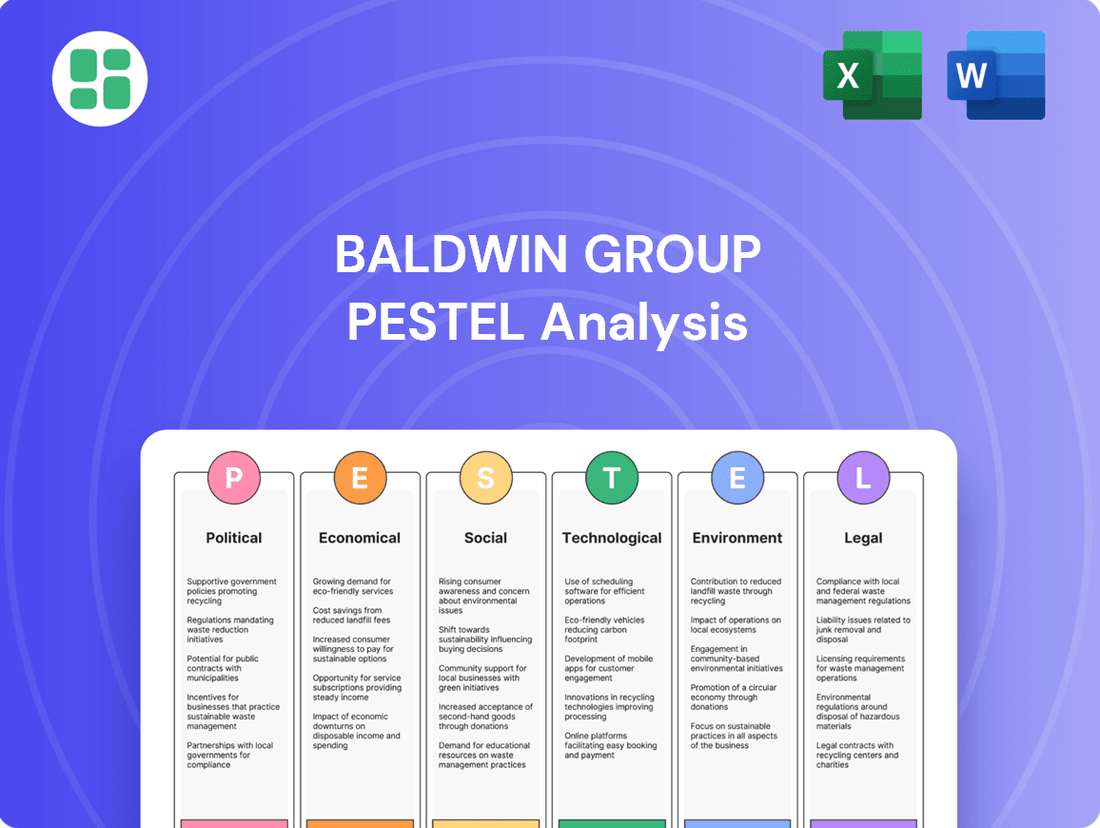

Baldwin Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baldwin Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Baldwin Group's trajectory. Our comprehensive PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full report to gain a strategic advantage and make informed decisions for Baldwin Group's future.

Political factors

Government policy on mergers and acquisitions significantly shapes the Baldwin Group's expansion. While the overall M&A pace in insurance saw a dip in 2024, largely due to higher borrowing costs, the desire for good acquisition targets remains strong, suggesting continued deal-making into 2025.

Regulatory attitudes towards consolidation and antitrust concerns directly influence which agencies Baldwin Group can pursue and the size of those potential deals, impacting their strategic growth trajectory.

The stability of the political landscape and the predictability of insurance regulations are paramount for Baldwin Group's success. Unforeseen shifts in regulatory policies, especially within the fragmented U.S. state-based system, can introduce significant compliance hurdles and necessitate rapid adjustments to existing business strategies.

The National Association of Insurance Commissioners (NAIC) is actively shaping the future regulatory environment, with key priorities for 2025 focusing on enhanced financial oversight and evolving data reporting mandates. These directives are expected to influence how Baldwin Group manages its capital and reports its performance.

Global geopolitical risks, including ongoing conflicts and trade disputes, create significant uncertainty that can ripple through the broader economic landscape, directly impacting consumer demand. For example, the persistence of global tariff disputes in recent years has prompted numerous companies to postpone their financial guidance, signaling a more challenging economic outlook.

These geopolitical tensions can indirectly influence the insurance sector by affecting investment income streams and dampening overall client confidence. In 2024, for instance, the International Monetary Fund (IMF) projected a slowdown in global growth, partly attributed to these persistent geopolitical uncertainties and trade fragmentation, which could constrain investment returns for insurers.

Consumer Protection Initiatives

Political pressure and regulatory focus on consumer protection are intensifying, directly impacting the insurance sector. State insurance departments are actively scrutinizing disclosure practices and instances of overcharging, with a particular emphasis on auto and homeowners insurance policies. This trend suggests increased compliance burdens for companies like Baldwin Group.

Anticipated new privacy protection model laws will further shape the landscape. These regulations are expected to mandate stricter guidelines for data disclosures, retention periods, and overall security measures. Baldwin Group will need to invest in robust data governance and cybersecurity protocols to ensure compliance and maintain client trust.

The National Association of Insurance Commissioners (NAIC) has been a key driver in developing these consumer protection frameworks. For instance, their work on data security has led to updated model laws that many states are adopting, creating a more uniform, albeit stringent, regulatory environment for data handling by insurers.

