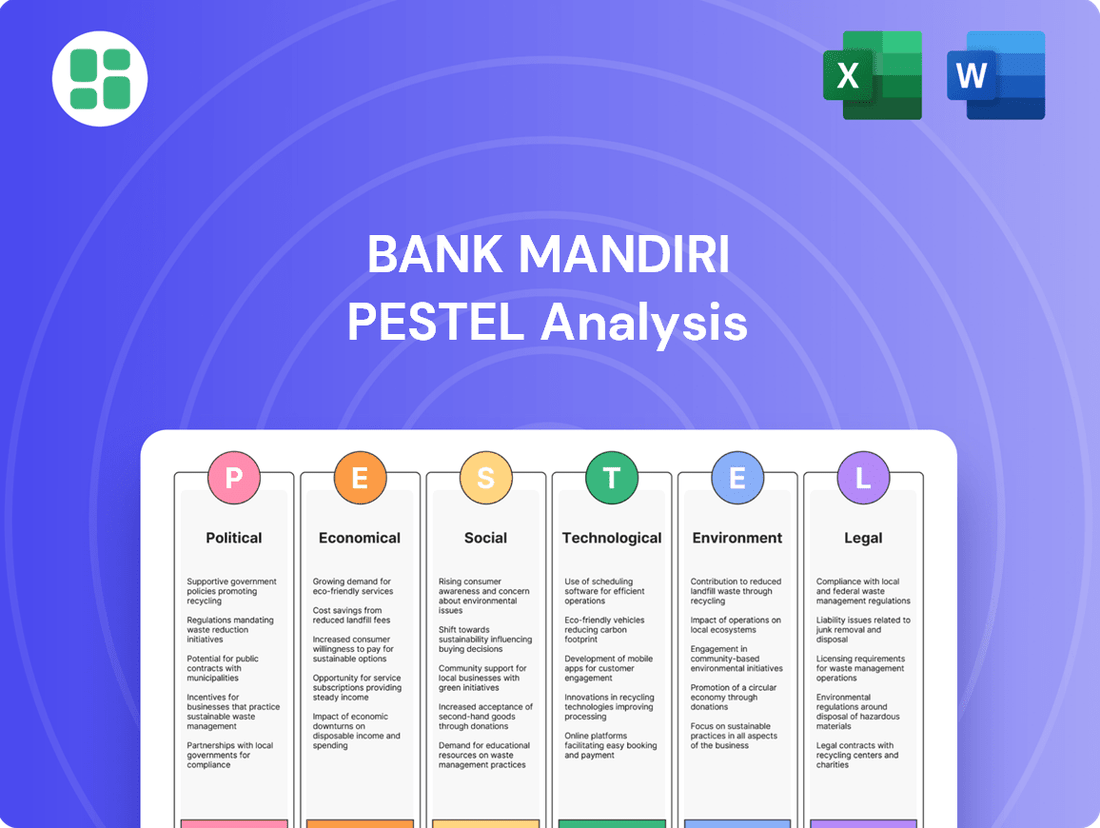

Bank Mandiri PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Mandiri Bundle

Navigate the complex external forces shaping Bank Mandiri's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental concerns, and socio-cultural trends are creating both challenges and opportunities for this leading Indonesian bank. Gain the strategic foresight you need to make informed decisions and stay ahead of the curve.

Unlock actionable intelligence by diving deep into the political, economic, social, technological, legal, and environmental factors impacting Bank Mandiri. Our expertly crafted PESTLE analysis provides a clear roadmap to understanding the external landscape. Download the full version now to equip yourself with the insights essential for strategic planning and competitive advantage.

Political factors

Bank Mandiri, as a state-owned enterprise, is deeply intertwined with the political landscape of Indonesia. The stability of the current government, led by President Joko Widodo until October 2024, and the direction set by the incoming administration are paramount. For instance, the government's continued emphasis on infrastructure development, which saw significant budget allocations in 2024, directly translates into lending opportunities and strategic focus for Bank Mandiri.

Policy shifts concerning state-owned enterprises (SOEs) or the financial sector can materially alter Bank Mandiri's operational environment. The government's economic agenda, including its approach to digital transformation and financial inclusion, shapes the bank's strategic planning and investment priorities. Indonesia's commitment to economic growth, evidenced by a projected GDP growth of around 5.1% for 2024, underpins the banking sector's stability and Bank Mandiri's performance.

Bank Mandiri's status as a majority state-owned enterprise (SOE) means its strategic direction is closely aligned with the Indonesian government's national development priorities. This can translate into mandates to support key industries, such as infrastructure development or small and medium-sized enterprises (SMEs), and to participate in government-backed initiatives. For instance, as of early 2024, the Indonesian government continued to leverage SOEs like Bank Mandiri to drive economic growth and social welfare programs.

