Banca IFIS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca IFIS Bundle

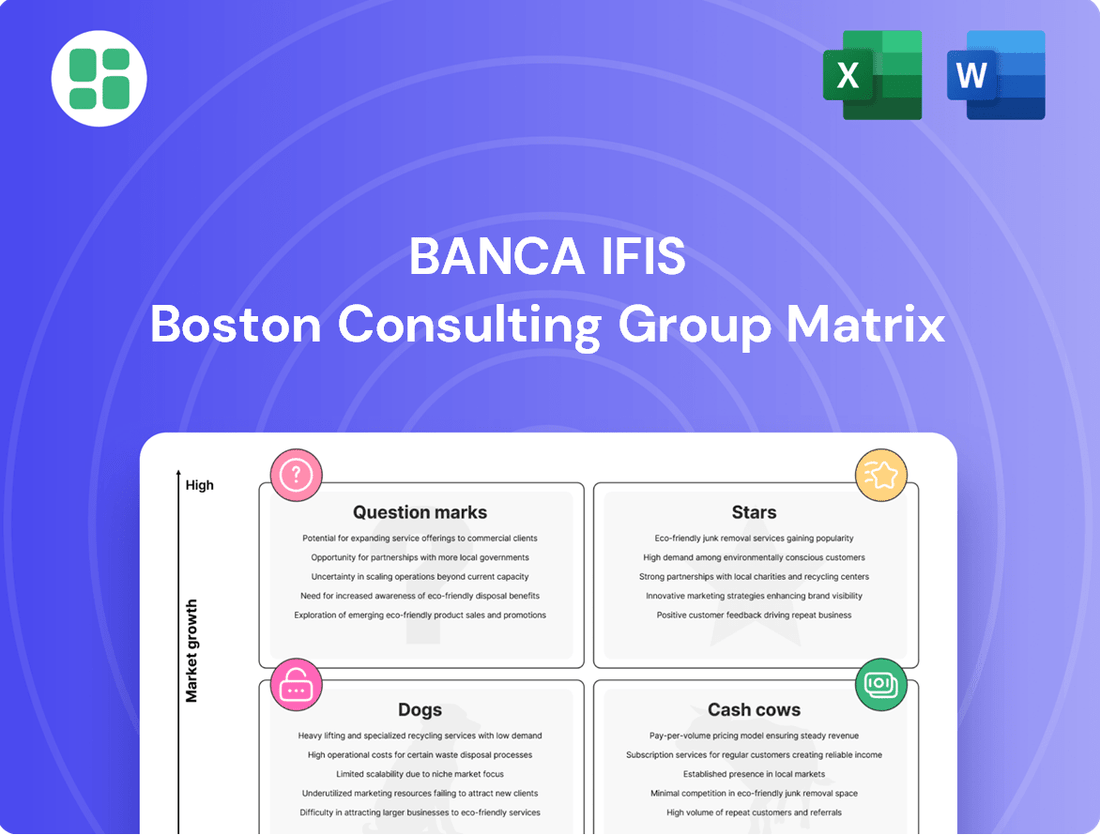

Uncover Banca IFIS's strategic positioning with our comprehensive BCG Matrix analysis. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and gain a crucial understanding of their market potential.

This preview offers a glimpse into Banca IFIS's product portfolio performance. Purchase the full BCG Matrix for detailed quadrant placements, actionable insights, and a clear roadmap to optimizing their investments and product strategy.

Stars

Factoring Services (Active Clients) represent a significant 'Star' for Banca IFIS. The bank commands a substantial 22% share of the Italian factoring market, highlighting its dominant presence. This segment is poised for robust expansion, with projections indicating an 8% compound annual growth rate for the Italian factoring market between 2025 and 2030.

The anticipated turnover growth for 2025, estimated between +0.16% and +4.19%, further underscores the positive trajectory of factoring services. Banca IFIS's strategic focus on empowering small and medium-sized enterprises (SMEs) with essential liquidity through specialized factoring solutions directly fuels this segment's strong performance and future potential.

Banca IFIS is significantly boosting its digital and innovation efforts, aiming to double customer acquisition via digital channels by the end of 2024. This push is designed to streamline operations, with a target of completing over 90% of loan disbursements in under three days. Such investments are vital for competitiveness in Italy's rapidly evolving banking landscape.

