Bank of India Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of India Bundle

Unlock the strategic blueprint behind Bank of India's operations with our comprehensive Business Model Canvas. This detailed analysis reveals how they attract customers, build partnerships, and generate revenue in a dynamic market. Discover the core components that drive their success and gain actionable insights for your own ventures.

Partnerships

As a public sector bank, Bank of India's key partnerships include the Reserve Bank of India (RBI) and the Government of India. These relationships are vital for ensuring regulatory adherence and participating in crucial government initiatives.

The bank actively engages with government-sponsored schemes, such as the Pradhan Mantri Mudra Yojana (PMMY), which aims to provide loans to micro and small enterprises. In 2023-24, PMMY disbursed over ₹2.28 lakh crore, highlighting the scale of these partnerships.

Furthermore, these partnerships facilitate capital infusions from the government, which are essential for strengthening Bank of India's financial standing and supporting its growth objectives. For instance, the government has provided capital support to public sector banks to enhance their capital adequacy ratios.

Bank of India actively collaborates with fintech companies and digital solution providers to bolster its digital banking capabilities. These partnerships are vital for integrating cutting-edge technologies, thereby enriching customer experiences across mobile banking and online payment platforms.

For instance, in 2024, Bank of India continued to leverage these alliances to enhance its digital offerings, aiming to improve operational efficiency and expand its customer reach. Such strategic integrations are key to staying competitive in the rapidly evolving digital financial landscape.

Bank of India collaborates with insurance providers through bancassurance agreements, expanding its product portfolio to include life, health, and general insurance. This strategic move diversifies the bank's revenue streams by generating fee-based income and offers customers a more complete suite of financial services.

Other Banks and Financial Institutions

Bank of India's partnerships with other banks and financial institutions are crucial for its operations. These alliances enable smooth interbank transactions, allowing for efficient fund transfers and liquidity management. For instance, in 2023-24, Bank of India participated in various interbank market operations, contributing to the overall stability of the financial system.

Collaborations also extend to co-lending arrangements and participation in syndicated loans. These structured partnerships allow the bank to share risks and increase its lending capacity, particularly for large-scale corporate financing. In FY24, the bank actively engaged in syndicated loan facilities, diversifying its credit portfolio and supporting significant infrastructure and industrial projects across India.

These strategic alliances are instrumental in expanding Bank of India's reach, both domestically and internationally. By working with other financial entities, the bank can tap into new markets and customer segments, while also enhancing its risk management capabilities through shared expertise and capital. This network of partnerships underpins its ability to offer a comprehensive suite of financial products and services.

- Interbank Transactions: Facilitates seamless fund transfers and liquidity management.

- Co-lending & Syndicated Loans: Enhances lending capacity and diversifies risk for larger projects.

- Market Reach: Expands access to new domestic and international markets.

- Risk Management: Strengthens risk mitigation through shared expertise and capital.

Technology and Infrastructure Providers

Bank of India strategically partners with technology and infrastructure providers to ensure its vast IT systems and cybersecurity are robust and up-to-date. These alliances are crucial for maintaining secure, reliable, and efficient banking operations across all customer touchpoints. For instance, in 2024, the bank continued its focus on digital transformation, leveraging partnerships to enhance its core banking solutions and expand its digital service offerings.

These collaborations enable the bank to adapt to evolving technological landscapes and regulatory requirements, ensuring a seamless customer experience. Partnerships with cloud service providers and network infrastructure companies are key to scaling operations and improving service delivery.

- IT System Upgrades: Collaborations with vendors like Infosys Finacle for core banking system enhancements are ongoing.

- Cybersecurity Enhancements: Partnerships with leading cybersecurity firms to fortify defenses against digital threats.

- Infrastructure Modernization: Investments in modernizing ATM networks and data centers through alliances with hardware and connectivity providers.

- Digital Platform Development: Working with fintech partners to integrate new digital payment solutions and customer engagement tools.

Bank of India's key partnerships extend to government entities, fintech innovators, insurance providers, and other financial institutions. These collaborations are vital for regulatory compliance, digital advancement, product diversification, and operational efficiency. For example, in 2023-24, Bank of India continued to leverage its bancassurance partnerships to offer a wider range of insurance products, contributing to its fee-based income growth.

These alliances are crucial for enhancing its digital banking capabilities and expanding its market reach. In 2024, the bank actively worked with technology partners to upgrade its IT systems and cybersecurity measures, ensuring secure and seamless customer transactions. Such partnerships are fundamental to staying competitive and offering comprehensive financial solutions.

Collaborations with other banks and financial institutions facilitate essential interbank transactions and risk-sharing through co-lending and syndicated loans. These partnerships bolster the bank's lending capacity for large projects and improve liquidity management, as seen in its active participation in market operations during FY24.

The bank also partners with technology and infrastructure providers to maintain robust IT systems and cybersecurity. In 2024, these efforts focused on digital transformation, enhancing core banking solutions and expanding digital service offerings through alliances with firms like Infosys Finacle for system enhancements.

What is included in the product

A comprehensive, pre-written business model tailored to Bank of India's strategy, covering customer segments, channels, and value propositions in detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for informed decision-making.

The Bank of India Business Model Canvas serves as a pain point reliever by offering a clear, one-page snapshot of its core banking operations, allowing for quick identification of inefficiencies and areas for improvement.

Activities

Bank of India's key activity centers on attracting and managing a diverse range of deposits, from everyday savings and current accounts to term deposits for individuals, businesses, and institutional clients. This forms the bedrock of the bank's financial stability.

In fiscal year 2024, Bank of India reported a significant growth in its deposit base, reaching ₹6,72,757 crore. This robust increase underscores the success of their deposit mobilization strategies, providing ample liquidity to fuel lending activities and overall business operations.

Bank of India's core function revolves around offering a wide array of lending products. This includes everything from home and vehicle loans for individuals to substantial credit facilities for corporations, the agricultural sector, and Micro, Small, and Medium Enterprises (MSMEs).

The process involves meticulous credit appraisal to gauge borrower risk, followed by the efficient disbursement of funds and ongoing monitoring. This diligent approach is crucial for maintaining the quality of the bank's loan portfolio and ensuring consistent revenue streams through interest income.

