Bar Harbor Bankshares SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bar Harbor Bankshares Bundle

Bar Harbor Bankshares is strategically positioned with strong community ties and a solid regional presence, but understanding its competitive landscape and potential regulatory shifts is crucial for informed decisions. Our comprehensive SWOT analysis delves into these factors, offering a clear roadmap for navigating opportunities and mitigating risks.

Want the full story behind Bar Harbor Bankshares' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bar Harbor Bankshares boasts a strong regional footprint, operating across Maine, New Hampshire, and Vermont. This strategic positioning allows for deep cultivation of community relationships and fosters significant customer loyalty. For instance, as of Q1 2024, their deposit base across these states reflects this ingrained trust.

The bank's core strategy hinges on local decision-making and delivering superior customer service. This approach is vital for community banks, enabling them to effectively attract and retain core deposits. This localized focus is a key driver in building and maintaining enduring customer relationships, a hallmark of their operational success.

Bar Harbor Bankshares boasts a robust, diversified financial services portfolio, encompassing personal and business banking, alongside specialized wealth management and trust services. This broad spectrum of offerings enables the company to serve a wide array of client needs, thereby generating revenue beyond conventional lending activities.

The strategic advantage of this diversification is evident in the consistent growth of wealth management income. For instance, Q1 2025 saw a notable increase in this segment, building on the positive trends observed in Q4 2024, underscoring the effectiveness of their cross-selling strategies and client retention efforts.

Bar Harbor Bankshares demonstrates a strong commitment to disciplined risk management, consistently maintaining a lower non-performing loan ratio than many of its industry peers. This focus on asset quality is further supported by a conservative approach to its allowance for credit losses, signaling a proactive stance against potential economic downturns.

The bank's emphasis on robust credit underwriting, particularly within its commercial real estate segment, is a key strength. This careful approach is designed to ensure the portfolio's resilience, positioning Bar Harbor Bankshares to navigate economic uncertainties more effectively. Management's dedication to long-term value and stability underpins these prudent practices.

Strategic Acquisitions for Expanded Footprint

Bar Harbor Bankshares' strategic acquisition of Guaranty Bancorp, Inc., the parent of Woodsville Guaranty Savings Bank, has been a significant growth driver. This move bolstered their footprint across Northern New England.

The acquisition effectively increased Bar Harbor Bankshares' total assets to approximately $4.8 billion and expanded its branch network to 62 locations as of their reporting period. This expansion enhances their market penetration and operational capacity.

- Expanded Market Presence: The acquisition significantly deepens Bar Harbor Bankshares' reach in key Northern New England markets.

- Increased Scale: With total assets nearing $4.8 billion and 62 branches, the bank benefits from greater operational scale.

- Synergy Potential: The integration offers opportunities for cost efficiencies and revenue growth through cross-selling initiatives.

Consistent Shareholder Returns and Dividend Growth

Bar Harbor Bankshares has a strong track record of rewarding its shareholders. The company consistently delivers shareholder returns through its dividend policy, which has seen recent growth. For example, in the first quarter of 2025, a notable 7% increase in the cash dividend was announced. This commitment to returning value is further underscored by a history of dividend raises, even when economic conditions were less favorable.

This dedication to consistent dividend growth makes Bar Harbor Bankshares an appealing choice for investors prioritizing income generation. Their proactive approach to shareholder returns, evidenced by the Q1 2025 dividend hike, signals financial stability and a focus on long-term investor value.

- Consistent Dividend Payments: The company maintains a regular schedule of dividend payouts to its shareholders.

- Recent Dividend Increase: A 7% increase in cash dividend was declared in Q1 2025, reflecting growing profitability and confidence.

- Resilience in Economic Downturns: Bar Harbor Bankshares has a history of increasing dividends even during challenging economic periods, demonstrating financial fortitude.

- Attractive for Income Investors: The steady and growing dividend stream makes the stock a compelling option for those seeking regular income from their investments.

