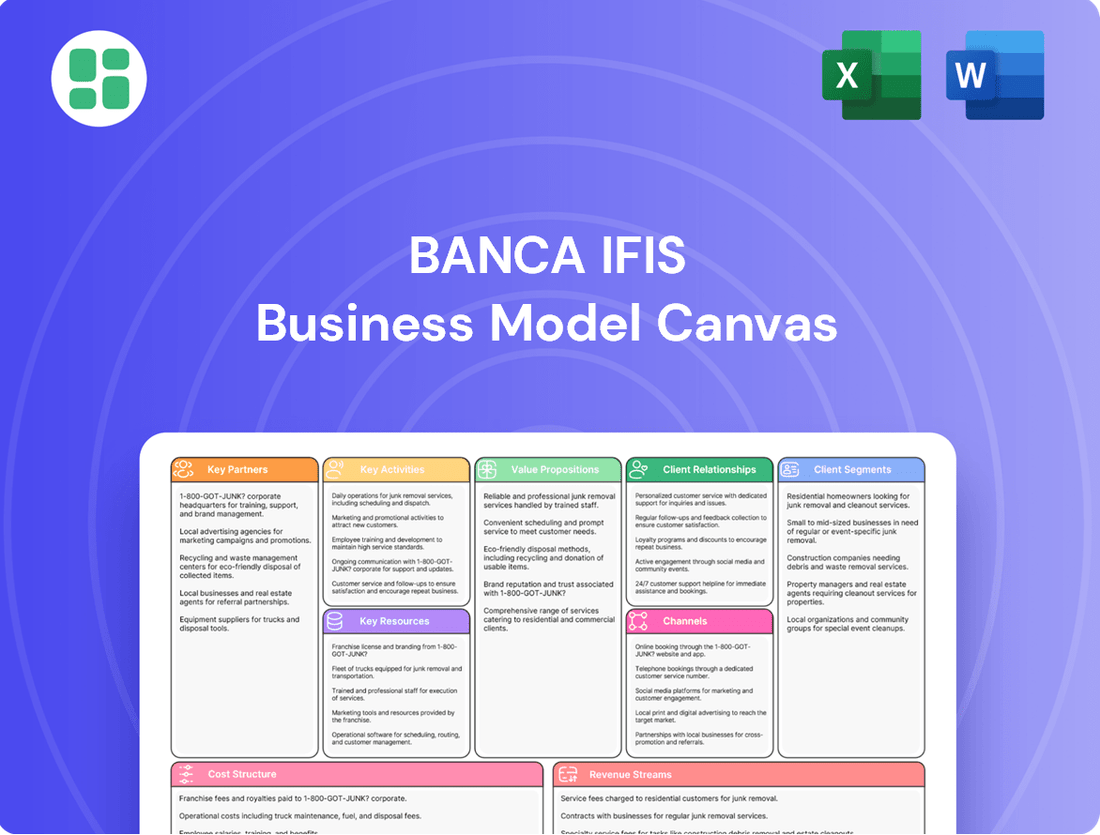

Banca IFIS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca IFIS Bundle

Discover the core of Banca IFIS's success with its comprehensive Business Model Canvas. This detailed breakdown illuminates how they attract and retain customers, manage key resources, and generate revenue in the competitive financial sector. Perfect for anyone looking to understand effective business strategy.

Partnerships

Banca IFIS strategically partners with technology providers like InfoCert to drive its digital transformation forward. These collaborations are key to modernizing crucial banking processes such as customer onboarding, digital signature implementation, and secure document archiving.

The bank's commitment to digital innovation is substantial, with significant investments aimed at establishing a robust 'bank-as-a-platform' infrastructure. This approach is designed to streamline operations and create a superior, digitally-enabled experience for all its customers.

Banca IFIS collaborates with specialized NPL servicers and collection agencies to enhance its debt recovery operations. This strategic outsourcing leverages external expertise, particularly for managing a high volume of small-ticket unsecured loans, a segment where Banca IFIS holds a strong market position.

In 2023, Banca IFIS continued to demonstrate its commitment to efficient NPL management by actively engaging these partners. The bank’s approach balances in-house capabilities with external support to optimize both the acquisition and recovery phases of its NPL portfolio.

Banca IFIS actively partners with other banks and financial institutions to facilitate co-lending initiatives, participate in syndicated loans, and diversify its funding sources. These collaborations are crucial for managing risk and accessing larger capital pools.

A prime example of this strategy in action is the integration of Revalea with Mediobanca. This partnership was instrumental in helping Banca IFIS surpass its non-performing loan (NPL) reduction targets ahead of schedule, demonstrating the tangible benefits of strategic alliances in achieving financial objectives.

These types of relationships not only bolster Banca IFIS's standing in the competitive financial landscape but also enable the expansion of its product and service portfolio, ultimately benefiting its clients and stakeholders.

Institutional Investors and Lead Managers

Banca IFIS relies on strong relationships with institutional investors and lead managers for its capital market activities. These partnerships are crucial for successfully executing bond issuances and securing necessary funding.

Collaborations with entities like EQUITA, a prominent joint lead manager, are instrumental in accessing diverse funding sources and tapping into broader capital markets. This strategic engagement ensures Banca IFIS can efficiently raise capital to support its growth and operations.

- Institutional Investors: These entities, such as pension funds and asset managers, provide significant capital for bond issuances.

- Joint Lead Managers: Firms like EQUITA structure and underwrite bond offerings, facilitating access to investors.

- Capital Market Access: Partnerships enable Banca IFIS to diversify its funding base and obtain capital at favorable terms.

- Funding Success: The €400 million senior preferred bond placement in July 2025 highlights the effectiveness of these key partnerships in achieving funding objectives.

Cultural and Social Initiatives Partners

Banca IFIS actively engages with cultural and social initiatives, forging key partnerships with esteemed institutions. Collaborations with entities such as the Pinacoteca di Brera and the Galleria Nazionale di Arte Moderna di Roma underscore the bank's dedication to preserving and promoting Italy's rich artistic heritage.