As of March 31, 2024, Bank of India reported a Gross Non-Performing Asset (GNPA) ratio of 4.10%, demonstrating its ongoing efforts in credit management. The bank's net advances stood at ₹5,68,216 crore for the fiscal year ending March 2024, highlighting the significant volume of its lending activities.

Bank of India actively develops, maintains, and upgrades its digital banking platforms. This includes their mobile banking application and internet banking services, ensuring customers have convenient access to their accounts and a wide range of banking transactions.

A significant focus is placed on investing in robust cybersecurity measures and enhancing IT infrastructure. This is crucial for safeguarding customer data and ensuring the reliable, secure, and uninterrupted delivery of digital banking services, a critical component for customer trust and operational efficiency.

In 2024, the bank continued to push for digital adoption. For instance, as of September 2023, Bank of India reported a substantial increase in digital transactions, with mobile banking transactions alone seeing a significant year-on-year growth, reflecting the success of their technology enhancement efforts.

Foreign Exchange and Trade Finance Operations

Bank of India actively facilitates foreign exchange and trade finance operations, a crucial component for its corporate and institutional clients engaged in international commerce. These services are designed to manage currency fluctuations and streamline the complexities of cross-border transactions, thereby generating significant non-interest income for the bank.

In 2024, the bank's commitment to supporting global trade is evident. For instance, Bank of India's trade finance portfolio, encompassing services like letters of credit and guarantees, plays a vital role in mitigating risks for businesses involved in import and export activities. This segment is a key contributor to the bank's overall financial performance.

- Foreign Exchange Services: The bank offers a comprehensive suite of forex products, including spot and forward contracts, to help clients manage currency exposure and execute international payments efficiently.

- Trade Finance Solutions: Bank of India provides essential trade finance instruments such as Letters of Credit, Bank Guarantees, and Bills Discounting to facilitate smooth international trade for its customers.

- Risk Management: A core activity involves advising clients on and implementing strategies to hedge against foreign exchange rate volatility, protecting their profit margins in global markets.

- Contribution to Income: These operations are a significant driver of non-interest income, reflecting the bank's expertise in international banking and its role as a facilitator of global business.

Wealth Management and Financial Advisory

Bank of India's wealth management and financial advisory services are crucial for catering to high-net-worth individuals and other client segments. This involves offering a diverse range of investment products, personalized portfolio management, and comprehensive financial planning. These activities not only diversify the bank's revenue streams but also deepen client relationships by providing tailored financial solutions.

In 2024, the Indian wealth management market continued its robust growth trajectory, driven by increasing disposable incomes and a growing investor base. Bank of India actively participates in this segment, aiming to capture a larger market share. For instance, the bank's focus on digital platforms for advisory services saw increased adoption, reflecting a broader trend in the financial sector.

- Investment Product Distribution: Offering a wide array of mutual funds, equities, bonds, and alternative investment options.

- Portfolio Management Services (PMS): Providing customized investment strategies and active management for client portfolios.

- Financial Planning: Assisting clients with retirement planning, estate planning, and goal-based investment strategies.

- Digital Wealth Solutions: Enhancing client experience through online advisory tools and seamless transaction platforms.

Bank of India actively manages its balance sheet through treasury operations. This involves investing in government securities and other permissible instruments to maintain liquidity and generate stable returns. They also manage the bank's overall funding profile and interest rate risk.

In fiscal year 2024, Bank of India's investment portfolio demonstrated prudent management. The bank held a significant portion of its assets in government securities, providing a stable income stream and meeting regulatory liquidity requirements. This strategic allocation supports their overall financial health.

Bank of India's treasury operations are vital for its financial stability and profitability. As of March 31, 2024, the bank's investments in government securities and other instruments amounted to ₹2,15,487 crore, contributing to its overall asset base and income generation.

| Activity | Description | Fiscal Year 2024 Data |

|---|---|---|

| Deposit Mobilization | Attracting and managing various types of customer deposits. | Deposit Base: ₹6,72,757 crore |

| Lending Operations | Providing diverse loan products to individuals and businesses. | Net Advances: ₹5,68,216 crore; GNPA Ratio: 4.10% |

| Digital Banking Enhancement | Developing and maintaining secure online and mobile banking platforms. | Significant year-on-year growth in mobile banking transactions (as of Sep 2023) |

| Foreign Exchange & Trade Finance | Facilitating international trade and managing currency risks for clients. | Key contributor to non-interest income through forex and trade services. |

| Wealth Management & Advisory | Offering investment products and financial planning to clients. | Focus on digital advisory services with increasing client adoption. |

| Treasury Operations | Managing liquidity, investments, and funding profile. | Investments in government securities: ₹2,15,487 crore |

