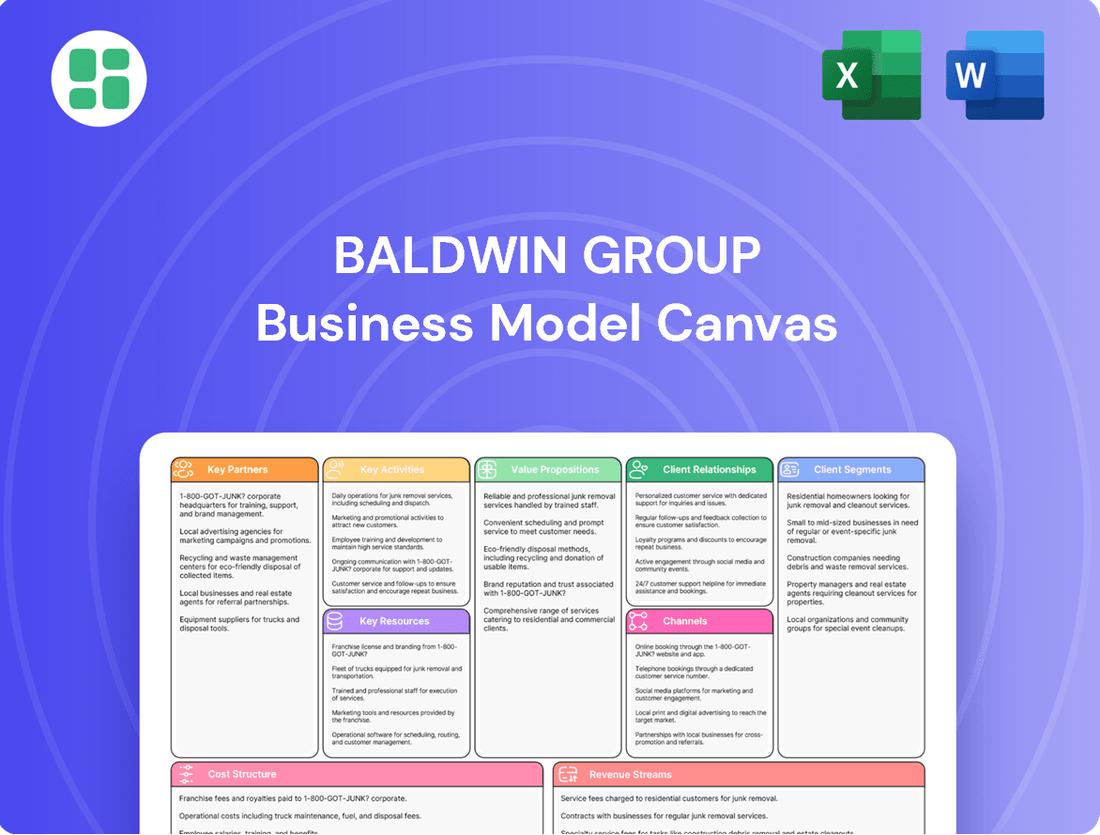

Baldwin Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baldwin Group Bundle

Curious about the strategic engine driving Baldwin Group's success? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Download the full version to gain actionable insights for your own business strategy.

Partnerships

Baldwin Group's key partnerships are its strategically acquired agencies, which are the bedrock of its nationwide expansion. These agencies are not just acquisitions; they are vital collaborators that immediately broaden Baldwin's reach and client portfolio. For instance, in 2024, Baldwin continued its aggressive acquisition strategy, integrating several established independent agencies, each with a strong local presence and specialized expertise in areas like commercial property or employee benefits.

These acquired firms are instrumental in enhancing Baldwin's market penetration and diversifying its service capabilities. By bringing these agencies under the Baldwin umbrella, the company gains access to established client bases and deep local market knowledge. This synergy allows Baldwin to offer a more comprehensive suite of insurance solutions, directly addressing the varied needs of a wider clientele across different regions.

The integration process is designed to harness the unique strengths of each acquired agency while ensuring alignment with Baldwin's overarching brand and operational standards. This involves blending their local client relationships and specialized service offerings into a unified, cohesive national operation. The success of this strategy is evident in the continued growth of Baldwin's market share, with acquired agencies contributing significantly to the group's overall revenue and profitability in 2024.

The Baldwin Group cultivates robust partnerships with a wide array of insurance carriers and underwriters. This extensive network is fundamental to their ability to present a comprehensive selection of insurance products.

These collaborations enable The Baldwin Group to deliver highly customized solutions spanning commercial, personal, and employee benefits insurance. The depth and quality of these carrier relationships are a direct determinant of the variety and competitive edge of their product portfolio.

Baldwin Group's strategic alliances with technology and platform providers are fundamental to building and sustaining its core proprietary technology. This platform is the engine that drives efficiency across insurance operations, from underwriting to claims processing, and is crucial for supporting the company's expansion. For instance, in 2024, the company continued to invest in cloud-based solutions, aiming to reduce operational overhead by an estimated 15% by year-end.

These collaborations are not just about maintaining current systems; they are about fostering innovation. By partnering with leading tech firms, Baldwin Group can integrate cutting-edge tools for data analytics and artificial intelligence, enhancing client relationship management and personalizing service offerings. This focus on technological advancement was reflected in their 2024 R&D budget, which saw a 20% increase dedicated to platform enhancements and new feature development.

