Bakkt Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bakkt Bundle

Explore the core components of Bakkt's innovative business model with our comprehensive Business Model Canvas. Understand how they connect customer segments to key resources and revenue streams in the evolving digital asset space.

Unlock the full strategic blueprint behind Bakkt's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Bakkt's strategic alliance with Distributed Technologies Research (DTR), announced in March 2025, is a pivotal development. This partnership is set to integrate DTR's advanced AI and stablecoin payment infrastructure directly into Bakkt's regulated trading platform.

The collaboration is designed to unlock innovative product offerings, including a merchant checkout widget and a white-label AI-powered plug-in specifically for global money movement. This strategic move positions Bakkt to capture substantial market share within the rapidly expanding stablecoin payments ecosystem.

A definitive commercial agreement is anticipated by the third quarter of 2025, signifying a concrete step towards realizing the full potential of this synergistic relationship.

Bakkt's acquisition of approximately 30% of Marusho Hotta, a Japanese firm, positions it as the largest shareholder and signals a significant expansion into the Japanese market. This strategic move, announced in August 2025, will see Marusho Hotta rebranded as 'bitcoin.jp', directly aligning with Bakkt's focus on crypto treasury management.

This partnership is crucial for Bakkt's business model as it allows them to leverage Japan's supportive regulatory landscape for digital assets. By integrating Bitcoin and other digital assets into Marusho Hotta's operations, Bakkt aims to offer comprehensive crypto treasury solutions, catering to businesses looking to manage digital assets effectively within their financial strategies.

Bakkt's strategic partnership with Intercontinental Exchange (ICE) solidified in March 2025 with the definitive agreement for ICE to acquire Bakkt's Trust custody business. This move is crucial for Bakkt's business model, enabling a sharper focus on its core crypto trading and payment solutions by divesting non-core assets.

This divestiture allows Bakkt to streamline operations and reallocate resources, particularly by reducing operating expenses and freeing up regulatory capital. Such strategic realignments are vital for companies navigating the dynamic digital asset landscape, ensuring capital is deployed effectively towards growth areas.

Sale of Loyalty Business

Bakkt's strategic pivot involves divesting its Loyalty business to Project Labrador Holdco, LLC, an affiliate of Roman DBDR Technology Advisors, Inc., as agreed in July 2025. This move is crucial for Bakkt to concentrate its efforts and capital on its core cryptocurrency infrastructure and the burgeoning stablecoin payments ecosystem.

The sale, anticipated to finalize in the third quarter of 2025, signifies Bakkt's transformation into a focused, pure-play crypto entity. By shedding non-core assets, Bakkt aims to streamline operations and enhance its competitive position within the digital asset space.

- Divestiture Agreement: Definitive agreement signed in July 2025 with Project Labrador Holdco, LLC.

- Transaction Rationale: Enables Bakkt to become a pure-play crypto infrastructure company.

- Strategic Focus: Allows Bakkt to dedicate all resources to core crypto offerings and stablecoin payments.

- Expected Closing: Q3 2025.

Broadening Institutional Client Network

Bakkt is actively working to expand its reach by bringing more institutional clients into the fold. This includes forging new relationships with entities like Bitcoin ETF providers, crypto-native firms, neobanks, and various fintech companies.

The goal is to not only grow the number of clients but also to make sure existing ones are actively engaged within the rapidly changing digital asset landscape. This strategic expansion is key to Bakkt's growth in the evolving crypto economy.

- Expanding Institutional Outreach: Bakkt targets Bitcoin ETF issuers and other crypto-focused financial services for new partnerships.

- Deepening Existing Relationships: The company aims to increase engagement with its current retail and institutional client base.

- Activating the Crypto Economy: Bakkt's strategy focuses on bringing more participants into and activating within the digital asset ecosystem.

Bakkt's key partnerships are designed to solidify its position in the digital asset ecosystem. The strategic alliance with Distributed Technologies Research (DTR) in March 2025 aims to integrate AI and stablecoin payments, with a commercial agreement expected by Q3 2025.

Furthermore, Bakkt's acquisition of a significant stake in Marusho Hotta in August 2025, rebranding it as bitcoin.jp, signals a strong push into the Japanese market for crypto treasury management.

