Bank Mandiri Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Mandiri Bundle

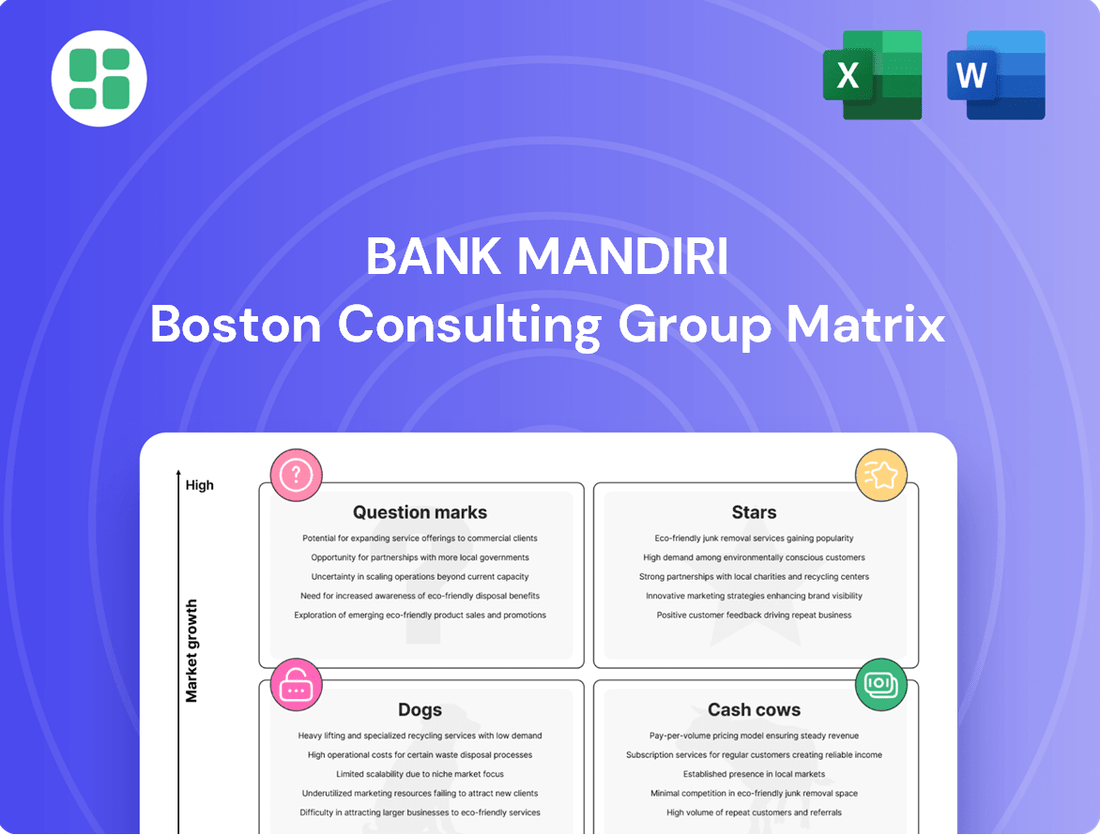

Curious about Bank Mandiri's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas, but for a truly actionable understanding of their Stars, Cash Cows, Dogs, and Question Marks, you need the full picture.

Unlock the complete Bank Mandiri BCG Matrix and gain a comprehensive view of their market position and product performance. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investments.

Don't miss out on the strategic clarity that the full Bank Mandiri BCG Matrix provides. Purchase it now to receive a detailed breakdown, enabling you to identify growth opportunities and optimize your investment strategy.

Stars

Livin' by Mandiri, Bank Mandiri's retail digital super app, is a clear star in the BCG matrix. Its user base has exploded, surpassing 30 million by March 2025, marking a substantial 30-39% year-on-year growth. This rapid expansion highlights its strong market appeal and dominance within Indonesia's digital banking landscape.

The app's success is further evidenced by a significant surge in transaction frequency and value, indicating deep user engagement and a robust ecosystem. Bank Mandiri's continued substantial investment in Livin' by Mandiri, focusing on new features and ecosystem expansion, solidifies its position as a high-growth, high-market-share product.

