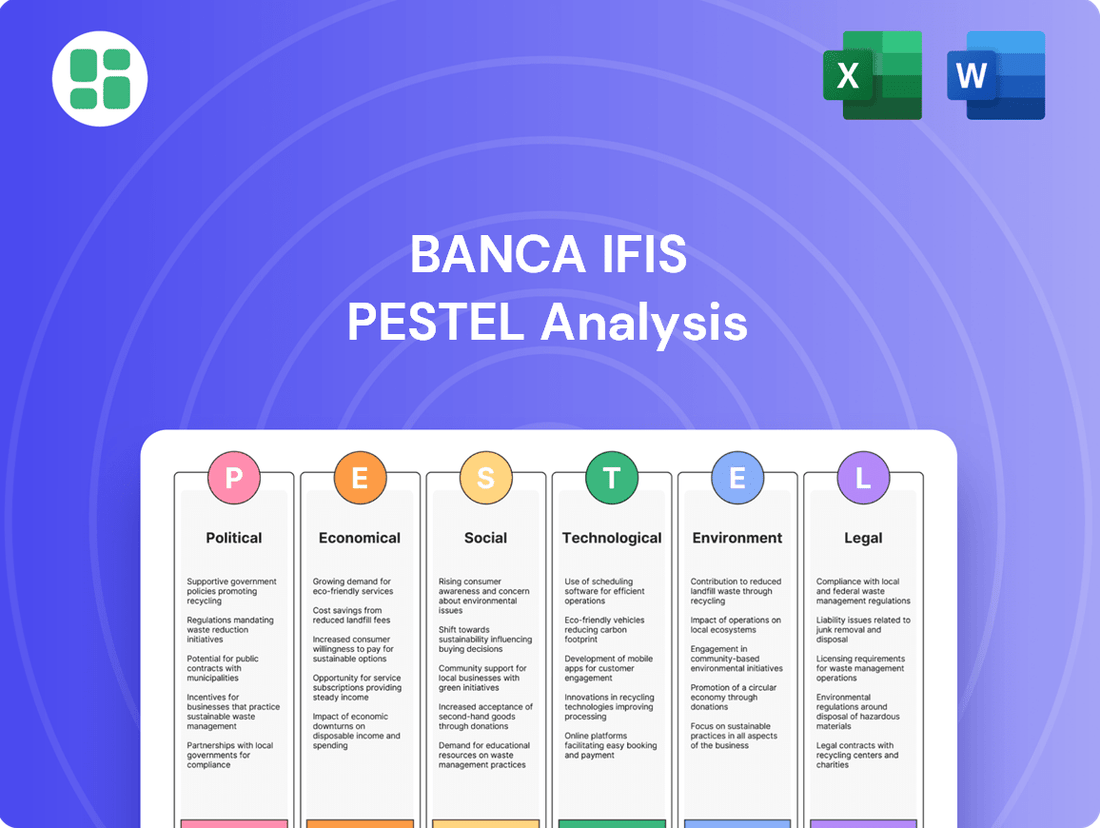

Banca IFIS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca IFIS Bundle

Navigate the complex external forces shaping Banca IFIS with our comprehensive PESTEL Analysis. Understand the political, economic, social, technological, legal, and environmental factors that create both opportunities and threats for the company. This expertly crafted report provides the clarity you need to make informed strategic decisions. Download the full version now and gain a critical competitive advantage.

Political factors

The stability of the Italian government is a critical factor for Banca IFIS, influencing the regulatory landscape and economic outlook. Recent political developments, including the approval of the 2025 budget, signal the government's direction on fiscal matters. Discussions around potential new levies on banks, as part of broader fiscal strategies, directly affect profitability and operational planning for institutions like Banca IFIS.

Banca IFIS navigates a dense landscape of European Union and Italian national banking regulations. The upcoming implementation of CRR III and CRD VI from January 2025 signifies a significant shift, directly impacting capital adequacy ratios and operational resilience for institutions like Banca IFIS.

These EU directives, alongside national prudential rules set by the Bank of Italy, dictate everything from liquidity management to risk assessment. For instance, the Bank of Italy's supervisory priorities for 2024 emphasized digital transformation and climate-related risks, areas requiring substantial compliance efforts from Banca IFIS.

