Bank of Jiujiang PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Jiujiang Bundle

Navigate the dynamic landscape of China's financial sector with our comprehensive PESTLE analysis of the Bank of Jiujiang. Understand how political stability, economic growth, social shifts, technological advancements, environmental regulations, and legal frameworks are shaping its operations and future trajectory. Equip yourself with critical insights to inform your investment and strategic decisions.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis of the Bank of Jiujiang. Uncover the external forces that present both opportunities and challenges, allowing you to anticipate market changes and refine your business strategy. Download the full version now for actionable intelligence that drives success.

Political factors

The Chinese government's robust oversight of its banking sector is a defining political factor for Bank of Jiujiang. Policies are strategically designed to foster financial stability and steer economic growth, creating a predictable operational environment for regional banks.

As a commercial entity, Bank of Jiujiang aligns with this national economic strategy, benefiting from clear policy direction while adhering to government mandates on lending targets and risk mitigation practices.

The government's commitment to 'high-quality development' and its projected GDP growth targets of approximately 5% for both 2024 and 2025 offer a stable, albeit measured, economic landscape for the bank's strategic planning and operational execution.

The People's Bank of China (PBOC) is expected to maintain a moderately loose monetary policy throughout 2025. This strategy involves using tools such as interest rate adjustments and Reserve Requirement Ratio (RRR) cuts to ensure ample liquidity and lower borrowing costs. For instance, in late 2023 and early 2024, the PBOC implemented RRR cuts, releasing trillions of yuan into the financial system, a trend likely to continue in some form.

These supportive monetary measures are designed to invigorate the real economy and boost consumer spending. For regional banks like the Bank of Jiujiang, this translates into a more conducive lending landscape. Lower financing costs for businesses and individuals can stimulate demand for loans, thereby supporting the bank's core business operations and contributing to stable economic growth within its operating regions.

Furthermore, the PBOC's policies are crucial for managing potential financial risks and fostering sustainable development. By ensuring adequate liquidity and managing credit conditions, the central bank aims to prevent systemic financial issues and encourage a stable economic environment, which is beneficial for all financial institutions, including the Bank of Jiujiang.

Chinese regulators are strongly pushing financial institutions to focus on five key areas: technology finance, green finance, inclusive finance, pension finance, and digital finance. This strategic direction from Beijing directly impacts how banks like Bank of Jiujiang operate and where they can find growth.

Bank of Jiujiang is already aligning with these priorities, demonstrating success in green and technology loans, with growth rates surpassing 20%. The bank has also introduced pension financial brands, such as 'Gan Yangle', indicating a proactive approach to capturing opportunities in these mandated sectors.

This strategic alignment is crucial as it positions Bank of Jiujiang to potentially benefit from policy support and unlock new avenues for business development, directly responding to national economic objectives and fostering a more sustainable and inclusive financial ecosystem.

Regional Development Strategies

Jiangxi Province is strategically investing in its economic openness and technological advancement, with a clear focus on expanding foreign trade and attracting foreign direct investment. This aligns with national directives aimed at fostering a more robust and globally integrated economy.

Bank of Jiujiang, as a key financial institution rooted in Jiangxi, is well-positioned to capitalize on these provincial development strategies. Initiatives supporting emerging sectors and infrastructure upgrades are expected to stimulate economic activity, thereby increasing the demand for banking products and services. For instance, in 2023, Jiangxi’s GDP grew by 4.1%, reaching over 3.2 trillion yuan, showcasing the positive impact of such development efforts.

The provincial government's commitment to innovation and international cooperation can translate into new opportunities for the bank. These include financing for export-oriented businesses and projects that leverage technological advancements. In the first half of 2024, Jiangxi saw a 15.2% year-on-year increase in its import and export volume, highlighting the growing trade environment.

- Provincial GDP Growth: Jiangxi's GDP reached over 3.2 trillion yuan in 2023, with a growth rate of 4.1%.

- Foreign Trade Expansion: Import and export volume in Jiangxi increased by 15.2% in the first half of 2024.

- Investment Attraction: Provincial policies aim to boost foreign investment, creating opportunities for financial services supporting new ventures.

- Infrastructure Development: Enhanced infrastructure facilitates trade and economic activity, indirectly benefiting banking sector growth.

Regulatory Environment and Risk Management

The Chinese banking sector is navigating an evolving regulatory landscape, with new capital adequacy rules taking effect in early 2024. These regulations, overseen by bodies like the National Financial Regulation Administration (NFRA), aim to bolster the resilience of financial institutions.

