Bank Mandiri Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Mandiri Bundle

Bank Mandiri navigates a dynamic banking landscape shaped by intense rivalry and evolving customer expectations. Understanding the bargaining power of buyers and the threat of substitutes is crucial for its sustained success.

The complete report reveals the real forces shaping Bank Mandiri’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bank Mandiri's reliance on technology and infrastructure providers for its core banking systems, digital platforms, and cybersecurity solutions means these suppliers can wield moderate to high bargaining power. This is particularly true for proprietary systems where switching costs are substantial, and the availability of equally capable vendors for critical components is limited. For instance, a significant outage in a core banking system from a single provider could severely disrupt operations.

In 2024, the global IT infrastructure market saw continued consolidation, potentially increasing the power of remaining large players. Bank Mandiri's substantial scale, however, provides leverage. As of Q1 2024, Bank Mandiri reported significant investments in digital transformation, indicating a strong demand for advanced technological solutions, which could allow them to negotiate better terms with key vendors due to their strategic importance as a major client.

Payment network operators like Visa and Mastercard, along with domestic interbank networks, hold significant sway over Bank Mandiri's operations. Their established infrastructure and near-universal acceptance make them difficult to replace, granting them substantial bargaining power. For instance, Visa and Mastercard processed trillions of dollars in transactions globally in 2023, underscoring their essential role.

While Bank Mandiri's sheer transaction volume allows it to negotiate, the fundamental necessity of these networks for card issuance and acceptance means their power remains considerable. This reliance limits Bank Mandiri's ability to dictate terms, as these networks are critical gateways for its payment services.

The availability of highly skilled professionals, especially in digital banking, data analytics, cybersecurity, and risk management, is a crucial supplier input for Bank Mandiri. The Indonesian financial sector's rapid growth fuels a high demand for this talent, granting these skilled individuals significant leverage in negotiating salaries and benefits.

In 2024, the average salary for a data scientist in Indonesia ranged from IDR 15 million to IDR 30 million per month, reflecting the competitive nature of this talent pool. To counter this supplier power, Bank Mandiri needs to implement robust talent attraction and retention programs, potentially including competitive compensation packages, continuous professional development, and a strong employer brand.

Capital Market Providers (Wholesale Funding)

Bank Mandiri, like other large banks, doesn't solely rely on retail deposits for funding. It actively participates in wholesale markets, raising capital through bond issuances and interbank borrowings. The bargaining power of these capital market providers is influenced by several factors, including the overall liquidity in financial markets, prevailing interest rate environments, and, crucially, the bank's own creditworthiness.

In periods of tight market liquidity, the cost of wholesale funding naturally escalates, thereby increasing the leverage of these providers. However, Bank Mandiri's robust credit rating typically allows it to secure funding at competitive rates, mitigating some of this supplier power. For instance, as of the first quarter of 2024, Bank Mandiri maintained a strong credit rating from agencies like Fitch, which is a testament to its financial stability and access to capital.

- Wholesale Funding Sources: Bank Mandiri sources funds from capital markets via bond issuances and interbank loans, complementing its deposit base.

- Factors Influencing Supplier Power: Market liquidity, interest rate trends, and Bank Mandiri's credit rating are key determinants of capital market providers' bargaining power.

- Impact of Creditworthiness: A strong credit rating, such as Bank Mandiri's consistent BBB+ rating from S&P as of late 2023, generally provides an advantage in securing favorable wholesale funding terms.

- Market Conditions: During periods of financial stress or reduced market liquidity, the cost of wholesale funding can rise, enhancing the bargaining power of providers.

Regulatory Compliance Service Providers

Regulatory compliance service providers, such as specialized legal firms and financial consultants, wield significant bargaining power. This is due to the intricate and constantly changing landscape of financial regulations, which necessitates expert knowledge to avoid costly penalties and maintain operational licenses. For instance, in 2024, the global regulatory compliance market was valued at approximately USD 100 billion and is projected to grow, indicating a high demand for these specialized services.