Kopra by Mandiri is a key player in Bank Mandiri's wholesale banking strategy, demonstrating robust growth. In 2024, its transaction value soared to Rp22,700 trillion, with a further Rp6,000 trillion recorded in the first quarter of 2025. This surge is underpinned by a healthy transaction volume increase of 17-23% year-on-year.

This digital platform is instrumental for the corporate segment, enhancing operational efficiency and extending Bank Mandiri's digital reach across domestic and international markets. Kopra's strategic significance lies in its ability to reinforce the bank's leadership in wholesale banking and expand its market share.

Bank Mandiri's retail lending through digital channels is a clear star in its BCG matrix. In 2024, the bank saw a remarkable 113% surge in retail and subsidiary loans, a testament to the effectiveness of its digital acquisition strategies. This impressive growth highlights both strong market demand and Bank Mandiri's successful pivot towards digital-first customer engagement, particularly through its popular Livin' by Mandiri app.

Digital MSME Lending and Services

Bank Mandiri is heavily invested in boosting digital services for Micro, Small, and Medium Enterprises (MSMEs). Initiatives like Livin' Merchant are a testament to this, attracting a substantial user base. By March 2025, Livin' Merchant had already onboarded 2.6 million users, showcasing strong adoption and market penetration.

This focus on digital MSME lending and services positions Bank Mandiri to capitalize on high growth potential. Platforms such as Kopra by Mandiri are crucial in this strategy, enhancing financial access and connectivity for a vast number of SMEs. This expansion is vital for fostering inclusive economic growth.

- Digital MSME Lending and Services

- Strategic Focus: Accelerating SME digitization through innovative platforms.

- Key Initiative: Livin' Merchant achieved 2.6 million users by March 2025.

- Growth Driver: Kopra by Mandiri enhances financial access and connectivity for SMEs.

- Market Impact: Tapping into a rapidly expanding market for inclusive economic growth.

Digital Investment Products (Livin' Invest)

Livin' Invest, a prominent feature within Bank Mandiri's super app, Livin' by Mandiri, has emerged as a significant growth driver, fitting the 'Star' category in the BCG Matrix. Its success is underscored by a tenfold surge in stock account openings since its inception, highlighting strong market demand for accessible digital investment tools.

This digital platform simplifies the process of investing in mutual funds and Sukuk, effectively drawing in a new demographic of retail investors. The swift uptake and increasing transaction volumes solidify Livin' Invest's position as a leading player in the rapidly expanding digital investment sector.

- Tenfold increase in stock account openings: This signifies robust market adoption and a successful strategy in attracting new investors to digital platforms.

- Integration within Livin' by Mandiri super app: This seamless integration provides users with convenient access to investment products alongside other banking services, enhancing user experience and engagement.

- Simplified access to mutual funds and Sukuk: By streamlining the investment process, Livin' Invest lowers the barrier to entry for retail investors, fostering financial inclusion.

- Rapid adoption and transaction volume growth: These metrics confirm Livin' Invest's status as a high-growth, high-market-share product, characteristic of a 'Star' in the BCG matrix.

Livin' by Mandiri continues to shine as a star, with its user base exceeding 30 million by March 2025, reflecting a strong 30-39% year-on-year growth. This digital super app's success is further cemented by increasing transaction frequency and value, indicating deep user engagement. Bank Mandiri's ongoing investment in Livin' by Mandiri, focusing on new features and ecosystem expansion, ensures its continued dominance in Indonesia's digital banking sector.