Divesting its Trust custody business to ICE in March 2025 and its Loyalty business to Project Labrador Holdco, LLC in July 2025 allows Bakkt to focus resources on its core crypto trading and payment solutions.

| Partner | Date Announced | Key Objective | Impact on Bakkt |

|---|---|---|---|

| Distributed Technologies Research (DTR) | March 2025 | Integrate AI & stablecoin payments | Unlock new product offerings, capture stablecoin market share |

| Marusho Hotta (bitcoin.jp) | August 2025 | Expand into Japanese market, crypto treasury | Leverage Japan's regulatory landscape, offer comprehensive crypto solutions |

| Intercontinental Exchange (ICE) | March 2025 | Acquire Trust custody business | Sharpen focus on core crypto trading & payments, divest non-core assets |

| Project Labrador Holdco, LLC | July 2025 | Acquire Loyalty business | Become pure-play crypto infrastructure, focus on core offerings |

What is included in the product

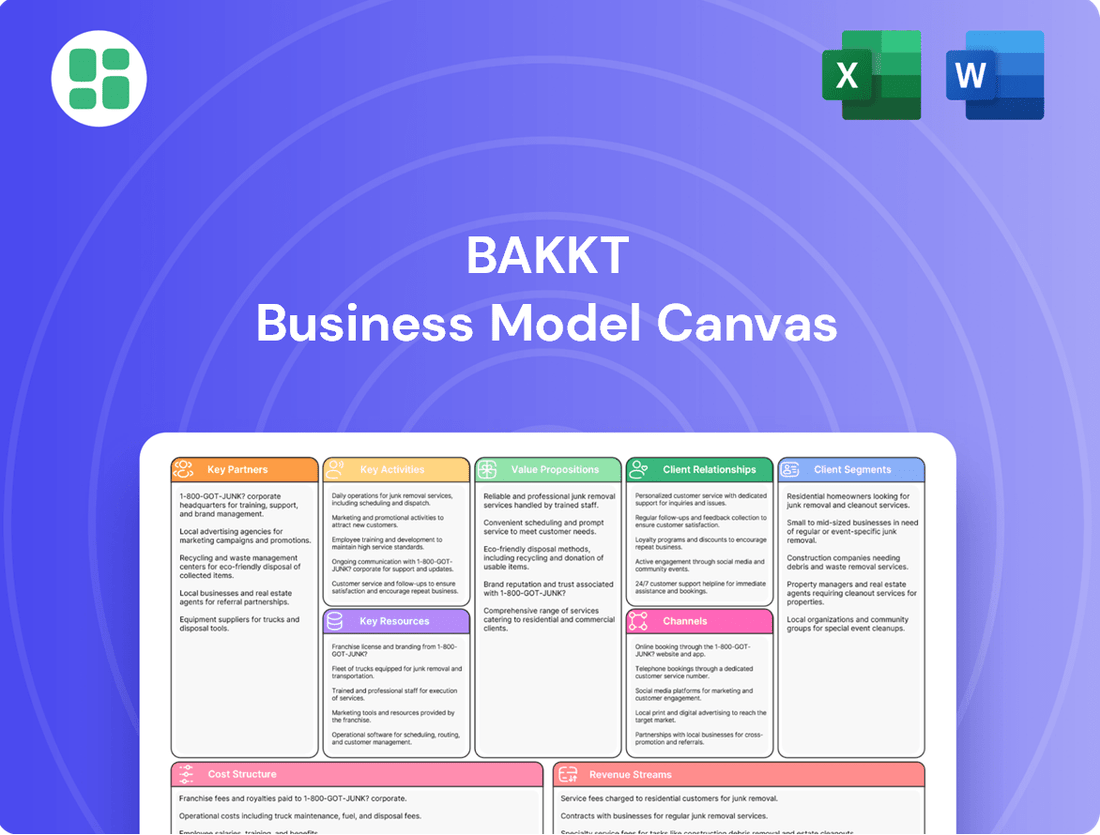

Bakkt's Business Model Canvas outlines its strategy for a regulated platform offering institutional-grade Bitcoin futures and custody solutions, targeting sophisticated investors and financial institutions seeking to engage with digital assets.

Bakkt's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their digital asset custody and trading platform, simplifying complex operations for institutional clients.

