Bank of Jiujiang Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Jiujiang Bundle

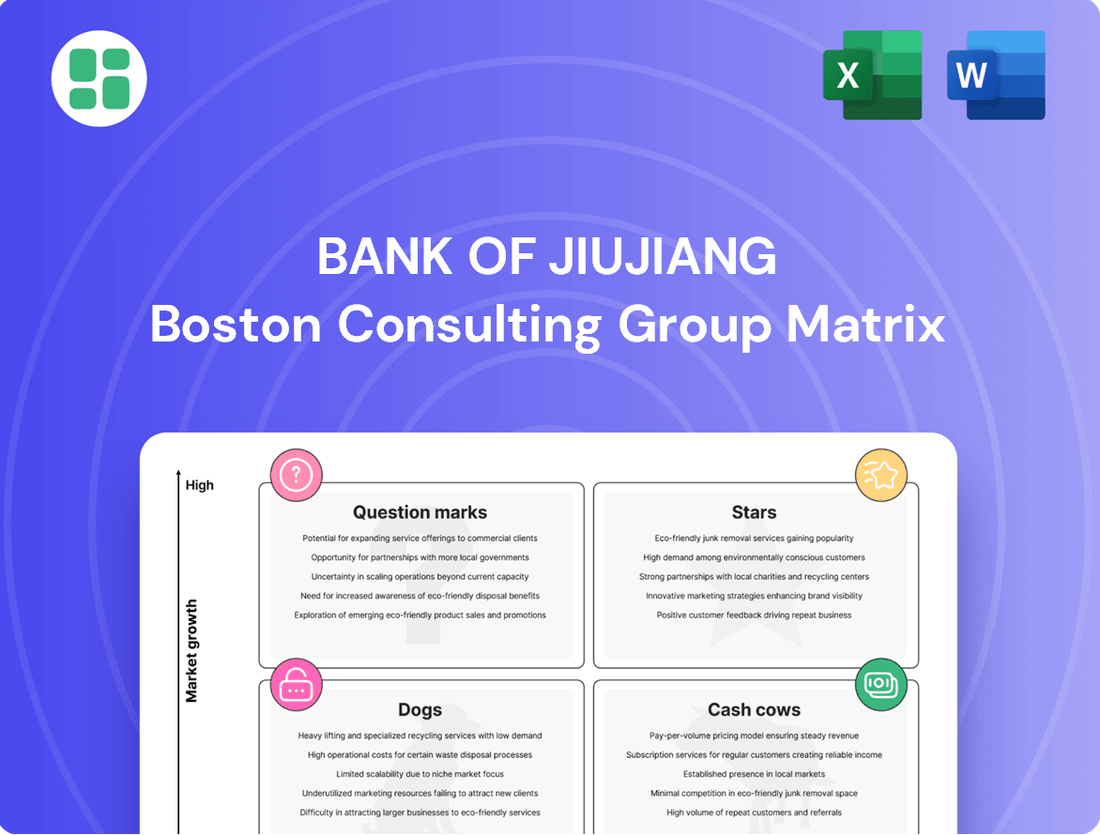

Uncover the strategic positioning of Bank of Jiujiang's product portfolio with our insightful BCG Matrix preview. See which of their offerings are poised for growth and which may require a strategic rethink.

This snapshot is just the beginning. Purchase the full BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with data-driven recommendations for optimizing their market share and profitability.

Stars

Bank of Jiujiang's digital payment solutions, particularly its mobile payment and credit card services, are performing exceptionally well. This strong showing, recognized with multiple awards, highlights the bank's significant footprint in China's rapidly growing digital finance sector.

With China's fintech market anticipated to reach US$19 trillion in transaction volume by the close of 2025, Bank of Jiujiang is strategically positioned in a high-growth environment. Its established competitive advantage in this dynamic market solidifies its status as a Star in the BCG Matrix.