Bar Harbor Bankshares benefits from a strong, diversified revenue stream, with its wealth management and trust services showing consistent growth. This diversification is a key strength, providing stability and additional income beyond traditional lending. For instance, Q1 2025 saw a notable uptick in wealth management income, reinforcing the success of their cross-selling strategies.

The bank's disciplined approach to risk management is a significant advantage, evidenced by its consistently lower non-performing loan ratios compared to industry averages. This focus on asset quality, coupled with a conservative allowance for credit losses, positions them well to weather economic fluctuations.

Shareholder returns are a priority for Bar Harbor Bankshares, demonstrated by a history of consistent dividend payments and recent increases. The 7% dividend hike announced in Q1 2025 highlights their commitment to rewarding investors, making them an attractive option for income-focused portfolios.

The strategic acquisition of Guaranty Bancorp significantly expanded Bar Harbor Bankshares' market presence and scale. This integration bolstered their footprint across Northern New England, increasing total assets to approximately $4.8 billion and growing their branch network to 62 locations by Q1 2025.

What is included in the product

Delivers a strategic overview of Bar Harbor Bankshares’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable SWOT analysis for Bar Harbor Bankshares, enabling swift identification of strategic opportunities and threats to alleviate planning uncertainties.

Weaknesses

Bar Harbor Bankshares' significant geographic concentration in Northern New England, primarily Maine, New Hampshire, and Vermont, presents a notable weakness. This reliance on a specific region makes the bank particularly susceptible to localized economic slowdowns or adverse events impacting these states.

For instance, a regional recession or a downturn in key industries within Northern New England could disproportionately affect Bar Harbor Bankshares' loan portfolio and overall financial performance. The higher cost of living in some of these areas might also dampen loan demand or create challenges for borrowers, potentially impacting credit quality.

Bar Harbor Bankshares, like any financial institution, faces a significant weakness in its sensitivity to interest rate fluctuations. Even with strategies to manage its position, substantial changes in rates can directly affect its net interest margin. For instance, the bank experienced a notable increase in its cost of deposits during 2023, impacting its profitability as loan yields adjusted more slowly.

Bar Harbor Bankshares, as a community bank, faces significant competitive pressure from larger regional and national banks. These larger players often possess greater financial resources, enabling more substantial investments in advanced technology and a wider array of financial products. This disparity can make it challenging for Bar Harbor to attract and retain customers, especially those who prioritize cutting-edge digital banking solutions.

Reliance on Traditional Banking Model

Bar Harbor Bankshares' primary strength lies in its traditional banking model, but this also presents a significant weakness. Its core business still heavily depends on net interest income generated from traditional loans and deposits. This reliance can make the company less nimble in responding to the swift pace of technological advancements and evolving customer expectations, especially when compared to more digitally native financial institutions.

This traditional approach requires ongoing, substantial investment in technology to keep pace. For instance, as of the first quarter of 2024, Bar Harbor Bankshares reported a net interest margin of 3.36%, a key indicator of its reliance on interest-based revenue. While this is a solid figure, it underscores the need to modernize infrastructure and digital offerings to remain competitive.

- Core Business Model: Heavily reliant on traditional lending and deposit-taking, leading to a strong dependence on net interest income.

- Agility Challenge: The traditional model can be slower to adapt to rapid technological changes and evolving consumer preferences.

- Investment Needs: Continuous and significant investment in technology is crucial to bridge the gap with digitally advanced competitors.

- Competitive Landscape: Faces pressure from fintech companies and larger banks with more robust digital platforms.

Integration Risks of Acquisitions

The recent acquisition of Woodsville Guaranty Bancorp, Inc. by Bar Harbor Bankshares presents significant integration risks. A primary concern is the potential inability to realize the anticipated synergies, cost savings, and overall financial benefits within the initially projected timelines. For instance, a common challenge in such mergers is achieving the full operational efficiencies that were modeled pre-acquisition.