| Product | BCG Category | Key Metrics (as of March 2025) | Strategic Significance |

|---|---|---|---|

| Livin' by Mandiri | Star | 30+ million users; 30-39% YoY user growth | Dominant retail digital super app; high user engagement |

| Kopra by Mandiri | Star | Rp22.7 trillion transaction value (2024); Rp6 trillion (Q1 2025); 17-23% YoY transaction volume growth | Key wholesale banking platform; enhances corporate efficiency |

| Digital Retail Lending | Star | 113% surge in retail/subsidiary loans (2024) | Leverages digital channels for significant loan growth |

| Digital MSME Services (e.g., Livin' Merchant) | Star | 2.6 million users (Livin' Merchant by March 2025) | Expands financial access for SMEs; drives inclusive growth |

| Livin' Invest | Star | Tenfold increase in stock account openings | Simplifies digital investing; attracts new retail investors |

What is included in the product

This BCG Matrix overview for Bank Mandiri offers tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

A clear visual of Bank Mandiri's BCG Matrix helps prioritize resources, alleviating the pain of scattered strategic focus.

Cash Cows

Bank Mandiri's established corporate lending portfolio is a true Cash Cow. As Indonesia's largest bank, its dominance in corporate banking provides a substantial and reliable income source. This segment experienced robust growth in 2024, underscoring its mature market leadership and consistent profit generation.

The bank's strategic focus on reinforcing its wholesale banking strength is designed to preserve this leading market share and ensure ongoing profitability. This commitment to its core corporate lending business highlights its stability and consistent performance within the financial sector.

Bank Mandiri's Current Account Savings Account (CASA) base stands as a robust Cash Cow, a testament to its strong market position. In 2024, this low-cost funding source represented a significant 80.3% of the bank's total Third Party Funds (DPK).

This substantial and stable pool of funds is a key differentiator, significantly reducing Bank Mandiri's overall cost of funds and enhancing its profitability. It provides a solid foundation for lending activities and investment.

The bank actively cultivates this advantage through its advanced digital platforms, such as Livin' and Kopra. These initiatives are instrumental in driving further CASA growth, solidifying this critical funding advantage.

Bank Mandiri's traditional payment and transaction services are a cornerstone of its revenue, consistently delivering robust fee-based income. These services, encompassing everything from interbank transfers to widespread bill payment options via established channels, benefit from the bank's vast network and substantial customer base.

This segment operates within a mature market, where Bank Mandiri holds a significant market share. While growth in this area is relatively modest, its stability and predictability provide a reliable revenue stream. For instance, in 2023, transaction banking, which heavily relies on these traditional services, contributed significantly to the bank's overall income, demonstrating its enduring strength.

Treasury Services

Bank Mandiri's Treasury Services, including foreign exchange, money markets, and fixed income, are a consistent source of non-interest income. This division operates within a mature market, where Bank Mandiri enjoys a substantial market share, ensuring stable profitability and bolstering the bank's overall financial health.

This business line is characterized by its high market share but lower growth potential, fitting the profile of a Cash Cow. For instance, in 2024, treasury operations are expected to contribute significantly to the bank's fee-based income, reflecting their established and reliable revenue generation capabilities.

- Stable Revenue: Treasury services provide a predictable and ongoing stream of income for Bank Mandiri.

- Market Dominance: The bank holds a strong position in the treasury market, leveraging its scale.

- Profitability Driver: This segment is a key contributor to the bank's overall profitability, particularly in non-interest income.

- Low Growth, High Share: While not expanding rapidly, its established presence ensures consistent returns.

Branch-Based Retail Deposits

Bank Mandiri's extensive network of physical branches across Indonesia acts as a significant anchor for its retail deposit base, contributing substantially to its Third Party Funds. This established infrastructure ensures a steady and dependable inflow of funds from a loyal customer segment.

While digital platforms are key for attracting new customers, the physical branches provide a consistent and often lower-cost funding source from traditional account holders. This stability is crucial for the bank's financial health, even if growth in this segment is more measured.

- Branch Network Strength: As of Q1 2024, Bank Mandiri maintained a vast network of over 3,300 branches and sub-branches throughout Indonesia, supporting its retail deposit gathering capabilities.

- Deposit Contribution: Retail deposits from its branch network form a core component of Bank Mandiri's total Third Party Funds, providing a stable and predictable funding base.

- Cost Efficiency: While digital channels offer scalability, the established branch network often translates to a lower average cost of funds for these traditional deposits.