This significant state ownership provides a degree of inherent stability and backing, as the government acts as a major shareholder. However, it also implies that the bank's operational autonomy and strategic decision-making can be influenced by national interests and political objectives. This dynamic can sometimes lead to directives that prioritize broader economic or social goals over purely commercial considerations, potentially impacting the bank's agility in certain market conditions.

The regulatory environment for Indonesian State-Owned Enterprises (SOEs) significantly shapes Bank Mandiri's operational landscape. For instance, OJK Regulation No. 26 of 2024, enacted in early 2024, aims to bolster SOE flexibility and competitiveness within the banking sector. This regulation impacts governance, reporting standards, and capital adequacy requirements, directly influencing Bank Mandiri's strategic decision-making and execution capabilities.

Geopolitical Relations & Trade Policies

Indonesia's geopolitical positioning and its evolving trade policies significantly shape the economic landscape, directly influencing Bank Mandiri's corporate and international banking operations. Shifts in global trade dynamics or regional alliances can alter foreign direct investment, disrupt supply chains, and impact the overall business climate, thereby affecting the bank's loan book and treasury activities.

Global economic instability and geopolitical conflicts often spill over into domestic economies and their banking sectors. For instance, rising protectionist measures by major economies could reduce Indonesia's export opportunities, potentially slowing economic growth and increasing credit risk for businesses reliant on international trade, which Bank Mandiri serves.

- Trade Agreements: Indonesia's participation in regional trade blocs like the ASEAN Free Trade Area (AFTA) and bilateral agreements can foster trade growth, benefiting Bank Mandiri's trade finance services.

- Foreign Investment: Geopolitical stability is crucial for attracting foreign investment, which can boost economic activity and demand for banking services. Indonesia's efforts to improve its investment climate are ongoing, with a focus on streamlining regulations.

- Global Economic Outlook: The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that can be sensitive to geopolitical events, impacting Indonesia's economic performance and Bank Mandiri's financial results.

- Supply Chain Resilience: Geopolitical tensions can highlight the need for supply chain diversification, potentially creating opportunities for Indonesian businesses and, consequently, for Bank Mandiri's lending and advisory services.

Anti-Corruption & Governance Initiatives

Government initiatives focused on anti-corruption and enhancing corporate governance are paramount for Bank Mandiri, especially given its status as a state-owned enterprise. These efforts directly impact the bank's reputation and ensure its operational integrity. For instance, Indonesia's Corruption Eradication Commission (KPK) continues to pursue cases, underscoring the ongoing need for robust internal controls and transparency.

Adherence to strong corporate governance principles is not merely a compliance issue; it's a strategic imperative for boosting market value and retaining investor trust. In 2024, Bank Mandiri reported significant improvements in its governance metrics, reflecting proactive measures against financial misconduct.

- Enhanced Transparency: Bank Mandiri has been actively implementing digital solutions to improve transparency in its financial reporting and operational processes, aligning with global best practices.

- Regulatory Compliance: The bank consistently meets and often exceeds regulatory requirements set forth by the Financial Services Authority (OJK) concerning governance and risk management.

- Investor Confidence: Strong governance frameworks are directly correlated with investor confidence, a factor that has contributed to Bank Mandiri's stable market performance.

- Anti-Corruption Measures: The bank has established dedicated units and implemented rigorous training programs to combat corruption internally, reinforcing its commitment to ethical business conduct.

The political landscape in Indonesia significantly shapes Bank Mandiri's operations, particularly its role as a state-owned enterprise. Government policies on economic development, such as infrastructure spending, directly influence lending opportunities, with the government continuing to prioritize these areas in its 2024 budget. The stability of the current administration and the economic agenda of the incoming one are crucial for the bank's strategic direction.

What is included in the product

This PESTLE analysis critically examines the external macro-environmental forces impacting Bank Mandiri across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of its operating landscape.

Offers a clear, actionable framework to identify and mitigate external threats and opportunities, alleviating the pain of navigating complex market dynamics for Bank Mandiri.

Economic factors

Indonesia's economic trajectory is a key driver for Bank Mandiri. In 2024, the nation's GDP growth is projected to remain strong, with forecasts generally hovering around 5%. This robust economic expansion directly fuels demand for banking services, from increased credit uptake by businesses to greater investment activity. A healthy GDP means more opportunities for banks like Mandiri to grow their loan portfolios and maintain high asset quality.