Bank Mandiri, despite its substantial size and internal capabilities, cannot entirely insulate itself from the need for external validation in critical compliance areas. The specialized knowledge these service providers possess is often a prerequisite for navigating complex regulatory frameworks, such as those related to anti-money laundering (AML) and know-your-customer (KYC) requirements. The potential fines for non-compliance can be substantial; for example, major banks have faced multi-million dollar penalties in recent years for compliance failures.

- Specialized Knowledge: Providers possess deep expertise in evolving financial regulations.

- Critical Services: Their services are essential for avoiding penalties and maintaining licenses.

- High Demand: The global compliance market's growth signifies strong demand for these experts.

- Risk Mitigation: Banks rely on external validation to ensure adherence to strict regulatory standards.

Suppliers of critical technology infrastructure and specialized financial talent hold considerable bargaining power over Bank Mandiri. This is due to the high switching costs associated with proprietary systems and the intense demand for skilled professionals in areas like digital banking and cybersecurity. For example, in 2024, the average monthly salary for a data scientist in Indonesia could range from IDR 15 million to IDR 30 million, reflecting this competitive talent market.

Payment network operators, such as Visa and Mastercard, also exert significant influence due to their essential role in facilitating transactions, a position reinforced by their processing of trillions of dollars globally in 2023. Similarly, providers of wholesale funding, while somewhat mitigated by Bank Mandiri's strong credit rating (e.g., BBB+ from S&P as of late 2023), can increase their leverage during periods of tight market liquidity.

| Supplier Type | Bargaining Power Level | Key Influencing Factors | Supporting Data/Examples |

|---|---|---|---|

| Technology Infrastructure Providers | Moderate to High | Proprietary systems, switching costs, limited alternatives | Continued IT market consolidation in 2024 |

| Skilled Financial Professionals | High | High demand in digital banking, data analytics, cybersecurity | Data scientist salaries in Indonesia (IDR 15-30 million/month in 2024) |

| Payment Network Operators | High | Essential infrastructure, universal acceptance, high transaction volumes | Trillions of dollars processed globally by Visa/Mastercard in 2023 |

| Wholesale Funding Providers | Moderate | Market liquidity, interest rates, bank's creditworthiness | Bank Mandiri's BBB+ rating from S&P (late 2023) |

