BAC Holding International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAC Holding International Bundle

Unlock the secrets of BAC Holding International's external environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its trajectory and discover how to leverage these insights for your own strategic advantage. Download the full version now and gain a critical edge in your market analysis.

Political factors

BAC Holding International's operations are significantly shaped by the political stability of Central American nations. For instance, recent years have seen varying degrees of political calm across the region, with some countries experiencing peaceful transitions of power while others have faced periods of social unrest. This stability directly impacts investor confidence, a critical factor for financial institutions like BAC Holding.

Shifts in government or economic policy can introduce considerable uncertainty. For example, a new administration might implement changes to banking regulations or fiscal policies, potentially affecting BAC Holding's profitability and strategic direction. The International Monetary Fund (IMF) has noted in its 2024 reports that political predictability remains a key driver for foreign direct investment in emerging markets, underscoring its importance for BAC Holding's growth prospects.

A stable political environment is paramount for financial institutions as it fosters a predictable operational landscape. This predictability allows BAC Holding to engage in long-term planning, such as expanding its service offerings or investing in new technologies, with greater assurance. Countries with consistent governance and clear regulatory frameworks tend to attract more capital, benefiting the entire financial sector.

Financial sector regulation is a critical political factor for BAC Holding International. Regulatory frameworks, covering everything from licensing and capital adequacy to risk management and consumer protection, are constantly evolving across Central America. For instance, in 2024, several Central American nations were reviewing or implementing updated Basel III requirements, which could increase capital demands for banks like BAC Holding.

Navigating these diverse and often changing regulations directly impacts BAC Holding's operational costs, the types of products it can offer, and its ability to enter new markets. A shift towards stricter oversight, as seen in some regional discussions around digital banking and cybersecurity in late 2024, can significantly raise compliance burdens. Conversely, more lenient regulations might foster competition but could also introduce new systemic risks that BAC Holding must manage.

Regional integration initiatives, such as the Central American Integration System (SICA), aim to foster economic cooperation. As of early 2024, SICA continues to work towards harmonizing regulations and reducing trade barriers, potentially easing capital flows for companies like BAC Holding International. However, the pace of this integration can vary, with some member states adopting more protectionist stances, which could create uneven market access.

Anti-Money Laundering (AML) and Sanctions Regimes

BAC Holding International must navigate a complex web of anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. For instance, in 2024, the Financial Action Task Force (FATF) continued to emphasize the importance of robust AML/CTF frameworks, with many jurisdictions updating their national risk assessments and implementation strategies. Failure to comply can lead to severe penalties, including significant fines and reputational damage, impacting client trust and business operations.

The dynamic nature of international sanctions regimes presents ongoing challenges. In 2024 and early 2025, we've seen continued adjustments to sanctions lists and enforcement actions by bodies like the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC). BAC Holding International needs to maintain vigilant monitoring and sophisticated internal controls to ensure it does not engage with sanctioned entities or individuals, thereby avoiding legal repercussions and operational disruptions.

- FATF Recommendations: Continuous adherence to the FATF's 40 Recommendations remains paramount for global financial institutions.

- OFAC Enforcement: In 2024, OFAC continued to issue substantial penalties for sanctions violations, underscoring the need for stringent compliance.

- Evolving Regulations: Keeping pace with updated national AML/CTF laws and international sanctions lists is a constant operational requirement.

- Risk Mitigation: Robust internal controls are essential to prevent illicit financial activities and safeguard the company's reputation and financial health.

Geopolitical Risks and Foreign Relations

Geopolitical tensions, such as ongoing regional disputes or evolving alliances in Central America, can indirectly impact BAC Holding International by influencing foreign direct investment. For instance, increased regional instability could deter foreign capital, potentially reducing the demand for financial services and affecting the creditworthiness of businesses operating in affected areas. The World Bank noted that in 2023, foreign direct investment into Latin America and the Caribbean saw a slight decline, highlighting the sensitivity of capital flows to the geopolitical climate.

Shifts in international relations, including trade policy changes or new diplomatic agreements involving Central American nations, can also shape BAC Holding International's operating environment. These changes can alter trade volumes and economic growth prospects across the region. For example, a new trade agreement could boost economic activity, leading to increased demand for loans and other financial products, while protectionist measures could have the opposite effect.

- Regional Instability: Heightened geopolitical risks in Central America could lead to a decrease in foreign direct investment, impacting the financial sector.

- Trade Dynamics: Changes in international trade policies and agreements directly influence economic activity and the demand for financial services.

- Investor Confidence: The perception of regional stability plays a crucial role in attracting and retaining foreign capital, affecting lending and investment opportunities.

Political stability is a cornerstone for BAC Holding International's operations in Central America. Fluctuations in governance and policy shifts can introduce significant uncertainty, impacting investor confidence and the overall economic climate. For instance, the IMF highlighted in its 2024 outlook that political predictability is crucial for attracting foreign direct investment into emerging markets, a key factor for BAC Holding's growth.

