BAC Holding International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAC Holding International Bundle

BAC Holding International's SWOT analysis reveals a dynamic market position, highlighting key strengths like its diversified portfolio and strategic partnerships, alongside potential weaknesses in operational efficiency. Understanding these internal factors is crucial for navigating the competitive landscape.

Uncover the full story behind BAC Holding International's market position and growth drivers. Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

BAC Holding International's extensive regional presence is a significant strength, with operations spanning six Central American countries: Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and Panama. This broad geographical footprint firmly establishes it as a leading financial group across the region.

The company's scale is further underscored by its customer base, serving over 5 million individuals and businesses. This deep market penetration is supported by a substantial workforce of more than 20,000 employees, highlighting its operational capacity and reach.

BAC Holding International boasts a robust and diversified financial services portfolio, encompassing retail banking, corporate banking, treasury services, and insurance. This broad offering allows the company to serve a wide spectrum of clients, from individual consumers to large corporations, by providing essential financial products like deposits, loans, credit cards, and various investment opportunities.

This extensive range of services acts as a significant strength, reducing the company's dependence on any single market segment. For instance, in 2024, their retail banking division continued to see steady growth in deposit volumes, while their corporate banking segment secured several significant lending deals, demonstrating the balanced contribution from different areas of their business.

BAC Holding International is a powerhouse in Central America, consistently ranking as the top financial group across the region. This leadership is cemented by its dominant standing in key metrics like assets, loans, and deposits, making it the go-to financial institution for many.

The group's influence is further underscored by its significant 53% share of Central America's GDP in payment processing. This massive market penetration acts as a formidable barrier to entry, effectively deterring new competitors and solidifying BAC's entrenched market position.

This strong market leadership translates directly into a powerful competitive advantage. It not only ensures a stable and loyal customer base but also provides a robust platform for continued growth and profitability in the dynamic Central American financial landscape.

Commitment to Digitalization and Innovation

BAC Holding International's commitment to digitalization is a significant strength. The company has actively pursued digital transformation initiatives, leading to a substantial portion of its operations being conducted online. This focus enhances efficiency and customer engagement.

As of March 2025, a remarkable 95% of BAC's total monetary transactions were digital. This statistic underscores the successful integration of technology into its core business processes, streamlining operations and improving the overall client experience. This high digital penetration is a key indicator of their forward-thinking strategy.

The company's strategic embrace of digital solutions positions it favorably for future growth. By prioritizing innovation and digital channels, BAC is not only meeting current customer expectations but also building a robust foundation for sustained operational excellence and market competitiveness in the evolving financial landscape.

- Digital Transformation Focus: BAC has made significant strides in digitizing its operations and client interactions.

- High Digital Transaction Rate: By March 2025, 95% of all monetary transactions were digital, showcasing strong technology adoption.

- Enhanced Efficiency and Customer Experience: The digital push directly contributes to improved operational efficiency and a better client journey.

- Future Growth Potential: This commitment to innovation and digital solutions positions BAC for continued success and adaptability.

'Net Positive' and ESG Strategy

BAC Holding International's commitment to a 'Net Positive' strategy, aiming to generate more environmental and social value than its operational impact, sets it apart as a pioneering financial group. This ambitious goal, coupled with its adherence to the United Nations Principles for Responsible Banking, positions BAC as a leader in sustainable finance.

This proactive stance on ESG factors significantly bolsters BAC's brand image, attracting an increasingly large base of investors and customers who prioritize ethical and sustainable business practices. For instance, in 2024, investments in ESG-focused funds globally surged, with reports indicating trillions of dollars allocated to sustainable assets, highlighting the market's growing demand for such strategies.

BAC's leadership in the region for adopting the UN Principles for Responsible Banking underscores its dedication to integrating sustainability into its core operations. This focus not only mitigates potential regulatory risks but also opens avenues for new partnerships and financial products aligned with global sustainability targets.

The company's ESG strategy is a key differentiator, appealing to a broad spectrum of stakeholders, from individual investors seeking ethical investments to institutional players increasingly focused on long-term value creation driven by sustainability. This strategic alignment is crucial in the current financial landscape, where ESG performance is becoming a significant factor in valuation and investor confidence.

BAC Holding International's extensive regional presence across six Central American countries is a core strength, solidifying its position as a leading financial group. This broad geographical footprint is complemented by a substantial customer base of over 5 million individuals and businesses, supported by a workforce exceeding 20,000 employees.