- Steady Growth: In 2023, Bank Mandiri reported a steady increase in its retail deposit portfolio, with a significant portion attributed to its widespread physical presence.

Bank Mandiri's established corporate lending portfolio is a true Cash Cow, representing a significant and reliable income source. This segment saw robust growth in 2024, highlighting its mature market leadership and consistent profit generation.

The bank's strategic focus on reinforcing its wholesale banking strength aims to preserve this leading market share, ensuring ongoing profitability and stability within the financial sector.

Bank Mandiri's Current Account Savings Account (CASA) base is a robust Cash Cow, a testament to its strong market position. In 2024, this low-cost funding source represented a significant 80.3% of the bank's total Third Party Funds (DPK), providing a solid foundation for lending activities.

The bank actively cultivates this advantage through advanced digital platforms like Livin' and Kopra, instrumental in driving further CASA growth and solidifying this critical funding advantage.

Traditional payment and transaction services are a cornerstone of Bank Mandiri's revenue, consistently delivering robust fee-based income. These services benefit from the bank's vast network and substantial customer base, providing a stable and predictable revenue stream.

Bank Mandiri's Treasury Services, including foreign exchange and money markets, are a consistent source of non-interest income. This division operates within a mature market where Bank Mandiri enjoys substantial market share, ensuring stable profitability.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Insight |

| Corporate Lending | Cash Cow | Dominant market share, stable income | Robust growth in 2024, mature market leadership |

| CASA Base | Cash Cow | Low-cost funding, significant market share | 80.3% of total Third Party Funds (DPK) in 2024 |

| Payment & Transaction Services | Cash Cow | Mature market, stable fee income | Significant market share, predictable revenue stream |

| Treasury Services | Cash Cow | Stable non-interest income, market dominance | Expected significant contribution to fee-based income in 2024 |

What You See Is What You Get

Bank Mandiri BCG Matrix

The Bank Mandiri BCG Matrix preview you are currently viewing is the exact, fully comprehensive document you will receive immediately upon purchase. This means you're seeing the complete analysis, free from any watermarks or demo limitations, ready for immediate strategic application. You can confidently assess its value, knowing the final version will be identical and prepared for your business planning needs. This ensures transparency and guarantees you are purchasing a polished, professional report designed to provide actionable insights into Bank Mandiri's product portfolio.

Dogs

Bank Mandiri's commitment to digital transformation means that any lingering legacy systems, those that are still manual or paper-based, are likely drains on resources. These systems, by their nature, struggle to keep pace with the speed and efficiency demanded by today's financial services environment.

These outdated operations represent a significant challenge. They offer very little in terms of growth potential and provide minimal competitive edge in a market increasingly dominated by digital solutions. Consequently, they are prime candidates for either a thorough restructuring or a complete divestment to streamline operations and focus on more modern, profitable ventures.

Certain specialized conventional loan portfolios within Bank Mandiri might be experiencing persistent underperformance. These could be niche segments or geographically concentrated areas where loan defaults are consistently higher, or where growth has stalled significantly. For example, if a particular sector saw a downturn in 2024, loans to that sector might show elevated NPLs.

These underperforming portfolios can act as cash traps, tying up valuable capital and resources without generating adequate returns. Without strategic intervention or a clear plan for revitalization, they drain profitability. Consider a scenario where a specific industry, like traditional retail in certain regions, faced significant challenges in 2024, leading to increased defaults on business loans.

Bank Mandiri may hold smaller, non-core subsidiaries or investments that haven't gained substantial market traction or don't align synergistically with its primary banking functions. These entities might be using up valuable resources without significantly contributing to the bank's overall strategic expansion. For instance, a small fintech venture acquired in 2022 that has yet to demonstrate significant user growth or revenue could fall into this category.

Traditional Fee-Based Services with Declining Volumes

Certain traditional fee-based services within Bank Mandiri, particularly those tied to physical branch transactions or legacy administrative functions, are facing a downturn in usage. These services, like manual account updates or over-the-counter remittances, are increasingly being superseded by more streamlined digital platforms. For instance, while specific figures for 2024 are still emerging, the broader trend in Indonesian banking shows a significant shift towards digital channels for everyday transactions.

