Bar Harbor Bankshares Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bar Harbor Bankshares Bundle

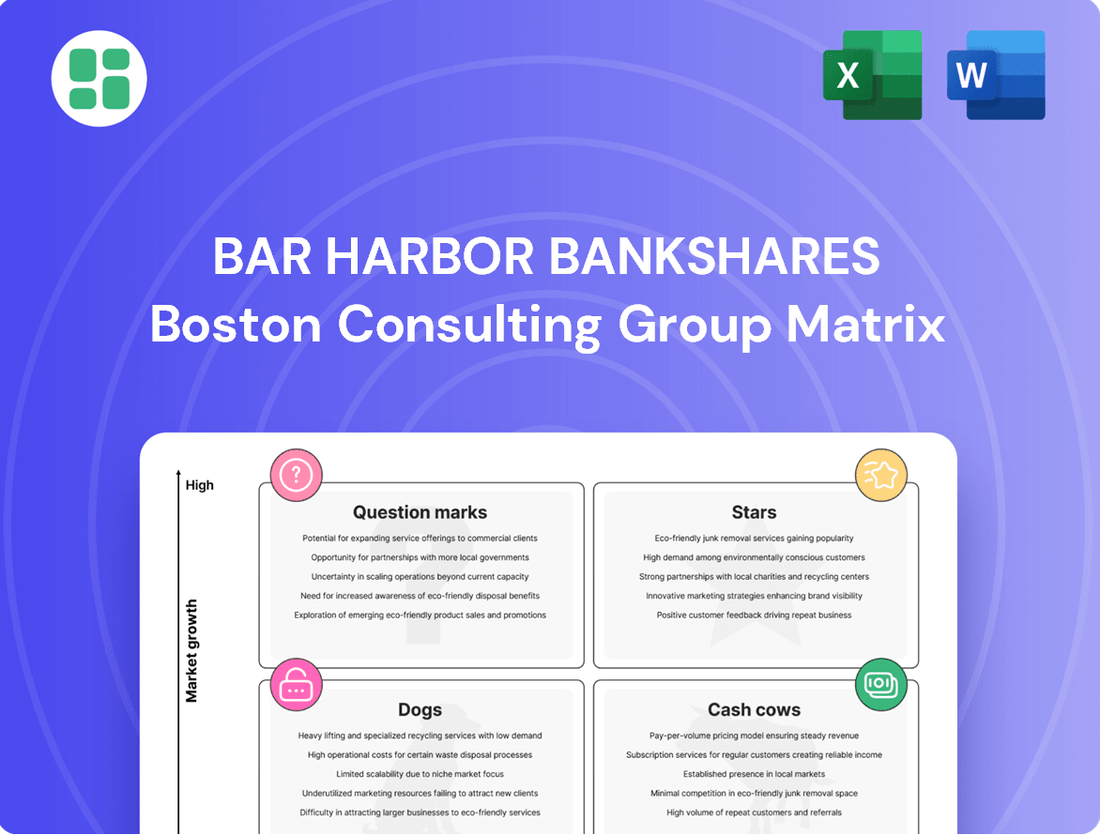

Curious about Bar Harbor Bankshares' strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Uncover the full picture and gain actionable insights to inform your investment decisions.

Don't settle for a partial view. Purchase the complete Bar Harbor Bankshares BCG Matrix to receive a detailed breakdown of each quadrant, complete with data-backed recommendations and a clear roadmap for optimizing their product strategy. Elevate your understanding and make informed choices.

Stars

Bar Harbor Bankshares is prioritizing growth in its Commercial & Industrial (C&I) lending, signaling a strategic push into a high-potential market. This segment is seen as a cornerstone for future leadership within the company's overall portfolio.

The commercial lending team achieved a significant milestone, originating $50 million in new loans during the first quarter of 2025. This robust performance underscores the bank's commitment and early success in expanding its C&I lending footprint.

Bar Harbor Wealth Management is a strong performer within Bar Harbor Bankshares, fitting the profile of a Star in the BCG Matrix. Its income saw a healthy 6.7% increase in Q1 2025 compared to the previous year, demonstrating robust growth.

The segment is capitalizing on a growing market for financial advisory services. In 2024 alone, Bar Harbor Bankshares successfully onboarded over 130 new wealth management clients, indicating effective client acquisition strategies and a rising demand for their expertise.