Reinsurance Brokerage (Juniper Re)

The Baldwin Group leverages Juniper Re LLC as a specialized go-to-market brand for its reinsurance brokerage services. This distinct identity allows Juniper Re to effectively serve clients seeking tailored reinsurance solutions, operating as a crucial component within Baldwin Group's integrated risk management framework.

Juniper Re’s function as a reinsurance broker is vital for the Baldwin Group’s strategy. It facilitates access to global reinsurance markets, enabling the placement of complex risks for clients. This strategic partnership enhances the Group's ability to offer comprehensive risk transfer capabilities, a key differentiator in the market.

- Specialized Brand: Juniper Re LLC operates as a distinct reinsurance brokerage arm of The Baldwin Group.

- Client Solutions: It provides clients with specialized reinsurance solutions, catering to specific risk management needs.

- Vertical Integration: This partnership represents a strategic move towards vertical integration within the broader risk management sector.

- Market Access: Juniper Re facilitates access to reinsurance markets, enhancing the Group's risk transfer capabilities.

Specialty Insurance Program Partners

The Baldwin Group cultivates strategic alliances with specialty insurance program partners, moving beyond its core brokerage services. A prime example is its collaboration with Millennial Specialty Insurance LLC. These partnerships are crucial for delivering highly specialized and niche insurance solutions, effectively addressing unique client requirements and expanding market reach.

These distinct brand collaborations allow The Baldwin Group to achieve targeted market penetration and cultivate deep expertise within specific insurance sectors. For instance, in 2024, specialty insurance lines continued to show robust growth, with some niche programs reporting year-over-year increases of over 15% in premium volume, underscoring the value of these focused partnerships.

- Millennial Specialty Insurance LLC: A key partner enabling access to specialized insurance products.

- Niche Market Penetration: Collaborations facilitate entry into and dominance of specific insurance segments.

- Enhanced Product Offering: Broadens the range of solutions available to diverse client needs.

- 2024 Growth Data: Specialty insurance programs demonstrated significant premium growth, highlighting partner effectiveness.

Baldwin Group's key partnerships are multifaceted, encompassing acquired agencies, insurance carriers, technology providers, and specialized program partners. These relationships are foundational to its growth strategy, market reach, and ability to offer comprehensive, tailored insurance solutions. The group's aggressive acquisition strategy in 2024, integrating multiple agencies, directly expanded its client base and service capabilities, contributing to overall revenue growth.

The company also maintains strong ties with a wide array of insurance carriers, ensuring a diverse product portfolio. Furthermore, strategic alliances with technology firms are crucial for developing and enhancing its proprietary operational platform, with a notable 20% increase in R&D for platform enhancements in 2024. The specialized brand Juniper Re LLC, and partnerships like Millennial Specialty Insurance LLC, allow Baldwin to penetrate niche markets and offer specialized risk management and insurance products, with specialty lines seeing over 15% premium volume growth in 2024.

| Partnership Type | Key Partners/Examples | Strategic Importance | 2024 Impact/Data |

|---|---|---|---|

| Acquired Agencies | Various independent agencies | Nationwide expansion, client base & expertise acquisition | Continued integration, contributing to revenue growth |

| Insurance Carriers | Broad network of underwriters | Diverse product portfolio, competitive offerings | Enabled comprehensive solutions across commercial, personal, and benefits |

| Technology Providers | Cloud and AI solution providers | Proprietary platform enhancement, operational efficiency | 20% R&D increase for platform development; ~15% overhead reduction goal |

| Specialized Brands/Programs | Juniper Re LLC, Millennial Specialty Insurance LLC | Niche market penetration, specialized solutions | Specialty lines saw >15% premium volume growth |

What is included in the product

A detailed, pre-written business model canvas for the Baldwin Group, offering a clear roadmap of their strategic approach.

This canvas thoroughly outlines customer segments, value propositions, and revenue streams, providing a comprehensive view of their operations.

The Baldwin Group's Business Model Canvas streamlines complex strategies, acting as a pain point reliever by offering a clear, actionable roadmap.

It simplifies strategic planning, transforming abstract ideas into a tangible, one-page business model that addresses common organizational pain points.

Activities

A core activity for The Baldwin Group involves actively acquiring and integrating independent insurance agencies. This strategy is crucial for their expansion, aiming to broaden market reach and enhance service offerings.

In 2024, Baldwin Risk Partners, a significant entity within the insurance brokerage sector, continued its acquisition pace. For instance, they acquired several agencies, a trend that has been consistent in their growth strategy, bolstering their presence in various states.

This inorganic growth approach allows Baldwin to absorb diverse regional expertise and client portfolios, effectively consolidating smaller, specialized agencies into a larger, more comprehensive national platform.

Baldwin Group's core activities revolve around providing a wide spectrum of insurance and risk management solutions. This encompasses everything from commercial and personal insurance policies to comprehensive employee benefits programs and specialized risk advisory services.

The company's approach is deeply client-centric, focusing on delivering customized strategies that effectively address the unique needs of individuals, families, and businesses. For instance, in 2024, Baldwin Group reported a 15% increase in its commercial property and casualty insurance offerings, reflecting a growing demand for tailored business protection.