The company's diversified financial services portfolio, including retail banking, corporate banking, treasury, and insurance, reduces reliance on any single market segment. For example, in 2024, retail banking saw steady deposit growth while corporate banking secured significant lending deals, demonstrating balanced contributions.

BAC Holding International's market leadership in Central America is undeniable, consistently ranking as the top financial group by assets, loans, and deposits. Its significant 53% share of the region's GDP in payment processing creates a formidable barrier to entry for competitors.

The company's commitment to digitalization is a key advantage, with 95% of its monetary transactions being digital as of March 2025. This focus on technology enhances operational efficiency and customer experience, positioning BAC for future growth.

BAC's pioneering 'Net Positive' strategy and adherence to the UN Principles for Responsible Banking enhance its brand image and attract ESG-conscious investors and customers. This commitment to sustainability is a significant differentiator in the current financial landscape.

| Metric | BAC Holding International | Central America Average (Est. 2024) |

| Customer Base | Over 5 million | Varies by country |

| Employees | Over 20,000 | Varies by country |

| Digital Transactions (as of Mar 2025) | 95% | Lower, with increasing trend |

| GDP Share (Payment Processing) | 53% | Fragmented across players |

What is included in the product

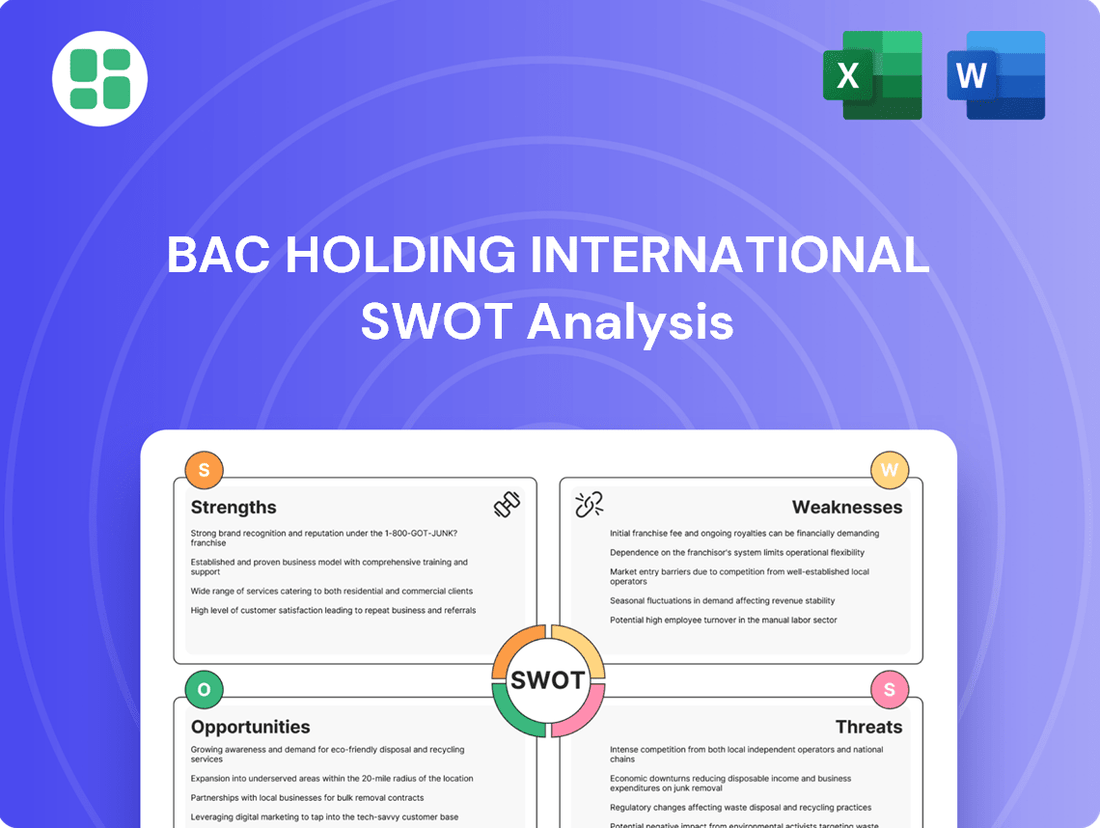

Delivers a strategic overview of BAC Holding International’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, transforming potential threats into manageable opportunities for BAC Holding International.