Non-brokerage assets under management reached $2.8 billion, marking a 6.0% increase. This substantial asset growth, coupled with increasing income and client numbers, solidifies Wealth Management's position as a key growth driver for the bank.

Bar Harbor Bankshares' acquisition of Guaranty Bancorp, Inc. on July 31, 2025, is a prime example of a strategic move fitting the Stars quadrant. This integration boosted total assets to around $4.8 billion and expanded the branch network to 62 locations across New Hampshire and Vermont.

The acquisition is designed to unlock significant synergies, improve liquidity, and achieve greater operational scale, especially within a consolidating regional banking landscape. This expansion clearly marks the combined entity as a high-growth prospect with a strengthened market position.

Digital Banking Solutions

Digital Banking Solutions likely fall into the Stars category for Bar Harbor Bankshares. The broader banking sector is experiencing significant growth in digital adoption, and Bar Harbor & Trust actively promotes its online services. This strategic focus allows them to attract and retain customers in the rapidly expanding digital banking landscape across Northern New England.

Bar Harbor Bank & Trust's investment in and promotion of its digital platforms, including mobile banking, online account opening, and digital payments, positions it to capture a substantial portion of the increasing digital customer base. This is crucial as the banking industry continues its digital transformation, with many consumers preferring convenient online interactions.

- High Industry Growth: The overall banking industry is witnessing a surge in digital channel usage.

- Bar Harbor's Emphasis: Bar Harbor & Trust highlights its online capabilities as a core service.

- Market Share Capture: Investment in digital platforms aims to secure a larger share of the growing digital customer segment.

- Geographic Focus: These efforts are particularly relevant across Bar Harbor's Northern New England markets.

Commercial Real Estate (CRE) Loan Portfolio

The commercial real estate (CRE) loan portfolio at Bar Harbor Bankshares shows robust performance, with yields climbing from 5.47% in Q1 2024 to 5.58% in Q1 2025. This growth is a key driver for the bank's overall loan portfolio yield.

This segment is a substantial part of their lending activities and is managed with a focus on disciplined expansion. The bank actively pursues growth in this area, reflecting a solid market standing.

- Yield Growth: CRE loan yields increased to 5.58% in Q1 2025 from 5.47% in Q1 2024.

- Portfolio Significance: This segment represents a considerable portion of the bank's total loan book.

- Strategic Management: The portfolio is actively managed for disciplined growth, indicating strategic focus.

- Market Position: Demonstrates a strong market position in an expanding lending sector.

Bar Harbor Wealth Management and Digital Banking Solutions are strong contenders for the Stars quadrant within Bar Harbor Bankshares' BCG Matrix. Wealth Management saw a 6.7% income increase in Q1 2025 and acquired over 130 new clients in 2024, with assets under management growing by 6.0% to $2.8 billion. Digital Banking benefits from the broader industry's digital adoption surge, with Bar Harbor actively promoting its online services to capture a growing customer base.

The acquisition of Guaranty Bancorp, Inc. on July 31, 2025, is a strategic move that positions the combined entity as a Star. This deal significantly boosted total assets to approximately $4.8 billion and expanded the branch network to 62 locations, enhancing scale and market position in a consolidating environment.

Commercial & Industrial (C&I) lending is a key growth area, with $50 million in new loans originated in Q1 2025. Commercial Real Estate (CRE) loans also show strength, with yields rising to 5.58% in Q1 2025 from 5.47% in Q1 2024, indicating disciplined expansion in a substantial portfolio segment.

| Segment | BCG Category | Key Performance Indicators (Q1 2025 vs. Q1 2024) | Strategic Rationale |

|---|---|---|---|

| Bar Harbor Wealth Management | Star | Income: +6.7% New Clients (2024): >130 Assets Under Management: +6.0% to $2.8B |

Capitalizing on growing demand for financial advisory services. |

| Digital Banking Solutions | Star | High industry digital adoption growth Bar Harbor's emphasis on online services |

Capturing a growing digital customer base in Northern New England. |

| Guaranty Bancorp Acquisition | Star | Total Assets: ~$4.8B (post-acquisition) Branch Network: 62 locations |

Enhancing scale, operational efficiency, and market position. |

| Commercial & Industrial (C&I) Lending | Star | New Loan Originations (Q1 2025): $50M | Prioritizing growth in a high-potential market segment. |

| Commercial Real Estate (CRE) Lending | Star | Loan Yields: 5.58% (Q1 2025) vs. 5.47% (Q1 2024) | Disciplined expansion in a substantial and growing lending sector. |

What is included in the product

This BCG Matrix overview for Bar Harbor Bankshares highlights strategic recommendations for each business unit, guiding investment and divestment decisions.