These strategic alliances extend to supporting significant art restoration projects, exemplified by their involvement with Banksy's 'The Migrant Child.' Such initiatives are intrinsically linked to Banca IFIS's broader Environmental, Social, and Governance (ESG) commitments and its dedicated Social Impact Lab programs.

- Partnerships with Cultural Institutions: Collaborations with the Pinacoteca di Brera and Galleria Nazionale di Arte Moderna di Roma.

- Support for Art Restoration: Involvement in projects like Banksy's 'The Migrant Child.'

- Alignment with ESG Goals: These initiatives reinforce Banca IFIS's commitment to sustainability.

- Brand Reputation Enhancement: Social and cultural engagement contributes positively to the bank's image.

Banca IFIS cultivates vital partnerships with technology providers, financial institutions, and cultural organizations to enhance its operational efficiency, expand its market reach, and fulfill its ESG commitments. These alliances are instrumental in digital transformation, NPL management, capital raising, and supporting Italy's artistic heritage.

| Partner Type | Example Partners | Strategic Benefit | 2024 Impact/Data Point |

|---|---|---|---|

| Technology Providers | InfoCert | Digital onboarding, secure document management | Continued investment in 'bank-as-a-platform' infrastructure |

| NPL Servicers/Collection Agencies | Specialized Agencies | Efficient debt recovery, especially for unsecured loans | Optimized NPL portfolio management |

| Financial Institutions | Mediobanca (via Revalea) | Co-lending, syndicated loans, risk management | Surpassed NPL reduction targets ahead of schedule |

| Capital Markets Participants | EQUITA (Joint Lead Manager) | Bond issuances, diversified funding | Facilitated successful capital raises |

| Cultural Institutions | Pinacoteca di Brera, Galleria Nazionale di Arte Moderna di Roma | ESG alignment, brand enhancement, support for art restoration | Support for initiatives like Banksy's 'The Migrant Child' |

What is included in the product

Banca IFIS's Business Model Canvas outlines its strategy of focusing on niche markets and specialized financial services, particularly in factoring and non-performing loans, supported by a strong digital transformation and a lean operational structure.

Banca IFIS's Business Model Canvas offers a clear, visual framework that helps identify and address the core challenges and inefficiencies within their financial operations.

This structured approach allows Banca IFIS to pinpoint areas of friction and develop targeted solutions, effectively relieving operational pain points.

Activities

A central activity for Banca IFIS is delivering factoring services and corporate banking solutions specifically for small and medium-sized enterprises (SMEs). This encompasses providing essential liquidity, various financing options, and a suite of financial services designed to meet diverse business requirements, which are key drivers of the bank's net income.

The factoring segment demonstrated consistent performance, achieving a turnover of €3.0 billion in the first quarter of 2025. This highlights the ongoing demand and effectiveness of these services in supporting Italian businesses.

Banca IFIS is a key player in acquiring and managing non-performing loans (NPLs). They act as both an investor and owner of a servicer that handles these loans. This is a core part of their business, focusing on getting money back from these troubled assets.

Their approach involves using both legal (judicial) and less formal (extrajudicial) methods to recover funds. The main goal is to make these recovery processes as efficient as possible to boost the returns they get from the NPL portfolios they own.

In the first quarter of 2025, Banca IFIS saw significant success in this area, collecting €101 million in cash from their NPL business. This demonstrates the scale and effectiveness of their operations in managing and recovering these loans.

Banca IFIS places a strong emphasis on digital transformation, channeling investments into cutting-edge technologies. These advancements are designed to boost operational efficiency, elevate the customer journey, and streamline internal workflows. For instance, the bank has rolled out digital onboarding processes and automated loan disbursement systems, making banking more accessible and faster.

A significant aspect of their digital strategy involves leveraging data analytics and robotic process automation, particularly in the non-performing loan (NPL) recovery segment. This technological integration is a core component of their growth strategy, aiming to optimize recovery rates and reduce operational costs. In 2023, Banca IFIS reported a net profit of €250.2 million, demonstrating the positive impact of such strategic initiatives.

Risk Management and Capital Optimization

Banca IFIS actively manages its risk profile through continuous assessment and mitigation strategies. This includes diligent oversight of credit, market, and operational risks to safeguard the bank's financial health.

Capital optimization is a core activity, ensuring the bank maintains a robust capital structure. As of Q1 2025, Banca IFIS reported a Common Equity Tier 1 (CET1) ratio of 16.55%, significantly exceeding regulatory minimums and providing a strong buffer against potential economic downturns.

The bank focuses on optimizing its funding costs by diversifying funding sources and managing interest rate sensitivity effectively. This proactive approach helps maintain profitability and supports sustainable growth.

- Continuous Risk Assessment: Rigorous evaluation of credit, market, and operational risks.

- Capital Strength: CET1 ratio stood at 16.55% in Q1 2025, exceeding regulatory requirements.

- Funding Cost Optimization: Diversification of funding sources and active management of interest rate sensitivity.

- Asset Quality Maintenance: Strong focus on maintaining high asset quality to minimize potential losses.

Sustainability and ESG Initiatives

Banca IFIS is actively embedding environmental, social, and governance (ESG) principles throughout its operations. This commitment is a cornerstone for driving sustainable growth and enhancing its overall ESG profile.

The bank's dedication to ESG is evident in its efforts to improve its ESG rating and its focus on social impact. Banca IFIS's Social Impact Lab is a key initiative, fostering projects that create tangible social value and contribute to a more sustainable future.

- ESG Integration: Banca IFIS prioritizes the integration of ESG factors into its business strategy and daily operations, aiming to bolster its sustainability performance.

- Social Impact Lab: The bank champions social impact through its dedicated Social Impact Lab, supporting projects designed to generate positive societal outcomes.