Broader geopolitical uncertainties, such as potential international trade wars, can significantly impact global growth, which in turn affects the Italian economy and the financing needs of Italian businesses. For Banca IFIS, which primarily serves small and medium-sized enterprises (SMEs), these external macroeconomic shifts are particularly influential.

For instance, the ongoing tensions and potential for trade disputes in late 2024 and early 2025 could lead to increased volatility in international markets, impacting Italian export volumes and overall economic sentiment. This could translate into higher credit risk for SMEs and a potential slowdown in lending activity for Banca IFIS.

Government Support for SMEs

The Italian government's commitment to Small and Medium-sized Enterprises (SMEs) directly impacts Banca IFIS, as these businesses form its core clientele. Initiatives like the National Recovery and Resilience Plan (PNRR) are injecting significant funds into the economy, with a substantial portion earmarked for SME development and digitalization. For instance, the PNRR allocated €13.7 billion for the period 2021-2026, with a focus on supporting business competitiveness and innovation, directly benefiting Banca IFIS's target market.

While some earlier state guarantee schemes on loans are gradually expiring, the underlying political will to ensure continued credit access for SMEs persists. This ongoing focus on credit availability for SMEs, even as specific programs evolve, remains a critical political consideration for Banca IFIS. The Italian government's continued emphasis on fostering SME growth through financial instruments and support programs underscores a stable, albeit adapting, political landscape for the bank.

- PNRR Funding for SMEs: The PNRR has dedicated significant resources to bolster Italian SMEs, fostering an environment conducive to lending.

- Evolution of Guarantee Schemes: While some past loan guarantee programs are concluding, the government's intent to maintain credit support for SMEs signals continued political engagement.

- Government Focus on Competitiveness: Policies aimed at enhancing SME competitiveness, such as digital transformation incentives, create new avenues for banking services and support.

Anti-Money Laundering (AML) and Financial Crime Policies

Banca IFIS operates within a political landscape where anti-money laundering (AML) and financial crime policies are increasingly stringent. The Italian government and bodies like the Bank of Italy are consistently refining these regulations, demanding robust compliance measures from financial institutions.

Ensuring adherence to these evolving rules, especially those encompassing new asset classes like crypto-assets under MiCAR, presents ongoing operational challenges and can significantly influence compliance expenditures for Banca IFIS. For instance, the European Union's continued focus on AML directives, including updates expected in 2024 and 2025, necessitates continuous investment in technology and personnel to manage risks effectively.

- Evolving AML Frameworks: Italian regulators are actively updating AML legislation, requiring financial institutions to adapt their internal controls and reporting mechanisms.

- MiCAR and Crypto-Assets: The Markets in Crypto-Assets (MiCA) regulation introduces specific AML requirements for crypto-asset service providers, impacting banks that engage with this sector.

- Compliance Costs: Enhanced AML and financial crime prevention measures often lead to increased operational costs related to technology, training, and specialized staff.

- International Cooperation: Political efforts at the EU level foster greater cooperation in combating financial crime, influencing national policy implementation and enforcement.

The Italian political environment significantly shapes Banca IFIS's operational framework, particularly concerning SME support and fiscal policy. Government initiatives like the National Recovery and Resilience Plan (PNRR) continue to inject capital into the economy, with substantial allocations for SME development, aiming to enhance competitiveness and digitalization. For instance, the PNRR's €13.7 billion earmarked for SMEs between 2021 and 2026 directly benefits Banca IFIS's core customer base.

While specific loan guarantee schemes are evolving, the underlying political commitment to ensuring credit access for SMEs remains a constant. This sustained focus on fostering SME growth through financial instruments and supportive policies creates a stable, albeit dynamic, political backdrop for Banca IFIS's strategic planning and lending activities.

Furthermore, the ongoing refinement of anti-money laundering (AML) and financial crime regulations, driven by both national and EU directives, necessitates continuous adaptation and investment in compliance infrastructure for Banca IFIS. The anticipated updates to AML frameworks in 2024 and 2025, including those related to crypto-assets under MiCAR, underscore the increasing complexity and cost of regulatory adherence.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Banca IFIS, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies, equipping stakeholders with the understanding needed to navigate challenges and capitalize on emerging opportunities within the Italian financial sector.

Banca IFIS's PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of sifting through complex data for quick referencing during meetings or presentations.