SME lending is a key area for Bank of Jiujiang, reflecting China's strong support for small and medium-sized enterprises. Outstanding inclusive micro and small loans saw a significant 19.3% year-on-year increase by May 2024, highlighting the robust growth in this sector. Bank of Jiujiang, being a regional player, is well-positioned to capture a substantial share of this government-backed, expanding market.

Green Finance Loans are a significant growth driver for the Bank of Jiujiang, aligning with China's national strategy for a low-carbon economy. The sector's robust expansion, with green loans seeing a 19% rise in outstanding balances by the third quarter of 2024, presents a prime opportunity.

If the Bank of Jiujiang has a substantial green loan portfolio and actively participates in these initiatives, this segment positions it as a potential market leader within its service areas. This strategic focus taps into a high-growth market fueled by supportive government policies.

Innovative Wealth Management Products

Bank of Jiujiang's innovative wealth management products are crucial for its position within the BCG matrix. China's wealth management market is a rapidly expanding sector, anticipated to surpass $100 trillion by 2025, fueled by a growing affluent population.

The bank's recognition through awards in wealth management highlights its capability to serve regional high-net-worth individuals effectively. Developing unique and personalized wealth solutions allows Bank of Jiujiang to tap into this substantial market growth and solidify its offerings.

- Focus on bespoke investment strategies

- Offer diversified product suites including alternative investments

- Leverage digital platforms for enhanced client engagement

- Provide expert financial planning and advisory services

Fintech Innovation Projects

Bank of Jiujiang's commitment to fintech is evident through its award-winning projects. In 2024, the bank was recognized for its 'New Generation Online Industrial Financial Platform' and 'Digital Intelligent Financial Brain Platform'.

These initiatives highlight a strategic focus on high-growth technological advancements within the financial sector. Such forward-thinking projects position the bank to potentially capture substantial market share in emerging fintech segments.

- New Generation Online Industrial Financial Platform: Awarded for innovation in 2024.

- Digital Intelligent Financial Brain Platform: Recognized for its technological advancements in 2024.

- Market Potential: These projects target high-growth fintech areas, indicating strong future market share potential.

Bank of Jiujiang's digital payment solutions are a prime example of its Star performers. With China's fintech market projected for significant growth, the bank's mobile and credit card services are capturing a considerable share. This strategic positioning in a high-demand sector, evidenced by multiple accolades, underscores its Star status.

The bank's engagement in SME lending aligns with national economic priorities, particularly China's push to support small and medium-sized enterprises. The robust growth in inclusive micro and small loans, up 19.3% year-on-year by May 2024, demonstrates the market's expansion, which Bank of Jiujiang is well-equipped to capitalize on.

Green Finance Loans represent another key Star for Bank of Jiujiang, directly supporting China's low-carbon economic transition. The 19% increase in outstanding green loans by Q3 2024 highlights the sector's rapid development, and the bank's focus here positions it for leadership within its operational regions.

Bank of Jiujiang's wealth management offerings are also classified as Stars, tapping into China's burgeoning wealth management market, expected to exceed $100 trillion by 2025. The bank's award-winning ability to serve high-net-worth individuals regionally, through bespoke solutions, solidifies its strong performance in this high-growth area.

The bank's investment in innovative fintech platforms, like the 'New Generation Online Industrial Financial Platform' and 'Digital Intelligent Financial Brain Platform', both recognized in 2024, marks them as Stars. These projects are geared towards high-growth technological segments, promising substantial future market capture.

