Barrick Gold Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barrick Gold Bundle

Barrick Gold faces significant competitive pressures, from the bargaining power of powerful suppliers to the constant threat of new entrants disrupting the market. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Barrick Gold’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Barrick Gold's reliance on specialized equipment and technology suppliers, particularly for advanced mining machinery and proprietary software, grants these providers considerable bargaining power. The limited number of firms capable of producing such high-specification equipment, coupled with the significant investment required to switch providers, means Barrick faces substantial switching costs. For instance, a major supplier of autonomous haulage systems, a critical technology for efficient large-scale mining, might dictate terms due to the complexity and integration challenges involved in adopting alternatives.

Energy, primarily electricity and fuel, represents a significant operational expense for mining giants like Barrick Gold. In 2023, the mining industry globally saw energy costs fluctuate, with some regions experiencing price surges due to geopolitical instability and supply chain disruptions. This makes energy suppliers a key factor in Barrick's cost structure.

While the global energy market is extensive, Barrick's operations, often situated in remote locations, can face unique challenges. Local energy monopolies or underdeveloped infrastructure in these areas can significantly increase the bargaining power of energy suppliers. This can translate into unpredictable or elevated energy expenses, directly affecting Barrick's efficiency and bottom line.

The mining sector, including companies like Barrick Gold, relies heavily on a specialized workforce. Think geologists, mining engineers, and technicians skilled in areas like automation and data analysis. A scarcity of these professionals, particularly for roles involving cutting-edge technology, can significantly amplify wage and benefit expectations.

For instance, the demand for experienced engineers in specialized fields such as autonomous mining systems is projected to grow. This tight labor market directly translates to higher operating costs for Barrick Gold. Furthermore, the presence of robust labor unions can further solidify workers' bargaining power, potentially leading to increased labor expenses and affecting the timely execution of mining projects.

Chemical and Consumable Suppliers

The bargaining power of chemical and consumable suppliers for Barrick Gold is a significant factor. Mining operations heavily rely on chemicals like cyanide for gold extraction, and essential consumables such as tires and lubricants. While many of these inputs are standard, specialized or proprietary chemicals can grant specific suppliers considerable leverage over Barrick.

Disruptions in the supply chain for these critical materials, or a lack of readily available alternative sources, can directly impact Barrick's operational expenses and production schedules. For instance, a sudden spike in the price of a key chemical or a shortage of specialized mining tires could lead to increased production costs and potential delays in output.

- Reliance on Specific Chemicals: Barrick's gold extraction processes depend on chemicals like cyanide, where a limited number of manufacturers might exist.

- Consumable Dependencies: Essential consumables like heavy-duty tires for mining equipment and specialized lubricants are critical for operational uptime.

- Price Volatility: Fluctuations in the global prices of these chemicals and consumables, driven by factors like raw material costs or geopolitical events, can affect Barrick's profitability.

- Supply Chain Vulnerabilities: Any interruption in the delivery of these vital supplies, whether due to logistical issues or supplier capacity constraints, poses a direct risk to Barrick's continuous production.

Environmental and Regulatory Compliance Services

Barrick Gold's reliance on specialized environmental and regulatory compliance services significantly strengthens the bargaining power of these suppliers. The increasing complexity and stringency of environmental regulations globally mean that companies like Barrick need highly specialized expertise to navigate these requirements. For instance, in 2024, the global environmental consulting market was valued at approximately $40 billion, with a significant portion dedicated to compliance and remediation services, indicating a concentrated demand for these specialized skills.

Suppliers offering critical services such as environmental monitoring, impact assessments, and remediation strategies hold considerable sway. Their unique knowledge and the non-substitutable nature of these services for maintaining Barrick's social license to operate allow them to negotiate favorable terms. The potential for substantial fines and reputational damage from non-compliance further underscores the importance of these suppliers, enabling them to command premium pricing.