- Sustainable Growth Driver: ESG initiatives are recognized as a crucial element for achieving long-term, sustainable growth for Banca IFIS.

Banca IFIS's key activities revolve around providing specialized financial services, particularly factoring and corporate banking for SMEs, which generated €3.0 billion in turnover in Q1 2025. They are also a significant player in acquiring and managing non-performing loans (NPLs), successfully collecting €101 million in Q1 2025. Furthermore, the bank invests heavily in digital transformation to enhance efficiency and customer experience, as evidenced by their 2023 net profit of €250.2 million.

| Key Activity | Description | Q1 2025 Data/2023 Data | Significance |

|---|---|---|---|

| Factoring & SME Banking | Providing liquidity and financing to SMEs | €3.0 billion turnover (Q1 2025) | Core revenue driver |

| NPL Acquisition & Management | Investing in and recovering distressed loans | €101 million cash collected (Q1 2025) | Profitability from asset recovery |

| Digital Transformation | Investing in technology for efficiency and customer experience | €250.2 million net profit (2023) | Operational improvement and growth |

Full Version Awaits

Business Model Canvas

The Banca IFIS Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering a transparent and accurate representation of what you're buying. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Banca IFIS, as a banking group, relies heavily on its substantial financial capital. A key indicator of this strength is its Common Equity Tier 1 (CET1) ratio, which stood at a robust 17.3% as of the first quarter of 2024. This strong capital base is fundamental for supporting its diverse lending activities, including the acquisition of Non-Performing Loans (NPLs), and for funding strategic investments.

Furthermore, the bank maintains robust liquidity, essential for its day-to-day operations and for meeting its financial obligations. This liquidity, coupled with its capital strength, allows Banca IFIS to navigate market fluctuations, pursue growth opportunities, and consider potential strategic acquisitions, thereby ensuring its continued financial stability and capacity for expansion.

Banca IFIS recognizes that its highly skilled personnel are a cornerstone of its success. This includes financial professionals, specialists in non-performing loan (NPL) recovery, and IT experts, all crucial for its operations.

The bank actively invests in continuous training and reskilling initiatives to bolster employee capabilities. This commitment ensures Banca IFIS maintains its specialized expertise, particularly within its core niche markets such as factoring and NPL management.

For instance, in 2024, Banca IFIS reported a workforce of approximately 1,900 employees, underscoring the significant human capital investment. This focus on specialized knowledge allows them to effectively navigate complex financial landscapes and deliver tailored solutions.

Banca IFIS leverages advanced technology platforms and a robust IT infrastructure to streamline operations and deliver digital products efficiently. This digital backbone is crucial for managing customer interactions and enabling data-driven strategies.

Significant investments in technology, including data analytics capabilities, empower Banca IFIS to automate processes and enhance its NPL recovery efforts. For instance, in 2024, the bank continued to focus on digital transformation, aiming to improve operational efficiency through enhanced IT systems and data utilization.

Proprietary NPL Portfolios and Collection Network

Banca IFIS distinguishes itself through its significant proprietary portfolio of non-performing loans (NPLs). This internal asset base is a cornerstone of its business model, enabling direct control over recovery strategies and maximizing value extraction from distressed debt.

The bank complements its NPL portfolio with a robust collection network, comprising both internal expertise and external partnerships. This dual approach ensures flexibility and efficiency in managing a diverse range of NPL assets, a critical factor in the Italian financial landscape.

This integrated capability provides Banca IFIS with a distinct competitive edge in the Italian NPL market. For instance, as of the first quarter of 2024, Banca IFIS reported a gross NPL ratio of 3.2%, demonstrating its ongoing success in managing and reducing non-performing exposures within its portfolio.

- Proprietary NPL Portfolio: Banca IFIS maintains a substantial internal book of non-performing loans, offering direct control and strategic flexibility in recovery efforts.

- Collection Network: The bank leverages a combination of in-house specialists and external partners for efficient and effective NPL collection and management.

- Market Advantage: This integrated approach provides a significant competitive advantage within the Italian NPL market, characterized by specialized recovery expertise.

- Performance Metric: In Q1 2024, Banca IFIS reported a gross NPL ratio of 3.2%, underscoring its capacity for effective NPL management.

Brand Reputation and Market Leadership

Banca IFIS's strong brand reputation and market leadership are crucial intangible assets, particularly within its core areas of factoring, non-performing loans (NPLs), and corporate banking for small and medium-sized enterprises (SMEs). This established presence fosters client loyalty and attracts new business, underpinning the bank's growth strategy.

This recognition directly translates into tangible benefits. For instance, in 2024, Banca IFIS continued to solidify its position in the Italian factoring market, a sector where it is a recognized leader. Its ability to attract and retain clients is a testament to the trust built through consistent performance and specialized expertise.

- Market Leadership in Factoring: Banca IFIS is a prominent player in the Italian factoring market, a key segment for its business model.

- NPL Specialization: The bank's expertise in managing and acquiring non-performing loans is a significant differentiator, attracting both sellers and investors.

- SME Corporate Banking: A strong reputation among SMEs enhances its ability to secure deposits and offer tailored lending solutions.

- Facilitates Funding: A well-regarded brand name makes it easier to access capital markets and secure wholesale funding, essential for its operations.

Banca IFIS's key resources include its strong financial capital, evidenced by a CET1 ratio of 17.3% in Q1 2024, and robust liquidity. Its human capital comprises around 1,900 skilled employees in 2024, with expertise in NPL management and factoring. The bank also possesses a significant proprietary NPL portfolio and advanced IT infrastructure, crucial for its operations and digital product delivery.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Financial Capital | CET1 Ratio | 17.3% (Q1 2024) |

| Human Capital | Number of Employees | Approx. 1,900 (2024) |

| Intellectual Capital | NPL Management Expertise | Core competency, driving recovery strategies |

| Physical Assets | IT Infrastructure | Enables digital products and operational efficiency |

| Proprietary Assets | NPL Portfolio | Cornerstone of business model, direct control over recovery |

Value Propositions

Banca IFIS is a key provider of liquidity and specialized financial services for Italian small and medium-sized enterprises (SMEs). Through offerings like factoring and corporate banking, the bank directly addresses the critical need for working capital and growth financing within this vital economic sector.