The Bar Harbor Bankshares BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of strategic uncertainty.

Cash Cows

Bar Harbor Bankshares' traditional retail deposit base, including checking and savings accounts, functions as a cash cow. These deposits provide a stable and consistent source of low-cost funding, essential for the bank's operations.

In Q2 2025, total deposits were $3.3 billion, highlighting the significant scale of this mature product. The low maintenance investment required for this base further solidifies its role as a reliable cash generator for the company.

Bar Harbor Bankshares' established residential mortgage portfolio acts as a classic cash cow. This mature asset base consistently generates predictable interest income, contributing significantly to the bank's net interest margin. As of the first quarter of 2024, the bank reported a robust net interest income, a substantial portion of which is derived from its mortgage lending activities.

Bar Harbor Bankshares' core business checking and treasury management services represent their Cash Cows in the BCG Matrix. These offerings are mature, well-established products in their operating regions, providing reliable fee income and a stable deposit base. For instance, in 2023, Bar Harbor Bankshares reported total deposits of $5.2 billion, a testament to the strength of these foundational banking relationships.

Net Interest Income from Core Lending

Bar Harbor Bankshares' core lending activities, represented by Net Interest Income, are a significant cash cow. The bank's net interest margin (NIM) demonstrated resilience, holding strong at 3.17% in the first quarter of 2025 and further improving to 3.23% in the second quarter of 2025. This upward trend in NIM highlights effective management of its lending and deposit operations, translating into consistent cash generation.

The consistent profitability derived from Net Interest Income positions it as a stable cash generator for Bar Harbor Bankshares. This strength is underpinned by the bank's ability to maintain healthy margins on its existing loan and investment portfolios.

- Net Interest Margin (Q1 2025): 3.17%

- Net Interest Margin (Q2 2025): 3.23%

- Key Driver: Efficient management of core lending and deposit-taking.

- Outcome: Consistent cash generation from established portfolios.

Established Branch Network Operations

Bar Harbor Bankshares' established branch network, encompassing over 60 locations across Maine, New Hampshire, and Vermont following recent acquisitions, functions as a significant cash cow within its BCG Matrix.

These numerous physical locations are instrumental in providing traditional banking services and fostering strong community relationships. While the era of aggressive branch expansion may be waning, this extensive network offers a stable foundation for consistent revenue generation through established customer bases and ongoing transactional activities.

- Established Presence: Over 60 branches across ME, NH, VT.

- Revenue Stability: Consistent cash flow from traditional banking services.

- Customer Engagement: Strong community ties and customer relationship management.

- Operational Efficiency: Leverages existing infrastructure for service delivery.

Bar Harbor Bankshares' core retail deposit base, including checking and savings accounts, serves as a prime example of a cash cow. This mature segment provides a consistent and low-cost funding source, crucial for the bank's operations. In the second quarter of 2025, total deposits reached $3.3 billion, underscoring the significant scale and stability of this foundational product.

| Financial Metric | Q1 2025 | Q2 2025 |

|---|---|---|

| Total Deposits | N/A | $3.3 billion |

| Net Interest Margin (NIM) | 3.17% | 3.23% |

Preview = Final Product

Bar Harbor Bankshares BCG Matrix

The Bar Harbor Bankshares BCG Matrix document you are previewing is the exact, unwatermarked report you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered directly to you, ready for immediate use in your business planning and competitive analysis.

Dogs

Bar Harbor Bankshares' outdated ATM infrastructure represents a classic 'Dog' in the BCG Matrix. In the first quarter of 2025, the company reported losses from selling off premises and equipment, directly citing aging ATMs. This situation highlights assets that are no longer competitive and require either costly upgrades or disposal, offering little prospect for future growth.

Bar Harbor Bankshares' 2024 proxy statement highlights a strategic push to reduce paper usage, signaling a move away from legacy paper-based processes. These outdated methods are inherently less efficient and more costly compared to digital alternatives, offering minimal competitive advantage in today's fast-paced banking environment.