Merging disparate operational frameworks, technology infrastructures, and distinct corporate cultures is inherently complex. These integration processes can easily lead to unforeseen disruptions in customer service or internal workflows, potentially incurring additional, unbudgeted expenses if not meticulously managed. For example, the cost of integrating two different core banking systems can be substantial and time-consuming.

- Synergy Realization: The risk of failing to achieve projected revenue enhancements and cost reductions from the Woodsville acquisition.

- Operational Disruption: Potential for service interruptions or inefficiencies during the merger of systems and processes.

- Cultural Clash: Challenges in harmonizing the distinct organizational cultures of Bar Harbor Bankshares and Woodsville Guaranty Bancorp.

- Unforeseen Costs: The possibility of exceeding budget due to unexpected complexities in system integration or operational adjustments.

Bar Harbor Bankshares' significant geographic concentration in Northern New England, primarily Maine, New Hampshire, and Vermont, presents a notable weakness. This reliance on a specific region makes the bank particularly susceptible to localized economic slowdowns or adverse events impacting these states. For instance, a regional recession or a downturn in key industries within Northern New England could disproportionately affect Bar Harbor Bankshares' loan portfolio and overall financial performance.

The bank's traditional banking model, while a strength, also poses a weakness due to its heavy reliance on net interest income from traditional loans and deposits. This dependence can hinder its ability to adapt quickly to technological advancements and evolving customer expectations compared to more digitally advanced competitors. For example, as of the first quarter of 2024, Bar Harbor Bankshares reported a net interest margin of 3.36%, underscoring this reliance and the need for ongoing tech investment.

Bar Harbor Bankshares faces significant integration risks following its acquisition of Woodsville Guaranty Bancorp, Inc. The potential failure to realize anticipated synergies and cost savings, coupled with the complexities of merging disparate systems and cultures, could lead to unforeseen disruptions and increased expenses. For example, integrating different core banking systems is a common, costly, and time-consuming challenge in such mergers.

The bank is also sensitive to interest rate fluctuations, which can directly impact its net interest margin. Even with management strategies, substantial rate changes can affect profitability, as seen with the increased cost of deposits during 2023 while loan yields adjusted more slowly.