What is included in the product

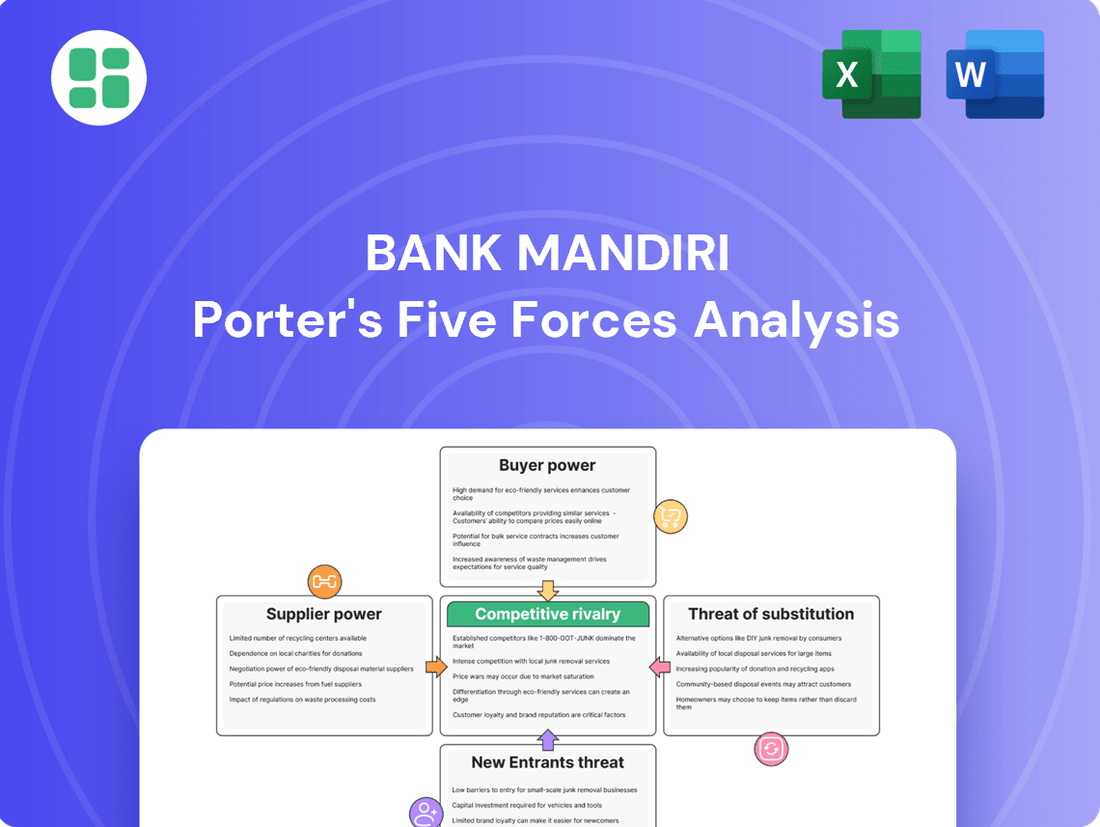

This analysis of Bank Mandiri's competitive environment dissects the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly identify and address competitive threats with a comprehensive breakdown of Bank Mandiri's industry landscape.

Customers Bargaining Power

Retail depositors and borrowers at Bank Mandiri, while individually possessing limited bargaining power due to standardized offerings and manageable switching costs in a crowded banking landscape, collectively wield influence. Their sensitivity to interest rates, service fees, and the quality of digital banking experiences can significantly shape the bank's strategic decisions and product development.

The increasing accessibility of digital banking and fintech solutions means customers can readily open accounts with alternative providers, thereby amplifying their collective leverage. For instance, as of early 2024, Indonesia's digital banking sector has seen rapid growth, with many new players offering attractive rates and lower fees, directly challenging traditional banks like Bank Mandiri for retail customer deposits and loan business.

SME clients generally possess moderate bargaining power. While they need more tailored services than individual consumers, they don't command the same leverage as major corporations. Their ability to negotiate is often tied to the availability of other funding sources, such as competing banks and alternative lenders.

In 2024, Bank Mandiri's focus on digital transformation aimed to streamline services for SMEs, potentially reducing their reliance on personalized, high-touch interactions that could amplify bargaining power. For instance, the bank's digital lending platforms offer faster approvals, a key concern for SMEs needing working capital.

Bank Mandiri's corporate and institutional clients possess considerable bargaining power. Their large transaction volumes and complex financial requirements mean they can negotiate for better rates and customized services across loans, treasury, and investment banking. For instance, in 2024, the bank's corporate lending segment continued to be a significant revenue driver, highlighting the importance of these relationships.

Digital Platform Users

Digital platform users at Bank Mandiri wield growing bargaining power. This is fueled by the ease of comparing financial products online and the simplicity of switching between competing digital banking services. Their expectations are high for intuitive interfaces, swift transactions, and tailored financial solutions.

Bank Mandiri's digital users are increasingly discerning, expecting seamless experiences and readily available comparisons. In 2024, the demand for personalized digital banking services continued to surge, pushing banks to invest heavily in user experience and data analytics to meet these evolving needs. This segment's ability to switch providers with minimal friction directly impacts Bank Mandiri's customer retention strategies.

- High Expectations: Digital users anticipate intuitive app design, instant transaction confirmations, and personalized financial advice, driving the need for continuous platform upgrades.

- Ease of Switching: The low cost and minimal effort required to switch between digital banking platforms empower customers, forcing Bank Mandiri to offer competitive features and superior service.

