Bakkt PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bakkt Bundle

Bakkt operates within a dynamic global landscape, heavily influenced by political stability, economic fluctuations, and evolving social attitudes towards digital assets. Understanding these external forces is crucial for navigating the future of cryptocurrency adoption and trading. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence for strategic planning. Unlock a clearer vision of Bakkt's opportunities and challenges – download the full report now.

Political factors

Government regulation of digital assets is a significant political factor for Bakkt, shaping its operational landscape. The United States Securities and Exchange Commission's approval of spot Bitcoin ETFs in January 2024, a landmark decision, indicates a more accommodating regulatory approach, potentially unlocking greater institutional investment in the digital asset space. This regulatory clarity, while still evolving, could significantly benefit companies like Bakkt by facilitating broader market access and product development.

However, the ongoing debate and potential reclassification of certain digital assets as securities by regulatory bodies, such as the SEC, present substantial compliance challenges. Should Bakkt's offerings be deemed securities, it would necessitate adherence to stringent regulatory frameworks, increasing operational costs and potentially limiting certain business activities. The global regulatory environment remains fragmented, with differing approaches across jurisdictions, adding another layer of complexity for Bakkt's international operations.

The absence of a consistent global regulatory approach for digital assets presents both hurdles and advantages for Bakkt. While certain areas, such as Europe with its Markets in Crypto-Assets (MiCA) regulation, are moving toward more defined rules, varying national policies can complicate Bakkt's international growth and cross-border operations.

Bakkt's operational strategy must be flexible enough to navigate this complex regulatory landscape. This involves identifying and capitalizing on jurisdictions with more supportive or clearer digital asset regulations, while simultaneously implementing robust risk management protocols for regions with less defined or more restrictive frameworks.

Political stability in Bakkt's key markets and broader geopolitical events significantly impact investor confidence in digital assets. For instance, heightened geopolitical tensions in late 2023 and early 2024 led to increased volatility in global markets, potentially influencing capital flows into and out of digital assets. This directly affects trading volumes and asset valuations on platforms like Bakkt.

Shifts in government priorities regarding cryptocurrency regulation, driven by geopolitical considerations or domestic economic policies, can create uncertainty. As of mid-2024, regulatory frameworks for digital assets continue to evolve globally, with some nations adopting more stringent controls while others explore supportive measures. Bakkt must remain agile in adapting to these varying political landscapes to mitigate risks and capitalize on opportunities.

Government Support for Digital Innovation

Government initiatives aimed at fostering financial technology (FinTech) and blockchain adoption directly benefit companies like Bakkt. For instance, the U.S. government's increasing focus on digital asset regulation, while complex, signals an acknowledgment of the sector's potential, which can lead to clearer frameworks for innovation. Supportive policies, such as regulatory sandboxes or research grants, could significantly accelerate Bakkt's development and market penetration.

The presence of government-backed programs designed to encourage blockchain research and development, like those seen in various European nations in 2024, can provide crucial early-stage funding and validation for emerging technologies. Bakkt could leverage such support to refine its platform and expand its service offerings. A lack of proactive governmental engagement, however, might create an environment where innovation is stifled, potentially slowing the adoption of new digital asset solutions domestically.

- Regulatory Sandboxes: Several countries, including the UK and Singapore, have active FinTech regulatory sandboxes that allow companies to test innovative products and services in a controlled environment, potentially benefiting Bakkt's product testing phases.

- Government Funding for Blockchain Research: In 2024, various national science foundations and innovation agencies continued to allocate funds towards blockchain technology research, creating opportunities for partnerships or grants that could support Bakkt's technological advancements.

- Digital Asset Policy Development: Ongoing discussions and policy drafting by bodies like the U.S. Treasury and SEC in 2024-2025 regarding digital assets indicate a move towards more defined regulatory landscapes, which could provide clarity and stability for Bakkt's operations.

Data Privacy and Cybersecurity Policies

Government policies concerning data privacy and cybersecurity are paramount for Bakkt, a company entrusted with sensitive financial and personal information. Regulations like the European Union's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) impose stringent requirements on data handling and protection. For instance, non-compliance with GDPR can result in fines up to 4% of annual global revenue or €20 million, whichever is higher, underscoring the financial implications of lax data security.

These strict regulations demand substantial investment in robust security infrastructure and comprehensive compliance programs, inevitably increasing operational expenses for Bakkt. However, demonstrating a commitment to high data protection standards can significantly enhance consumer and institutional trust. This adherence can serve as a competitive advantage, positioning Bakkt as a secure and reliable platform in the digital asset space.

The evolving landscape of cybersecurity threats means Bakkt must continuously adapt its policies and technologies. In 2024, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. This highlights the critical need for proactive security measures and ongoing investment to mitigate risks and maintain operational integrity.

- GDPR fines: Up to 4% of global annual revenue or €20 million.