Risk management and compliance are paramount for banks like Bank of Jiujiang. The NFRA's continued focus on industry-wide stability means that adherence to these strengthened capital requirements is critical for operational continuity and avoiding penalties.

This intensified regulatory scrutiny, while presenting challenges, ultimately fosters a more stable financial ecosystem. By mandating robust risk management practices, regulators mitigate systemic threats, which is particularly important for regional banks operating within the broader Chinese economy.

- Enhanced Capital Rules: New capital adequacy rules implemented in early 2024 are designed to strengthen the Chinese banking sector.

- Regulatory Oversight: The National Financial Regulation Administration (NFRA) is actively focused on improving compliance and ensuring sound operations.

- Risk Mitigation: Stringent regulatory oversight aims to reduce systemic risks, thereby enhancing the stability of the financial system.

The Chinese government's strategic focus on economic growth, targeting approximately 5% GDP growth for both 2024 and 2025, provides a stable backdrop for Bank of Jiujiang. This national economic direction, coupled with the People's Bank of China's anticipated moderately loose monetary policy, including potential Reserve Requirement Ratio (RRR) cuts, aims to ensure ample liquidity and lower borrowing costs, stimulating lending and economic activity.

Regulatory directives strongly encourage financial institutions to prioritize technology, green, inclusive, pension, and digital finance. Bank of Jiujiang's proactive engagement in these areas, evidenced by over 20% growth in green and technology loans and the introduction of pension financial brands, positions it to benefit from policy support and new growth avenues.

Jiangxi Province's commitment to economic openness and technological advancement, reflected in a 4.1% GDP growth in 2023 (over 3.2 trillion yuan) and a 15.2% increase in import-export volume in H1 2024, creates a favorable environment for Bank of Jiujiang to expand its services to trade and investment-related sectors.

The implementation of new capital adequacy rules in early 2024 by the National Financial Regulation Administration (NFRA) underscores a heightened focus on the banking sector's resilience and risk management. Bank of Jiujiang's adherence to these strengthened regulations is crucial for its operational stability and compliance.

| Political Factor | Description | Implication for Bank of Jiujiang | Relevant Data (2023-2025) |

| Government Economic Policy | Focus on stable, high-quality development. | Provides a predictable operating environment; alignment with national goals is key. | Targeted GDP growth: ~5% for 2024 & 2025. |

| Monetary Policy | Moderately loose policy by PBOC. | Lower borrowing costs and ample liquidity stimulate lending demand. | Continued RRR cuts and interest rate adjustments expected. |

| Regulatory Directives | Emphasis on tech, green, inclusive, pension, and digital finance. | Opportunities for growth in mandated sectors; requires strategic alignment. | 20%+ growth in green/tech loans; introduction of pension brands. |

| Provincial Development Strategy | Jiangxi's focus on openness and technology. | Growth opportunities in trade finance and investment support. | Jiangxi GDP growth: 4.1% (2023); Import/Export growth: 15.2% (H1 2024). |

| Banking Sector Regulation | Strengthened capital adequacy and risk management. | Necessitates robust compliance and risk mitigation for operational continuity. | New capital adequacy rules effective early 2024. |