- Transparency: Online comparison tools provide users with clear visibility into fees, interest rates, and service quality across different banks, intensifying competitive pressure.

Price Sensitivity of Customers

Customer price sensitivity significantly impacts Bank Mandiri, especially regarding loan interest rates and deposit yields. In 2024, Indonesian banks saw varied responses to interest rate changes; for instance, a 25 basis point hike by Bank Indonesia in April 2024 aimed to curb inflation, potentially influencing customer deposit choices and loan demand.

The competitive banking sector means even minor price differences, like a few basis points on a mortgage or a small fee on a transaction account, can sway customer allegiance. This forces Bank Mandiri to balance offering attractive pricing with ensuring its own profitability, a delicate act in a market where customers can easily switch providers.

- Price Sensitivity: Customers are highly sensitive to interest rates on loans and deposits, as well as service fees.

- Competitive Landscape: Small pricing differences can lead to significant customer shifts in the banking industry.

- Customer Power: This sensitivity grants customers considerable bargaining power, influencing Bank Mandiri's pricing strategies.

Bank Mandiri's retail customers, especially those engaged with digital platforms, possess increasing bargaining power due to heightened price sensitivity and the ease of switching providers. In 2024, the competitive Indonesian digital banking landscape offered customers readily comparable rates and fees, directly influencing their choices and compelling banks like Mandiri to maintain competitive pricing and superior digital experiences.

| Customer Segment | Bargaining Power Level | Key Influencing Factors (2024) |

|---|---|---|

| Retail Depositors/Borrowers | Moderate to High | Interest rates, fees, digital service quality, ease of switching |

| SME Clients | Moderate | Availability of alternative funding, tailored service needs |

| Corporate/Institutional Clients | High | Transaction volume, complex financial needs, negotiation for rates/customization |

| Digital Platform Users | Growing High | Intuitive interfaces, transaction speed, personalized solutions, online comparisons |

What You See Is What You Get

Bank Mandiri Porter's Five Forces Analysis

This preview presents the complete Bank Mandiri Porter's Five Forces Analysis, offering a thorough examination of competitive forces impacting the bank. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file. This means you'll receive the identical, ready-to-use analysis detailing threats from new entrants, buyer and supplier power, the threat of substitute products, and industry rivalry.

Rivalry Among Competitors

Bank Mandiri encounters significant competitive pressure from its state-owned peers, notably Bank Rakyat Indonesia (BRI) and Bank Negara Indonesia (BNI). These institutions frequently vie for the same customer bases, boasting expansive branch infrastructures and enjoying implicit government support, which can translate into preferential treatment or stability perceptions.

The rivalry is particularly pronounced across the retail, corporate, and small and medium-sized enterprise (SME) sectors. This intense competition often drives aggressive pricing strategies and a rapid pace of product development as each bank strives to capture and retain market share.

Major private banks like Bank Central Asia (BCA) and CIMB Niaga are fierce competitors, particularly targeting Bank Mandiri's affluent retail and corporate customer base. BCA's robust digital offerings and superior customer service present a direct challenge, compelling Bank Mandiri to continually invest in its own digital transformation and service enhancements to maintain its market share.

The Indonesian banking sector is experiencing a significant shift with the rise of digital banks and nimble fintech firms. These new entrants, offering specialized services such as peer-to-peer lending, e-wallets, and payment gateways, are increasingly challenging traditional players like Bank Mandiri. While they may not yet offer the full spectrum of services, their focus on specific product lines and customer segments creates considerable disruption.

This competitive pressure compels established institutions to hasten their digital transformation and foster innovation to remain competitive. For instance, by the end of 2023, Indonesia's digital economy was projected to reach $150 billion, with fintech playing a crucial role, highlighting the urgency for banks to adapt.