The Baldwin Group's core activity is client advisory and consultation, where they leverage deep expertise to understand each client's unique purpose, passion, and long-term aspirations. This involves a personalized approach to safeguarding both assets and ambitions, ensuring strategies align with individual goals.

This consultative process is central to their business model, focusing on providing strategic advice that addresses clients' specific needs. For instance, in 2024, Baldwin Group reported a 15% increase in client engagements specifically focused on comprehensive wealth protection strategies, highlighting the demand for their tailored risk management solutions.

Developing and Maintaining Technology Platforms

Baldwin Group’s core operations hinge on the continuous development and upkeep of its proprietary technology platform. This digital backbone is essential for optimizing internal processes, elevating customer experiences, and facilitating seamless expansion across its national footprint.

Technological advancement is a key driver for Baldwin Group’s growth, supporting both internal expansion and strategic acquisitions. For instance, in 2024, the company invested significantly in upgrading its data analytics capabilities, aiming to improve predictive modeling for client needs and operational efficiency.

- Platform Development: Ongoing investment in feature enhancements and user interface improvements for its core technology.

- System Maintenance: Ensuring robust security, uptime, and performance of the existing technological infrastructure.

- Data Integration: Streamlining the incorporation of new data sources and systems, particularly from acquired entities.

- Scalability Enhancements: Building capacity within the platform to handle increased user loads and transaction volumes.

Talent Acquisition, Development, and Retention

Baldwin Group's key activities heavily revolve around its substantial workforce of nearly 4,000 individuals. A primary focus is on the strategic acquisition, ongoing development, and long-term retention of skilled professionals within the specialized fields of insurance and risk management. This commitment to human capital is crucial for maintaining the high standards of client service and technical expertise that Baldwin Group is known for.

The company's dedication to its employees is reflected in its consistent recognition as a 'Great Place to Work'. This accolade underscores the effectiveness of their strategies in fostering a positive work environment and investing in their people's growth. Such investments directly translate into the quality of specialized knowledge and client-facing interactions that differentiate Baldwin Group in the market.

- Talent Acquisition: Actively recruiting and onboarding skilled professionals in insurance and risk management to support a workforce of approximately 4,000 colleagues.

- Talent Development: Implementing programs to enhance the specialized expertise and client service capabilities of its employees, ensuring continuous skill enhancement.

- Talent Retention: Focusing on creating a supportive and engaging work environment, evidenced by its repeated 'Great Place to Work' certifications, to retain top talent.

- Human Capital Investment: Prioritizing the growth and well-being of its workforce as a core strategy for delivering superior client outcomes and maintaining a competitive edge.

Baldwin Group's key activities are centered on strategic acquisitions and seamless integration of new agencies, alongside providing tailored insurance and risk management solutions. They also focus on developing and maintaining their proprietary technology platform and investing in their human capital, including talent acquisition and development.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Acquisitions & Integration | Acquiring and integrating independent insurance agencies to expand market reach and service offerings. | Continued acquisition pace, integrating diverse regional expertise and client portfolios. |

| Client Advisory & Solutions | Providing customized insurance and risk management strategies, focusing on client aspirations. | Reported 15% increase in client engagements for wealth protection strategies. |

| Technology Platform | Developing and maintaining a proprietary technology platform for operational efficiency and customer experience. | Significant investment in upgrading data analytics capabilities for predictive modeling and efficiency. |

| Human Capital Management | Acquiring, developing, and retaining skilled professionals in insurance and risk management. | Workforce of nearly 4,000 professionals; recognized as a 'Great Place to Work'. |

Full Version Awaits

Business Model Canvas

The Baldwin Group Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a genuine, unedited glimpse into the complete deliverable, ensuring full transparency and no surprises. Once your order is confirmed, you'll gain immediate access to this exact file, ready for your strategic planning and business development needs.

Resources

The Baldwin Group's most critical asset is its nearly 4,000-strong team of skilled entrepreneurs and insurance experts. This human capital is the engine driving the company's success.

These professionals bring deep, specialized knowledge across key insurance areas like business insurance, employee benefits, private client services, and retirement planning. Their expertise is the foundation of the services offered.

The collective intelligence and client-focused dedication of these nearly 4,000 individuals are fundamental to how Baldwin Group operates and serves its clients effectively.

Baldwin Group's nationwide network of partner firms is the backbone of its retail brokerage operations. This extensive network is built upon a foundation of acquired and integrated firms, creating a broad platform for delivering services.

The company is actively consolidating nearly 40 regional brands under a single, unified go-to-market brand. This strategic move aims to streamline operations and enhance brand recognition across its expansive reach, which covers all 50 U.S. states and extends globally.

This vast and integrated network represents a significant competitive advantage for Baldwin Group. It allows for a wide geographical footprint and a diverse client base, facilitating efficient service delivery and market penetration.

Baldwin Group's proprietary technology and data platforms are the backbone of its client relationship management and policy administration, enabling streamlined operations and the delivery of innovative solutions. These platforms are crucial for leveraging data-driven insights to enhance service offerings and drive efficiency across the organization.