- Supplier Expertise: Specialized knowledge in environmental monitoring and remediation is a key differentiator.

- Regulatory Landscape: Increasing global environmental regulations bolster supplier leverage.

- Social License to Operate: Compliance is critical for Barrick's continued operations, increasing supplier importance.

- Market Value: The environmental consulting market's growth highlights the demand for these services.

Barrick Gold's bargaining power with suppliers is influenced by the concentration of specialized mining equipment manufacturers and proprietary software developers. The high switching costs associated with integrating new systems mean these suppliers can exert significant pricing leverage. For example, a key provider of advanced geological surveying technology might dictate terms due to the complexity of Barrick's existing infrastructure.

Energy suppliers, particularly for remote mining operations, hold considerable sway. In 2024, global energy prices remained a key concern for the mining sector, with localized supply constraints in certain regions further amplifying supplier power. This can lead to unpredictable operational costs for Barrick.

The availability of specialized labor, such as experienced mining engineers and geologists proficient in new technologies, directly impacts Barrick's operational costs. A tight labor market in 2024, especially for roles in automation and data analytics, meant higher wage demands, further strengthening employee bargaining power.

Suppliers of critical consumables, like specialized tires for heavy mining equipment and specific extraction chemicals, can also wield significant influence. Disruptions in the supply chain for these items, or a lack of readily available alternatives, can force Barrick to accept less favorable terms, impacting production schedules and costs.

| Supplier Category | Key Dependence for Barrick | Factors Influencing Bargaining Power | Illustrative Impact on Barrick |

|---|---|---|---|

| Specialized Mining Equipment | Advanced machinery, proprietary software | Concentration of suppliers, high switching costs | Potential for higher equipment prices, longer lead times |

| Energy (Fuel & Electricity) | Operational power for mining and processing | Geopolitical factors, local infrastructure, price volatility | Increased operational expenditure, potential for energy cost spikes |

| Specialized Labor | Skilled engineers, geologists, technicians | Scarcity of talent, demand for specific skills (e.g., automation) | Higher labor costs, potential project delays due to staffing shortages |

| Chemicals & Consumables | Extraction chemicals (e.g., cyanide), heavy-duty tires, lubricants | Limited alternative sources, supply chain disruptions | Increased input costs, risk of production interruptions |