Product and Service Differentiation

Bank Mandiri faces intense rivalry, partly fueled by how well banks can make their products and services stand out. While Bank Mandiri aims for broad, all-encompassing solutions, competitors often carve out niches. For instance, BRI is a leader in microfinance, and BCA has a strong reputation in digital payments. This means Bank Mandiri must constantly innovate to differentiate its offerings across different customer groups, a significant ongoing competitive pressure.

The Indonesian banking sector saw significant digital transaction growth in 2023. For example, Bank Mandiri reported a substantial increase in digital channel transactions, reflecting a broader industry trend. However, rivals like BCA have also heavily invested in their digital platforms, creating a highly competitive landscape where product differentiation is key to attracting and retaining customers.

- Bank Mandiri's broad product suite versus specialized offerings from competitors.

- The need for continuous innovation to maintain differentiation.

- Competitors like BRI excelling in microfinance and BCA in digital payments.

- Digital banking growth as a key battleground for product differentiation.

Market Share and Growth Objectives

Competitive rivalry among Indonesian banks is intense as they all chase market share in a developing economy. This competition manifests through aggressive marketing campaigns, expanding both physical branch networks and digital platforms, and offering competitive interest rates and fees. For instance, in 2023, the Indonesian banking sector saw a significant increase in digital transactions, with Bank Mandiri actively investing in its digital channels to capture this growing segment.

Bank Mandiri, being a large, state-owned entity, possesses inherent advantages such as a strong brand reputation and access to capital. However, it faces the perpetual challenge of balancing ambitious growth targets with maintaining healthy profitability. This balancing act is crucial given the highly contested nature of the market, where even minor shifts in pricing or service offerings can impact customer acquisition and retention.

Key competitive actions observed in 2024 include significant digital transformation investments by all major players to enhance user experience and operational efficiency. Furthermore, banks are actively expanding their reach into underserved segments and regions, employing tailored product strategies to attract new customer bases.

- Market Share Focus: All major Indonesian banks are actively competing to increase their share of the growing financial services market.

- Aggressive Strategies: Competition drives aggressive marketing, network expansion (physical and digital), and competitive pricing strategies.

- Bank Mandiri's Position: Its size and state-backed status offer advantages, but it must continually manage growth objectives against profitability pressures.

- Digitalization Drive: The sector is witnessing a strong push towards digital banking solutions to meet evolving customer demands and gain a competitive edge.

The Indonesian banking landscape is characterized by fierce competition, with Bank Mandiri facing intense rivalry from both state-owned peers like BRI and BNI, and major private banks such as BCA. This competition is driven by a strong focus on market share, leading to aggressive strategies in marketing, network expansion, and pricing. The ongoing digital transformation across the sector, with significant investments in 2024 to enhance user experience, further intensifies this rivalry, making product differentiation a critical factor for customer acquisition and retention.

| Competitor | Key Strengths | Competitive Focus Areas |

|---|---|---|

| BRI | Extensive microfinance network, strong rural presence | MSME lending, digital financial inclusion |

| BNI | Strong corporate banking, international presence | Trade finance, corporate services, digital transformation |

| BCA | Superior digital banking, excellent customer service, affluent segment | Digital payments, wealth management, retail banking |

| CIMB Niaga | Digital innovation, Islamic banking | Digital banking, retail and SME segments |

SSubstitutes Threaten

Fintech payment and lending platforms present a significant threat of substitutes for Bank Mandiri. Services like e-wallets and QR code payments directly compete with traditional bank transfer and card services, while P2P lending platforms offer an alternative to the bank's small loan products. These digital alternatives frequently attract customers with their enhanced convenience and speed.

The appeal of fintech substitutes is evident in their rapid adoption. For instance, in 2023, Indonesia saw a substantial increase in digital payment transactions, with e-wallets playing a crucial role. This trend indicates a growing customer preference for faster, more accessible financial solutions, potentially diverting transaction volumes and lending opportunities away from established banks like Bank Mandiri.

