Bank of India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of India Bundle

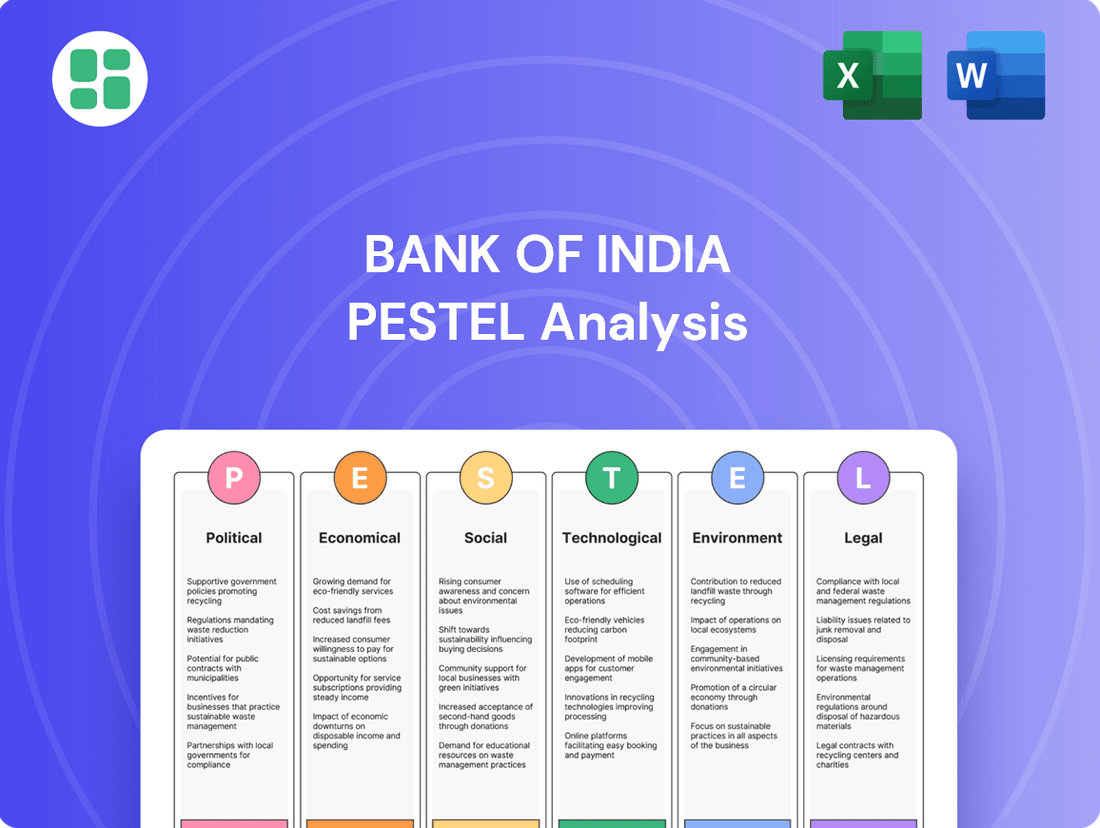

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Bank of India's trajectory. Our expertly crafted PESTLE analysis provides the actionable intelligence you need to navigate this complex landscape and identify strategic opportunities. Download the full version now and gain a decisive advantage.

Political factors

As a public sector bank, Bank of India's strategic direction is heavily shaped by the Indian government's policies. The government's emphasis on initiatives like financial inclusion and support for key economic sectors directly influences the bank's lending and expansion plans. For instance, the government's push for digital banking, a key component of financial inclusion, saw public sector banks, including Bank of India, investing significantly in digital infrastructure throughout 2023 and into 2024.

The Reserve Bank of India (RBI) and the Ministry of Finance maintain rigorous regulatory oversight of public sector banks like the Bank of India. New legislation, such as the anticipated Banking Laws (Amendment) Act of 2025, is set to bolster governance, audit standards, and depositor safeguards, directly impacting the bank's operational procedures and financial reporting.

The Indian government's push for reforms in public sector banks, including potentially lowering its stake below 75% in select institutions, aims to foster greater market discipline and accountability. This strategic shift could influence Bank of India's operational freedom, its capacity to secure additional capital, and its competitive standing in the evolving financial sector.