These legacy services often represent a cost burden without contributing substantially to new revenue streams or market growth. Their operational expenses, from staffing to infrastructure, outweigh the diminishing income they generate. This makes them prime candidates for the 'dog' category in a BCG matrix analysis, indicating low growth and low market share.

- Declining Transaction Volumes: Services like in-branch cheque processing or physical statement requests are seeing reduced customer engagement.

- High Operational Costs: Maintaining the infrastructure and personnel for these less-utilized services incurs significant expenses.

- Limited Growth Potential: The shift to digital alternatives severely restricts the future growth prospects of these traditional offerings.

- Strategic Review Needed: Bank Mandiri may need to consider phasing out or significantly re-evaluating the cost-effectiveness of these services.

Limited-Use International Banking Operations (Non-Digitalized)

Within Bank Mandiri's portfolio, certain non-digitalized international banking operations, particularly those that are older or smaller, might be classified as dogs. These units often exhibit limited market share and haven't received substantial strategic investment, especially as the bank prioritizes its digital expansion, exemplified by the growth of Kopra by Mandiri.

These operations may struggle to compete in the rapidly evolving global financial landscape. For instance, if a particular overseas branch still relies heavily on manual processes and has not integrated advanced digital banking solutions, its operational efficiency and customer acquisition capabilities would likely be significantly lower compared to its digitally-enabled counterparts.

Consider a scenario where a small, non-digitalized international representative office in a less developed market has seen its transaction volumes stagnate. While Bank Mandiri reported a significant increase in its digital transaction volume, reaching trillions of Rupiah in 2024, these older operations represent a shrinking portion of the bank's overall international business.

- Low Market Share: These operations typically hold a minimal percentage of the market in their specific geographic locations.

- Limited Strategic Investment: They have not been a focus for significant capital allocation or strategic development initiatives.

- Misalignment with Digital Strategy: Their non-digitalized nature contrasts sharply with the bank's aggressive push towards digital international banking services.

- Stagnant Growth: These units often show little to no growth in customer base or transaction volume, unlike the bank's digitally driven international offerings.

Bank Mandiri's "Dogs" represent business units or services with low market share and low growth potential. These are typically legacy systems or offerings that are being outpaced by digital alternatives. For example, certain manual, in-branch transaction services are seeing declining usage and high operational costs, making them candidates for divestment or significant restructuring.

These underperforming segments, like specialized conventional loan portfolios with persistently high non-performing loans (NPLs) or non-core subsidiaries that haven't gained traction, drain resources without contributing significantly to strategic expansion. Their limited growth prospects and minimal competitive edge necessitate a careful review to optimize capital allocation.

Consider specific non-digitalized international operations or older fee-based services tied to physical transactions. These often have high operational expenses relative to diminishing income, exemplifying the characteristics of a "dog" in the BCG matrix. Bank Mandiri's overall digital transaction volume, which reached trillions of Rupiah in 2024, highlights the stark contrast with these lagging segments.

These "dog" segments require strategic attention to either revitalize them or phase them out to enhance overall profitability and focus on high-growth digital initiatives.

Question Marks

Bank Mandiri is actively investing in new AI and Generative AI applications, particularly for enhancing operational efficiency, streamlining document verification, and bolstering fraud detection capabilities. These advanced technologies represent a significant growth area, promising future innovation and cost savings.

While the potential is high, the direct revenue contribution and market share of these AI initiatives are still in their early stages and unproven. Significant investment is required to scale these applications effectively, positioning them as potential Stars or Question Marks within a strategic framework.

Bank Mandiri is actively pursuing partnerships within emerging digital ecosystems, aiming to broaden its reach and enhance its banking services. This strategy involves collaborating with innovative FinTechs and other digital players, a move that aligns with the growth potential often seen in "question mark" categories within the BCG matrix.