In 2024, Banca IFIS continued its commitment to supporting SMEs, recognizing their foundational role in the Italian economy. Factoring, a core service, helps businesses convert receivables into immediate cash, thereby improving their cash flow management and enabling them to invest in expansion or operational needs.

The bank's tailored financial solutions are designed to foster stability and growth for SMEs. By providing access to capital and expert financial guidance, Banca IFIS empowers these businesses to navigate economic challenges and capitalize on opportunities, contributing to their long-term success and the broader Italian economic landscape.

Banca IFIS distinguishes itself through deep expertise in managing non-performing loans (NPLs). They employ an ethical and efficient collection model, which is a core part of their value proposition. This approach benefits NPL originators by acquiring distressed portfolios and contributes to the financial system's health by reducing bad debt.

This specialized NPL management not only cleanses balance sheets for originating institutions but also aims for the financial re-inclusion of debtors. For instance, in 2023, Banca IFIS reported a significant volume of NPL acquisitions, demonstrating their active role in this market. Their strategy focuses on recovery and rehabilitation, rather than just liquidation.

Banca IFIS truly shines by crafting financial solutions that are anything but one-size-fits-all. They focus on tailoring their offerings, whether it's for businesses or individuals, to precisely match unique requirements. This approach allows them to serve niche markets effectively, providing a level of customization that larger institutions often can't replicate.

This flexibility is a key differentiator for Banca IFIS, especially in the current economic climate. For instance, in 2024, many businesses are seeking agile financing options to navigate supply chain disruptions and evolving market demands. Banca IFIS's ability to adapt its product suite, perhaps offering shorter-term credit lines or more adaptable leasing agreements, directly addresses these pressing needs.

Their commitment to tailored solutions means clients aren't forced into generic packages. This could translate to specialized factoring services for SMEs or bespoke investment products for high-net-worth individuals, ensuring that the financial tools provided are the right fit, thereby fostering stronger client relationships and better financial outcomes.

Digitalized and Efficient Banking Experience

Banca IFIS is heavily investing in making banking smoother and quicker for everyone. They've put a lot of money into digital tools to speed things up, like getting loans approved faster and making it easier to open new accounts online. This focus on digitization means clients can do more themselves, right from their computers or phones, making banking much more convenient.

The bank's commitment to a digital-first approach translates into tangible benefits for its customers. For instance, by streamlining the loan application and approval process through online platforms, Banca IFIS aims to significantly reduce the time from application to disbursement. This efficiency is a key part of their value proposition in today's fast-paced financial environment.

- Faster Loan Processing: Digitized workflows enable quicker assessment and approval of loan applications, reducing client waiting times.

- Digital Customer Onboarding: New clients can open accounts and access services entirely online, simplifying the initial engagement.

- Online Self-Service: Customers have 24/7 access to manage their accounts, perform transactions, and find information without needing to visit a branch.

- Enhanced Accessibility: Digital channels ensure banking services are available anytime, anywhere, catering to modern lifestyle needs.

Commitment to Sustainable and Responsible Banking

Banca IFIS demonstrates a profound commitment to sustainable and responsible banking, integrating environmental, social, and governance (ESG) principles deeply into its operations. This dedication is reflected in its consistently strong ESG ratings, underscoring its role as a leader in ethical finance.

The bank actively pursues social impact initiatives, resonating with a growing segment of clients and stakeholders who prioritize ethical business conduct and positive societal contributions. This focus aligns perfectly with prevailing market trends favoring responsible investment and corporate citizenship.

- ESG Leadership: Banca IFIS consistently achieves high ESG ratings, reflecting robust environmental stewardship, social responsibility, and strong corporate governance.

- Social Impact Focus: The bank actively engages in initiatives aimed at creating tangible social benefits, enhancing community well-being and promoting financial inclusion.

- Stakeholder Alignment: By prioritizing sustainability, Banca IFIS attracts and retains clients and investors who value ethical practices and a positive impact on society.

- Market Trend Responsiveness: The bank's commitment to responsible banking positions it favorably within a market increasingly driven by ESG considerations and conscious consumerism.

Banca IFIS offers specialized financial solutions, particularly for Italian SMEs, focusing on factoring and corporate banking to enhance working capital and facilitate growth. Their expertise in managing non-performing loans (NPLs) also provides value by cleaning balance sheets for originators and aiming for debtor rehabilitation.

The bank's core value proposition lies in its ability to craft highly tailored financial products, catering to niche markets and unique client needs, a flexibility crucial in dynamic economic conditions. This customization ensures clients receive precisely what they require, fostering stronger relationships and better financial outcomes.

Furthermore, Banca IFIS is committed to digital transformation, investing in technology to streamline banking processes, offering faster loan approvals and enhanced online self-service capabilities for greater customer convenience and accessibility.

Finally, the bank champions sustainable and responsible banking, integrating ESG principles into its operations and actively pursuing social impact initiatives, aligning with the growing demand for ethical finance and corporate citizenship.

| Value Proposition | Description | 2024 Impact/Focus |

|---|---|---|

| SME Liquidity & Growth | Factoring and corporate banking for working capital and expansion. | Continued support for SMEs vital to the Italian economy. |

| NPL Management Expertise | Efficient and ethical acquisition and management of distressed loan portfolios. | Active role in the NPL market, aiming for financial re-inclusion of debtors. |

| Tailored Financial Solutions | Customized offerings for diverse client needs, serving niche markets effectively. | Agile financing options to address supply chain disruptions and market demands. |

| Digital Banking Experience | Investment in digital tools for faster processing and enhanced customer self-service. | Streamlined loan application and approval via online platforms for reduced client waiting times. |

| Sustainable & Responsible Banking | Integration of ESG principles and focus on social impact initiatives. | Strong ESG ratings reflecting leadership in ethical finance and stakeholder alignment. |

Customer Relationships

Banca IFIS emphasizes dedicated relationship management, assigning account managers and leveraging commercial networks to build direct connections with business clients. This strategy allows for a granular understanding of each client's unique financial requirements and operational context.