However, inflation presents a more complex picture. While a moderate inflation rate can accompany economic growth, persistent or high inflation, potentially reaching 3-4% in 2024-2025, necessitates careful monetary policy. This can lead to higher interest rates, which might dampen consumer spending and borrowing appetite, thereby impacting both deposit and lending growth for Bank Mandiri.

Bank Indonesia's monetary policy, particularly its benchmark interest rate (BI Rate), directly impacts Bank Mandiri's Net Interest Margin (NIM). For instance, as of early 2024, the BI Rate stood at 6.00%, a level maintained to combat inflation. Any upward revision would increase Bank Mandiri's cost of funds, potentially squeezing profitability if lending rates cannot be adjusted proportionally.

Fluctuations in interest rates, often driven by inflation targets or exchange rate stability, influence consumer and business borrowing decisions. Higher rates can dampen loan demand, affecting Bank Mandiri's loan growth and overall revenue. Conversely, lower rates might stimulate borrowing but could also lead to margin compression.

The Otoritas Jasa Keuangan (OJK) continues to emphasize robust risk management for banks like Bank Mandiri, especially in navigating economic uncertainties. This includes maintaining strong capital adequacy ratios, with Bank Mandiri consistently reporting a Capital Adequacy Ratio (CAR) well above regulatory minimums, such as 23.64% as of Q1 2024, providing a buffer against potential economic headwinds.

Fluctuations in the Indonesian Rupiah (IDR) against major currencies like the US Dollar significantly influence Bank Mandiri's financial performance. For instance, a weaker IDR can increase the value of the bank's foreign currency-denominated assets when translated back into Rupiah, but it also raises the cost of foreign currency-denominated liabilities.

In 2024, the IDR experienced volatility, trading around IDR 16,000 per US Dollar at various points. This directly affects Bank Mandiri's net interest income and the cost of funds, especially for its international operations and clients engaged in import-export activities.

Managing foreign exchange risk is therefore a critical component of Bank Mandiri's treasury operations, requiring sophisticated hedging strategies to mitigate potential losses arising from adverse currency movements and to ensure the financial stability of its corporate clients involved in international trade.

Consumer Spending & Disposable Income

Consumer spending and disposable income are crucial for Bank Mandiri's retail operations. Higher disposable income generally translates to increased demand for banking products like loans and savings accounts. For instance, Indonesia's inflation rate remained relatively stable in early 2024, hovering around 3% year-on-year, which supports consumer purchasing power.

A slowdown in consumer spending, perhaps due to economic uncertainty, can directly impact Bank Mandiri's growth in its consumer loan and credit card portfolios. If consumers become more hesitant to spend, they are less likely to take on new debt or increase their credit card usage. This caution can be influenced by factors like job security concerns or rising living costs.

Key indicators to watch for Bank Mandiri include:

- Consumer Confidence Index: A rising index suggests consumers feel more optimistic about their financial future, likely leading to increased spending and demand for banking services.

- Retail Sales Growth: Strong retail sales figures indicate healthy consumer spending, which directly benefits Bank Mandiri's retail banking segments.

- Household Debt-to-Income Ratio: This metric helps assess the sustainability of consumer borrowing and its potential impact on future spending capacity.

Foreign Direct Investment (FDI) Trends

Foreign Direct Investment (FDI) plays a crucial role in Indonesia's economic landscape, directly impacting sectors like corporate and investment banking. When FDI inflows rise, it typically signals increased business activity and expansion, leading to a higher demand for sophisticated financial services. This often translates into more opportunities for Bank Mandiri's wholesale banking operations, including corporate financing and project finance.

Indonesia has seen notable FDI trends in recent years. For instance, in 2023, the Investment Ministry reported FDI realization reaching IDR 1,380.3 trillion (approximately USD 89.2 billion), with a significant portion directed towards manufacturing and infrastructure development. This influx of foreign capital directly fuels demand for the financial products and advisory services that Bank Mandiri offers to large corporations and infrastructure projects.

- Increased FDI in 2023: Indonesia attracted IDR 1,380.3 trillion (approx. USD 89.2 billion) in FDI.

- Sectoral Focus: Key sectors attracting FDI, like manufacturing and infrastructure, require substantial corporate and project financing.

- Impact on Banking: Higher FDI inflows directly correlate with increased demand for Bank Mandiri's wholesale banking services.

- Economic Stimulation: FDI acts as a catalyst for economic activity, creating a more robust environment for banking growth.

Indonesia's economic growth remains a primary driver for Bank Mandiri, with GDP growth projected around 5% for 2024, boosting demand for banking services. However, inflation, potentially around 3-4% in 2024-2025, necessitates careful monetary policy, which could influence interest rates and borrowing appetite. Bank Indonesia's benchmark rate, at 6.00% in early 2024, directly impacts Bank Mandiri's Net Interest Margin, with any increases potentially squeezing profitability.