Geopolitical Stability and National Security

Geopolitical stability and national security significantly influence Bank of India's operations, given its public sector status and vast branch network. The bank, like other public sector entities, is enhancing its resilience against potential disruptions. This includes bolstering cash reserves and strengthening cybersecurity measures, particularly in strategically sensitive regions.

In 2024, Indian banks, including Bank of India, have been actively investing in advanced cybersecurity solutions to counter evolving threats. For instance, the Reserve Bank of India has mandated enhanced security protocols, leading to increased spending on digital defense. Bank of India’s commitment to national security also translates to stringent compliance with regulations designed to prevent financial crimes and ensure the stability of the banking system amidst global uncertainties.

- Increased Cybersecurity Investment: Public sector banks, including Bank of India, are projected to increase their cybersecurity budgets by an average of 10-15% in 2024-2025 to combat sophisticated cyber threats.

- Resilience in Frontier States: Enhanced cash reserve ratios and physical security measures are being implemented in border areas and regions prone to geopolitical tension to ensure uninterrupted service delivery.

- Regulatory Compliance: Adherence to RBI directives on data protection and anti-money laundering frameworks is a critical aspect of national security for financial institutions.

- Digital Infrastructure Protection: Safeguarding digital banking platforms and customer data against state-sponsored or organized cyberattacks remains a top priority.

Emphasis on Financial Inclusion Initiatives

Government focus on financial inclusion, exemplified by programs like the Pradhan Mantri Jan Dhan Yojana (PMJDY), significantly shapes the banking landscape. Bank of India's active participation in these initiatives, which aim to bring unbanked populations into the formal financial system, directly impacts its customer base and product strategy. As of March 2024, PMJDY accounts had surpassed 51 crore, with a substantial portion held by women, highlighting the broad reach of these government-driven efforts.

These initiatives compel banks like Bank of India to develop and offer accessible, low-cost banking products tailored for mass market segments. This includes simplified savings accounts, micro-insurance, and remittance services. The success of these programs is often measured by account penetration and transaction volumes, encouraging banks to invest in digital infrastructure and agent networks to serve remote areas effectively.

- Government Mandates: Schemes like PMJDY and social security programs necessitate broad outreach, pushing banks to serve previously unbanked populations.

- Product Development: Financial inclusion drives the creation of mass-market banking products, focusing on simplicity and affordability.

- Digital Push: To serve underserved segments, banks are compelled to enhance their digital capabilities and expand their agent networks.

- Regulatory Alignment: Compliance with financial inclusion targets often involves specific reporting and performance metrics mandated by regulatory bodies.

Government policies significantly steer Bank of India's strategy, especially regarding financial inclusion initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY). By March 2024, PMJDY had over 51 crore accounts, underscoring the government's drive to bring more citizens into the formal banking system, directly impacting Bank of India's customer base and product development.

The Reserve Bank of India (RBI) and the Ministry of Finance impose stringent regulations, with upcoming legislation like the Banking Laws (Amendment) Act of 2025 expected to enhance governance and depositor protection, influencing Bank of India's operational frameworks.

Government reforms aimed at improving public sector bank efficiency, potentially reducing state stakes, could grant Bank of India more operational autonomy and capital-raising flexibility, thereby altering its competitive positioning.

National security and geopolitical stability are critical, prompting Bank of India to bolster cybersecurity and cash reserves, particularly in sensitive areas, with projected cybersecurity budget increases of 10-15% for 2024-2025.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the Bank of India, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the Indian banking sector.

A clear, concise PESTLE analysis for Bank of India acts as a pain point reliever by providing a structured overview of external factors, enabling proactive strategy development and mitigating potential risks.

Economic factors

India's economy is showing strong growth, with projections indicating a GDP expansion of around 6.5% for fiscal year 2025. This robust economic activity is expected to continue, with forecasts suggesting growth rates between 7% and 7.2% for FY2025.

This sustained economic momentum creates a very positive landscape for the banking sector, including institutions like the Bank of India. The underlying drivers for this growth are strong domestic demand and increasing investment, which directly fuel the need for credit.