What is included in the product

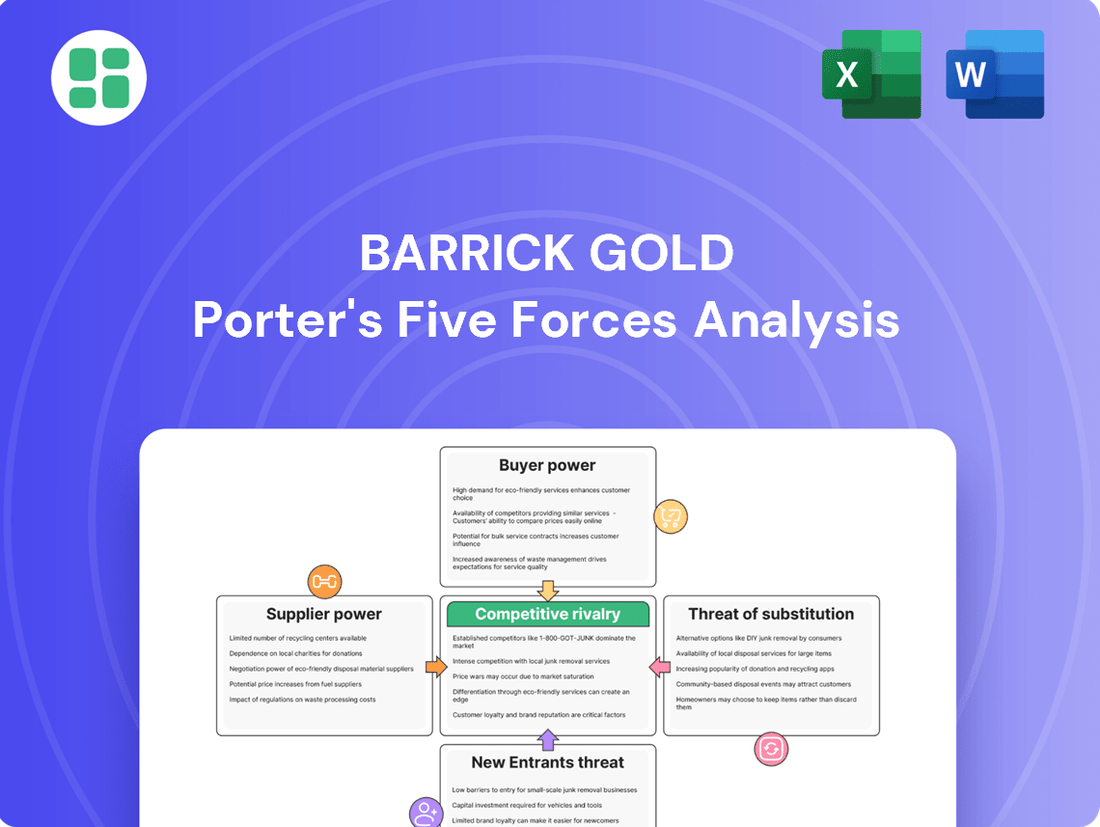

This analysis delves into the competitive forces impacting Barrick Gold, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining industry.

Easily assess Barrick Gold's competitive landscape and identify key threats with a streamlined Porter's Five Forces analysis, simplifying complex market dynamics for strategic planning.

Customers Bargaining Power

Gold and copper are fundamentally commodities, meaning Barrick Gold's output is virtually indistinguishable from that of its competitors. This inherent lack of differentiation means customers, like smelters and refiners, have little reason to favor one producer over another, making price the primary deciding factor.

This commodity nature significantly amplifies customer bargaining power. Buyers can readily switch suppliers if Barrick's pricing isn't competitive, forcing the company to accept lower prices and squeezing profit margins. For instance, in 2023, the average realized price for gold was $1,940 per ounce, and for copper, it was $3.84 per pound, with any deviation from market rates quickly leading to lost sales.

Barrick Gold's customer base is quite varied. For gold, they sell to central banks, large investment funds, jewelry makers, and various industrial users. Copper customers are primarily in different industrial sectors.

This wide spread of buyers, along with the consistent global need for gold and copper, means no single customer or small group holds significant sway over Barrick. In 2023, Barrick reported selling approximately 4.06 million ounces of gold, demonstrating the broad reach of their sales channels.

Barrick Gold, as a significant player in the global gold and copper markets, largely operates as a price taker. The prices for these commodities are shaped by a confluence of global supply and demand, overarching macroeconomic trends, and the ebb and flow of speculative trading, rather than individual customer negotiations.

Consequently, the bargaining power of customers is somewhat constrained. They primarily react to the prevailing global market prices, which are outside the direct influence of any single buyer negotiating with Barrick. This dynamic limits the ability of customers to dictate terms or significantly impact Barrick's pricing strategies.

Importance of Quality and Consistency

While gold and copper are largely seen as commodities, industrial customers and refiners place significant importance on consistent quality and a dependable supply chain. This is a crucial factor in their purchasing decisions.

Barrick Gold's standing as a major, stable producer with a strong track record of high-quality output and an extensive reserve base can somewhat mitigate customer price sensitivity. The assurance of supply and purity often weighs heavily on purchasing considerations, extending beyond the immediate spot market price.

- Consistent Quality: Industrial users require metals that meet stringent purity standards for their manufacturing processes, reducing the need for costly reprocessing.

- Reliable Supply: Disruptions in supply can halt production lines, making a stable supplier like Barrick Gold highly valuable.