Banca IFIS's acquisition of illimity Bank, reaching over 90% ownership by July 2025, exemplifies a Stars strategy. This move consolidates strengths in SME credit and NPLs, aiming for market leadership in Italy.

The integration targets significant synergies and expands Banca IFIS's presence in digital retail banking, a key growth area for illimity. This high-investment approach is characteristic of Stars, driving market consolidation and future dominance.

Specialized Corporate Banking for SMEs

Banca IFIS is a leader in Italy for specialized corporate banking, offering customized financial solutions to small and medium-sized enterprises (SMEs). Despite a slight contraction in the broader corporate lending market, Banca IFIS is well-positioned for growth in this niche due to its focused strategy and use of digital channels for client acquisition.

The demand for working capital financing and factoring services remains robust, supporting SME expansion in a competitive landscape. Banca IFIS's expertise enables it to capture market share, particularly in specific SME segments where digital innovation drives growth potential.

- Market Position: Banca IFIS holds a leading position in providing tailored financial solutions to Italian SMEs.

- Growth Drivers: Digital channels for customer acquisition and specialized offerings are key to growth in the SME segment.

- Market Trends: Continued demand for working capital and factoring services indicates a sustained, competitive market.

- Potential: High growth potential exists in specific SME sub-segments, especially with ongoing digital enhancements.

Proprietary Finance and Structured Finance

Banca IFIS's proprietary and structured finance operations are key revenue drivers, showcasing the bank's ability to capitalize on niche market opportunities. This segment thrives on specialized expertise, delivering robust returns.

These activities, while more focused than broader areas like factoring or non-performing loans, represent high-profitability ventures with substantial growth potential. Their impact on the bank's overall net income underscores their strategic value as high-return, high-growth initiatives.

- Proprietary Finance & Structured Finance Performance: Banca IFIS's specialized finance units have demonstrated strong revenue contributions.

- Leveraging Expertise: This segment capitalizes on the bank's deep knowledge to achieve high returns in targeted market segments.

- Niche Market Focus: Activities are often concentrated in areas with specific, often underserved, market opportunities.

- Profitability and Growth: These ventures are characterized by high profitability and significant growth potential within their specialized niches.

Banca IFIS's proprietary and structured finance operations are identified as Stars due to their high profitability and significant growth potential within specialized niches. These units leverage deep expertise to deliver robust returns, contributing substantially to the bank's net income and capitalizing on targeted market opportunities.

| Segment | Market Position | Growth Potential | Profitability |

|---|---|---|---|

| Proprietary Finance | Niche Leader | High | High |

| Structured Finance | Specialized Expertise | High | High |

What is included in the product

Banca IFIS BCG Matrix: Strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

The Banca IFIS BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Factoring services, or turnover, represent a stable cornerstone for Banca IFIS. Despite a steady performance in the first quarter of 2025, the bank maintains a significant 5% share of the Italian factoring market. This positions it firmly within the Cash Cow quadrant of the BCG matrix.

The Italian factoring market itself is characterized as mature, yet it still experiences modest growth. Projections indicate a growth rate of approximately 1.72% for 2024, expected to rise to 3.79% in 2025. Banca IFIS's substantial market share within this low-growth environment means factoring reliably generates consistent cash flow.

This established competitive advantage necessitates minimal promotional investment, allowing Banca IFIS to effectively leverage its leadership in factoring. The substantial gains from this mature business can then be strategically deployed to fund other, potentially higher-growth initiatives within the bank's portfolio.

Banca IFIS stands as a significant force in Italy's non-performing loans (NPL) sector, managing a substantial proprietary portfolio valued at €21.6 billion (Gross Book Value) by the close of 2024. This specialization positions it as a key player in a market that, while seeing a general slowdown in transaction volumes across Italy, benefits from IFIS's deep-rooted expertise and highly effective collection strategies. These capabilities ensure a steady inflow of cash, a crucial element for any cash cow business.

The NPL segment proved its mettle in the first quarter of 2025, generating €81 million in revenue. This performance underscores its role as a powerful cash generator for Banca IFIS, particularly in a market characterized by low growth but high market share for the bank. Such consistent cash flow is vital, providing the financial fuel needed to support and advance the bank's other strategic ventures and growth initiatives.