Consequently, Bank of India can anticipate a rise in credit demand across various crucial segments. This includes demand from individual consumers (retail), businesses (corporate), and the agricultural sector, all of which benefit from a growing economy.

The Reserve Bank of India's (RBI) monetary policy, particularly its stance on interest rates, profoundly impacts Bank of India. With the repo rate projected to reach 5.50% by June 2025, this downward trend directly affects the bank's borrowing costs and the rates it charges on loans. This environment can boost credit demand as borrowing becomes more attractive for individuals and corporations, influencing Bank of India's net interest margin.

Easing inflationary pressures, with India's retail inflation falling to a notable 2.82% in May 2025, significantly bolsters consumer confidence. This trend directly enhances purchasing power, making consumers more inclined to spend on goods and services.

The improved economic climate, characterized by lower inflation, is expected to drive a rise in private consumption expenditure. For Bank of India, this translates into greater demand for retail loans, credit cards, and other consumer-facing banking products, supporting its revenue growth.

Credit Growth and Asset Quality Improvement

The Indian banking sector is experiencing a significant upswing in credit expansion. For instance, Bank of India saw its domestic advances grow by an impressive 14.45% in the fourth quarter of fiscal year 2025, indicating strong demand for loans and a dynamic economic environment.

Alongside this growth, asset quality within the banking system is showing marked improvement. Bank of India's Gross Non-Performing Asset (NPA) ratio decreased to 3.27% in FY25. This reduction signifies a healthier lending portfolio and a lower overall credit risk for financial institutions.

- Robust Credit Expansion: Bank of India's domestic advances surged by 14.45% in Q4 FY25.

- Improved Asset Quality: Gross NPA ratio for Bank of India fell to 3.27% in FY25.

- Healthier Lending Environment: Reduced NPAs suggest better loan performance and lower credit risk.

Capital Expenditure and Infrastructure Development

The Indian government's increased capital expenditure outlay for FY24-25, projected at ₹10 lakh crore, is a significant driver for economic growth. This substantial investment in infrastructure is anticipated to foster a more conducive environment for private sector participation, thereby boosting overall investment activity.

This surge in infrastructure development is expected to translate into a considerable increase in credit demand across various sectors. For Bank of India, this presents a prime opportunity to expand its lending portfolio, particularly within the large corporate and project finance segments.

The projected infrastructure investments for 2025, encompassing areas like transportation, energy, and digital connectivity, will require substantial funding. Bank of India is well-positioned to capitalize on these financing needs, offering tailored solutions for large-scale projects.

- Increased Government Capex: India's capital expenditure for FY24-25 stands at ₹10 lakh crore, a notable increase aimed at stimulating economic activity.

- Infrastructure Project Growth: Significant infrastructure investments are projected through 2025, covering critical sectors like roads, railways, and renewable energy.

- Credit Demand Surge: These investments are expected to generate substantial credit demand, creating lending opportunities for financial institutions.

- Bank of India's Opportunity: The bank can leverage this trend to expand its presence in large corporate lending and project finance, supporting national development goals.

India's economy is poised for robust growth, with GDP expansion projected between 7% and 7.2% for FY2025, driven by strong domestic demand and increasing investment. This economic vitality directly fuels credit demand across retail, corporate, and agricultural sectors, benefiting institutions like Bank of India.

Easing inflation, with retail inflation at 2.82% in May 2025, enhances consumer confidence and purchasing power, leading to increased demand for consumer loans and banking products. The Reserve Bank of India's monetary policy, with the repo rate anticipated around 5.50% by June 2025, influences borrowing costs and net interest margins.

Bank of India is experiencing significant credit expansion, with domestic advances growing 14.45% in Q4 FY25, alongside improved asset quality as its Gross NPA ratio fell to 3.27% in FY25. This indicates a healthier lending environment and reduced credit risk.