Regulatory frameworks are constantly evolving, with 2024 seeing several Central American nations reviewing updated Basel III requirements, potentially increasing capital demands for banks. Navigating these diverse and changing regulations directly affects BAC Holding's operational costs and market access. Regional integration efforts, like those within SICA, aim to harmonize regulations, but varying adoption rates can create uneven market conditions as of early 2024.

BAC Holding International must also contend with stringent anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. The Financial Action Task Force (FATF) continued to emphasize robust frameworks in 2024, with jurisdictions updating their strategies. Furthermore, evolving international sanctions regimes, monitored by entities like OFAC, necessitate vigilant compliance to avoid severe penalties and reputational damage.

What is included in the product

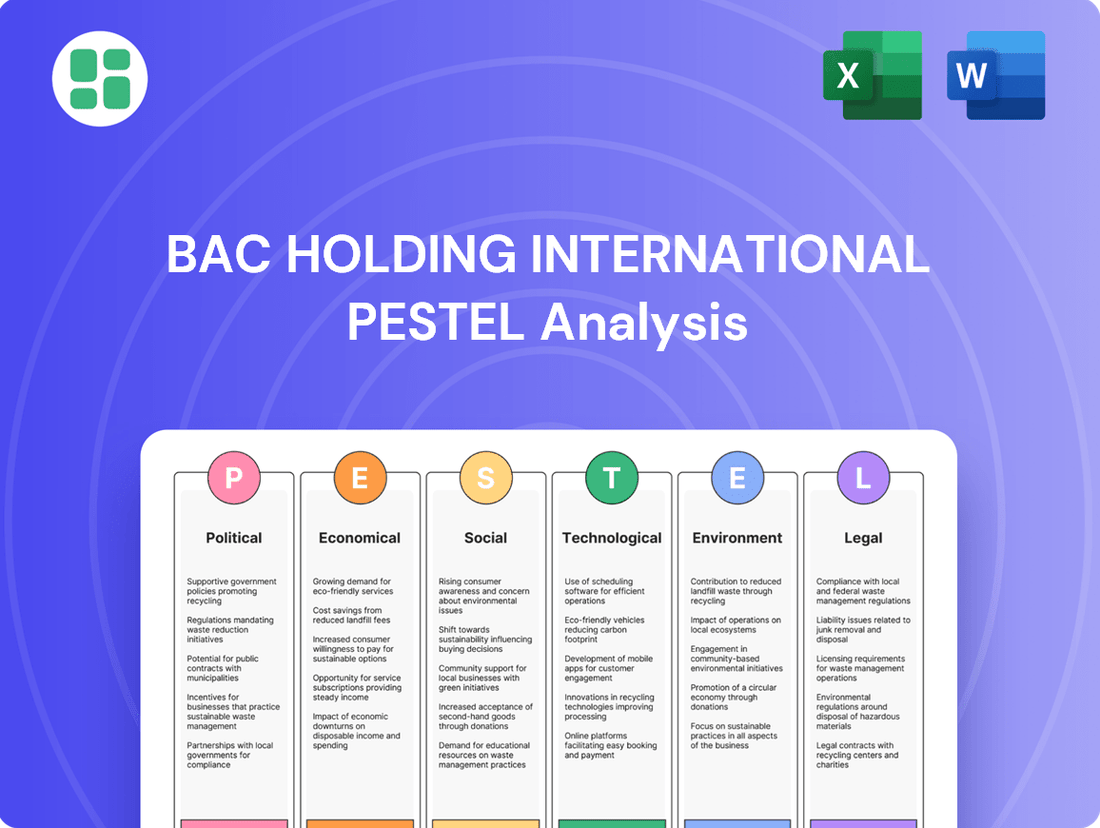

BAC Holding International's PESTLE analysis provides a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operations. This evaluation highlights how these external forces create both challenges and strategic advantages for the company.

The BAC Holding International PESTLE analysis offers a clean, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby relieving the pain point of information overload.

Economic factors

Central America's economic performance, as indicated by GDP growth, is a crucial driver for BAC Holding International. For instance, projections for 2024 suggest a regional GDP growth of around 3.5%, a figure that directly influences the demand for banking products and services.

A robust economic expansion in the region, characterized by increased consumer spending and business investment, creates a fertile ground for BAC Holding International's loan portfolios to grow and revenue streams to strengthen. This positive correlation was evident in 2023, where several Central American economies experienced growth exceeding 4%, leading to a noticeable uptick in credit demand.

Conversely, any deceleration in regional economic activity, such as the projected slowdown in certain economies to below 2% in 2025, poses challenges. Such downturns can result in elevated non-performing loans and a general dampening of business operations, impacting BAC Holding International's profitability and risk exposure.