What is included in the product

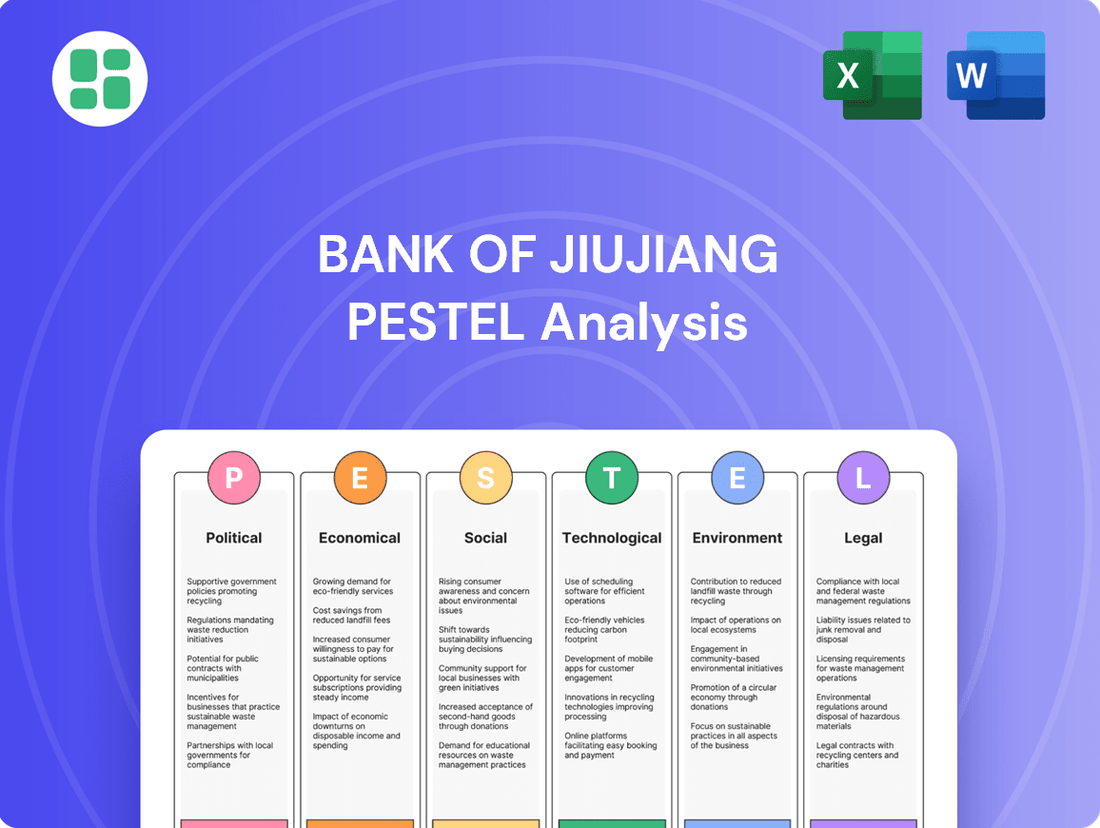

This PESTLE analysis of the Bank of Jiujiang examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

A concise PESTLE analysis for the Bank of Jiujiang acts as a pain point reliever by offering a clear, summarized version of complex external factors, enabling quick referencing during meetings and facilitating efficient strategy development.

Economic factors

China's economic growth target of approximately 5% for both 2024 and 2025 indicates a steady, albeit moderate, expansionary environment. This focus on high-quality development suggests a stable economic landscape for institutions like the Bank of Jiujiang.

For the Bank of Jiujiang, this moderate growth translates into a predictable, yet not explosive, market. Success will hinge on the bank's capacity to adapt to evolving economic conditions and leverage localized growth opportunities within this framework.

The People's Bank of China's policy of lowering benchmark lending rates, such as the Loan Prime Rate (LPR), has created a low-interest-rate environment. For instance, the 1-year LPR saw reductions throughout 2023 and into early 2024, impacting the cost of borrowing and lending across the financial sector.

This sustained period of lower rates directly pressures banks' net interest margins (NIMs), which represent the difference between interest income and interest expense. While lower rates can encourage borrowing and economic activity, they also mean less profit from traditional lending for institutions like Bank of Jiujiang.

To navigate this, Bank of Jiujiang must focus on diversifying revenue streams beyond core lending and improving operational efficiency. Developing fee-based services and managing operating costs will be crucial to maintaining profitability amidst compressed NIMs.

Loan growth across China's banking sector is projected to decelerate, with profitability continuing to be a significant concern heading into 2025. This environment presents regional banks like Bank of Jiujiang with heightened competition for desirable lending opportunities and potential hurdles in growing their loan portfolios.

Despite a more than 6% increase in total assets and liabilities reported by Bank of Jiujiang in 2024, suggesting a degree of operational stability, the bank must remain vigilant in managing its non-performing loan (NPL) ratios. For instance, while specific NPL data for Bank of Jiujiang in late 2024 or early 2025 isn't yet widely published, the broader Chinese banking sector saw its NPL ratio hover around 1.6% at the end of Q3 2024, a figure that could pressure smaller institutions more acutely if economic headwinds persist.

Local Economic Dynamics in Jiangxi

Jiangxi Province experienced strong economic growth in 2024, with its open economy expanding and a notable surge in exports for 'new three' products like electric vehicles and lithium batteries. This dynamism directly impacts Bank of Jiujiang, as its lending and investment strategies are deeply intertwined with the province's industrial advancements and key sector investments.

The bank's performance is therefore closely linked to Jiangxi's ongoing industrial transformation. For instance, the province's commitment to developing new energy sectors presents targeted lending opportunities for Bank of Jiujiang. In 2024, Jiangxi's industrial added value increased by 7.5%, with high-tech manufacturing showing even stronger growth.

- Export Growth: Jiangxi's exports of new energy vehicles, photovoltaic products, and lithium batteries saw a year-on-year increase of 25% in the first half of 2024.

- Industrial Investment: The province attracted over 150 billion yuan in fixed-asset investment in strategic emerging industries during 2024.