- CCPA compliance: Focuses on consumer rights regarding personal data.

- Global data breach cost (2024): $4.45 million average.

Government policy shifts regarding digital assets significantly influence Bakkt’s operational environment. The U.S. SEC's approval of spot Bitcoin ETFs in January 2024 marked a pivotal moment, signaling a potentially more favorable regulatory climate for institutional involvement in digital assets. This evolving clarity, though still developing, could unlock broader market access and new product avenues for Bakkt.

The fragmented global regulatory landscape presents both challenges and opportunities for Bakkt. While regions like Europe, with its MiCA framework, are establishing clearer rules, differing national policies can complicate Bakkt’s international expansion and cross-border transactions. Adapting to these varied political terrains is crucial for risk mitigation and capitalizing on emerging opportunities.

Governmental support for FinTech and blockchain innovation directly benefits companies like Bakkt. In 2024, continued government focus on digital asset regulation, while complex, acknowledges the sector's potential, paving the way for clearer operational frameworks. Supportive policies, such as regulatory sandboxes, can accelerate Bakkt's technological advancements and market penetration.

Bakkt's strategic approach must accommodate the dynamic nature of digital asset regulation. Identifying and leveraging jurisdictions with clearer or more supportive policies is key, alongside implementing robust risk management for regions with less defined or more restrictive frameworks. This adaptability is essential for navigating the global political landscape.

| Political Factor | Impact on Bakkt | Relevant Data/Examples (2024-2025) |

| Regulatory Clarity (Digital Assets) | Facilitates institutional investment, product development, and market access. | U.S. SEC approves spot Bitcoin ETFs (Jan 2024). Ongoing policy discussions by U.S. Treasury and SEC. |

| Global Regulatory Fragmentation | Creates operational complexity for international expansion and cross-border transactions. | Europe's MiCA regulation vs. varying national policies. |

| Government Support for FinTech/Blockchain | Accelerates technological advancement and market penetration. | Government-backed blockchain research programs in Europe. U.S. focus on digital asset regulation. |

| Geopolitical Stability & Investor Confidence | Influences capital flows into digital assets, impacting trading volumes and valuations. | Heightened geopolitical tensions in late 2023/early 2024 led to market volatility. |

What is included in the product

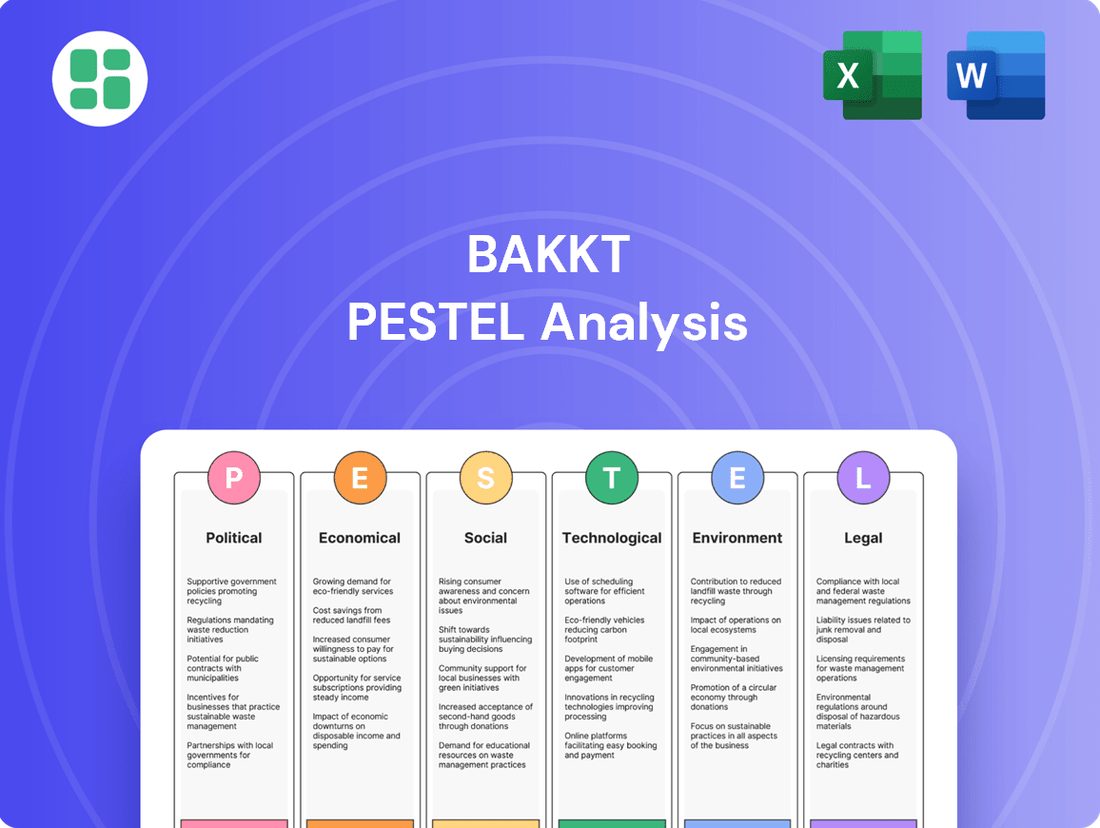

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bakkt across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making for Bakkt's growth and risk mitigation.