Certain declining customer service fees, specifically those related to non-sufficient fund (NSF) charges, saw a decrease in Q2 2025. This decline indicates a shift in revenue streams, potentially influenced by evolving regulatory landscapes or altered customer financial habits. The bank's financial reports for the second quarter of 2025 showed a notable dip in income from these specific service fees.

Underperforming Niche Loan Products

Underperforming niche loan products, perhaps those focused on industries experiencing a downturn in Bar Harbor Bankshares' operating regions, would likely be classified as Dogs in the BCG Matrix. These products would exhibit low growth and a low market share.

For instance, if Bar Harbor Bankshares had a specialized loan product for a niche agricultural sector that saw a significant contraction in 2024, this product would fit the Dog profile. Such a product would likely contribute very little to the bank's overall revenue and profitability, potentially even incurring losses due to its limited uptake and the resources required to maintain it.

- Low Market Share: Specialized loan products with minimal customer adoption.

- Low Market Growth: Tied to industries with declining demand or economic activity.

- Capital Inefficiency: Funds allocated to these products are not generating substantial returns.

- Potential for Divestment: Such offerings might be considered for discontinuation or restructuring.

Inefficient Operations in Stagnant Micro-Markets

Even with Bar Harbor Bankshares' solid regional footprint, certain individual branch operations or specific services in very small, economically stagnant areas might show both low growth and low market share. These operations could be considered Dogs in the BCG Matrix.

These underperforming segments might not generate enough income to cover their operational expenses, potentially becoming cash traps. For instance, a branch in a declining rural town might experience a shrinking customer base and limited loan demand, making it difficult to achieve profitability.

- Low Revenue Generation: Areas with minimal economic activity and a shrinking population limit opportunities for new accounts and loan origination.

- High Operating Costs: Maintaining physical branches in low-traffic areas incurs significant overhead, including staffing, rent, and utilities, which are not offset by generated revenue.

- Limited Growth Potential: The economic outlook for these micro-markets offers little prospect for increased market share or expansion of services.

- Cash Drain: Such operations require ongoing investment to sustain, draining resources that could be better allocated to more promising areas of the business.

Bar Harbor Bankshares' aging ATM infrastructure, identified as a 'Dog' in the BCG Matrix, directly contributed to losses reported in Q1 2025 from asset sales, highlighting the need for costly upgrades or disposal. Similarly, the bank's strategic move to reduce paper usage, as noted in its 2024 proxy statement, indicates a departure from outdated, less efficient processes that offer minimal competitive advantage.

Declining revenue from certain customer service fees, such as those for non-sufficient funds (NSF) charges, which saw a dip in Q2 2025, further exemplify 'Dog' characteristics. These shifts suggest revenue streams that are either facing regulatory changes or evolving customer behavior, diminishing their contribution to overall profitability.

Underperforming niche loan products, particularly those tied to contracting industries in Bar Harbor's operating regions during 2024, also fit the 'Dog' profile due to low market share and growth, potentially becoming cash drains. Even specific branch operations in economically stagnant, small areas can be classified as Dogs if they exhibit low revenue generation and high operating costs, offering limited growth potential.

| BCG Category | Bar Harbor Bankshares Example | Characteristics | Financial Indicator (Illustrative) |

| Dogs | Outdated ATM Infrastructure | Low Market Share, Low Growth, High Maintenance Cost | Q1 2025: Losses from asset sales (aging ATMs) |

| Dogs | Legacy Paper-Based Processes | Low Efficiency, High Operational Cost, Declining Relevance | 2024 Proxy Statement: Strategic reduction in paper usage |

| Dogs | Declining Service Fees (e.g., NSF) | Low Market Share, Low Growth, Regulatory/Behavioral Impact | Q2 2025: Dip in income from specific service fees |

| Dogs | Niche Loan Products in Contracting Industries | Low Market Share, Low Growth, Low Profitability | 2024: Reduced demand in specific sectors |

Question Marks

Following its acquisition of Guaranty Bancorp, Bar Harbor Bankshares (BBH) has strategically entered new markets in New Hampshire and Vermont. These regions are identified as having high growth potential, aligning with the characteristics of a question mark in the BCG Matrix.

BBH's initial market share in these newly acquired territories is relatively low, necessitating substantial investment to build brand recognition, expand service offerings, and integrate acquired operations. For example, in 2024, BBH announced plans to open new branches in key Vermont towns, signaling its commitment to these emerging markets.