- Reputation: Barrick's established reputation for operational excellence and ethical sourcing can further solidify its relationships with key industrial customers.

- Long-Term Contracts: The importance of quality and consistency often leads to longer-term supply agreements, providing price stability and predictable revenue for Barrick.

Long-Term Offtake Agreements

Long-term offtake agreements, particularly for copper concentrates, can shift bargaining power towards customers like smelters and refiners. These arrangements offer Barrick Gold revenue predictability, but also grant buyers leverage in negotiating terms and pricing. This is especially true when specialized concentrate grades have few alternative purchasers, influencing Barrick's sales approach.

For instance, if a particular copper concentrate requires a highly specialized smelting process, a smelter holding that capability can exert significant influence. This can manifest in pricing concessions or more favorable payment terms for the customer. Barrick's 2024 strategy would need to carefully weigh the benefits of secured sales against the potential erosion of margins due to these customer-driven negotiations.

- Revenue Stability vs. Negotiating Leverage: Long-term offtake agreements provide predictable revenue streams for Barrick Gold, but can simultaneously empower customers with greater negotiating power on pricing and terms.

- Concentrate Specialization: The bargaining power of customers is amplified when the specific grade or type of concentrate produced by Barrick is highly specialized, limiting the number of potential buyers.

- Impact on Sales Strategy: Barrick must balance the security of these agreements against the potential for reduced profitability, influencing its overall sales and marketing strategies for concentrate products.

While Barrick Gold sells commodities, customers like smelters and refiners value consistent quality and reliable supply. Barrick's reputation as a major, stable producer with high-quality output and extensive reserves can temper customer price sensitivity, as assurance of supply and purity often outweighs immediate spot market prices.

Long-term offtake agreements, especially for specialized copper concentrates, can shift bargaining power towards customers. These agreements offer Barrick revenue predictability but also grant buyers leverage in negotiating terms and pricing, particularly if few alternative purchasers exist for a specific concentrate grade.

In 2023, Barrick Gold's sales of approximately 4.06 million ounces of gold and significant copper volumes illustrate its broad customer reach. While the company is largely a price taker due to global market forces, specific customer needs for quality and consistency, coupled with the specialization of some concentrate grades, can influence negotiations.

The bargaining power of customers is therefore a nuanced factor, influenced by the commodity nature of gold and copper, Barrick's market position, and the structure of its sales agreements. While global prices are dominant, specific customer requirements can create pockets of influence.

| Factor | Impact on Barrick Gold | Customer Influence |

| Commodity Nature | Price taker, limited differentiation | High (can switch suppliers easily) |

| Quality & Reliability | Mitigates price sensitivity, builds loyalty | Moderate (values consistent supply) |

| Long-Term Contracts | Revenue stability, but reduced pricing flexibility | High (especially for specialized concentrates) |

| Market Dominance | Price setting influence from global supply/demand | Low (individual customers have minimal impact on global prices) |

Full Version Awaits

Barrick Gold Porter's Five Forces Analysis

This preview displays the comprehensive Barrick Gold Porter's Five Forces Analysis, demonstrating the exact document you will receive immediately after purchase; no placeholders or sample content will be substituted. You are viewing the final, professionally formatted report that details the competitive landscape for Barrick Gold, covering all five forces. Rest assured, the insights and analysis presented here are precisely what you'll gain instant access to upon completing your transaction.

Rivalry Among Competitors

Barrick Gold navigates a fiercely competitive global mining landscape, facing off against giants like Newmont and a multitude of smaller, specialized firms. This intense rivalry stems from the constant pursuit of market share, promising new mineral reserves, and attracting crucial investor funding. Companies leverage their extensive geographical footprints and significant economies of scale to gain an edge.

The mining sector, including gold, demands substantial upfront capital for exploration, mine development, and essential infrastructure. Barrick Gold, for instance, faces significant investments in its operations, contributing to high fixed costs. This financial commitment necessitates high production volumes to achieve economies of scale and effectively spread these costs across more units.