Bakkt's PESTLE analysis offers a clear, summarized version of external factors for easy referencing during meetings, relieving the pain point of wading through complex data.

Economic factors

The cryptocurrency market's inherent volatility directly impacts Bakkt's performance, influencing trading volumes and assets under custody. While periods of high volatility can spur increased trading activity, they also introduce substantial risk for both Bakkt and its clientele, affecting revenue streams derived from transaction fees and the fluctuating value of held assets.

Bakkt's Q4 2024 performance demonstrated this dynamic, with significant upticks in both trading volume and assets under custody. This growth was largely attributed to a more robust crypto market environment and a general rise in cryptocurrency prices during that period.

Interest rates and inflation are key macroeconomic forces impacting digital asset markets, and by extension, companies like Bakkt. For instance, in early 2024, inflation remained a persistent concern in many developed economies, leading central banks to maintain higher interest rate policies. This environment can create a dual effect on digital assets.

High inflation, often seen in 2023 and continuing into 2024, can indeed push investors toward assets like Bitcoin as a potential hedge against the erosion of purchasing power. If this trend continues, it could bolster demand for Bakkt's platform, which facilitates access to and trading of digital assets. However, the flip side is that elevated interest rates, such as those maintained by the Federal Reserve throughout much of 2023 and into early 2024, make safer, yield-bearing investments more attractive. This could divert capital away from more speculative digital assets, potentially dampening trading volumes on platforms like Bakkt.

The landscape of institutional investment is rapidly evolving, with significant implications for companies like Bakkt. The approval of spot Bitcoin ETFs in the United States in early 2024 marked a watershed moment, opening the doors for substantial capital inflows from traditional financial institutions. This development is directly fueling the demand for regulated and secure digital asset infrastructure.

Bakkt is strategically positioning itself to capitalize on this trend by enhancing its institutional-grade platforms. Initiatives like BakktX are designed to meet the specific needs of these larger players, offering the high-performance, low-latency trading capabilities essential for sophisticated digital asset strategies. This focus on institutional clients is expected to drive more consistent and larger trading volumes for Bakkt.

The increasing comfort of major asset managers, such as BlackRock and Fidelity, with digital assets, as evidenced by their substantial Bitcoin ETF holdings, underscores this economic shift. As of mid-2024, Bitcoin ETFs have seen billions in inflows, demonstrating a clear appetite for regulated digital asset exposure among institutional investors.

Global Economic Growth and Recession Risks

Global economic growth projections for 2024 and 2025 indicate a moderate but potentially uneven recovery. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, with a slight uptick expected in 2025. However, persistent inflation and higher interest rates in major economies could dampen consumer and institutional spending, impacting investment in digital assets like those facilitated by Bakkt.

Recessionary risks remain a concern, particularly in Europe and potentially the United States, as central banks continue to manage inflation. A significant economic downturn would likely reduce discretionary income and investment capital available for newer asset classes. This could translate to lower trading volumes and a more cautious approach from investors, directly affecting Bakkt's revenue streams and user engagement.

- Global growth forecast (IMF): 3.2% for 2024, slight increase projected for 2025.

- Key economic headwinds include persistent inflation and elevated interest rates impacting disposable income and investment capital.

- Recessionary pressures in major economies could lead to reduced trading activity and a shift towards risk-averse investment strategies.

- These factors directly influence consumer and institutional spending on digital assets, impacting Bakkt's financial performance.

Competitive Landscape and Pricing Pressures

The digital asset market is intensely competitive, with many platforms battling for dominance. This crowded environment naturally leads to significant pricing pressures, forcing companies like Bakkt to constantly re-evaluate their strategies and cost structures to stay ahead.

Bakkt's competitive position was notably impacted in 2024 by the loss of key clients. Webull, a major user of Bakkt's crypto services, and Bank of America, a significant contributor to its loyalty revenue, both ceased their partnerships. These departures represent a substantial reduction in Bakkt's revenue streams, underscoring the need for aggressive innovation and cost management to maintain viability in this dynamic sector.

- Intense Competition: Numerous digital asset platforms vie for market share, intensifying pricing pressures.

- Client Losses in 2024: Bakkt experienced significant client attrition, including Webull (crypto services) and Bank of America (loyalty revenue).

- Revenue Impact: These client losses directly affected Bakkt's crypto and loyalty revenue segments, necessitating cost optimization.

- Innovation Imperative: Continuous innovation and efficient cost structures are crucial for Bakkt to remain competitive post-client departures.