Economic factors

The European Central Bank's (ECB) monetary policy, particularly its interest rate decisions, directly shapes Banca IFIS's financial performance. Changes in rates affect how much interest the bank earns on its loans and how much it pays for its funding.

With expectations pointing towards potential ECB rate cuts continuing through the third quarter of 2025, the overall interest rate environment is likely to moderate. This shift could put pressure on bank profitability, though Italian banks have demonstrated a notable capacity to adapt and maintain stability amidst such changes, as evidenced by their performance in recent periods.

Italy's GDP growth is projected to be modest, with forecasts for 2024 generally hovering around 0.7% to 0.9%, and a slight uptick anticipated for 2025, potentially reaching around 1.0% to 1.2%. However, these projections are tempered by uncertainties, notably the winding down of significant government support measures like certain tax credits, which could dampen domestic demand.

A slowdown in economic expansion directly impacts the financial resilience of small and medium-sized enterprises (SMEs), a crucial segment for Banca IFIS. Reduced economic activity can lead to tighter cash flows for businesses, potentially increasing credit risk and dampening the demand for essential services like factoring and corporate lending.

The Italian non-performing loan (NPL) market is at a significant turning point. After a decade of consistent reduction, the total stock of non-performing exposures (NPE) saw a slight uptick in the first half of 2024. Despite this, Italy's NPL levels remain lower than many other European Union countries.

Banca IFIS's performance in its NPL sector is directly tied to several key factors. These include the volume of NPL transactions, the prices achieved in these sales, and the rate at which credit quality deteriorates. Encouragingly, the credit deterioration rate in Italy has stayed at historically low levels, providing a stable operating environment.

SME Financing Needs and Credit Availability

SMEs in Italy continue to navigate a complex financing landscape. While there was an observed uptick in financing availability towards the end of 2024, many small and medium-sized enterprises still encounter hurdles in securing traditional credit lines. This persistent challenge directly impacts their growth potential and operational agility.

Banca IFIS's strategic focus on delivering liquidity and tailored financial solutions to SMEs positions it advantageously. The company's business model is intrinsically linked to the financing demands of this crucial economic sector. Projections indicate a rebound in these financing needs starting from 2024, suggesting a favorable market environment for Banca IFIS's offerings.

- SME Financing Gap: Despite improvements, a significant portion of Italian SMEs still struggle with accessing bank loans, a situation that persisted through much of 2024.

- Banca IFIS's Role: The bank's specialization in providing alternative financing and factoring services directly addresses this gap, offering vital liquidity.

- Market Outlook: Anticipated recovery in SME investment and operational needs from 2024 onwards is expected to drive increased demand for financial services like those offered by Banca IFIS.

- Economic Impact: Improved access to finance for SMEs is critical for Italy's overall economic recovery and job creation, a trend Banca IFIS aims to support.

Inflation and Wage Pressures

Moderating headline inflation forecasts for 2025, projected to be around 2.5% in the Eurozone, coupled with stabilizing energy prices, could offer a much-needed reprieve for businesses and consumers alike. This economic stability is anticipated to bolster the repayment capacity of Banca IFIS's clients and improve the overall credit risk landscape.

Easing wage pressures are also a key factor. For instance, while wage growth in Italy remained elevated in late 2024, forecasts for 2025 suggest a moderation, potentially bringing it closer to productivity gains. This shift can reduce operational costs for businesses, indirectly benefiting their financial health and their ability to service debt.

- Inflation Forecasts: Eurozone headline inflation expected around 2.5% in 2025, down from higher levels in 2023-2024.

- Energy Prices: Stabilization in global energy markets, with oil prices projected to trade within a narrower band in 2025.

- Wage Growth: Italian wage growth, while robust in 2024, is forecast to moderate in 2025, aligning more closely with economic productivity.

- Credit Risk: Lower inflation and stable costs can lead to improved borrower solvency, reducing non-performing loan ratios for Banca IFIS.

The economic outlook for Italy in 2024-2025 presents a mixed but cautiously optimistic picture for Banca IFIS. While GDP growth is projected to be modest, around 0.7%-1.2%, the unwinding of government support measures could temper domestic demand.

Despite a slight uptick in non-performing exposures in early 2024, Italy's NPL levels remain below the EU average, and the credit deterioration rate has stayed low, providing a stable operating environment for Banca IFIS's NPL division.