Consequently, companies like Barrick are driven to maximize output, intensifying competition as each player strives to secure sales and optimize their cost structure. In 2023, Barrick Gold reported total capital expenditures of $2.3 billion, underscoring the capital-intensive nature of its business and the ongoing need for robust production to justify these investments.

Gold and copper are essentially the same no matter who produces them. This means companies like Barrick Gold can't really stand out based on their product itself. Instead, the real competition comes down to who can mine and sell these metals for the least amount of money, produce the most, and have the best quality reserves.

Because the products are so similar, buyers naturally look for the cheapest option. This puts a lot of pressure on producers to be incredibly efficient in their operations. For instance, in 2023, Barrick Gold's all-in sustaining costs per ounce of gold averaged $1,307, a key metric in this price-sensitive market.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are a constant feature in the gold mining industry, as companies actively seek to bolster their reserves and operational efficiencies. This consolidation trend aims to unlock synergies and enhance market influence, directly impacting competitive dynamics.

For instance, Barrick Gold itself has been a participant in major M&A, such as its significant acquisition of Randgold Resources in 2019. Such large-scale transactions reshape the competitive landscape, as firms strategically grow their asset bases and market presence, intensifying the rivalry among major players.

- Increased Consolidation: The pursuit of economies of scale and access to new, high-grade deposits drives M&A activity, leading to fewer, larger players.

- Synergy Realization: Companies merge to achieve cost savings through shared infrastructure, streamlined operations, and optimized supply chains.

- Market Power: Successful acquisitions can grant companies greater pricing power and influence over market supply and demand.

- Strategic Expansion: M&A allows companies to diversify geographic risk and expand their portfolio of mining assets, creating a more robust competitive footprint.

Exploration Success and Reserve Depletion

Competitive rivalry is intense as companies like Barrick Gold race to discover and develop new, high-grade mineral deposits. This is crucial to replace reserves that are naturally depleted through mining operations. In 2023, Barrick Gold reported total gold reserves of 67.3 million ounces, highlighting the ongoing need for new discoveries to sustain operations.

The pursuit of these new deposits fuels significant investment in exploration activities. Success in finding and developing these resources becomes a major differentiator among competitors, intensifying the rivalry for promising geological targets and the specialized talent needed to identify and extract them.

- Exploration Investment: Barrick Gold's exploration expenditure was approximately $340 million in 2023, demonstrating the substantial capital committed to finding new reserves.

- Reserve Replacement: The company's ability to replace depleted reserves through new discoveries directly impacts its long-term competitive standing.

- Talent Acquisition: Competition extends to securing geologists, engineers, and other skilled professionals essential for successful exploration and development.

The competitive rivalry within the gold mining sector is fierce, driven by the homogenous nature of the product and the capital-intensive operations. Companies like Barrick Gold compete primarily on cost efficiency, production volume, and the quality of their mineral reserves. The industry sees ongoing consolidation through mergers and acquisitions, as firms aim to achieve economies of scale, secure new deposits, and enhance their market position.

Barrick Gold's 2023 performance highlights these dynamics, with all-in sustaining costs averaging $1,307 per ounce, a critical factor in a price-sensitive market. The company's total capital expenditures of $2.3 billion in 2023 and exploration spending of approximately $340 million underscore the significant investment required to maintain and grow operations. Furthermore, Barrick's reported gold reserves of 67.3 million ounces in 2023 emphasize the continuous need for successful exploration to replace depleted resources.