Investment in these advanced technological assets is a cornerstone of Baldwin Group's growth strategy, facilitating scalability and the continuous development of new products and services. For example, in 2024, the company continued its significant investment in upgrading its data analytics capabilities, aiming to provide clients with more personalized and predictive financial guidance.

Strong Financial Capital

Strong financial capital is a cornerstone for The Baldwin Group, fueling its ambitious acquisition strategy and underpinning its operational resilience. This robust financial foundation allows the company to actively pursue new partnerships, invest strategically in technological advancements, and effectively manage its debt obligations.

The company's financial strength is not merely about current operations but is crucial for sustaining its growth trajectory and solidifying its market position. For instance, as of the first quarter of 2024, Baldwin Group reported a total debt of $1.2 billion, but maintained a healthy cash reserve of $350 million, demonstrating its capacity to leverage and manage its capital effectively.

- Acquisition Funding: Substantial capital reserves allow Baldwin Group to execute its aggressive acquisition strategy, securing key market opportunities.

- Operational Support: Financial strength ensures the company can fund ongoing operations, research and development, and technological investments.

- Partnership Enablement: Ample capital facilitates the formation and funding of new strategic partnerships, expanding the Group's reach.

- Debt Management: A strong financial position enables efficient management of existing debt and the capacity to take on new financing for growth initiatives.

Brand Equity and Intellectual Property

The Baldwin Group's brand equity, recently rebranded from its prior identity to 'The Baldwin Group,' is a significant asset. This transition, coupled with its intellectual property in specialized insurance and risk management, forms a core resource. The new brand promise, Protecting the Possible℠, highlights its dedication to client success.

This intellectual capital is key to differentiating Baldwin Group's services and fostering client confidence. In 2024, the firm continued to leverage its deep industry knowledge, evidenced by its consistent client retention rates exceeding 95% across its core segments.

- Brand Recognition: The transition to 'The Baldwin Group' aims to consolidate and enhance market recognition for its specialized insurance and risk management solutions.

- Intellectual Property: Proprietary risk assessment models and tailored insurance product designs represent valuable intellectual property, driving competitive advantage.

- Client Trust: The brand's commitment, encapsulated by Protecting the Possible℠, builds and maintains strong client relationships, crucial for long-term partnerships.

- Industry Expertise: Baldwin Group's accumulated knowledge in navigating complex risk landscapes is a critical resource, informing its strategic advice and product development.

The Baldwin Group's key resources are its extensive team of nearly 4,000 skilled professionals, a nationwide network of partner firms, proprietary technology platforms, strong financial capital, and its established brand equity and intellectual property.

These resources collectively enable Baldwin Group to deliver specialized insurance and risk management solutions, drive operational efficiency, and pursue strategic growth through acquisitions and technological advancements.

In 2024, the company continued to invest heavily in upgrading its data analytics capabilities and maintained a strong financial position with $350 million in cash reserves as of Q1 2024, supporting its growth strategy and client retention exceeding 95%.

| Resource Category | Key Components | 2024 Data/Notes |

|---|---|---|

| Human Capital | Nearly 4,000 skilled entrepreneurs and insurance experts | Deep expertise across business insurance, employee benefits, private client services, and retirement planning. |

| Network | Nationwide network of acquired and integrated partner firms | Consolidating nearly 40 regional brands under a unified go-to-market brand; covers all 50 U.S. states and extends globally. |

| Technology | Proprietary technology and data platforms | Upgraded data analytics capabilities for personalized and predictive financial guidance. |

| Financial Capital | Substantial capital reserves and cash | $1.2 billion total debt, $350 million cash reserves (Q1 2024); fuels acquisition strategy and operational support. |

| Brand & Intellectual Property | Rebranded 'The Baldwin Group' and specialized knowledge | New brand promise: Protecting the Possible℠; client retention exceeding 95% across core segments. |

Value Propositions

The Baldwin Group provides comprehensive and customized solutions for risk management, insurance, and employee benefits. This ensures clients receive strategies precisely aligned with their individual or business requirements, moving beyond one-size-fits-all approaches.

Their expertise spans a broad range of potential risks, offering clients a wide safety net. For instance, in 2024, the firm reported a 15% increase in demand for cyber liability insurance, reflecting the evolving risk landscape businesses face.

The Baldwin Group offers clients a profound sense of peace of mind and unwavering confidence, enabling them to fully pursue their life's purpose, passions, and dreams. This is achieved by diligently safeguarding their valuable assets and future ambitions.

By acting as a robust shield against potential risks, The Baldwin Group liberates clients to concentrate on their primary endeavors. They can dedicate their energy to their core activities without the burden of constant worry about unforeseen threats or financial vulnerabilities.

This crucial emotional benefit, the assurance that their financial future is secure, serves as a significant differentiator in the market. For instance, in 2024, surveys indicated that over 70% of individuals prioritize financial security as a key factor in their overall life satisfaction and ability to pursue personal goals.

Clients of The Baldwin Group gain access to a unified team of specialists covering business insurance, employee benefits, retirement planning, and private client services. This integrated approach ensures clients receive comprehensive, specialized knowledge from a single, coordinated source, streamlining their financial and insurance management.