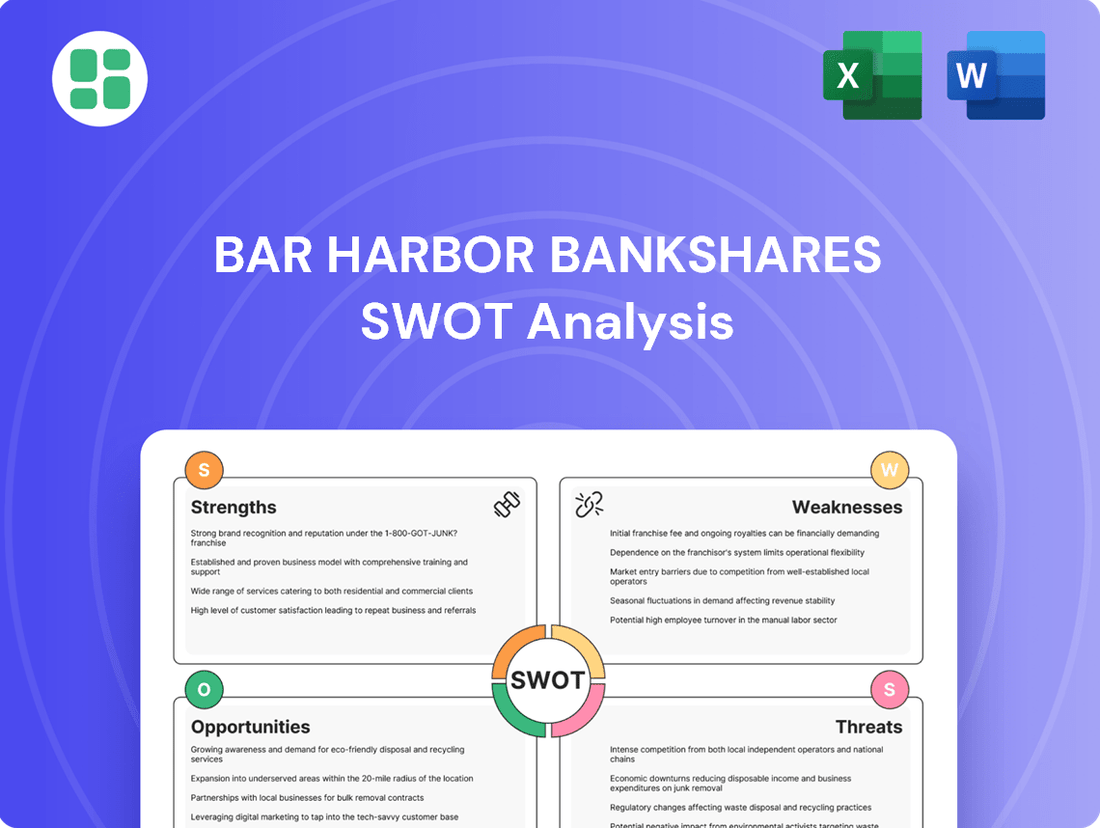

Preview the Actual Deliverable

Bar Harbor Bankshares SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Bar Harbor Bankshares' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Bar Harbor Bankshares' market position and future growth potential.

Opportunities

Bar Harbor Bankshares has a clear opportunity to grow its wealth management services, building on recent successes. Non-brokerage assets under management saw continued increases in both the fourth quarter of 2024 and the first quarter of 2025, indicating strong client trust and demand.

The bank can capitalize on this momentum by strategically targeting affluent communities within its existing operating regions. This focused approach, combined with the expanded customer base from recent acquisitions, presents a significant avenue for further service penetration and revenue growth in the wealth management sector.

Bar Harbor Bankshares can significantly boost its operations by adopting advanced technologies like automation and AI. This move presents a prime opportunity to streamline manual tasks, bolster cybersecurity defenses, and improve the speed and accuracy of fraud detection. For instance, in 2024, banks that invested in AI for fraud detection saw an average reduction in false positives by 15%, according to industry reports.

These technological upgrades are expected to translate into tangible benefits, including enhanced operational efficiency and reduced overhead costs. Furthermore, a superior digital banking experience, driven by these innovations, is crucial for customer retention and acquisition in the highly competitive financial sector. As of early 2025, customer satisfaction scores for banks with robust digital platforms are consistently 10% higher than those with lagging technology.

Bar Harbor Bankshares has a clear strategic focus on expanding its Commercial & Industrial (C&I) lending, aiming to build upon its existing Commercial Real Estate (CRE) strength. This move is designed to diversify the bank's loan book and access new business opportunities.

By targeting C&I growth, the bank anticipates driving increased interest income. A key part of this strategy involves bringing in experienced professionals to bolster the C&I team, enhancing their capacity to originate and manage these loans effectively.

For instance, as of the first quarter of 2024, Bar Harbor Bankshares reported a total loan portfolio of approximately $5.1 billion, with commercial loans representing a significant portion. Accelerating C&I growth could further enhance this balance, potentially contributing to a higher net interest margin.

Potential for Further Regional Consolidation

The regional banking landscape is ripe for consolidation, with many institutions aiming for greater scale and competitive edge. Bar Harbor Bankshares, having recently integrated a new acquisition, is strategically positioned to pursue additional mergers or acquisitions of smaller, complementary banks. This approach can effectively broaden its geographic reach and increase its overall market share.

Further consolidation offers Bar Harbor Bankshares the chance to:

- Achieve greater operational efficiencies through economies of scale, potentially lowering per-unit costs.