The banking sector is experiencing a surge in digital payment innovations and fintech collaborations. Bar Harbor Bankshares, like many institutions, is likely evaluating these trends, which offer high growth prospects but currently represent a small portion of its market presence. Significant investment will be crucial to capitalize on this evolving landscape.

Bar Harbor Bankshares is strategically targeting expansion in the middle market commercial banking sector, a move that positions this segment as a potential growth engine. The addition of experienced professionals in early 2025 underscores this commitment to accelerating growth in this area.

While the middle market presents a high-growth opportunity, Bar Harbor Bankshares' current market share within this specific segment may be relatively modest compared to larger, established players. This suggests it's a question mark within their BCG Matrix, requiring significant investment and strategic focus to capture greater market share and achieve star status.

Specialized Trust Services for Emerging Affluent

While Bar Harbor Bankshares' wealth management is a strong performer, their specialized trust services for the emerging affluent may represent a question mark. This segment is experiencing significant wealth creation, with the emerging affluent market projected to grow substantially in the coming years. For instance, by 2025, it's estimated that individuals with net worth between $1 million and $5 million will represent a significant portion of the wealth management market.

Bar Harbor Bankshares might be entering this niche with a smaller existing market share, necessitating focused marketing efforts and strategic resource allocation to capture growth. This means they need to actively reach out to this demographic, perhaps through tailored financial education programs or partnerships with organizations catering to young professionals and entrepreneurs.

- Market Opportunity: The emerging affluent demographic is a rapidly expanding segment with increasing demand for sophisticated financial planning and trust services.

- Competitive Landscape: While the market is growing, Bar Harbor Bankshares may face established players with deeper penetration in this specific niche.

- Resource Allocation: Success hinges on effectively allocating marketing and operational resources to build brand awareness and service capacity within this target group.

- Service Development: Continuous innovation and adaptation of trust services to meet the evolving needs of the emerging affluent will be crucial for sustained growth.

Enhanced Data Analytics and AI-driven Banking Solutions

Bar Harbor Bankshares is likely investing in enhanced data analytics and AI to drive personalized customer experiences and streamline operations. These advanced solutions, while currently in early adoption phases for the bank, represent a significant opportunity for future growth and differentiation in the competitive financial landscape.

The banking sector globally saw a substantial increase in AI adoption, with projections indicating continued rapid expansion. For instance, a 2024 report highlighted that over 70% of financial institutions were actively exploring or implementing AI for customer service and risk assessment, suggesting Bar Harbor's strategic alignment with industry trends.

These data-driven initiatives can lead to improved customer segmentation, more accurate credit scoring, and enhanced fraud detection. If Bar Harbor Bankshares is focusing on these areas, their current investments position them to capitalize on evolving customer expectations and regulatory requirements, potentially leading to higher market share in the long term.

- AI in Banking Adoption: In 2024, AI adoption in banking was projected to reach significant levels, with a focus on personalization and efficiency.

- Customer Insights: Leveraging AI for deeper customer insights can enable Bar Harbor to offer more tailored financial products and services.

- Risk Management Enhancement: AI-powered risk management tools can improve accuracy in identifying and mitigating financial risks, a critical area for banks.

- Competitive Advantage: Early investment in these technologies provides a crucial competitive edge by fostering innovation and operational excellence.

Bar Harbor Bankshares' expansion into New Hampshire and Vermont, alongside its focus on the emerging affluent and digital banking solutions, positions these as question marks in its BCG Matrix. These ventures require significant investment to build market share amidst high growth potential.

The bank's strategic investments in data analytics and AI in 2024 also fall into this category, aiming to enhance customer experience and operational efficiency in a rapidly evolving financial landscape.

These initiatives represent opportunities for future growth, but their current market penetration and the substantial resources needed to establish a strong competitive position classify them as question marks, demanding careful strategic management.

| BCG Category | Business Unit/Initiative | Market Growth Rate | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | New Hampshire & Vermont Markets | High | Low | Requires significant investment to gain market share. |

| Question Mark | Emerging Affluent Trust Services | High | Low to Moderate | Needs targeted marketing and service development. |

| Question Mark | Data Analytics & AI Initiatives | High | Early Stage | Investment to build competitive advantage and customer insights. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.