Activities

Bakkt's primary focus lies in delivering sophisticated trading infrastructure and crucial liquidity services, primarily through its BakktX platform, to institutional clientele. This core function experienced notable expansion throughout 2024, fueled by heightened activity within the cryptocurrency markets and a growing need for regulated trading solutions.

The company is dedicated to fostering a secure and compliant ecosystem for high-volume cryptocurrency transactions, ensuring trust and stability for its institutional partners. This commitment is crucial in an evolving regulatory landscape, positioning Bakkt as a key player for large-scale digital asset engagement.

A core activity involves integrating DTR's advanced payments infrastructure and AI to build a seamless global digital payment ecosystem. This includes developing robust APIs, secure fiat-to-stablecoin bridges, and efficient foreign exchange settlement mechanisms across various international markets.

The strategic aim is to secure a substantial portion of the burgeoning stablecoin payment market. For instance, the global stablecoin market capitalization reached over $150 billion in early 2024, highlighting the immense growth potential Bakkt aims to tap into.

Bakkt's key activity in managing its corporate Bitcoin treasury involves integrating digital assets, like Bitcoin, into the financial and operational strategies of its newly acquired Japanese entity, bitcoin.jp. This move is designed to capitalize on Japan's evolving digital asset regulations.

This strategic integration is crucial for Bakkt as it seeks to expand its Bitcoin holdings and establish a Bitcoin-centric growth business within a favorable regulatory landscape. The company is actively working to embed Bitcoin into the core of its Japanese operations.

Operational Streamlining and Cost Management

Bakkt is actively streamlining operations to boost efficiency and manage costs. This includes significant headcount reductions, with reports indicating workforce adjustments to optimize resources.

The company is also divesting non-core assets, such as its Trust custody and Loyalty segments. These strategic moves are designed to sharpen focus on core crypto infrastructure opportunities.

- Headcount Reductions: Bakkt has undertaken workforce reductions to improve operational efficiency.

- Divestiture of Non-Core Assets: The sale of segments like Trust custody and Loyalty is underway.

- Focus on Core Business: Resources are being redirected towards higher-growth crypto infrastructure areas.

- Cost Optimization: These actions aim to lower overall operating expenses and improve financial performance.

Maintaining and Enhancing Regulatory Compliance

Bakkt's core activities revolve around maintaining and enhancing regulatory compliance. This is paramount for operating within the digital asset space, especially given the evolving legal landscape. The company actively works to adhere to regulations in key markets, including the United States, which is a critical step in building trust with institutional investors.

This commitment to a secure and regulated infrastructure is not merely a procedural requirement; it's a strategic imperative. By ensuring robust compliance, Bakkt aims to attract and retain institutional clients who demand a high level of security and predictability in their digital asset dealings. This focus is particularly important in a market known for its volatility and regulatory uncertainty.

- Regulatory Adherence: Bakkt prioritizes continuous monitoring and adaptation to evolving financial regulations in the U.S. and globally.

- Institutional Trust: Maintaining strict compliance builds the necessary trust for attracting and serving institutional clients in the digital asset market.

- Secure Infrastructure: A regulated operational framework is key to providing a safe and reliable platform for digital asset trading and custody.

Bakkt's key activities include developing and operating regulated crypto trading platforms and providing institutional liquidity solutions. They are also integrating DTR's payment technology to build a global digital payment ecosystem, focusing on stablecoin payments. Additionally, Bakkt is strategically managing its corporate Bitcoin treasury and streamlining operations through cost optimization and divestitures of non-core assets to focus on core crypto infrastructure.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Crypto Trading & Liquidity | Operating regulated platforms for institutional clients. | Expansion driven by crypto market activity and demand for regulated solutions. |

| Digital Payments Ecosystem | Integrating DTR's payments infrastructure and AI for global payments. | Developing APIs, fiat-to-stablecoin bridges, and FX settlement; targeting the stablecoin market (over $150 billion cap in early 2024). |

| Bitcoin Treasury Management | Integrating digital assets into Japanese operations (bitcoin.jp). | Expanding Bitcoin holdings and establishing a Bitcoin-centric growth business in Japan. |

| Operational Efficiency | Streamlining operations, cost optimization, and divestitures. | Headcount reductions and divestment of Trust custody and Loyalty segments to focus on core crypto infrastructure. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises and full readiness for your strategic planning.