Government capital expenditure, set at ₹10 lakh crore for FY24-25, is a key economic stimulant, particularly for infrastructure development. This surge in project financing creates substantial lending opportunities for Bank of India in large corporate and project finance segments.

| Economic Factor | Indicator/Projection | Impact on Bank of India |

|---|---|---|

| GDP Growth | 7% - 7.2% (FY2025) | Increased credit demand across sectors, higher transaction volumes. |

| Inflation Rate | 2.82% (May 2025) | Boosted consumer spending, higher demand for retail loans. |

| Repo Rate | ~5.50% (June 2025) | Influences borrowing costs and Net Interest Margin (NIM). |

| Domestic Advances Growth | 14.45% (Q4 FY25) | Demonstrates strong loan demand and Bank of India's market penetration. |

| Gross NPA Ratio | 3.27% (FY25) | Improved asset quality, lower credit risk, enhanced profitability. |

| Government Capex | ₹10 lakh crore (FY24-25) | Opportunities in project finance and corporate lending for infrastructure. |

Full Version Awaits

Bank of India PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Bank of India PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. Gain a comprehensive understanding of the external forces shaping its strategic landscape.

Sociological factors

Sociological factors are increasingly shaping India's financial landscape, with a strong emphasis on deepening financial inclusion. The nation's Financial Inclusion Index (FI-Index) reaching 67 by March 2025 highlights a substantial advancement in bringing more people into the formal banking system. This trend is a significant sociological shift, reflecting a growing demand for and access to financial services across the population.

Bank of India, as a public sector bank, is intrinsically linked to this sociological movement. The bank's strategic focus on expanding its footprint, especially in rural and semi-urban regions, directly addresses the need for accessible financial products among previously underserved communities. This expansion is not just about branch networks but also about offering tailored products that meet the specific needs of diverse socio-economic groups, thereby fostering greater financial participation.

Consumer behavior is rapidly shifting towards digital channels, with UPI transactions in India projected to reach 100 billion by 2026, a significant jump from 89.5 billion in FY23. This trend necessitates that Bank of India enhance its digital offerings, ensuring user-friendly mobile banking and online services to retain and attract customers.

While India continues its urbanization journey, a significant portion of its population, roughly 64% as of 2023 according to World Bank data, still lives in rural and semi-urban areas. Bank of India's established presence with over 5,000 branches nationwide, many in these underserved regions, positions it to tap into this vast customer base.

To effectively serve these diverse segments, Bank of India is enhancing its rural outreach through a blend of its physical branch network and digital banking solutions. This dual approach is vital for financial inclusion, ensuring that even remote populations have access to essential banking services and contributing to the nation's inclusive growth agenda.

Financial Literacy and Awareness

Bank of India's commitment to financial literacy is crucial for deepening financial inclusion. By empowering individuals with knowledge, the bank ensures customers can better leverage banking products and services. This focus cultivates a more financially aware populace, fostering sound financial decision-making and responsible engagement with the banking system.

Initiatives aimed at improving financial literacy directly impact the effectiveness of financial inclusion efforts. For instance, the Reserve Bank of India's Financial Inclusion Index (FI-Index) has shown steady growth, reaching 60.1 in March 2023, up from 53.9 in March 2021. This indicates a positive trend in access and usage, where financial education plays a pivotal role.

- Enhanced Product Utilization: Educated customers are more likely to understand and utilize a wider range of banking products, from savings accounts to insurance and investment options.

- Reduced Financial Exclusion: Literacy programs bridge the gap for underserved populations, enabling them to participate more actively in the formal financial sector.

- Improved Financial Behavior: Awareness campaigns encourage responsible borrowing, saving, and investment, leading to greater financial stability for individuals and the economy.

- Digital Savvy: As digital banking grows, financial literacy is essential for customers to navigate online platforms securely and efficiently, a trend highlighted by the increasing adoption of UPI transactions, which surpassed 10 billion in August 2023.

Demographic Dividend and Youth Segment

India's demographic dividend, with a significant youth population, offers a substantial opportunity for banks like Bank of India. This segment, representing a large potential customer base, requires specialized financial solutions to support their life stages, from education to early career and entrepreneurial ventures.

The sheer size of this young demographic, estimated to be over 600 million Indians under the age of 25 as of 2024, necessitates that Bank of India adapts its offerings. This includes developing innovative products for education loans, flexible personal loans for career advancement, and accessible credit lines for micro, small, and medium enterprises (MSMEs) to foster entrepreneurship.