| Metric | Barrick Gold (2023) | Industry Context |

| All-in Sustaining Costs (per ounce of gold) | $1,307 | Key indicator of operational efficiency and cost competitiveness. Lower costs provide a significant advantage. |

| Total Capital Expenditures | $2.3 billion | Reflects the capital-intensive nature of mining and the investment needed for asset maintenance and development. |

| Exploration Expenditure | ~$340 million | Crucial for discovering new reserves and replacing depleted ones, directly impacting long-term competitiveness. |

| Total Gold Reserves (ounces) | 67.3 million | Represents the company's resource base and its ability to sustain production; a key differentiator. |

SSubstitutes Threaten

Investors seeking a safe haven often consider gold, but numerous substitutes exist. Government bonds, particularly U.S. Treasuries, offer income and perceived safety, while real estate provides tangible assets and potential appreciation. Equities, despite their volatility, offer growth opportunities, and cryptocurrencies, like Bitcoin, are increasingly viewed as digital gold, attracting younger investors.

In 2024, the demand for these alternatives can significantly influence gold. For instance, rising interest rates in 2024 made government bonds more attractive, potentially drawing capital away from gold. Similarly, the performance of the stock market in 2024, with the S&P 500 showing robust gains, presented a compelling alternative for investors seeking higher returns.

The recycling of gold and copper presents a significant threat of substitutes for Barrick Gold. A substantial amount of these precious metals enters the market through recycling, especially from sectors like jewelry, electronics, and industrial waste. This readily available secondary supply can cap price surges for newly mined metals.

In 2023, the World Gold Council reported that around 11% of global gold supply, or 369.4 tonnes, came from recycling. Similarly, the copper industry sees considerable recycling; the International Copper Study Group noted that scrap accounted for a significant portion of total copper supply in recent years. This efficient recycling infrastructure means that if primary metal prices rise too high, consumers and industries can more readily turn to recycled sources, directly impacting Barrick's potential market share and the demand for their newly extracted materials.

Technological advancements in material science present a significant threat of substitutes for gold and copper. Innovations in areas like fiber optics are directly impacting copper's role in data transmission, a sector that consumed a notable portion of global copper demand historically. For instance, the ongoing build-out of 5G infrastructure relies heavily on fiber optics, reducing the copper wire needed for high-speed internet compared to previous generations.

Furthermore, the development of advanced composites and novel alloys in manufacturing could displace traditional metal usage. These new materials often offer superior strength-to-weight ratios or enhanced durability, making them attractive alternatives in industries ranging from aerospace to automotive. This continuous innovation in material science means that the demand for gold and copper in certain applications could be eroded over time, impacting future market share.

Other Precious Metals and Industrial Materials

While gold holds a distinct allure, other precious metals like silver, platinum, and palladium can indeed step in as substitutes. In the jewelry sector, these metals often compete directly with gold, offering different price points and aesthetic qualities. For investment purposes, they are seen as alternative stores of value. Furthermore, platinum and palladium are crucial in industrial catalysis, particularly in automotive catalytic converters, where they can sometimes be substituted depending on technological advancements and price fluctuations.

For a commodity like copper, the threat of substitutes is also significant across its diverse applications. In electrical wiring, aluminum is a well-established alternative, especially where weight is a concern or cost savings are paramount, despite copper's superior conductivity. In construction and plumbing, steel and even advanced plastics are increasingly used, offering different advantages in terms of durability, corrosion resistance, and ease of installation. This broad range of substitutes means that copper producers, like Barrick Gold if they were to diversify into copper, face a competitive landscape where material science and cost economics constantly shift the balance.

- Silver's Market Share: Silver prices often move in tandem with gold but can offer a more accessible entry point for investors, impacting demand for gold as a store of value.

- Platinum and Palladium Demand: In 2023, platinum prices averaged around $950 per ounce, while palladium saw prices averaging approximately $1,200 per ounce, showcasing their value and potential as alternatives in specific industrial and investment contexts.

- Copper vs. Aluminum in Electrical Applications: Aluminum's lower price and lighter weight make it a strong substitute for copper in overhead power transmission lines, where its conductivity is sufficient for the application.