Resources

Bakkt's proprietary technology platform is its bedrock, featuring a robust trading infrastructure, extensive APIs, and sophisticated digital asset management solutions. This advanced technology underpins secure, efficient crypto trading, custody, and payment processing, catering to both individual and institutional clients.

The platform's capabilities are further amplified by the integration of DTR's AI and stablecoin infrastructure. This synergy allows for enhanced transaction speeds and innovative financial product development, a critical differentiator in the digital asset space.

Bakkt's business model heavily relies on its regulatory licenses and a comprehensive compliance framework, crucial for operating within the digital asset industry. These licenses, obtained from various jurisdictions, allow Bakkt to legally offer its services, fostering trust and security for its users.

As of early 2024, Bakkt holds licenses such as a New York BitLicense, enabling it to operate in a key financial market. This adherence to stringent regulatory standards, including those related to anti-money laundering (AML) and know-your-customer (KYC) protocols, differentiates Bakkt from less regulated platforms and is fundamental to its value proposition.

Bakkt's financial capital is a cornerstone, significantly bolstered by a recent equity raise and a substantial $1 billion shelf offering. This financial muscle is crucial for powering its day-to-day operations and enabling strategic acquisitions of Bitcoin.

Furthermore, Bakkt's digital asset holdings are growing impressively. By the fourth quarter of 2024, the company reported assets under custody reaching $2.3 billion, underscoring its expanding role in the digital asset ecosystem.

Skilled Workforce and Leadership Expertise

Bakkt’s skilled workforce and leadership expertise are cornerstones of its business model. The company boasts a team of seasoned market experts, adept engineers, and financial professionals who are crucial for navigating the complex fintech and digital asset landscapes. This human capital directly fuels innovation and the effective execution of Bakkt's strategic initiatives.

The leadership team's depth is particularly noteworthy. With the appointment of new co-CEOs, Bakkt has reinforced its strategic direction and operational capabilities. This leadership continuity and expertise are vital for driving growth and adapting to the rapidly evolving digital asset market.

- Expertise in Fintech and Digital Assets: Bakkt's team possesses deep knowledge in financial technology and the burgeoning digital asset sector, enabling them to develop and manage innovative products and services.

- Strengthened Leadership: The recent appointment of co-CEOs signifies a commitment to robust governance and strategic foresight, essential for guiding the company through market volatility and expansion.

- Innovation and Execution: The collective expertise of engineers, market analysts, and financial professionals empowers Bakkt to drive product development and execute its business strategy effectively in a competitive environment.

Strategic Partnerships and Client Network

Bakkt's strategic partnerships are a cornerstone of its business model, significantly amplifying its market reach and service offerings. A prime example is the collaboration with DTR, which enhances Bakkt's capabilities in specific market segments. Furthermore, the investment in Marusho Hotta demonstrates a commitment to expanding its ecosystem and leveraging specialized expertise. These alliances are not merely transactional; they represent a strategic pooling of resources and market access.

The company's client network is equally vital, acting as a direct channel for revenue generation and market validation. Bakkt actively cultivates relationships with a diverse range of clients, with a particular focus on institutional players. This growing base of institutional clients is a testament to Bakkt's ability to meet the demanding requirements of sophisticated market participants. The expansion of this network directly translates into increased transaction volumes and a stronger market presence.

- Strategic Alliances: Partnerships like the one with DTR are crucial for expanding Bakkt's technological capabilities and market penetration.

- Investment in Expertise: The investment in Marusho Hotta signifies Bakkt's strategy to integrate specialized knowledge and talent, thereby enhancing its service portfolio.

- Institutional Client Growth: Bakkt's expanding network of institutional clients, a key demographic for digital asset services, underscores its growing credibility and market traction.

- Market Reach Extension: These partnerships and client relationships collectively serve as invaluable assets, extending Bakkt's operational reach and competitive edge in the evolving digital asset landscape.