Banca IFIS's traditional SME lending and corporate banking services are a prime example of a cash cow. The bank offers medium and long-term loans to small and medium-sized enterprises, a core part of its business. Despite modest overall loan growth in Italy for non-financial companies, Banca IFIS benefits from its deep roots and specialization in the SME market, ensuring a steady, if not rapid, income.

This established segment boasts a significant market share among its intended customers and experiences consistent demand, translating into dependable cash flow for the bank. Banca IFIS's success in maintaining high asset quality and effectively managing credit risk further reinforces this segment's status as a reliable source of earnings.

Liquidity Management and Deposits

Banca IFIS's liquidity management and deposit base function as a Cash Cow within its BCG Matrix framework. This area demonstrates a high market share in a low-growth segment, consistently generating substantial capital for the bank. The bank's ability to maintain a robust liquidity position, supported by a stable deposit base, is crucial for its operations.

Despite a slight dip in household deposits, Banca IFIS has experienced growth in corporate deposits. This shift highlights a strategic focus on attracting and retaining business clients, which often provides a more stable and predictable funding source. For instance, as of the first quarter of 2024, the bank reported a solid liquidity coverage ratio, underscoring its prudent management of funding needs.

The bank's effective liquidity management, coupled with its success in attracting stable funding, including through strategic bond issuances, directly contributes to its consistent net interest income. This operational strength ensures a reliable inflow of capital, which can then be reinvested in higher-growth areas of the business. The bank's net interest income for 2023 demonstrated resilience, reflecting the stability of its core deposit-gathering and liquidity management activities.

- Stable Funding Sources: Banca IFIS leverages a mix of household and corporate deposits, with corporate deposits showing growth in early 2024.

- Liquidity Position: The bank maintains a strong liquidity coverage ratio, ensuring it can meet short-term obligations.

- Net Interest Income: Consistent net interest income is generated through effective management of its deposit base and strategic bond issuances.

- Operational Efficiency: This segment represents a low-growth, high-share area that reliably provides capital for the bank's strategic initiatives.

Established Client Base and Relationship Banking

Banca IFIS's strategic focus on Small and Medium-sized Enterprises (SMEs) has cultivated a deep and loyal client base, especially within its factoring and corporate banking divisions. This established network significantly lowers the pressure and cost associated with acquiring new clients in these already developed markets, enabling the bank to achieve robust profit margins derived from its existing relationships.

The bank's commitment to offering personalized financial solutions, backed by its well-regarded expertise, fosters exceptional client loyalty and retention. This strong market penetration within its core demographic, combined with a low rate of client attrition, positions these operations as dependable generators of consistent revenue, characteristic of a Cash Cow within the BCG Matrix framework.

- Established SME Focus: Banca IFIS has a long-standing specialization in serving SMEs, a segment that values tailored financial services.

- High Profitability from Existing Clients: The bank leverages its strong relationships within mature segments to generate high profit margins, minimizing the need for costly new client acquisition.

- Client Retention and Loyalty: Tailored solutions and recognized expertise contribute to a high client retention rate, ensuring a steady revenue stream.

- Consistent Revenue Generation: The combination of market share and low churn in its core SME business makes these operations a reliable Cash Cow for Banca IFIS.

Banca IFIS's factoring and NPL management services are prime examples of its Cash Cows. These established business lines operate in mature, albeit growing, markets where the bank holds significant market share. This strong position allows them to generate consistent, reliable cash flow with minimal investment, effectively fueling other strategic initiatives.

The bank's SME lending and corporate banking, alongside its robust liquidity management and deposit base, also function as Cash Cows. They benefit from deep client relationships and stable funding, translating into predictable earnings. These segments are characterized by high market share in low-growth areas, ensuring a steady capital inflow for Banca IFIS.

| Business Segment | BCG Matrix Quadrant | Key Characteristics | 2024/2025 Data Points |

| Factoring Services | Cash Cow | Stable cornerstone, significant market share in a mature market. | 5% Italian factoring market share; 1.72% (2024) to 3.79% (2025) market growth. |

| NPL Management | Cash Cow | Expertise in a specialized market, consistent revenue generation. | €21.6 billion (GBV) proprietary NPL portfolio (end of 2024); €81 million revenue (Q1 2025). |

| SME Lending & Corporate Banking | Cash Cow | Deep roots and specialization, dependable cash flow. | Consistent demand and steady income from medium/long-term loans. |

| Liquidity Management & Deposits | Cash Cow | High market share in low-growth segment, stable funding. | Growth in corporate deposits; solid liquidity coverage ratio (Q1 2024); resilient net interest income (2023). |