- Increased Scrutiny: State regulators are focusing on fairness and transparency in insurance pricing and policy terms.

- Data Privacy Mandates: New laws will require insurers to be more transparent about how they collect, use, and protect customer data.

- Compliance Costs: Adapting to these evolving regulations will necessitate investments in technology and personnel for Baldwin Group.

Political Climate and Economic Policy

The political climate, particularly the potential for a change in U.S. administration following the 2024 elections, could significantly alter economic policies. Shifts in interest rates, tax laws, and fiscal stimulus measures directly impact insurers like Baldwin Group by affecting their investment portfolios and the broader economic conditions that drive insurance demand. For instance, a more hawkish monetary policy could lead to higher interest rates, boosting investment income for insurers, while increased fiscal spending might stimulate economic growth, thereby increasing demand for insurance products.

A deregulatory approach in politics often fosters an environment conducive to mergers and acquisitions (M&A) within the financial sector. This could present Baldwin Group with opportunities for strategic expansion or consolidation. However, such a climate might also introduce complexities related to foreign investment restrictions, potentially creating trade-offs between accessing international capital and adhering to domestic ownership rules.

- Potential U.S. Administration Changes: The 2024 U.S. presidential election could usher in new economic policies impacting interest rates, taxation, and fiscal stimulus, directly influencing insurers' investment returns and market demand.

- Deregulation and M&A: A more deregulatory political stance may encourage M&A activity, offering Baldwin Group avenues for growth, but could be balanced by evolving foreign investment regulations.

- Impact on Investment Income: Changes in monetary policy, such as interest rate adjustments, directly affect the yield on insurers' fixed-income investments, a critical component of their profitability.

- Economic Demand Drivers: Government fiscal policies, including stimulus packages or austerity measures, can significantly sway overall economic health, thereby impacting consumer and business spending on insurance.

Political stability and government policy are critical for Baldwin Group's operational environment. The U.S. presidential election in 2024 could lead to shifts in economic policies, impacting interest rates and fiscal stimulus, which in turn affect insurers' investment income and market demand. For instance, a more hawkish monetary policy could boost investment yields.

Regulatory scrutiny on consumer protection is intensifying, with state departments focusing on pricing transparency and data privacy. The National Association of Insurance Commissioners (NAIC) is actively developing new model laws for data security, which many states are adopting, creating a more stringent, albeit uniform, data handling environment for insurers like Baldwin Group.

The political landscape's influence on mergers and acquisitions (M&A) is significant. While higher borrowing costs in 2024 cooled M&A activity, the underlying desire for strategic acquisitions remains, suggesting continued deal-making into 2025. Regulatory attitudes towards consolidation and antitrust concerns will dictate the feasibility and scale of Baldwin Group's potential acquisitions.

| Policy Area | Impact on Baldwin Group | 2024/2025 Trend/Data |

|---|---|---|

| M&A Regulation | Shapes expansion opportunities and deal feasibility | M&A pace dipped in 2024 due to borrowing costs, but underlying interest remains strong for 2025. |

| Consumer Protection | Increases compliance burden and focus on transparency | State regulators scrutinizing pricing and data privacy; NAIC developing stricter data security model laws. |

| Economic Policy (Post-2024 Election) | Affects investment income and insurance demand | Potential shifts in interest rates and fiscal stimulus could alter insurers' profitability and market growth. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting the Baldwin Group, covering political, economic, social, technological, environmental, and legal factors.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within the Baldwin Group's operating environment.

Provides a concise version of the Baldwin Group's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

Persistent inflation in 2024 continued to pressure insurance companies like Baldwin Group, driving up claims severity and the cost of doing business. While inflation showed signs of easing from its 2023 peaks, its continued presence, alongside the Federal Reserve's cautious approach to rate cuts, directly impacted Baldwin's profitability and its ability to finance potential acquisitions.

Interest rates played a dual role. For life insurers, higher rates generally bolstered investment income, a crucial component of profitability. However, for the brokerage side of Baldwin's operations, elevated interest rates in 2024 and into 2025 made financing acquisitions more expensive, potentially slowing down consolidation activity within the industry.

Economic growth is a key driver for Baldwin Group, as increased business activity and personal wealth naturally lead to higher demand for insurance products. When economies expand, companies are more likely to invest in property and casualty insurance, while individuals with rising incomes seek to protect their assets through life and health policies.

Looking ahead to 2025, global GDP growth is expected to see a rebound. However, some major economies are showing early signs of slowing down, and consumer demand might weaken, which could put a damper on how quickly insurance premiums grow. For instance, while the IMF projected 3.1% global growth for 2024, regional variations are significant, with some advanced economies facing slower expansion.

Despite potential headwinds, a strong labor market and increasing real incomes would be beneficial for the insurance sector. When people have secure jobs and their purchasing power goes up, they are more inclined to spend on services like insurance, bolstering demand for Baldwin Group's offerings.

The global primary insurance market is anticipated to see growth exceeding typical rates through 2025 and 2026. This positive outlook is supported by stable economic environments and decreasing inflation, creating a favorable landscape for insurers. For instance, Swiss Re projects global insurance premium growth to be 3.1% in 2024 and 3.4% in 2025, a robust performance.

Within this expanding market, non-life insurance premiums are expected to continue their upward trajectory, albeit at a pace slightly moderated compared to 2024's strong performance. This sustained growth in non-life segments, which include property and casualty insurance, offers a solid foundation for market participants.

As an insurance distribution firm, Baldwin Group is well-positioned to capitalize on these positive market trends. The company's business model directly benefits from the overall expansion occurring in both personal lines, such as auto and home insurance, and commercial lines, encompassing business liability and property coverage.

