By providing regular updates and engaging in dialogue, the company aims to build trust and demonstrate its commitment to environmental and social governance.

- Platforms Used: LinkedIn, Twitter, Instagram, Facebook.

- Content Focus: Company news, sustainability updates, responsible mining commitments.

- Engagement Goal: Manage public image, foster transparency, and build stakeholder trust.

- Impact: Crucial for communicating corporate responsibility and operational transparency to a broad audience.

Barrick Gold's primary sales channels involve direct engagement with major global customers, including bullion banks, central banks, and industrial users of gold and copper. This direct approach streamlines transactions and ensures competitive pricing for its substantial output. For instance, in 2024, Barrick's consistent direct sales strategy underpinned its strong financial results, reinforcing its position as a key supplier in international commodity markets.

The company also utilizes its corporate website and investor relations portal as vital channels for disseminating financial reports, operational data, and strategic updates. These platforms offer transparency, with Barrick's first-quarter 2024 report detailing gold production of 1,311,000 ounces. Additionally, financial news services are employed to ensure broad and timely access to company news and regulatory filings, covering critical information such as their 2030 greenhouse gas emission reduction targets.

Community engagement programs, including development committees and local offices, serve as crucial channels for building trust and fostering positive relationships with local populations. In 2024, Barrick invested over $50 million globally in these community development initiatives, demonstrating their commitment. Furthermore, participation in major industry conferences like PDAC 2024, which attracted over 30,000 attendees, provides essential networking and best practice-sharing opportunities.

Barrick Gold leverages digital and social media platforms, such as LinkedIn and Twitter, to communicate company news, sustainability efforts, and operational progress, thereby enhancing transparency and public engagement. These channels are critical for managing public perception and showcasing the company's dedication to responsible mining practices.

| Channel Type | Key Platforms/Activities | Purpose | 2024 Highlight/Data Point |

|---|---|---|---|

| Direct Sales | Bullion Banks, Central Banks, Industrial Consumers | Efficient, large-scale transactions, competitive pricing | Supported robust financial performance through consistent sales. |

| Digital Communication | Corporate Website, Investor Relations Portal, Financial News Services | Information dissemination, transparency, stakeholder access | Q1 2024 report detailed 1,311,000 oz gold production. |

| Community Engagement | Community Development Committees, Local Offices | Relationship building, feedback, local development | Over $50 million invested globally in community projects. |

| Industry Engagement | Mining Conferences (e.g., PDAC), Industry Associations (e.g., World Gold Council) | Networking, best practice sharing, policy influence | PDAC 2024 had over 30,000 attendees; WGC reported 10% central bank gold demand increase in 2023. |

Customer Segments

Global Precious Metals Investors, encompassing institutional players like hedge funds and mutual funds, alongside individual investors, are drawn to gold for its role as a store of value, an inflation hedge, and a safe haven. These investors closely monitor Barrick's production volumes, reserve growth, cost efficiencies, and dividend policies, as these metrics directly impact their investment returns. For instance, in 2024, Barrick reported significant production figures and demonstrated a commitment to cost management, which are crucial factors for this segment.

Industrial and manufacturing consumers are a cornerstone for Barrick Gold, representing sectors like electronics, construction, automotive, and the burgeoning renewable energy industry. These businesses rely on copper as a fundamental input for their products, making Barrick's production volumes, the quality of its copper, and the dependability of its supply chain paramount to their operations.

The global demand for copper is on a significant upward trajectory, largely fueled by the accelerating green energy transition. For instance, electric vehicles typically require about four times more copper than traditional internal combustion engine vehicles, and wind turbines and solar farms also demand substantial amounts of copper for wiring and components. This growing appetite underscores the strategic importance of this customer segment for Barrick.

Governments of host countries are crucial partners for Barrick Gold, influencing operational success through licensing, taxation, and regulatory frameworks. In 2024, Barrick's operations contributed significantly to national economies, with tax and royalty payments forming a substantial portion of government revenue in countries like Tanzania and the Democratic Republic of Congo.

These governments prioritize economic contributions, including job creation and infrastructure development, alongside Barrick's commitment to high environmental and social standards. For instance, Barrick's Lumwana mine in Zambia has been a major employer, directly and indirectly supporting thousands of jobs and investing in community projects.