Preview Before You Purchase

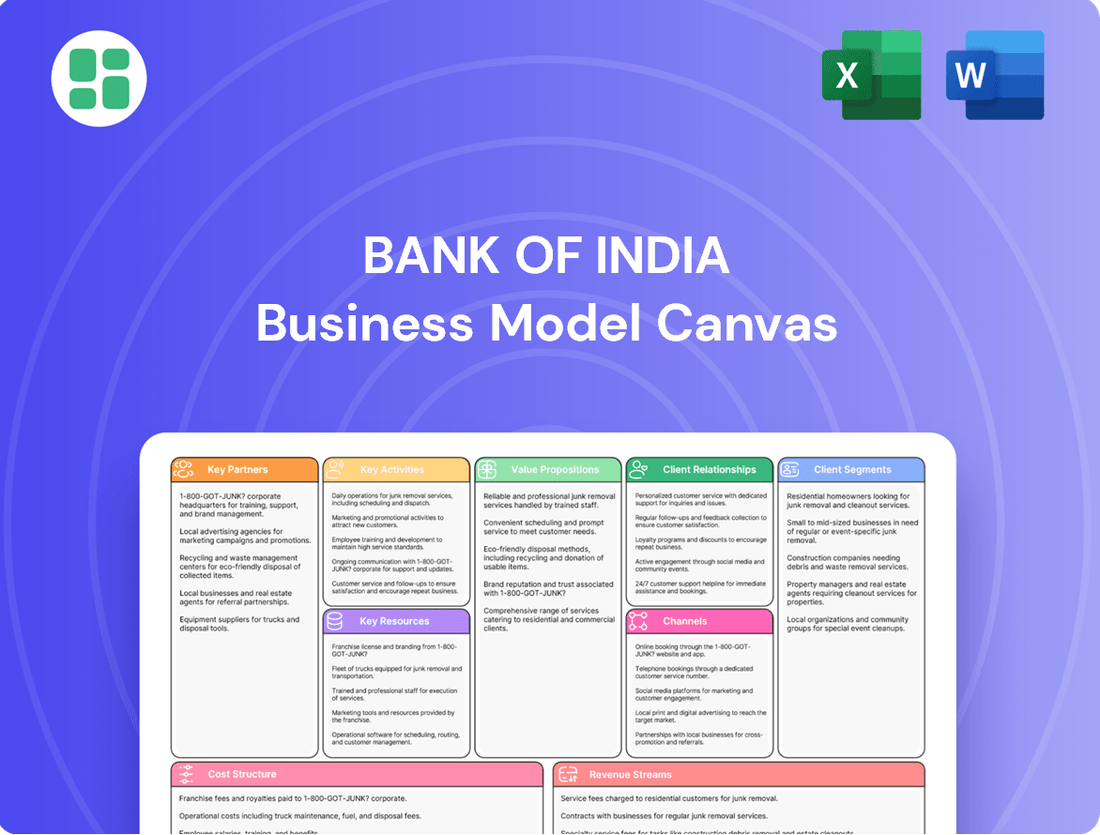

Business Model Canvas

The Bank of India Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive snapshot showcases the core elements of the bank's strategy, including its key partners, activities, value propositions, customer relationships, customer segments, key resources, channels, cost structure, and revenue streams. You can be assured that the content and formatting displayed here are precisely what you will get, ready for your analysis and application.

Resources

Bank of India boasts an extensive physical network, a cornerstone of its business model. As of March 31, 2024, the bank operated 5,075 branches, a substantial number that underscores its commitment to widespread accessibility across India.

This vast network, including 4,896 domestic branches and 179 overseas branches, is particularly crucial for deposit mobilization, especially in semi-urban and rural regions where digital penetration might be lower. The sheer scale of its presence provides a significant competitive edge.

Complementing its branch network, Bank of India also maintained 9,964 ATMs as of the same date. This robust ATM infrastructure further enhances customer convenience and service delivery, allowing for easy cash withdrawals and other banking transactions, thereby strengthening customer relationships and loyalty.

Bank of India's human capital is a cornerstone, featuring a robust team of banking professionals, IT specialists, and dedicated relationship managers. This skilled workforce is essential for navigating complex financial landscapes and delivering exceptional customer service. For instance, as of March 31, 2024, Bank of India reported a total workforce of 48,375 employees, underscoring the scale of its human resource investment.

Bank of India's robust IT infrastructure and digital platforms are critical resources, underpinning its operational efficiency and customer service delivery. The bank leverages advanced IT systems and secure data centers to manage vast amounts of financial data and process transactions seamlessly. In 2024, the bank continued to invest heavily in these areas, recognizing their importance in the digital age.

Key to this strategy is the 'BOI Mobile Omni Neo Bank' app, a prime example of their digital banking platform. This app, along with other digital channels, facilitates a wide range of modern banking services, from account management to loan applications, directly to customers. This digital push is essential for meeting evolving customer expectations and maintaining a competitive edge in the financial sector.

Strong Brand Reputation and Trust

Bank of India, as a public sector bank with a heritage stretching back decades, enjoys a robust brand reputation and a deep well of public trust. This intangible asset is foundational to its business model, serving as a significant draw for new customers and a key factor in retaining existing ones within the highly competitive banking sector. For instance, in fiscal year 2023-24, Bank of India reported a significant increase in its customer base, a testament to the enduring trust placed in its services.

This established trust translates directly into customer loyalty and a willingness to engage with the bank's diverse financial products and services. It acts as a powerful differentiator, allowing Bank of India to compete effectively against newer, often more agile private sector banks. The bank's consistent performance and commitment to customer service have solidified its standing.

- Brand Equity: Bank of India's long-standing presence and history of reliable service build significant brand equity.

- Customer Trust: Public sector status and a track record of stability foster high levels of trust among depositors and borrowers.

- Competitive Advantage: This reputation helps attract and retain customers, reducing customer acquisition costs and increasing lifetime value.

- Market Perception: In FY24, the bank's market capitalization reflected investor confidence, partly driven by its strong brand perception.

Capital Base and Financial Reserves

The Bank of India's capital base and financial reserves are crucial for its operational stability and lending power. These resources act as a buffer against unexpected financial shocks and ensure the bank can continue its core functions, including providing credit to businesses and individuals. A strong capital foundation is directly linked to a bank's capacity to take on new loans and investments.

Government capital infusions play a significant role in bolstering the Bank of India's financial reserves. For instance, as of March 31, 2023, the bank's total capital adequacy ratio (CAR) stood at 14.76%, exceeding the regulatory requirement. This indicates a healthy cushion to absorb potential losses.

The bank's commitment to maintaining robust financial reserves is evident in its strategic planning. These reserves are not only for regulatory compliance but also to support future growth initiatives and ensure long-term financial health.

- Capital Adequacy Ratio (CAR): The Bank of India maintained a CAR of 14.76% as of March 31, 2023, demonstrating a strong capital position relative to its risk-weighted assets.

- Tier 1 Capital: This forms the core of the bank's capital. Specific figures for Tier 1 capital are integral to assessing the quality of the bank's capital base.

- Retained Earnings: Profits retained by the bank contribute to its reserves, enhancing its financial strength and ability to fund operations and growth.

- Government Support: Past capital injections from the government have historically strengthened the bank's capital base, providing a vital layer of financial security.

Bank of India's extensive physical network, comprising 5,075 branches and 9,964 ATMs as of March 31, 2024, is a primary resource for deposit mobilization and customer service. This widespread presence, including 4,896 domestic and 179 overseas branches, ensures accessibility, particularly in less digitized areas. The bank’s robust IT infrastructure and digital platforms, including the 'BOI Mobile Omni Neo Bank' app, are also critical, enabling efficient operations and modern banking services.