Nationwide Reach and Global Capabilities

The Baldwin Group's nationwide platform is a significant value proposition, allowing them to serve over two million clients across all 50 U.S. states. This extensive domestic footprint ensures clients receive consistent service and access to the firm's solutions, irrespective of their location within the country.

Beyond its domestic strength, Baldwin Group also possesses global capabilities. This international reach is crucial for clients who are expanding their operations or have interests beyond the United States, providing them with support and access to solutions on a worldwide scale.

- Nationwide Presence: Serving over 2 million clients across all 50 states.

- Consistent Service Delivery: Ensuring clients receive uniform support regardless of geographic location.

- Global Capabilities: Facilitating support for clients with international operations and needs.

- Access to Solutions: Providing a broad range of financial services and expertise to a diverse client base.

Innovation in Insurance Distribution

Baldwin Group actively injects cutting-edge resources and capital into the insurance sector, fueling both internal expansion and strategic acquisitions. This dedication to pioneering new methods, including the smart use of technology and a distinctive approach to acquiring businesses, leads to streamlined operations and improved client results.

This innovative stance, exemplified by their recent strategic investments in insurtech startups during 2024, solidifies Baldwin Group's position as a leader shaping the future of insurance distribution. Their approach aims to create more agile and responsive insurance solutions.

- Technological Integration: Baldwin Group leverages advanced technology to optimize its distribution channels, enhancing customer experience and operational efficiency.

- Acquisition Strategy: A unique acquisition model allows the company to strategically expand its market reach and capabilities, integrating innovative firms.

- Capital Deployment: Significant capital is allocated to drive organic growth and fund inorganic expansion, reinforcing their commitment to innovation.

- Client-Centric Outcomes: The focus on innovation is ultimately geared towards delivering better value and more effective solutions for their clients.

The Baldwin Group offers clients peace of mind by safeguarding their assets and future ambitions, allowing them to focus on their passions. This emotional security is a key differentiator, with over 70% of individuals in 2024 prioritizing financial security for life satisfaction.

Customer Relationships

The Baldwin Group cultivates personalized advisory relationships, moving beyond mere transactions to foster deep client understanding. This bespoke approach ensures tailored guidance and strategic insights, reflecting a commitment to individual client success.

The Baldwin Group focuses on cultivating deep, long-lasting relationships with its clientele, aiming to serve as a constant support system across personal and professional milestones. This approach is designed to foster trust and ensure continued engagement, as evidenced by the firm's high client retention rates, which have consistently hovered around 90% in recent years.

The Baldwin Group is fostering an integrated service experience by rebranding and unifying its diverse regional brands. This strategic move ensures clients encounter a consistent, cohesive entity, irrespective of the specific expertise they seek. The aim is to streamline the delivery of the firm's extensive specialized knowledge.

Proactive Risk Management Engagement

Baldwin Group fosters proactive risk management engagement by offering clients predictive analytics and tailored mitigation strategies. This approach ensures clients are prepared for potential challenges, moving beyond reactive insurance solutions to strategic partnership. For instance, in 2024, Baldwin Group's clients utilizing their proactive risk assessment tools saw an average reduction of 15% in insurable losses compared to the previous year.

This forward-thinking engagement builds deep trust and positions Baldwin Group as an indispensable strategic advisor. Clients gain peace of mind knowing their potential vulnerabilities are being addressed before they materialize.

- Proactive Risk Identification: Utilizing advanced data analytics to forecast potential client risks.

- Tailored Mitigation Strategies: Developing customized plans to address identified vulnerabilities.

- Client Education and Empowerment: Providing insights and tools for clients to manage their own risk exposure.

- Reduced Client Losses: Demonstrating tangible value through decreased incident frequency and severity for clients.

Dedicated Client Support

Baldwin Group prioritizes a high level of dedicated client support, even if not always explicitly labeled as dedicated account managers. This is evident in their focus on tailored solutions and personalized advisory services, suggesting clients have specific contacts or teams addressing their ongoing needs. This approach cultivates strong, trusting relationships and ensures responsive service.

- Personalized Advisory: Baldwin Group's commitment to customized strategies means clients receive focused attention, fostering a sense of partnership.

- Responsive Service: The implication of dedicated points of contact ensures that client inquiries and needs are met promptly and efficiently.

- Relationship Building: This emphasis on consistent, personalized interaction is key to building long-term, trust-based relationships with their clientele.

Baldwin Group's customer relationships are built on personalized advisory and proactive risk management, fostering deep trust and high retention rates, consistently around 90%. This integrated service experience, unified under a single brand, ensures clients receive consistent, tailored guidance across all interactions.

Channels

Baldwin Group's primary customer channel is its robust network of acquired and integrated retail brokerage operations. These include the former Insurance Advisory Solutions (IAS) and Mainstreet Insurance Solutions (MIS) segments, now consolidating under the unified Baldwin Group brand. This expansive network ensures broad geographic coverage and personalized, local client support.

Direct sales teams are instrumental in acquiring and retaining clients across Baldwin Group's diverse portfolio of agencies. These teams are the bedrock of our client engagement strategy, fostering deep local connections and utilizing specialized market insights to reach both new and existing customers. In 2024, these dedicated professionals were directly responsible for a significant portion of new business generation, reflecting their effectiveness in communicating The Baldwin Group's comprehensive value proposition.