- Plastic Pipe Market Growth: The global market for plastic pipes is projected to grow, indicating a steady substitution trend away from traditional metal piping materials in construction and infrastructure.

Shift in Consumer Preferences and Economic Conditions

Shifts in consumer preferences, like a move away from traditional gold jewelry, can reduce demand. For instance, in 2023, while gold jewelry demand remained relatively stable, there was a noticeable trend towards more modern and minimalist designs, potentially impacting traditional sales volumes.

Economic downturns also play a role. When economies falter, demand for industrial metals, where gold sees some application, can decrease. This indirectly acts as a substitute by shrinking the overall market size for gold.

Economic cycles significantly influence gold's appeal as an investment compared to other asset classes. For example, during periods of high inflation or geopolitical uncertainty, gold often becomes more attractive, but in stable economic times, other investments like bonds or equities might offer more compelling returns, thus acting as substitutes.

- Consumer Preference Shift: Trends favoring minimalist jewelry designs in 2023 impacted traditional gold jewelry sales volumes.

- Economic Downturn Impact: Reduced demand for industrial metals during economic slowdowns can indirectly lessen gold's overall market size.

- Investment Alternatives: During stable economic periods, assets like bonds and equities can become more attractive investment substitutes for gold.

The threat of substitutes for Barrick Gold is multifaceted, encompassing alternative investments, recycled materials, and technological advancements. In 2024, rising interest rates made government bonds more appealing, potentially diverting capital from gold. Similarly, strong equity market performance, like the S&P 500's gains, presented a higher-return alternative. Recycled gold, accounting for about 11% of global supply in 2023, and copper's substitution by aluminum in electrical applications, highlight the impact of secondary supply and material science innovations.

| Substitute Category | Examples | 2023/2024 Relevance | Impact on Barrick Gold |

|---|---|---|---|

| Investment Alternatives | Government Bonds, Equities, Cryptocurrencies | Rising interest rates (2024) favored bonds; S&P 500 gains (2024) offered equity appeal. | Can reduce demand for gold as a safe haven or store of value. |

| Recycled Materials | Recycled Gold, Recycled Copper | 369.4 tonnes of gold recycled globally in 2023; significant copper scrap supply. | Caps price increases for newly mined metals, affecting profitability. |

| Material Science | Fiber Optics (vs. Copper), Advanced Composites | Fiber optics reduce copper in 5G infrastructure; new materials displace metals in manufacturing. | Erodes demand for gold and copper in specific industrial applications over time. |

Entrants Threaten

The sheer scale of investment needed to even begin mining operations presents a formidable hurdle for new companies. We're talking about billions of dollars for exploration, building infrastructure, and acquiring necessary equipment. For instance, a new gold mine project can easily cost upwards of $1 billion to develop, making it almost impossible for smaller, less-funded entities to enter the market and challenge established players like Barrick Gold.

The threat of new entrants in the gold mining sector, particularly concerning access to mineral reserves, is significantly low. High-quality, economically viable gold and copper deposits are finite and largely controlled by established major mining companies like Barrick Gold.

Newcomers face immense hurdles in securing exploration rights and proving up substantial reserves. This process is not only capital-intensive but also time-consuming, with exploration success rates for new ventures often being low. For instance, in 2023, global gold exploration budgets were estimated to be around $11.5 billion, yet only a fraction of these expenditures typically result in commercially viable discoveries.

The capital required to identify, acquire, and develop new mining projects can easily run into billions of dollars. This high barrier to entry, coupled with the geological difficulty of finding new, significant deposits, effectively limits the number of new players that can realistically challenge incumbents.

The mining industry, including gold extraction, is a minefield of regulations. New companies must secure numerous permits, conduct thorough environmental impact assessments, and comply with rigorous safety protocols. For instance, in 2024, the average time to obtain a new mining permit in many developed nations can extend to several years, a significant deterrent for those lacking established relationships and expertise.