- Economic Diversification: Jiangxi's GDP grew by 6.8% in 2024, outperforming the national average and indicating a healthy local economic environment.

- Banking Sector Impact: Bank of Jiujiang's loan portfolio reflects this trend, with a significant portion directed towards manufacturing and technology sectors within Jiangxi.

Consumer Spending and Investment Trends

Domestic demand in China offers promising avenues for growth, fueled by government stimulus aimed at bolstering both consumption and investment. While consumer spending growth was moderate in 2024, specific policy initiatives are actively encouraging digital, eco-conscious, and health-focused spending patterns.

Bank of Jiujiang's retail banking division, serving over 1.9 million individual customers and experiencing an expansion in its credit card portfolio, is well-positioned to capitalize on these evolving consumer behaviors. Strategic product development that aligns with these emerging trends will be crucial for leveraging this potential.

- Stimulus Measures: Government policies are designed to inject vitality into domestic demand, supporting consumer purchasing power and encouraging business investment.

- Consumption Focus: Policies are specifically targeting growth areas like digital services, sustainable products, and health and wellness, indicating a shift in consumer priorities.

- Bank of Jiujiang's Retail Segment: With a substantial customer base exceeding 1.9 million and a growing credit card segment, the bank has a solid foundation to adapt its offerings.

- Tailored Products: Success hinges on the bank's ability to create and promote financial products that directly address the increasing demand for digital, green, and health-related consumption.

China's economic trajectory, targeting around 5% growth for 2024-2025, signals a stable, albeit measured, expansion. This focus on quality development creates a predictable environment for Bank of Jiujiang, necessitating adaptability to capitalize on localized opportunities.

The People's Bank of China's policy of reducing benchmark lending rates, like the Loan Prime Rate, has led to lower borrowing costs. This sustained low-interest-rate environment pressures banks' net interest margins, requiring Bank of Jiujiang to diversify revenue and manage costs effectively.

Jiangxi Province's robust economic expansion in 2024, particularly in exports of new energy vehicles and lithium batteries, directly influences Bank of Jiujiang's strategic lending. The province's commitment to industrial transformation, with a 7.5% increase in industrial added value in 2024, presents targeted growth avenues.

| Economic Factor | 2024/2025 Data/Trend | Impact on Bank of Jiujiang |

|---|---|---|

| GDP Growth Target (China) | Approx. 5% | Stable market, need for localized strategy |

| Interest Rate Policy | Lowering benchmark rates (e.g., LPR) | Pressure on Net Interest Margins, need for diversification |

| Jiangxi Province Growth | 6.8% GDP growth (2024), 7.5% industrial added value increase | Opportunities in manufacturing and tech sectors |

| Key Export Sectors (Jiangxi) | 25% YoY increase in NEVs, PV, Li-ion batteries (H1 2024) | Targeted lending for high-growth industries |

| Domestic Demand Stimulus | Government policies to boost consumption and investment | Potential for retail banking growth, requires tailored products |

Preview the Actual Deliverable

Bank of Jiujiang PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Bank of Jiujiang's PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain valuable insights into the strategic landscape surrounding the Bank of Jiujiang.

Sociological factors

China's population is aging rapidly, with the number of people aged 65 and over projected to reach 300 million by 2025. This demographic shift impacts Bank of Jiujiang by potentially increasing savings as older individuals focus on wealth preservation and reducing demand for traditional loans. The bank may need to develop new financial products and services tailored to the needs of an aging clientele, such as retirement planning and healthcare-related financing.

China's aging population is a significant sociological trend, with projections indicating that by 2035, over 30% of the population will be 60 or older. This demographic shift fuels a substantial demand for advanced wealth management and pension finance solutions. Bank of Jiujiang's strategic initiatives, such as its 'Gan Yangle' pension finance brand and the development of elderly care finance demonstration sites, are well-positioned to capture this expanding market, creating new revenue streams from fees and services.

Urbanization in Jiangxi Province is a key driver for financial services demand. As more people move to cities, the need for accessible banking, loans, and investment products increases. This trend directly impacts where Bank of Jiujiang should focus its expansion and service offerings.

Regional migration patterns, both towards urban centers and potentially back to rural areas for specific opportunities, mean Bank of Jiujiang's established network is a significant advantage. With branches across Jiangxi and county banks, the institution can cater to diverse financial needs arising from these population movements, supporting both established urban dwellers and those transitioning between regions.

Understanding the granular needs of local communities is paramount for Bank of Jiujiang's success. For instance, as of late 2024, urban areas in Jiangxi are seeing a growing demand for mortgage and consumer credit products, while rural areas might require more agricultural financing and small business loans, reflecting the differing economic activities and life stages of the populations.