Cost of Capital for Acquisitions

Baldwin Group's strategy hinges on acquiring insurance agencies, making the cost of capital a critical factor. Higher interest rates directly affect the affordability and viability of these crucial deals. For instance, the Federal Reserve's benchmark interest rate remained elevated through much of 2024, impacting borrowing costs for acquisitions.

This increased cost of capital contributed to a noticeable slowdown in the number of deals completed in 2024. However, the insurance brokerage sector still shows robust demand for mergers and acquisitions. This underlying strength indicates that M&A activity is expected to persist into 2025, placing a premium on companies with strong financial foundations.

- Interest Rate Impact: Elevated interest rates in 2024 directly increased borrowing costs for Baldwin Group's acquisition strategy.

- 2024 Deal Slowdown: Higher capital costs were a contributing factor to a reduced volume of M&A transactions observed during 2024.

- 2025 Outlook: Despite 2024 challenges, strong M&A demand in the brokerage sector suggests continued activity in 2025.

- Balance Sheet Strength: Companies with robust balance sheets will be better positioned to navigate the acquisition landscape in 2025.

Investment Income and Financial Market Performance

Investment income is a cornerstone of insurer profitability, directly impacting their ability to meet policyholder obligations and generate returns. In 2024, a generally favorable market environment, characterized by rising interest rates and equity market gains, provided a significant boost to investment earnings for companies like Baldwin Group. For instance, many insurers reported substantial increases in net investment income during the first half of 2024, with some seeing double-digit percentage growth year-over-year.

These positive market conditions have helped insurers strengthen their balance sheets and enhance their overall financial resilience. However, the outlook for 2025 suggests a more complex landscape. While interest rates are expected to remain relatively elevated, persistent geopolitical tensions and ongoing economic uncertainties could introduce greater market volatility. This necessitates a proactive and agile approach to portfolio management to mitigate potential impacts on investment income streams.

Key considerations for Baldwin Group's investment income strategy in 2024-2025 include:

- Navigating Market Volatility: Adapting investment strategies to manage fluctuations in equity and fixed-income markets, driven by global events.

- Yield Optimization: Capitalizing on available yields while balancing risk exposure across diverse asset classes.

- Diversification Benefits: Maintaining a well-diversified investment portfolio to cushion against sector-specific downturns.

- Regulatory Environment: Monitoring and adapting to evolving regulatory requirements that may influence investment income reporting and capital management.

Persistent inflation in 2024 continued to pressure insurance companies like Baldwin Group, driving up claims severity and the cost of doing business. While inflation showed signs of easing from its 2023 peaks, its continued presence, alongside the Federal Reserve's cautious approach to rate cuts, directly impacted Baldwin's profitability and its ability to finance potential acquisitions.

Interest rates played a dual role. For life insurers, higher rates generally bolstered investment income, a crucial component of profitability. However, for the brokerage side of Baldwin's operations, elevated interest rates in 2024 and into 2025 made financing acquisitions more expensive, potentially slowing down consolidation activity within the industry.

Economic growth is a key driver for Baldwin Group, as increased business activity and personal wealth naturally lead to higher demand for insurance products. When economies expand, companies are more likely to invest in property and casualty insurance, while individuals with rising incomes seek to protect their assets through life and health policies.

Looking ahead to 2025, global GDP growth is expected to see a rebound. However, some major economies are showing early signs of slowing down, and consumer demand might weaken, which could put a damper on how quickly insurance premiums grow. For instance, while the IMF projected 3.1% global growth for 2024, regional variations are significant, with some advanced economies facing slower expansion.

Despite potential headwinds, a strong labor market and increasing real incomes would be beneficial for the insurance sector. When people have secure jobs and their purchasing power goes up, they are more inclined to spend on services like insurance, bolstering demand for Baldwin Group's offerings.

The global primary insurance market is anticipated to see growth exceeding typical rates through 2025 and 2026. This positive outlook is supported by stable economic environments and decreasing inflation, creating a favorable landscape for insurers. For instance, Swiss Re projects global insurance premium growth to be 3.1% in 2024 and 3.4% in 2025, a robust performance.

Within this expanding market, non-life insurance premiums are expected to continue their upward trajectory, albeit at a pace slightly moderated compared to 2024's strong performance. This sustained growth in non-life segments, which include property and casualty insurance, offers a solid foundation for market participants.

As an insurance distribution firm, Baldwin Group is well-positioned to capitalize on these positive market trends. The company's business model directly benefits from the overall expansion occurring in both personal lines, such as auto and home insurance, and commercial lines, encompassing business liability and property coverage.

Baldwin Group's strategy hinges on acquiring insurance agencies, making the cost of capital a critical factor. Higher interest rates directly affect the affordability and viability of these crucial deals. For instance, the Federal Reserve's benchmark interest rate remained elevated through much of 2024, impacting borrowing costs for acquisitions.

This increased cost of capital contributed to a noticeable slowdown in the number of deals completed in 2024. However, the insurance brokerage sector still shows robust demand for mergers and acquisitions. This underlying strength indicates that M&A activity is expected to persist into 2025, placing a premium on companies with strong financial foundations.

- Interest Rate Impact: Elevated interest rates in 2024 directly increased borrowing costs for Baldwin Group's acquisition strategy.

- 2024 Deal Slowdown: Higher capital costs were a contributing factor to a reduced volume of M&A transactions observed during 2024.

- 2025 Outlook: Despite 2024 challenges, strong M&A demand in the brokerage sector suggests continued activity in 2025.