This personalized approach is crucial for delivering tailored financial advice and developing bespoke solutions that truly address client challenges. For instance, in 2024, Banca IFIS reported a significant increase in client satisfaction scores directly linked to the effectiveness of its relationship management initiatives.

Banca IFIS goes beyond basic banking by offering specialized advisory and consultancy. This is particularly valuable for Small and Medium-sized Enterprises (SMEs) looking to improve their financial health and for those selling non-performing loans (NPLs) who need to manage intricate portfolios.

These value-added services are crucial for building deeper, more enduring relationships with clients. For instance, in 2024, Banca IFIS continued to focus on supporting Italian SMEs, a sector that represents a significant portion of the Italian economy, by providing tailored financial guidance to navigate economic shifts and optimize their capital structures.

Banca IFIS enhances customer relationships through robust digital self-service options. Clients can efficiently manage their accounts and access a wide array of banking services online, reflecting the bank's dedication to digital innovation and accessibility.

This digital focus is crucial for meeting evolving customer expectations. For instance, in 2024, the banking sector globally saw a significant increase in digital transaction volumes, with many customers preferring online channels for routine banking tasks. Banca IFIS's investment in these platforms ensures it remains competitive and customer-centric.

Long-Term Partnership Approach

Banca IFIS cultivates enduring client relationships by prioritizing their long-term growth and financial well-being. This commitment is a cornerstone of their strategy, particularly in supporting Small and Medium-sized Enterprises (SMEs).

The bank's approach to Non-Performing Loans (NPLs) exemplifies this long-term perspective, focusing on responsible recovery methods that aim to preserve value and relationships where possible. This strategy contributed to Banca IFIS's robust performance in 2024, with reported net profit reaching €297 million as of September 30, 2024, up 14.9% year-on-year.

- Focus on SME Growth: Banca IFIS actively supports SMEs, recognizing their vital role in the economy and fostering partnerships that extend beyond simple transactions.

- Responsible NPL Management: Their NPL strategy emphasizes ethical and sustainable recovery, aiming to find solutions that benefit all parties involved.

- Client-Centricity: The bank's operational model is designed to build trust and loyalty through consistent support and tailored financial solutions.

- Financial Stability: By focusing on long-term client health, Banca IFIS aims to achieve its own sustained financial stability and growth.

Community and Social Engagement

Banca IFIS actively fosters community ties through its dedicated ESG initiatives and its Social Impact Lab. This engagement resonates with clients who increasingly prioritize a bank's commitment to corporate social responsibility, thereby indirectly strengthening customer relationships.

This focus on social impact builds trust and solidifies Banca IFIS's reputation as a conscientious and responsible financial institution. For example, in 2023, Banca IFIS reported a €1.6 million investment in social impact projects, demonstrating a tangible commitment to community well-being.

- ESG Initiatives: Banca IFIS's environmental, social, and governance programs actively involve the community.

- Social Impact Lab: This dedicated lab drives projects that benefit society, fostering goodwill.

- Client Value Alignment: The bank's CSR efforts align with client values, enhancing loyalty and trust.

- Reputational Enhancement: Demonstrating social responsibility reinforces a positive brand image.

Banca IFIS builds strong customer relationships through a blend of personalized service, digital accessibility, and a commitment to client growth. This approach is evident in its dedicated support for SMEs and its responsible management of non-performing loans, fostering trust and loyalty.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Relationship Management | Account managers provide tailored advice and solutions. | Increased client satisfaction scores linked to relationship initiatives. |

| Digital Self-Service | Online platforms for efficient account management and banking services. | Supports growing trend of digital transactions in the banking sector. |

| Value-Added Advisory | Specialized consultancy for SMEs and NPL management. | Focus on supporting Italian SMEs to navigate economic shifts. |

| Long-Term Client Focus | Prioritizing client financial well-being and growth. | Contributed to net profit of €297 million (as of Sept 30, 2024). |

Channels

Banca IFIS leverages a dedicated direct sales force and a robust commercial network to connect with its business clientele. This approach fosters deep client relationships and facilitates tailored financial solutions, particularly for small and medium-sized enterprises (SMEs) and larger corporations.

In 2024, Banca IFIS continued to expand its reach through this channel, focusing on personalized client engagement. This direct interaction is crucial for understanding the evolving needs of businesses and offering specialized products like factoring and leasing, which are key drivers of their commercial banking operations.

Banca IFIS leverages its digital platforms and online portals as a primary channel for engaging customers, facilitating everything from account opening to ongoing service requests. This digital-first approach is central to their strategy for efficient customer acquisition and streamlined service delivery.

In 2024, Banca IFIS continued to invest heavily in enhancing its digital offerings, aiming to provide seamless and intuitive user experiences. This focus on digital channels is crucial for meeting evolving customer expectations and maintaining a competitive edge in the rapidly digitizing banking sector.

The bank's online portals and mobile applications are designed to offer a comprehensive suite of services, enabling customers to manage their finances, access information, and interact with the bank conveniently. This strategic emphasis on digital channels supports operational efficiency and reinforces Banca IFIS's commitment to its digital transformation journey.

Banca IFIS actively sources Non-Performing Loans (NPLs) through direct negotiations with originating banks and financial institutions, building strategic partnerships for a steady flow of assets. In 2024, the European NPL market continued to see significant activity, with Italy remaining a key focus, and Banca IFIS positioned to capitalize on these opportunities.

The bank also engages in secondary market transactions, acquiring NPL portfolios from other investors and servicers. This diversified approach ensures access to a broad range of NPL assets, supporting its growth strategy in this specialized segment.