- Expand its service offerings by acquiring institutions with specialized products or technologies.

- Strengthen its competitive position against larger national banks by building a more robust regional presence.

- Enhance shareholder value through accretive acquisitions that contribute to earnings growth and market capitalization.

Favorable Regulatory Environment for Regional Banks

The current financial landscape presents a more favorable regulatory environment for regional banks. Anticipated easing of constraints and a pro-growth, deregulatory stance could significantly benefit institutions like Bar Harbor Bankshares.

This shift could translate into reduced compliance burdens and lower operational costs, freeing up capital. For Bar Harbor Bankshares, this might mean greater flexibility in strategic initiatives and enhanced capacity for lending and expansion.

- Reduced Compliance Costs: Potential savings on regulatory adherence could improve profitability.

- Increased Lending Capacity: Relaxed rules may allow for more aggressive loan portfolio growth.

- Strategic Flexibility: Greater operational freedom to pursue mergers, acquisitions, or new product development.

Bar Harbor Bankshares can leverage its recent acquisitions to cross-sell a wider array of banking products to an expanded customer base. This strategic integration creates a fertile ground for increasing customer wallet share and deepening existing relationships.

The bank has a significant opportunity to grow its wealth management services, building on recent successes. Non-brokerage assets under management saw continued increases in both the fourth quarter of 2024 and the first quarter of 2025, indicating strong client trust and demand.

Bar Harbor Bankshares can capitalize on this momentum by strategically targeting affluent communities within its existing operating regions. This focused approach, combined with the expanded customer base from recent acquisitions, presents a significant avenue for further service penetration and revenue growth in the wealth management sector.

The bank can also enhance its competitive standing by investing in advanced technologies like AI and automation. This strategic move is expected to streamline operations, improve cybersecurity, and boost fraud detection efficiency, as seen in 2024 where AI investment in fraud detection reduced false positives by an average of 15%.

Threats

Broader economic uncertainties, including recessionary fears, could dampen corporate investment and consumer spending, potentially increasing loan charge-offs for Bar Harbor Bankshares. The Federal Reserve's Beige Book, as of its latest report in early 2024, indicated mixed economic conditions across districts, with some regions showing slowing activity, underscoring these broader concerns.

An economic downturn specifically impacting Maine, New Hampshire, and Vermont, Bar Harbor Bankshares' core operating areas, could significantly reduce loan demand. Furthermore, it would likely strain the credit quality of existing loan portfolios, directly affecting the bank's profitability and asset quality metrics.

Cybersecurity and data privacy are increasingly critical for financial institutions like Bar Harbor Bankshares. The average cost of a data breach in 2024 is projected to reach $5.07 million, a significant increase that underscores the growing threat landscape.

As a custodian of sensitive customer information, Bar Harbor Bankshares is a prime target for cybercriminals. A successful breach could result in substantial financial losses, severe reputational damage, and costly legal liabilities, demanding ongoing investment in advanced security protocols.

Persistent inflation remains a significant challenge for community banks like Bar Harbor Bankshares. Rising deposit costs and increased personnel expenses are direct consequences, impacting the overall cost of doing business. While Bar Harbor Bankshares demonstrated resilience in maintaining its net interest margin through much of 2023 and into early 2024, continued inflationary pressures could escalate its cost of funds and operational outlays, potentially pressuring profitability if not proactively managed.

Stiff Competition in Deposit Gathering

Competition for core deposits is a persistent hurdle, especially as higher interest rates compel financial institutions to offer more attractive pricing on interest-bearing accounts. This environment directly impacts Bar Harbor Bankshares' ability to attract and retain stable, low-cost funding. The pressure to remain competitive can erode profitability if not managed effectively.

Bar Harbor Bankshares has observed a noticeable shift in its deposit composition. Specifically, there's been a move towards time deposits, which typically carry higher interest rates compared to demand or savings accounts. This change in deposit mix directly increases the bank's cost of funds, a crucial factor in its financial performance.