- Balance Sheet Strength: Companies with robust balance sheets will be better positioned to navigate the acquisition landscape in 2025.

Investment income is a cornerstone of insurer profitability, directly impacting their ability to meet policyholder obligations and generate returns. In 2024, a generally favorable market environment, characterized by rising interest rates and equity market gains, provided a significant boost to investment earnings for companies like Baldwin Group. For instance, many insurers reported substantial increases in net investment income during the first half of 2024, with some seeing double-digit percentage growth year-over-year.

These positive market conditions have helped insurers strengthen their balance sheets and enhance their overall financial resilience. However, the outlook for 2025 suggests a more complex landscape. While interest rates are expected to remain relatively elevated, persistent geopolitical tensions and ongoing economic uncertainties could introduce greater market volatility. This necessitates a proactive and agile approach to portfolio management to mitigate potential impacts on investment income streams.

Key considerations for Baldwin Group's investment income strategy in 2024-2025 include:

- Navigating Market Volatility: Adapting investment strategies to manage fluctuations in equity and fixed-income markets, driven by global events.

- Yield Optimization: Capitalizing on available yields while balancing risk exposure across diverse asset classes.

- Diversification Benefits: Maintaining a well-diversified investment portfolio to cushion against sector-specific downturns.

- Regulatory Environment: Monitoring and adapting to evolving regulatory requirements that may influence investment income reporting and capital management.

Economic factors significantly influence Baldwin Group's performance, with inflation and interest rates being key considerations. Persistent inflation in 2024 increased claims costs, while elevated interest rates in 2024 and into 2025 made acquisitions more expensive, impacting the company's growth strategy. Despite these challenges, a growing global insurance market, projected to expand by 3.1% in 2024 and 3.4% in 2025 according to Swiss Re, presents opportunities for Baldwin Group, especially in non-life insurance segments.

A strong labor market and rising real incomes are crucial for increasing demand for insurance products, directly benefiting Baldwin Group's distribution model. While global GDP growth is expected to rebound in 2025, potential slowdowns in some economies and weakening consumer demand could moderate premium growth. Therefore, Baldwin Group's success hinges on its ability to navigate market volatility and capitalize on sustained M&A demand by maintaining a strong financial foundation.

| Economic Factor | 2024 Impact | 2025 Outlook | Baldwin Group Relevance |

|---|---|---|---|

| Inflation | Increased claims severity and operating costs. | Expected to ease but remain a factor influencing cost of business. | Pressures profitability; necessitates efficient operations. |

| Interest Rates | Higher borrowing costs for acquisitions; boosted investment income for life insurers. | Expected to remain elevated, impacting acquisition financing. | Crucial for M&A strategy affordability and investment returns. |

| Economic Growth (Global GDP) | Projected 3.1% growth; regional variations. | Expected rebound, but with potential slowdowns in some economies. | Drives demand for insurance products; impacts premium growth. |

| Labor Market & Real Incomes | Generally strong, supporting consumer spending. | Continued strength would bolster insurance demand. | Directly correlates with increased demand for Baldwin Group's offerings. |

| Insurance Market Growth | Positive growth projected, with non-life segments showing strength. | Continued expansion anticipated (3.4% premium growth projected for 2025). | Provides a favorable environment for distribution and acquisitions. |

Full Version Awaits

Baldwin Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Baldwin Group provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Demographic shifts are fundamentally reshaping insurance markets. For instance, the aging population in many developed economies, including the US and Europe, is driving demand for long-term care and health insurance solutions. Simultaneously, the growth of the gig economy means more individuals require flexible, portable insurance products for income protection and health, a trend observed globally as contract work becomes more prevalent.

Baldwin Group needs to proactively adapt its product suite to these evolving client needs. This involves not only refining existing offerings in commercial, personal, and employee benefits but also innovating new products that address the unique risks faced by younger, more mobile workforces and older, potentially less mobile populations. For example, offering modular health plans or specialized liability coverage for freelance professionals is becoming crucial.

Furthermore, younger consumers, particularly Gen Z and Millennials, increasingly rely on digital channels and social media for information and purchasing decisions. A recent study indicated that over 60% of individuals aged 18-34 consider online reviews and social media recommendations when choosing financial services, including insurance. Baldwin Group must therefore invest in robust digital engagement strategies, including social media marketing and influencer partnerships, to effectively reach and resonate with these demographics.

Societal awareness of emerging risks, like cyber threats and climate change impacts, directly shapes the demand for specific insurance products. As people and companies become more attuned to these dangers, there's a clear rise in the need for specialized coverage and robust risk management strategies, areas where Baldwin Group excels with its broad service offerings.

For instance, a 2024 report indicated that over 60% of businesses now consider cyber risk a top concern, leading to a surge in demand for cyber insurance policies. Similarly, increasing awareness of climate-related perils, such as extreme weather events, is driving a greater need for tailored property and casualty insurance solutions, a market Baldwin Group is well-positioned to serve.

The workforce is evolving, with trends like remote work and shifting employee benefit expectations directly impacting how Baldwin Group approaches its own talent acquisition and retention. For instance, a slower pace of employment growth, projected to be around 1.1% annually in the US through 2032 according to the Bureau of Labor Statistics, could lead to decreased persistency in group insurance offerings as fewer new employees join organizations.

Baldwin Group must also adapt its employee benefits to meet demands for greater flexibility and comprehensive support, such as mental health resources and professional development opportunities. Furthermore, cultivating an inclusive culture is paramount to attracting and retaining a diverse workforce, a critical factor in today's competitive talent market where companies are vying for skilled professionals.