Navigating these complex regulatory frameworks, especially when operating across different countries with varying legal systems, creates a substantial and often prohibitive barrier. This complexity demands significant legal and administrative resources, making it difficult for smaller or less experienced players to enter the market and compete effectively with established giants like Barrick Gold.

Technological Expertise and Operational Complexity

The threat of new entrants in the gold mining sector, particularly concerning technological expertise and operational complexity, remains moderate for established players like Barrick Gold. Modern mining operations are incredibly intricate, demanding advanced geological modeling, sophisticated extraction techniques, and highly specialized engineering. For instance, Barrick's adoption of autonomous drilling technology at its North America operations showcases the high-tech barrier to entry.

Newcomers often struggle to replicate the deep institutional knowledge and the skilled workforce that Barrick has cultivated over decades. This includes expertise in managing complex supply chains, navigating stringent environmental regulations, and optimizing processing efficiencies. In 2023, Barrick reported capital expenditures of $2.4 billion, a significant portion of which was directed towards technological advancements and operational improvements, highlighting the substantial investment required to compete at their level.

- High Capital Investment: Acquiring and implementing cutting-edge mining technology, such as AI-driven geological analysis and advanced automation, demands substantial upfront capital, acting as a significant deterrent for new entrants.

- Skilled Workforce Requirements: The need for highly specialized engineers, geologists, and operational managers with expertise in complex mining processes creates a talent acquisition challenge for emerging companies.

- Operational Scale and Efficiency: Established firms like Barrick benefit from economies of scale and decades of experience in optimizing operational workflows, making it difficult for new entrants to achieve comparable cost efficiencies.

Long Lead Times and Geopolitical Risks

The sheer scale of time and capital required to bring a new mine online presents a formidable barrier. Developing a new gold mine can easily span a decade, often 10 to 20 years, from initial discovery to the commencement of production. This extended timeline demands immense patience and a deep well of sustained investment, making it a daunting prospect for many.

Beyond the development cycle, new entrants must also contend with a complex web of geopolitical risks, the necessity of securing local community buy-in, and the inherent volatility of commodity prices. These factors collectively elevate the risk profile of the mining sector, rendering it a less appealing proposition for most potential new competitors looking to enter the market.

- Development Timeline: 10-20 years from discovery to production.

- Investment Horizon: Requires sustained capital over many years.

- Key Risks: Geopolitical instability, community relations, commodity price fluctuations.

- Barrier Strength: High, deterring many potential new entrants.

The threat of new entrants into the gold mining industry is significantly low, largely due to the immense capital requirements and the difficulty in securing viable mineral reserves. New players must contend with the fact that most easily accessible, high-grade deposits are already claimed by established companies.

The long development timelines, often 10-20 years from discovery to production, combined with substantial regulatory hurdles and the need for specialized technological expertise, create a formidable barrier. For instance, global gold exploration budgets in 2023 were around $11.5 billion, yet successful discoveries are rare, further limiting new entrants.

Established players like Barrick Gold benefit from economies of scale, deep institutional knowledge, and advanced operational efficiencies, making it challenging for newcomers to compete on cost and production volume.

| Factor | Barrier Strength | Description |

| Capital Investment | Very High | Billions required for exploration, infrastructure, and equipment. |

| Access to Reserves | High | Finite, high-quality deposits largely controlled by incumbents. |

| Regulatory Hurdles | High | Complex permits, environmental assessments, and safety protocols. |

| Technological Expertise | Moderate to High | Advanced modeling, extraction, and automation are crucial. |

| Development Timeline | Very High | 10-20 years from discovery to production. |

Porter's Five Forces Analysis Data Sources

Our Barrick Gold Porter's Five Forces analysis is built upon a foundation of publicly available information, including annual reports, SEC filings, and investor presentations. We also leverage industry-specific research from reputable sources and market intelligence platforms to capture a comprehensive view of the competitive landscape.