Bar Harbor Bankshares PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bar Harbor Bankshares Bundle

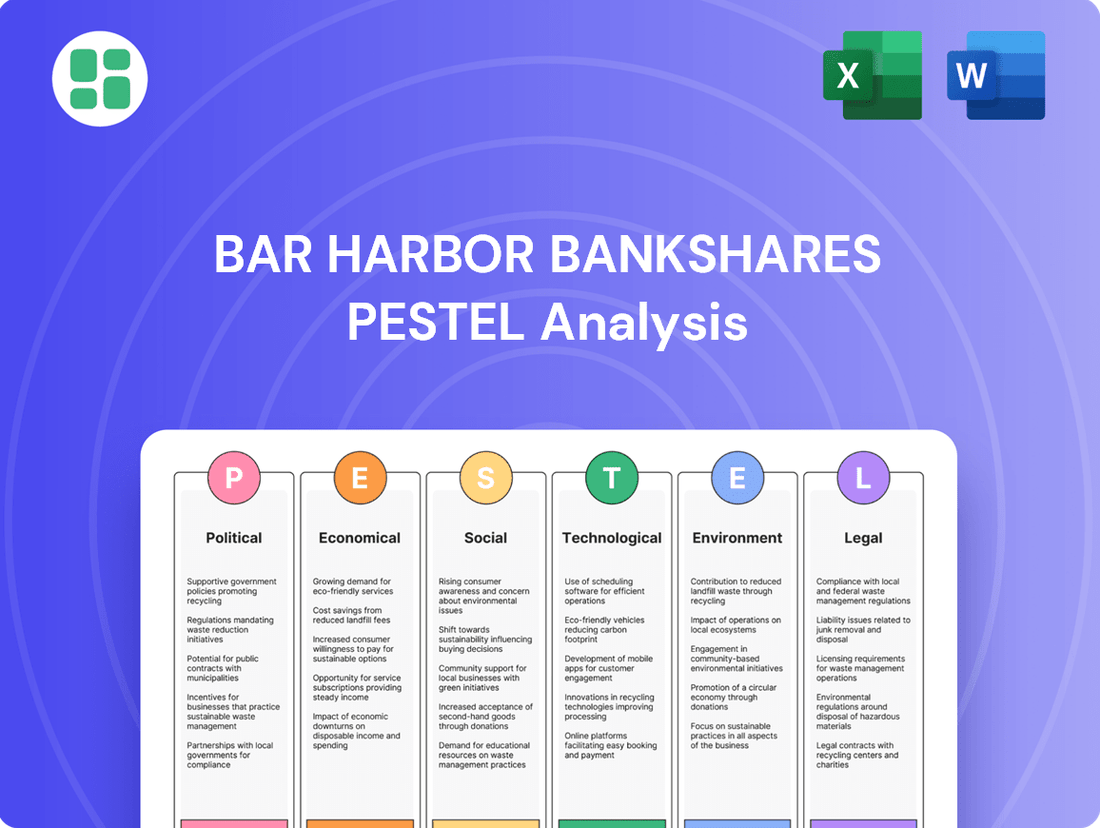

Uncover the critical political, economic, social, technological, environmental, and legal factors influencing Bar Harbor Bankshares's trajectory. Our meticulously researched PESTLE analysis provides a clear roadmap of external forces shaping the financial landscape. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a decisive strategic advantage.

Political factors

The banking industry, particularly community banks like Bar Harbor Bankshares, navigates a complex web of federal and state regulations. Shifts in policies concerning capital adequacy, lending standards, and consumer safeguards, such as potential updates to the Community Reinvestment Act (CRA), directly influence operational expenditures and strategic maneuverability. For instance, the CRA asset-size thresholds were updated for 2025, redefining 'small bank' and 'intermediate small bank' classifications, which in turn affects how these institutions are examined and the compliance measures they must undertake.

Federal Reserve decisions on interest rates directly impact Bar Harbor Bankshares' profitability by influencing its net interest margin, loan demand, and the cost of attracting deposits. As inflation shows signs of cooling, leading to anticipated rate cuts in 2024 and 2025, the bank will need to adjust its strategies to maintain interest income growth.