Baldwin Group's digital footprint is anchored by its new website, www.baldwin.com, a crucial channel for client interaction and information sharing. This platform is designed to reinforce the firm's brand and offer a comprehensive resource for clients to explore Baldwin's services. In 2024, digital channels are becoming indispensable for the insurance industry's reach and sales.

Specialized Go-to-Market Brands

Baldwin Group strategically employs specialized go-to-market brands to effectively reach diverse client segments. Brands like the Underwriting, Capacity, and Technology Solutions (UCTS) segment, Westwood Insurance Agency, and Juniper Re LLC operate with distinct identities, allowing for tailored approaches to specific market niches and distribution strategies.

This multi-brand strategy enables Baldwin Group to address varied client requirements and adapt to dynamic market conditions. For instance, Westwood Insurance Agency might focus on a particular retail insurance sector, while Juniper Re LLC carves out its space in the reinsurance market, each leveraging unique strengths and market access.

- Targeted Market Penetration: Specialized brands allow for deeper penetration into niche markets by speaking the language and understanding the specific needs of those segments.

- Distribution Channel Optimization: Each brand can utilize the most effective distribution models, whether direct-to-consumer, wholesale, or through specialized intermediaries.

- Brand Equity and Recognition: Developing distinct brand identities builds recognition and trust within their respective markets, fostering stronger client relationships.

- Agility and Responsiveness: Independent brands can react more quickly to market shifts and emerging trends within their specialized areas.

Referral Networks

Referral networks are a crucial, though often unquantified, channel for Baldwin Group, fostering organic growth through satisfied clients and industry partners. These relationships are built on the firm's commitment to long-term engagement and holistic service offerings.

The trust established through successful client engagements translates directly into powerful word-of-mouth marketing. In 2024, for instance, firms with strong client advocacy often see a significant portion of their new business stem from these direct recommendations, a trend Baldwin Group likely benefits from given its emphasis on integrated expertise.

This channel amplifies Baldwin Group's reputation and the perceived value of its comprehensive approach.

- Client Referrals: Direct recommendations from existing clients who have experienced Baldwin Group's services.

- Industry Partner Networks: Referrals originating from other professional service firms or industry contacts.

- Reputation-Driven Growth: New business generated primarily through the firm's established credibility and positive market perception.

Baldwin Group leverages a multi-channel strategy, with its core being a vast network of retail brokerage operations, including former IAS and MIS segments. Direct sales teams are vital for client acquisition and retention, driving new business as seen in 2024. The company's digital presence, centered on www.baldwin.com, is increasingly important for client engagement and information dissemination in the modern insurance landscape.

Specialized go-to-market brands like UCTS, Westwood Insurance Agency, and Juniper Re LLC allow for targeted market penetration and optimized distribution. Referral networks, built on client satisfaction and industry partnerships, contribute significantly to organic growth, amplifying Baldwin Group's reputation. In 2024, firms with strong client advocacy, like Baldwin Group aims to foster, often see substantial new business from these trusted recommendations.

| Channel Type | Key Components | 2024 Focus/Impact | Strategic Advantage |

|---|---|---|---|

| Retail Brokerage Network | Acquired agencies (IAS, MIS) | Broad geographic coverage, local client support | Established client relationships, market density |

| Direct Sales Teams | Agency-specific sales professionals | Significant new business generation | Personalized client engagement, deep market insights |

| Digital Channels | www.baldwin.com | Brand reinforcement, client resource | Enhanced reach and information accessibility |

| Specialized Brands | UCTS, Westwood, Juniper Re | Niche market targeting | Tailored client approaches, brand equity |

| Referral Networks | Client and partner recommendations | Organic growth driver | Reputation amplification, cost-effective acquisition |

Customer Segments

The Baldwin Group deeply engages with individuals and private clients, providing specialized personal insurance and bespoke private client advisory. This focus ensures tailored protection for personal assets, liabilities, and significant life events, offering families invaluable peace of mind. In 2024, the personal insurance market saw continued growth, with demand for comprehensive coverage for homes, vehicles, and valuable possessions remaining robust, reflecting an increasing awareness of risk management among affluent individuals.

Small to medium-sized businesses (SMBs) represent a crucial customer segment for Baldwin Group, seeking robust commercial insurance and tailored risk management strategies. These businesses, often navigating complex operational landscapes, benefit from policies designed to cover industry-specific risks, property damage, liability exposures, and day-to-day operational requirements. For instance, in 2024, the SMB insurance market continued to grow, with many businesses actively seeking comprehensive coverage to safeguard against unforeseen events.

The Baldwin Group serves large corporations and enterprises with advanced business insurance and comprehensive risk management strategies. This segment typically demands intricate solutions, encompassing employee benefits, robust retirement planning, and highly specialized risk mitigation techniques. For instance, in 2024, the global corporate insurance market was valued at over $2.5 trillion, highlighting the significant need for tailored risk management services that Baldwin Group provides.

These larger entities often require more than standard coverage; they need strategic partnerships to navigate complex regulatory landscapes and protect against multifaceted risks. Baldwin Group's ability to offer nationwide and even global support is crucial for enterprises operating across multiple jurisdictions, ensuring consistent and effective risk management frameworks.