Evolving Consumer Financial Behavior

Consumers are increasingly embracing digital channels for their banking needs. By the end of 2024, it's projected that over 70% of banking transactions in China will be conducted digitally, a significant jump from previous years. This shift necessitates that Bank of Jiujiang prioritizes robust online and mobile platforms to cater to this growing demand for convenience and accessibility.

The expectation for seamless digital experiences extends beyond basic transactions. Customers now anticipate personalized financial advice, investment tools, and customer support through digital interfaces. Bank of Jiujiang's investment in user-friendly apps and secure online portals is crucial for retaining and attracting customers who value efficiency and modern service delivery.

- Digital Transaction Growth: Projections indicate over 70% of Chinese banking transactions will be digital by year-end 2024.

- Mobile Banking Preference: A significant majority of consumers now prefer mobile banking for its convenience.

- Demand for Digital Services: Customers expect a wide range of financial services, from transactions to advice, to be available digitally.

- Bank of Jiujiang's Digital Investment: Continued enhancement of digital platforms is vital for meeting evolving customer expectations.

Financial Inclusion Initiatives

The Chinese government strongly promotes financial inclusion, aiming to bolster small and micro-enterprises and reach underserved populations. This focus creates a favorable environment for banks like Bank of Jiujiang to expand their services and customer reach.

Bank of Jiujiang actively participates in these initiatives, demonstrating its commitment to social responsibility and strategic growth. For instance, its efforts to meet regulatory targets for inclusive loans to micro and small enterprises are crucial for its business strategy.

- In 2023, China's inclusive finance sector saw significant growth, with outstanding inclusive loans to micro and small enterprises increasing by 25.4% year-on-year, reaching ¥21.2 trillion (approximately $2.9 trillion USD).

- Bank of Jiujiang's strategy involves leveraging digital channels to offer accessible financial products, thereby broadening its customer base beyond traditional urban centers.

- By supporting local economic vitality through these inclusive lending practices, Bank of Jiujiang not only fulfills its social mandate but also taps into new revenue streams and strengthens its market position.

Societal expectations are shifting towards greater environmental responsibility, influencing consumer choices and regulatory landscapes. Bank of Jiujiang must integrate sustainable practices into its operations and product offerings to align with these evolving values.

The increasing demand for ethical and socially responsible banking products means institutions like Bank of Jiujiang need to demonstrate a commitment to environmental, social, and governance (ESG) principles. This can attract a growing segment of environmentally conscious customers and investors.

Financial literacy levels are rising, empowering individuals to make more informed decisions about savings, investments, and credit. Bank of Jiujiang can leverage this by offering educational resources and tailored financial advice.

The bank’s focus on community engagement and financial education, particularly in its service regions, directly addresses the growing societal emphasis on informed financial participation and responsible wealth management.

Technological factors

The digital banking transformation in China is accelerating, with a significant push towards mobile and online platforms. By the end of 2023, over 1.1 billion mobile payment users were reported in China, highlighting the deep integration of digital finance into daily life. Bank of Jiujiang's commitment to enhancing its digital financial services capacity is therefore not just about customer convenience but a fundamental requirement for staying competitive.

This ongoing digital evolution directly impacts how Bank of Jiujiang operates and interacts with its customers. Improvements in areas like online account management, mobile banking apps, and digital lending platforms are key to meeting evolving customer expectations and streamlining internal processes. For instance, a successful digital strategy can lead to reduced operational costs and a wider customer reach, critical factors for growth in the dynamic Chinese financial sector.

FinTech innovations like AI and big data analytics are rapidly reshaping the financial landscape, introducing new business models and intensifying competition. For Bank of Jiujiang, embracing these technologies is crucial for developing cutting-edge financial products and enhancing risk assessment capabilities.

To stay competitive against larger national banks and nimble FinTech startups, Bank of Jiujiang needs to prioritize investments in areas like mobile payments and AI-driven customer service. This strategic investment will allow them to streamline operations and offer more personalized financial solutions, a key differentiator in the evolving market.

The increasing reliance on digital platforms for banking operations exposes the Bank of Jiujiang to significant cybersecurity risks. As financial services become more digitized, the potential for cyber threats, data breaches, and sophisticated attacks escalates dramatically, necessitating advanced protective measures.

China's commitment to data security is underscored by new regulations, such as the Network Data Regulations, which took effect on January 1, 2025. These laws impose stringent requirements on how data is handled and protected, directly impacting financial institutions like the Bank of Jiujiang.