Investor Relations and Financial Media

Banca IFIS leverages dedicated investor relations platforms and financial press releases to communicate effectively with investors and the broader financial community. These channels are vital for ensuring transparency and nurturing investor confidence, which are critical for successful bond issuances and capital raising activities.

In 2024, Banca IFIS continued to prioritize clear and consistent communication. For instance, their investor relations website provides access to financial reports, presentations, and webcasts, facilitating informed decision-making for stakeholders. This commitment to open dialogue supports the bank's strategic objectives and its ability to access capital markets efficiently.

- Investor Relations Platforms: Banca IFIS maintains a comprehensive investor relations section on its corporate website, offering timely updates, financial statements, and presentations.

- Financial Media Engagement: The bank actively engages with financial media through press releases and interviews to disseminate key financial information and strategic updates.

- Capital Raising Facilitation: Transparent communication through these channels is instrumental in supporting bond issuances and other capital-raising initiatives, ensuring investor trust and market receptiveness.

- Transparency and Confidence: By providing readily accessible and accurate financial data, Banca IFIS aims to build and maintain strong investor confidence, a cornerstone of its financial strategy.

Strategic Partnerships for Distribution

Banca IFIS actively cultivates strategic partnerships to broaden the distribution of its credit products and financial services. This approach, often termed a 'bank-as-a-platform' strategy, significantly extends the bank's market reach.

By collaborating with various entities, Banca IFIS can access new customer segments and capitalize on emerging market opportunities. This model allows for agile expansion without the need to solely depend on its internal infrastructure. For instance, in 2024, Banca IFIS continued to enhance its digital channels and explore collaborations with fintech companies to streamline credit origination and servicing.

- Distribution Channels: Leveraging partnerships with businesses and online platforms to offer credit solutions.

- Market Expansion: Accessing previously untapped customer bases through third-party networks.

- Operational Efficiency: Reducing reliance on internal sales forces for wider product dissemination.

Banca IFIS utilizes a multi-channel approach, blending direct sales with digital platforms and strategic partnerships. This ensures broad customer engagement and efficient service delivery across its diverse product offerings.

In 2024, the bank continued to emphasize personalized client relationships through its direct sales force, while simultaneously investing in digital enhancements for seamless online interactions. This dual focus supports growth in both commercial banking and NPL acquisition.

Banca IFIS's channels are designed for both customer acquisition and ongoing relationship management, aiming for operational efficiency and market expansion.

| Channel | 2024 Focus | Key Activities |

|---|---|---|

| Direct Sales Force | Personalized client engagement, SME & Corporate focus | Tailored financial solutions, factoring, leasing |

| Digital Platforms (Online/Mobile) | Enhanced user experience, seamless service | Account opening, service requests, financial management |

| NPL Sourcing | Direct negotiation, secondary market transactions | Acquisition of NPL portfolios, strategic partnerships |

| Investor Relations | Transparency, market communication | Financial reports, press releases, investor presentations |

| Strategic Partnerships | Credit product distribution, market reach expansion | Fintech collaborations, third-party network access |

Customer Segments

Banca IFIS places a significant focus on Italian Small and Medium-Sized Enterprises (SMEs), recognizing their critical role in the national economy. These businesses often seek specialized financial support, such as factoring and corporate banking services, to manage their cash flow and growth. In 2023, Banca IFIS continued to solidify its position as a key partner for Italian SMEs, providing essential liquidity solutions.

While Banca IFIS is well-known for its focus on small and medium-sized enterprises (SMEs), it also actively engages with larger corporations. For these clients, the bank offers tailored corporate banking services and specialized financing solutions designed to meet complex financial requirements.

This dual approach allows Banca IFIS to cultivate a diversified client base, reducing reliance on any single market segment. The inclusion of large enterprises contributes significantly to the bank's overall revenue streams, providing stability and opportunities for growth in more sophisticated financial markets.

In 2024, Banca IFIS reported a robust performance in its corporate banking division, with a notable increase in lending to larger entities, particularly in sectors like manufacturing and infrastructure. This segment's contribution underscores the bank's capacity to handle substantial financial transactions and provide strategic support to major players in the economy.

Banca IFIS targets banks, financial institutions, and other originators looking to sell portfolios of non-performing loans (NPLs). These sellers are motivated to clean up their balance sheets and free up capital. For instance, in 2023, the Italian banking system continued its deleveraging efforts, with NPL ratios showing a downward trend, creating opportunities for buyers like Banca IFIS.

High-Net-Worth Individuals (HNWIs) and Entrepreneurs

Banca IFIS is strategically expanding its reach by launching a dedicated Private division in 2025. This initiative specifically targets entrepreneurs and existing high-value Rendimax clients, aiming to offer them specialized investment and wealth management services. This move signifies a clear intent to capture a larger share of the affluent market by providing tailored financial solutions.

The bank's focus on entrepreneurs and high-net-worth individuals (HNWIs) reflects a growing trend in the financial sector to cater to clients with substantial assets and complex financial needs. These clients often seek personalized advice, sophisticated investment products, and comprehensive wealth planning.

- Targeted Client Base: Entrepreneurs and high-end Rendimax clients represent a segment with significant financial capacity and a need for specialized wealth management.

- Strategic Expansion: The 2025 launch of the Private division underscores Banca IFIS's commitment to growing its presence in the affluent market.

- Service Offering: The division will focus on investment and wealth management, providing tailored solutions to meet the unique financial objectives of its clientele.

Institutional Investors (for Funding)

Institutional investors, like asset managers and other financial institutions, are vital for Banca IFIS's capital structure, even though they don't directly use banking services. They provide substantial funding by purchasing the bank's bonds, which is essential for Banca IFIS's growth and operations.

In 2024, Banca IFIS continued to tap into this market for its capital-raising needs. For instance, in March 2024, the bank successfully issued a €500 million subordinated bond, which was largely subscribed by institutional investors. This highlights their significant role in supporting the bank's financial stability and strategic initiatives.