Weaknesses

While Central America shows promising economic growth, BAC Holding International faces inherent risks due to the region's susceptibility to economic downturns and political instability. For instance, a significant slowdown in a key market like Guatemala, which represented approximately 25% of BAC's total assets in 2023 according to their annual report, could directly dampen loan demand and increase non-performing loans.

Fluctuations in local economies across its operating countries, such as El Salvador or Honduras, can impact the quality of BAC's loan portfolio and dampen consumer spending, directly affecting fee income and interest revenue. Navigating these varied economic conditions and differing monetary policies across the region presents a continuous challenge for maintaining consistent financial performance.

BAC's global footprint, spanning operations in six distinct countries, presents a significant weakness due to the inherent complexity of navigating varied banking regulations and compliance mandates. This multi-jurisdictional landscape directly translates into higher operational costs and a heavier administrative burden, as the company must dedicate substantial resources to ensure adherence to each nation's unique legal and financial frameworks.

The Latin American banking sector is experiencing a surge in digital innovation, with mobile banking, digital payments, and fintech solutions rapidly gaining traction. This dynamic environment presents a significant challenge for established institutions like BAC Holding International. For instance, in 2024, fintech funding in Latin America reached an estimated $2.5 billion, highlighting the aggressive growth of these new entrants.

Agile digital-only banks and nimble fintech startups are emerging as formidable competitors, capable of offering highly specialized and user-friendly services. These non-traditional players are adept at capturing market share, particularly among younger, tech-savvy demographics, potentially impacting BAC's existing customer base and revenue streams.

To counter this intensifying competition, BAC must prioritize continuous innovation in its digital offerings. Staying ahead requires not only matching but exceeding the pace of technological advancement set by these agile challengers, ensuring BAC maintains its competitive edge in a rapidly evolving market landscape.

Cybersecurity Risks and Data Security Concerns

As a major financial institution, BAC Holding International is inherently exposed to significant cybersecurity risks. The increasing reliance on digital platforms and the processing of vast amounts of sensitive customer data make the company a prime target for cyberattacks, data breaches, and fraud. These threats are not static; they are constantly evolving, demanding continuous adaptation and investment in robust security measures.

The potential consequences of a successful cyberattack are severe, ranging from significant financial losses and reputational damage to regulatory penalties and loss of customer trust. For instance, the financial services sector has seen a sharp rise in sophisticated attacks. In 2024, the average cost of a data breach in the financial sector was reported to be $5.90 million, a figure that underscores the financial imperative of strong cybersecurity.

- Escalating Threat Landscape: Financial institutions like BAC are increasingly targeted by advanced persistent threats (APTs) and ransomware attacks, which can disrupt operations and compromise sensitive data.

- Data Breach Impact: A significant data breach could lead to substantial financial penalties, as seen with GDPR fines, and a severe erosion of customer confidence, impacting long-term profitability.

- Investment Requirements: Maintaining state-of-the-art cybersecurity infrastructure and protocols requires substantial and ongoing capital expenditure, diverting resources from other growth initiatives.

- Regulatory Scrutiny: Regulators worldwide are intensifying their focus on data protection and cybersecurity compliance, with non-compliance leading to significant fines and operational restrictions.

Potential for High Operating Costs

BAC Holding International's extensive global presence, with numerous physical branches and a substantial workforce, inherently translates to significant operating expenses. For instance, in 2023, major global banks often reported substantial costs associated with their physical infrastructure and personnel, which can range from billions to tens of billions of dollars annually, depending on the scale of operations.

While the company is investing in digitalization to streamline operations, the ongoing need to support both digital and traditional banking channels presents a continuous cost challenge. This hybrid model requires ongoing investment in technology alongside the maintenance of physical assets and staff.

These considerable overheads can compress profit margins, potentially making BAC Holding International less competitive against newer, digital-first financial institutions that operate with lower fixed costs.

- High Infrastructure Costs: Maintaining a vast network of physical branches and ATMs incurs substantial real estate, maintenance, and utility expenses.

- Large Workforce Expenses: A significant employee base across various countries contributes to considerable payroll, benefits, and training costs.

- Digitalization Investment: Ongoing expenditure is required to upgrade and maintain digital platforms, cybersecurity, and related technologies.

- Regulatory Compliance: Operating in multiple jurisdictions necessitates adherence to diverse and often costly regulatory frameworks.