| Business Segment | BCG Category | Key Growth Drivers | Market Data Point (2024/2025) | Bank of Jiujiang's Position |

|---|---|---|---|---|

| Digital Payments | Star | Growing fintech market, mobile adoption | Fintech market transaction volume to reach US$19 trillion by 2025 | Strong performance, award-winning services |

| SME Lending | Star | Government support for SMEs, economic growth | 19.3% YoY increase in inclusive micro and small loans by May 2024 | Well-positioned to capture market share |

| Green Finance Loans | Star | National low-carbon strategy, environmental focus | 19% rise in outstanding green loans by Q3 2024 | Potential market leader in service areas |

| Wealth Management | Star | Rising affluent population, demand for personalized services | Market to exceed $100 trillion by 2025 | Award-winning capabilities, strong regional presence |

| Fintech Innovation Platforms | Star | Technological advancements, digital transformation | Recognized for innovation in 2024 | Poised to capture share in emerging fintech segments |

What is included in the product

The Bank of Jiujiang BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

The Bank of Jiujiang BCG Matrix provides a clear, visual overview of its business units, easing the pain of understanding portfolio performance.

Cash Cows

Bank of Jiujiang's traditional retail deposit base in Jiangxi Province serves as a significant cash cow. This stable funding source, built on local customer relationships, provides consistent and low-cost capital.

As of the first quarter of 2024, Bank of Jiujiang reported total deposits of RMB 238.5 billion, with a substantial portion attributed to its retail segment. This robust deposit franchise allows the bank to generate reliable cash flows, underpinning its ability to finance lending activities and invest in growth areas.

Bank of Jiujiang's established corporate lending portfolio, built on decades of local relationships in Jiangxi province, acts as a significant cash cow. This mature segment, serving stable, established businesses, consistently delivers interest income, even as broader loan growth in China moderates. Its high market share within its core area solidifies its role as a dependable revenue source.

Bank of Jiujiang's basic payment and settlement services are firmly positioned as cash cows. These foundational offerings are indispensable for its broad client base, both individual and corporate, facilitating everyday transactions and core business operations.

While not experiencing rapid expansion, the sheer volume and deep integration of these services ensure consistent revenue generation through transaction fees. This steady income stream is vital for the bank's financial stability, acting as a reliable source of cash flow.

In 2024, the bank reported a significant portion of its fee and commission income derived from transaction-based services, underscoring their role as a consistent performer. This consistent usage solidifies their status as a low-risk, high-volume contributor to the bank's overall financial health.

Mortgage Lending (Existing Portfolio)

Bank of Jiujiang's existing mortgage portfolio acts as a classic cash cow. This segment generates a steady and reliable income stream primarily from interest payments on a substantial base of residential mortgage loans. Despite potential headwinds in China's property market impacting new loan origination, the sheer volume and long-term nature of these existing loans ensure consistent cash generation with minimal need for significant new capital investment.

The stability of this segment is underscored by its maturity. While new mortgage growth might be constrained, the existing portfolio represents a predictable source of funds for the bank. This allows Bank of Jiujiang to allocate resources to other strategic areas or return capital to shareholders.

- Stable Income: The existing mortgage portfolio provides a predictable revenue stream through interest payments.

- Low Investment Needs: As a mature asset, it requires minimal ongoing investment to maintain its cash flow generation.

- Mature Asset: A large, established base of long-term loans ensures consistent performance.

Interbank and Treasury Operations

Bank of Jiujiang's Interbank and Treasury Operations function as a cash cow, generating steady income through efficient liquidity management. In 2024, the bank's strategic deployment of capital in interbank lending and a diversified treasury portfolio, including government bonds, yielded consistent returns despite a prevailing low-interest rate environment.

This segment of the bank's business is characterized by its stability and ability to convert surplus capital into predictable cash flow. For instance, while specific 2024 interbank lending rates fluctuated, the overall strategy of active liability and asset management ensured that this operation remained a reliable contributor to the bank's earnings, even if growth was modest.

- Stable Income Generation: Efficiently manages liquidity, providing a supplementary and consistent income stream.

- Low-Interest Rate Resilience: Skillful asset-liability management allows for consistent cash generation even with narrow margins.

- Capital Surplus Utilization: Effectively converts excess capital into predictable cash flow through treasury activities.

