Baldwin Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baldwin Group Bundle

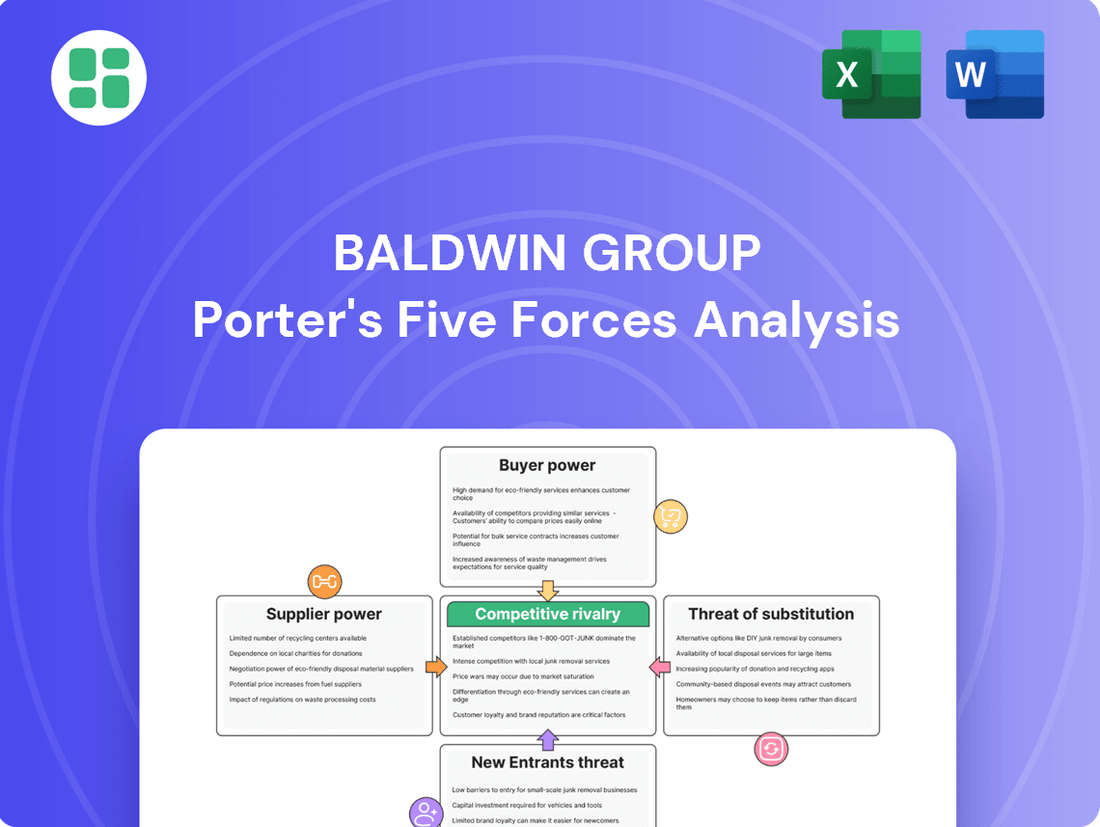

Baldwin Group operates within a dynamic industry where understanding the competitive landscape is paramount. Our Porter's Five Forces analysis reveals the intricate interplay of buyer power, supplier leverage, threat of new entrants, availability of substitutes, and the intensity of rivalry. This foundational insight is crucial for any strategic decision.

The complete report reveals the real forces shaping Baldwin Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Baldwin Group operates within an insurance brokerage landscape characterized by a vast number of providers. This sheer volume, with over 5,900 insurance companies operating in the U.S. market as of 2023, significantly dilutes the bargaining power of any individual insurer. Brokers like Baldwin can leverage this extensive supplier base to negotiate favorable terms and access a wide array of products, thereby reducing dependency on any single carrier.

The Baldwin Group, a major player in the insurance brokerage market, strategically partners with select insurance carriers. These key partnerships often grant access to exclusive products, more competitive rates, and specialized programs, which can be a significant draw for clients.

If The Baldwin Group develops a substantial reliance on a particular carrier's offerings, that carrier's bargaining power increases. This dependency could manifest if a large segment of The Baldwin Group's product catalog is sourced from a single provider, potentially influencing commission structures or contractual terms.