Local Communities and Indigenous Populations

Barrick Gold's relationship with local communities and Indigenous populations is fundamental to its operations. These groups are directly affected by mining activities and are considered key stakeholders whose support is vital for the company's social license to operate. Barrick engages with these communities by providing economic benefits through employment opportunities and local procurement initiatives.

In 2024, Barrick continued its focus on community development, investing in projects aimed at improving infrastructure, education, and healthcare in areas surrounding its mines. For instance, at its North Mara mine in Tanzania, the company has been involved in various community enhancement programs, contributing to improved water access and local economic diversification.

- Community Investment: Barrick's commitment to local development is demonstrated through tangible investments in social programs and infrastructure near its operational sites.

- Local Employment and Procurement: The company prioritizes hiring from local communities and sourcing goods and services from local businesses, fostering economic growth.

- Social License to Operate: Maintaining positive relationships and ensuring mutual benefit with local and Indigenous populations is critical for the continuity and success of Barrick's mining ventures.

- Partnership and Engagement: Barrick actively seeks to partner with communities on development initiatives, recognizing their invaluable role in the company's long-term sustainability.

Employees and Prospective Talent

Barrick Gold views its employees and prospective talent as a crucial customer segment, recognizing that their well-being and development directly impact operational success. The company prioritizes providing safe working conditions, fair compensation, and robust training programs. For instance, in 2023, Barrick reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.76, demonstrating its commitment to safety.

A key focus for Barrick is the development of host country nationals, aiming to build local capacity and foster long-term employment. This strategy is vital for sustainable operations and community relations. In 2023, the company continued its efforts to increase the proportion of local employees across its global operations.

Attracting and retaining skilled professionals is paramount for Barrick's ability to maintain operational excellence and drive innovation. The company invests in career development pathways and competitive remuneration packages to secure top talent in a demanding industry. Barrick's ongoing recruitment efforts are designed to ensure a pipeline of qualified individuals capable of meeting the company's strategic objectives.

- Safe Working Conditions: Barrick's 2023 TRIFR of 0.76 underscores its dedication to employee safety.

- Fair Wages and Benefits: Competitive compensation is a cornerstone for attracting and retaining talent.

- Training and Development: Investment in upskilling, particularly for host country nationals, is a strategic priority.

- Talent Acquisition: Maintaining a skilled workforce is critical for operational excellence and future growth.

Barrick Gold's customer segments are diverse, ranging from large-scale institutional investors seeking stability and inflation hedges to industrial consumers reliant on copper for manufacturing. Governments of host nations are also key partners, benefiting from tax revenues and job creation, while local communities and Indigenous populations are vital for social license to operate. Employees and prospective talent form another critical group, with Barrick focusing on safety, development, and retention.

| Customer Segment | Key Needs/Interests | 2024/2023 Data Points |

|---|---|---|

| Global Precious Metals Investors | Store of value, inflation hedge, safe haven, production volumes, reserve growth, cost efficiencies, dividend policies | Barrick reported significant production in 2024; commitment to cost management |

| Industrial and Manufacturing Consumers | Copper supply, quality, dependability | Growing demand for copper driven by green energy transition (e.g., EVs require ~4x more copper than traditional vehicles) |

| Governments of Host Countries | Economic contribution (tax, royalties, jobs), infrastructure development, environmental and social standards | Significant tax and royalty payments in 2024 in countries like Tanzania and DRC; Lumwana mine (Zambia) is a major employer |

| Local Communities & Indigenous Populations | Economic benefits (employment, local procurement), community development (infrastructure, education, healthcare) | Investments in community projects in 2024 (e.g., North Mara mine, Tanzania); focus on local procurement |

| Employees and Prospective Talent | Safe working conditions, fair compensation, training and development, career progression | 2023 TRIFR of 0.76; focus on increasing host country nationals in workforce; investment in career development |

Cost Structure

Barrick's operating costs are a significant part of its business model, covering everything from extracting ore to running the company. These expenses include the wages for its workforce, the substantial energy needed for mining and processing operations, and the materials and upkeep required to keep everything running smoothly. For example, in 2023, Barrick reported total operating costs of $10.8 billion, highlighting the scale of these expenditures.