The persistent SME financing gap, where many small and medium-sized enterprises struggle to access traditional credit, is a key opportunity for Banca IFIS, which specializes in alternative financing and factoring, with demand expected to rebound from 2024.

Moderating inflation forecasts for the Eurozone in 2025, around 2.5%, and stabilizing energy prices, coupled with easing wage pressures in Italy, are expected to improve borrower solvency and reduce credit risk for the bank.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Banca IFIS |

|---|---|---|---|

| Italy GDP Growth | 0.7% - 0.9% | 1.0% - 1.2% | Modest growth may limit loan demand but supports SME resilience. |

| Eurozone Inflation | ~3.0% - 3.5% | ~2.5% | Lower inflation improves borrower repayment capacity and reduces credit risk. |

| Italian NPL Stock Change | Slight uptick in H1 2024 | Stable/Declining | Low credit deterioration rate supports NPL business; market remains manageable. |

| SME Financing Needs | Persistent Gap | Rebound expected from 2024 | Directly benefits Banca IFIS's core business in alternative financing and factoring. |

Preview the Actual Deliverable

Banca IFIS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Banca IFIS PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping Banca IFIS's strategic landscape.

Sociological factors

Italy's demographic profile is rapidly evolving, with a significant aging population. By 2024, projections indicate that individuals over 65 will constitute over 24% of the total population, a trend expected to continue through 2025. This shift impacts consumer spending, potentially favoring services catering to older demographics, and alters labor market dynamics, affecting the availability of skilled workers and the entrepreneurial landscape that Banca IFIS serves.

While Banca IFIS primarily focuses on corporate clients and the "Made in Italy" sector, the broader economic implications of an aging society are undeniable. A shrinking working-age population can lead to slower economic growth, influencing overall business investment and the demand for financing solutions. This demographic trend subtly shapes the economic vitality of the nation, indirectly affecting the pool of entrepreneurs seeking capital and the general health of the Italian economy.

The financial literacy of Italian SME owners directly impacts their engagement with digital financial solutions. A 2024 survey indicated that while 65% of Italian SMEs recognize the importance of digital tools, only 40% actively utilize advanced digital banking services for core operations, highlighting a gap Banca IFIS can address through targeted education and user-friendly platforms.

Italy's growing digital banking culture, evidenced by a 15% year-on-year increase in mobile banking transactions among businesses by late 2024, creates a fertile ground for Banca IFIS. This trend suggests a strong receptiveness to digital financial services, pushing the bank to further innovate its mobile and online offerings to meet evolving client expectations.

Cultural perceptions of debt significantly influence a market's receptiveness to financial services like factoring and Non-Performing Loan (NPL) management. In Italy, where Banca IFIS operates, there's a growing societal shift towards more responsible financial practices, impacting how businesses view and manage their liabilities.

Banca IFIS's strategy of engaging with debtors in a structured, relationship-focused manner for NPL recovery resonates with an evolving cultural attitude that prioritizes social responsibility alongside financial recovery. This approach can foster greater trust and acceptance of their services.

For instance, in 2023, Italy's NPL ratio for the banking system continued its downward trend, reaching approximately 2.3% of total loans, reflecting both regulatory efforts and a changing cultural approach to debt management among Italian businesses and consumers, making services like those offered by Banca IFIS more palatable.

Social Inclusion and Access to Finance

Banca IFIS actively pursues financial and social inclusion, a key societal expectation for modern financial institutions. By prioritizing support for small and medium-sized enterprises (SMEs), especially those facing traditional credit barriers, the bank directly addresses the need to empower underserved economic segments.

This strategic focus is crucial in today's economic landscape, where inclusive financial systems are vital for broad-based growth. For instance, in 2023, Italian SMEs, a core target for Banca IFIS, represented over 99% of all businesses and employed more than 75% of the workforce, highlighting the significant impact of their financial well-being.

- Financial Inclusion Drive: Banca IFIS's commitment to social inclusion is demonstrated through its targeted lending programs for SMEs.

- SME Support: The bank's strategy specifically aims to provide credit access to businesses often overlooked by larger, more traditional lenders.

- Economic Impact: Supporting SMEs is critical as they form the backbone of the Italian economy, contributing significantly to employment and GDP.