Global economic growth, projected by the IMF at 3.2% for 2024 and slightly higher for 2025, presents a mixed outlook for Bakkt. Persistent inflation and elevated interest rates continue to impact consumer and institutional spending, potentially dampening investment in digital assets.

Recessionary risks in key regions could further reduce available investment capital, forcing a more cautious approach to riskier assets like cryptocurrencies. This economic climate directly influences trading volumes and the overall demand for Bakkt's services.

The competitive landscape remains intense, with pricing pressures a constant challenge. Bakkt's 2024 client departures, including Webull and Bank of America, significantly impacted revenue, highlighting the critical need for ongoing innovation and cost management to maintain market position.

| Economic Factor | 2024 Projection/Status | Impact on Bakkt | Key Data Point |

|---|---|---|---|

| Global Growth | IMF: 3.2% (2024), slight increase for 2025 | Moderate but uneven recovery; potential dampening of digital asset investment. | IMF Global Growth Forecast |

| Inflation & Interest Rates | Persistent inflation, elevated rates | Reduces disposable income and investment capital; makes safer assets more attractive. | Central Bank Policies |

| Recessionary Risks | Concerns in Europe and US | Could lead to reduced trading activity and a shift to risk-averse strategies. | Economic Indicators |

| Competition | Intense | Pricing pressures and need for continuous innovation. | Market Share Dynamics |

| Client Attrition (2024) | Webull, Bank of America departures | Significant revenue reduction, necessitates cost optimization. | Company Financial Reports |

Full Version Awaits

Bakkt PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bakkt delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and future growth.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Bakkt's strategic landscape, from regulatory shifts to evolving consumer adoption of digital assets.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed report provides actionable insights for stakeholders looking to navigate the complexities of the cryptocurrency and digital asset market.

Sociological factors

Public perception of digital assets is shifting, with a growing number of individuals expressing interest. For instance, a 2023 survey revealed that over 40% of Americans now own or have owned cryptocurrency, a significant increase from previous years. This growing acceptance is a positive sign for Bakkt's retail ambitions, as it indicates a larger potential customer base.

However, moving beyond mere interest to active platform usage requires continued education and trust-building efforts. Bakkt's strategy of developing user-friendly applications directly addresses this by aiming to simplify the often complex process of engaging with digital assets, thereby lowering the barrier to entry for newcomers.

Societal trends increasingly favor digital transactions, with a growing preference for cashless payments. This shift is a significant tailwind for companies like Bakkt, whose infrastructure supports digital asset-based payments. For instance, in the US, digital payment transaction volume was projected to reach $2.1 trillion in 2024, highlighting the expanding market for such solutions.

As consumers become more accustomed to online and mobile payment methods, the demand for efficient and secure digital asset payment systems naturally rises. Bakkt's focus on building this infrastructure, including stablecoin payment solutions, aligns perfectly with this evolving consumer behavior. This growing comfort with digital finance directly supports Bakkt's strategic direction.

Societal trust in digital asset platforms and concerns about cybersecurity breaches remain significant hurdles. A 2024 survey indicated that over 60% of potential cryptocurrency investors cite security as their primary concern, a sentiment that directly impacts platforms like Bakkt.

Bakkt's strategic focus on offering secure and regulated infrastructure is therefore crucial for building confidence and attracting a wider audience beyond early adopters. This commitment to compliance and security is essential to counter the lingering public skepticism surrounding digital assets.

Furthermore, high-profile security incidents within the broader cryptocurrency market, such as the reported $1.7 billion lost to hacks in the first half of 2024, can cast a long shadow. Such events erode trust across the entire ecosystem, potentially deterring new users from engaging with platforms like Bakkt, regardless of their individual security measures.

Financial Literacy and Education

A significant hurdle for digital asset adoption, and by extension for platforms like Bakkt, remains the general public's limited financial literacy concerning cryptocurrencies and blockchain technology. This knowledge gap can understandably create hesitation for individuals and institutions looking to engage with new financial instruments.

However, as public understanding grows, Bakkt is positioned to capitalize on this trend. Increased awareness and education around digital assets can demystify the space, fostering greater trust and encouraging broader participation in the digital economy.

Educational initiatives are therefore crucial. For instance, a 2024 survey indicated that while 70% of Americans had heard of Bitcoin, only 20% felt they understood it well enough to invest. Platforms that actively engage in educational outreach can bridge this gap.

- Growing Awareness: Public interest in digital assets continues to rise, with many seeking to understand their potential.

- Educational Gaps: Despite awareness, deep understanding of digital asset mechanics and risks remains low for a significant portion of the population.

- Bakkt's Opportunity: Increased financial literacy directly benefits platforms like Bakkt by expanding their potential user base.

- Impact of Education: Targeted educational programs can accelerate the adoption of digital assets and related financial services.