To maintain customer trust and operational integrity, the Bank of Jiujiang must prioritize robust cybersecurity protocols and ensure strict adherence to these evolving data protection mandates. Non-compliance could lead to severe penalties and reputational damage in the highly competitive financial landscape.

AI and Big Data Integration

The integration of AI and big data is transforming financial services, enabling personalized customer experiences and bolstering fraud detection capabilities. For Bank of Jiujiang, this presents a significant opportunity to deepen its understanding of its local market, thereby refining its loan offerings and wealth management strategies.

By harnessing AI and big data, the bank can achieve more precise credit scoring and optimize operational efficiency. This technological advancement is crucial for staying competitive in the evolving financial landscape. For instance, in 2024, the global financial services sector saw a substantial increase in AI adoption, with many institutions reporting improved risk management and customer satisfaction metrics.

- Personalized Product Development: AI can analyze customer data to create tailored banking products and services, increasing engagement and loyalty.

- Enhanced Fraud Detection: Advanced algorithms can identify and prevent fraudulent transactions in real-time, protecting both the bank and its customers.

- Optimized Credit Scoring: Big data analytics allows for more accurate and nuanced credit assessments, reducing default rates and expanding access to credit for deserving individuals.

- Improved Operational Efficiency: Automation of routine tasks through AI can lead to cost savings and faster service delivery.

Mobile Payment and Online Platforms

The pervasive adoption of mobile payment systems and online platforms across China, including in regions like Jiangxi, demands that financial institutions like Bank of Jiujiang prioritize robust digital offerings. This shift means customers expect effortless transactions and banking services accessible through their smartphones and online portals.

Bank of Jiujiang's strategic focus on expanding its digital channels and aligning with mobile-first consumer behaviors is critical for attracting and keeping customers. This is particularly true for engaging younger generations who are digital natives and for supporting the growing number of e-commerce businesses operating within Jiangxi province.

- Digital Transformation Investment: In 2024, Chinese banks collectively invested billions in upgrading their digital infrastructure, with a significant portion allocated to mobile banking enhancements.

- Mobile Payment Growth: By the end of 2024, over 90% of urban Chinese consumers were reported to use mobile payment methods for daily transactions.

- E-commerce Integration: The digital banking segment saw a 25% year-over-year increase in services catering specifically to e-commerce merchants by early 2025.

The technological landscape for Bank of Jiujiang is defined by rapid digitalization and the integration of advanced tools like AI and big data. By early 2025, over 90% of urban Chinese consumers utilize mobile payments, underscoring the necessity for the bank to excel in digital offerings and mobile-first strategies to capture market share and cater to evolving consumer habits.

Investments in digital infrastructure, particularly in mobile banking, saw billions allocated by Chinese banks in 2024. This trend highlights a competitive environment where technological adoption directly correlates with customer acquisition and retention, especially for younger demographics and e-commerce businesses.

The bank must also navigate the increasing cybersecurity risks associated with this digital shift, adhering to stringent data protection regulations like the Network Data Regulations effective January 1, 2025, to maintain trust and avoid penalties.

AI and big data offer significant opportunities for Bank of Jiujiang to personalize services, enhance fraud detection, and optimize credit scoring, as evidenced by the global financial services sector's increased AI adoption in 2024, leading to better risk management and customer satisfaction.

| Technology Area | 2024/2025 Impact | Bank of Jiujiang Strategic Focus |

|---|---|---|

| Mobile Payments & Online Platforms | 90%+ urban Chinese consumers use mobile payments (early 2025). Billions invested in digital infrastructure by Chinese banks (2024). | Enhance mobile banking apps, expand online services, integrate with e-commerce. |

| AI & Big Data Analytics | Increased AI adoption in global financial services (2024) for risk management and customer satisfaction. | Develop personalized products, improve fraud detection, optimize credit scoring, refine loan and wealth management offerings. |

| Cybersecurity | Stringent data protection regulations (e.g., Network Data Regulations, Jan 1, 2025). Escalating cyber threats with digitization. | Implement robust cybersecurity protocols, ensure regulatory compliance, protect customer data. |

Legal factors

China's financial regulatory landscape, overseen by entities like the People's Bank of China (PBOC), the National Financial Regulatory Administration (NFRA), and the China Securities Regulatory Commission (CSRC), is in constant flux. These bodies are actively updating rules to bolster banking sector stability and manage risks. For instance, in 2024, the PBOC continued its focus on prudent monetary policy, aiming to balance economic growth with financial security.

Bank of Jiujiang must diligently adhere to these evolving legal requirements. This includes ensuring compliance across all its operations, from corporate and retail banking to its financial markets activities. Navigating these dynamic regulations is crucial for maintaining operational integrity and fostering trust within the financial system.