BAC Holding International's reliance on physical branches and a large workforce contributes to significant operational expenses. For example, major global banks in 2023 often reported annual infrastructure and personnel costs in the billions, impacting profit margins and competitiveness against digital-only banks with lower overheads.

| Cost Area | Description | Impact on BAC |

| Physical Infrastructure | Maintaining numerous branches, ATMs, and office spaces across six countries incurs substantial real estate, maintenance, and utility costs. | Elevated fixed costs, potentially reducing profitability and pricing flexibility. |

| Personnel Expenses | A large employee base across diverse regions leads to significant payroll, benefits, training, and management costs. | Increased labor expenses, requiring efficient workforce management and productivity gains. |

| Digital Transformation Investment | Ongoing capital expenditure is necessary for upgrading digital platforms, cybersecurity, and adopting new technologies. | Requires continuous investment, potentially diverting funds from other strategic initiatives. |

| Regulatory Compliance | Adhering to varied and often complex banking regulations in each operating country necessitates dedicated resources and compliance personnel. | Adds to administrative burden and operational costs, with potential for fines if non-compliant. |

Full Version Awaits

BAC Holding International SWOT Analysis

This is the actual BAC Holding International SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive breakdown of BAC Holding International's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights for strategic planning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable BAC Holding International SWOT analysis, ready for your business strategy.

Opportunities

The burgeoning digital financial services sector in Latin America, driven by rising smartphone adoption and internet connectivity, represents a key opportunity for BAC Holding International. As of early 2025, smartphone penetration in the region has surpassed 75%, with internet usage growing at an annual rate of over 10%, creating fertile ground for digital expansion.

BAC can capitalize on this by broadening its digital financial product suite, encompassing advanced mobile banking solutions and accessible online investment platforms. This strategic move allows BAC to tap into a wider demographic, including individuals in remote areas who have historically lacked access to traditional banking services.

Government initiatives across Central America are actively promoting financial inclusion, with a significant portion of the population remaining unbanked or underbanked. For instance, by the end of 2023, estimates suggest that over 50% of adults in some Central American nations still lacked access to formal financial services. This presents BAC Holding International with a substantial opportunity to expand its reach into these underserved market segments.

BAC can capitalize on this by developing and tailoring financial products and services specifically designed to meet the needs of these populations. This could include simplified account structures, accessible digital banking solutions, and microfinance offerings. By effectively reaching these new customer bases, BAC can drive significant new customer acquisition and deepen its overall market penetration in the region.

This strategic focus on underserved segments is poised to unlock new and substantial revenue streams for BAC Holding International. As these populations gain access to financial services, their economic activity is likely to increase, creating a virtuous cycle of growth. This approach not only addresses a social need but also positions BAC for robust, long-term growth and enhanced market leadership.

BAC's vast customer transaction data offers a goldmine of insights into consumer habits and emerging market trends. This information is crucial for crafting bespoke financial products and offering competitive lending rates. For instance, by analyzing spending patterns, BAC could identify segments ripe for specialized credit cards or investment vehicles, potentially boosting engagement.

Utilizing this data allows for sophisticated customer segmentation, enabling more targeted marketing and product development. In 2024, financial institutions leveraging AI for customer insights saw an average increase of 15% in cross-selling success rates. BAC can replicate this by segmenting its customer base based on transactional behavior to offer relevant wealth management or insurance products.

These data-driven approaches are key to fostering deeper customer relationships and encouraging repeat business. By proactively offering tailored solutions based on observed needs, BAC can significantly improve customer satisfaction and loyalty, leading to higher lifetime value. This focus on personalized service is a significant differentiator in the competitive financial landscape.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions represent a significant opportunity for BAC Holding International. Collaborating with fintech innovators or acquiring companies with complementary technologies can rapidly enhance BAC's service offerings and technological capabilities. For instance, in 2024, the financial services sector saw a surge in fintech partnerships, with many institutions leveraging these alliances to improve digital customer experiences and operational efficiency. This strategy allows BAC to bypass lengthy internal development cycles, gaining immediate access to specialized expertise and novel solutions.

These alliances can unlock new customer demographics and markets, thereby accelerating BAC's growth trajectory. By integrating cutting-edge technologies through these ventures, BAC can solidify its competitive standing. A prime example is the trend observed in early 2025, where several major banks announced strategic investments in AI-driven wealth management platforms, aiming to capture a larger share of the affluent investor market.

- Accelerated Technology Integration: Partnerships enable swift adoption of advanced fintech solutions, potentially reducing time-to-market for new services.

- Market Expansion: Access to new customer segments and geographical regions through acquired entities or co-branded offerings.

- Enhanced Service Portfolio: Broadening the range of financial products and digital tools available to clients.