The Baldwin Group's growth hinges on acquiring independent insurance agencies and retaining their talent. The M&A landscape for these agencies, though seeing some cooling in 2024, remains robust for well-aligned targets. This competitive environment, with average deal multiples for smaller agencies sometimes exceeding 7x EBITDA in early 2024, empowers selling agencies and their key personnel with considerable bargaining power.

This leverage translates directly into higher acquisition costs and more favorable terms for sellers. Agencies with strong client bases, specialized expertise, or highly sought-after talent can command premium valuations, directly impacting Baldwin's integration expenses and the overall cost of its growth strategy.

Technology and Data Providers

The insurance sector's growing dependence on sophisticated technologies, including AI, data analytics, and cloud infrastructure, significantly elevates the bargaining power of specialized insurtech firms and IT service providers. Baldwin Group's requirement for advanced tools to enhance operational efficiency, refine underwriting processes, and improve customer interaction positions these technology suppliers with considerable leverage, especially when offering unique or deeply integrated solutions.

In 2024, the global insurtech market was valued at approximately $5.7 billion and is projected to grow substantially, highlighting the critical role these technology providers play. Companies like Baldwin Group that are slow to integrate these advancements risk falling behind competitors who leverage them for a distinct market advantage.

- Increased Reliance on Specialized Software: Baldwin Group's operational efficiency is directly tied to the performance of its technology partners, granting these suppliers significant influence.

- Proprietary Technology Advantage: Suppliers offering unique AI algorithms or data analytics platforms that are difficult to replicate can command higher prices and more favorable terms.

- Industry-Wide Digital Transformation: The broader trend of digital transformation across the insurance industry means fewer alternatives for essential, cutting-edge technological solutions, consolidating supplier power.

- Data Security and Integration Costs: The complexity and cost associated with integrating new technologies and ensuring data security can further strengthen the position of established, trusted technology vendors.

Reinsurance Market Dynamics

The bargaining power of suppliers, specifically reinsurers, significantly influences the operations of Managing General Agents (MGAs) like Juniper Re, a part of The Baldwin Group. The availability and cost of reinsurance capacity directly affect an MGA's underwriting profitability and its ability to provide specialized insurance products.

Despite a generally robust performance in the global reinsurance market throughout 2024, factors such as increasing catastrophe losses and evolving risk landscapes can empower reinsurers. This can lead to higher pricing or more restrictive terms for MGAs, impacting their business models. For instance, reinsurers might demand higher premiums or impose stricter coverage limitations if they perceive increased volatility or specific risk concentrations in the MGA's portfolio.

- Reinsurer Capacity: The overall capacity available in the reinsurance market is a key determinant of supplier power. Limited capacity typically translates to higher prices.

- Market Conditions: Periods of high insured losses or economic uncertainty can strengthen the bargaining position of reinsurers.

- Pricing Power: Reinsurers can leverage their market position to dictate pricing, which directly impacts the MGA's cost of doing business.

- Specialized Risk Demand: For MGAs underwriting highly specialized or niche risks, the pool of reinsurers willing and able to offer coverage might be smaller, increasing supplier leverage.

The bargaining power of suppliers for The Baldwin Group is generally moderate, influenced by the fragmented nature of the insurance carrier market and the strategic partnerships Baldwin cultivates. However, the growing reliance on specialized technology and the consolidation within certain niche insurance sectors can elevate supplier leverage.

The increasing demand for advanced insurtech solutions, valued at approximately $5.7 billion globally in 2024, grants significant power to technology providers. Similarly, the M&A environment for independent agencies, with deal multiples sometimes exceeding 7x EBITDA in early 2024, empowers selling agencies and their key personnel.

Reinsurers also hold considerable sway, especially for Managing General Agents like Juniper Re, as the availability and cost of reinsurance capacity directly impact underwriting profitability. Market conditions, such as increased catastrophe losses observed in 2024, can further strengthen reinsurers' pricing power.

| Supplier Type | Key Influencing Factors | Impact on Baldwin Group |

|---|---|---|

| Insurance Carriers | Large number of providers, strategic partnerships | Generally low to moderate; ability to negotiate favorable terms. |

| Technology Providers (Insurtech) | Proprietary technology, industry-wide digital transformation | Increasingly high; critical for operational efficiency and competitive advantage. |

| Acquired Agencies/Talent | M&A market conditions, agency specialization | High; influences acquisition costs and integration expenses. |

| Reinsurers | Reinsurer capacity, market conditions, specialized risk demand | Significant for MGAs; affects pricing, coverage terms, and profitability. |

What is included in the product

This analysis meticulously examines the five forces impacting Baldwin Group's industry, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, Baldwin Group's strategic positioning.