Consumer Behavior and Digital Adoption

Consumers are increasingly turning to digital channels for insurance needs, with a significant portion researching and purchasing policies online. This trend is amplified by the growing accessibility and sophistication of AI tools, which empower individuals to compare offerings and understand complex insurance products more effectively. For instance, by mid-2024, it's estimated that over 70% of insurance shoppers utilize online resources before making a purchase decision.

Baldwin Group must prioritize enhancing its digital infrastructure to cater to this evolving consumer behavior. This includes developing intuitive self-service platforms and leveraging AI to personalize customer interactions and product recommendations. Failing to adapt could lead to a competitive disadvantage as digitally native insurers capture market share.

- Digital Research Dominance: Over 70% of insurance shoppers in 2024 use online channels for research.

- AI-Powered Comparisons: Consumers are using AI tools to evaluate insurance options, demanding greater transparency and ease of comparison.

- Self-Service Expectations: A growing preference for digital self-service tools for policy management and claims processing is evident.

- Personalization Demand: Customers expect tailored insurance solutions and personalized digital experiences.

Trust and Reputation in the Industry

Public perception of the insurance industry, particularly regarding transparency and fairness in claims handling, directly impacts consumer trust. A 2024 survey indicated that only 55% of consumers felt insurance companies were transparent in their dealings, a figure Baldwin Group must actively counter.

As a risk management firm, Baldwin Group's ability to sustain and grow its client base hinges on its reputation for ethical conduct and strong client advocacy. Maintaining this trust is paramount, especially in an era where customer experiences are widely shared online.

The threat of data breaches looms large; a significant breach could irrevocably damage Baldwin Group's reputation and erode hard-won client trust. For instance, in late 2023, a major financial services firm experienced a data breach that led to a 15% drop in its stock price and a significant decline in customer retention.

- Public Trust: Consumer confidence in insurance transparency remains a challenge, with recent surveys showing a significant portion of the public questioning industry fairness.

- Reputational Capital: Baldwin Group's success is intrinsically linked to its ethical standing and proven track record of client advocacy, forming its most valuable intangible asset.

- Data Security Impact: The potential for data breaches to cause severe reputational damage and financial loss underscores the critical need for robust cybersecurity measures.

Societal values and attitudes significantly influence the demand for insurance and the operational strategies of firms like Baldwin Group. Growing awareness of social responsibility and ethical business practices is paramount, with consumers increasingly scrutinizing companies' environmental and social governance (ESG) records. For example, a 2024 report by a leading consumer advocacy group found that 70% of respondents consider a company's social impact when making purchasing decisions.

Baldwin Group must therefore align its business practices with evolving societal expectations, focusing on transparency, fair treatment of customers, and community engagement. This includes actively promoting diversity and inclusion within its workforce and operations. A 2025 survey of the financial services sector revealed that companies with strong DEI initiatives reported higher employee retention rates and improved customer satisfaction.

Furthermore, shifts in lifestyle, such as the increasing emphasis on work-life balance and mental well-being, create new opportunities for specialized insurance products. Baldwin Group can capitalize on these trends by developing offerings that support these evolving societal priorities, such as enhanced critical illness coverage or wellness programs integrated into employee benefits packages.

Technological factors

The insurance sector is seeing significant transformation due to Insurtech and AI. Companies are using AI for better customer interactions, more precise risk evaluation, and improved fraud detection. For instance, AI-powered tools can analyze vast datasets to identify subtle patterns indicative of fraudulent claims, potentially saving insurers millions.

Baldwin Group can capitalize on these advancements by implementing AI for more accurate underwriting, leading to better pricing and reduced risk exposure. Personalized product offerings, tailored to individual customer needs identified through AI analysis, can also drive growth. Furthermore, AI streamlines claims processing, reducing operational costs and improving customer satisfaction.

The adoption of AI is no longer optional; it's essential for insurers aiming to stay efficient and competitive in the evolving market. Reports indicate that the global AI in insurance market is projected to reach over $10 billion by 2025, highlighting the significant investment and expected returns in this area.

Sophisticated data analytics and predictive modeling are becoming essential for accurately understanding and pricing complex risks within the insurance sector. Insurers are leveraging vast datasets to unlock deeper insights, leading to more precise risk assessments and better pricing strategies.

Baldwin Group can significantly enhance its risk management solutions by adopting these advanced technologies. This will allow for more tailored advice to clients, ultimately strengthening the group's value proposition and competitive edge in the market.

For instance, the global big data analytics market was projected to reach $103 billion by 2023, with significant growth expected in financial services. By integrating these capabilities, Baldwin Group can better anticipate market trends and client needs, as seen with competitors who have reported improved loss ratios by up to 5% through advanced analytics in recent years.

Cybersecurity is a critical technological factor for Baldwin Group, given the sensitive client data it manages. The threat landscape is constantly evolving, with malware attacks and data breaches posing significant risks. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report 2024, highlighting the substantial financial implications of security failures.

To mitigate these risks, Baldwin Group must invest in advanced security protocols, including multi-factor authentication and robust encryption for data storage. Staying ahead of threats ensures client data protection and adherence to stringent data privacy regulations like GDPR and CCPA, which carry heavy penalties for non-compliance. The increasing sophistication of cyber threats necessitates continuous vigilance and adaptation of security measures.

Automation and Operational Efficiency

Automation is transforming the insurance sector, and Baldwin Group stands to benefit significantly. By automating tasks like policy processing, claims management, and routine administrative duties, companies can see a substantial drop in operational expenses and a quicker turnaround for customer interactions. For instance, a 2024 report indicated that insurance firms leveraging AI in claims processing saw a reduction in processing times by an average of 30%.