The intense competition in the deposit market poses a significant threat to Bar Harbor Bankshares' net interest margin. As funding costs rise due to competitive pressures and the shift towards more expensive deposit products, the bank's profitability could be squeezed. For instance, if the average cost of deposits increases by 50 basis points while loan yields remain static, the net interest margin would contract, impacting overall earnings.

- Increased Funding Costs: Rising interest rates necessitate higher payouts on deposits, directly increasing operating expenses for Bar Harbor Bankshares.

- Deposit Mix Shift: A trend towards higher-cost time deposits over lower-cost demand deposits strains the bank's net interest margin.

- Competitive Pressure: Competitors offering more aggressive deposit rates can lure customers away, forcing Bar Harbor Bankshares to match those rates, further escalating funding costs.

- Margin Compression: The combination of increased funding costs and potentially slower loan growth can lead to a reduction in the bank's net interest margin, a key indicator of profitability.

Regulatory Changes and Compliance Burden

Despite some shifts, financial institutions like Bar Harbor Bankshares continue to navigate a complex regulatory landscape. The potential for new or revised banking regulations, particularly in areas like capital requirements or consumer protection, could necessitate costly adjustments to operations and technology. For instance, the Federal Reserve's stress tests, while a regular occurrence, can impose significant compliance burdens and require substantial capital planning.

Increased scrutiny from bodies such as the FDIC or OCC can translate into higher operational costs and potentially limit strategic flexibility. Bar Harbor Bankshares, like its peers, must allocate resources to ensure ongoing compliance, which can divert funds from growth initiatives or impact profitability. The cost of compliance for community banks, for example, can be disproportionately higher than for larger institutions, creating a competitive disadvantage.

- Evolving Capital Requirements: Potential changes in Basel III or IV implementation could impact Bar Harbor Bankshares' capital ratios and lending capacity.

- Consumer Protection Laws: Stricter enforcement of fair lending practices or data privacy regulations could lead to increased compliance costs and potential fines.

- Cybersecurity Mandates: Growing threats necessitate ongoing investment in robust cybersecurity infrastructure and compliance with evolving data security standards.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Continuous updates to AML/KYC regulations require significant investment in technology and personnel to maintain compliance.

Broader economic uncertainties, including recessionary fears, could dampen corporate investment and consumer spending, potentially increasing loan charge-offs for Bar Harbor Bankshares. Cybersecurity and data privacy are increasingly critical, with the average cost of a data breach in 2024 projected to reach $5.07 million. Persistent inflation remains a significant challenge, directly impacting deposit costs and personnel expenses, potentially pressuring profitability if not proactively managed.

The intense competition for core deposits, especially as higher interest rates compel institutions to offer more attractive pricing, directly impacts Bar Harbor Bankshares' ability to attract and retain stable, low-cost funding, potentially eroding profitability. Furthermore, evolving regulatory landscapes, particularly concerning capital requirements and consumer protection, could necessitate costly operational adjustments and divert funds from growth initiatives.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data Point |

| Economic | Recessionary Fears | Increased loan charge-offs, reduced loan demand | Beige Book (early 2024) indicated mixed economic conditions, some regions slowing. |

| Operational | Cybersecurity Breach | Financial loss, reputational damage, legal liabilities | Average cost of data breach projected at $5.07 million in 2024. |

| Financial | Persistent Inflation | Higher deposit costs, increased personnel expenses, margin compression | Inflationary pressures could escalate cost of funds. |

| Competitive | Deposit Competition | Eroded profitability due to higher deposit pricing | Shift towards higher-cost time deposits observed. |

| Regulatory | New Regulations | Costly operational adjustments, reduced strategic flexibility | Potential changes in Basel III/IV implementation. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Bar Harbor Bankshares' official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-informed strategic overview.