Baldwin Group's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, transforming complex market dynamics into manageable strategic insights.

Customers Bargaining Power

The proliferation of digital platforms and online comparison tools has dramatically shifted power towards insurance consumers. Customers can now effortlessly research, compare, and even purchase policies directly, making it simpler than ever to find the most advantageous terms and pricing. This heightened transparency forces intermediaries like The Baldwin Group to sharpen their competitive edge through aggressive pricing and enhanced service offerings.

Customers, both businesses and individuals, are increasingly demanding insurance solutions that are specifically designed for their unique needs, along with expert advice on managing their risks. This trend means clients expect more than just basic policy coverage; they want a personalized approach to their financial security.

For The Baldwin Group, this presents a chance to shine with its comprehensive strategy, but it also raises the bar for customization and the overall quality of service expected. Meeting these specific client requirements is crucial, as failing to do so can result in customers seeking alternatives, impacting retention rates.

Ongoing economic uncertainty and inflation have significantly increased customer price sensitivity in the insurance and brokerage sectors. For The Baldwin Group, this means clients are scrutinizing premiums and fees more closely, potentially leading to a demand for lower costs. For instance, in late 2023 and into 2024, many consumers reported actively searching for cheaper insurance alternatives due to rising household expenses.

This heightened sensitivity pressures brokers like The Baldwin Group to prove their value proposition or risk accepting slimmer profit margins to retain business. Customers might consolidate policies or opt for less comprehensive coverage to manage their budgets effectively, a trend observed in early 2024 consumer spending reports.

Low Switching Costs for Many Products

For many standard insurance products, customers face minimal hurdles when switching providers, particularly with the rise of online comparison tools and direct purchasing channels. This ease of switching significantly amplifies the bargaining power of customers, compelling The Baldwin Group to prioritize exceptional service and competitive value to foster client retention.

The threat of customers migrating to alternative insurers or opting for direct channels remains a persistent factor. In 2024, the insurance industry saw a notable increase in digital adoption, with an estimated 60% of new policy purchases initiated online, underscoring the importance of a seamless digital customer experience for companies like The Baldwin Group.

- Low Switching Costs: Customers can easily compare and move between insurance providers without incurring substantial penalties or complex processes.

- Digital Accessibility: Online platforms and direct-to-consumer models have reduced the reliance on traditional intermediaries, empowering customers with more choices.

- Price Sensitivity: With readily available price comparisons, customers are often more inclined to switch for better rates, putting pressure on providers to remain competitive.

- Customer Loyalty: The Baldwin Group must actively cultivate loyalty through superior service and tailored offerings to mitigate the impact of low switching costs.

Client Size and Sophistication

The bargaining power of customers for Baldwin Group is notably influenced by their size and sophistication. Larger, more complex clients, such as multinational corporations, often wield significant power. This is due to their substantial purchase volumes and their capacity to request highly specialized services, which can drive down prices or necessitate tailored solutions.

Baldwin Group serves a broad client base, ranging from individual investors to major global enterprises. This diversity means the group encounters a wide spectrum of customer bargaining power. For instance, a large institutional client might negotiate more aggressively on fees than a smaller retail investor.

In 2024, the financial services sector saw continued pressure on fees. For example, average asset management fees for large institutional mandates in North America hovered around 0.35%, a figure that sophisticated clients can leverage in negotiations. This highlights how client sophistication directly impacts pricing power.

- Client Size: Larger clients, like institutional investors, command greater bargaining power due to higher transaction volumes.

- Client Sophistication: Clients with a deep understanding of financial markets and services can negotiate more effectively for better terms.

- Service Customization: The demand for bespoke financial solutions by sophisticated clients can increase their leverage.

- Baldwin Group's Reach: Serving both individual and corporate clients exposes Baldwin Group to a wide range of customer power dynamics.

The bargaining power of customers for The Baldwin Group is amplified by the ease with which they can switch providers, a trend accelerated by digital platforms. In 2024, an estimated 60% of new insurance policy purchases began online, demonstrating how readily available comparison tools and direct purchasing channels empower consumers. This low switching cost means clients can easily seek better rates or service elsewhere, forcing Baldwin Group to focus on value and retention.