Inflationary pressures and central bank monetary policies, especially interest rate decisions, significantly impact BAC Holding International's profitability. High inflation can diminish purchasing power and asset values, while shifting interest rates affect lending margins, deposit expenses, and investment portfolio valuations.

For instance, the U.S. Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through mid-2024, a stance influenced by persistent inflation readings that remained above the 2% target. This environment necessitates robust management of interest rate risk to ensure financial stability for institutions like BAC Holding International.

Currency exchange rate volatility presents a considerable economic challenge for BAC Holding International, given its global operational footprint. Fluctuations in exchange rates directly affect the reported value of assets and liabilities held in foreign currencies, potentially impacting financial statements and investor confidence.

The cost of conducting cross-border transactions, from sourcing raw materials to repatriating profits, is also susceptible to these currency swings. For example, a strengthening US dollar against the Euro in late 2024 could increase the cost of European imports for BAC Holding International, while a weakening dollar might reduce the value of its dollar-denominated earnings when converted back into other currencies.

These movements can significantly influence the profitability of international business segments. In 2024, many multinational corporations experienced mixed impacts; for instance, companies heavily reliant on exports from countries with depreciating currencies saw improved competitiveness, while those with substantial foreign debt in appreciating currencies faced higher repayment burdens. Effective foreign exchange risk management strategies, such as hedging, are therefore essential for BAC Holding International to mitigate these economic uncertainties and maintain stable financial performance.

Consumer Spending and Credit Demand

Consumer spending and credit demand are critical indicators for BAC Holding International. In Q1 2024, US retail sales saw a modest increase, signaling continued consumer engagement, though growth rates are moderating compared to post-pandemic surges. This directly impacts the demand for BAC's credit cards and personal loans.

The health of individual finances, measured by factors like unemployment rates and disposable income, directly influences credit uptake. For instance, the US unemployment rate remained historically low in early 2024, generally supporting loan demand. However, rising interest rates in 2023 and early 2024 have made borrowing more expensive, potentially dampening credit demand for larger purchases.

- Consumer Confidence: The Conference Board Consumer Confidence Index hovered around 100 in early 2024, indicating a cautious but generally stable outlook among consumers, which supports spending on discretionary items.

- Credit Card Delinquencies: While still relatively low, there has been a slight uptick in credit card delinquency rates in late 2023 and early 2024, suggesting some consumers are feeling financial pressure.

- Mortgage Demand: Demand for mortgages, a key product for corporate and retail banking, has been sensitive to interest rate fluctuations, with a noticeable dip in applications when rates peaked in late 2023.

- Business Investment: Corporate demand for credit is also tied to economic outlook and investment plans. Businesses are likely to borrow more for expansion when they anticipate strong future demand and stable economic conditions.

Foreign Direct Investment (FDI) and Remittances

Foreign Direct Investment (FDI) and remittances are crucial economic drivers for Central America. In 2023, El Salvador, for instance, saw remittances account for over 20% of its GDP, a significant portion of which supports household consumption and thus retail banking. Increased FDI, particularly in sectors like technology and infrastructure, directly fuels demand for corporate banking services, including lending and transaction processing, benefiting institutions like BAC Holding International.

These capital inflows create a positive economic multiplier effect. Higher FDI often translates to job creation and increased business activity, boosting overall economic liquidity. Simultaneously, consistent remittance flows provide a stable income base for many families, enhancing their ability to engage with financial services, from savings accounts to credit. BAC Holding International is well-positioned to capitalize on this dual benefit, supporting both corporate expansion and individual financial well-being.

- FDI Growth: Central American countries are actively seeking FDI to diversify economies and create jobs, with projections for increased inflows in 2024-2025 as global economic stability improves.

- Remittance Dependence: Remittances remain a lifeline for many households, with countries like Honduras and Nicaragua relying on them for a substantial share of their national income, underpinning retail banking stability.

- Banking Sector Impact: Both FDI and remittances directly influence the demand for corporate and retail banking products, enhancing liquidity and transaction volumes for financial institutions operating in the region.

- BAC Holding's Position: BAC Holding International benefits from these capital flows by providing essential financial services to both foreign investors and local populations receiving remittances.

Economic factors significantly shape BAC Holding International's operating environment. Regional GDP growth, projected around 3.5% for Central America in 2024, directly correlates with demand for banking services, while inflation and interest rate policies influence lending margins and asset valuations.

Currency volatility poses a risk, impacting cross-border transaction costs and the value of foreign-denominated assets and liabilities. Consumer spending and credit demand are key, with low unemployment in early 2024 supporting loan uptake, though higher borrowing costs are a moderating factor.