Consumer spending, supported by stable inflation around 3% year-on-year in early 2024, fuels Bank Mandiri's retail operations, but economic uncertainty could dampen loan demand. Foreign Direct Investment, reaching approximately USD 89.2 billion in 2023, particularly in manufacturing and infrastructure, directly increases demand for Bank Mandiri's wholesale banking services.

| Economic Factor | 2024 Projection/Data | Impact on Bank Mandiri |

|---|---|---|

| GDP Growth | ~5% | Increased demand for banking services, loan growth |

| Inflation | 3-4% | Potential for higher interest rates, impact on borrowing |

| BI Rate (Early 2024) | 6.00% | Affects Net Interest Margin (NIM) |

| FDI (2023) | ~USD 89.2 billion | Increased demand for wholesale banking services |

Preview Before You Purchase

Bank Mandiri PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bank Mandiri covers all critical external factors influencing its operations. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental aspects impacting the bank.

Sociological factors

Indonesia's demographic profile, characterized by a substantial youth population, presents a significant growth avenue for Bank Mandiri. This burgeoning segment, particularly Gen Z and millennials, is increasingly adopting digital banking solutions, creating a strong demand for innovative financial products and services. In 2024, Indonesia's median age was around 30 years, with a large proportion of the population under 30, indicating a vast pool of potential customers eager for digital financial engagement.

Bank Mandiri is well-positioned to capitalize on Indonesia's push for greater financial inclusion and literacy. As of early 2024, the Financial Services Authority (OJK) reported that the national financial literacy rate stood at 49.8%, indicating significant room for growth, particularly in rural and remote regions. Bank Mandiri's strategic focus on expanding its digital banking services and agent network directly addresses this opportunity.

By extending its reach to previously unbanked and underbanked segments, the bank not only fosters economic empowerment but also aligns with Indonesia's broader national development objectives. For instance, the government's ongoing initiatives to digitize financial services and promote financial literacy are creating a more receptive market for Bank Mandiri's offerings, potentially unlocking new customer bases and revenue streams in the coming years.

Bank Mandiri is observing a significant shift in how consumers want to bank. There's a clear move towards digital platforms, with customers expecting seamless online experiences and personalized services. This means Bank Mandiri needs to keep evolving its retail banking products to meet these demands.

The growing popularity of digital wallets and other fintech solutions presents a challenge to traditional banks. To keep customers engaged, Bank Mandiri must prioritize enhancing its digital offerings, ensuring they are competitive and user-friendly.

In 2024, for instance, a significant portion of Bank Mandiri's transactions were already occurring through digital channels, highlighting this trend. By Q3 2024, the bank reported a substantial increase in mobile banking usage, with over 70% of its retail customers actively using the app for daily banking needs.

Urbanization & Rural Development

Indonesia's ongoing urbanization trend, with a significant portion of its population now residing in cities, directly influences where banking services are most needed. Simultaneously, government initiatives aimed at rural development are creating new economic opportunities and increasing the demand for financial products in previously underserved areas. This dynamic requires Bank Mandiri to strategically adjust its physical presence and digital offerings to cater to both booming urban markets and emerging rural economies.

Bank Mandiri must ensure its branch network and digital channels are optimized to serve the concentrated demand in urban centers while also expanding its reach to support credit growth in developing rural regions. For instance, as of early 2024, urban areas continue to attract a larger share of economic activity, but the government's push for inclusive growth means rural areas are seeing increased investment and potential for banking expansion. This dual focus is crucial for maintaining equitable credit distribution across the archipelago.

- Urban Concentration: Over 58% of Indonesia's population lived in urban areas by 2023, driving concentrated demand for banking services.

- Rural Development Focus: Government programs in 2024 continue to prioritize infrastructure and economic development in rural areas, creating new customer segments.

- Digital Reach: Bank Mandiri's digital banking penetration is key to serving dispersed rural populations where physical branches are less feasible.

- Equitable Credit Growth: The bank's strategy must balance serving high-transaction urban centers with fostering financial inclusion and credit access in rural economies.

Cultural Trust in State Institutions

As a state-owned enterprise, Bank Mandiri enjoys a foundational level of public trust in Indonesia, stemming from the perceived stability and reliability of government institutions. This inherent trust acts as a significant competitive advantage, particularly during periods of economic volatility. For instance, in 2024, state-owned banks continued to hold a substantial share of the Indonesian banking sector's total assets.

This cultural trust translates into a willingness among Indonesians to engage with Bank Mandiri for their financial needs, viewing it as a secure and dependable option. This can be seen in customer deposit growth figures, where state-owned banks often exhibit resilience. Maintaining this trust is crucial, and Bank Mandiri actively works to reinforce it through transparent operations and consistent service delivery.