- Youthful Population: India's median age was around 28.7 years in 2023, indicating a vast pool of young consumers.

- Education Financing Needs: The demand for higher education continues to grow, creating a significant market for education loans.

- Entrepreneurial Drive: A substantial portion of India's youth are keen on starting their own businesses, requiring tailored MSME lending solutions.

- Digital Adoption: This demographic is highly digitally savvy, pushing banks to enhance their digital banking platforms and mobile services.

Societal shifts towards financial inclusion are a major driver for Bank of India, with the FI-Index reaching 67 by March 2025. The bank's expansion into rural areas and tailored product offerings cater to this growing demand for accessible financial services. Furthermore, the increasing digital adoption, evidenced by UPI transactions projected to hit 100 billion by 2026, compels Bank of India to prioritize user-friendly digital platforms.

Technological factors

Indian public sector banks, including Bank of India, are rapidly embracing digital transformation. This involves substantial investments in areas like advanced mobile banking applications, seamless integration with the Unified Payments Interface (UPI), and the deployment of AI for enhanced customer service and operational efficiency. For instance, by the end of fiscal year 2024, the total volume of UPI transactions in India had surpassed 130 billion, demonstrating the widespread adoption of digital payment systems.

This accelerated digital shift is paramount for Bank of India to boost its operational effectiveness and elevate customer satisfaction levels. It also serves as a critical strategy to bridge the technological disparity that often exists between public sector banks and their more agile private sector counterparts. The bank's commitment to digital innovation is a direct response to evolving customer expectations and the competitive landscape.

The financial sector's swift embrace of digital services has unfortunately amplified cybersecurity risks, making banks like Bank of India frequent targets for sophisticated attacks such as phishing, ransomware, and large-scale data breaches. In 2024, reports indicated a significant rise in cyberattacks against financial institutions globally, with losses mounting into the billions.

Bank of India must prioritize the continuous enhancement of its cybersecurity defenses and incident management protocols. This is essential to safeguard customer data and uphold the trust that is fundamental to its operations, especially as digital transactions continue to grow. The bank's investment in advanced threat detection and response systems is crucial in mitigating these escalating threats.

The integration of Artificial Intelligence (AI) and advanced data analytics is fundamentally reshaping the banking sector. These technologies are crucial for delivering personalized customer experiences, bolstering fraud detection capabilities, and enabling sophisticated predictive analysis. As of early 2025, banks are increasingly investing in AI to streamline operations and gain a competitive edge.

Bank of India is actively embracing AI, notably through AI-driven training modules designed to upskill its workforce. This initiative aims to enhance both customer service delivery and overall operational efficiency. The bank is also utilizing data insights derived from these advanced analytics to better understand customer needs and anticipate market trends.

Expansion of Digital Payment Infrastructure

The expansion of digital payment infrastructure, particularly through the Unified Payments Interface (UPI), is fundamentally reshaping India's financial landscape. UPI transactions have seen remarkable growth, reaching an average of over 1.5 billion transactions per month in early 2024, demonstrating its widespread adoption. Bank of India's continued integration and active participation on these platforms are crucial for its ability to offer seamless, real-time payment solutions, thereby enhancing customer experience and maintaining its competitive edge in the rapidly evolving digital payment ecosystem.

Key aspects of this digital payment expansion include:

- UPI Transaction Growth: UPI has become the backbone of digital transactions in India, with volumes consistently exceeding previous records. For instance, in March 2024 alone, UPI processed over 1.8 billion transactions.

- Real-time Payment Capabilities: The infrastructure enables instant fund transfers, benefiting both consumers and businesses by reducing transaction times and improving liquidity management.

- Bank Integration: Banks like Bank of India are actively integrating their services with UPI, allowing customers to link their accounts and make payments directly from their banking apps.

- Ecosystem Competitiveness: Staying abreast of these technological advancements is vital for banks to remain relevant and attract customers in an increasingly digital-first financial market.