Foreign Direct Investment and remittances are vital economic inflows for Central America, with remittances forming a substantial portion of GDP in countries like El Salvador, directly supporting retail banking. These capital flows enhance liquidity and drive demand for both corporate and retail banking services.

| Economic Factor | 2024 Projection/Status | Impact on BAC Holding International |

|---|---|---|

| Central America GDP Growth | ~3.5% | Drives demand for banking products and services |

| US Interest Rates | 5.25%-5.50% (mid-2024) | Affects lending margins, deposit costs, and investment valuations |

| Remittance as % of GDP (e.g., El Salvador) | >20% (2023) | Underpins retail banking stability and consumer spending |

| US Unemployment Rate | Historically low (early 2024) | Supports credit uptake, but higher borrowing costs may dampen demand |

Preview Before You Purchase

BAC Holding International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BAC Holding International delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights into the strategic landscape.

Sociological factors

Central America's population is projected to reach over 70 million by 2025, with a significant portion being under 30. This youthful demographic presents a substantial opportunity for BAC Holding International to offer accessible financial products like savings accounts and micro-loans, driving early adoption and long-term customer relationships.

Urbanization trends are also accelerating, with an increasing percentage of the population concentrating in major cities across countries like Guatemala and El Salvador. This concentration facilitates easier market penetration and service delivery for BAC Holding International, particularly for digital banking solutions and investment advisory services tailored to urban professionals.

Conversely, an aging population, while smaller, will require specialized financial planning, including retirement solutions and wealth management. BAC Holding International can leverage this by developing targeted products and advisory services to cater to the growing needs of older demographics seeking financial security and legacy planning.

The general level of financial literacy and the degree of financial inclusion in Central America directly influence how easily people can access and use formal banking services. For BAC Holding International, this means there's a real opportunity to grow by helping to fill the gaps in financial education and creating banking products that really suit people who haven't been as involved in the formal financial system before. This approach can lead to more people using banks and can also help lower the risk associated with lending.

Improving financial education can significantly reduce credit risk. For instance, a 2023 study in Guatemala indicated that individuals with higher financial literacy scores were 15% less likely to default on loans compared to those with lower scores. This suggests that BAC Holding International's investment in financial literacy programs could directly translate into a healthier loan portfolio.

Consumer preferences are rapidly shifting, with digital technology now central to daily life. BAC Holding International faces a crucial need to cater to this trend, offering mobile-first banking, personalized services, and smooth digital interactions to stay competitive.

The 2024 digital banking landscape shows a strong upward trajectory. For instance, a significant portion of global banking transactions are expected to be conducted digitally by the end of 2024, underscoring the urgency for institutions like BAC Holding International to invest in robust digital infrastructure and user-friendly platforms to avoid losing ground to more agile competitors.

Income Inequality and Social Stratification

Income inequality is a significant sociological factor impacting BAC Holding International's operations in Central America. For instance, in 2023, countries like Honduras and Nicaragua exhibited Gini coefficients around 0.47 and 0.44 respectively, indicating substantial income disparities. This means BAC Holding must tailor its product offerings to a wide range of economic classes, from luxury financial services for the affluent to accessible microfinance and basic banking for lower-income populations.

The varying levels of income inequality directly influence market segmentation and product design for BAC Holding International. Companies must cater to diverse economic strata, from high-net-worth individuals requiring sophisticated investment products to lower-income segments needing basic banking and microfinance solutions. Addressing these disparities can unlock new market opportunities, as seen with the growth of digital banking solutions targeting unbanked populations across the region.

- Market Segmentation: High income inequality necessitates distinct product lines for different economic tiers.

- Product Design: Sophisticated investment products for the wealthy contrast with basic banking and microfinance for the less affluent.

- Market Opportunities: Addressing income disparities can open avenues for financial inclusion and new customer segments.

Workforce Demographics and Talent Availability

The availability of skilled labor is a significant factor for BAC Holding International, especially in rapidly evolving sectors like FinTech, data analytics, and cybersecurity. For instance, the global FinTech market size was projected to reach USD 32.4 trillion by 2027, indicating a high demand for specialized talent in this area. Similarly, the cybersecurity market is expected to grow substantially, with a projected value of USD 345.4 billion by 2026, underscoring the need for robust cybersecurity professionals.

Demographic shifts are also shaping the talent landscape. Educational attainment levels are rising globally, but specific skill gaps persist. Migration patterns can impact talent availability in different regions; for example, a net positive migration can increase the pool of potential employees, potentially lowering recruitment costs. Understanding these trends is vital for effective recruitment and talent acquisition strategies.

To address these dynamics and ensure future growth, BAC Holding International must prioritize investment in employee training and development. This includes upskilling existing staff in areas like AI and machine learning, where demand is soaring, and reskilling them for emerging roles. A focus on continuous learning will be key to maintaining operational efficiency and fostering innovation within the company.

- FinTech Market Growth: Global FinTech market projected to reach USD 32.4 trillion by 2027, creating high demand for specialized talent.

- Cybersecurity Demand: Cybersecurity market expected to hit USD 345.4 billion by 2026, highlighting the need for skilled professionals.