Customers, especially larger and more sophisticated ones, exert considerable influence through their purchasing volume and demand for tailored services. For instance, in 2024, average asset management fees for large institutional clients in North America were around 0.35%, a benchmark sophisticated clients use in negotiations. This client sophistication directly translates into greater leverage for better terms and pricing.

| Factor | Impact on Baldwin Group | 2024 Data Point |

| Digital Accessibility & Price Sensitivity | Increased customer ability to compare and switch for better rates. | ~60% of new insurance policies initiated online in 2024. |

| Client Sophistication & Size | Larger clients negotiate harder on fees and demand customized solutions. | North American institutional asset management fees averaged ~0.35% in 2024. |

| Low Switching Costs | Customers can easily move to competitors, pressuring Baldwin Group on service and value. | Minimal barriers to switching providers observed across the insurance sector. |

Same Document Delivered

Baldwin Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of the Baldwin Group, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering no surprises and providing immediate value for your strategic planning.

Rivalry Among Competitors

The U.S. insurance brokerage sector is a complex landscape, marked by persistent fragmentation yet experiencing a significant surge in consolidation. This trend is fueled by robust merger and acquisition (M&A) activity, reshaping the competitive arena.

Baldwin Group navigates a market populated by a vast array of competitors, ranging from multinational behemoths to specialized local agencies, all vying for dominance. This intense rivalry is a constant, propelled by both efforts to expand organically and strategic M&A plays.

In 2023 alone, the insurance brokerage sector saw over 200 M&A deals, a testament to the ongoing consolidation. This environment necessitates continuous adaptation and strategic maneuvering for firms like Baldwin Group to maintain and grow their market standing amidst fierce competition.

The Baldwin Group actively pursues aggressive merger and acquisition (M&A) strategies, a core element of its business model focused on acquiring and integrating insurance agencies. This positions Baldwin directly against other prominent acquisitive brokers such as Marsh McLennan, Arthur J. Gallagher, Acrisure, and Hub International, all vying for market share through similar expansion tactics.

While the M&A landscape saw a moderation in 2024, industry analysts anticipate a significant resurgence in acquisition activity by 2025. This projected increase in deal-making will undoubtedly intensify competition for attractive acquisition targets, inevitably driving up valuations for desirable insurance agencies and further straining Baldwin's M&A resources.

The competitive rivalry within the financial services sector is intensifying, significantly driven by the ongoing digital transformation and innovation race. Companies are heavily investing in technologies like artificial intelligence, advanced analytics, and automation to streamline operations and elevate customer experiences. For instance, in 2024, the global financial technology market was projected to reach over $3.5 trillion, highlighting the massive investment in digital capabilities.

Brokers are actively competing on their technological prowess, aiming to offer more efficient services and novel products. This technological arms race means that firms like The Baldwin Group must consistently allocate capital towards upgrading their systems and adopting new digital tools. Failure to do so risks falling behind against both established, tech-forward competitors and agile insurtech startups that are rapidly gaining market share by leveraging innovative digital solutions.

Competition for Talent

The insurance industry, like many others, faces intense competition for skilled professionals, especially as the workforce ages. This creates a significant challenge for companies like The Baldwin Group. The demand for experienced producers and specialized experts remains high, driving up the cost and difficulty of acquiring and retaining top talent.

Companies must go beyond just offering competitive salaries. They need to cultivate attractive company cultures, provide robust resources, and offer clear pathways for career development. This holistic approach is vital for attracting and keeping the best people, which directly impacts growth and the quality of services provided. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 4% job growth for insurance underwriters between 2022 and 2032, indicating continued demand.

- Aging Workforce: A significant portion of the insurance sector's experienced workforce is nearing retirement, creating knowledge gaps and increasing the need for new talent.

- Demand for Specialists: There's a pronounced need for skilled producers, actuaries, data analysts, and cybersecurity experts within insurance firms.

- Beyond Compensation: Attracting talent requires offering appealing work environments, professional development, and strong corporate values, not just higher pay.

- Industry Growth: The insurance market's expansion, driven by factors like increased demand for specialized products and digital transformation, further fuels the competition for qualified individuals.