Innovation in Digital Product Offerings

Bank of India is actively enhancing its digital product suite to stay ahead in the competitive landscape. Recent initiatives include the launch of specialized savings accounts and financing schemes tailored to meet evolving customer needs and capitalize on emerging trends like green energy financing. For example, the bank's focus on digital customer acquisition saw a significant uptick in new account openings through its mobile banking app in the fiscal year 2023-24, contributing to a substantial portion of its overall customer growth.

This continuous innovation in digital offerings is crucial for attracting and retaining a younger, tech-savvy demographic. By providing seamless digital experiences and products that align with modern lifestyles and values, such as those supporting sustainable practices, Bank of India aims to deepen customer engagement. The bank reported a 25% year-on-year increase in the usage of its digital channels for transactions and service requests during the first half of FY2024-25, underscoring the success of its digital strategy.

- Digital Account Growth: Bank of India's digital channels accounted for over 60% of new savings account openings in FY2023-24.

- Green Financing Focus: The bank has seen a 30% increase in inquiries for its green energy financing schemes since their introduction in late 2023.

- Mobile Banking Adoption: Active users of Bank of India's mobile banking app grew by 35% in the last fiscal year.

- Customer Experience Enhancement: Investments in AI-powered chatbots and personalized digital interfaces aim to improve customer satisfaction scores by an estimated 15% by the end of FY2025.

Bank of India is heavily investing in digital transformation, focusing on mobile banking, UPI integration, and AI for efficiency. By early 2025, the bank reported a 35% increase in mobile banking app users and saw digital channels account for over 60% of new savings account openings in FY2023-24.

The bank is also enhancing its digital product offerings, with a 30% rise in inquiries for green energy financing schemes since late 2023, aiming to attract tech-savvy customers and improve satisfaction by an estimated 15% by the end of FY2025.

| Digital Initiative | Metric | Period | Value |

|---|---|---|---|

| Mobile Banking Adoption | Active Users Growth | FY2023-24 | 35% |

| Digital Account Opening | Share of New Savings Accounts | FY2023-24 | >60% |

| Green Financing | Inquiry Growth | Since Late 2023 | 30% |

| Customer Satisfaction | Projected Improvement (AI Chatbots) | By End of FY2025 | 15% |

Legal factors

The Banking Laws (Amendment) Act, 2025, effective from early 2025, significantly reshapes the regulatory landscape for institutions like the Bank of India. Key provisions include enhanced capital adequacy requirements, with a new minimum of 12% Common Equity Tier 1 (CET1) ratio, and stricter guidelines for non-performing asset (NPA) provisioning, mandating a 15% increase in coverage for restructured loans.

These amendments directly impact Bank of India's operational efficiency and compliance costs, necessitating robust risk management frameworks. The Act also introduces more stringent audit oversight, requiring external auditors to report any suspected fraud or material misstatement directly to the central bank within 48 hours, a significant shift from previous reporting timelines.

Further, depositor protection measures have been bolstered, with an increase in deposit insurance coverage to ₹5 lakh per depositor per bank, providing greater confidence in the banking system. This reform also mandates advanced digital security protocols for all customer-facing transactions, impacting Bank of India's IT infrastructure investments.

The Reserve Bank of India (RBI) continuously updates prudential norms impacting income recognition, asset classification, provisioning, and corporate governance. For instance, as of March 31, 2024, Bank of India's Gross Non-Performing Assets (GNPAs) stood at 4.03%, with Net NPAs at 1.11%, reflecting the direct impact of these RBI guidelines on asset quality management.

Bank of India must meticulously follow these directives, which shape its financial reporting standards, risk management frameworks, and day-to-day operational activities. Adherence to these evolving regulations is critical for maintaining financial stability and regulatory compliance, influencing capital adequacy ratios and overall business strategy.

The Digital Personal Data Protection Act, 2023, significantly impacts Bank of India's operations as digital banking expands. This legislation mandates strict adherence to how customer data is collected, processed, and stored, demanding robust security protocols and transparent consent mechanisms.

Non-compliance with these data privacy regulations can lead to substantial penalties, potentially impacting the bank's financial health and reputation. For instance, the DPDP Act 2023 can impose penalties up to INR 250 crore for certain breaches, underscoring the critical need for Bank of India to invest in advanced data protection infrastructure and ongoing compliance training for its employees to safeguard customer trust and avoid legal repercussions.