Demographic Shifts and Generational Preferences

Demographic shifts, particularly the increasing influence of younger, digitally native generations, significantly impact Bakkt's market. These demographics, including Gen Z and Millennials, often exhibit a greater comfort level with and interest in digital assets and innovative financial technologies. For instance, a 2024 survey indicated that over 40% of Gen Z adults in the US own or have owned cryptocurrency, a figure notably higher than older generations.

Bakkt's strategic imperative involves adapting its product suite and marketing to resonate with these evolving consumer preferences. This means not only offering cryptocurrency trading and custody services but also ensuring they are user-friendly and integrated into familiar digital experiences. By 2025, it's projected that digital asset adoption among those under 35 could surpass 50% in developed markets, presenting a substantial growth opportunity for platforms like Bakkt.

- Digital Native Adoption: Younger demographics (Gen Z, Millennials) are more inclined towards digital assets, with significant ownership already observed.

- Evolving Financial Preferences: Bakkt must cater to a spectrum of age groups, making digital asset management accessible and relevant to their diverse financial needs.

- Market Growth Potential: Projections suggest a substantial increase in digital asset adoption among younger populations by 2025, highlighting a key demographic for Bakkt to target.

- User Experience Focus: Success hinges on providing intuitive and integrated digital asset solutions that align with the digital-first expectations of these key consumer segments.

Societal trust in digital asset platforms and concerns about cybersecurity breaches remain significant hurdles. A 2024 survey indicated that over 60% of potential cryptocurrency investors cite security as their primary concern, a sentiment that directly impacts platforms like Bakkt.

Bakkt's strategic focus on offering secure and regulated infrastructure is therefore crucial for building confidence and attracting a wider audience beyond early adopters. This commitment to compliance and security is essential to counter the lingering public skepticism surrounding digital assets.

High-profile security incidents within the broader cryptocurrency market, such as the reported $1.7 billion lost to hacks in the first half of 2024, can cast a long shadow, potentially deterring new users regardless of individual platform security measures.

A significant hurdle for digital asset adoption, and by extension for platforms like Bakkt, remains the general public's limited financial literacy concerning cryptocurrencies and blockchain technology. For instance, a 2024 survey indicated that while 70% of Americans had heard of Bitcoin, only 20% felt they understood it well enough to invest.

| Sociological Factor | Impact on Bakkt | Supporting Data (2023-2025) |

|---|---|---|

| Public Perception of Digital Assets | Growing interest, but trust and understanding are key for adoption. | Over 40% of Americans owned/owned crypto in 2023. |

| Digital Transaction Preference | Favors Bakkt's payment infrastructure. | US digital payment transaction volume projected to reach $2.1 trillion in 2024. |

| Cybersecurity Concerns | Major barrier; requires robust security and regulation. | Over 60% cite security as primary concern (2024 survey). |

| Financial Literacy | Knowledge gaps hinder engagement; education is crucial. | Only 20% of Americans understood Bitcoin well enough to invest (2024 survey). |

| Demographic Shifts (Younger Generations) | Higher adoption rates and interest in digital assets. | Over 40% of Gen Z adults owned/owned crypto in 2024. |

Technological factors

Advances in blockchain technology, particularly in scalability and transaction speed, are crucial for Bakkt's operational efficiency. Improvements in these areas directly influence Bakkt's ability to handle increasing trading volumes and offer more sophisticated digital asset services. For instance, the continued development of Layer 2 scaling solutions for networks like Ethereum, which underpins many digital asset transactions, could significantly reduce settlement times and fees for Bakkt users.

Bakkt's reliance on cutting-edge cybersecurity is non-negotiable, especially with digital assets. In 2024, the global cybersecurity market was valued at over $270 billion, highlighting the immense investment in this area. Bakkt must continually enhance its defenses with advanced encryption, multi-factor authentication, and sophisticated threat detection to safeguard user funds and maintain platform trustworthiness.

Bakkt is actively integrating Artificial Intelligence (AI) to refine its cryptocurrency and stablecoin services, aiming for greater operational efficiency and a transformed user experience. This strategic push is evident in their collaboration with DTR, which grants access to advanced AI frameworks.

This partnership is poised to introduce AI-driven insights, streamline operations through automation, and potentially pave the way for highly personalized financial services. The company's commitment to AI development is a key technological factor influencing its market position and future growth trajectory.

Digital Payment Infrastructure Development

The continuous enhancement of digital payment infrastructure, particularly real-time payment systems and interoperability, is paramount for Bakkt’s growth in stablecoin payments. Bakkt's strategy hinges on facilitating seamless transitions between cryptocurrency trading and worldwide digital transactions.

Leveraging emerging technologies, Bakkt is developing merchant checkout widgets and white-label AI plugins designed for efficient money movement. For instance, by mid-2024, the global digital payments market was projected to reach over $1.5 trillion, with a significant portion driven by advancements in infrastructure that support new payment rails.

