Bank of India Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of India Bundle

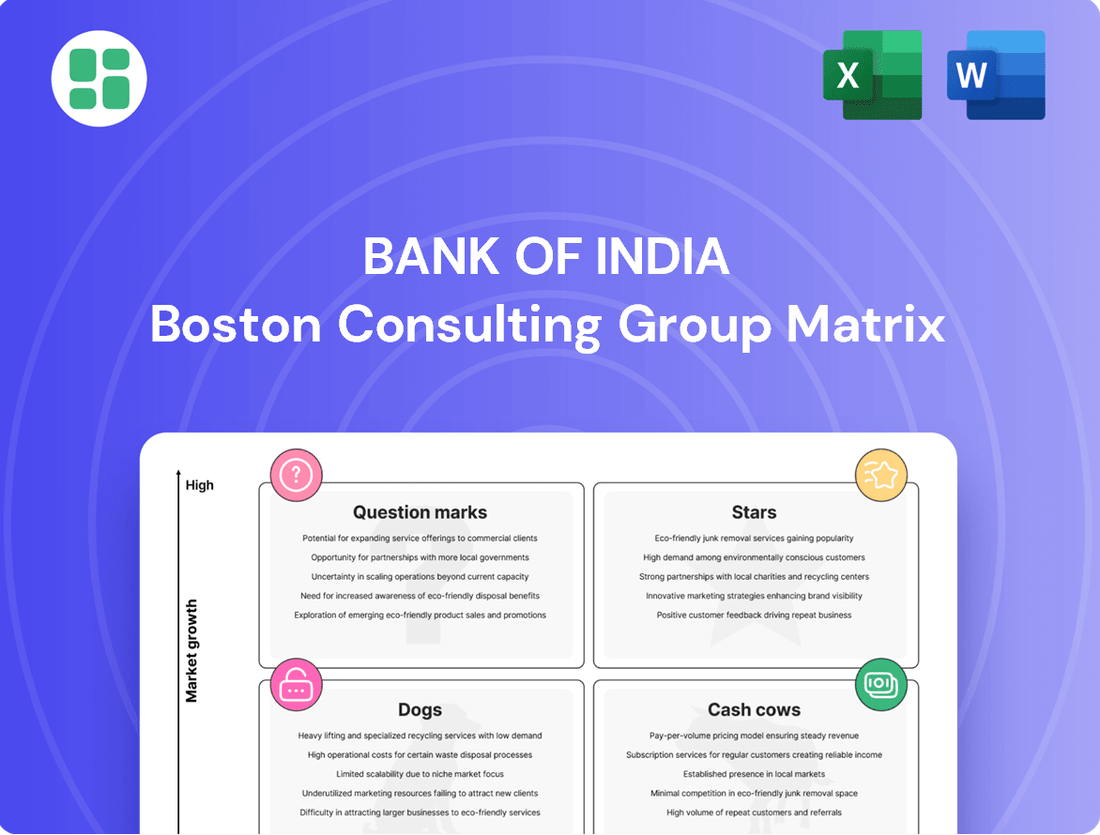

Unlock the strategic potential of the Bank of India by understanding its position within the BCG Matrix. Discover which of its offerings are market leaders, which are stable cash generators, and which require careful consideration for future investment. This essential analysis will illuminate your path to optimal resource allocation and growth.

Don't miss out on the complete picture! Purchase the full Bank of India BCG Matrix report to gain detailed quadrant placements, actionable insights, and a clear roadmap for strategic decision-making. Elevate your understanding and drive informed choices for the bank's future success.

Stars

Bank of India's retail loan portfolio, a significant component of its business, demonstrates a strong upward trajectory. This segment, which includes personal loans, home loans, and vehicle loans, has experienced impressive expansion.

The data from Q1 FY26 highlights this robust performance, with home loans registering a healthy 14% year-on-year increase. Furthermore, personal loans and vehicle loans have shown even more dynamic growth, exceeding 21% in the same period.

This substantial growth underscores the high market acceptance and increasing consumer demand for these retail credit products. Consequently, the retail loan segment is a pivotal contributor to Bank of India's overall revenue generation and market presence.

Bank of India's digital banking platform, specifically the BOI Mobile Omni Neo Bank app, is a clear star in its portfolio. This initiative is seeing impressive user growth, with over 10 million customers already onboarded via the mobile app.