Workforce Skills and Talent Availability

The availability of skilled professionals, especially in digital transformation, data analytics, and ESG (Environmental, Social, and Governance) areas, is critical for Banca IFIS's strategic expansion. For instance, a 2024 report indicated a significant demand for data scientists, with a projected 36% growth in job openings by 2025. This highlights the need for Banca IFIS to focus on acquiring and developing talent in these key domains to maintain its competitive edge.

Investing in talent development and fostering a robust ecosystem of skills is paramount for the bank's ongoing evolution and market positioning. The European banking sector, in general, has seen a surge in demand for cybersecurity experts, with a shortage of around 200,000 professionals by the end of 2024, according to industry analyses. Banca IFIS can leverage this by upskilling its existing workforce and attracting specialized talent to bolster its digital infrastructure and compliance capabilities.

- Digital Transformation Skills: Growing demand for IT specialists, cloud architects, and AI/ML engineers.

- Data Analytics Expertise: Need for data scientists, business intelligence analysts, and big data engineers.

- ESG Competencies: Increasing requirement for professionals skilled in sustainable finance, climate risk assessment, and ethical governance.

- Talent Acquisition and Retention: Strategic focus on competitive compensation, continuous learning opportunities, and a supportive work environment.

Societal expectations are shifting, with a growing emphasis on financial inclusion and support for SMEs, which form the backbone of the Italian economy. Banca IFIS's focus on these segments aligns with this trend, as SMEs accounted for over 99% of Italian businesses and 75% of employment in 2023. The bank's approach to NPL management also reflects a cultural move towards more responsible financial practices, with Italy's NPL ratio decreasing to around 2.3% in 2023.

Technological factors

Banca IFIS is actively driving its digital transformation, allocating substantial resources to new technologies and establishing a dedicated digital innovation unit. This strategic push is designed to significantly boost customer acquisition via online platforms, expedite loan processing times, and cultivate entirely digital customer interactions, ultimately improving operational efficiency and customer satisfaction.

By 2024, the bank aimed to onboard a quarter of its new customers digitally, reflecting a tangible commitment to digital channels. This focus on innovation isn't just about customer acquisition; it's also about streamlining internal processes, as evidenced by their efforts to accelerate loan disbursement cycles, a key area where digital solutions can offer a competitive advantage.

The Italian fintech landscape is rapidly evolving, with new entrants increasingly capturing market share. This surge in innovation, particularly around open banking initiatives and the rise of embedded finance, creates a dynamic competitive environment for Banca IFIS. For instance, by the end of 2023, fintech investments in Italy had already shown significant growth, signaling a robust market.

Banca IFIS can strategically navigate this competitive pressure by embracing collaboration. Forming partnerships with agile fintech firms allows the bank to quickly integrate cutting-edge technologies and expand its service portfolio. This approach not only addresses the competitive threat but also unlocks new revenue streams and enhances customer experience through seamless digital integration.

As Banca IFIS expands its digital operations, cybersecurity and data protection are critical. The increasing reliance on digital platforms necessitates strong defenses against cyber threats. For instance, the European Union's Digital Operational Resilience Act (DORA), fully applicable from January 2025, mandates stringent requirements for financial entities' ICT risk management, setting a new benchmark for operational resilience.

Banca IFIS must navigate complex data protection regulations to safeguard sensitive customer information. Failure to comply can lead to significant penalties and reputational damage. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved in maintaining robust data security for institutions like Banca IFIS.

Automation and AI in Financial Services

The integration of Artificial Intelligence (AI) and automation is fundamentally transforming the financial services landscape. AI applications are becoming crucial across various functions, including sophisticated fraud detection, more accurate lending assessments, and robust anti-money laundering (AML) processes, significantly boosting the fintech sector. For Banca IFIS, harnessing these advancements offers a strategic advantage.

Banca IFIS can strategically deploy AI to refine its non-performing loan (NPL) recovery operations, potentially leading to more efficient and effective debt management. Furthermore, AI's analytical capabilities can bolster risk management frameworks, allowing for more proactive identification and mitigation of financial risks. This technological adoption also promises to streamline internal processes, driving overall operational efficiency and cost savings.

Consider these specific applications:

- AI-powered predictive analytics for NPL portfolio segmentation and tailored recovery strategies.

- Machine learning algorithms for enhanced credit scoring and risk assessment in lending operations.

- Automated transaction monitoring systems utilizing AI to detect and flag suspicious activities for AML compliance.

- Robotic Process Automation (RPA) to automate repetitive back-office tasks, freeing up human capital for more strategic initiatives.