The bank's human capital, numbering 48,375 employees as of March 31, 2024, provides the expertise needed for complex financial operations and customer engagement. This skilled workforce is supported by a strong brand reputation and public trust, built over decades of reliable service as a public sector bank. This trust translates into customer loyalty and a competitive advantage.

Bank of India's financial strength is underpinned by its capital base and reserves, with a Capital Adequacy Ratio (CAR) of 14.76% as of March 31, 2023, exceeding regulatory norms. Government capital infusions have historically bolstered these reserves, ensuring operational stability and lending capacity. Retained earnings further contribute to financial health, supporting growth and long-term viability.

| Key Resource | Description | As of March 31, 2024 (unless otherwise stated) | Significance |

| Physical Network | Branches and ATMs | 5,075 Branches (4,896 Domestic, 179 Overseas); 9,964 ATMs | Widespread accessibility, deposit mobilization, customer service |

| Human Capital | Employees | 48,375 | Expertise in financial services, customer relationship management |

| IT Infrastructure & Digital Platforms | Core banking systems, mobile app | Continued investment in advanced IT systems and secure data centers; 'BOI Mobile Omni Neo Bank' app | Operational efficiency, seamless transactions, modern service delivery |

| Brand Reputation & Customer Trust | Public sector status, heritage | Strong public trust and brand equity | Customer acquisition and retention, competitive advantage |

| Capital Base & Financial Reserves | Capital Adequacy Ratio (CAR) | 14.76% (as of March 31, 2023) | Operational stability, lending capacity, buffer against shocks |

Value Propositions

Bank of India provides a broad spectrum of financial solutions, encompassing everything from everyday savings and checking accounts to specialized services like trade finance and NRI banking. This extensive offering ensures that individuals, small businesses, and large corporations can find tailored financial products to meet their unique requirements.

In 2024, Bank of India reported a robust growth in its retail loan portfolio, demonstrating strong demand for its diverse lending products. The bank's commitment to offering comprehensive services, including wealth management and investment advisory, further solidifies its position as a one-stop financial partner for its clientele.

Bank of India's status as a public sector bank is a cornerstone of its value proposition, fostering deep trust and reliability. This government backing provides a significant safety net, reassuring customers about the security of their deposits, especially crucial in volatile economic climates. For example, as of March 31, 2024, Bank of India reported a robust Capital Adequacy Ratio of 15.23%, well above the regulatory requirement, underscoring its financial strength and stability.

Bank of India’s extensive accessibility and pan-India presence is a cornerstone of its business model, ensuring customers can bank anytime, anywhere. The bank boasts a significant network of 5,100+ branches and 5,000+ ATMs spread across the country, catering to diverse geographical needs, from bustling metros to remote villages.

This widespread physical footprint is complemented by a robust digital infrastructure. Through its mobile banking and internet banking platforms, Bank of India offers seamless transactions and account management, significantly enhancing convenience and reach for its vast customer base, particularly in 2024.

Competitive Interest Rates and Product Offerings

Bank of India aims to attract and retain customers by providing attractive interest rates on savings accounts, fixed deposits, and various loan products. In fiscal year 2023-24, the bank maintained a competitive stance, with retail term deposit rates often ranging up to 7.25% for select tenures, and home loan interest rates starting from competitive levels, often linked to external benchmarks.

The bank also focuses on developing specialized financial products catering to diverse customer needs. This includes tailored solutions for the agricultural sector, such as crop loans with favorable terms, and dedicated financing schemes for Micro, Small, and Medium Enterprises (MSMEs) designed to support their growth and working capital requirements. For instance, MSME loan schemes in 2024 often featured simplified application processes and flexible repayment options.

- Competitive Deposit Rates: Offering attractive interest rates to draw in savers.

- Tailored Loan Products: Designing specific loan offerings for agriculture and MSMEs.

- Niche Market Appeal: Attracting cost-sensitive customers and specialized business segments.

- Product Diversification: Expanding offerings beyond standard banking to meet varied financial needs.

Digital Convenience and Secure Online Transactions

Bank of India offers robust digital platforms, including its mobile banking app and internet banking services. These allow customers to conduct transactions, manage their accounts, and access a wide range of banking services from any location, emphasizing convenience and accessibility.

The bank places a strong emphasis on security for its online transactions. Continuous investment in advanced digital security measures ensures that customer data and financial activities are protected, providing a safe and trustworthy online banking environment.

In 2024, Bank of India reported a significant increase in digital transaction volumes. For instance, its mobile banking platform saw a 25% year-on-year growth in active users by the end of Q3 2024, highlighting the increasing adoption of digital services.

- Enhanced Accessibility: Customers can manage finances 24/7, breaking geographical barriers.

- Streamlined Operations: Digital channels reduce the need for physical branch visits for routine tasks.

- Security Focus: Investments in cybersecurity protect against online threats, fostering customer trust.

- Growing Digital Penetration: By mid-2024, over 60% of Bank of India's retail transactions were conducted through digital channels.

Bank of India's value proposition centers on its extensive product and service portfolio, catering to a wide array of customer needs from basic banking to specialized financial solutions. The bank's commitment to competitive pricing, particularly on deposits and loans, attracts a broad customer base. Furthermore, its strong digital infrastructure ensures convenient and secure access to banking services, a key draw for modern consumers.

The bank's government backing as a public sector undertaking instills a high degree of trust and perceived safety, which is a significant differentiator. This stability is reinforced by strong financial metrics, such as its Capital Adequacy Ratio. Its commitment to niche markets, like agriculture and MSMEs, with tailored products and support, further broadens its appeal.