What You’re Viewing Is Included

Banca IFIS BCG Matrix

The Banca IFIS BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This ensures complete transparency and guarantees that you are acquiring a ready-to-use strategic tool without any alterations or missing sections. The comprehensive analysis and clear presentation are precisely what you can expect to implement immediately in your business planning.

Dogs

The Non-Core and Governance & Services (G&S) segments of Banca IFIS, as analyzed within a BCG Matrix framework, represent areas with minimal strategic importance and limited growth potential. In the first quarter of 2025, these segments collectively generated a mere €8 million in revenue. This figure starkly contrasts with the substantial contributions from the bank's core activities, such as Commercial Banking and Non-Performing Loan (NPL) management, highlighting their peripheral role in the bank's overall financial performance.

The low revenue generation from Non-Core and G&S suggests they are likely positioned as 'Dogs' in the BCG Matrix. These are typically characterized by low market share and low growth, consuming resources without yielding significant returns. For Banca IFIS, this implies these segments may not align with the bank's strategic focus on specialized financial services, potentially diverting valuable capital and management attention away from more promising and profitable ventures.

Considering the underperformance, Banca IFIS may explore strategic options for these 'Dog' segments. Divestiture or a substantial restructuring could be viable paths to unlock value or reallocate resources more effectively. Such actions would allow the bank to concentrate its efforts and investments on its core competencies, thereby enhancing overall profitability and shareholder value.

Within Banca IFIS's NPL management, certain legacy portfolios, especially those acquired at higher costs or presenting greater recovery challenges, could be categorized as Dogs. The NPL market's increasing competition and shrinking volumes of newer credits make these older, more difficult portfolios less profitable.

These older NPLs may only break even or even drain resources through collection efforts that provide little return, thus immobilizing capital inefficiently. For instance, by the end of 2023, the overall Italian NPL market saw a significant reduction in new acquisitions, forcing institutions to focus on managing existing, often older, portfolios.

Banca IFIS's stated strategy to assess ongoing acquisitions and potentially divest 'tail portfolios' indicates an awareness of these underperforming assets. This approach aims to optimize capital allocation by divesting from portfolios with low potential returns.

Within the Italian corporate banking sector, characterized by giants like UniCredit and Intesa Sanpaolo, Banca IFIS's standard banking products, if they exist and lack unique features, would likely fall into a weak position. These offerings would struggle to capture significant market share in a crowded and mature market, facing intense price wars and operational cost pressures.

Such undifferentiated products would likely perform poorly, potentially breaking even at best or incurring losses. This aligns with Banca IFIS's strategic focus on specialization, suggesting that generic, non-specialized products are not its core strength and would therefore be classified as Dogs in a BCG matrix analysis.

Outdated or Low-Digital Adoption Services

Outdated or low-digital adoption services within Banca IFIS represent offerings that haven't been significantly integrated into the bank's digital transformation. These services often rely on manual processes and may experience low client engagement in an increasingly online banking landscape.

Services with low digital adoption by clients or significant internal operational inefficiencies would struggle to maintain market share and profitability. Such segments are likely to see limited growth and necessitate substantial resources for upkeep, offering little to no competitive edge.

Banca IFIS's substantial investments in digitalization signal a deliberate move away from these legacy processes. For instance, while the bank reported a digital customer base exceeding 70% by the end of 2023, specific legacy services might lag considerably behind this average, potentially impacting their overall contribution.

- Low Digital Adoption: Services with less than 30% of transactions conducted digitally could be categorized here.

- Operational Inefficiency: Processes requiring over 5 manual touchpoints per transaction indicate potential legacy issues.

- Declining Profitability: Services showing a year-over-year profit decline of more than 10% might be candidates.

- Resource Drain: Segments consuming more than 15% of operational costs without significant revenue contribution are a concern.