Specialization and Niche Market Focus

Many brokers, including The Baldwin Group, differentiate themselves by cultivating deep expertise within specific industry verticals or risk categories, such as cyber insurance, construction projects, or employee benefits programs. This focused approach enables them to offer tailored solutions and often command premium pricing. For instance, in 2024, the global cyber insurance market was projected to reach $15.5 billion, highlighting the significant value in specialized knowledge.

This specialization, however, intensifies competition within these niche segments. Firms like Baldwin face rigorous rivalry from other highly specialized competitors who also possess deep domain knowledge. Success in these areas necessitates ongoing innovation and a commitment to superior client service. In 2023, the employee benefits consulting market saw substantial growth, with major players investing heavily in digital platforms and data analytics to maintain their competitive edge.

- Niche Market Dominance Brokers focus on specific industries or risk types to build expertise.

- Value Differentiation Specialization allows for premium pricing and tailored solutions.

- Intensified Competition Niche markets attract specialized rivals, demanding continuous innovation.

- Market Growth Example The cyber insurance market's projected $15.5 billion value in 2024 underscores specialization's financial impact.

Competitive rivalry in the insurance brokerage sector is fierce, characterized by constant M&A activity and a digital innovation race. Baldwin Group competes with major players like Marsh McLennan and Arthur J. Gallagher, all aggressively acquiring agencies to expand market share.

The drive for technological superiority is a key battleground, with firms investing heavily in AI and automation to enhance services. This necessitates continuous capital allocation for system upgrades to avoid falling behind agile insurtech startups.

Talent acquisition and retention are critical, as the industry faces an aging workforce and high demand for specialists, pushing compensation and benefits beyond just salary.

Specialization in niche markets, such as cyber or construction insurance, offers differentiation and premium pricing but also intensifies competition from equally specialized rivals.

| Competitor | 2023 Revenue (Est. USD Billions) | Key Strategy |

|---|---|---|

| Marsh McLennan | ~60 | Global expansion, specialty lines, digital solutions |

| Arthur J. Gallagher | ~16 | Aggressive M&A, niche specialization, talent acquisition |

| Acrisure | ~4.5 | Roll-up strategy, technology integration, diverse verticals |

| Hub International | ~3.5 | Regional consolidation, specialized client solutions, organic growth |

SSubstitutes Threaten

Direct-to-consumer (DTC) insurance models present a significant substitute threat to traditional brokerage firms like The Baldwin Group. These online platforms allow customers to bypass intermediaries, purchasing policies directly from insurers through websites or mobile applications. This trend, amplified by increasing digital adoption, means customers can often find convenience and potentially lower premiums, directly challenging the value proposition of personalized advice and comprehensive service that Baldwin offers.

Insurtech platforms are increasingly offering digital solutions that can bypass traditional brokers, directly impacting The Baldwin Group. These innovations, such as AI-driven customer service and automated claims, provide alternative avenues for consumers to access insurance products. For instance, by mid-2024, over 60% of insurance inquiries were being handled by chatbots, demonstrating a significant shift in customer interaction preferences.

These technology-first companies are not just complementing existing models; many are actively seeking to disintermediate brokers entirely. This poses a direct threat to The Baldwin Group's established distribution channels by offering more streamlined, often cheaper, alternatives. The market share of direct-to-consumer insurance sales through digital channels saw a notable increase of 15% in 2023, a trend expected to accelerate.

Embedded insurance, where coverage is bundled with other purchases like travel insurance with flight bookings, acts as a significant substitute. This integration bypasses traditional insurance intermediaries, making insurance a seamless add-on rather than a standalone product. Projections indicate this trend could divert a substantial portion of property and casualty sales by 2030, impacting established distribution channels.

Self-Insurance and Alternative Risk Transfer

For substantial commercial clients, self-insurance or alternative risk transfer methods, such as captive insurance companies, present viable substitutes for conventional insurance brokered through firms like The Baldwin Group. These sophisticated clients often opt to manage their own risks or utilize specialized structures to exert more control and potentially achieve cost savings. For instance, in 2024, the global captive insurance market continued its robust growth, with premiums written by captives projected to exceed $100 billion, reflecting a significant portion of commercial risk being managed outside traditional channels.