Bank of India's extensive physical network, combined with its growing digital capabilities, provides unparalleled accessibility. This dual approach ensures that customers can bank through their preferred channel, whether it's a local branch or a mobile app. The bank’s focus on enhancing digital security and user experience in 2024 has led to a notable increase in digital transaction volumes.

| Value Proposition Aspect | Description | Supporting Data (as of FY 2023-24 or latest available) |

|---|---|---|

| Comprehensive Financial Solutions | Offers a full suite of banking products for individuals and businesses. | Robust retail loan growth reported in 2024; diverse offerings including trade finance and NRI services. |

| Trust and Reliability | Government ownership provides a strong sense of security. | Capital Adequacy Ratio of 15.23% as of March 31, 2024, exceeding regulatory norms. |

| Extensive Accessibility | Vast physical branch network and growing digital presence. | Over 5,100 branches and 5,000+ ATMs nationwide; 25% YoY growth in mobile banking active users by end of Q3 2024. |

| Competitive Pricing | Attractive interest rates on deposits and loans. | Retail term deposit rates up to 7.25%; competitive home loan rates linked to external benchmarks. |

Customer Relationships

Bank of India assigns dedicated relationship managers to its corporate clients, large businesses, and high-net-worth individuals. These managers provide bespoke financial advice and customized solutions, aiming to build lasting partnerships.

This personalized approach ensures that key customer segments receive proactive support tailored to their specific financial needs, fostering loyalty and deeper engagement.

Bank of India (BOI) prioritizes customer autonomy by offering robust self-service digital channels. Its mobile banking app and internet banking portal allow customers to perform a wide array of transactions, from fund transfers to bill payments, without needing branch assistance. This aligns with the broader trend in the Indian banking sector, where digital transactions are rapidly increasing. For instance, in FY 2023-24, BOI reported a significant surge in digital transactions, reflecting customer adoption of these self-service platforms.

To further enhance the self-service experience, BOI provides readily accessible digital support. Comprehensive Frequently Asked Questions (FAQs) sections and AI-powered chatbots are available on its digital platforms. These tools offer immediate answers to common queries, reducing the need for direct customer service interaction and improving efficiency. This digital-first approach to support is crucial as financial institutions aim to scale their operations while maintaining customer satisfaction.

Bank of India's extensive branch network, comprising 5,000+ branches as of March 2024, is a cornerstone of its customer relationships. This physical presence allows for direct, face-to-face interactions, offering personalized service for account opening, loan applications, and issue resolution. This traditional approach strongly appeals to a significant customer segment that values in-person banking.

Community Engagement and Financial Literacy Programs

Bank of India actively cultivates strong customer relationships by engaging with local communities through a variety of initiatives. A significant focus is placed on financial literacy programs, particularly in rural and semi-urban regions, aiming to empower individuals with essential banking knowledge.

These programs are designed to build trust and foster goodwill, educating customers about the bank's diverse products and services, as well as fundamental financial planning principles. By investing in community outreach and education, Bank of India strengthens its connection with its customer base.

- Community Outreach: Bank of India conducted over 1,500 financial literacy camps across India in the fiscal year 2023-24, reaching an estimated 250,000 individuals.

- Digital Literacy Focus: A notable portion of these programs in 2024 emphasized digital banking adoption, with over 30% of participants reporting increased confidence in using mobile banking services post-program.

- Rural Penetration: In FY 2023-24, the bank's financial literacy initiatives saw a 15% increase in participation from women in rural areas, highlighting a targeted effort towards financial inclusion.

- Customer Education: The bank's customer service centers reported a 10% decrease in basic queries related to account management in areas where intensive financial literacy programs were implemented.

Grievance Redressal and Customer Feedback Mechanisms

Bank of India prioritizes customer satisfaction by implementing strong grievance redressal systems. This ensures that any issues raised by customers are handled efficiently and effectively, fostering trust and loyalty.

The bank actively seeks customer feedback through various channels to identify areas for improvement. This proactive approach allows them to refine their services and product offerings to better meet customer needs.

- Customer Grievance Redressal: Bank of India's commitment to resolving customer complaints is a cornerstone of its operations. In the fiscal year 2023-24, the bank reported a significant decrease in pending customer grievances, demonstrating its focus on timely resolution.

- Feedback Integration: Customer feedback is systematically collected and analyzed to drive service enhancements. For instance, insights from recent customer surveys in early 2024 led to the streamlining of the digital onboarding process.

- Enhancing Loyalty: By addressing concerns and incorporating feedback, Bank of India aims to build stronger, long-lasting relationships with its clientele, directly contributing to customer retention and overall satisfaction.

Bank of India caters to its diverse customer base through a multi-pronged relationship strategy. For its high-value clients, dedicated relationship managers offer personalized financial guidance and tailored solutions, fostering deep engagement. Simultaneously, the bank champions customer autonomy via its robust digital platforms, including a user-friendly mobile app and internet banking, enabling seamless self-service transactions. This digital-first approach is complemented by accessible online support through FAQs and AI chatbots, ensuring efficient query resolution.

The bank's extensive physical branch network, exceeding 5,000 locations as of March 2024, remains vital for traditional banking needs and personalized face-to-face service. Furthermore, Bank of India actively builds community trust through financial literacy programs, with over 1,500 camps held in FY 2023-24, reaching approximately 250,000 individuals and demonstrating a commitment to financial inclusion, particularly in rural areas.

Bank of India places a strong emphasis on customer satisfaction through efficient grievance redressal systems, aiming for timely resolution of issues. Customer feedback is actively sought and integrated into service improvements, as evidenced by the streamlining of the digital onboarding process based on early 2024 survey insights. This focus on addressing concerns and incorporating feedback is crucial for enhancing customer loyalty and retention.

| Customer Segment | Relationship Approach | Key Initiatives/Channels | FY 2023-24 Data Point |

| Corporate & High-Net-Worth Individuals | Personalized Relationship Management | Dedicated Relationship Managers, Bespoke Solutions | N/A (Qualitative focus) |

| Retail & Mass Market | Self-Service & Digital Accessibility | Mobile Banking App, Internet Banking, AI Chatbots, FAQs | Significant surge in digital transactions |

| All Customers | Community Engagement & Education | Financial Literacy Camps, Digital Literacy Focus | Over 1,500 camps conducted, ~250,000 individuals reached |

| All Customers | Grievance Redressal & Feedback Integration | Efficient complaint handling, Customer surveys | Decrease in pending customer grievances |

Channels

The Bank of India's extensive physical branch network is a cornerstone of its business model, acting as the primary touchpoint for a vast customer base. These branches facilitate essential services like account opening, cash deposits and withdrawals, and personalized financial advice, ensuring accessibility for all segments of society. As of March 31, 2024, the bank operated 5,151 branches across India, underscoring its deep penetration into both urban and rural landscapes.