Peripheral or Non-Strategic Investment Holdings

Peripheral or non-strategic investment holdings within Banca IFIS's portfolio, particularly those not directly supporting its core factoring, NPL, or corporate banking operations, represent potential 'Dogs' in a BCG-like analysis. These could be small equity stakes in unrelated industries that offer limited growth prospects and minimal strategic synergy.

While Banca IFIS has demonstrated robust performance in areas like structured finance, some of these peripheral holdings might be lagging, tying up valuable capital without generating commensurate returns or contributing to the bank's overarching strategic objectives. For instance, a 2023 report indicated that while the bank's overall return on equity was strong, certain smaller, non-core asset classes showed a significantly lower yield.

Divesting these underperforming or non-strategic assets could be a prudent move, freeing up capital that could be reinvested into higher-growth areas or used to strengthen its core business lines. This strategic reallocation of resources is crucial for optimizing the bank's financial performance and market positioning.

- Limited Strategic Alignment: Holdings outside factoring, NPLs, and corporate banking.

- Low Growth Potential: Investments unlikely to generate significant future returns.

- Capital Inefficiency: Assets that tie up funds without substantial yield.

- Divestiture Opportunity: Potential to redeploy capital into core, high-performing segments.

The Non-Core and Governance & Services segments of Banca IFIS, generating only €8 million in revenue in Q1 2025, are likely positioned as 'Dogs' in the BCG Matrix due to their low market share and growth potential. These segments consume resources without significant returns, potentially diverting capital from more profitable ventures.

Legacy NPL portfolios with high acquisition costs or difficult recovery prospects also fit the 'Dog' profile, especially as the Italian NPL market sees shrinking new credits. Banca IFIS's strategy to assess acquisitions and divest 'tail portfolios' acknowledges the need to optimize capital from these low-potential return assets.

Undifferentiated corporate banking products, if offered by Banca IFIS without unique features, would struggle in a mature market, likely breaking even or incurring losses. This aligns with the bank's focus on specialization, marking generic offerings as 'Dogs'.

Services with low digital adoption or high operational inefficiencies, requiring significant resources for upkeep with little competitive edge, also fall into the 'Dog' category. Banca IFIS's investments in digitalization aim to move away from these legacy processes, as evidenced by its digital customer base exceeding 70% by the end of 2023.

Peripheral or non-strategic investment holdings, such as small equity stakes in unrelated industries, represent potential 'Dogs' if they offer limited growth and minimal strategic synergy. Divesting these underperforming assets allows for capital redeployment into core, high-performing segments, optimizing overall financial performance.

Question Marks

Banca IFIS's acquisition of illimity Bank represents a bold entry into the digital retail banking space. This move positions Banca IFIS in a high-growth sector, but as a new player, its initial market share within this segment is naturally low.

The illimity Bank venture is classified as a Question Mark in the BCG Matrix due to its high growth potential coupled with a low current market share for Banca IFIS. This segment demands significant investment and strategic focus to capture market share and become a Star performer.

Success for Banca IFIS in this new retail banking arena hinges on seamlessly integrating illimity's digital infrastructure and customer base. For instance, as of Q1 2024, illimity Bank reported a CET1 ratio of 16.2%, indicating a solid capital foundation for future growth initiatives.

Banca IFIS is strategically expanding its Commercial & Corporate Banking portfolio by introducing new products tailored for entrepreneurs. These offerings are designed to capture the burgeoning SME market focused on technology and sustainability investments. In 2024, the SME sector's investment in digital transformation and green initiatives saw a significant uptick, with European SMEs allocating an estimated 15% of their capital expenditure to these areas, according to industry reports.

These new product introductions are positioned as Question Marks within the BCG Matrix. Their success hinges on gaining market traction, which will require substantial marketing investment and depend heavily on customer adoption rates. For instance, a new digital financing platform for sustainable projects might experience slow initial uptake, needing robust outreach to build awareness and trust among its target audience.

The bank must meticulously evaluate the potential of each new product to ascend to market leadership. Factors influencing this trajectory include competitive landscape, regulatory environment, and the evolving needs of tech- and sustainability-focused SMEs. Early indicators from 2024 suggest that financial institutions offering integrated digital solutions and ESG-linked financing products are gaining a competitive edge.