- Real-time Payment Growth: Many countries are actively implementing or expanding real-time payment networks, such as the Faster Payments System in the UK or FedNow in the US, creating a foundation for instant stablecoin settlements.

- Interoperability Initiatives: Projects focused on bridging different blockchain networks and traditional financial systems are crucial for Bakkt to enable broad adoption of its payment solutions.

- Merchant Adoption Tools: The development of user-friendly tools like checkout widgets and AI plugins directly addresses merchant needs, aiming to simplify the integration of digital asset payments into existing business operations.

- Stablecoin Market Expansion: The stablecoin market capitalization surpassed $150 billion in early 2024, indicating a growing demand for digital currencies that offer price stability, which Bakkt aims to capitalize on.

Competitive Technology Landscape

Bakkt navigates a rapidly evolving technological landscape, facing competition from a multitude of fintech firms and established cryptocurrency platforms. Staying ahead demands consistent investment in research and development, forging strategic alliances, and maintaining the flexibility to embrace new technologies and competitor advancements.

The company's strategic divestiture of non-core assets in 2023, such as its mortgage origination business, is a key move to concentrate resources on strengthening its core cryptocurrency infrastructure. This focus is crucial as the digital asset space sees rapid innovation, with companies like Coinbase reporting over $1.1 billion in revenue for Q1 2024, highlighting the scale of the market Bakkt aims to capture.

- Technological Agility: Bakkt must continuously adapt to emerging blockchain protocols and digital asset management solutions to remain competitive.

- R&D Investment: Significant investment in research and development is vital for creating innovative products and services in the fast-paced fintech sector.

- Strategic Partnerships: Collaborations with technology providers and financial institutions are essential for expanding reach and enhancing service offerings.

- Competitor Innovation: Keeping pace with competitors like Ripple and its ongoing development of cross-border payment solutions necessitates a proactive approach to technological advancement.

Bakkt's technological strategy is centered on leveraging advancements in blockchain, AI, and digital payment infrastructure to enhance its cryptocurrency and stablecoin services. The company is actively integrating AI through partnerships to drive operational efficiency and personalize user experiences, aiming to capitalize on the growing digital payments market, which was projected to exceed $1.5 trillion by mid-2024.

The firm's focus on real-time payment systems and interoperability is crucial for facilitating seamless digital asset transactions globally, supported by the expanding stablecoin market capitalization, which reached over $150 billion in early 2024. Continuous investment in R&D and strategic alliances are paramount for Bakkt to maintain its competitive edge in the rapidly evolving fintech landscape, especially when considering competitor revenues, such as Coinbase's $1.1 billion in Q1 2024.

| Technological Factor | Description | Impact on Bakkt | Supporting Data (2024/2025) |

| Blockchain Scalability | Improvements in transaction speed and capacity. | Enhances operational efficiency and ability to handle volume. | Layer 2 solutions for Ethereum continue to mature. |

| Cybersecurity | Advanced encryption, authentication, and threat detection. | Safeguards user funds and maintains platform trust. | Global cybersecurity market valued over $270 billion in 2024. |

| Artificial Intelligence (AI) | Integration for operational efficiency and personalized services. | Drives innovation and user experience improvements. | Partnerships with AI framework providers. |

| Digital Payment Infrastructure | Real-time payments and interoperability. | Facilitates seamless crypto-to-fiat transitions. | Digital payments market projected over $1.5 trillion by mid-2024. |

| Stablecoin Market Growth | Increasing demand for price-stable digital currencies. | Provides a foundation for Bakkt's payment solutions. | Stablecoin market cap surpassed $150 billion in early 2024. |

Legal factors

The legal environment for cryptocurrencies remains a significant hurdle for companies like Bakkt, characterized by its fragmented and rapidly changing nature across various global jurisdictions. This complexity necessitates substantial investment in legal expertise to navigate and ensure adherence to a patchwork of regulations, some of which can be contradictory.

However, there have been encouraging developments, such as the positive regulatory outlook for stablecoins in the United States, which could significantly influence Bakkt's strategic planning and operational expansion. For instance, the U.S. Treasury's continued focus on stablecoin regulation, with ongoing discussions and potential legislative actions throughout 2024 and into 2025, provides a clearer pathway for product development and market entry.

Bakkt, operating as a regulated digital asset platform, is bound by strict Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. These regulations are critical for preventing financial crimes and ensuring the integrity of its operations. For instance, in 2023, global AML spending was projected to reach $12.7 billion, highlighting the significant investment required in compliance infrastructure.

Adherence to AML and KYC mandates requires Bakkt to implement comprehensive compliance programs. This includes rigorous identity verification for all users and sophisticated transaction monitoring systems to detect suspicious activities. These measures are foundational to Bakkt's market positioning as a secure and regulated entity, fostering trust among its user base and regulatory bodies.