- Key Funding Source: Institutional investors are a primary source of capital through bond issuances.

- Market Confidence: Their participation signals confidence in Banca IFIS's financial health and business model.

- Capital Raising: These investors enable Banca IFIS to meet regulatory capital requirements and fund expansion.

Banca IFIS serves a diverse clientele, with a core focus on Italian Small and Medium-Sized Enterprises (SMEs) seeking specialized financial solutions like factoring and corporate banking. The bank also caters to larger corporations with complex financial needs, offering tailored services. This strategy diversifies its client base and revenue streams.

Furthermore, Banca IFIS targets banks and financial institutions looking to divest non-performing loan (NPL) portfolios, aiding their balance sheet cleanup. In 2024, the bank expanded its reach by launching a Private division in 2025, specifically targeting entrepreneurs and existing high-value Rendimax clients for wealth management services.

Institutional investors, such as asset managers, are crucial for Banca IFIS’s capital structure, primarily through bond purchases. In March 2024, Banca IFIS successfully issued a €500 million subordinated bond, largely subscribed by these investors, underscoring their role in supporting the bank's financial stability.

| Customer Segment | Key Needs | Banca IFIS Offering | 2024/2025 Relevance |

|---|---|---|---|

| Italian SMEs | Factoring, Corporate Banking, Liquidity | Specialized financial support | Core focus, continued provision of liquidity solutions |

| Large Corporations | Tailored Corporate Banking, Complex Financing | Sophisticated financial services | Increased lending, particularly in manufacturing and infrastructure |

| Banks/Financial Institutions (NPL Sellers) | Balance Sheet Cleanup, Capital Release | Acquisition of NPL portfolios | Continued opportunities due to ongoing deleveraging in the Italian banking system |

| Entrepreneurs & High-Value Clients | Investment & Wealth Management | Dedicated Private division (launching 2025) | Strategic expansion into the affluent market |

| Institutional Investors | Capital for Funding | Bond Issuances | Essential for capital structure; €500M subordinated bond issued March 2024 |

Cost Structure

Personnel costs represent a substantial component of Banca IFIS's operational expenses, encompassing salaries, benefits, and ongoing development for its skilled employees. In 2024, the bank continued to invest in its human capital, recognizing its importance in delivering specialized financial services.

Efficient management of these personnel costs is crucial for maintaining the bank's profitability and competitive edge in the financial sector. Banca IFIS focuses on optimizing workforce productivity and ensuring that investments in training translate directly into enhanced service quality and operational efficiency.

Banca IFIS dedicates significant capital to its digital transformation, a cornerstone of its business model. These investments in IT infrastructure and technology development are substantial, covering everything from advanced software and hardware to robust cybersecurity measures.

In 2024, the banking sector, including institutions like Banca IFIS, continued to prioritize digital channels. For instance, a significant portion of operational budgets across European banks was allocated to cloud migration and data analytics platforms, reflecting a trend towards modernizing core banking systems.

Maintaining and enhancing these advanced digital platforms is crucial for supporting seamless banking operations and customer interactions. This ongoing commitment ensures Banca IFIS remains competitive in an increasingly digital financial landscape.

Funding costs, primarily interest paid on deposits and issued bonds, represent a significant expense for Banca IFIS. For instance, in the first half of 2024, the bank reported interest expenses on financial liabilities.

Banca IFIS places a strong emphasis on managing these funding costs to mitigate interest rate risk. This involves strategies to diversify funding sources and optimize the maturity profile of its liabilities.

NPL Acquisition and Management Costs

Banca IFIS incurs substantial costs in acquiring non-performing loan (NPL) portfolios. These expenses are crucial for building their asset base. For example, the acquisition of NPL portfolios represents a significant capital outlay, directly impacting the bank's cost structure.

Operational expenses for managing and recovering these NPLs are also a major component. This includes outlays for legal counsel, fees paid to specialized collection agencies, and the internal resources dedicated to workout processes. These ongoing costs are essential for maximizing recovery rates.

The integration of Revalea, a company specializing in NPL management, demonstrably increased Banca IFIS's NPL-related expenses. This strategic move, while aimed at enhancing recovery capabilities, also brought with it a higher cost base. For instance, in 2023, Banca IFIS reported a significant increase in personnel costs and operating expenses, partly attributable to the expanded NPL management operations.

- Acquisition Costs: Direct expenses related to purchasing NPL portfolios from originators.

- Management & Recovery Expenses: Costs for legal fees, collection agencies, and internal recovery teams.

- Integration Impact: Increased NPL-related expenses following acquisitions like Revalea.

- 2024 Outlook: Continued investment in NPL management infrastructure is expected, impacting operational costs.

Regulatory Compliance and Operational Expenses

Banca IFIS faces significant costs related to adhering to stringent banking regulations, a crucial aspect of its operational framework. These compliance expenses are fundamental to its business model, ensuring trust and stability in its financial dealings.

Beyond regulatory necessities, the bank incurs substantial operational expenses. These include the costs associated with its administrative functions, marketing initiatives to reach its customer base, and the upkeep of its physical branch network, all contributing to the overall cost structure.

The bank is committed to rigorous cost control and actively engages in process redesign to optimize its expenditure. This focus on efficiency is vital for maintaining profitability and competitiveness in the dynamic financial sector.

- Regulatory Compliance Costs: Banca IFIS dedicates resources to meet evolving banking laws and supervisory requirements, a non-negotiable expenditure.

- Operational Overhead: This encompasses salaries, IT infrastructure, and general administrative expenses necessary for daily operations.

- Marketing and Sales: Investment in customer acquisition and retention through various marketing channels forms a key cost component.

- Branch Network Maintenance: Costs associated with operating and maintaining its physical presence, including rent, utilities, and staff, are factored in.