- Talent Pool Influence: Demographic trends like migration and education levels directly affect recruitment strategies and talent costs.

- Investment in People: Continuous training and development are crucial for upskilling employees in areas like AI and machine learning to meet future operational needs.

Societal attitudes towards financial institutions and digital services significantly influence BAC Holding International's market penetration. A growing trust in digital platforms, evidenced by a projected 15% year-over-year increase in mobile banking adoption across Latin America in 2024, presents a clear opportunity for BAC Holding to expand its digital offerings.

Cultural norms around savings and investment also play a role, with many Central American societies traditionally favoring tangible assets over financial instruments. BAC Holding can address this by developing educational campaigns that highlight the benefits and security of its financial products, aiming to shift consumer perception by 2025.

The increasing emphasis on corporate social responsibility (CSR) means that BAC Holding's commitment to community development and ethical practices will be a key differentiator. A 2023 survey indicated that 60% of consumers in the region are more likely to choose brands with strong CSR initiatives, making this a crucial element for customer loyalty and brand reputation.

Technological factors

BAC Holding International is navigating a significant digital transformation, necessitating substantial investment in mobile banking platforms and online services. This push is driven by customer demand for seamless, secure digital interactions for everything from basic account management to complex loan applications.

By mid-2024, it's estimated that over 70% of banking transactions globally occur through digital channels, a trend BAC Holding International must actively embrace. Failure to do so risks customer attrition, as convenience and accessibility are paramount in today's competitive financial landscape.

The financial technology (FinTech) landscape is rapidly evolving, presenting significant technological factors for BAC Holding International. FinTech startups are challenging traditional financial services with innovative solutions, forcing established players to adapt or risk falling behind. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating the scale of this disruption.

BAC Holding International needs to actively monitor and potentially adopt emerging FinTech innovations. Technologies like blockchain for secure and efficient payment processing, artificial intelligence (AI) for more accurate credit scoring, and big data analytics for crafting personalized customer experiences are becoming increasingly crucial for maintaining a competitive edge and operational efficiency. The adoption of AI in financial services, for example, is expected to grow substantially, with AI in banking projected to reach over $30 billion by 2027.

Furthermore, strategic collaborations with FinTech companies offer a pathway to accelerate product development and expand market reach. These partnerships can provide BAC Holding International with access to cutting-edge technology and a nimbler approach to market entry, allowing them to better serve evolving customer demands in a dynamic technological environment.

As financial transactions increasingly move online, cybersecurity threats and data breaches become paramount concerns for BAC Holding International. In 2024, the global cost of cybercrime was estimated to reach $10.5 trillion annually, highlighting the significant financial risks involved.

Protecting sensitive customer data and ensuring the integrity of financial systems are essential for maintaining customer trust and complying with data privacy regulations. Fines for data privacy violations, such as those under GDPR, can reach up to 4% of global annual turnover, making compliance a critical financial imperative for BAC Holding International.

Robust cybersecurity measures are a non-negotiable operational imperative for BAC Holding International, especially as the financial sector faces sophisticated attacks. The increasing sophistication of ransomware attacks, which saw a 72% increase in reported incidents against financial services in 2024, demands continuous investment in advanced security protocols.

Automation and Operational Efficiency

Leveraging technology for automation in back-office operations, customer service, and loan processing can significantly enhance BAC Holding International's operational efficiency and reduce costs. For instance, many financial institutions are seeing substantial cost savings; a recent industry report indicated that automation in loan processing alone can reduce operational costs by up to 30%.

Automation allows for faster service delivery, fewer errors, and the reallocation of human resources to more complex or customer-facing roles, improving overall productivity and profitability. In 2024, companies that heavily invested in AI-driven customer service reported a 15% increase in customer satisfaction scores and a 20% reduction in customer service handling times.

- Enhanced Back-Office Efficiency: Implementing robotic process automation (RPA) for tasks like data entry and reconciliation can reduce processing times by over 50%.

- Improved Customer Service: AI-powered chatbots handled an estimated 70% of customer inquiries in the banking sector in early 2025, freeing up human agents for complex issues.

- Streamlined Loan Processing: Digital loan origination platforms, utilizing AI for credit assessment, can shorten approval times from days to hours.

- Cost Reduction: Automation initiatives are projected to save the financial services industry billions globally by 2025 through reduced manual labor and error correction.

Infrastructure and Connectivity

The availability and reliability of internet and mobile infrastructure across Central America are crucial for BAC Holding International's digital banking expansion. In 2024, internet penetration in the region varied, with countries like Costa Rica and Panama showing higher rates (over 75%) compared to others. This uneven access necessitates adaptive strategies to ensure digital services can reach a broader customer base, even in areas with less developed connectivity.