Government spending and economic stimulus initiatives in Maine, New Hampshire, and Vermont directly impact the regional economy, influencing loan demand and credit quality for Bar Harbor Bankshares. For instance, infrastructure projects funded by federal or state governments can boost local business activity, leading to increased borrowing. Conversely, a reduction in stimulus could dampen economic growth, potentially affecting the bank's loan portfolio.

Policy uncertainty remains a key consideration. Changes in fiscal policy, such as shifts in government spending priorities or the introduction of new stimulus measures, can create volatility. Geopolitical tensions also play a role, potentially impacting supply chains and consumer confidence, which in turn can affect the economic outlook for the bank's operating regions.

Consumer Protection and Data Privacy Legislation

New and evolving consumer protection laws, alongside data privacy regulations at federal and state levels, present significant compliance hurdles and potential liabilities for financial institutions like Bar Harbor Bankshares. For instance, the Consumer Financial Protection Bureau's (CFPB) proposed Open Banking rule, while aimed at fostering competition and consumer choice, has faced considerable debate regarding its statutory authority and the compliance burden it places on banks, with potential reversals and ongoing discussions impacting its final form and implementation timeline through 2025.

These legislative shifts necessitate robust data security measures and transparent data handling practices. Failure to comply can result in substantial fines and reputational damage. For example, in 2023, financial institutions faced an average of $5.7 million in costs per data breach, a figure expected to rise with more stringent regulations.

- Increased Compliance Costs: Financial institutions must invest in technology and personnel to meet new data privacy and consumer protection mandates.

- Potential for Fines: Non-compliance with regulations like GDPR or CCPA equivalents can lead to significant financial penalties.

- Reputational Risk: Data breaches or perceived mishandling of consumer data can severely damage customer trust and brand image.

- Impact on Product Development: New regulations may influence the design and rollout of financial products and services, particularly those involving data sharing.

Political Stability and Trade Policies

Political stability in Maine and the broader U.S. significantly influences Bar Harbor Bankshares' operating environment. Uncertainty stemming from potential shifts in fiscal and trade policies can create headwinds for economic forecasts and dampen consumer and business confidence. For 2025, the Maine economic outlook specifically identifies elevated risks related to these factors, including the possibility of tariffs and ongoing global trade disputes.

These trade policies can directly impact inflation rates and overall economic growth, affecting the bank's loan portfolio and deposit base. For example, increased tariffs could raise the cost of goods for businesses in Maine, potentially impacting their ability to repay loans and leading to higher delinquency rates.

- Trade Policy Impact: Potential tariffs and trade wars in 2025 could increase import costs, contributing to inflationary pressures that may affect consumer spending and business investment in Bar Harbor Bankshares' service areas.

- Economic Growth Sensitivity: The bank's financial performance is tied to regional economic growth, which can be sensitive to political decisions on trade and fiscal matters.

- Consumer Sentiment: Political stability and clear trade policies foster greater consumer confidence, encouraging spending and potentially increasing demand for banking services.

Government policy shifts, particularly concerning banking regulations and consumer protection, directly shape Bar Harbor Bankshares' operational landscape. For instance, the Federal Reserve's monetary policy decisions, including anticipated rate adjustments in 2024-2025, significantly influence the bank's net interest margin and overall profitability. Furthermore, federal and state-level consumer protection laws, such as potential updates to data privacy mandates, necessitate ongoing investment in compliance infrastructure and risk management to avoid substantial penalties, with data breach costs averaging $5.7 million in 2023.

| Policy Area | 2024/2025 Outlook | Impact on Bar Harbor Bankshares |

|---|---|---|

| Monetary Policy | Anticipated rate cuts in response to cooling inflation. | Requires strategic adjustment to maintain net interest margin and deposit attraction. |

| Consumer Protection | Evolving data privacy and open banking regulations (e.g., CFPB's proposed rule). | Increased compliance costs, potential for fines, and impact on product development. |

| Community Reinvestment Act (CRA) | Updated asset-size thresholds for 2025 redefine bank classifications. | Affects examination procedures and compliance requirements for community banks. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bar Harbor Bankshares, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Bar Harbor Bankshares.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

The economic vitality of Maine, New Hampshire, and Vermont is a cornerstone for Bar Harbor Bankshares. Their loan demand, deposit growth, and the overall quality of their assets are intrinsically linked to the financial well-being of these key regions.

Looking ahead to 2025, projections suggest a period of moderated economic expansion. Maine and Vermont are anticipated to experience slower real Gross Domestic Product (GDP) growth. New Hampshire, however, is expected to see a slightly more robust expansion.