Bakkt's key resources are its advanced technology platform, regulatory licenses, substantial financial capital, a growing digital asset portfolio, and a highly skilled workforce led by experienced executives. These elements combine to form a robust foundation for its operations in the digital asset market.

| Resource Category | Key Assets | Data/Notes (as of Q4 2024) |

|---|---|---|

| Technology Platform | Proprietary trading infrastructure, APIs, digital asset management | Enables secure crypto trading, custody, and payments. |

| Intellectual Property & Licenses | Regulatory licenses (e.g., NY BitLicense), compliance framework | Facilitates legal operation and builds user trust. |

| Financial Capital | Equity raises, $1 billion shelf offering | Supports operations and strategic Bitcoin acquisitions. |

| Digital Assets | Assets under custody | Reached $2.3 billion by Q4 2024, indicating growth. |

| Human Capital | Skilled workforce, experienced leadership (co-CEOs) | Drives innovation and strategic execution in fintech. |

Value Propositions

Bakkt provides a secure and regulated pathway into the world of digital assets, offering a crucial layer of trust for both individual investors and large institutions. This focus on compliance and robust security is a significant advantage in the often unpredictable digital asset market. It creates a dependable environment for engaging with digital assets, from acquisition to safekeeping.

Bakkt's platform acts as a vital link, merging the evolving digital economy with the robust infrastructure of traditional finance. This integration allows for smoother transactions and greater accessibility to digital assets for a wider audience.

By facilitating this connection, Bakkt aims to drive mainstream adoption of digital assets, making them more approachable for everyday users and institutions alike. This bridges the gap, enabling participation from both established financial players and emerging digital innovators.

Bakkt offers institutions a robust platform for managing digital assets, encompassing a marketplace, custody services, and advanced analytics. This institutional-grade approach is designed to meet the complex demands of businesses engaging with the digital asset economy.

These solutions are crucial for financial institutions seeking to navigate the evolving digital asset landscape. For example, Bakkt's custody services are built to meet stringent regulatory requirements, providing a secure environment for institutional holdings.

By integrating trading and liquidity services, Bakkt empowers businesses to actively participate in digital asset markets. This comprehensive offering supports sophisticated strategies for growth and risk management within the crypto economy.

Simplified Consumer Access to Cryptocurrencies

Bakkt's user-friendly app provides a simplified gateway for consumers to engage with cryptocurrencies and other digital assets. This platform allows individuals to effortlessly buy, sell, and store a range of digital assets, significantly lowering the barrier to entry for new investors in the digital asset space.

This enhanced accessibility is crucial as the digital asset market continues to mature. For instance, as of early 2024, the global cryptocurrency market capitalization has seen significant fluctuations, demonstrating a growing interest and participation from retail investors seeking easier ways to get involved.

- Simplified Onboarding: Bakkt's app streamlines the process of setting up accounts and making transactions, making it less intimidating for those new to crypto.

- Diverse Digital Asset Support: Beyond Bitcoin and Ethereum, Bakkt aims to support a broader spectrum of digital assets, catering to a wider range of investor interests.

- Enhanced User Experience: The focus on an intuitive interface ensures that managing digital assets feels as familiar as traditional banking applications.

Future-Proof Global Stablecoin Payments and AI-Powered Solutions

Bakkt's value proposition centers on transforming global payments through stablecoin technology and AI. Their partnership with DTR is key to developing these advanced solutions, aiming to make international money movement seamless and efficient.

This strategic alliance positions Bakkt to offer innovative tools for global financial transactions. The focus is on creating a future-proof ecosystem for stablecoin payments and leveraging AI to optimize cross-border settlements, a critical need in today's interconnected economy.

- Global Stablecoin Payments: Enabling secure and efficient cross-border transactions using stablecoins.

- AI-Powered Solutions: Utilizing artificial intelligence to optimize payment processes and provide advanced financial tools.

- Frictionless Transfers: Reducing the complexity and cost associated with international money movement.

- Strategic Partnerships: Collaborating with entities like DTR to accelerate innovation and market reach.

Bakkt offers a regulated and secure environment for digital asset participation, bridging traditional finance with the digital economy. This allows for easier adoption by both individuals and institutions, making digital assets more accessible and trustworthy.

The platform provides institutional-grade solutions, including custody and trading, designed to meet the complex needs of businesses navigating the digital asset space. This focus on compliance and robust infrastructure is key to fostering institutional confidence.

Bakkt's consumer app simplifies cryptocurrency engagement, enabling effortless buying, selling, and storing of digital assets. This user-friendly approach aims to lower the entry barrier for retail investors, aligning with growing market interest as seen in early 2024's fluctuating market caps.