Large corporations increasingly bypass traditional banking channels by directly accessing capital markets through bond issuances and equity offerings. This trend is particularly evident as Indonesian capital markets mature, offering competitive alternatives to bank loans. For instance, in 2023, the Indonesia Stock Exchange (IDX) saw a significant increase in new listings and bond issuances, indicating growing direct financing activity among major Indonesian companies.

Various Non-Bank Financial Institutions (NBFIs) present a significant threat of substitutes for Bank Mandiri. Companies specializing in multifinance, insurance, and pawnbroking offer tailored financial solutions that can directly compete with core banking services. For example, multifinance firms capture market share in vehicle and consumer goods financing, while insurance providers increasingly offer investment-linked products, siphoning off potential deposits and investment capital.

In 2024, the Indonesian multifinance sector continued its growth trajectory, with total financing receivables reported at IDR 460.7 trillion as of September 2024, according to the Financial Services Authority (OJK). This demonstrates a substantial pool of capital being channeled through these NBFIs, directly impacting the customer base and revenue streams that Bank Mandiri might otherwise capture through its lending products.

Blockchain and Cryptocurrency Solutions

The burgeoning adoption of blockchain and cryptocurrencies poses a nascent, yet significant, threat of substitution for traditional banking services. These decentralized technologies offer alternative avenues for cross-border payments and digital asset management, potentially bypassing established financial intermediaries. As of early 2024, the global cryptocurrency market capitalization fluctuated around $1.5 trillion, indicating a growing user base and transaction volume that could divert business from conventional channels.

The inherent decentralization of blockchain solutions challenges the bank's traditional role as a central financial intermediary. While regulatory landscapes are still developing, the potential for peer-to-peer transactions and asset custody without a central authority represents a direct substitute for many banking functions. For instance, the growth of decentralized finance (DeFi) platforms offers lending and borrowing services that compete with traditional banking products, with total value locked (TVL) in DeFi protocols reaching hundreds of billions of dollars throughout 2023 and into 2024.

- Cross-border Payments: Blockchain-based remittance services, like RippleNet, are facilitating faster and cheaper international money transfers, directly competing with SWIFT and traditional bank wire services.

- Digital Asset Management: Cryptocurrencies and tokenized assets offer alternative investment and storage solutions, potentially reducing the need for traditional bank accounts and custody services.

- Decentralized Finance (DeFi): DeFi platforms provide services such as lending, borrowing, and trading without traditional financial institutions, creating a parallel financial system.

- Regulatory Evolution: As regulatory frameworks for digital assets mature, the legitimacy and accessibility of these substitute solutions are likely to increase, amplifying their competitive threat.

In-House Corporate Finance Departments

Large corporations increasingly possess the internal expertise to handle complex financial operations, such as treasury management and cash flow optimization. This growing in-house capability can directly substitute for certain services traditionally offered by banks like Bank Mandiri. For instance, a significant portion of corporate treasury functions, which previously would have been outsourced, can now be managed internally, potentially reducing the need for external banking partnerships.

This trend is particularly evident in treasury and cash management. By developing robust internal finance departments, companies can reduce their reliance on banks for day-to-day liquidity management and short-term financing needs. In 2024, many large enterprises continued to invest heavily in their finance departments, enhancing their capacity for sophisticated financial planning and execution, thereby presenting a direct substitute threat to specific bank offerings.

- Internal Treasury Management: Companies can manage their own cash pooling, foreign exchange hedging, and investment of surplus funds, bypassing bank treasury services.

- In-House Lending and Factoring: Larger firms can establish internal credit facilities or factoring operations, substituting for corporate loans and receivables financing.

- Sophisticated Financial Technology: The availability of advanced financial software and platforms empowers companies to perform complex analyses and transactions internally.

- Reduced Transaction Volumes: As corporations internalize these functions, the volume of business Bank Mandiri can secure from its largest clients for these specific services may diminish.

Fintech payment and lending platforms are significant substitutes, offering convenience and speed that challenge traditional banking services. The rapid adoption of e-wallets and QR code payments, as seen in Indonesia's digital transaction growth in 2023, highlights a customer shift towards faster financial solutions.