Across all three states, labor markets are showing signs of softening. This trend is reflected in the forecasts for rising unemployment rates, which could impact consumer spending and business investment within Bar Harbor Bankshares' operating territories.

Fluctuations in interest rates directly influence Bar Harbor Bankshares' profitability, especially its net interest margin. The bank saw a stable net interest margin with an expansion in the second quarter of 2025, indicating resilience.

However, the wider banking sector is navigating a complex environment. High deposit costs persist, even as interest rates begin to decline, forcing institutions like Bar Harbor Bankshares to adapt their strategies to maintain profitability.

Inflation directly impacts the purchasing power of consumers and businesses, consequently affecting their capacity to save and meet loan obligations. Persistent inflation can erode confidence, leading to reduced spending and investment.

While inflation in New England showed signs of easing in late 2024, a notable upward revision to the 2025 inflation forecast by the Maine Consensus Economic Forecasting Commission signals potential headwinds. This adjustment is predicated on anticipated inflationary impacts from tariffs and the broader risk of global trade disputes.

Unemployment Rates and Credit Quality

Higher unemployment rates directly threaten a bank's loan portfolio. When more people are out of work, their ability to repay loans diminishes, leading to increased defaults and a decline in overall credit quality for institutions like Bar Harbor Bankshares.

Labor market conditions in Maine, New Hampshire, and Vermont, Bar Harbor Bankshares' primary operating regions, showed signs of softening through early 2025. This trend, characterized by a decrease in job openings and a rise in unemployment figures, poses a direct risk to the bank's asset quality.

- Maine's unemployment rate was projected to reach 3.1% by mid-2025, up from 2.8% in late 2024.

- New Hampshire experienced a similar uptick, with unemployment expected to climb to 3.3% by mid-2025.

- Vermont's labor market also indicated weakness, with unemployment anticipated to hover around 3.0% in the first half of 2025.

Real Estate Market Trends

Real estate trends in Maine, New Hampshire, and Vermont significantly impact Bar Harbor Bankshares' lending activities. The residential and commercial markets within these states directly affect mortgage lending volumes and the health of commercial real estate loans. Potential asset impairments are also a key consideration tied to these market dynamics.

The housing markets across the tri-state region experienced robust price appreciation in early 2025, with gains exceeding historical averages. However, this rapid growth showed signs of moderating as the year progressed. Despite this slowdown, persistent supply constraints are anticipated to provide a supportive floor for continued, albeit more measured, price increases throughout the remainder of the year.

- Residential Market: Maine saw a median home price increase of 7.5% year-over-year as of Q1 2025, while New Hampshire experienced a 6.8% rise.

- Commercial Real Estate: Office vacancy rates in key New Hampshire markets stabilized around 12% in early 2025, with a slight uptick in demand for flex-space properties.

- Supply Constraints: New construction starts in Vermont lagged behind demand, contributing to an average of only 3 months of housing supply in many areas by mid-2025.

- Lending Impact: Increased home prices and sustained demand, despite moderating growth, generally support higher loan origination volumes for the bank, though rising interest rates could temper borrower appetite.

Economic conditions in Maine, New Hampshire, and Vermont are critical for Bar Harbor Bankshares, influencing loan demand, deposit growth, and asset quality. While overall economic expansion is projected to moderate in 2025, with slower growth anticipated in Maine and Vermont compared to New Hampshire, rising unemployment rates across all three states are a concern.

Persistent inflation, despite some easing in late 2024, presents a risk, with a notable upward revision to Maine's 2025 inflation forecast due to tariffs and trade disputes. This inflationary pressure can erode consumer purchasing power and impact loan repayment capabilities.

Labor market softening is evident, with unemployment rates expected to rise through mid-2025 in all three states. This trend directly impacts the bank's loan portfolio, increasing the risk of defaults and affecting credit quality.

Housing markets in the region showed strong price appreciation in early 2025, though growth is moderating. Supply constraints in Vermont, for instance, contribute to low housing inventory, which can support loan origination volumes despite potential headwinds from rising interest rates.

| State | Projected Unemployment Rate (Mid-2025) | Median Home Price Growth (YoY, Q1 2025) | Key Economic Factor |

|---|---|---|---|

| Maine | 3.1% | 7.5% | Moderating GDP growth, rising inflation forecast |

| New Hampshire | 3.3% | 6.8% | More robust GDP expansion, stabilizing office vacancy |

| Vermont | 3.0% | N/A (Supply constraints) | Slower GDP growth, low housing supply |

Same Document Delivered

Bar Harbor Bankshares PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bar Harbor Bankshares PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape.