Consumer protection laws are paramount for companies like Bakkt operating in the digital asset space. These regulations, often enforced by bodies such as the Consumer Financial Protection Bureau (CFPB), mandate fair dealing, clear communication, and robust dispute resolution processes. For instance, CFPB enforcement actions in 2023 resulted in over $3.7 billion in relief for consumers, highlighting the significant impact of these protections.

Data Privacy Regulations

Data privacy laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) place significant obligations on Bakkt regarding the collection, storage, and processing of user data. For instance, GDPR, implemented in 2018, carries fines up to 4% of annual global revenue or €20 million, whichever is higher, for violations. Bakkt must align its data handling with these stringent legal frameworks, a challenge amplified by its international operations in the digital asset space.

Ensuring compliance is critical to avoid substantial financial penalties and protect Bakkt's reputation. The complexity is heightened as Bakkt operates across jurisdictions with varying data protection standards. Failure to adhere to these regulations can result in loss of customer trust and significant operational disruptions.

Bakkt's commitment to data privacy is therefore a key legal consideration. The company must continuously monitor and adapt its practices to evolving privacy legislation worldwide. This includes transparent data usage policies and robust security measures to safeguard sensitive user information.

Securities Laws and Asset Classification

The classification of digital assets as securities remains a significant legal hurdle for Bakkt. If regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC), reclassify assets like Bitcoin as securities, Bakkt would face substantial new compliance requirements. This could necessitate significant alterations to its business model and operational framework, as explicitly acknowledged in Bakkt's own disclosures. For instance, the SEC's ongoing scrutiny of crypto assets, as seen in enforcement actions throughout 2023 and early 2024, highlights the potential for stricter regulatory definitions that could impact platforms like Bakkt.

These potential reclassifications introduce considerable uncertainty regarding Bakkt's future operational landscape. Navigating evolving securities laws could lead to increased costs associated with compliance, legal counsel, and potential restructuring of its offerings. The company's 2023 annual report, filed in early 2024, reiterates the material risk posed by changes in the regulatory treatment of digital assets, underscoring the dynamic legal environment in which Bakkt operates.

The legal landscape for digital assets, including those Bakkt handles, is a complex and evolving area. Regulatory clarity, particularly around stablecoins in the U.S. through 2024 and 2025, offers potential pathways for growth. However, strict adherence to AML and KYC regulations, which saw global AML spending projected at $12.7 billion in 2023, is critical for maintaining operational integrity and trust.

Consumer protection laws, with the CFPB securing over $3.7 billion in consumer relief in 2023, and stringent data privacy laws like GDPR (with fines up to 4% of global revenue) necessitate robust compliance frameworks. The ongoing uncertainty regarding the classification of digital assets as securities by bodies like the SEC, as evidenced by enforcement actions in 2023-2024, presents a significant risk that could reshape Bakkt's business model and operational costs.

| Legal Factor | Relevance to Bakkt | Key Data/Trend (2023-2025) |

|---|---|---|

| Regulatory Clarity (Stablecoins) | Impacts product development and market entry | Positive outlook in U.S. discussions throughout 2024-2025 |

| AML/KYC Compliance | Essential for preventing financial crime and ensuring integrity | Global AML spending projected at $12.7 billion in 2023 |

| Consumer Protection | Ensures fair dealing and dispute resolution | CFPB secured over $3.7 billion in consumer relief in 2023 |

| Data Privacy (GDPR/CCPA) | Governs collection, storage, and processing of user data | GDPR fines up to 4% of global revenue |

| Digital Asset Classification (Securities) | Potential for new compliance requirements and business model changes | Ongoing SEC scrutiny and enforcement actions (2023-2024) |

Environmental factors

While Bakkt doesn't mine cryptocurrencies, its platform facilitates trading in assets like Bitcoin, which historically relies on energy-intensive Proof-of-Work (PoW) consensus. The energy consumption of Bitcoin mining has been a significant concern, with estimates in early 2024 suggesting it consumes more electricity annually than entire countries. This environmental impact is increasingly drawing attention from investors and regulators.

Growing environmental, social, and governance (ESG) scrutiny could pressure Bakkt to encourage the adoption of more energy-efficient digital assets or promote sustainable practices within the broader cryptocurrency ecosystem. For instance, the rise of Proof-of-Stake (PoS) consensus mechanisms, used by networks like Ethereum post-Merge, offers a substantially lower energy footprint compared to PoW.

The growing emphasis on Environmental, Social, and Governance (ESG) factors is significantly shaping investment choices, especially among institutional clients looking for digital asset platforms. This trend means Bakkt needs to clearly articulate its sustainability efforts, such as backing eco-friendly cryptocurrency projects or implementing greener operational strategies, to appeal to and keep investors prioritizing these criteria. For example, as of early 2025, a significant portion of institutional capital is earmarked for ESG-compliant investments, making this a crucial differentiator.