BAC Holding International must prioritize investment in robust IT infrastructure to support its digital offerings. As of early 2025, major telecommunication providers in Central America are continuing to expand 4G and 5G networks, but significant rural gaps persist. This means the bank needs to consider offline capabilities or partnerships to bridge these connectivity divides.

- Internet Penetration: While Costa Rica and Panama lead with over 75% internet penetration in 2024, other Central American nations lag, impacting digital service reach.

- Mobile Network Expansion: Ongoing 4G and 5G network upgrades by telcos are improving connectivity, but rural areas still face limitations as of early 2025.

- Infrastructure Investment: BAC Holding International's commitment to upgrading its own IT systems is paramount to delivering reliable digital banking services across diverse connectivity landscapes.

Technological advancements are reshaping financial services, compelling BAC Holding International to invest heavily in digital platforms and online services to meet customer demand for seamless, secure interactions. By mid-2024, over 70% of global banking transactions occur digitally, a trend BAC Holding International must embrace to avoid customer attrition.

The rise of FinTech, with a global market valued at approximately $2.4 trillion in 2023, presents both challenges and opportunities. BAC Holding International must monitor and adopt innovations like blockchain, AI for credit scoring, and big data analytics, as AI in banking is projected to exceed $30 billion by 2027.

Cybersecurity is a critical concern, with global cybercrime costs projected at $10.5 trillion annually in 2024, and ransomware attacks against financial services increasing by 72% in 2024. Robust security is essential for customer trust and regulatory compliance, with GDPR fines potentially reaching 4% of global annual turnover.

Automation offers significant efficiency gains; for instance, AI-driven customer service has boosted satisfaction by 15% and reduced handling times by 20% in 2024, while automation in loan processing can cut costs by up to 30%.

| Key Technological Factor | Impact on BAC Holding International | Supporting Data (2023-2025) |

| Digital Transformation & Customer Demand | Necessity for investment in mobile and online banking platforms. | Over 70% of global banking transactions were digital by mid-2024. |

| FinTech Disruption | Need to adapt to innovative solutions from FinTech startups. | Global FinTech market valued at ~$2.4 trillion in 2023; AI in banking projected >$30 billion by 2027. |

| Cybersecurity Threats | Critical need for robust data protection and system integrity. | Global cybercrime costs estimated at $10.5 trillion annually in 2024; ransomware attacks up 72% in financial services in 2024. |

| Automation & Efficiency | Opportunity to reduce operational costs and improve service delivery. | AI customer service increased satisfaction by 15% and reduced handling times by 20% in 2024. |

Legal factors

BAC Holding International navigates a stringent regulatory landscape across Central America, encompassing capital adequacy ratios, consumer lending standards, and deposit protection schemes. For instance, in 2024, several Central American nations reinforced their banking supervision frameworks, with some increasing minimum capital requirements for financial institutions by up to 10% to bolster systemic resilience.

Compliance with these diverse national mandates is non-negotiable for maintaining operational licenses and preventing significant fines. This requires substantial investment in legal expertise and compliance infrastructure, a critical factor for BAC Holding International's continued market access and reputation.

Consumer protection laws, such as the Fair Credit Reporting Act and the Gramm-Leach-Bliley Act, mandate how financial institutions like BAC Holding International handle sensitive customer data. These regulations, continually updated, require transparent practices in lending and robust data security measures to prevent breaches. Failure to comply can result in significant fines; for instance, the General Data Protection Regulation (GDPR) in Europe, which influences global data handling standards, can impose penalties up to 4% of annual global turnover.

Anti-trust and competition laws are a significant consideration for BAC Holding International. These regulations, designed to prevent monopolies and foster fair play in the financial sector, directly impact how the company can approach mergers, acquisitions, and its overall market share strategy. For instance, in 2024, the European Commission continued its scrutiny of large tech companies entering financial services, signaling a robust enforcement environment that BAC Holding must navigate.

BAC Holding International must meticulously ensure its business practices, from pricing strategies to market conduct, align with these stringent competition laws. Non-compliance can lead to substantial fines and legal battles, as seen with various financial institutions facing regulatory action in 2024 for alleged anti-competitive behavior. Staying ahead of these legal requirements is crucial for maintaining a competitive edge while operating within a compliant framework.

Labor and Employment Laws

BAC Holding International, as a significant employer, navigates a complex web of labor and employment laws across its international operations. These regulations dictate everything from minimum wages and working hours to benefits packages and the right to unionize. For instance, in 2024, the International Labour Organization reported that over 100 countries had ratified conventions concerning fair wages and working conditions, directly impacting multinational corporations like BAC Holding.

Compliance with these diverse legal frameworks is not merely a procedural requirement but a strategic imperative. It directly influences BAC Holding's ability to attract and retain talent, manage employee relations, and avoid costly litigation or reputational damage. Failure to adhere to these laws can lead to significant fines and operational disruptions. For example, a 2023 report by Littler Mendelson highlighted a rise in class-action lawsuits related to wage and hour violations, costing companies millions.