Blockchain and Distributed Ledger Technology (DLT)

The evolving Italian regulatory landscape, particularly with the upcoming implementation of MiCA (Markets in Crypto-Assets) regulation in 2024, signals a growing acknowledgment of distributed ledger technology (DLT) and crypto-assets. This regulatory shift presents both challenges and opportunities for financial institutions like Banca IFIS.

While Banca IFIS's primary operations are not directly centered on cryptocurrency trading or issuance, the underlying blockchain technology offers significant potential for enhancing operational efficiency and transparency within traditional banking services. Exploring DLT for areas like trade finance, identity verification, or streamlining back-office processes could provide a competitive edge.

- Regulatory Adaptation: Italy, like other EU nations, is actively integrating DLT and crypto-asset regulations, with MiCA set to harmonize rules across the bloc from late 2024.

- Efficiency Gains: Blockchain's inherent features of immutability and distributed consensus can reduce reconciliation needs and enhance data integrity, potentially lowering operational costs for Banca IFIS.

- Future Opportunities: Banca IFIS could investigate DLT applications for new financial products or services, leveraging increased transparency and security to build customer trust.

Banca IFIS is heavily investing in digital transformation, aiming for a quarter of new customers to be onboarded digitally by 2024. This focus on technology is crucial as the Italian fintech sector experiences rapid growth, with fintech investments showing significant increases by the end of 2023, creating a competitive landscape that necessitates innovation.

The bank must also prioritize robust cybersecurity measures, especially with the EU's Digital Operational Resilience Act (DORA) coming into full effect in January 2025, which sets stringent ICT risk management standards. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the financial imperative of strong data security.

Artificial Intelligence (AI) and automation are reshaping financial services, with AI proving vital for fraud detection, lending assessments, and AML processes. Banca IFIS can leverage AI for NPL recovery and enhanced risk management, as well as for automating back-office tasks through Robotic Process Automation (RPA).

The evolving regulatory environment, including the Markets in Crypto-Assets (MiCA) regulation from late 2024, acknowledges distributed ledger technology (DLT). While not directly involved in crypto trading, Banca IFIS can explore DLT for operational efficiencies in areas like trade finance and identity verification, potentially reducing costs and increasing transparency.

Legal factors

Banca IFIS operates under a strict regulatory framework, with European and national banking rules shaping its operations. Key among these are the Basel III and upcoming Basel IV standards, implemented through CRR III and CRD VI. These crucial regulations, fully effective from January 2025, dictate capital adequacy, risk management practices, and the overall prudential oversight of banks.

The implementation of CRR III and CRD VI signifies a heightened focus on bank resilience. For Banca IFIS, this means adapting to revised capital requirements, which could impact lending capacity and profitability. For instance, the output floor for the internal ratings-based approach, a key element of Basel IV, is set to increase, potentially requiring higher capital allocations for certain risk exposures.

Changes in legislation concerning Non-Performing Loan (NPL) management, such as reforms to securitization of unpaid claims and insolvency procedures, directly impact Banca IFIS's core business. For instance, Italy's legislative framework for NPLs has seen continuous evolution, with new rules aimed at facilitating faster resolution and recovery. Banca IFIS must remain agile, adapting its recovery strategies to this dynamic legal environment, including staying abreast of discussions around potential new classifications for NPLs, which could influence provisioning and capital requirements.

Consumer protection and transparency regulations are paramount in the financial services sector. Banca IFIS must adhere to stringent rules ensuring fair treatment, clear disclosure of terms and conditions, and robust safeguards for its business clients. These regulations are designed to build trust and prevent predatory practices, a critical aspect for any financial institution operating in 2024 and beyond.

In 2023, Italy's financial regulatory landscape continued to emphasize consumer protection. For instance, the Bank of Italy's supervisory activities often focus on ensuring that financial institutions provide clear and comprehensive information regarding loan terms, fees, and associated risks. Banca IFIS's commitment to transparency in its factoring and lending products directly impacts client confidence and regulatory standing.

Data Protection Regulations (e.g., GDPR, DORA)

The Digital Operational Resilience Act (DORA), effective from January 2025, mandates enhanced digital operational resilience for financial entities, including Banca IFIS. This regulation, alongside existing data protection frameworks like GDPR, is critical for effectively managing information and communications technology (ICT) risk and bolstering data security measures.