The bank's overall digital transaction share has surged to approximately 95.4% as of Q1 FY26, a testament to the success of these digital efforts. This rapid adoption indicates a high-growth segment with substantial market penetration and future potential.

MSME advances at Bank of India are a significant growth driver, reflecting the bank's strategic focus on this vital economic sector. These advances saw a robust 18.39% year-on-year growth in the fourth quarter of fiscal year 2025, and continued this strong momentum with a 17% increase in the first quarter of fiscal year 2026.

This impressive growth underscores the MSME segment as a high-potential area for Bank of India, indicating an expanding market share and a successful strategy in serving these businesses. The bank's performance here suggests a positive outlook for its MSME lending portfolio.

Agriculture Advances

Agriculture Advances represent a significant growth area for Bank of India. The bank has seen its agriculture loan portfolio expand, with advances climbing by an impressive 16.30% in the fourth quarter of fiscal year 2025. This upward trend continued into the first quarter of fiscal year 2026, with a further 12% increase.

This sector is a key focus for public sector banks across India, and Bank of India's performance highlights its strength in this vital market. The sustained growth in agriculture advances underscores the bank's commitment and success in a high-demand segment.

- Consistent Growth: Agriculture loan advances rose by 16.30% in Q4 FY25 and 12% in Q1 FY26.

- Sector Priority: Agriculture remains a strategic priority for public sector banks in India.

- Market Position: Sustained growth in this high-demand market positions agriculture advances as a star performer for Bank of India.

Non-Interest Income (Fee-based and Treasury Gains)

Bank of India's non-interest income, driven by fee-based activities and treasury gains, has shown remarkable growth, contributing substantially to its profitability. This surge, evidenced by a 66.4% increase in Q1 FY26, underscores the bank's strategic focus on revenue diversification.

- Fee Income Growth: The bank has successfully boosted its fee-based income, a key indicator of its ability to generate revenue from services beyond traditional lending.

- Treasury Gains Contribution: Significant treasury gains have further bolstered non-interest income, reflecting effective management of the bank's investment portfolio.

- Revenue Diversification Success: The substantial rise in non-interest income highlights Bank of India's progress in reducing reliance on net interest income and building a more resilient revenue base.

- Leading Position: This strong performance in fee and treasury income suggests a competitive and leading position for Bank of India in these high-growth segments of the financial market.

Bank of India's digital banking platform, particularly the BOI Mobile Omni Neo Bank app, stands out as a star performer. With over 10 million customers onboarded and digital transactions comprising approximately 95.4% of the total in Q1 FY26, this segment demonstrates high growth and market penetration.

The MSME advances are another star, showing robust year-on-year growth of 18.39% in Q4 FY25 and continuing at 17% in Q1 FY26, indicating a strong market position and successful strategy in serving businesses.

Agriculture advances also shine, with a 16.30% increase in Q4 FY25 and 12% in Q1 FY26, reflecting Bank of India's commitment and success in this vital, high-demand sector.

Finally, non-interest income, boosted by a 66.4% surge in Q1 FY26 from fee-based activities and treasury gains, highlights effective revenue diversification and a leading position in high-growth financial market segments.

| Star Segment | Key Metric | Q1 FY26 Performance | Growth (YoY) |

|---|---|---|---|

| Digital Banking (BOI Mobile) | Customer Onboarding | 10 Million+ | High Growth |

| MSME Advances | Loan Growth | 17% | 17% (Q1 FY26) |

| Agriculture Advances | Loan Growth | 12% | 12% (Q1 FY26) |

| Non-Interest Income | Overall Growth | 66.4% | 66.4% (Q1 FY26) |

What is included in the product

Highlights which Bank of India units to invest in, hold, or divest based on market share and growth.

The Bank of India BCG Matrix provides a clear overview of business units, simplifying strategic decisions and alleviating the pain of resource allocation confusion.

Cash Cows

Bank of India's core deposit base acts as a significant Cash Cow, demonstrating a robust 9.07% year-on-year growth in its global deposits as of Q1 FY26.

This stable and low-cost funding, primarily from current and savings accounts (CASA) and retail term deposits, fuels the bank's operations without requiring substantial new investment.

The consistent cash flow generated by this mature segment underscores its Cash Cow status within the BCG Matrix.