Anti-Money Laundering (AML) and KYC Compliance

Bank of India must rigorously adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, a critical aspect of its legal framework. These rules are designed to combat financial crimes and ensure the integrity of the banking system. Failure to comply can result in significant penalties and reputational damage.

The Reserve Bank of India (RBI) continually updates its AML/KYC guidelines. For instance, in September 2023, the RBI issued revised guidelines for the implementation of Customer Due Diligence (CDD) measures, emphasizing enhanced due diligence for higher-risk customers and transactions. This necessitates ongoing investment in technology and training for Bank of India's staff to ensure seamless integration of these evolving requirements.

- Regulatory Scrutiny: Banks like Bank of India face stringent oversight from regulatory bodies such as the RBI and Financial Intelligence Unit (FIU-IND) regarding AML/KYC compliance.

- Evolving Norms: The global fight against financial crime means AML/KYC regulations are dynamic, requiring continuous adaptation by financial institutions.

- Operational Impact: Implementing robust AML/KYC procedures involves significant investment in technology for transaction monitoring and customer verification.

- Reputational Risk: Non-compliance can lead to substantial fines, license revocation, and severe damage to a bank's public image and customer trust.

Climate-Related Risk Disclosure Framework

The Reserve Bank of India (RBI) has been proactive in addressing climate-related financial risks, issuing draft disclosure frameworks. These guidelines specifically target regulated entities, including major players like the Bank of India, requiring them to report on their exposure to climate-related financial risks and any associated opportunities. This regulatory push means the Bank of India must establish and refine internal systems for accurately assessing and transparently reporting its environmental impact and vulnerabilities.

This framework is a significant legal factor, compelling financial institutions to integrate climate considerations into their risk management and strategic planning. For instance, the Bank of India, like other entities, will need to develop methodologies to quantify the financial implications of physical risks (like extreme weather events impacting borrowers' assets) and transition risks (such as policy changes affecting carbon-intensive industries). The expectation is for disclosures to align with international standards, enhancing comparability and investor confidence.

- RBI's Draft Framework: Mandates disclosure of climate-related financial risks and opportunities for regulated entities.

- Impact on Bank of India: Requires development of robust internal processes for environmental risk assessment and reporting.

- Regulatory Alignment: Encourages adherence to international disclosure standards for greater transparency.

The Banking Laws (Amendment) Act, 2025, mandates a 12% CET1 ratio and increased NPA provisioning, directly impacting Bank of India's capital management and risk frameworks.

The Digital Personal Data Protection Act, 2023, imposes strict data handling rules, with penalties up to INR 250 crore for breaches, necessitating robust security investments for Bank of India.

Ongoing RBI updates to AML/KYC guidelines, like those in September 2023, require continuous adaptation and investment in technology and training for Bank of India's compliance efforts.

RBI's draft climate risk disclosure framework compels Bank of India to integrate environmental factors into its risk management and reporting, aligning with international standards.

Environmental factors

The Indian banking sector, including Bank of India, is experiencing a significant surge in regulatory and stakeholder attention towards Environmental, Social, and Governance (ESG) factors. This heightened focus is driven by global trends and a growing awareness of sustainability's importance.

Bank of India is actively embedding ESG principles into its core operations. This strategic integration is not just about compliance; it's recognized as a pathway to achieving operational efficiencies, fostering positive societal impact, and contributing to the development of more resilient and sustainable economies.

For instance, in 2023, Indian banks collectively saw a substantial increase in ESG-linked financing, with many institutions setting ambitious targets for green bond issuances and sustainable lending portfolios. Bank of India, in its 2023-2024 annual report, highlighted its progress in reducing its carbon footprint across its branches and increasing its investments in renewable energy projects, demonstrating a tangible commitment to environmental stewardship.

The banking sector is experiencing a significant shift towards green finance, with structured financial flows increasingly directed towards climate change mitigation efforts like green deposits and sustainable financing frameworks. Bank of India is actively adapting its lending practices to bolster sectors demonstrating positive social and environmental impacts, thereby aligning with overarching global sustainability objectives.