Compliance with DORA is not merely a legal obligation but a strategic imperative. Financial institutions must invest in robust systems and processes to meet the stringent requirements for ICT risk management, incident reporting, and third-party risk oversight. Failure to comply could result in significant penalties and reputational damage.

- DORA's Scope: DORA imposes comprehensive requirements on financial entities regarding ICT risk management, governance, and reporting.

- Data Protection: Adherence to GDPR and similar regulations remains paramount for safeguarding customer data and maintaining trust.

- Operational Resilience: Banca IFIS must ensure its digital infrastructure can withstand and recover from disruptions, a core tenet of DORA.

- Third-Party Risk: DORA also extends its reach to third-party ICT service providers, requiring diligent oversight and contractual safeguards.

Corporate Governance and Remuneration Rules

Italian law and Bank of Italy regulations, aligned with EU directives such as CRD V, impose stringent corporate governance and remuneration standards on banks. Banca IFIS must continuously adapt its internal structures and compensation policies to meet these evolving legal mandates, ensuring robust oversight and responsible pay practices.

Compliance with these rules is crucial for maintaining regulatory approval and investor confidence. For instance, the Bank of Italy's supervisory framework emphasizes the importance of independent board members and effective risk management committees, areas where Banca IFIS must demonstrate adherence. The remuneration policies, in particular, are scrutinized to ensure they do not incentivize excessive risk-taking, a key tenet of prudential banking supervision.

- Board Composition: Ensuring a majority of independent non-executive directors as per regulatory guidelines.

- Remuneration Structure: Aligning variable compensation with long-term performance and risk management objectives.

- Risk Alignment: Implementing clawback provisions and deferral periods for executive bonuses to mitigate risk.

- Regulatory Reporting: Providing transparent disclosures on governance and remuneration practices to the Bank of Italy and the market.

Banca IFIS operates within a dynamic legal framework shaped by EU directives and Italian legislation, impacting its capital requirements and risk management. The full implementation of Basel IV, through CRR III and CRD VI from January 2025, will necessitate adjustments to capital adequacy, potentially affecting lending capacity due to increased output floors for internal ratings-based approaches.

Environmental factors

Banca IFIS has firmly established sustainability as a key driver of its value creation strategy. This commitment is evident in its business plan, which actively incorporates ESG principles, leading to an improved MSCI ESG rating. The bank's focus on sustainable growth and its active role in facilitating the green transition for its corporate clients underscore this integration.

European regulators, including the European Central Bank (ECB) and the Bank of Italy, are pushing financial institutions to embed climate and environmental risks into their core governance and risk management. This means Banca IFIS must actively identify, assess, and mitigate these exposures, particularly those arising from the transition to a low-carbon economy within its loan book.

Banca IFIS is therefore tasked with evaluating the physical risks from climate change, such as extreme weather events impacting borrowers' assets, and transition risks, like policy changes or technological shifts that could devalue carbon-intensive investments. For instance, as of late 2024, the ECB's stress tests continue to highlight the potential financial impact of climate-related events on bank portfolios, underscoring the urgency for robust risk management.

The increasing emphasis on sustainability and environmental issues offers Banca IFIS a prime opportunity to finance green technologies and eco-conscious operations. This aligns with global trends pushing for a low-carbon economy.

Italian Small and Medium-sized Enterprises (SMEs), a key segment for Banca IFIS, face significant capital requirements for their energy transition. For instance, the Italian government has allocated substantial funds, like the over €2 billion for the PNRR’s green transition component, which SMEs can leverage with appropriate financial instruments.

This creates a strong demand for tailored green financing solutions, such as green loans and sustainability-linked bonds, enabling Banca IFIS to capture market share and support its clients in this crucial adaptation phase.

Regulatory Push for Green Finance

European regulations are significantly driving the shift towards green finance. Directives like the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive, both gaining traction through 2024 and into 2025, mandate that companies actively manage their environmental impacts across their entire value chain. This regulatory pressure is compelling institutions like Banca IFIS to integrate sustainability into their core operations and client relationships.

These directives mean Banca IFIS must increasingly consider the environmental performance of its clients and partners. By 2024, a growing number of European companies are already reporting under the CSRD, with many more preparing for its full implementation. This creates a clear demand for financial products and services that support sustainable business practices, influencing lending criteria and investment strategies.