Established Corporate Lending, a key component of Bank of India's portfolio, functions as a Cash Cow. This segment benefits from its maturity, consistently delivering reliable interest income. Corporate loans saw a robust 9.59% growth in Q4 FY25, bolstering the bank's total advances which surpassed ₹6 lakh crore.

The sheer scale and enduring relationships within this segment ensure it remains a substantial generator of stable revenue for Bank of India. This consistent performance underscores its role as a dependable income stream.

Bank of India's traditional branch network, numbering 5,148 as of March 2024, acts as a significant cash cow. This extensive physical footprint is crucial for acquiring new customers and delivering essential banking services.

The vast network ensures a stable and loyal customer base, consistently generating transaction volumes and deposits. While the pace of new branch openings might be slow, the existing branches provide a reliable revenue stream.

Government Business & Priority Sector Lending

Bank of India's involvement in government schemes and priority sector lending positions it firmly within the Cash Cows quadrant of the BCG matrix. As a public sector bank, these areas represent a substantial and consistent revenue stream, even if profit margins are sometimes narrower.

For the fiscal year 2024, Bank of India reported that priority sector lending accounted for a significant 44.08% of its Adjusted Net Bank Credit (ANBC). This demonstrates a considerable and stable business base mandated by regulatory requirements.

- Mandated Business: Government schemes and priority sector lending are core to Bank of India's operations, ensuring consistent business flow.

- Stable Revenue: While margins may be lower, these sectors provide a predictable and stable income source, contributing to overall financial health.

- Social Mandate: These activities fulfill the bank's social responsibility, aligning business objectives with national development goals.

- FY24 Performance: Priority sector lending represented 44.08% of ANBC, highlighting its substantial contribution to the bank's portfolio.

Interbank and Treasury Investments

Bank of India's Interbank and Treasury Investments act as a solid Cash Cow. These operations generate steady, low-risk income by effectively managing the bank's liquidity and investment portfolio. This segment is crucial for the bank's non-interest income, benefiting from gains on investments and foreign exchange transactions.

These treasury activities are a dependable source of both funds and profit, underpinned by well-established operational processes. For instance, in the fiscal year 2023-24, Bank of India reported a significant portion of its income from treasury operations, highlighting its role as a consistent revenue generator.

- Consistent Revenue: Treasury and interbank placements offer a stable income stream.

- Low Risk Profile: These investments are generally considered low-risk, contributing to financial stability.

- Non-Interest Income Driver: Gains from investments and forex trading boost non-interest earnings.

- Liquidity Management: Essential for managing the bank's overall financial health and operational needs.

Bank of India's retail lending portfolio, particularly its secured retail loans, represents a significant Cash Cow. These loans, which include home loans and vehicle loans, benefit from a large, established customer base and consistent demand, generating stable interest income.

The bank's focus on expanding its retail assets, which grew by 13.16% year-on-year as of Q1 FY26, highlights the strength of this segment. This steady growth in a mature market segment ensures a reliable cash flow without requiring extensive new investment or innovation.

The consistent performance and predictable returns from retail lending solidify its position as a key Cash Cow for Bank of India.

| Segment | BCG Status | Key Characteristics | FY24/FY25 Data Points |

|---|---|---|---|

| Core Deposit Base (CASA & Retail Term Deposits) | Cash Cow | Stable, low-cost funding, fuels operations | Global deposits grew 9.07% YoY (Q1 FY26) |

| Established Corporate Lending | Cash Cow | Maturity, reliable interest income, scale | Corporate loans grew 9.59% YoY (Q4 FY25); Total advances > ₹6 lakh crore |

| Traditional Branch Network | Cash Cow | Extensive physical presence, customer acquisition, stable revenue | 5,148 branches (as of March 2024) |

| Government Schemes & Priority Sector Lending | Cash Cow | Mandated business, stable revenue, social mandate | 44.08% of Adjusted Net Bank Credit (ANBC) in FY24 |

| Interbank & Treasury Investments | Cash Cow | Steady, low-risk income, liquidity management | Significant contribution to non-interest income (FY23-24) |

| Retail Lending (Secured) | Cash Cow | Large customer base, consistent demand, stable income | Retail assets grew 13.16% YoY (Q1 FY26) |

What You See Is What You Get

Bank of India BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully-formatted document you will receive upon purchase. This means the strategic insights and analysis presented are exactly what you will gain access to, ready for immediate application to Bank of India's portfolio.