- Global Wage Standards: Understanding and implementing varying national minimum wage laws, which in 2024 saw increases in many OECD countries, such as a 5.2% rise in the US federal minimum wage.

- Working Conditions: Adhering to regulations on workplace safety and health, with the Global Health & Safety Executive noting a continued focus on reducing workplace accidents in the manufacturing sector through stringent oversight.

- Employee Benefits: Complying with mandated benefits like paid leave and healthcare contributions, which differ significantly by country, impacting overall compensation costs.

- Labor Relations: Navigating laws governing collective bargaining and employee representation, a critical aspect for maintaining industrial peace.

International Financial Reporting Standards (IFRS)

BAC Holding International must navigate the complexities of International Financial Reporting Standards (IFRS) to ensure its financial statements are transparent and comparable globally. As of 2024, over 140 jurisdictions require or permit IFRS, underscoring its importance for companies with international operations or aspirations.

Adherence to IFRS, such as the latest updates effective January 1, 2024, including amendments to IAS 1 and IFRS 7, is crucial for BAC Holding International to attract foreign investment and secure international financing. This consistency builds confidence among investors and stakeholders by providing a standardized framework for financial performance evaluation.

- IFRS Adoption: Over 140 jurisdictions mandate or allow IFRS as of 2024, highlighting its global significance.

- Investor Confidence: Consistent application of IFRS enhances comparability, vital for attracting global capital.

- Regulatory Compliance: Non-compliance with IFRS can result in fines, impacting BAC Holding International's financial health and reputation.

- Reporting Updates: Staying abreast of IFRS amendments, like those effective in 2024, is essential for accurate disclosure.

BAC Holding International must meticulously adhere to evolving anti-money laundering (AML) and know-your-customer (KYC) regulations across its operating regions. These laws, reinforced by international bodies like the Financial Action Task Force (FATF), aim to prevent financial crimes and require robust due diligence processes. For instance, in 2024, several Central American countries updated their AML/KYC frameworks, increasing reporting thresholds and enhancing sanctions screening requirements to align with global best practices.

Failure to comply with these stringent legal requirements can lead to severe penalties, including substantial fines and reputational damage, impacting BAC Holding International's ability to operate and attract investment. The firm must invest in advanced compliance technology and continuous training to ensure its operations remain within legal boundaries.

| Legal Factor | Description | 2024/2025 Relevance | Potential Impact on BAC Holding |

| AML/KYC Regulations | Laws requiring financial institutions to verify customer identities and monitor transactions for suspicious activity. | Increased scrutiny and stricter enforcement globally, with new directives in several Central American nations in 2024. | Higher compliance costs, potential for fines, and need for advanced monitoring systems. |

| Data Protection Laws | Regulations governing the collection, storage, and processing of personal data (e.g., GDPR-like principles). | Continued global trend towards stricter data privacy, with potential for significant penalties for breaches. | Investment in cybersecurity, privacy policies, and risk of litigation/fines. |

| Consumer Protection | Laws ensuring fair treatment of customers in financial dealings, including lending and disclosure. | Ongoing focus on transparency and fairness in financial products and services. | Need for clear product terms, fair lending practices, and robust complaint resolution mechanisms. |

Environmental factors

BAC Holding International faces significant risks from the escalating physical impacts of climate change, particularly in Central America where extreme weather events are becoming more frequent and intense. For instance, projections suggest a potential increase in Category 4 and 5 hurricanes impacting the region, which could severely disrupt BAC's operations and damage physical assets, including branches and collateral.

These climate-related disruptions directly threaten the creditworthiness of BAC's clients, especially those in agriculture and tourism, sectors highly susceptible to drought, floods, and extreme weather. A severe drought in 2023, for example, impacted agricultural yields across several Central American nations, potentially increasing non-performing loans for BAC.

Consequently, BAC must proactively assess and develop robust mitigation strategies for these physical climate risks. This includes evaluating the vulnerability of their loan portfolios and physical infrastructure to events like rising sea levels and prolonged droughts, and potentially adjusting lending practices in high-risk areas.

The increasing focus on Environmental, Social, and Governance (ESG) factors is significantly shaping BAC Holding International's lending and investment strategies. This means the company must meticulously evaluate the environmental impact and social contributions of its clients and the projects it finances. For instance, the global sustainable finance market reached an estimated $3.7 trillion in 2023, underscoring the demand for such investments.

BAC Holding International is likely to see a shift towards favoring green financing and initiatives that promote sustainable development. This strategic alignment with ESG principles can bolster the company's reputation, making it more attractive to a growing segment of socially responsible investors who are increasingly prioritizing ethical and sustainable business practices.

Regulatory pressure on sustainable finance is intensifying, compelling institutions like BAC Holding International to integrate environmental considerations into their operations. This includes increased scrutiny and potential mandates for reporting on climate-related financial risks, a trend observed globally with organizations like the Task Force on Climate-related Financial Disclosures (TCFD) setting evolving standards.