Large corporations increasingly bypass banks by directly accessing capital markets through bond and equity issuances, a trend bolstered by the IDX's active listings in 2023. Additionally, Non-Bank Financial Institutions (NBFIs) like multifinance companies, which saw IDR 460.7 trillion in financing receivables by September 2024, capture market share in lending and investment products.

Blockchain and cryptocurrencies offer alternative payment and asset management avenues, with the global crypto market capitalization fluctuating around $1.5 trillion in early 2024. DeFi platforms further provide lending and borrowing services without traditional intermediaries, showcasing a growing parallel financial system.

Companies are also developing in-house treasury management capabilities, reducing reliance on banks for liquidity and short-term financing. This internal expertise allows for sophisticated financial planning and execution, directly substituting specific bank offerings.

| Substitute Type | Key Services Offered | Impact on Bank Mandiri | 2023/2024 Data Point |

|---|---|---|---|

| Fintech Platforms | E-wallets, QR payments, P2P lending | Diverts transaction volumes and lending opportunities | Indonesia's digital payment transaction growth |

| Capital Markets | Bond issuances, Equity offerings | Reduces demand for corporate loans | Increased IDX listings and bond issuances in 2023 |

| Non-Bank Financial Institutions (NBFIs) | Multifinance, Insurance, Pawnbroking | Captures market share in financing and investment products | IDR 460.7 trillion in multifinance receivables (Sep 2024) |

| Blockchain/Crypto/DeFi | Cross-border payments, Digital asset management, Decentralized lending | Offers alternative financial intermediaries | Global crypto market cap ~$1.5 trillion (early 2024) |

| In-house Corporate Finance | Treasury management, Cash flow optimization | Reduces need for external banking services | Increased investment in corporate finance departments (2024) |

Entrants Threaten

The Indonesian banking sector is characterized by substantial regulatory and capital requirements, acting as a significant deterrent to new entrants. The Otoritas Jasa Keuangan (OJK), Indonesia's financial services authority, mandates stringent licensing procedures and continuous compliance, demanding considerable financial resources and operational expertise. For instance, in 2024, the minimum paid-up capital for commercial banks in Indonesia was set at IDR 3 trillion (approximately USD 200 million), a figure that presents a formidable barrier for aspiring new players. These high entry costs, coupled with the need for robust risk management frameworks and extensive branch networks, effectively shield incumbent institutions like Bank Mandiri from immediate competitive pressures, thereby reinforcing their market position.

The banking sector, by its very nature, thrives on trust and a solid reputation, elements that new entrants find incredibly difficult to cultivate rapidly. Bank Mandiri, with its deep roots and state-backed backing, has cultivated decades of customer loyalty, presenting a significant hurdle for newcomers aiming to capture market share without considerable investment in brand building and trust establishment.

Bank Mandiri's formidable distribution network, encompassing thousands of branches and ATMs across Indonesia, alongside robust digital platforms, presents a substantial barrier to entry. Replicating this extensive infrastructure requires immense capital investment and considerable time, making it difficult for new competitors to establish a comparable physical and digital presence. In 2023, Bank Mandiri operated over 4,000 ATMs and over 3,000 branches, highlighting the sheer scale new entrants must overcome.

Technological Investment and Digital Infrastructure

The threat of new entrants into the banking sector, particularly concerning technological investment and digital infrastructure, is significant but tempered by substantial barriers. Establishing a competitive presence today necessitates enormous outlays in cutting-edge digital platforms, robust cybersecurity measures, and sophisticated data analytics. For instance, in 2024, major banks continued to allocate billions towards digital transformation initiatives. Bank Mandiri, for example, has been investing heavily in its digital banking services, aiming to enhance customer experience and operational efficiency through technology.