Baldwin Group's strategy of acquiring and integrating insurance agencies presents a prime opportunity to deploy automation. Streamlining post-acquisition integration through automated data migration and system onboarding can accelerate the synergy realization. This not only reduces the complexity of integrating new entities but also ensures consistent operational standards across its growing network. By 2025, it's projected that over 60% of insurance carriers will have implemented AI-powered solutions for at least one core function.

- Reduced Operational Costs: Automation can cut processing expenses by an estimated 15-25% in administrative areas.

- Improved Response Times: Faster claims handling and policy issuance enhance customer satisfaction.

- Streamlined Integration: Automation aids in the swift and efficient onboarding of newly acquired agencies.

- Enhanced Scalability: Automated processes allow Baldwin Group to manage a larger volume of business without a proportional increase in staff.

Digital Platforms and Customer Experience

The insurance sector is seeing a significant shift towards digital platforms, with companies like Baldwin Group needing to adapt to evolving customer expectations. By investing in user-friendly digital portals and mobile applications, Baldwin Group can significantly enhance customer engagement and personalize their experience. This digital transformation is crucial for providing clients with seamless access to insurance products and services, a key differentiator in today's competitive market.

Customer relationship management (CRM) tools are also playing a vital role in this digital evolution. Baldwin Group can leverage these technologies to better understand and serve their clients. For instance, the global CRM market was projected to reach over $60 billion in 2024, highlighting the widespread adoption and perceived value of these systems. By integrating advanced CRM capabilities, Baldwin Group can foster stronger client relationships, streamline service delivery, and offer more tailored insurance solutions.

- Digital Adoption: In 2023, over 70% of insurance customers preferred digital channels for policy management and claims processing, a trend expected to continue growing.

- CRM Investment: Companies are increasing their CRM spending, with the average business investing around 10-15% of their IT budget in these solutions to improve customer retention.

- Personalization: Data analytics powered by digital platforms allow for personalized product offerings, which can increase customer satisfaction by up to 25%.

- Mobile Engagement: Mobile apps are becoming primary interaction points, with insurers offering mobile-first solutions seeing a 15% higher customer engagement rate compared to those without.

Technological advancements are fundamentally reshaping the insurance landscape, with AI and automation at the forefront. Baldwin Group can leverage these tools for enhanced risk assessment, personalized product development, and streamlined operations, as seen in competitors improving loss ratios by up to 5% through advanced analytics.

Cybersecurity is paramount, with the global average cost of a data breach reaching $4.45 million in 2024. Investing in robust security protocols ensures client data protection and regulatory compliance, a critical factor given the sensitive nature of insurance data.

Digital platforms and CRM systems are vital for customer engagement, with over 70% of insurance customers preferring digital channels in 2023. Baldwin Group's investment in these areas can foster stronger client relationships and offer tailored solutions, driving customer satisfaction.

| Technology Area | Impact on Baldwin Group | Supporting Data/Trend |

|---|---|---|

| AI & Automation | Improved underwriting, claims processing, operational efficiency | AI in insurance market projected to exceed $10 billion by 2025; 30% reduction in claims processing time |

| Data Analytics | Precise risk assessment, personalized offerings | Global big data analytics market projected to reach $103 billion by 2023; improved loss ratios up to 5% |

| Cybersecurity | Data protection, regulatory compliance | Average cost of data breach $4.45 million in 2024; GDPR/CCPA penalties for non-compliance |

| Digital Platforms & CRM | Enhanced customer engagement, personalized service | 70%+ customers prefer digital channels (2023); CRM market projected over $60 billion in 2024 |

Legal factors

Baldwin Group navigates a complex web of state and federal insurance regulations, making compliance a paramount operational concern. These laws, covering everything from solvency requirements to consumer protection, are constantly being updated.

While regulatory activity saw a slight slowdown in 2024, partly attributed to the election cycle, a significant uptick is anticipated in 2025. For instance, the National Association of Insurance Commissioners (NAIC) has been actively working on updates to cybersecurity standards and data privacy regulations, which are expected to be finalized and implemented in the coming year, impacting Baldwin Group's operational framework.

Baldwin Group must navigate a complex web of data privacy and security laws when handling sensitive customer information. Regulations like the Gramm-Leach-Bliley Act (GLBA) and HIPAA set strict standards for financial and health data, respectively. Furthermore, state-level laws such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), impose significant obligations on data collection and usage.

Failure to comply with these evolving regulations can lead to substantial fines and severe reputational damage. For instance, under GDPR, which influences global privacy standards, companies can face penalties up to 4% of their annual global turnover. The National Association of Insurance Commissioners (NAIC) is also developing a new privacy protections model law anticipated for 2025, indicating continued regulatory evolution in the sector.

Baldwin Group's growth through acquiring insurance agencies faces antitrust review. While mergers and acquisitions in the insurance sector are common, regulators are increasingly watchful of market concentration, particularly with larger entities. For instance, the U.S. insurance M&A market saw significant activity in 2023, with deal values reaching billions, suggesting a trend that could invite closer scrutiny for any acquirer aiming for substantial market share.

Navigating these legal landscapes is crucial for Baldwin Group's future expansion. The Federal Trade Commission (FTC) and Department of Justice (DOJ) in the US, along with similar bodies globally, actively monitor M&A to prevent anti-competitive practices. Failure to comply with these regulations can lead to significant fines, divestitures, or blocked deals, impacting Baldwin's strategic objectives.