Governments and international organizations are intensifying their focus on the environmental consequences of financial activities, including those involving digital assets. This growing awareness suggests future regulations could require Bakkt to disclose energy consumption and carbon footprints associated with its crypto-related services, thereby introducing new compliance obligations.

Potential regulatory measures might include incentives for trading less energy-intensive digital assets or imposing restrictions on those with significant environmental impacts. For instance, as of early 2024, discussions around Bitcoin's energy consumption continue, with some jurisdictions exploring taxes or outright bans on proof-of-work mining, a factor that could indirectly affect platforms like Bakkt that facilitate crypto trading.

Climate Change and Operational Resilience

Climate change presents indirect operational risks for Bakkt. Extreme weather events, such as severe storms or prolonged heatwaves, could impact the physical infrastructure, including data centers, that supports digital asset trading platforms. Ensuring the resilience of this underlying infrastructure is crucial for maintaining service availability and security.

Bakkt's operational continuity hinges on the robustness of its technological backbone. Therefore, assessing potential disruptions from climate-related phenomena is a necessary component of its risk management framework. This includes evaluating the susceptibility of data centers and network facilities to physical environmental stresses.

For instance, the increasing frequency of extreme weather events globally, as documented by organizations like the Intergovernmental Panel on Climate Change (IPCC), highlights the growing need for businesses to build resilience into their physical and digital assets. While specific 2024/2025 data on climate events directly impacting Bakkt's infrastructure is not publicly available, the general trend underscores the importance of this consideration.

Key considerations for Bakkt include:

- Geographic Diversification of Data Centers: Spreading infrastructure across different regions can mitigate the impact of localized extreme weather.

- Disaster Recovery and Business Continuity Planning: Robust plans are essential to ensure services can be restored quickly after any disruption.

- Energy Efficiency and Sustainability: While not directly an operational risk, adopting sustainable practices can align with broader environmental concerns and potentially reduce long-term operational costs related to energy.

- Supply Chain Resilience: Ensuring that hardware and network components are sourced from resilient supply chains that are also prepared for climate-related disruptions.

Reputational Risk from Environmental Concerns

Public perception of the environmental impact associated with cryptocurrencies presents a significant reputational risk for companies like Bakkt. As awareness grows regarding the energy consumption of certain blockchain technologies, negative sentiment can impact the broader digital asset ecosystem.

For instance, concerns about Bitcoin's energy usage, which has been estimated to consume more electricity annually than countries like Argentina, can cast a shadow over the entire industry. This scrutiny can lead to activist campaigns or critical media coverage, potentially dampening both consumer and institutional enthusiasm for digital assets. Such a shift in sentiment could indirectly affect Bakkt's growth trajectory and its public image as a trusted platform in the digital asset space.

- Energy Consumption Debate: The ongoing discussion around the energy intensity of proof-of-work cryptocurrencies continues to shape public opinion.

- Media Scrutiny: Negative media portrayals of crypto's environmental footprint can influence investor confidence and regulatory approaches.

- Consumer Sentiment: A growing segment of consumers are increasingly factoring environmental, social, and governance (ESG) principles into their investment decisions.

Environmental factors present a dual challenge for Bakkt, involving both the energy consumption of underlying blockchain technologies and the physical risks posed by climate change. The significant energy demands of proof-of-work cryptocurrencies, such as Bitcoin, continue to draw scrutiny, with estimates in early 2024 suggesting Bitcoin's annual energy consumption surpassed that of entire nations. This growing awareness of environmental impact is driving increased investor and regulatory focus on ESG principles, pushing platforms like Bakkt to demonstrate sustainability commitments. Furthermore, the increasing frequency of extreme weather events globally, as highlighted by bodies like the IPCC, underscores the need for Bakkt to ensure the resilience of its data centers and operational infrastructure against climate-related disruptions.

| Environmental Factor | Impact on Bakkt | Data/Trend (as of early 2024/2025) |

|---|---|---|

| Cryptocurrency Energy Consumption | Reputational risk, potential regulatory pressure, preference for ESG-compliant assets | Bitcoin's energy consumption estimated to exceed that of Argentina annually; growing institutional capital allocated to ESG-compliant investments. |

| Climate Change & Extreme Weather | Operational risk to data centers and infrastructure, need for business continuity planning | Increasing frequency of extreme weather events globally, necessitating robust disaster recovery and geographic diversification of infrastructure. |

| ESG Scrutiny | Demand for transparency on sustainability, potential competitive advantage for eco-friendly platforms | Significant portion of institutional capital earmarked for ESG-compliant investments by early 2025. |

PESTLE Analysis Data Sources

Our Bakkt PESTLE Analysis is built on data from leading financial news outlets, regulatory filings from the U.S. Securities and Exchange Commission (SEC), and reports from cryptocurrency analytics firms. We incorporate insights from technology trend forecasts and consumer adoption studies to ensure a comprehensive view.