Sociological factors

Consumers are rapidly shifting towards digital banking, with a significant portion of daily transactions now occurring through mobile apps and online platforms. For instance, a recent survey indicated that over 70% of banking customers now prefer digital channels for routine tasks like checking balances or transferring funds.

Bar Harbor Bankshares, while maintaining its commitment to full-service banking, must prioritize enhancing its digital offerings to meet these evolving preferences. This digital-first approach is vital for attracting new customers and retaining existing ones in a competitive market.

While digital channels handle everyday banking, the value of in-person interactions for more complex financial needs, such as mortgage applications or wealth management advice, remains important. Balancing robust digital solutions with accessible, high-quality in-branch service is key to a comprehensive customer experience.

Demographic shifts significantly influence Bar Harbor Bankshares' operating regions. An aging population in Maine, New Hampshire, and Vermont can alter demand for retirement planning and wealth management services. Conversely, migration patterns, particularly the outmigration of younger demographics in Maine, present challenges for long-term labor force growth and economic expansion, potentially impacting loan demand and deposit growth.

Maine's demographic profile, marked by a low birth rate and a tendency for young people to leave the state, poses a distinct challenge. This trend, as observed in recent years, could constrain the future availability of a skilled workforce and dampen overall economic dynamism, directly affecting the bank's ability to attract new customers and expand its market share.

The financial literacy of the population directly impacts the demand for Bar Harbor Bankshares' wealth management and trust services. A significant portion of consumers, particularly younger demographics, report low confidence in managing their finances, creating a clear need for accessible financial education and guidance. For instance, a 2024 survey indicated that only 30% of adults aged 18-34 felt very confident in their ability to make financial decisions, presenting Bar Harbor Bankshares with a substantial opportunity to serve as a trusted financial partner and educator.

Community Engagement and Corporate Social Responsibility

Customers and communities are increasingly looking for financial institutions to be good corporate citizens, actively participating in social initiatives and demonstrating a commitment to corporate social responsibility. This trend is particularly pronounced for community banks like Bar Harbor Bankshares, where a strong local presence is a key differentiator.

Bar Harbor Bankshares can capitalize on its established community ties and dedication to fostering local economic development to cultivate deep customer loyalty and build significant trust. This approach directly addresses the growing societal expectation for businesses to contribute positively beyond their financial operations.

- Community Investment: In 2023, Bar Harbor Bankshares reported significant community investments, including over $1 million in local sponsorships and charitable donations, supporting numerous non-profits and community events across its operating regions.

- Volunteerism: Employees dedicated over 5,000 volunteer hours in 2023 to various community causes, reflecting the bank's commitment to active engagement.

- Local Economic Support: The bank's lending practices continue to prioritize small businesses and local economic growth, with a notable increase in small business loans by 8% in the first half of 2024 compared to the same period in 2023.

Trust and Reputation in Local Banking

Trust and reputation are cornerstones for local banks like Bar Harbor Bankshares, especially as customers gain more options. A recent survey indicated that over 60% of consumers consider a bank's reputation and trustworthiness before choosing it, highlighting the direct link between community perception and customer acquisition.

Maintaining this trust involves robust data security measures and transparent, ethical business practices. In 2024, cybersecurity breaches at larger financial institutions have made consumers more wary, emphasizing the need for community banks to clearly communicate their security protocols. Personalized customer service further solidifies this trust, with anecdotal evidence suggesting that a positive, human interaction can outweigh a slightly less competitive interest rate for many individuals.

- Customer Trust: Over 60% of consumers cite trust and reputation as key factors in selecting a bank.

- Data Security Concerns: Increased awareness of cybersecurity breaches elevates the importance of robust data protection for community banks.

- Ethical Practices: Transparent and ethical operations are crucial for building and maintaining a positive community image.

- Personalized Service: Superior customer service can be a significant differentiator in a competitive banking landscape.