While agile fintech firms can disrupt specific niches, constructing a complete, secure, and scalable banking ecosystem from the ground up remains a monumental undertaking. This requires not only substantial capital but also deep reserves of specialized technical talent. The sheer scale of investment needed for regulatory compliance, data protection, and seamless integration across various financial services acts as a considerable deterrent for many potential new players.

Key considerations for new entrants include:

- Capital Requirements: The upfront investment for a fully functional and compliant digital banking infrastructure can easily run into hundreds of millions of dollars.

- Technological Expertise: Access to and retention of highly skilled personnel in areas like AI, blockchain, cybersecurity, and cloud computing is critical and competitive.

- Regulatory Hurdles: Navigating complex banking regulations and obtaining necessary licenses requires significant time, resources, and legal expertise.

- Cybersecurity Investment: Protecting customer data and financial assets from increasingly sophisticated cyber threats demands continuous and substantial investment in security protocols and personnel.

Talent Acquisition and Management

The threat of new entrants concerning talent acquisition and management for banks like Bank Mandiri is significant. Attracting and retaining experienced banking professionals, especially in critical fields such as risk management, compliance, and digital innovation, presents a substantial hurdle for newcomers. Established institutions benefit from existing, deep talent pools and well-developed organizational frameworks that are challenging and time-consuming for new players to quickly replicate, thereby acting as a considerable barrier to entry.

For instance, in 2024, the Indonesian banking sector continued to face a competitive labor market. Bank Mandiri, along with other major players, actively invests in employee development and attractive compensation packages. A report from early 2024 indicated that the demand for cybersecurity and data analytics specialists in Indonesian banks outstripped supply by approximately 20%, making it harder for new entrants to build a skilled workforce from scratch.

- Talent Competition: New banks must compete with established giants like Bank Mandiri for a limited pool of specialized talent.

- Retention Challenges: High employee turnover can plague new entrants as they struggle to match the career progression and benefits offered by incumbents.

- Development Costs: Building internal training programs to upskill new hires to the required banking standards is a costly and lengthy endeavor for new entrants.

The threat of new entrants in Indonesia's banking sector, while present due to fintech advancements, remains significantly mitigated by substantial barriers. High capital requirements, stringent regulatory oversight from the OJK, and the immense cost of building a trusted brand and extensive distribution network all deter new players. For example, the minimum paid-up capital for commercial banks in Indonesia was IDR 3 trillion (approximately USD 200 million) in 2024, a substantial hurdle.

Newcomers face considerable challenges in replicating the established infrastructure and digital capabilities of incumbents like Bank Mandiri. Replicating Bank Mandiri's network of over 3,000 branches and 4,000 ATMs as of 2023 requires vast capital and time. Furthermore, attracting and retaining specialized talent, particularly in cybersecurity and digital innovation, is a significant obstacle, with demand for such specialists outstripping supply by about 20% in early 2024 according to market reports.

| Barrier Type | Description | Impact on New Entrants | Example (2024 Data) |

|---|---|---|---|

| Capital Requirements | Mandatory minimum paid-up capital for banks. | High barrier, requires significant upfront investment. | IDR 3 trillion (approx. USD 200 million) for commercial banks. |

| Regulatory Hurdles | OJK licensing, compliance, and ongoing supervision. | Time-consuming, resource-intensive, and complex to navigate. | Stringent data protection and cybersecurity compliance mandates. |

| Brand & Trust | Customer loyalty built over years of operation. | Difficult and expensive to build, essential for market share. | Incumbents leverage decades of established customer relationships. |

| Infrastructure & Technology | Extensive branch networks and advanced digital platforms. | Requires massive investment in physical presence and tech. | Bank Mandiri's network of 3,000+ branches and 4,000+ ATMs. |

| Talent Acquisition | Competition for skilled professionals in banking and tech. | Challenging to attract and retain key personnel. | 20% supply-demand gap for cybersecurity/data specialists. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank Mandiri leverages data from official company filings, reputable financial news outlets, and industry-specific research reports to provide a comprehensive view of the competitive landscape.