The company actively pursues disciplined cost management strategies to keep these expenses in check. This involves seeking out efficiency improvements across all its mining and processing sites. By focusing on optimizing labor, energy consumption, and the use of consumables, Barrick aims to maintain a competitive cost base. This focus on efficiency is crucial for profitability, especially in a volatile commodity market.

Barrick Gold's capital expenditures are substantial, primarily directed towards developing new mining projects and enhancing existing ones. In 2023, the company reported capital expenditures of $2.4 billion, a slight increase from $2.2 billion in 2022, reflecting ongoing investments in growth initiatives.

Key investments driving this expenditure include the Pueblo Viejo expansion project and the significant development at Reko Diq in Pakistan. These projects are critical for securing and increasing future gold and copper production volumes, ensuring the long-term viability of Barrick's operations.

Furthermore, ongoing maintenance and upgrades to existing infrastructure and equipment constitute a significant portion of CapEx. This is essential for operational efficiency and safety across Barrick's global mining portfolio, including the Fourmile project in the United States.

Barrick's cost structure heavily features exploration and development expenses. These include significant outlays for mineral exploration, extensive drilling programs to assess potential deposits, and detailed feasibility studies for new mining ventures. These are crucial for Barrick's ongoing success and future growth.

In 2024, Barrick continued to invest substantially in exploration, with a focus on expanding existing operations and discovering new gold and copper deposits. For instance, their exploration and business development expenditures for the first quarter of 2024 totaled $107 million. This demonstrates a commitment to replenishing reserves and identifying future growth opportunities, a cornerstone of their long-term strategy.

Sustainability and Community Investment Costs

Barrick Gold dedicates significant capital to environmental stewardship and community engagement, recognizing these as crucial for long-term operational success. In 2023, the company reported approximately $1.2 billion in sustainability expenditures, a notable portion of which supports environmental management and social programs.

These investments are strategically channeled into areas such as renewable energy adoption, greenhouse gas emission reduction targets, and direct support for community-driven development projects near its mining sites. For instance, Barrick has invested in solar power initiatives at its Kibali mine in the Democratic Republic of Congo, aiming to reduce reliance on fossil fuels.

- Environmental Management: Costs associated with pollution control, water management, biodiversity conservation, and rehabilitation of disturbed land.

- Social Programs: Investments in health, education, and economic development initiatives benefiting local communities.

- Community Development: Funding for infrastructure projects, local employment, and small business support designed to foster sustainable local economies.

- Renewable Energy and Emissions Reduction: Capital allocated to transitioning to cleaner energy sources and meeting climate change commitments.

Taxes, Royalties, and Dividends

Barrick Gold faces considerable expenses from taxes and royalties paid to governments where it operates. These payments are often linked to the volume of gold produced and the company's financial performance. For instance, in 2023, Barrick's total tax and royalty payments amounted to approximately $2.6 billion. This highlights a significant cost driver directly influenced by operational success and the regulatory environments in its key mining regions.

Beyond governmental obligations, Barrick also allocates substantial capital towards shareholder returns. These outflows primarily take the form of dividends and share repurchases. In 2023, Barrick returned $1.2 billion to shareholders through these mechanisms. These distributions are crucial for maintaining investor confidence and are a direct consequence of the company's profitability and cash flow generation.

- Taxes and Royalties: Barrick paid approximately $2.6 billion in taxes and royalties in 2023, directly tied to production and profitability in host countries.

- Shareholder Returns: The company distributed $1.2 billion to shareholders in 2023 via dividends and share buybacks, reflecting its commitment to investors.

- Financial Commitments: These outflows represent significant financial obligations Barrick must manage to ensure sustainable operations and stakeholder value.

Barrick's cost structure is multifaceted, encompassing operational expenditures, capital investments, exploration, environmental and social programs, taxes, and shareholder returns. These elements are critical for understanding the company's financial health and strategic direction.

In 2023, Barrick reported operating costs of $10.8 billion and capital expenditures of $2.4 billion, underscoring the significant financial resources dedicated to maintaining and expanding its operations. The company's commitment to future growth is evident in its exploration spending, which reached $107 million in Q1 2024 alone.