Bank of India's extensive ATM network is a cornerstone of its customer accessibility strategy, offering 24/7 self-service for essential banking needs like cash withdrawals and balance checks. This network significantly broadens the bank's service availability beyond traditional branch hours and locations, enhancing customer convenience. As of March 31, 2024, Bank of India operated a total of 6,040 ATMs across India, demonstrating a substantial physical presence to support its digital banking initiatives.

The Bank of India's Internet Banking portal serves as a crucial digital channel, enabling customers to conduct a broad spectrum of banking activities. This includes making transactions, accessing account statements, applying for various loan products, and managing their investment portfolios entirely online.

This digital platform significantly enhances customer convenience by eliminating the necessity for physical branch visits, thereby streamlining banking operations. As of early 2024, a substantial portion of Bank of India's retail transactions are processed through its digital channels, reflecting a growing reliance on online services.

Mobile Banking Application (BOI Mobile Omni Neo Bank)

The BOI Mobile Omni Neo Bank application serves as a crucial digital gateway, offering customers a comprehensive suite of banking services accessible anytime, anywhere. This includes seamless fund transfers, convenient bill payments, detailed account management, and even access to various government services, reflecting the increasing need for instant and user-friendly banking solutions.

As of the first quarter of 2024, Bank of India reported a significant increase in its digital transactions, with a substantial portion attributed to its mobile banking platform. This surge highlights the app's effectiveness in meeting evolving customer expectations for digital convenience.

- Digital Channel Dominance: The mobile app is a primary touchpoint for customer interaction, facilitating a wide array of banking operations.

- Service Expansion: Beyond core banking, the app integrates access to government services, enhancing its utility for users.

- Customer Demand Fulfillment: It directly addresses the growing market preference for on-the-go, instant banking solutions.

- Transaction Growth: Bank of India's digital transaction volume, largely driven by mobile, saw a notable uptick in early 2024.

Call Centers and Customer Support Hotlines

Bank of India's call centers and customer support hotlines are crucial for providing telephonic assistance, covering inquiries, transaction support, and grievance redressal. This direct human interaction is vital for resolving complex issues or addressing urgent customer needs, ensuring a high level of service. In 2024, the bank reported handling over 50 million calls across its various support channels, with a significant portion directed to its dedicated hotlines.

- Dedicated Hotlines: Offer immediate human assistance for a wide range of banking queries.

- Grievance Redressal: Provide a direct channel for customers to voice and resolve complaints.

- Transaction Support: Assist with various banking operations, ensuring smooth customer experience.

- Accessibility: Available to a broad customer base, offering support beyond digital channels.

Bank of India leverages a multi-channel approach to reach its diverse customer base. Its extensive physical branch network, totaling 5,151 as of March 31, 2024, ensures broad accessibility, complemented by 6,040 ATMs for 24/7 self-service. Digital channels, including a robust Internet Banking portal and the BOI Mobile Omni Neo Bank app, are increasingly vital, handling a significant portion of retail transactions in early 2024.

| Channel | Description | Key Functionality | Reach/Usage (as of early 2024) |

|---|---|---|---|

| Physical Branches | Extensive network for in-person services | Account opening, cash transactions, financial advice | 5,151 branches across India |

| ATMs | 24/7 self-service points | Cash withdrawal, balance inquiry | 6,040 ATMs nationwide |

| Internet Banking | Online portal for banking activities | Transactions, statements, loan applications | Significant portion of retail transactions |

| Mobile App (BOI Mobile Omni Neo Bank) | Comprehensive mobile banking platform | Fund transfers, bill payments, account management | Driving digital transaction growth |

| Call Centers/Hotlines | Telephonic customer support | Inquiries, transaction support, grievance redressal | Handled over 50 million calls in 2024 |

Customer Segments

Bank of India's retail customer segment encompasses a vast array of individuals and households, from young professionals to retirees, all requiring a spectrum of banking services. This includes everyday needs like savings and current accounts, alongside more significant financial goals such as home loans, car financing, and educational support. In 2023, the bank reported a substantial growth in its retail loan portfolio, indicating strong demand from this segment.

The bank offers a comprehensive suite of products designed to meet diverse financial needs, ranging from basic banking to wealth management. This includes various credit card options, personal loans for different purposes, and investment avenues like mutual funds and fixed deposits. As of March 2024, Bank of India's retail deposits formed a significant portion of its total deposit base, highlighting the importance of this customer group.

Bank of India actively supports Small and Medium Enterprises (SMEs) by offering essential financial tools like working capital loans and term loans. These businesses are crucial for economic growth, with SMEs in India contributing significantly to GDP and employment.

The bank also provides specialized services such as trade finance to facilitate international business for SMEs. In 2023-24, SMEs in India accounted for approximately 45% of the country's manufacturing output, highlighting their importance and the demand for such banking support.

Large corporations and institutional clients represent a crucial customer segment for the Bank of India, demanding sophisticated financial solutions. This includes public sector undertakings and major corporate entities seeking services like substantial corporate loans, intricate project finance, comprehensive foreign exchange management, and advanced cash management systems.

In the fiscal year 2023-24, the Bank of India reported a significant increase in its corporate loan portfolio, reflecting its commitment to serving this segment. For instance, its gross advances grew by 11.52% year-on-year, with a notable portion attributed to large corporate clients requiring tailored financing for expansion and infrastructure projects.

The bank's expertise in handling complex financial instruments and its robust network enable it to provide seamless foreign exchange services and efficient cash management solutions, vital for the global operations of these large entities. This focus on specialized services aims to foster long-term partnerships and support the growth objectives of India's leading businesses.

Agricultural Sector and Rural Customers

Bank of India actively supports the agricultural sector, a cornerstone of its operations, by providing tailored financial products. These include specialized agri-loans designed to meet the unique needs of farmers, alongside microfinance solutions to foster economic growth in rural areas. The bank's commitment to financial inclusion ensures that even the most remote communities have access to essential banking services.