Dogs

Despite a notable improvement in its overall asset quality, with the gross NPA ratio falling to 2.92% in Q1 FY26, Bank of India still grapples with legacy non-performing assets (NPAs). These older, problematic loans, often linked to specific government schemes, continue to represent a drain on the bank's resources.

These legacy NPAs yield minimal returns and necessitate substantial effort and ongoing costs for resolution and recovery. While the bank's proactive measures have reduced the overall NPA burden, managing these specific older assets remains a persistent challenge, impacting profitability and requiring continued provisioning.

Outdated manual processes within Bank of India, such as traditional cheque clearing or physical loan application processing, are likely categorized as Dogs in a BCG Matrix analysis. These operations, still reliant on paper-based systems and significant human intervention, are characterized by low growth and low market share in an increasingly digital banking landscape.

The operational costs associated with these manual functions are substantial, encompassing staffing, physical infrastructure, and error correction, without yielding proportionate returns. For instance, while digital transactions surged by over 40% year-on-year in India by early 2024, many legacy banking functions continued to bottleneck progress.

As customer preference and regulatory push favor digital channels, these manual processes are becoming increasingly obsolete and uncompetitive. Their inability to scale efficiently or attract new customers places them firmly in the Dog quadrant, requiring strategic decisions regarding their future, such as automation or divestment.

The Bank of India's international operations, while contributing to its global footprint, have certain ventures that are not meeting expectations. These underperforming segments, characterized by a low market share in their respective regions, are not significantly boosting the bank's overall profitability. For instance, some branches in emerging markets might be struggling against established local competitors.

These international ventures often grapple with intense regional competition and unique market dynamics, resulting in sluggish growth. This situation can lead to capital being tied up in these operations without generating adequate returns, impacting the bank's efficiency. As of the fiscal year ending March 31, 2024, while the bank's total international advances grew, specific regional performances varied, with some overseas operations showing slower growth compared to others.

Low-Value, High-Cost Physical Services

Low-value, high-cost physical services represent a significant challenge within the Bank of India's operational framework, particularly when viewed through the lens of the BCG Matrix. These services are characterized by their substantial reliance on physical infrastructure and manual processes, leading to elevated operational expenditures. Despite these costs, they often yield minimal transaction fees or attract limited customer engagement, placing them in a precarious position.

Examples of such services include extensive paper-based record keeping and certain traditional counter services. The operational costs associated with maintaining these legacy systems are considerable. For instance, in 2024, the cost of maintaining physical branches and associated staffing for traditional services continued to be a major expense for many banks, including Bank of India, even as digital alternatives gained traction.

The diminishing returns from these physical services are exacerbated by the rapid shift towards digital banking solutions. As customers increasingly opt for online and mobile platforms, the demand for in-person, paper-heavy transactions declines. This creates a scenario where the bank is investing heavily in infrastructure and personnel for services that are becoming obsolete, resulting in a negative cash flow and a weak market position.

- High Operational Costs: Maintaining physical branches and staff for traditional services incurred significant expenses for Bank of India in 2024.

- Low Revenue Generation: These services often generate minimal transaction fees, failing to cover their high operational outlays.

- Declining Customer Engagement: The shift to digital channels has led to reduced customer reliance on physical, paper-based banking services.

- Diminishing Returns: Investments in these legacy services yield increasingly poor financial outcomes as their relevance wanes.

Specific Niche Loan Products with Low Uptake

Bank of India, like many financial institutions, has explored niche loan products to diversify its offerings. However, some of these specialized segments have struggled to gain market traction, leading to low uptake. For instance, initiatives targeting very specific artisanal crafts or highly localized agricultural sub-sectors may have faced challenges in terms of borrower awareness, product suitability, or the sheer scale of the addressable market.

These underperforming niche products often result in a disproportionate administrative burden relative to the business generated. The costs associated with marketing, underwriting, and servicing these loans can outweigh the interest income and fees collected. This scenario places them in a position akin to a 'Dog' in the Boston Consulting Group (BCG) matrix, consuming resources without contributing significantly to the bank's overall growth or profitability.

- Low Disbursement Rates: Certain specialized loans, such as those for niche renewable energy installations or specific types of small-scale manufacturing, might have seen disbursements well below initial projections. For example, a pilot program for financing bespoke furniture makers in 2023 might have only achieved 15% of its targeted disbursement volume.