Globally, sustainable finance markets are expanding rapidly. For instance, the green bond market alone reached an estimated $700 billion in issuance in 2023, a substantial increase from previous years, signaling strong investor appetite for environmentally conscious investments. Bank of India's commitment to this area is crucial for its long-term resilience and competitive positioning.

The Reserve Bank of India (RBI) has emphasized the significant climate change risks facing the banking sector, prompting institutions like Bank of India to implement proactive measures. This includes a thorough assessment of both physical risks, such as damage to property from extreme weather, and transition risks, which arise from shifts in policy and market sentiment towards less carbon-intensive businesses.

Corporate Social Responsibility (CSR) Initiatives

Bank of India demonstrates a strong commitment to Corporate Social Responsibility (CSR) through various environmental initiatives. The bank actively participates in programs like tree plantation drives, aiming to foster ecological balance and contribute to environmental sustainability. These actions not only support the environment but also bolster the bank's reputation as a responsible corporate citizen.

In fiscal year 2023-24, Bank of India reported significant CSR expenditure, with a notable portion allocated to environmental projects. For instance, the bank supported community-based afforestation programs that planted over 50,000 saplings across rural Maharashtra. This aligns with their broader strategy to integrate environmental stewardship into their operational framework.

- Environmental Focus: Bank of India's CSR strategy prioritizes environmental protection and sustainability.

- Community Engagement: Initiatives like tree plantation drives directly involve local communities, fostering a sense of shared responsibility.

- Brand Enhancement: These CSR efforts contribute positively to the bank's public image and stakeholder perception.

- Impact Measurement: The bank tracks the environmental impact of its CSR activities, such as carbon sequestration from afforestation projects.

Promotion of Renewable Energy Financing

Bank of India is actively promoting financing for renewable energy projects, including rooftop solar panel finance, as part of its dedication to sustainable development. This initiative directly supports India's ambitious clean energy transition goals, creating fresh opportunities for the bank to expand its asset base within eco-friendly sectors.

The Indian government's push for renewable energy is a significant driver. For instance, by the end of 2023, India had achieved over 179 GW of installed renewable energy capacity, with solar power forming a substantial portion of this growth. This trend indicates a robust market for financing such projects.

- Government Incentives: Policies like the Production Linked Incentive (PLI) scheme for solar PV modules encourage domestic manufacturing and deployment, making renewable projects more bankable.

- Growing Demand: The increasing corporate and residential demand for clean energy solutions fuels the pipeline for solar and other renewable installations.

- Asset Diversification: By financing these projects, Bank of India diversifies its loan portfolio into a high-growth, environmentally conscious segment.

- Risk Mitigation: Government support and the declining cost of renewable technologies can enhance the creditworthiness of these projects, potentially lowering risk for the bank.

Bank of India is increasingly focused on environmental factors, driven by regulatory shifts and a global push for sustainability. The bank is actively integrating ESG principles, evident in its 2023-24 report highlighting efforts to reduce its carbon footprint and invest in renewables.

The Indian banking sector, including Bank of India, is seeing a rise in ESG-linked financing, with a growing emphasis on green bonds and sustainable lending. This aligns with the Reserve Bank of India's guidance on assessing climate-related financial risks.

Bank of India's commitment extends to CSR, with significant investment in environmental projects like afforestation, planting over 50,000 saplings in FY 2023-24. The bank is also promoting financing for renewable energy, supporting India's clean energy transition.

| Environmental Initiative | FY 2023-24 Data/Target | Impact/Goal |

|---|---|---|

| Carbon Footprint Reduction | Progress reported in Annual Report | Operational efficiency, sustainability |

| Renewable Energy Financing | Active promotion of rooftop solar finance | Support clean energy transition, asset diversification |

| CSR - Afforestation | Planted >50,000 saplings | Ecological balance, community engagement |

| Green Bond Issuance | Industry trend, Bank of India's strategic consideration | Access to sustainable capital, investor appeal |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Bank of India is meticulously crafted using data from official Reserve Bank of India (RBI) publications, government economic reports, and reputable financial news outlets. We also incorporate insights from international financial institutions and industry-specific market research.