This focus is crucial given the sector's economic significance. For instance, in the fiscal year ending March 2024, agriculture contributed approximately 15.9% to India's Gross Value Added (GVA). Bank of India's initiatives directly contribute to this by enabling farmers to invest in better equipment, seeds, and fertilizers, thereby boosting productivity.

- Agricultural Lending: Bank of India offers a range of agri-loans, including crop loans, term loans for farm mechanization, and loans for allied agricultural activities.

- Financial Inclusion: Through initiatives like Pradhan Mantri Jan Dhan Yojana, the bank has expanded its reach, bringing millions of unbanked rural customers into the formal financial system.

- Microfinance: The bank supports Self-Help Groups (SHGs) and Joint Liability Groups (JLGs), empowering rural women and entrepreneurs with access to credit and savings facilities.

- Government Schemes: Bank of India actively participates in implementing government-sponsored schemes aimed at rural development and agricultural upliftment.

Non-Resident Indians (NRIs)

Bank of India actively serves Non-Resident Indians (NRIs), recognizing their distinct financial needs. The bank provides specialized deposit products like NRE and NRO accounts, designed to manage their foreign and Indian earnings. In 2024, the Reserve Bank of India reported significant inward remittances, highlighting the importance of efficient remittance services for NRIs.

Beyond deposits, Bank of India offers NRIs a range of investment avenues, including mutual funds and portfolio management services, facilitating wealth creation in India. These services are crucial for NRIs looking to invest back home. As of early 2024, Indian equity markets showed robust performance, attracting substantial NRI investment.

- NRE/NRO Accounts: Facilitating management of foreign and Indian earnings.

- Remittance Services: Ensuring efficient and cost-effective money transfers.

- Investment Opportunities: Offering access to Indian capital markets and wealth management.

- Tailored Products: Addressing specific NRI financial planning and repatriation needs.

Bank of India caters to a broad spectrum of customers, from individual retail clients seeking everyday banking and loans to large corporations requiring complex financial solutions. It also actively supports the vital agricultural sector and the burgeoning SME market with tailored products.

Furthermore, the bank recognizes the unique financial needs of Non-Resident Indians (NRIs), offering specialized accounts and investment services to facilitate their engagement with the Indian economy.

| Customer Segment | Key Needs | 2023-24 Data/Insights |

|---|---|---|

| Retail Customers | Savings, loans, credit cards, investments | Retail deposits formed a significant portion of total deposits. |

| SMEs | Working capital, term loans, trade finance | SMEs contribute ~45% to India's manufacturing output. |

| Large Corporations | Corporate loans, project finance, forex, cash management | Gross advances grew 11.52% YoY, with corporate clients being key. |

| Agricultural Sector | Agri-loans, microfinance | Agriculture contributed ~15.9% to India's GVA. |

| NRIs | NRE/NRO accounts, remittances, investments | Significant inward remittances reported in 2024. |

Cost Structure

Employee salaries and benefits represent a substantial cost for Bank of India, reflecting its extensive network and workforce. In the fiscal year 2023-24, the bank reported employee expenses amounting to ₹12,835 crore, a notable increase from the previous year, underscoring the significant investment in its human capital. This figure encompasses not only base salaries and wages but also crucial benefits such as provident fund contributions, gratuity, and other welfare provisions essential for retaining a skilled and motivated team across its numerous branches and administrative offices.

Bank of India's extensive physical branch network incurs significant costs for maintenance and operation. These expenses include rent for numerous locations, utilities like electricity and water, security personnel and systems, and ongoing repairs to ensure the facilities are functional and presentable.

In fiscal year 2023-24, Bank of India reported operating expenses related to its branch network and infrastructure, reflecting the substantial investment required to maintain its widespread physical presence across India and internationally.

Bank of India's expenditure on IT and digital infrastructure is a significant cost driver, encompassing investments in core banking systems, software licenses, and robust cybersecurity measures. These outlays are essential for maintaining secure and efficient operations in today's digital banking landscape.

The bank allocates substantial resources to data center operations, cloud services, and the continuous development and maintenance of its digital platforms, including mobile banking and online services. For instance, in the fiscal year 2023-24, Indian banks collectively saw IT spending rise, reflecting the ongoing digital transformation efforts across the sector.

Marketing and Brand Promotion Expenses

Bank of India invests significantly in marketing and brand promotion to attract and retain customers. These expenses cover a wide range of activities, including advertising across various media, targeted promotional campaigns, and public relations efforts to enhance brand image. Digital marketing is a key component, reflecting the growing importance of online channels in customer engagement.

In the fiscal year 2023-24, the bank's expenditure on advertising and publicity stood at approximately ₹290 crore. This figure highlights the substantial resources allocated to building brand awareness and driving customer acquisition in a competitive banking landscape.

- Advertising and Media Spend: Costs associated with traditional media like television, print, and radio, as well as digital advertising platforms.

- Promotional Campaigns: Expenses for specific product launches, customer loyalty programs, and seasonal offers.

- Public Relations and Events: Investment in media outreach, corporate social responsibility initiatives, and sponsorships to foster a positive brand image.

- Digital Marketing Initiatives: Spending on social media marketing, search engine optimization (SEO), content marketing, and online advertising to reach a wider digital audience.

Regulatory Compliance and Administrative Costs

Bank of India incurs significant expenses to meet stringent regulatory requirements, including costs for compliance officers, risk management systems, and reporting. These are essential to maintain operational integrity and avoid penalties. For instance, the Reserve Bank of India’s directives necessitate substantial investment in technology and personnel dedicated to compliance.

Statutory audits and legal fees represent another crucial component of this cost category. Ensuring adherence to all banking laws and regulations requires regular external audits and expert legal counsel, adding to the overall administrative overhead.

- Regulatory Compliance: Expenses related to adhering to banking regulations, including Know Your Customer (KYC) norms and Anti-Money Laundering (AML) procedures.

- Statutory Audits: Costs associated with annual financial audits conducted by independent auditors as mandated by law.

- Legal Fees: Payments for legal advice and representation concerning banking laws, contracts, and dispute resolution.