The Baldwin Group faces a competitive pressure from these substitute strategies, as large organizations can leverage their financial strength and risk management expertise to retain risk. This allows them to avoid premium costs and potentially benefit from favorable claims experience. The increasing availability of reinsurance for captives further solidifies their position as a credible alternative. In 2023, the number of new captives formed globally saw a notable increase, particularly in domiciles like Bermuda and the Cayman Islands, indicating a sustained trend towards self-insuring large risks.

- Self-insurance allows large clients to retain risk, potentially reducing overall insurance expenditure by eliminating insurer profit margins and administrative overhead.

- Captive insurance companies offer a structured way for businesses to insure their own risks, providing greater control over claims handling and investment of reserves.

- The global captive insurance market is substantial, with premiums written by captives estimated to surpass $100 billion in 2024.

- The Baldwin Group must therefore emphasize its value proposition in complex risk management, offering specialized expertise and tailored solutions that these sophisticated clients cannot easily replicate internally.

Non-Insurance Risk Mitigation Services

Companies are increasingly turning to non-insurance risk mitigation services, such as specialized cybersecurity consulting or robust business continuity planning, to address specific threats. This trend means that businesses might bypass traditional insurance brokers for these tailored solutions.

For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, indicating a significant investment in specialized risk management outside of insurance policies. While The Baldwin Group provides broad risk management, the growing availability of these niche service providers can diminish the reliance on comprehensive insurance packages.

- Cybersecurity Consulting: Businesses may opt for direct cybersecurity services rather than relying solely on cyber insurance.

- Business Continuity Planning: Specialized firms offer in-depth BCP services, reducing the need for insurance as the primary mitigation tool.

- Advanced Safety Protocols: Investments in enhanced safety measures can preemptively reduce insurable losses.

- In-house Expertise: Developing internal risk management capabilities can lessen the demand for external brokered insurance solutions.

The threat of substitutes for The Baldwin Group is substantial, stemming from direct-to-consumer (DTC) insurance models and insurtech platforms that bypass traditional brokers. These digital alternatives offer convenience and potentially lower costs, directly challenging the value proposition of personalized service. For instance, by mid-2024, over 60% of insurance inquiries were handled by chatbots, highlighting a significant shift in customer preferences towards digital interactions.

Embedded insurance, where coverage is bundled with other purchases, also acts as a substitute, streamlining the insurance acquisition process. Furthermore, large commercial clients increasingly utilize self-insurance or captive insurance companies, a market projected to exceed $100 billion in premiums written in 2024, as a means to retain risk and gain greater control.

| Substitute Type | Description | Impact on Baldwin Group | Supporting Data (2023-2024) |

|---|---|---|---|

| DTC & Insurtech Platforms | Online purchase of policies, AI-driven services, automated claims. | Disintermediation, reduced reliance on brokers, potential commoditization. | 60%+ insurance inquiries handled by chatbots (mid-2024); 15% increase in DTC sales (2023). |

| Embedded Insurance | Insurance bundled with other products (e.g., travel). | Bypasses traditional channels, reduces standalone insurance purchases. | Projected to divert significant P&C sales by 2030. |

| Self-Insurance/Captives | Clients retain risk, form captive insurance companies. | Loss of large commercial accounts, clients manage risk directly. | Global captive insurance market premiums > $100 billion (2024 projection); notable increase in new captives formed (2023). |

| Specialized Risk Mitigation | Cybersecurity consulting, business continuity planning. | Reduced demand for comprehensive insurance packages, focus shifts to niche services. | Global cybersecurity market > $300 billion (2024 projection). |

Entrants Threaten

The insurance brokerage sector faces significant regulatory barriers, making it tough for newcomers to enter. These hurdles include stringent licensing procedures and adherence to diverse state and federal compliance standards, which demand substantial investment in legal and operational infrastructure.

Navigating this complex web of regulations can cost smaller firms upwards of $1 million annually, a significant deterrent for potential entrants lacking deep pockets and specialized legal knowledge. This high cost of entry effectively shields established players like Baldwin Group from immediate competitive threats.

For a company like The Baldwin Group, which focuses on acquiring insurance agencies to build a nationwide network, the initial capital needed is immense. New companies entering this space would face a significant hurdle, requiring vast sums to replicate this strategy.

To compete effectively, new entrants must have deep pockets to fund agency acquisitions, invest in crucial technology upgrades, and establish a recognizable brand. For instance, the US insurance industry saw over $700 billion in premiums written in 2023, indicating the scale of capital required to gain even a small market share through acquisition.