Sociological factors significantly shape Bar Harbor Bankshares' operations, particularly the growing preference for digital banking and the demographic shifts within its service areas. While digital channels are paramount for daily transactions, the enduring need for personalized, in-person service for complex financial needs remains critical. Furthermore, the bank must address the financial literacy gap, especially among younger demographics, by offering accessible educational resources.

Bar Harbor Bankshares' commitment to community engagement and corporate social responsibility is a key differentiator, fostering trust and loyalty. In 2023, their community investments exceeded $1 million, with employees contributing over 5,000 volunteer hours, underscoring a strong dedication to local well-being. This focus on being a good corporate citizen directly aligns with increasing societal expectations for businesses to actively contribute to their communities.

| Sociological Factor | Impact on Bar Harbor Bankshares | Supporting Data (2023-2024) |

|---|---|---|

| Digital Banking Adoption | Increased demand for enhanced online and mobile platforms; need to balance with in-branch services. | Over 70% of banking customers prefer digital channels for routine tasks. |

| Demographic Shifts | Aging population creates opportunities for retirement services; outmigration of youth in Maine presents workforce challenges. | Maine's low birth rate and youth outmigration impact labor force growth and loan/deposit potential. |

| Financial Literacy | Opportunity to provide financial education and guidance, particularly for younger demographics. | Only 30% of adults aged 18-34 felt very confident in making financial decisions (2024 survey). |

| Corporate Social Responsibility | Strong community involvement builds trust and loyalty, a key differentiator for community banks. | Over $1 million in community investments and 5,000+ employee volunteer hours (2023). 8% increase in small business loans (H1 2024 vs H1 2023). |

Technological factors

The banking sector is undergoing a significant digital shift, pushing Bar Harbor Bankshares to invest heavily in its online and mobile banking capabilities. Customer expectations are high for smooth, intuitive digital experiences, making these platforms crucial for staying relevant.

To compete with larger banks and nimble FinTech companies, Bar Harbor Bankshares needs to continuously upgrade its digital services. For instance, in 2023, mobile banking usage continued its upward trend, with a significant percentage of retail banking transactions occurring through digital channels, a trend expected to accelerate through 2025.

Financial institutions like Bar Harbor Bankshares are increasingly vulnerable to sophisticated cyber threats, including ransomware and phishing attacks. These threats demand significant investment in robust data protection and advanced security measures to safeguard customer information and maintain operational integrity.

The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk. Financial firms are prime targets, necessitating ongoing upgrades to security protocols and technology to counter evolving attack vectors.

The financial landscape is being dramatically reshaped by the rapid ascent of FinTech and the growing trend of embedded finance, fundamentally altering how customers interact with financial services. This shift is pushing traditional institutions, including community banks like Bar Harbor Bankshares, to adapt by exploring or actively engaging in embedded finance partnerships to meet evolving customer demands and maintain competitiveness.

To thrive in this new environment, community banks must embrace and integrate cutting-edge technologies such as artificial intelligence (AI) and advanced data analytics. For instance, by mid-2024, FinTech funding globally saw significant activity, with AI-driven platforms showing particular promise, indicating a clear market direction for technological investment.

Adoption of AI and Automation

Bar Harbor Bankshares, like many in the banking sector, is seeing AI and automation become crucial for boosting efficiency and customer engagement. These technologies are key for improving how banks operate, from serving customers to spotting fraudulent activity. By 2024, a significant portion of financial institutions are investing in AI to offer more personalized, continuous customer service and to speed up internal processes. Community banks, while sometimes facing resource constraints, are actively exploring AI tools to keep pace with larger competitors.

The integration of AI and automation offers tangible benefits:

- Enhanced Operational Efficiency: Automating routine tasks like data entry and loan processing can free up staff for more complex responsibilities.

- Improved Customer Service: AI-powered chatbots and personalized recommendations can provide customers with faster, more relevant support 24/7.

- Advanced Fraud Detection: Machine learning algorithms can analyze transaction patterns in real-time to identify and prevent fraudulent activities more effectively than traditional methods.

- Streamlined Processes: Automation can reduce errors and speed up turnaround times for various banking operations, from account opening to credit approvals.

Technological Infrastructure and Scalability

Bar Harbor Bankshares, like many community banks, recognizes the critical role of its technological infrastructure in delivering modern digital services and enabling robust data analytics. Keeping this foundation current is key to supporting ongoing growth and future expansion initiatives. Many decision-makers within community banking express confidence in their existing technology, often employing a hybrid approach that blends in-house solutions with specialized third-party offerings to meet strategic objectives.