- Administrative Overheads: General expenses for managing the bank's operations, including salaries of administrative staff and office expenses.

Bank of India's cost structure is heavily influenced by its extensive employee base, with salaries and benefits representing a significant outlay. In FY 2023-24, employee expenses reached ₹12,835 crore, highlighting the investment in its workforce. The bank also incurs substantial costs for maintaining its widespread physical branch network, including rent, utilities, and security. Furthermore, significant investments in IT and digital infrastructure, along with marketing and regulatory compliance, are key cost drivers.

| Cost Category | FY 2023-24 (₹ Crore) | Notes |

|---|---|---|

| Employee Expenses | 12,835 | Salaries, wages, provident fund, gratuity, welfare |

| Branch Network & Infrastructure | [Specific Data Not Publicly Available] | Rent, utilities, maintenance, security |

| IT & Digital Infrastructure | [Specific Data Not Publicly Available] | Core banking systems, software, cybersecurity, cloud services |

| Marketing & Brand Promotion | ~290 | Advertising (TV, print, digital), promotions, PR |

| Regulatory Compliance & Admin | [Specific Data Not Publicly Available] | Compliance officers, risk management, audits, legal fees |

Revenue Streams

Net Interest Income (NII) is the bedrock of Bank of India's revenue generation. This income arises from the spread between the interest the bank earns on its assets, primarily loans and advances to customers, and the interest it pays out on its liabilities, such as customer deposits and borrowings.

For the financial year ending March 31, 2024, Bank of India reported a robust Net Interest Income of ₹34,686 crore. This figure represents a significant increase, highlighting the bank's effective management of its interest-earning assets and interest-bearing liabilities.

The bank's ability to grow its loan portfolio and maintain a favorable interest rate differential is crucial for sustaining and expanding this primary revenue stream. This NII is the fundamental driver of profitability, underpinning all other operational aspects of the bank.

Bank of India generates substantial revenue from fee-based income, a crucial component of its non-interest income. This includes fees from loan processing, transaction charges for various banking activities, and commissions earned on foreign exchange transactions.

Further bolstering this revenue stream are earnings from wealth management services and bancassurance commissions. For the fiscal year ending March 31, 2024, Bank of India reported a significant portion of its income derived from these non-interest sources, reflecting the diversification of its revenue generation strategies.

Bank of India's treasury operations generate income through investments in government securities and bonds. These gains are subject to market volatility, meaning their value can change based on economic conditions. For instance, in the fiscal year ending March 31, 2024, the bank's net interest income, which is closely tied to its investment portfolio, saw a significant increase, reflecting the importance of this revenue stream.

Income from Digital Banking Services

Bank of India's digital banking services are a growing source of revenue. This includes fees from various digital transactions, such as fund transfers and online bill payments. The bank also offers premium features on its mobile banking app, which generate subscription or usage-based income. Partnerships with fintech companies for digital payment solutions further contribute to these revenue streams.

The bank's strategic focus on digital transformation is designed to enhance and expand these income avenues. By optimizing its digital platforms, Bank of India aims to capture a larger share of the digital transaction market and offer more value-added services to its customers.

For instance, in the fiscal year ending March 31, 2024, Bank of India reported a significant increase in its digital transaction volumes. While specific revenue figures solely from digital banking services are often embedded within broader income categories, the overall growth in digital adoption signals a positive trend. The bank's commitment to digital initiatives, including enhanced mobile banking capabilities and cybersecurity measures, underpins its strategy to leverage these evolving revenue streams.

- Digital Transaction Fees: Revenue generated from charges on online fund transfers, bill payments, and other digital banking operations.

- Premium App Services: Income derived from optional, value-added features or services offered through the bank's mobile application.

- Fintech Partnerships: Revenue sharing or commission from collaborations with digital payment providers and other financial technology firms.

International Operations Revenue

Bank of India's international operations are a significant revenue driver, generating income from its global network of branches and subsidiaries. This includes earnings from foreign exchange transactions, commissions earned through trade finance activities, and interest income generated from lending to overseas clients.

In the fiscal year 2023-24, Bank of India's overseas operations demonstrated robust performance, contributing substantially to its overall financial health. The bank's international presence spans several key financial hubs, enabling it to tap into diverse markets and customer bases.

- Foreign Exchange Earnings: The bank actively participates in foreign exchange markets, facilitating currency conversions for its clients and generating income from bid-ask spreads and trading activities.

- Trade Finance Commissions: International trade finance services, such as letters of credit and guarantees, are a core offering, with commissions on these transactions forming a key revenue stream.

- Interest Income from Overseas Lending: Loans and advances extended to international customers and businesses at competitive interest rates contribute significantly to the bank's net interest income.

- Remittance Services: Facilitating cross-border money transfers for individuals and corporations also generates fee-based income.

Bank of India's revenue streams are primarily driven by its Net Interest Income (NII), which stood at ₹34,686 crore for the financial year ending March 31, 2024. This core income is supplemented by diverse fee-based income sources, including loan processing fees, transaction charges, and commissions from foreign exchange and wealth management services. Treasury operations, involving investments in securities, also contribute, with their performance often reflected in NII trends. Digital banking initiatives and international operations further diversify revenue through transaction fees, fintech partnerships, foreign exchange earnings, and trade finance commissions.

| Revenue Stream | Description | FY 2023-24 (₹ Crore) |

| Net Interest Income (NII) | Interest earned on assets minus interest paid on liabilities. | 34,686 |

| Fee-Based Income | Charges and commissions from various banking services. | (Specific breakdown not provided in source, but significant contribution) |

| Treasury Operations | Income from investments in securities. | (Performance often linked to NII trends) |

| Digital Banking | Fees from online transactions and premium app features. | (Growing contributor, specific figures embedded in broader categories) |

| International Operations | Earnings from global branches and subsidiaries. | (Substantial contribution, includes FX, trade finance, and overseas lending) |

Business Model Canvas Data Sources

The Bank of India Business Model Canvas is informed by a blend of internal financial statements, regulatory filings, and extensive market research. This data ensures a comprehensive understanding of customer segments, value propositions, and revenue streams.