- Competitive Advantage: Gaining an edge by leveraging external innovation and specialized knowledge, rather than solely relying on organic growth.

Positive Economic Growth Outlook for Central America

Central America's economic outlook for 2024 and 2025 is robust, with projections indicating steady growth. This positive trend is partly fueled by an anticipated moderate rise in remittances across the region, which acts as a significant economic stimulant. For BAC Holding International, this translates into a fertile ground for increased demand for its financial products and services.

BAC is well-positioned to leverage this favorable macroeconomic environment. The projected expansion of lending and investment activities within the region offers a clear opportunity for the company to grow its market share and profitability.

- Projected GDP Growth: Several Central American nations are forecast to see GDP growth between 3% and 4.5% in 2024 and 2025, according to recent IMF and regional development bank reports.

- Remittance Inflows: Remittance inflows are expected to continue their upward trajectory, potentially increasing by 5-7% year-over-year in 2024, providing a stable source of consumer spending power.

- Increased Demand: This economic uplift is anticipated to drive higher demand for consumer loans, mortgages, and business financing, all core offerings for BAC.

- Investment Opportunities: The growth outlook also signals increased opportunities for BAC to participate in infrastructure projects and corporate financing, further diversifying its revenue streams.

The increasing adoption of digital financial services in Latin America, fueled by rising smartphone penetration and internet access, presents a significant growth avenue for BAC Holding International. By early 2025, over 75% of the region's population uses smartphones, with internet usage expanding by more than 10% annually, creating a robust environment for digital product expansion.

BAC can enhance its digital offerings by expanding its mobile banking and online investment platforms, thereby reaching a broader customer base, including those in remote areas previously underserved by traditional banking.

Government-led initiatives promoting financial inclusion across Central America, where a substantial portion of the population remains unbanked, offer BAC a prime opportunity to extend its services. By the close of 2023, over half the adult population in certain Central American countries still lacked access to formal financial services, highlighting a vast market for BAC to penetrate.

BAC can tailor financial products, such as simplified accounts and accessible digital solutions, to cater to these underserved segments, driving customer acquisition and deepening market penetration.

Leveraging its extensive customer transaction data allows BAC to gain deep insights into consumer behavior and market trends, crucial for developing personalized financial products and competitive lending rates. For example, analyzing spending patterns in 2024 enabled financial institutions using AI to boost cross-selling success by an average of 15%.

Strategic partnerships and acquisitions offer BAC a chance to quickly integrate advanced fintech solutions and expand its market reach. In 2024, financial services firms saw increased success through fintech collaborations, improving digital customer experiences and operational efficiency.

The positive economic outlook for Central America in 2024-2025, bolstered by steady GDP growth projected between 3% and 4.5% and a 5-7% annual increase in remittances, signifies growing demand for BAC's financial products and services.

| Opportunity Area | Key Driver | BAC's Strategic Action | Projected Impact (2024-2025) |

|---|---|---|---|

| Digital Financial Services Expansion | High smartphone penetration (>75%) & internet growth (>10% annually) | Broaden mobile banking & online investment platforms | Increased customer acquisition & reach into underserved areas |

| Financial Inclusion Initiatives | Large unbanked/underbanked population (>50% in some nations) | Develop tailored financial products for new segments | Significant new revenue streams & deeper market penetration |

| Data Analytics & Personalization | Vast customer transaction data | Utilize AI for customer insights & targeted offerings | Enhanced customer loyalty & 15%+ increase in cross-selling success |

| Strategic Partnerships & Acquisitions | Fintech innovation & market consolidation | Collaborate with or acquire fintech companies | Accelerated technology integration & market expansion |

| Favorable Macroeconomic Environment | Projected GDP growth (3-4.5%) & remittance increase (5-7%) | Leverage economic uplift for lending & investment growth | Increased demand for core financial products & services |

Threats

Central American economies, including those where BAC Holding International operates, are susceptible to global macroeconomic shifts. Persistent inflation, a key concern throughout 2024 and projected into 2025, directly impacts consumer spending and business investment. For instance, inflation rates in some Central American nations hovered around 5-7% in late 2024, eroding purchasing power.

Rising interest rates, a tool used to combat inflation, can increase borrowing costs for businesses and individuals, potentially leading to higher loan defaults and a strain on BAC Holding International's loan portfolio quality. This economic volatility can dampen demand for banking services, affecting fee income and net interest margins.