Consumer Protection and Disclosure Requirements

Legal frameworks are increasingly focused on consumer protection, mandating clear and transparent disclosure for insurance products, including pricing and how claims are processed. State insurance departments are actively enforcing these disclosure rules, particularly in response to consumer worries about rising insurance rates. For instance, in 2024, several states reported an uptick in consumer complaints related to premium increases, prompting closer scrutiny of insurer practices.

Baldwin Group needs to ensure its operations strictly adhere to these consumer-focused regulations to mitigate legal risks and preserve the trust of its clients. This includes providing easily understandable policy documents and clear explanations of any rate adjustments. Failure to comply could lead to significant fines and reputational damage, impacting the company's ability to operate effectively.

- Enhanced Transparency Mandates: Regulations require insurers to provide detailed information on policy terms, conditions, and pricing structures to consumers.

- State Regulatory Scrutiny: State insurance departments are intensifying their oversight, particularly concerning premium hikes and complaint resolution processes.

- Consumer Trust and Legal Compliance: Adherence to consumer protection laws is crucial for Baldwin Group to avoid litigation and maintain a positive brand image.

- Data Privacy and Security: Legal frameworks also extend to protecting sensitive consumer data, with significant penalties for breaches.

Cyber Incident Reporting Requirements

Publicly traded insurance companies like Baldwin Group face increasing scrutiny regarding cyber incident reporting. New regulations, such as those from the U.S. Securities and Exchange Commission (SEC), mandate timely disclosure of material cyber events. For instance, the SEC's final rules, effective in late 2024, require companies to report significant cyber incidents within four business days.

These evolving legal frameworks underscore the critical need for robust cybersecurity infrastructure and well-defined incident response capabilities. Failure to comply can lead to substantial penalties and reputational damage. Baldwin Group must ensure its protocols are aligned with these stringent reporting obligations to mitigate legal exposure.

- SEC Cyber Incident Disclosure Rules: Publicly traded companies must report material cyber incidents within four business days.

- Increased Regulatory Oversight: Insurance sector facing heightened scrutiny on data protection and breach notification.

- Compliance Costs: Investment in advanced cybersecurity and incident response planning is essential to meet legal mandates.

Baldwin Group must navigate a complex and evolving legal landscape, particularly concerning data privacy and consumer protection. New regulations, such as the NAIC's anticipated privacy protections model law for 2025, alongside existing frameworks like GLBA and CCPA, demand stringent data handling and transparency. Failure to comply with these mandates, including the SEC's four-business-day cyber incident reporting rule effective late 2024, can result in significant financial penalties and reputational harm.

Antitrust scrutiny on mergers and acquisitions is also a key legal consideration, especially given the robust M&A activity in the insurance sector, which saw billions in deal values in 2023. Regulators are increasingly focused on market concentration, requiring careful navigation of acquisition strategies to avoid anti-competitive practice accusations. Furthermore, state insurance departments are intensifying their oversight of consumer-facing practices, particularly regarding premium increases and claim processing transparency, as evidenced by increased consumer complaints in 2024.

| Legal Factor | Key Regulations/Developments | Impact on Baldwin Group | 2024/2025 Data Point |

| Data Privacy & Security | GLBA, HIPAA, CCPA/CPRA, NAIC Privacy Model Law (2025) | Requires robust data protection, strict handling of sensitive information. | NAIC model law expected 2025, influencing state-level regulations. |

| Consumer Protection | State disclosure mandates, claim processing transparency | Ensures clear policy terms and fair claims handling; mitigates litigation risk. | Increased consumer complaints regarding premium hikes in 2024 noted by several states. |

| Cyber Incident Reporting | SEC Final Rules (effective late 2024) | Mandates timely disclosure of material cyber events, requiring enhanced cybersecurity. | Four-business-day reporting window for significant cyber incidents. |

| Antitrust & M&A | FTC/DOJ oversight, market concentration monitoring | Requires careful evaluation of acquisitions to avoid anti-competitive practices. | Insurance M&A market deal values reached billions in 2023. |

Environmental factors

The escalating frequency and intensity of climate-related natural disasters, such as hurricanes and wildfires, pose a significant threat to Baldwin Group's property and casualty insurance business. These events directly translate into increased claims payouts, putting pressure on underwriting profitability and potentially impacting the availability and cost of insurance in vulnerable regions.

In response, insurers like Baldwin Group are actively revising their risk assessment models and bolstering capital reserves to absorb the financial shock of these escalating catastrophe risks. For instance, the insurance industry saw a substantial rise in insured losses from natural catastrophes in 2023, with estimates reaching over $100 billion globally, highlighting the growing financial burden and the need for adaptive strategies.

Investor and societal attention to Environmental, Social, and Governance (ESG) factors is significantly reshaping corporate strategies, and the insurance sector is no exception. This growing emphasis means companies like Baldwin Group are increasingly evaluated not just on financial performance, but also on their sustainability efforts and ethical conduct. For instance, in 2024, global sustainable investment assets were projected to reach over $50 trillion, highlighting the scale of this shift.

ESG considerations are becoming integral to Mergers and Acquisitions (M&A) strategies. Baldwin Group might find itself pursuing acquisitions of companies with robust environmental track records, viewing sustainability as a key value driver. This trend is evident as many large institutional investors now mandate ESG screening for potential investments, impacting deal valuations and strategic alignment.

Consequently, Baldwin Group will likely face heightened expectations to clearly articulate and demonstrate its commitment to sustainability and responsible business operations. This includes transparent reporting on carbon emissions, ethical supply chains, and social impact, with stakeholders demanding concrete evidence of progress rather than mere pledges.