Furthermore, Barrick allocated approximately $1.2 billion to sustainability initiatives in 2023 and paid out $2.6 billion in taxes and royalties, alongside $1.2 billion in shareholder returns. These figures highlight the comprehensive nature of Barrick's cost base and its responsibilities to various stakeholders.

| Cost Category | 2023 Actuals (USD Billions) | Q1 2024 (USD Millions) |

|---|---|---|

| Operating Costs | 10.8 | N/A |

| Capital Expenditures | 2.4 | N/A |

| Exploration & Business Development | N/A | 107 |

| Sustainability Expenditures | 1.2 | N/A |

| Taxes and Royalties | 2.6 | N/A |

| Shareholder Returns | 1.2 | N/A |

Revenue Streams

Barrick Gold's main source of income is selling refined gold produced from its mines worldwide. This revenue is closely tied to how much gold they extract and the current market price of gold. For instance, in the first quarter of 2025, Barrick reported total gold sales of 1.2 million ounces, with an average realized gold price of $2,050 per ounce, highlighting the direct impact of price fluctuations on their earnings.

Copper sales are becoming a significant and growing part of Barrick Gold's revenue. This stream comes from their copper operations, with key projects like Lumwana and the developing Reko Diq in Pakistan poised to substantially boost copper output.

In 2023, Barrick reported copper production of 406 million pounds, a slight increase from 404 million pounds in 2022. This expansion into copper is crucial for diversifying their revenue beyond gold and capitalizing on anticipated strong demand for the metal, especially with the energy transition.

Barrick Gold's revenue stream is impacted by provisional pricing adjustments, especially for copper concentrates. For instance, in the first quarter of 2024, Barrick reported that provisional pricing adjustments, particularly on copper sales, led to a $20 million unfavorable impact on earnings. This means the initial revenue recognized for these sales was adjusted downwards based on later market prices.

By-product Credits

Barrick Gold may generate some revenue from selling by-products recovered during its gold and copper mining operations. While not a significant revenue source, these sales can help offset operational expenses.

For instance, in 2023, Barrick reported that its copper operations, which often yield by-products like gold and silver, contributed to its overall financial performance. The company's focus remains on its primary commodities, but these ancillary sales add a layer of financial flexibility.

- By-product Revenue: Ancillary income from materials extracted alongside gold and copper.

- Cost Offset: Helps to reduce the overall cost of producing primary metals.

- 2023 Performance: Copper operations, which include by-product recovery, played a role in Barrick's financial results for the year.

Strategic Asset Sales (Infrequent)

Barrick Gold's revenue can also be bolstered by strategic asset sales, though this is an infrequent occurrence. These transactions involve divesting non-core assets or minority stakes in projects that no longer fit the company's long-term strategy, which prioritizes Tier One gold assets.

An example of this strategy in action is Barrick's announced sale of its interest in the Donlin gold mine. Such sales are not a consistent revenue source but serve to optimize capital allocation and enhance financial flexibility.

In 2023, Barrick continued to assess its portfolio, with potential for further strategic divestitures to sharpen its focus on core, high-quality assets.

- Strategic Asset Sales: Divestment of non-core or underperforming assets.

- Capital Optimization: Frees up capital for investment in core Tier One assets.

- Example: Announced sale of stake in Donlin gold mine.

- Infrequent Revenue: Not a primary or recurring income stream.

Barrick Gold's revenue streams are primarily driven by the sale of gold and, increasingly, copper. The company also generates income from by-products and occasional strategic asset sales, all of which contribute to its overall financial performance.

| Revenue Stream | Primary Commodity | 2023/Q1 2024 Data Point | Significance |

|---|---|---|---|

| Gold Sales | Gold | 1.2 million ounces sold in Q1 2025 at $2,050/oz | Core revenue driver, sensitive to market prices. |

| Copper Sales | Copper | 406 million pounds produced in 2023 | Growing diversification, boosted by projects like Reko Diq. |

| By-product Revenue | Gold, Silver, etc. | Contributes to overall financial performance of copper ops | Ancillary income, helps offset operational costs. |

| Strategic Asset Sales | Various | Assessing portfolio, potential divestitures (e.g., Donlin) | Infrequent, for capital optimization and focus. |

Business Model Canvas Data Sources

The Barrick Gold Business Model Canvas is informed by a robust combination of financial reports, operational data, and industry analyses. These sources provide the foundation for understanding customer segments, value propositions, and revenue streams within the gold mining sector.