- High Servicing Costs: The specialized nature of these loans often requires tailored servicing protocols and potentially more intensive monitoring, driving up administrative overhead per loan. This can make the cost-to-income ratio for these products significantly higher than for mainstream lending.

- Negligible Book Contribution: Despite marketing efforts, these products may represent less than 0.5% of the bank's total loan book. This lack of scale means they do not contribute meaningfully to overall asset growth or market share expansion.

- Strategic Re-evaluation Needed: Products consistently demonstrating these characteristics are candidates for discontinuation or a significant overhaul to address the underlying market or product design issues.

Bank of India's legacy manual processes, such as physical cheque clearing, are prime examples of 'Dogs' in the BCG Matrix. These operations are characterized by low market share in an increasingly digital banking environment and low growth potential. Their substantial operational costs, stemming from staffing and infrastructure, far outweigh the minimal returns they generate.

Underperforming international ventures and low-value, high-cost physical services also fall into the Dog category. These segments tie up capital without significant profitability, facing intense competition and declining customer engagement due to the shift towards digital banking. For instance, while digital transactions in India saw substantial growth by early 2024, these legacy functions remained bottlenecks.

Certain niche loan products have also struggled to gain market traction, leading to low disbursement rates and high servicing costs. These products contribute negligibly to the bank's loan book, necessitating a strategic re-evaluation. As of the fiscal year ending March 31, 2024, overseas operations showed varied performance, with some regions exhibiting slower growth, reinforcing the 'Dog' classification for underperforming segments.

| Category | Characteristics | Bank of India Example | Market Growth | Relative Market Share |

| Dogs | Low growth, low market share | Legacy manual processes (e.g., cheque clearing) | Declining | Low |

| Dogs | Low growth, low market share | Underperforming international ventures | Varies by region, often slow | Low |

| Dogs | Low growth, low market share | Low-value, high-cost physical services | Declining | Low |

| Dogs | Low growth, low market share | Underperforming niche loan products | Low | Low |

Question Marks

Bank of India is strategically positioning itself to capture the burgeoning green finance market, aiming to cultivate a substantial portfolio in areas like commercial solar plants, electric vehicle (EV) financing, and residential solar rooftop installations. This focus aligns with a global shift towards sustainability and supportive government policies, signaling a high-potential growth trajectory.

While the exact current contribution of these green initiatives to Bank of India's overall loan book is likely small, this represents a classic 'question mark' scenario within a BCG matrix framework. The nascent stage suggests significant room for expansion and market share gains as the bank scales its green lending operations.

For context, the Indian renewable energy sector alone attracted approximately $24.1 billion in investment between 2014 and 2023, with solar power being a dominant force. Bank of India's entry into this space, particularly with a focus on rooftop solar and EV financing, taps into a rapidly expanding segment driven by both consumer demand and regulatory push.

Bank of India's wealth management and investment advisory services are in a growth phase, though its market share may trail leading private sector banks. The Bank of India Mutual Fund, however, has demonstrated robust Assets Under Management (AUM) growth, reaching ₹50,000 crore as of March 2024, signaling strong potential in this segment.

While the mutual fund arm shows promise, the bank's broader wealth management product suite is still working towards wider market acceptance and deeper penetration. This suggests an opportunity for Bank of India to leverage its existing customer base and expand its advanced product offerings to capture a larger share of the rapidly expanding Indian wealth management market.

Bank of India is actively exploring new digital lending avenues, such as instant micro-loans, to meet evolving customer needs. These initiatives, including potential collaborations with fintech firms, aim to provide rapid credit access.

While these digital products address a rising demand for quick credit, they are currently in their nascent stages of market penetration. Substantial investment is necessary to expand their reach and secure a significant market share.

Targeted International Expansion

Targeted international expansion for Bank of India could be classified as a Question Mark in the BCG Matrix. This involves focusing on specific emerging markets or niche cross-border financial services. These areas offer significant growth potential but currently represent a small portion of the bank's global market share, necessitating considerable investment and strategic planning to gain traction.

For instance, expanding digital banking solutions into Southeast Asian economies like Vietnam or the Philippines, which are experiencing rapid economic growth and increasing internet penetration, could fit this category. As of early 2024, Vietnam's digital payment market alone was projected to grow significantly, presenting a prime opportunity for a bank with established technological capabilities.