Bank of Jiujiang's traditional retail deposit base in Jiangxi Province serves as a significant cash cow. This stable funding source, built on local customer relationships, provides consistent and low-cost capital. As of the first quarter of 2024, Bank of Jiujiang reported total deposits of RMB 238.5 billion, with a substantial portion attributed to its retail segment. This robust deposit franchise allows the bank to generate reliable cash flows, underpinning its ability to finance lending activities and invest in growth areas.

Bank of Jiujiang's established corporate lending portfolio, built on decades of local relationships in Jiangxi province, acts as a significant cash cow. This mature segment, serving stable, established businesses, consistently delivers interest income, even as broader loan growth in China moderates. Its high market share within its core area solidifies its role as a dependable revenue source.

Bank of Jiujiang's basic payment and settlement services are firmly positioned as cash cows. These foundational offerings are indispensable for its broad client base, both individual and corporate, facilitating everyday transactions and core business operations. While not experiencing rapid expansion, the sheer volume and deep integration of these services ensure consistent revenue generation through transaction fees. In 2024, the bank reported a significant portion of its fee and commission income derived from transaction-based services, underscoring their role as a consistent performer.

Bank of Jiujiang's existing mortgage portfolio acts as a classic cash cow. This segment generates a steady and reliable income stream primarily from interest payments on a substantial base of residential mortgage loans. Despite potential headwinds in China's property market impacting new loan origination, the sheer volume and long-term nature of these existing loans ensure consistent cash generation with minimal need for significant new capital investment.

| Business Segment | BCG Matrix Position | Key Characteristics | 2024 Data/Insight |

|---|---|---|---|

| Retail Deposits (Jiangxi) | Cash Cow | Stable, low-cost funding, strong local relationships | RMB 238.5 billion total deposits (Q1 2024), high retail contribution |

| Established Corporate Lending (Jiangxi) | Cash Cow | Mature, consistent interest income, high local market share | Reliable revenue from established businesses |

| Payment & Settlement Services | Cash Cow | High volume, indispensable for clients, consistent fee income | Significant portion of fee & commission income in 2024 |

| Existing Mortgage Portfolio | Cash Cow | Steady interest income from long-term loans, low investment needs | Predictable cash generation despite property market fluctuations |

Full Transparency, Always

Bank of Jiujiang BCG Matrix

The BCG Matrix for the Bank of Jiujiang that you are currently previewing is the complete and final document you will receive upon purchase. This comprehensive analysis, devoid of watermarks or demo content, is meticulously prepared for immediate strategic application, offering a clear roadmap for the bank's product portfolio.

Dogs

The Bank of Jiujiang's outdated branch-based services are likely facing a tough time. As China embraces digital banking, these traditional services, stuck in physical branches, are seeing fewer customers. This means lower engagement and higher costs to keep them running.

These services, if they don't get a digital upgrade, are in a slow-growth market. Their share of the bank's business is probably shrinking. They end up using up valuable resources without bringing in much profit in return. For instance, in 2023, China's digital banking penetration reached over 85%, highlighting the challenge for non-digitalized services.

In the current banking landscape, characterized by compressed net interest margins and a slowdown in loan expansion, Bank of Jiujiang likely faces challenges with its low-margin, undifferentiated corporate loans. These offerings, often generic and lacking a unique selling proposition for the bank, typically command a small market share within a mature sector.

These loans can easily become cash drains if not managed proactively. For instance, during 2024, the banking sector in China, where Bank of Jiujiang operates, experienced a notable increase in non-performing loan ratios for certain corporate segments, particularly those in highly competitive, commoditized industries. This trend underscores the inherent risk of these products becoming cash traps.

Legacy paper-based processes at Bank of Jiujiang are a significant drag on efficiency and profitability. These manual workflows for account opening, transactions, and approvals are costly to maintain and slow down operations, a stark contrast to the digital expectations of today's customers.