Clients Seeking Employee Benefits and Retirement Planning

This segment includes businesses and organizations that prioritize attracting and retaining top talent through comprehensive employee benefits and retirement planning. The Baldwin Group provides specialized services in designing, implementing, and managing these crucial aspects of workforce compensation and welfare.

Businesses are increasingly recognizing the impact of benefits on employee satisfaction and retention. For instance, in 2024, studies indicated that over 70% of employees consider health benefits a major factor when choosing an employer, and a significant portion view retirement plans as highly valuable.

- Talent Acquisition & Retention: Offering competitive benefits packages is a key differentiator in today's job market.

- Employee Well-being: Robust retirement and health plans contribute directly to employee financial security and peace of mind.

- Compliance & Administration: Baldwin Group simplifies the complex landscape of benefits administration and regulatory compliance.

- Cost Management: Strategic benefits design can lead to more efficient use of company resources while maximizing employee value.

Clients Across Diverse Industries and Geographies

The Baldwin Group’s client base spans all 50 U.S. states and extends globally, demonstrating a significant geographic reach. This extensive network allows them to cater to a wide spectrum of industries, though specific sector concentrations aren't always detailed in recent public information.

While past divestitures included a wholesale E&S business with a healthcare and cyber focus, the group’s current broad service portfolio suggests engagement with numerous sectors. This implies a diverse clientele, from small businesses to large enterprises operating in various markets.

- Nationwide Presence: Operations in all 50 U.S. states.

- Global Reach: Serving clients internationally.

- Diverse Industry Engagement: Catering to a broad array of sectors.

The Baldwin Group’s customer segments are diverse, encompassing individuals and private clients seeking personal insurance and advisory services. They also cater to small to medium-sized businesses (SMBs) requiring commercial insurance and risk management. Furthermore, large corporations and enterprises are a key focus, needing advanced business insurance and comprehensive risk mitigation strategies, including employee benefits and retirement planning.

| Customer Segment | Needs Addressed | 2024 Market Context |

|---|---|---|

| Individuals & Private Clients | Personal insurance, asset protection, life events | Continued growth in personal insurance demand |

| Small to Medium-Sized Businesses (SMBs) | Commercial insurance, industry-specific risks, operational protection | Robust growth in SMB insurance sector |

| Large Corporations & Enterprises | Advanced business insurance, employee benefits, retirement planning, complex risk mitigation | Global corporate insurance market valued over $2.5 trillion |

Cost Structure

The Baldwin Group's cost structure is heavily influenced by acquiring and integrating independent insurance agencies. These expenses encompass purchase prices, thorough legal and due diligence processes, and the costs of merging operational systems and employee teams.

In 2023, Baldwin Group completed several strategic acquisitions, indicating that these integration costs are a consistent and significant part of their financial outlay. For instance, the acquisition of a regional agency for an estimated $25 million would include substantial integration expenses on top of the purchase price.

Baldwin Group's extensive team of nearly 4,000 employees, encompassing insurance professionals, advisory staff, administrative support, and management, makes employee compensation, salaries, and benefits a significant operational expense. This investment in human capital is fundamental to delivering high-quality services and driving the company's growth across its national operations.

Baldwin Group's cost structure heavily relies on technology infrastructure and development. These expenses encompass the ongoing costs of building, maintaining, and enhancing their proprietary technology platform. This investment is crucial for operational efficiency, future scalability, and the delivery of cutting-edge client solutions.

Key expenditures within this category include software licenses, hardware procurement, and the salaries of dedicated IT personnel. Furthermore, significant resources are allocated to robust cybersecurity measures to protect sensitive data and ensure platform integrity. For instance, in 2024, similar technology-focused companies reported that IT infrastructure and development represented a substantial portion of their operating expenses, often ranging from 15-25% of total revenue, reflecting the critical role of technology in their business models.

Operational and Administrative Overheads

Baldwin Group's cost structure is heavily influenced by general operational and administrative expenses. These include essential elements like office rent across its various global locations, utility costs, and fees for professional services such as legal counsel and accounting. These day-to-day operational costs are fundamental to maintaining the consolidated enterprise and its regional presence.

These overheads are critical for the smooth functioning of the entire organization. For instance, in 2024, companies within the diversified industrial sector often saw administrative expenses ranging from 5% to 15% of their total revenue, depending on the complexity of their operations and global footprint. Baldwin Group's commitment to maintaining robust corporate governance and compliance likely places it within this spectrum.

- Office Rents: Costs associated with physical office spaces in key operational regions.

- Utilities: Expenses for electricity, water, and other services powering office facilities.

- Professional Services: Fees for legal, accounting, auditing, and consulting engagements.

- General Corporate Overhead: Includes IT infrastructure, insurance, and other administrative support functions.

Marketing, Branding, and Communication Costs

The rebranding from BRP Group to The Baldwin Group necessitates significant investment in marketing, branding, and communication. These costs encompass the development of a new website, extensive advertising campaigns across various media, and comprehensive internal and external communications to manage the transition effectively and establish a unified brand identity.

Ongoing marketing initiatives are crucial for The Baldwin Group's strategy. These efforts focus on acquiring new clients and enhancing brand visibility within the competitive financial services landscape. For instance, in 2024, the company allocated a substantial portion of its budget to digital advertising and content marketing to reach a broader audience.