Key aspects of this trust include:

- Perceived Stability: The backing of the Indonesian state provides a sense of security for customers.

- Government Mandate: Bank Mandiri often plays a role in implementing government economic policies, further solidifying its public perception.

- Accessibility: As a large, state-backed entity, its branch network and digital services are widely accessible across the archipelago.

Bank Mandiri's strategic focus on digital transformation aligns with evolving Indonesian consumer preferences, with a significant portion of transactions shifting to online channels. By Q3 2024, over 70% of its retail customers actively used the mobile banking app, underscoring the demand for seamless digital experiences and personalized services.

The bank's efforts to enhance financial inclusion are crucial, given that Indonesia's financial literacy rate was 49.8% in early 2024. By expanding digital services and agent networks, Bank Mandiri aims to reach underbanked populations, fostering economic empowerment and tapping into new customer bases.

Indonesia's demographic profile, with a median age around 30 in 2024 and a large youth population, presents a substantial growth opportunity. This younger demographic is increasingly adopting digital banking, creating a strong demand for innovative financial products and services tailored to their needs.

| Sociological Factor | Impact on Bank Mandiri | Supporting Data (2023-2024) |

| Demographics (Youth Population) | High demand for digital banking and innovative products. | Indonesia's median age approx. 30 in 2024; large segment under 30. |

| Financial Literacy | Opportunity to expand services to underbanked segments. | Financial literacy rate 49.8% (OJK, early 2024). |

| Consumer Behavior (Digital Shift) | Need for enhanced digital offerings and seamless online experiences. | Over 70% of retail customers used mobile banking app (Q3 2024). |

| Public Trust (State-Owned) | Competitive advantage due to perceived stability and reliability. | State-owned banks hold substantial share of banking sector assets. |

Technological factors

Bank Mandiri's aggressive digital transformation is a key technological factor, with its super app Livin' by Mandiri and wholesale platform Kopra at the forefront, ensuring its competitive edge. These platforms are crucial for catering to diverse customer needs and streamlining operations in an increasingly digital landscape.

Indonesia's fintech sector is experiencing rapid growth, compelling banks like Mandiri to continuously invest in digital infrastructure. This investment is essential to keep pace with evolving customer expectations and to enhance overall operational efficiency. For instance, Livin' by Mandiri reported over 20 million downloads by late 2023, showcasing significant user adoption.

Bank Mandiri's increasing digital footprint, a trend accelerated by the pandemic and ongoing digital transformation efforts, significantly elevates its exposure to cybersecurity threats. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, a stark reminder of the financial and reputational risks involved. Protecting sensitive customer data and maintaining the integrity of its digital banking platforms are paramount to preserving customer trust and ensuring operational continuity.

The evolving landscape of data privacy regulations, such as Indonesia's Personal Data Protection Law (UU PDP), necessitates continuous investment in robust security infrastructure and compliance protocols. Failure to adhere to these regulations can result in substantial fines and damage Bank Mandiri's brand reputation. Therefore, proactive measures in cybersecurity and data privacy are not just operational necessities but critical strategic imperatives for sustained growth and customer loyalty in the digital age.

Bank Mandiri is significantly increasing its investment in AI and big data analytics, aiming to triple their usage by 2025. This strategic push is designed to revolutionize core banking functions, including more robust risk management and fraud prevention systems. The bank also anticipates leveraging these technologies to deliver highly personalized customer experiences and streamline the loan application process, making it faster and more efficient.

Mobile Banking & E-wallet Penetration

Indonesia's high mobile penetration, exceeding 80% of the population in 2024, fuels a strong demand for sophisticated mobile banking solutions. This digital shift is further amplified by the rapid adoption of e-wallets, with transaction values projected to grow by over 15% annually through 2025. Bank Mandiri's Livin' app is a prime example, demonstrating its critical role in serving the digitally-inclined Indonesian consumer base.

The Livin' app's success, evidenced by its millions of active users and substantial transaction volumes in 2024, underscores the strategic imperative for banks to invest heavily in their mobile platforms. This focus is essential for attracting and retaining the growing segment of digital-first customers who expect intuitive and comprehensive banking services directly from their smartphones. The app's features, from fund transfers to bill payments and investment access, cater to this demand for convenience and integrated financial management.

- Mobile Penetration: Over 80% of Indonesians use smartphones as of 2024.

- E-wallet Growth: E-wallet transaction values expected to increase by over 15% annually through 2025.

- Livin' App Engagement: Bank Mandiri's Livin' app boasts millions of active users and significant transaction volumes in 2024.