- Emerging Market Focus: Targeting countries with high GDP growth forecasts, such as those in Africa or parts of South Asia, where the bank can establish an early presence.

- Specialized Services: Developing and marketing niche financial products, like trade finance solutions for specific industries or wealth management for expatriate communities in growing economies.

- Investment Requirement: These ventures demand substantial upfront capital for market research, regulatory compliance, technology integration, and building local partnerships.

- Risk and Reward: While the potential for high returns exists due to untapped market demand, the risk of failure is also elevated due to intense competition and unfamiliar regulatory landscapes.

AI and Data Analytics for Personalized Banking

Bank of India's investment in AI and data analytics for personalized banking, predictive insights, and fraud detection represents a strategic move into a high-potential, yet currently developing, market segment. While these technologies are foundational for future growth and operational efficiency, their immediate, quantifiable revenue impact may still be emerging.

The bank is focusing on leveraging advanced analytics to tailor customer experiences, offering personalized product recommendations and proactive support. For instance, in 2024, many leading banks reported significant increases in customer engagement metrics following the implementation of AI-driven personalization tools.

Furthermore, predictive insights powered by AI are crucial for anticipating customer needs and market shifts. Enhanced fraud detection capabilities, a key application of data analytics, are also critical in safeguarding assets and maintaining customer trust. By 2024, financial institutions globally were investing billions in cybersecurity and fraud prevention technologies, with AI playing a central role.

- Personalized Customer Experiences: AI algorithms analyze customer data to offer tailored product suggestions and financial advice, aiming to boost engagement and loyalty.

- Predictive Insights: Advanced analytics help forecast customer behavior, market trends, and potential risks, enabling proactive decision-making.

- Enhanced Fraud Detection: AI models identify and flag suspicious transactions in real-time, significantly reducing financial losses and protecting customers.

- Strategic Investment Area: While promising high future growth, the current direct revenue contribution of these technologies is still developing, classifying them as a 'Question Mark' requiring continued strategic investment.

Bank of India's foray into green finance, including EV and solar financing, represents a classic 'Question Mark' in the BCG matrix. While the market potential is significant, with the Indian renewable energy sector attracting substantial investment, the current contribution to the bank's loan book is nascent. This segment requires considerable investment to scale and capture market share.

Similarly, the bank's expansion in wealth management and digital lending initiatives, such as micro-loans, are also categorized as 'Question Marks'. These areas show promising growth, evidenced by the ₹50,000 crore AUM for Bank of India Mutual Fund as of March 2024, but they are still in the early stages of market penetration and require strategic investment to achieve significant market share.

International expansion into specific emerging markets and the development of AI and data analytics for personalized banking are also 'Question Marks'. These ventures offer high growth potential but demand substantial capital and strategic planning to navigate competitive and regulatory landscapes, with AI's direct revenue impact still developing.

| Segment | BCG Category | Key Characteristics | Market Potential | Investment Needs |

| Green Finance (EV, Solar) | Question Mark | Nascent but high-growth potential, driven by sustainability trends and government support. | Significant, with India's renewable energy sector attracting billions. | Substantial for scaling operations and market penetration. |

| Wealth Management | Question Mark | Growing market, with strong performance in mutual funds (₹50,000 crore AUM as of March 2024), but broader product suite needs development. | Rapidly expanding Indian wealth market. | Leveraging customer base and expanding advanced product offerings. |

| Digital Lending (Micro-loans) | Question Mark | Addresses rising demand for quick credit; currently in early stages of market penetration. | Growing demand for rapid credit access. | Requires substantial investment for reach and market share. |

| International Expansion (Emerging Markets) | Question Mark | Focus on specific high-growth emerging markets, offering early presence opportunities. | High GDP growth forecasts in target regions. | Significant capital for research, compliance, technology, and partnerships. |

| AI & Data Analytics | Question Mark | Foundational for future growth and efficiency; direct revenue impact still emerging. | High potential for personalized banking and predictive insights. | Continued strategic investment for development and implementation. |

BCG Matrix Data Sources

Our Bank of India BCG Matrix leverages official annual reports, Reserve Bank of India data, and market research reports to provide a comprehensive view of the bank's business units.