In 2024, the financial sector's rapid digital transformation means these paper-reliant methods hold a shrinking market share. Customers increasingly prefer seamless digital experiences, leaving these legacy systems with low customer adoption and minimal contribution to the bank's bottom line, positioning them as prime candidates for divestiture or comprehensive modernization.

Uncompetitive Basic Investment Products

Bank of Jiujiang's basic investment products are positioned as Dogs in the BCG matrix. These offerings, characterized by generic features and low yields, struggle to compete in today's market. For instance, if their standard savings accounts offer a 0.5% annual yield while leading fintech platforms are providing up to 4% on similar cash management products, the disparity is stark.

- Low Market Share: These products likely hold a minimal share of the investment market due to their inability to attract investors seeking growth.

- Stagnant Growth: With limited appeal, their market growth is expected to be negligible or even negative.

- Underperforming Assets: They represent assets that are not generating significant returns or attracting substantial capital.

- Need for Divestment or Revitalization: The bank should consider divesting these products or investing heavily to revamp them into more competitive offerings.

Underperforming Regional Expansion Efforts

Bank of Jiujiang's expansion efforts beyond its core Jiangxi province have shown signs of underperformance, potentially classifying these ventures as Dogs in a BCG Matrix analysis. For instance, if branches in cities like Guangzhou or Suzhou are not meeting performance expectations, they represent areas with limited growth and low market share.

These ventures may be struggling due to a lack of strategic focus or insufficient investment to compete effectively in these new, often more mature, markets. Without a clear competitive advantage or substantial backing, these regional forays can become drains on resources, generating low returns.

- Underperforming Branches: Branches in Guangzhou and Suzhou, if not achieving target market share or profitability, exemplify the Dog quadrant.

- Limited Market Share: These external branches likely hold a small percentage of the market in their respective, highly competitive regions.

- Low Growth Potential: The overall growth prospects for these specific geographic segments might be subdued, further solidifying their Dog status.

- Resource Drain: Continued investment in these underperforming areas without a clear turnaround strategy can divert capital from more promising opportunities.

Bank of Jiujiang's basic investment products, like standard savings accounts, are likely classified as Dogs. These offerings often have low yields, struggling to attract investors compared to higher-yielding fintech alternatives. For example, if a standard savings account offers a 0.5% annual yield while cash management products from competitors yield up to 4%, these products have a minimal market share and stagnant growth, representing underperforming assets that may need divestment or significant revitalization.

| Product Category | Market Share | Growth Rate | Profitability | BCG Classification |

|---|---|---|---|---|

| Basic Investment Products | Low | Stagnant/Negative | Low | Dog |

| Outdated Branch Services | Shrinking | Slow | Low | Dog |

| Legacy Paper Processes | Minimal | Declining | Negative | Dog |

Question Marks

The retail banking sector is seeing significant AI adoption, particularly in China, as institutions like Bank of Jiujiang explore AI for enhanced customer experiences and operational efficiency. This could translate into personalized product recommendations, faster credit approvals, and more responsive customer support powered by AI. The market for these advanced AI solutions is expanding quickly, with significant investment needed for banks to capture substantial market share in these nascent, high-potential segments.

While green loans are a significant focus, Bank of Jiujiang is also observing the rise of other green finance products. These include green bonds tailored for corporate clients, specialized green insurance policies, and dedicated green investment funds. These innovative offerings are tapping into a growing demand for sustainable financial solutions.

These emerging segments, like green bonds and green insurance, represent high-growth potential areas, strongly supported by national policies promoting environmental sustainability. For instance, the global green bond market saw significant expansion, with issuance reaching over $500 billion in 2023, indicating robust investor appetite. Bank of Jiujiang’s market share in these newer, specialized areas is likely still developing.

Capitalizing on the potential of these diverse green finance products will require strategic investment and a focused approach. Bank of Jiujiang may need to allocate resources towards developing expertise, building distribution channels, and forging partnerships to establish a stronger presence in these evolving markets.