This substantial capital requirement acts as a strong deterrent, making it difficult for smaller or less-funded players to challenge established entities that have already built significant scale through strategic acquisitions.

Building a strong brand reputation and earning client trust in the insurance sector is a lengthy and resource-intensive process. Established players like The Baldwin Group leverage decades of client interactions and industry recognition, creating a significant barrier for newcomers.

New entrants struggle to quickly build the necessary confidence and compete against the deeply entrenched relationships that incumbents have cultivated over many years. For instance, in 2024, the average client retention rate for established insurance brokers remained above 90%, a testament to the power of trust and long-standing relationships.

Difficulty in Securing Carrier Relationships

New entrants face significant hurdles in forging strong relationships with insurance carriers. Established players like The Baldwin Group benefit from deep, long-standing partnerships, granting them preferential access to a wider array of carrier products and services. This established trust and volume often make carriers hesitant to onboard new, unproven brokers.

Carriers tend to favor established brokers who demonstrate a consistent track record of high-volume business and client satisfaction. For instance, in 2024, the insurance brokerage market continued to consolidate, with larger firms like The Baldwin Group leveraging their scale to secure more favorable terms and product access from carriers, making it harder for newcomers to compete for carrier appointments.

- Limited Carrier Appointments: New entrants may find it difficult to secure appointments with a diverse range of insurance carriers, restricting their product offerings.

- Preference for High-Volume Brokers: Carriers often prioritize established brokers with proven sales volumes and client retention rates.

- Established Relationships: The Baldwin Group's existing, robust relationships provide a competitive advantage in accessing carrier products and support.

Emergence of Digital Brokerage Models

The financial services sector, traditionally protected by significant capital requirements and regulatory hurdles, is experiencing a shift due to the emergence of digital brokerage and insurtech platforms. These new models bypass many established barriers, allowing tech-savvy entrants to operate with considerably lower overheads by utilizing cloud infrastructure and direct-to-consumer online channels.

This trend significantly amplifies the threat of new entrants. For instance, in 2024, the global insurtech market was valued at approximately $11 billion, demonstrating substantial growth potential and attracting new players. Similarly, the digital brokerage space continues to see innovations, with platforms like Robinhood and eToro attracting millions of users by offering commission-free trading and user-friendly interfaces, proving that disruptive digital experiences can rapidly capture market share.

- Lower Capital Requirements: Digital platforms circumvent the need for extensive physical branch networks, reducing initial investment costs.

- Technological Agility: New entrants can leverage cutting-edge cloud technologies and AI to offer streamlined, personalized services.

- Disruptive Pricing Models: Many digital brokers offer commission-free trading, a stark contrast to traditional fee structures, attracting price-sensitive customers.

- Enhanced User Experience: Intuitive mobile apps and online portals provide a more accessible and engaging experience for a younger demographic.

While traditional insurance brokerage faces high entry barriers, the rise of digital platforms and insurtech significantly lowers these for tech-savvy newcomers. These digital entrants can operate with reduced overheads, utilizing cloud infrastructure and direct-to-consumer models, which amplifies the threat. For instance, the global insurtech market reached approximately $11 billion in 2024, highlighting the growth and attraction for new players.

These digital disruptors often employ competitive pricing, such as commission-free trading, and offer superior user experiences through intuitive apps, appealing to a broad customer base. This technological agility and focus on user experience allow them to quickly gain traction, challenging established firms like Baldwin Group by offering more accessible and often cheaper alternatives.

| Factor | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Regulatory Hurdles | High (licensing, compliance) | Annual compliance costs can exceed $1 million for smaller firms. |

| Capital Requirements | Very High (acquisitions, scale) | US premiums written in 2023 exceeded $700 billion, indicating scale needed. |

| Brand Reputation & Trust | Challenging to build | Client retention for established brokers remained above 90%. |

| Carrier Relationships | Difficult to establish | Market consolidation favors large firms securing better carrier terms. |

| Digital Disruption | Lowered Barriers | Insurtech market valued at ~$11 billion in 2024; platforms attract millions of users. |

Porter's Five Forces Analysis Data Sources

Our Baldwin Group Porter's Five Forces analysis is built upon a robust foundation of data, incorporating annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of competitive dynamics.