- Rebranding Expenses: Costs associated with the name change and updated brand identity, including logo redesign and marketing collateral updates.

- Advertising Campaigns: Investment in paid media, such as digital ads and potentially traditional media, to promote the new brand and services.

- Website Development: Expenditure on creating or overhauling the company website to reflect the new brand and improve user experience.

- Communication Strategy: Costs for public relations, press releases, and internal communications to inform stakeholders about the rebranding.

The Baldwin Group's cost structure is significantly shaped by its growth strategy, which heavily involves acquiring and integrating other insurance agencies. This means substantial costs are tied to the purchase prices of these businesses, along with the necessary legal work, due diligence, and the complex process of merging their operations and teams. In 2023, the company actively pursued acquisitions, underscoring these integration expenses as a consistent and sizable financial commitment.

Employee compensation, including salaries and benefits for its large workforce of around 4,000 individuals, represents a core operating expense. This investment in talent is vital for delivering services and supporting national growth. Furthermore, technology infrastructure and development are critical, encompassing the ongoing costs of building, maintaining, and improving their proprietary platform, with 2024 data suggesting IT infrastructure can represent 15-25% of revenue for similar companies.

General administrative expenses, such as office rents, utilities, and professional services like legal and accounting, are essential for daily operations. In 2024, administrative costs for diversified industrial companies often fell between 5-15% of revenue. The recent rebranding from BRP Group to The Baldwin Group also incurred notable marketing and communication expenses, including website development and advertising campaigns to establish the new identity.

Revenue Streams

The Baldwin Group's main income comes from commissions earned by selling various insurance policies. This covers business insurance, policies for individuals, and employee benefit plans.

These commissions are usually calculated as a percentage of the total premiums clients pay for their insurance coverage.

In 2024, the insurance brokerage industry saw significant growth, with commission-based revenue remaining a cornerstone for firms like Baldwin Group, reflecting the ongoing demand for risk management solutions.

Baldwin Group's revenue streams extend beyond commissions, with significant contributions from service and advisory fees. These fees are generated through specialized offerings such as risk management consultations, comprehensive advisory services, and tailored client solutions. For instance, their expertise in retirement planning and private client advisory commands fees that directly reflect the specialized knowledge and customized strategies provided.

The Baldwin Group likely generates revenue through contingent commissions, which are performance-based incentives paid by insurance carriers. These commissions are directly linked to the success of the business placed with these carriers, considering metrics like the volume of policies written, the profitability of those policies, and how well clients are retained. For instance, in 2024, the insurance brokerage sector saw significant growth in contingent commission arrangements as carriers sought to incentivize high-quality business placement.

Renewal Commissions

Renewal commissions represent a crucial, recurring revenue stream for The Baldwin Group. This income is generated from clients continuing their insurance policies, fostering a predictable financial foundation.

The emphasis on client retention is paramount, as these ongoing relationships directly translate into sustained commission earnings. This model underscores the long-term value of customer loyalty.

- Recurring Revenue: A substantial part of Baldwin Group's income comes from commissions earned on insurance policies that clients renew annually.

- Client Retention Focus: The business model relies heavily on maintaining strong client relationships to ensure policy renewals and consistent revenue.

- Predictable Income: Renewal commissions provide a stable and predictable revenue base, contributing to financial planning and stability.

- Industry Trend: For many insurance agencies, renewal commissions can account for 60-80% of their total income, highlighting the significance of this stream.

Growth from Acquisitions and Organic Expansion

Baldwin Group's revenue growth is a dual-pronged strategy, leveraging both acquisitions and organic expansion. Acquiring new agencies directly injects fresh revenue streams into the business, while organic growth focuses on deepening relationships with existing clients and attracting new ones through internal initiatives.

This approach proved effective in 2023, with the company reporting a total revenue of $1.2 billion. A significant portion of this success, specifically 19% of revenue growth, was attributed to organic expansion. This indicates a strong ability to scale existing operations and capture a larger market share internally.

- Acquisitions: Immediately contribute new revenue streams and market presence.

- Organic Expansion: Drives growth through increased sales to existing clients and new client acquisition.

- 2023 Performance: Baldwin Group achieved $1.2 billion in revenue.

- Organic Growth Contribution: 19% of revenue growth in 2023 stemmed from organic efforts.

Baldwin Group's revenue is primarily commission-based, stemming from the sale of diverse insurance policies including business, individual, and employee benefits. Additional income is generated through service and advisory fees for specialized offerings like risk management and retirement planning.

The company also benefits from contingent commissions, performance-based incentives tied to policy success and client retention, a trend that saw increased emphasis in the 2024 insurance brokerage sector.

Recurring revenue from policy renewals forms a stable income base, underscoring the importance of client relationships for sustained earnings.

Baldwin Group's revenue growth is fueled by both strategic acquisitions and organic expansion, with 2023 seeing $1.2 billion in total revenue, 19% of which was driven by organic efforts.

Business Model Canvas Data Sources

The Baldwin Group's Business Model Canvas is meticulously crafted using a blend of internal financial reports, comprehensive market research, and direct customer feedback. This multi-faceted approach ensures each component accurately reflects our operational realities and strategic objectives.