Bank of Jiujiang could be focusing on advanced digital lending platforms to tap into underserved or emerging markets, offering tailored solutions beyond standard digital loans. This strategic move aims to capture high-growth segments with currently limited digital penetration.

Developing these sophisticated platforms demands significant capital for technology and robust marketing campaigns to compete effectively with existing digital lenders. For instance, the global digital lending market was projected to reach over $10 trillion by 2025, indicating substantial potential but also intense competition.

Cross-border Financial Services

As China's global economic engagement expands, cross-border financial services for local businesses engaged in international trade and investment represent a promising, high-growth area. Bank of Jiujiang's potential entry into this complex sector likely means a smaller market share compared to established state-owned or international banks, requiring substantial investment in specialized expertise and robust infrastructure to carve out a competitive niche.

To effectively compete, Bank of Jiujiang would need to focus on building capabilities in areas like international trade finance, foreign exchange services, and cross-border payment solutions. The bank's current market share in these specialized services is likely nascent, demanding significant capital allocation to develop the necessary technological platforms and human capital to meet the sophisticated needs of businesses operating globally. For instance, by mid-2024, the total value of China's cross-border e-commerce transactions was projected to exceed 2.1 trillion yuan, highlighting the immense opportunity.

- Market Potential: The increasing volume of China's international trade and outbound investment creates a substantial demand for specialized cross-border financial services.

- Competitive Landscape: Bank of Jiujiang faces strong competition from large state-owned banks and international financial institutions with established global networks and expertise.

- Investment Requirements: Significant investment in technology, compliance, and skilled personnel is crucial for offering competitive cross-border financial solutions.

- Strategic Focus: The bank should prioritize developing niche expertise and tailored services to attract and retain businesses involved in international commerce.

Fintech Partnerships for Niche Services

Bank of Jiujiang can explore strategic alliances with specialized fintech firms to introduce novel, niche services. Think of areas like blockchain for trade finance, sophisticated data analytics for managing risk, or unique digital asset offerings.

These ventures are positioned as high-growth opportunities but currently represent a small fraction of the bank's market share. For instance, the global fintech market was valued at over $11 trillion in 2023 and is projected to grow significantly.

Such collaborations demand thorough assessment and considerable financial commitment to ascertain their potential to evolve into market leaders (Stars) or falter (Dogs). A 2024 report indicated that banks engaging in fintech partnerships saw an average revenue increase of 15% in their digital service offerings.

- Blockchain in Trade Finance: Potential to reduce transaction times by up to 40% and cut costs by 20%.

- Advanced Data Analytics: Enhances risk assessment accuracy, potentially lowering non-performing loans by 5-10%.

- Digital Asset Services: Taps into a rapidly expanding market, with digital asset investments projected to reach $5 trillion by 2030.

- Partnership ROI: Careful selection and integration are key, as failed partnerships can lead to significant financial write-offs.

Question Marks in the BCG Matrix represent business units or products with low market share in high-growth industries. For Bank of Jiujiang, these might include emerging digital asset services or specialized fintech collaborations. These areas require significant investment to grow market share, as they are in rapidly expanding sectors but currently hold a small position.

The bank must carefully analyze these Question Marks to determine if they have the potential to become Stars or if they are likely to remain Dogs, consuming resources without significant returns. Strategic decisions regarding resource allocation are critical for these nascent ventures.

| BCG Category | Market Growth | Market Share | Bank of Jiujiang Examples | Strategic Consideration |

|---|---|---|---|---|

| Question Mark | High | Low | Emerging Fintech Partnerships, Digital Asset Services | Invest to gain share or divest if potential is low |

BCG Matrix Data Sources

Our Bank of Jiujiang BCG Matrix is built on comprehensive financial disclosures, regional economic data, and market growth forecasts, ensuring a robust and accurate strategic overview.