The implementation of comprehensive data security laws, such as China's Data Security Law (DSL) and Personal Information Protection Law (PIPL), alongside the Network Data Regulations effective January 1, 2025, imposes stringent requirements on data handling. These regulations dictate how financial institutions like Bank of Jiujiang collect, store, process, and transfer sensitive customer data, including cross-border activities.

Bank of Jiujiang faces significant compliance obligations to ensure adherence to these evolving legal frameworks. Non-compliance can lead to substantial penalties, impacting operational continuity and financial performance, with fines potentially reaching millions of yuan for severe breaches.

China is progressively rolling out new ESG reporting guidelines, aiming for a mandatory system aligned with the International Sustainability Standards Board (ISSB) by 2030. Financial institutions, including Bank of Jiujiang, are anticipated to be at the forefront of adopting these enhanced disclosure standards.

This regulatory shift necessitates that Bank of Jiujiang strengthens its sustainability reporting to comply with increasing transparency demands and to effectively communicate its dedication to sustainable growth initiatives.

Anti-Money Laundering (AML) Regulations

Bank of Jiujiang must adhere to China's stringent anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. These rules are in place to curb illegal financial flows and require banks to implement strong internal controls and sophisticated transaction monitoring. Failure to comply can lead to substantial fines and significant damage to the bank's reputation.

Key compliance measures include:

- Enhanced Customer Due Diligence (CDD): Banks are mandated to verify customer identities and assess risks, especially for high-risk individuals and transactions.

- Suspicious Transaction Reporting (STR): Promptly reporting any unusual or suspicious activities to the authorities is a critical legal obligation.

- Record Keeping: Maintaining detailed records of all transactions and customer information for a specified period is essential for regulatory audits.

- Training and Awareness: Ensuring all staff are adequately trained on AML/CTF policies and procedures is vital for effective implementation.

Loan Classification and Asset Quality Rules

Regulations dictating how Bank of Jiujiang classifies loans, sets aside provisions, and manages non-performing loans (NPLs) are critical for its asset quality. These rules, set by bodies like the China Banking and Insurance Regulatory Commission (CBIRC), directly influence the bank's reported financial health and its ability to absorb potential losses. For instance, stricter provisioning requirements mean banks must hold more capital against riskier loans, impacting profitability but bolstering stability.

Adherence to these guidelines is paramount, particularly as the banking sector faces ongoing pressures on asset quality. The real estate market's challenges in 2024 and early 2025 have amplified concerns about loan performance, especially for banks with significant property-related exposures. Bank of Jiujiang must navigate these evolving legal landscapes to accurately reflect its credit risk exposure.

- Loan Classification Standards: China's banking regulations require loans to be categorized into five tiers: normal, special mention, substandard, doubtful, and loss. Each tier has specific provisioning requirements.

- NPL Management: Banks are mandated to report NPL ratios and implement strategies for NPL resolution, including restructuring, sale, or write-offs, in line with regulatory directives.

- Impact of Property Market: As of Q1 2025, the property sector's ongoing adjustments have led regulators to scrutinize loan portfolios more closely, potentially increasing provisioning needs for banks with high exposure.

Bank of Jiujiang operates within a framework of evolving legal and regulatory mandates, overseen by key bodies like the PBOC and NFRA. These regulations, particularly those concerning data security and anti-money laundering (AML), are stringent. For example, China's Data Security Law and Personal Information Protection Law impose significant obligations on how customer data is handled, with non-compliance risking substantial penalties, potentially millions of yuan.

The bank must also navigate evolving loan classification and provisioning rules, especially in light of property market challenges observed through early 2025. Stricter provisioning requirements directly impact profitability but bolster financial stability, requiring careful management of credit risk exposure.

Furthermore, the push towards enhanced ESG reporting, with a goal for mandatory alignment with ISSB standards by 2030, means Bank of Jiujiang needs to bolster its sustainability disclosures to meet increasing transparency demands.

Environmental factors

China's commitment to green finance is accelerating, with significant policy support for green bonds and the burgeoning national carbon market. These advancements are designed to channel capital towards environmentally sustainable projects, fostering a more robust green financial system.

Bank of Jiujiang actively participates in this national drive by expanding its green lending portfolio and engaging with green financial instruments. This strategic alignment not only supports the government's 'Beautiful China' initiative but also positions the bank to capitalize on the growing demand for sustainable finance.

China's commitment to sustainability is driving significant expansion in green finance. By the third quarter of 2024, outstanding green loans in the country reached an impressive 35.75 trillion yuan, accounting for 13.9% of all outstanding loans. This surge highlights a clear market shift towards environmentally conscious lending practices.