- Digital Consumer Demand: High demand for seamless, feature-rich mobile banking experiences among digitally-savvy Indonesians.

Cloud Computing Infrastructure

Bank Mandiri's strategic adoption of cloud computing infrastructure is a significant technological enabler. This move towards cloud solutions, like those offered by major providers such as Amazon Web Services (AWS) and Microsoft Azure, provides the bank with enhanced scalability and cost efficiencies. For instance, by leveraging the cloud, Bank Mandiri can dynamically adjust its computing resources based on demand, avoiding the capital expenditure of on-premise hardware for peak loads.

This technological shift directly supports Bank Mandiri's ongoing digital transformation efforts. By migrating core banking functions and data analytics to the cloud, the bank can process a significantly larger volume of transactions and complex data sets more rapidly. This improved data processing capability is crucial for offering personalized financial services and for sophisticated risk management, especially as digital banking transactions continue to surge. In 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the widespread industry trend towards cloud adoption.

The benefits of cloud infrastructure for Bank Mandiri are multifaceted:

- Scalability: Enables rapid expansion of services and transaction processing capacity without significant upfront investment in physical infrastructure.

- Cost Efficiency: Shifts IT spending from capital expenditure to operational expenditure, often leading to lower total cost of ownership through pay-as-you-go models.

- Enhanced Data Management: Facilitates advanced data analytics, improved data security, and more efficient data storage and retrieval for better decision-making.

Bank Mandiri's aggressive digital push is heavily reliant on technological advancements, particularly its super app Livin' by Mandiri and wholesale platform Kopra, which are central to its competitive strategy and operational efficiency. These platforms are vital for meeting diverse customer needs in an increasingly digital financial environment, with Livin' by Mandiri alone surpassing 20 million downloads by late 2023.

The bank's expanding digital presence makes it more vulnerable to cybersecurity threats, a significant concern given that global cybercrime costs were projected to hit $10.5 trillion annually in 2024. Compliance with Indonesia's Personal Data Protection Law (UU PDP) also demands ongoing investment in security, as non-compliance can lead to substantial fines and reputational damage.

Bank Mandiri is significantly increasing its investment in AI and big data analytics, aiming to triple their usage by 2025 to enhance risk management, fraud prevention, and customer personalization. This aligns with Indonesia's high mobile penetration, exceeding 80% in 2024, and the robust growth of e-wallets, with transaction values expected to rise by over 15% annually through 2025, underscoring the demand for sophisticated mobile banking solutions like the Livin' app.

The bank's strategic adoption of cloud computing, utilizing providers like AWS and Azure, offers critical scalability and cost efficiencies, allowing for dynamic resource adjustment and avoiding large capital expenditures. This cloud migration supports the processing of larger transaction volumes and complex data sets, crucial for personalized services and risk management, especially as the global cloud computing market was projected to exceed $600 billion in 2024.

| Technology Factor | Bank Mandiri's Action/Impact | Data/Statistic |

|---|---|---|

| Digital Transformation | Development of Livin' by Mandiri and Kopra platforms | Livin' by Mandiri: Over 20 million downloads (late 2023) |

| Cybersecurity | Increased exposure due to digital footprint | Global cybercrime costs projected at $10.5 trillion annually (2024) |

| Data Privacy Compliance | Investment in security and compliance protocols for UU PDP | N/A (regulatory requirement) |

| AI & Big Data Analytics | Tripling usage by 2025 for risk, fraud, and personalization | N/A (internal target) |

| Mobile Penetration & E-wallets | Leveraging high mobile usage for banking services | Mobile penetration >80% (2024); E-wallet growth >15% annually (through 2025) |

| Cloud Computing | Adoption of cloud infrastructure for scalability and efficiency | Global cloud market >$600 billion (2024) |

Legal factors

Indonesia's Financial Services Authority (OJK) plays a crucial role in shaping Bank Mandiri's operational landscape through its extensive banking laws and regulations. These rules cover critical areas such as minimum capital requirements, responsible lending practices, and the permissible scope for expanding business activities.

Recent regulatory updates, such as OJK Regulation 26/2024, signal a strategic shift towards fostering greater flexibility, encouraging innovation, and boosting the overall competitiveness of the banking sector. This evolution in the regulatory framework directly impacts Bank Mandiri's strategic planning and its ability to adapt to market dynamics.

Bank Mandiri's operations are heavily influenced by stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. Compliance with these laws, often monitored by bodies like the Indonesian Financial Transaction Reports and Analysis Center (PPATK), is essential to deter illegal financial flows and mitigate risks of substantial fines and damage to the bank's reputation. For instance, in 2023, PPATK reported blocking suspicious transactions totaling trillions of Indonesian Rupiah, highlighting the critical nature of these oversight functions.