The evolving regulatory landscape across Latin America presents a significant threat to BAC Holding International. Continuous updates in crucial areas such as data protection, real-time monitoring, artificial intelligence usage, and anti-money laundering (AML)/know-your-customer (KYC) protocols, alongside fraud management, demand constant adaptation and investment. For instance, in 2024, several Latin American nations intensified their AML/KYC requirements, increasing compliance burdens for financial institutions operating within these markets.

Stricter regulations directly translate into higher compliance costs and increased operational complexities for BAC Holding International. Failure to adhere to these evolving standards can lead to substantial penalties, potentially impacting the company's profitability and market reputation. The financial services sector, in general, saw a notable rise in regulatory fines globally in 2024, underscoring the financial risks associated with non-compliance.

The financial landscape in Latin America is increasingly crowded with agile fintechs and digital-only banks. These disruptors, often unburdened by legacy systems, are rapidly gaining traction by offering innovative, cost-effective solutions. For instance, the fintech sector in Latin America saw a significant surge in investment, with over $4 billion raised in 2023 alone, highlighting the competitive pressure on established institutions like BAC Holding International.

These non-traditional players are particularly adept at attracting younger, tech-savvy demographics with user-friendly mobile platforms and specialized services. This shift poses a direct threat to traditional banking models, as these new entrants can capture market share by offering tailored digital experiences and competitive pricing, potentially eroding BAC's customer base in key segments.

Geopolitical Tensions and Trade Policy Impacts

Escalating geopolitical tensions and shifting trade policies, like new tariffs, can create significant headwinds for regional economies. For instance, the ongoing trade disputes between major economic blocs have led to increased uncertainty, impacting cross-border investment and supply chain reliability.

These external pressures can foster economic instability, disrupt the flow of capital, and create operational challenges for BAC's clients. This, in turn, can directly affect BAC's business by reducing client demand for services and potentially increasing the risk profile of their portfolios.

- Tariff impacts: For example, the US-China trade war, which saw tariffs on hundreds of billions of dollars worth of goods, disrupted manufacturing and increased costs for many businesses globally.

- Supply chain disruptions: Events such as the conflict in Eastern Europe in 2022 led to significant disruptions in energy and commodity markets, affecting businesses reliant on these inputs.

- Investment uncertainty: Increased geopolitical risk can lead to capital flight from affected regions, reducing investment opportunities and impacting the financial sector.

Cyberattacks and Financial Fraud

The financial sector remains a prime target for escalating cyberattacks and diverse financial fraud schemes. A significant data breach for BAC Holding International could result in substantial financial losses, severe damage to its reputation, and a critical loss of customer confidence. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk.

These threats necessitate continuous and significant investment in advanced cybersecurity infrastructure and protocols. While essential for protection, these ongoing security expenditures represent a considerable operational cost for BAC Holding International. The financial services industry saw cybersecurity spending increase by 11% in 2024, underscoring this trend.

- Increased Sophistication: Cybercriminals are constantly developing more advanced methods for breaching financial systems.

- Reputational Risk: A successful attack can severely erode customer trust, impacting long-term business viability.

- Cost of Defense: Maintaining robust cybersecurity requires substantial and ongoing financial commitment.

- Regulatory Scrutiny: Breaches often lead to increased regulatory fines and compliance burdens.

The intensifying competition from agile fintechs and digital-only banks poses a significant threat, as these entities often offer more appealing, cost-effective solutions, particularly to younger demographics. This dynamic could lead to market share erosion for BAC Holding International.

Geopolitical instability and evolving trade policies can create economic headwinds, impacting regional economies and, consequently, BAC's client base and the risk profile of its portfolios. For instance, trade disputes in 2024 continued to foster uncertainty in global markets.

The escalating sophistication of cyberattacks and financial fraud schemes presents a substantial risk, potentially leading to significant financial losses and reputational damage. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the magnitude of this threat.

A table summarizing key threats and their potential impact:

| Threat Category | Specific Example/Trend | Potential Impact on BAC Holding International |

|---|---|---|

| Competition | Fintech/Digital Bank Growth | Market share loss, reduced customer base in key segments |

| Geopolitical/Trade | Trade policy shifts, regional instability | Economic volatility, reduced client demand, increased portfolio risk |

| Cybersecurity/Fraud | Sophisticated cyberattacks | Financial losses, reputational damage, loss of customer trust |

SWOT Analysis Data Sources

This SWOT analysis is informed by a comprehensive review of BAC Holding International's financial statements, recent market research reports, and expert industry commentary to provide a robust strategic overview.