Bank of Jiujiang is capitalizing on this trend, demonstrating robust growth in its green loan portfolio. In 2024, the bank saw its green loans expand by more than 20%. This strategic focus not only supports projects with positive environmental impacts but also serves to broaden and strengthen the bank's asset base.

The Chinese banking sector is seeing a significant push towards Environmental, Social, and Governance (ESG) integration, underscored by evolving disclosure requirements. For instance, the China Banking and Insurance Regulatory Commission (CBIRC) has been promoting green finance initiatives, encouraging banks to align their lending and investment with sustainability goals.

Bank of Jiujiang, like its peers, is expected to embed ESG principles across its business, from operational efficiency to credit risk assessment and investment strategies. This includes enhancing transparency through comprehensive sustainability reporting, a trend gaining momentum as investors increasingly prioritize ESG performance.

Climate Change Risk and Opportunity

Climate change poses significant risks to the Bank of Jiujiang, particularly concerning loan collateral in sectors vulnerable to extreme weather events and rising sea levels, impacting agricultural and coastal real estate portfolios. Conversely, it unlocks substantial opportunities for financing the burgeoning green economy. For instance, the bank can actively pursue lending for renewable energy projects and sustainable infrastructure development within Jiangxi province, aligning with national environmental goals and tapping into a growing market segment.

The Bank of Jiujiang must proactively assess its exposure to climate-related financial risks across its entire loan book. This involves understanding how physical risks, such as floods or droughts, might affect borrowers' ability to repay. Simultaneously, identifying and capitalizing on transition risks, like shifts in policy or technology favoring greener alternatives, is crucial for strategic positioning.

By embracing green finance, the Bank of Jiujiang can contribute to China's ambitious carbon neutrality targets, set for 2060. This strategic pivot allows the bank to not only mitigate its own climate-related financial risks but also to foster sustainable economic growth in its operating regions. For example, financing solar panel installations or energy-efficient building retrofits presents a clear path for both environmental stewardship and financial return.

- Risk Assessment: Evaluating loan portfolios for exposure to climate-sensitive industries like agriculture and real estate in flood-prone areas of Jiangxi.

- Opportunity Identification: Targeting financing for renewable energy projects, such as solar and wind farms, and sustainable infrastructure development in line with national green initiatives.

- Green Bond Market: Exploring the issuance or investment in green bonds to fund environmentally beneficial projects, potentially attracting ESG-focused investors.

- Portfolio Diversification: Shifting lending towards sectors less vulnerable to climate impacts and more aligned with a low-carbon economy.

Regional Environmental Protection Goals

Jiangxi Province, where the Bank of Jiujiang operates, has set ambitious environmental protection goals, emphasizing sustainable development. In 2023, the province reported a forest coverage rate of 70.1%, a key indicator of its commitment to ecological preservation. This focus on green principles is integrated into the region's economic planning.

The Bank of Jiujiang's strategic alignment with these provincial environmental objectives presents significant opportunities. By supporting local green initiatives and businesses committed to sustainability, the bank can tap into a growing market for eco-friendly financing. For instance, as of late 2024, there's a notable increase in government-backed green bonds issued within Jiangxi, signaling a strong demand for such financial products.

- Jiangxi's 2023 Forest Coverage: 70.1%

- Provincial Focus: Integration of green principles into economic development.

- Financing Opportunities: Increased demand for green project financing.

- Market Trend: Growing issuance of green bonds in the region.

China's national commitment to green finance, evidenced by a 35.75 trillion yuan outstanding green loan balance by Q3 2024, directly influences the Bank of Jiujiang's operational landscape. This strong regulatory push for sustainability, alongside Jiangxi Province's 70.1% forest coverage in 2023, creates both risks from climate change impacts and significant opportunities in financing eco-friendly projects.

| Factor | Description | Impact on Bank of Jiujiang |

|---|---|---|

| Climate Change Risks | Physical risks (floods, droughts) impacting collateral in agriculture/real estate; transition risks from policy shifts. | Potential loan defaults in vulnerable sectors; need for robust risk assessment. |

| Green Finance Growth | Accelerating national and provincial initiatives for green bonds and lending; 20%+ growth in Bank of Jiujiang's green loans in 2024. | Opportunity to expand green loan portfolio and attract ESG investors. |

| Environmental Regulations | Provincial goals for sustainable development and national carbon market development. | Requirement to align lending with sustainability goals; potential for new financial products. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bank of Jiujiang is meticulously constructed using data from official Chinese government publications, reports from the People's Bank of China, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, and regulatory landscape impacting the bank.