The push for green finance is not just about compliance; it's about risk management and opportunity. Companies failing to adapt to these environmental regulations may face increased scrutiny and reduced access to capital. Conversely, those embracing sustainability, potentially supported by financial institutions like Banca IFIS, are better positioned for long-term growth and resilience in the evolving market landscape.

Key aspects of this regulatory push include:

- Increased transparency requirements: Companies must disclose their environmental impacts, making it easier for financial institutions to assess sustainability risks.

- Due diligence obligations: Businesses are required to identify and address adverse environmental impacts within their operations and supply chains.

- Growing demand for sustainable financial products: Investors and consumers are increasingly favoring green bonds, loans, and investments.

- Potential for stricter capital requirements: Regulators may link capital adequacy to a bank's exposure to climate-related risks.

Reputational Risks from Environmental Performance

A bank's environmental performance is increasingly scrutinized, directly influencing its reputation with investors, clients, and the broader public. Negative environmental impacts can lead to boycotts, divestment, and a loss of trust, posing significant financial risks. For instance, a 2024 study by the Financial Times highlighted that companies with poor environmental track records saw their stock valuations lag by an average of 3% compared to their peers.

Banca IFIS actively addresses these reputational risks through its robust ESG (Environmental, Social, and Governance) framework and dedicated sustainability initiatives. By achieving strong ESG ratings, like its reported 2024 MSCI ESG rating of AA, the bank demonstrates a commitment to responsible operations. This proactive approach not only mitigates potential damage to its brand but also actively enhances its standing as a forward-thinking and ethical financial institution.

The bank's sustainability efforts are tangible, contributing to a positive public image and attracting environmentally conscious investors. For example, Banca IFIS's reported €500 million in green financing for renewable energy projects in 2024 directly supports its environmental credentials. This focus on sustainable finance positions Banca IFIS favorably in a market where environmental responsibility is becoming a key differentiator.

Key aspects of Banca IFIS's environmental performance impacting reputation include:

- ESG Ratings: Maintaining high ratings from agencies like MSCI and Sustainalytics, which are closely watched by institutional investors.

- Sustainable Finance: Actively increasing its portfolio of green loans and investments, as evidenced by its 2024 green bond issuance of €200 million.

- Carbon Footprint Reduction: Implementing strategies to lower its operational carbon emissions, with a target of a 30% reduction by 2025 from a 2020 baseline.

- Stakeholder Engagement: Transparently communicating its environmental policies and performance to build trust with clients and the public.

Banca IFIS is navigating a landscape increasingly shaped by environmental regulations and the growing demand for sustainable finance. European directives like the CSRD and the Corporate Sustainability Due Diligence Directive, with increased implementation through 2024-2025, are compelling institutions to integrate environmental performance into their core operations and client relationships. This regulatory push, alongside market demand for green financial products, presents significant opportunities for Banca IFIS to support clients in their energy transition, particularly Italian SMEs which require substantial capital for such shifts.

The bank's commitment to sustainability is reflected in its improved MSCI ESG rating, demonstrating a proactive approach to environmental risk management and the financing of green initiatives. For instance, Banca IFIS's €500 million in green financing for renewable energy projects in 2024 highlights its strategic alignment with the low-carbon economy transition. This focus not only mitigates reputational risks but also enhances its attractiveness to environmentally conscious investors and clients.

Banca IFIS is actively addressing the financial implications of climate change, including physical risks from extreme weather and transition risks associated with policy shifts. The ECB's ongoing stress tests, as of late 2024, continue to emphasize the potential financial impact of climate-related events on bank portfolios, reinforcing the need for robust environmental risk management. By providing tailored green financing solutions, Banca IFIS is well-positioned to capture market share and support its clients through this critical adaptation phase.

| Environmental Factor | Banca IFIS Action/Impact | Data Point (2024/2025) |

|---|---|---|

| Regulatory Compliance | Adherence to CSRD and other EU directives | Increased reporting requirements for clients |

| Green Financing | Supporting energy transition for SMEs | €500 million in green financing for renewables (2024) |

| Risk Management | Integrating climate risk into loan book assessment | ECB stress tests highlight climate impact (late 2024) |

| Reputational Enhancement | Strong ESG framework and initiatives | MSCI ESG rating of AA (2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Banca IFIS draws on data from official regulatory bodies, financial market reports, and economic forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.