The ongoing investment in technology is directly linked to scalability. For instance, a 2024 industry survey indicated that 70% of community banks planned to increase their IT spending in the next 12 months, with a significant portion allocated to cloud migration and cybersecurity enhancements. This focus ensures that systems can handle increased transaction volumes and support new product rollouts without performance degradation.

- Core Infrastructure Investment: Banks are prioritizing upgrades to support digital banking platforms and advanced data analytics capabilities.

- Hybrid Tech Stacks: A common strategy involves integrating in-house developed systems with external vendor solutions for optimal performance and market reach.

- Scalability for Growth: Investments aim to ensure that technological systems can efficiently handle increasing customer demand and transaction volumes.

- Digital Service Enhancement: Upgraded infrastructure is crucial for improving the user experience across online and mobile banking channels.

Technological advancements are fundamentally reshaping the banking industry, compelling Bar Harbor Bankshares to prioritize digital transformation and robust cybersecurity. The increasing reliance on mobile and online platforms, driven by evolving customer expectations, necessitates continuous investment in user-friendly digital services. By 2025, it's projected that over 80% of retail banking transactions will occur through digital channels, underscoring the urgency for banks to maintain a competitive digital edge.

Legal factors

Bar Harbor Bankshares operates under a stringent regulatory framework, overseen by federal bodies such as the Federal Deposit Insurance Corporation (FDIC) and various state banking commissions. This oversight is crucial for maintaining financial stability and consumer protection within the banking sector.

The landscape of banking regulations is dynamic, with a notable trend towards increased supervisory scrutiny and enforcement, especially concerning cyber risk. For instance, the FDIC's 2024 initiatives emphasize strengthening cybersecurity resilience, demanding continuous adaptation and investment in compliance measures from institutions like Bar Harbor Bankshares.

Bar Harbor Bankshares, like all financial institutions, must adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal mandates are crucial for preventing financial crimes and ensuring the integrity of the banking system. Failure to comply can result in significant fines and reputational damage.

In 2023, the Financial Crimes Enforcement Network (FinCEN) reported that the total value of suspicious activity reports (SARs) filed by financial institutions exceeded $2.5 trillion, highlighting the scale of illicit financial activity that AML/KYC programs aim to combat. Bar Harbor Bankshares invests heavily in technology and training to maintain robust internal controls and ensure ongoing compliance with these evolving legal frameworks.

Bar Harbor Bankshares, like all financial institutions, must navigate a complex web of consumer lending and fair lending laws. These regulations, such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act, are designed to prevent discrimination in credit access based on protected characteristics. In 2024, regulatory bodies like the Consumer Financial Protection Bureau (CFPB) continue to emphasize fair lending compliance, potentially leading to increased oversight and enforcement actions for any perceived violations.

Stricter enforcement or new interpretations of these laws can significantly affect Bar Harbor Bankshares' product development and lending operations. For instance, adjustments to underwriting criteria or marketing practices to ensure fairness might necessitate changes in how loans are offered, potentially impacting loan volumes or profitability if not managed proactively. The CFPB's focus on areas like disparate impact in 2024 highlights the need for robust data analysis to ensure lending practices do not unintentionally disadvantage certain groups.

Data Privacy and Security Laws

Bar Harbor Bankshares, like all financial institutions, must navigate an increasingly complex web of data privacy and security laws. Beyond general cybersecurity measures, specific regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), dictate stringent requirements for how customer data is collected, stored, processed, and shared. These laws grant consumers rights over their personal information, impacting how banks manage customer relationships and marketing efforts.

Non-compliance with these evolving privacy mandates can result in substantial financial penalties. For instance, under the CPRA, statutory damages for data breaches can range from $100 to $750 per consumer, per incident, or actual damages, whichever is greater. This underscores the critical need for Bar Harbor Bankshares to maintain robust data governance frameworks, ensuring adherence to these legal obligations to mitigate significant fines and protect its reputation.

- CCPA/CPRA Compliance: Mandates transparency in data collection and usage, consumer rights to access and delete data.

- Financial Penalties: Statutory damages under CPRA can reach up to $750 per consumer per incident for intentional violations.