These new ventures, while promising high growth, currently represent a smaller portion of Bank Mandiri's overall market presence. For instance, in 2024, digital banking transactions for Indonesian banks, including Mandiri, saw a significant surge, with many of these transactions facilitated through ecosystem collaborations. The success of these partnerships hinges on their ability to gain traction and scale effectively within the rapidly evolving digital landscape.

Livin' by Mandiri's expansion into Timor-Leste positions it as a potential star in a developing market. While Bank Mandiri is a domestic leader, this international venture faces a high-growth opportunity but currently holds a minimal market share. This requires significant investment to adapt services and build brand recognition against existing local banking solutions.

Sustainable Finance & ESG-linked Products

Bank Mandiri is actively integrating Environmental, Social, and Governance (ESG) principles into its core business, aiming to bolster its sustainable finance portfolio. This strategic shift is driven by a growing global demand for ESG-aligned investments and increasing regulatory pressure, positioning sustainable finance as a key growth area.

The market for ESG-linked products is experiencing significant expansion. For instance, global sustainable debt issuance reached a record high in 2023, with projections indicating continued robust growth through 2025. Bank Mandiri's current penetration in these specialized product segments is likely nascent, necessitating substantial capital allocation and strategic development to capitalize on this high-potential, rapidly evolving market.

- Market Growth: The global sustainable finance market is projected to grow substantially, driven by investor demand and regulatory tailwinds.

- Bank Mandiri's Position: While committed to ESG, Bank Mandiri's current market share in specific ESG-linked products is likely limited, presenting an opportunity for significant expansion.

- Investment Requirement: Capturing this high-growth potential will require strategic investments in product development, expertise, and market outreach.

- Competitive Landscape: The increasing focus on ESG means a competitive landscape is emerging, requiring proactive strategies to secure a strong market position.

Advanced Wealth Management Solutions

Bank Mandiri is likely exploring advanced wealth management solutions, potentially including sophisticated robo-advisory services and AI-driven personalized financial planning tools. These initiatives target a growing, affluent customer base seeking tailored investment strategies and digital convenience. For instance, as of early 2024, the digital banking sector in Indonesia, which underpins such advanced solutions, saw a significant surge in user adoption, with transaction values on digital platforms reaching trillions of Rupiah.

These cutting-edge offerings, while promising high growth potential, are still in their nascent stages of market penetration. Significant investment in marketing and continuous technological development is crucial to drive customer adoption and capture a larger market share in this competitive landscape. The bank’s strategic focus on digital transformation, evidenced by its continued investment in its digital platforms throughout 2023, suggests a commitment to nurturing these advanced wealth management capabilities.

- Robo-Advisory Development: Focus on building and refining automated investment platforms.

- Personalized Planning Tools: Enhancing digital tools for bespoke financial advice.

- Market Penetration Strategy: Implementing targeted marketing campaigns to drive adoption.

- Technological Investment: Allocating resources for ongoing platform innovation and user experience improvements.

Bank Mandiri's ventures into new digital ecosystems and international markets, like its Livin' by Mandiri expansion into Timor-Leste, represent classic "Question Marks." These initiatives offer high growth potential but currently have low market share, demanding significant investment to gain traction and establish a strong presence.

Similarly, its investments in AI and advanced wealth management solutions, while promising future innovation and efficiency, are in their early stages. These areas require substantial capital and strategic development to transition from potential growth opportunities to established market leaders, mirroring the characteristics of Question Marks in the BCG matrix.

The bank's focus on ESG-linked products also falls into this category. The sustainable finance market is expanding rapidly, but Bank Mandiri's current penetration in these niche segments is likely limited, necessitating strategic investment to build expertise and market share in this evolving landscape.

These initiatives collectively highlight Bank Mandiri's strategic pivot towards future growth engines, acknowledging the inherent risks and substantial investment required to cultivate them into market-leading "Stars."

BCG Matrix Data Sources

Our Bank Mandiri BCG Matrix is informed by a robust blend of internal financial statements, comprehensive market research reports, and official regulatory filings to ensure accurate strategic insights.