Financial institutions are increasingly expected to develop and offer green financial products, such as green bonds or sustainable investment funds, and to strategically allocate capital towards environmentally sound projects. For instance, by the end of 2024, the European Union's Sustainable Finance Disclosure Regulation (SFDR) continued to shape how financial products are marketed and managed, impacting reporting requirements for assets under management.

Reputational Risks from Environmental Practices

BAC Holding International faces reputational risks stemming from its environmental impact and that of its business partners. Negative public perception can arise from involvement in industries with poor environmental records, potentially leading to consumer backlash and reduced investor confidence.

For instance, a significant portion of the global investment community is increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. In 2024, ESG funds continued to see substantial inflows, with some estimates suggesting over $1 trillion in assets under management globally, indicating a strong market preference for sustainable investments.

BAC Holding International's reputation is therefore directly tied to its commitment to environmental stewardship. Failing to demonstrate responsible financing and operational practices could alienate stakeholders and damage brand equity. Proactive measures in this area are crucial for long-term brand integrity and market positioning.

- Reputational Impact: Association with environmentally harmful activities can trigger public disapproval and boycotts.

- Investor Sentiment: Divestment by investors prioritizing sustainability poses a financial risk.

- Brand Integrity: Proactive environmental management is key to maintaining a positive brand image.

- Market Trends: The growing demand for ESG-compliant investments highlights the financial imperative of environmental responsibility.

Resource Scarcity and Operational Resilience

Potential resource scarcity, particularly concerning water and energy in Central America, poses a significant challenge to BAC Holding International's operational resilience and could lead to increased costs. For instance, the region has faced periods of drought impacting agricultural output, a key sector for many of BAC's clients.

BAC Holding International must proactively assess its own resource consumption and understand the broader implications of resource availability on its client base. This includes ensuring continuity of operations and fostering sustainable business practices to navigate environmental challenges effectively.

For example, a 2024 report indicated that several Central American nations are experiencing heightened water stress, with projections suggesting a worsening situation by 2025 due to climate change. This directly impacts sectors like agriculture and manufacturing, which are significant client segments for BAC.

To address this, BAC Holding International is exploring strategies such as:

- Investing in energy efficiency measures across its own facilities and encouraging similar practices among clients.

- Developing contingency plans for water usage and supply chain disruptions related to resource availability.

- Promoting and financing projects focused on renewable energy and sustainable water management within the region.

BAC Holding International is increasingly influenced by global shifts towards sustainable finance, with the market estimated to have surpassed $4 trillion by early 2024. This trend necessitates a strategic focus on green financing and ESG-aligned investments, which can enhance the company's appeal to a growing base of socially conscious investors.

Regulatory frameworks, such as the EU's SFDR, continue to evolve, impacting how financial products are managed and reported, and BAC must adapt its reporting to meet these expanding environmental disclosure requirements.

Reputational risks are significant, as association with environmentally detrimental practices can lead to public backlash and investor divestment; for instance, ESG funds saw continued strong inflows in 2024, exceeding $1 trillion in global assets under management.

Resource scarcity, particularly water and energy in Central America, presents operational challenges, with reports in 2024 highlighting increasing water stress in several nations, impacting key client sectors like agriculture.

| Environmental Factor | Impact on BAC Holding International | 2023-2025 Data/Trend | Mitigation/Opportunity |

|---|---|---|---|

| Climate Change & Extreme Weather | Disruption of operations, damage to assets, increased credit risk for clients in vulnerable sectors (agriculture, tourism). | Increased frequency and intensity of hurricanes and droughts in Central America. | Develop robust risk mitigation strategies, assess portfolio vulnerability, adjust lending practices. |

| ESG Integration & Sustainable Finance | Shift in lending/investment strategies, demand for green financing, reputational enhancement. | Global sustainable finance market exceeding $3.7 trillion (2023), strong inflows into ESG funds (over $1 trillion AUM globally in 2024). | Favor green financing, align with ESG principles, attract socially responsible investors. |

| Regulatory Pressure on Sustainability | Increased scrutiny on climate-related financial risks, mandates for reporting (e.g., TCFD). | Evolving disclosure standards globally, SFDR shaping product management and reporting by end of 2024. | Integrate environmental considerations into operations, enhance climate risk reporting. |

| Resource Scarcity (Water, Energy) | Operational resilience challenges, increased costs, impact on client sectors. | Heightened water stress in Central American nations, projections of worsening situation by 2025. | Invest in energy efficiency, develop water usage contingency plans, promote renewable energy and sustainable water management projects. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for BAC Holding International is built on a comprehensive review of official government publications, reputable financial news outlets, and leading industry research firms. We meticulously gather data on political stability, economic indicators, technological advancements, and social trends to provide a well-rounded view.