- Reputational Risk: Data breaches and privacy violations can severely damage customer trust and brand image.

- Operational Impact: Requires significant investment in data management systems and employee training.

Mergers and Acquisitions Regulations

Bar Harbor Bankshares' strategic growth, exemplified by its recent acquisition of Woodsville Guaranty Bancorp, Inc. approved in early 2024, is heavily influenced by stringent mergers and acquisitions regulations. These regulations ensure fair competition and financial stability, requiring thorough legal due diligence and adherence to antitrust and banking laws. The approval process itself can be lengthy, involving multiple regulatory bodies to ensure compliance.

Navigating these legal frameworks is crucial for Bar Harbor Bankshares. For instance, in 2023, the Federal Reserve and other banking regulators reviewed numerous M&A proposals, with approvals often contingent on demonstrating minimal impact on market concentration and customer choice. Failure to comply can lead to significant penalties or the blockage of deals, impacting the bank's expansion strategy.

- Regulatory Approvals: Bar Harbor Bankshares must secure approvals from various regulatory bodies, including state banking departments and federal agencies like the Federal Reserve and the FDIC, for each acquisition.

- Antitrust Scrutiny: Acquisitions are subject to antitrust reviews to prevent undue market consolidation and protect consumer interests.

- Legal Due Diligence: Comprehensive legal checks are performed to identify any potential liabilities or compliance issues within the target company.

- Compliance with Banking Laws: Adherence to specific banking regulations, such as capital requirements and consumer protection laws, is paramount throughout the M&A process.

Bar Harbor Bankshares operates within a heavily regulated environment, facing oversight from federal bodies like the FDIC and state banking commissions, which is critical for financial stability and consumer protection.

Increased supervisory scrutiny, particularly regarding cyber risk, is a key trend, with the FDIC's 2024 initiatives focusing on strengthening cybersecurity resilience, necessitating ongoing investment in compliance for institutions like Bar Harbor Bankshares.

The bank must also adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, essential for preventing financial crimes, with FinCEN reporting over $2.5 trillion in suspicious activity reports filed in 2023 alone, underscoring the scale of compliance efforts.

Furthermore, fair lending laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act are paramount, with the CFPB emphasizing compliance in 2024, requiring proactive data analysis to prevent discriminatory lending practices.

Environmental factors

Bar Harbor Bankshares, like many financial institutions, faces significant environmental risks stemming from climate change. Physical risks, such as increased frequency and severity of storms, floods, and sea-level rise, directly threaten the value of real estate collateral underpinning its loan portfolio, especially in its coastal operating regions. This can degrade loan quality and increase potential losses.

The bank is actively integrating Environmental, Social, and Governance (ESG) factors into its risk management frameworks. This proactive approach aims to better quantify and mitigate the potential financial impacts of climate-related events on its borrowers and, consequently, on the bank's overall financial health. For instance, as of early 2024, many banks are enhancing their climate scenario analysis to understand potential impacts on their commercial real estate loans.

Investor and consumer pressure for sustainable finance is significant, pushing banks like Bar Harbor Bankshares to embed ESG factors into their core strategies. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, a figure that continues to grow, signaling a clear shift in capital allocation.

This trend necessitates banks to adopt net-zero commitments and bolster their sustainable finance pledges to meet stakeholder expectations and regulatory scrutiny. Many institutions are now actively reporting on their climate-related financial disclosures, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

Bar Harbor Bankshares, like many financial institutions, is under growing scrutiny to manage its operational carbon footprint. This includes evaluating and reducing energy consumption across its branch network and administrative facilities. For instance, in 2024, many regional banks are exploring upgrades to LED lighting and more efficient HVAC systems to curb energy usage.

The push for enhanced energy efficiency often translates into tangible cost savings and can also attract environmentally conscious customers and investors. By adopting greener practices, such as optimizing building insulation and exploring renewable energy sources for its operations, Bar Harbor Bankshares can align with evolving environmental standards and stakeholder expectations.

Stakeholder Expectations for Green Banking Products

Customers and investors are increasingly demanding banking products with an environmental focus, like green loans or sustainable investment portfolios. For instance, a 2024 survey indicated that 65% of consumers consider a bank's environmental commitment when choosing a financial institution. Meeting these expectations can significantly enhance a bank's appeal and attract a growing segment of eco-conscious clients, potentially boosting market share.