Furthermore, the Financial Services Authority (OJK) is actively working on refining regulations concerning dormant bank accounts. This initiative aims to bolster banking sector stability and prevent potential exploitation of inactive accounts for illicit purposes, underscoring the evolving legal landscape Bank Mandiri must navigate.

Consumer protection laws are crucial for Bank Mandiri, with regulations like OJK Regulation No. 22 of 2023 emphasizing fair practices, transparency, and robust data privacy. Adherence to these mandates is essential for safeguarding customer rights and fostering trust. In 2024, Indonesian banks, including Mandiri, are under increased scrutiny to ensure their digital offerings and product disclosures meet these stringent consumer protection standards.

Data Protection & Privacy Regulations (PDP Law)

Bank Mandiri, like all financial institutions, must navigate the evolving landscape of data protection and privacy regulations, notably Indonesia's Personal Data Protection (PDP) Law. This necessitates significant investment in robust systems for collecting, storing, and processing customer data securely. Failure to comply can result in substantial penalties and damage to the bank's reputation.

Compliance with the PDP Law is not just a legal obligation but a critical factor in maintaining customer trust. In 2023, Indonesia's financial sector saw a growing emphasis on data security, with regulatory bodies increasing scrutiny. For Bank Mandiri, this means ensuring every touchpoint, from digital onboarding to transaction processing, adheres to strict privacy standards.

- Enhanced Data Security Measures: Implementing advanced encryption and access controls for all customer information.

- Transparent Data Handling Policies: Clearly communicating to customers how their data is collected, used, and protected, aligning with PDP Law requirements.

- Regular Compliance Audits: Conducting frequent internal and external reviews to ensure ongoing adherence to data privacy mandates.

- Customer Consent Management: Establishing clear protocols for obtaining and managing customer consent for data processing activities.

Competition Law & Market Dominance

Bank Mandiri, as a significant state-owned entity, is subject to Indonesia's competition laws, designed to prevent any single player from unfairly dominating the market. This oversight is crucial as the banking sector evolves, with new digital banks and fintech companies actively entering the scene, fostering a more dynamic and competitive environment.

The Indonesian Competition Supervisory Commission (KPPU) plays a vital role in monitoring market practices. For instance, in 2023, the KPPU investigated several alleged anti-competitive practices across various sectors, highlighting the active enforcement of these regulations.

- Regulatory Scrutiny: Bank Mandiri must adhere to regulations that curb monopolistic behavior and ensure a level playing field for all financial institutions.

- Market Dynamics: The rise of digital banks, such as Bank Jago and Seabank Indonesia, intensifies competition, pushing incumbents like Bank Mandiri to innovate and offer competitive pricing and services.

- Consumer Protection: Competition laws ultimately aim to protect consumers by ensuring access to a variety of financial products and services at fair prices.

Bank Mandiri operates within a robust legal framework primarily governed by the Financial Services Authority (OJK), which sets stringent capital requirements and lending standards. Recent directives, like OJK Regulation 26/2024, aim to enhance sector competitiveness and innovation, directly influencing Mandiri's strategic adaptation. The bank must also navigate strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, with bodies like PPATK actively monitoring transactions; in 2023, PPATK reported blocking trillions of Rupiah in suspicious transactions, underscoring the critical nature of compliance.

Environmental factors

Indonesia's growing emphasis on ESG principles is significantly shaping Bank Mandiri's approach to lending and investment. This push is prompting the bank to embed ESG considerations into its core strategies, aiming to be a frontrunner in the nation's shift towards a greener economy.

Bank Mandiri's commitment is evident in its comprehensive Sustainability Framework, which encompasses Sustainable Finance, Sustainable Operations, and Sustainability Beyond Banking. This structured approach guides the bank's efforts to align its business with environmental and social objectives.

For instance, in 2023, Bank Mandiri reported that its sustainable finance portfolio reached IDR 243.5 trillion, demonstrating a tangible commitment to financing environmentally and socially responsible projects. This figure highlights the bank's active role in supporting Indonesia's low-carbon transition.

Bank Mandiri is exposed to climate change through physical risks like extreme weather events impacting its infrastructure and transition risks stemming from evolving environmental regulations and market shifts toward sustainability. For instance, increased frequency of natural disasters in Indonesia could damage bank branches or affect the collateral value of loans in affected areas.

To address these challenges, Bank Mandiri is a key player in Indonesia's green financing sector, holding approximately 30 percent of the market share as of early 2024. This commitment is demonstrated through substantial support for renewable energy projects and other environmentally sustainable initiatives, aiming to foster a low-carbon economy.