Banca IFIS's cost structure is heavily influenced by its personnel expenses, digital transformation investments, and funding costs. The bank actively manages these to ensure profitability and competitiveness.

Significant outlays are also directed towards acquiring and managing non-performing loan (NPL) portfolios, including integration costs from entities like Revalea. Regulatory compliance and general operational overhead, such as marketing and branch maintenance, form the remaining key cost drivers.

In 2024, Banca IFIS continued its strategic focus on these areas, with ongoing investments in technology and NPL management expected to shape its cost base. The bank's commitment to cost control remains paramount in navigating the financial landscape.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Personnel Costs | Salaries, benefits, employee development | Continued investment in human capital for specialized services. |

| Digital Transformation | IT infrastructure, software, cybersecurity | Prioritizing modernization, cloud migration, and data analytics. |

| Funding Costs | Interest on deposits and bonds | Emphasis on diversifying funding sources and managing interest rate risk. |

| NPL Acquisition & Management | Portfolio acquisition, legal fees, collection agencies | Significant capital outlay for NPLs; integration of Revalea impacting expenses. |

| Operational & Compliance | Administration, marketing, branches, regulatory adherence | Rigorous cost control and process optimization are key. |

Revenue Streams

Banca IFIS generates significant revenue through interest income earned on loans extended to businesses, a core activity within its commercial banking operations. This is complemented by income derived from factoring services, where the bank purchases accounts receivable from businesses at a discount, providing them with immediate cash flow.

In 2024, the Commercial Banking segment, heavily reliant on these interest-based revenue streams, continued to be a primary contributor to Banca IFIS's overall financial performance, reflecting the bank's strategic focus on supporting the Italian business ecosystem.

Banca IFIS actively generates revenue through the recovery of non-performing loans (NPLs) from its own portfolios. This involves both legal proceedings and direct negotiations to reclaim owed amounts.

In 2024, Banca IFIS reported a robust performance in its NPL recovery segment, demonstrating the effectiveness of its strategies. The bank's commitment to managing and resolving these assets contributes significantly to its overall financial health and profitability.

Fees and commissions are a significant part of Banca IFIS's revenue, stemming from a wide array of banking services. These include charges for corporate banking operations, specialized advisory services tailored for businesses, and other financial solutions designed to support small and medium-sized enterprises (SMEs).

In 2024, Banca IFIS continued to leverage these fee-based income streams. For instance, the bank reported a substantial increase in its net fee and commission income, reaching €160.5 million in the first nine months of 2024, a notable rise from €135.7 million in the same period of 2023. This growth highlights the effectiveness of their strategy in monetizing financial advisory and transactional services.

Income from Proprietary Finance and Investments

Banca IFIS generates significant income from its proprietary finance and investment activities. This segment encompasses a range of financial operations, including structured finance and asset management, demonstrating the bank's diversified revenue-generating capabilities.

The proprietary finance unit has been a strong performer, contributing positively to the bank's overall profitability. This growth underscores the strategic importance of these investment activities within Banca IFIS's business model.

For instance, in 2024, Banca IFIS reported robust performance in its investment banking and asset management divisions, which are key components of its proprietary finance income. These activities are crucial for enhancing shareholder value and supporting the bank's expansion strategies.

- Proprietary Finance: Revenue generated from the bank's own financial activities and investments.

- Strategic Investments: Income derived from holdings in various companies and financial instruments.

- Structured Finance: Earnings from complex financial products and transactions.

- Asset Management: Fees and returns from managing client assets.

Other Financial Income and Trading Gains

Banca IFIS diversifies its income through "Other Financial Income and Trading Gains." This encompasses profits generated from the bank's trading activities, involving various financial instruments. It also includes income from other non-core financial operations, contributing to overall profitability.

These additional revenue streams can significantly bolster the bank's net profit. For instance, in the first quarter of 2025, Banca IFIS experienced an increase in its trading profits, demonstrating the positive impact of these diverse income sources.

- Trading Gains: Profits realized from the buying and selling of financial assets like securities and derivatives.

- Financial Instruments: Income derived from managing and trading various financial products.

- Non-Core Operations: Revenue generated from activities outside of the bank's primary lending and deposit-taking functions.

- Profit Boost: These streams contribute to enhanced net profit, as evidenced by Q1 2025 trading profit increases.

Banca IFIS's revenue streams are robust and diversified, with a strong emphasis on interest income from commercial banking and significant contributions from factoring services. The bank also actively generates income through the efficient recovery of non-performing loans (NPLs), a testament to its strategic asset management. Furthermore, fees and commissions from a wide array of banking and advisory services, particularly for SMEs, play a crucial role in its financial performance.

In 2024, Banca IFIS reported a substantial increase in net fee and commission income, reaching €160.5 million in the first nine months, up from €135.7 million in the prior year. This growth highlights the success of its strategy in monetizing financial advisory and transactional services, demonstrating the bank's ability to extract value from its client relationships beyond traditional lending.

| Revenue Stream | Description | 2024 Data (Selected) |

| Interest Income (Commercial Banking) | Earnings from loans to businesses. | Primary contributor to overall financial performance. |

| Factoring Services | Income from purchasing accounts receivable. | Supports business cash flow and generates fees. |

| NPL Recovery | Profits from reclaiming owed amounts on non-performing loans. | Robust performance in 2024, contributing to profitability. |

| Fees and Commissions | Charges for banking services, advisory, and financial solutions. | €160.5 million (Jan-Sep 2024) for net fee and commission income. |

| Proprietary Finance and Investments | Revenue from structured finance, asset management, and strategic investments. | Strong performance in investment banking and asset management divisions. |

| Other Financial Income and Trading Gains | Profits from trading activities and non-core financial operations. | Increased trading profits observed in Q1 2025. |

Business Model Canvas Data Sources

The Banca IFIS Business Model Canvas is constructed using a blend of internal financial statements, customer transaction data, and competitive market analysis. These sources provide a comprehensive view of the bank's operations and market positioning.