Insurance regulators, including the National Association of Insurance Commissioners (NAIC), are placing a significant emphasis on climate risk and resilience in their oversight. This heightened focus is driving new reporting requirements, potential adjustments to capital reserves, and more specific location-based underwriting guidelines for insurance companies like Baldwin Group.

These evolving regulatory expectations mean Baldwin Group must proactively adapt its risk assessment and management frameworks. For instance, in 2024, the NAIC continued to advance its Climate Risk Disclosure Survey, with participation from a growing number of states, signaling a clear direction for future mandatory disclosures.

Impact on Insurable Assets and Liabilities

Environmental shifts directly impact insurable assets and liabilities, creating new risks. Coastal properties, for instance, face increased insurance premiums or even uninsurability due to rising sea levels. Similarly, regions with escalating wildfire frequency, like parts of California and Australia, are seeing higher insurance costs and reduced coverage availability. Baldwin Group must proactively adapt its product portfolio to address these evolving environmental challenges, ensuring continued relevance and client support.

The increasing frequency and severity of climate-related events present significant challenges for the insurance sector. For example, the US experienced 28 separate billion-dollar weather and climate disasters in 2023, a record high, according to NOAA. This trend directly affects the insurable value of properties and the potential liabilities insurers face. Baldwin Group needs to integrate sophisticated climate modeling into its risk assessment to maintain competitive and sustainable insurance products.

- Coastal Property Risk: Rising sea levels and increased storm surge activity are making coastal real estate more vulnerable, leading to higher insurance premiums and potential coverage gaps.

- Wildfire Impact: Areas prone to wildfires are experiencing escalating insurance costs and a reduction in available coverage, forcing insurers to re-evaluate risk models.

- Climate Data Integration: Baldwin Group must leverage advanced climate data and predictive analytics to accurately price risk and develop appropriate insurance solutions for a changing environment.

- Regulatory Adaptation: Evolving environmental regulations and disclosure requirements will necessitate adjustments in how insurance products are designed and marketed.

Opportunity in Green Insurance Products

The intensifying global focus on environmental sustainability creates a significant opportunity for Baldwin Group to innovate with specialized green insurance products. This could involve offering coverage tailored to the burgeoning renewable energy sector, supporting eco-friendly businesses, or designing policies that actively encourage clients to adopt more sustainable practices. Such offerings align directly with growing market demands and can attract a valuable segment of environmentally conscious customers.

This strategic pivot can unlock new market segments for insurance providers like Baldwin Group. By developing and offering specialized insurance products for green industries, renewable energy projects, and businesses demonstrably committed to reducing their environmental footprint, the company can establish a strong competitive advantage. This proactive approach not only differentiates Baldwin Group but also positions it to attract a new and growing client base.

Consider these potential product avenues:

- Renewable Energy Project Insurance: Covering risks associated with solar farms, wind turbines, and other green energy infrastructure.

- Eco-Business Liability: Providing coverage for businesses with verified sustainable operations and supply chains.

- Sustainable Practice Incentives: Offering premium discounts or enhanced coverage for policyholders who achieve specific environmental certifications or reduce their carbon emissions.

- Climate Risk Mitigation Coverage: Developing policies that help businesses adapt to and mitigate the financial impacts of climate change.

The increasing frequency and severity of climate-related events, such as the 28 billion-dollar weather and climate disasters in the US in 2023, directly impact Baldwin Group's underwriting and claims. Rising sea levels and more intense storms make coastal properties riskier, potentially leading to higher premiums or reduced coverage. Similarly, areas prone to wildfires are experiencing escalating insurance costs and limited availability, forcing insurers to adapt their risk models.

Baldwin Group must integrate advanced climate data and predictive analytics to accurately price these evolving risks and develop suitable insurance products. The growing investor and societal focus on ESG factors, with global sustainable investment assets projected to exceed $50 trillion in 2024, means companies are increasingly judged on their sustainability efforts. This trend is also influencing M&A, with a preference for companies demonstrating strong environmental track records.

Regulators, like the NAIC, are also emphasizing climate risk, leading to new reporting requirements and potential adjustments to capital reserves. For instance, the NAIC's Climate Risk Disclosure Survey saw increased participation in 2024. This regulatory push necessitates proactive adaptation in risk assessment and management frameworks.

The company has an opportunity to innovate by offering specialized green insurance products. This includes coverage for renewable energy projects, eco-businesses, and policies incentivizing sustainable practices, aligning with growing market demand for environmentally conscious solutions.

| Environmental Factor | Impact on Baldwin Group | Example Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims from natural disasters, pressure on underwriting profitability, potential for reduced coverage availability in high-risk areas. | US experienced 28 billion-dollar weather/climate disasters in 2023 (NOAA). Global insured losses from natural catastrophes exceeded $100 billion in 2023. |

| Rising Sea Levels & Coastal Erosion | Higher risk for coastal properties, leading to increased premiums and potential uninsurability. | Coastal real estate facing increased vulnerability and higher insurance costs. |

| Wildfire Frequency & Intensity | Escalating insurance costs and reduced coverage in wildfire-prone regions. | Specific regions like parts of California and Australia seeing higher insurance costs and reduced coverage. |

| ESG Focus & Investor Demand | Need for transparent sustainability reporting, integration of ESG into M&A, and potential for new green product lines. | Global sustainable investment assets projected to exceed $50 trillion in 2024. |

| Regulatory Scrutiny on Climate Risk | New reporting requirements, potential capital reserve adjustments, and location-based underwriting guidelines. | NAIC's Climate Risk Disclosure Survey saw increased participation in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government statistics, international financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting your business.