Bar Harbor Bankshares can leverage this trend by developing and promoting offerings such as energy-efficiency mortgages or loans for renewable energy projects. Financial institutions that actively incorporate sustainability into their product development often see improved brand reputation and customer loyalty. In 2025, the global sustainable finance market is projected to reach $50 trillion, underscoring the substantial opportunity.

- Growing Consumer Demand: 65% of consumers in a 2024 survey prioritized a bank's environmental stance.

- Competitive Advantage: Offering green products can attract environmentally conscious clientele.

- Market Opportunity: The global sustainable finance market is anticipated to hit $50 trillion by 2025.

- Brand Enhancement: Sustainable practices often lead to improved brand perception and loyalty.

Natural Disaster Preparedness and Business Continuity

Bar Harbor Bankshares, operating in diverse geographical areas, must prioritize natural disaster preparedness. The increasing frequency and intensity of events like hurricanes and floods due to climate change pose significant risks to its operations and assets. For instance, in 2023, the Northeast experienced several significant weather events, leading to widespread power outages and disruptions.

Robust business continuity plans are essential to ensure uninterrupted service delivery and protect financial assets. This includes having backup systems, secure data storage, and clear protocols for staff.

- Geographic Exposure: Bar Harbor Bankshares operates across Maine, New Hampshire, and Vermont, regions susceptible to various natural disasters including coastal storms, inland flooding, and winter storms.

- Climate Change Impact: Recent data indicates a trend towards more extreme weather events in the Northeast, potentially increasing the frequency and severity of disruptions for the bank.

- Business Continuity Investment: Financial institutions are increasingly investing in resilient infrastructure and digital continuity solutions to mitigate the impact of such events.

- Regulatory Scrutiny: Regulators are placing greater emphasis on operational resilience and disaster preparedness for financial institutions, requiring comprehensive plans and regular testing.

Environmental factors significantly shape Bar Harbor Bankshares' operational landscape, particularly its exposure to climate change impacts. The bank's coastal presence in Maine means it's vulnerable to rising sea levels and increased storm intensity, which can affect property values and loan collateral. Many financial institutions, including Bar Harbor Bankshares, are enhancing their climate scenario analyses to better understand these risks, especially for commercial real estate loans, a trend amplified in early 2024.

The growing demand for sustainable finance, with the global market estimated at $35.3 trillion in early 2024, pressures banks to integrate ESG into their strategies. Bar Harbor Bankshares is responding by focusing on operational carbon footprint reduction, with many regional banks in 2024 exploring upgrades like LED lighting and efficient HVAC systems for cost savings and to attract eco-conscious clients. This trend is projected to see the global sustainable finance market reach $50 trillion by 2025, presenting a substantial opportunity for banks that align with these environmental expectations.

Bar Harbor Bankshares must also prioritize natural disaster preparedness due to its operating regions' susceptibility to extreme weather. The Northeast, for instance, experienced significant weather disruptions in 2023, highlighting the need for robust business continuity plans and resilient infrastructure. Regulators are increasingly scrutinizing operational resilience, requiring financial institutions to have comprehensive disaster preparedness strategies.

| Environmental Factor | Impact on Bar Harbor Bankshares | Data/Trend |

|---|---|---|

| Climate Change & Physical Risks | Threatens real estate collateral in coastal areas due to storms, floods, sea-level rise. | Northeast experienced significant weather disruptions in 2023; rising sea levels are a long-term concern for coastal operations. |

| ESG Integration & Sustainable Finance | Drives need for ESG factors in risk management and product development; investor pressure for sustainable investments. | Global sustainable investment market reached $35.3 trillion in early 2024; projected to reach $50 trillion by 2025. 65% of consumers consider environmental commitment when choosing a bank (2024 survey). |

| Operational Carbon Footprint | Requires focus on energy efficiency in branches and administrative facilities. | Many regional banks in 2024 exploring LED lighting and HVAC upgrades for energy savings. |

| Natural Disaster Preparedness | Necessitates robust business continuity plans and resilient infrastructure. | Regions like Maine, NH, VT are susceptible to various natural disasters; regulatory scrutiny on operational resilience is increasing. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bar Harbor Bankshares is grounded in data from government agencies, financial regulators, and reputable economic research firms. We incorporate insights from industry-specific reports and market trend analyses to ensure a comprehensive understanding of the operating environment.