Banca IFIS's planned Private Banking and Wealth Management division, set to launch in 2025, is positioned as a Question Mark in its BCG Matrix. This new venture aims to serve entrepreneurs and high-end Rendimax clients with a dedicated investment and wealth management platform.

This segment represents a significant, high-growth opportunity for Banca IFIS, but one where the bank currently holds minimal to no market share. The bank anticipates needing substantial investment in infrastructure, skilled personnel, and brand recognition to establish a competitive foothold.

The success of this division hinges on its capacity to attract and retain high-net-worth individuals in a market characterized by intense competition. For instance, the global wealth management market was valued at approximately $10.1 trillion in assets under management as of 2023, highlighting the scale and competitive landscape Banca IFIS is entering.

Advanced Digital Solutions (AI, IoT for SMEs)

Banca IFIS's investment in advanced digital solutions like AI and IoT for small and medium-sized enterprises (SMEs) positions it in a high-growth segment. These technologies promise significant efficiency gains and improved customer interactions within the SME banking sector.

However, the market for these sophisticated digital banking tools is still developing, and widespread adoption by SMEs is not yet a certainty. Consequently, Banca IFIS's current market share in these specific advanced digital offerings is relatively low, reflecting the nascent stage of this market.

These initiatives are considered question marks, requiring substantial ongoing investment to demonstrate their scalability and profitability. Success hinges on wider SME adoption, which could elevate these digital solutions into 'Stars' within the BCG matrix.

- Investment Focus: Banca IFIS is actively investing in AI and IoT to enhance SME banking services.

- Market Position: Current market share in advanced digital solutions for SMEs is low due to evolving adoption rates.

- Growth Potential: High potential for efficiency and customer experience improvement in the SME sector.

- Strategic Classification: These initiatives are classified as question marks, needing further investment and market validation.

International Factoring Expansion

The international factoring segment represents a significant opportunity for Banca IFIS, positioned as a Question Mark within its BCG Matrix. While the domestic market is a strong point, the international arena is projected to be the most lucrative and fastest-growing segment in Italian factoring services from 2025 to 2030. This suggests substantial potential for expansion and increased revenue streams.

Banca IFIS's current lower market share in international factoring, despite its domestic leadership, defines it as a Question Mark. This category signifies high growth potential but also necessitates strategic investment and focused market penetration strategies. The goal is to leverage existing strengths and transform this segment into a future Star performer.

- High Growth Potential: The international factoring market is expected to experience robust growth, offering Banca IFIS a prime opportunity to expand its client base and service offerings beyond Italy.

- Strategic Investment Needed: To capitalize on this growth, Banca IFIS will need to allocate resources for market research, establishing international partnerships, and developing tailored factoring solutions for diverse global markets.

- Market Penetration Challenge: Gaining market share in established international factoring landscapes requires a competitive strategy that differentiates Banca IFIS from existing players and addresses the specific needs of foreign businesses.

- Transition to a Star: Successful execution of these strategies could see Banca IFIS transition its international factoring operations from a Question Mark to a Star, becoming a dominant player in a high-growth global market.

Question Marks in Banca IFIS's portfolio represent new ventures or underdeveloped segments with high growth potential but low current market share. These areas, such as the illimity Bank acquisition and the planned Private Banking division, require significant investment and strategic focus to capture market share. Success hinges on effective integration, customer adoption, and differentiation in competitive landscapes.

| Initiative | BCG Classification | Market Growth | Banca IFIS Market Share | Strategic Imperative |

| illimity Bank Acquisition | Question Mark | High (Digital Retail Banking) | Low (New entrant) | Seamless integration, capture market share |

| New SME Products (Tech/Sustainability) | Question Mark | High (SME Investment) | Low (New offerings) | Marketing investment, customer adoption |

| Private Banking & Wealth Management | Question Mark | High (Wealth Management) | Minimal/None | Infrastructure, talent, brand building |

| Advanced Digital Solutions (AI/IoT for SMEs) | Question Mark | High (SME Digitalization) | Low (Nascent market) | Scalability demonstration, wider SME adoption |

| International Factoring | Question Mark | High (Global Factoring) | Low (vs. domestic) | Market research, partnerships, tailored solutions |

BCG Matrix Data Sources

Our Banca IFIS BCG Matrix leverages comprehensive financial disclosures, detailed market research, and official regulatory filings to provide a robust strategic overview.