Bank Mandiri is actively integrating sustainable lending practices into its core operations, a move that aligns with growing global and national environmental concerns. This means that when evaluating potential borrowers, the bank now requires them to demonstrate adherence to specific environmental management criteria.

This commitment is not just a statement of intent; it's a crucial part of Bank Mandiri's credit policy, ensuring that financing is directed away from activities with detrimental environmental consequences. Examples of such excluded activities include illegal logging and the establishment of plantations on sensitive peatland areas, highlighting a clear stance against environmentally damaging business practices.

In 2024, Bank Mandiri's commitment to sustainability is further evidenced by its participation in initiatives like the ASEAN Green Bond Standards, aiming to channel funds towards environmentally friendly projects. The bank's sustainability financing portfolio saw a significant increase, reaching IDR 205.6 trillion by the end of 2023, demonstrating a tangible shift towards supporting greener economic activities.

Resource Scarcity & Operational Footprint

Bank Mandiri is actively addressing resource scarcity and its operational footprint, a critical environmental concern. The bank is committed to promoting energy efficiency across its vast network of branches and data centers. This focus is crucial for minimizing environmental impact and ensuring sustainable operations.

A significant driver for Bank Mandiri's environmental strategy is its ambitious target of achieving Net Zero Emissions in Operations by 2030. This commitment necessitates proactive measures to reduce carbon emissions throughout its business activities. Digitalization plays a key role in this endeavor, with initiatives like Digital Carbon Tracking being implemented to monitor and manage emissions effectively.

Bank Mandiri's operational footprint is directly impacted by resource availability and consumption. For instance, energy consumption in its data centers and branches contributes to its overall environmental impact. By prioritizing energy efficiency, the bank aims to reduce its reliance on scarce resources and lower its carbon emissions, aligning with global sustainability goals.

- Net Zero Emissions Target: Bank Mandiri aims to achieve Net Zero Emissions in Operations by 2030.

- Digital Carbon Tracking: This initiative is part of the bank's strategy to monitor and manage its carbon footprint.

- Energy Efficiency Focus: The bank is implementing measures to enhance energy efficiency across its extensive network.

Reputation & Stakeholder Pressure on Sustainability

Bank Mandiri faces growing demands from investors, customers, and regulators to prioritize environmental responsibility, shaping its strategic decisions. This pressure is a significant environmental factor influencing the bank's operational and investment strategies. The push for sustainability is becoming a core element of corporate governance.

Demonstrating a solid commitment to sustainability is crucial for Bank Mandiri's reputation and ability to attract capital. For instance, receiving accolades such as the KEHATI ESG Award 2025 highlights the bank's dedication to environmental, social, and governance principles. Such recognition can directly translate into a stronger brand image and appeal to a growing segment of ethically-minded investors.

- Stakeholder Pressure: Investors, customers, and regulators are increasingly demanding greater environmental accountability from financial institutions.

- Reputation Enhancement: Awards like the KEHATI ESG Award 2025 bolster Bank Mandiri's reputation as a sustainable financial player.

- Investment Attraction: A strong sustainability profile can attract responsible investment funds and environmentally conscious customers.

- Strategic Alignment: Bank Mandiri's strategic direction is being influenced by the need to integrate ESG factors into its core business.

Bank Mandiri is actively integrating sustainable lending practices, aligning with growing environmental concerns. This commitment is reflected in its substantial sustainable finance portfolio, which reached IDR 205.6 trillion by the end of 2023, demonstrating a tangible shift towards supporting greener economic activities.

The bank aims to achieve Net Zero Emissions in Operations by 2030, implementing initiatives like Digital Carbon Tracking to manage its carbon footprint and focusing on energy efficiency across its network.

Bank Mandiri holds a significant market share, approximately 30 percent as of early 2024, in Indonesia's green financing sector, underscoring its role in supporting renewable energy and other sustainable initiatives.

Growing stakeholder pressure from investors, customers, and regulators is compelling Bank Mandiri to prioritize environmental responsibility, influencing its strategic decisions and corporate governance.

| Metric | Value | Year | Notes |

|---|---|---|---|

| Sustainable Finance Portfolio | IDR 205.6 trillion | 2023 | Demonstrates commitment to greener economic activities. |

| Green Financing Market Share | ~30% | Early 2024 | Indicates leadership in supporting renewable energy. |

| Net Zero Emissions Target | By 2030 | Ongoing | Focus on operational carbon footprint reduction. |

PESTLE Analysis Data Sources

Our Bank Mandiri PESTLE Analysis is built on a robust foundation of data from official Indonesian government agencies, international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both accurate and current.