Furthermore, Bakkt is innovating in global payments through stablecoin technology and AI, aiming for seamless cross-border transactions. This focus on efficiency and reduced cost in international money movement is critical for global commerce.

Customer Relationships

Bakkt prioritizes a client-centric model, offering specialized institutional support. This means dedicated assistance for businesses navigating the digital asset landscape, from initial market entry to sophisticated trading and liquidity solutions.

In 2024, Bakkt continued to enhance its institutional offerings, focusing on providing tailored services. This commitment ensures that clients receive comprehensive guidance and tools to effectively manage and leverage digital assets, fostering growth and operational efficiency.

Bakkt's self-service digital platform, primarily the Bakkt app, empowers individual consumers to directly manage their digital assets. This allows users to buy, sell, and hold cryptocurrencies with ease, offering significant convenience and user autonomy. As of early 2024, a substantial portion of Bakkt's user base actively engages with these self-service features, indicating a strong preference for direct control over their crypto holdings.

For corporate clients, Bakkt builds strong relationships through comprehensive API and SaaS support, ensuring their crypto trading and loyalty programs integrate smoothly. This technical backbone is crucial for businesses looking to leverage digital assets.

This ongoing support helps clients manage their digital asset operations efficiently. For instance, in 2023, Bakkt reported that its platform facilitated a significant volume of digital asset transactions for its business partners.

Strategic Account Management for Key Partners

Bakkt focuses on strategic account management for its key partners and large institutional clients. This approach is designed to foster deeper relationships and uncover new avenues for collaboration, ensuring alignment with their evolving business requirements.

This involves proactive engagement and the development of bespoke solutions tailored to the specific needs of these critical relationships. For instance, in 2024, Bakkt continued to refine its offerings for institutional investors seeking regulated digital asset solutions, a segment where dedicated account management is paramount for adoption and sustained use.

- Deepened Engagement: Bakkt actively manages relationships with major partners to ensure their needs are met and to identify areas for growth.

- Customized Solutions: The company provides tailored solutions, recognizing that large institutional clients often have unique operational and strategic objectives.

- Opportunity Exploration: Strategic account management facilitates the discovery of new business opportunities and product integrations with key stakeholders.

- Relationship Value: By prioritizing these relationships, Bakkt aims to enhance partner loyalty and drive mutual value in the digital asset ecosystem.

Building Trust Through Transparency and Security

Bakkt prioritizes building trust with its customers by being upfront about its operations and safeguarding digital assets. This commitment to integrity and transparency is crucial for keeping clients and drawing in new users within the digital asset space.

Given the sensitive nature of digital assets, Bakkt cultivates customer relationships by emphasizing integrity, transparency, and robust security measures. This focus on building trust is paramount for retaining clients and attracting new users in a highly scrutinized industry.

- Security First: Bakkt implements advanced security protocols, including cold storage solutions and multi-signature wallets, to protect customer assets. In 2023, the digital asset industry saw significant efforts to bolster security following past incidents, with companies like Bakkt investing heavily in these measures.

- Transparent Operations: Bakkt provides clear information regarding its services, fees, and regulatory compliance, ensuring customers understand how their assets are managed and protected.

- Regulatory Adherence: Operating within regulated frameworks, Bakkt demonstrates a commitment to compliance, which is a key factor for trust among institutional and retail investors alike.

- Customer Support: Responsive and knowledgeable customer support is integral to maintaining positive relationships, addressing concerns, and reinforcing the sense of security and reliability.

Bakkt fosters customer relationships through a multi-pronged approach, catering to both individual consumers via its user-friendly app and institutional clients through dedicated support and robust API/SaaS solutions. This dual focus ensures accessibility for everyday users while providing sophisticated tools for businesses. By early 2024, Bakkt's self-service platform saw significant adoption, with a notable percentage of its user base actively managing their digital assets directly.

Strategic account management is key for Bakkt's institutional partnerships, aiming for deeper collaboration and tailored solutions. In 2024, the company continued to refine its regulated digital asset offerings for investors, underscoring the importance of personalized service in this segment. This proactive engagement helps align Bakkt's services with the evolving needs of its most critical clients, driving mutual growth.

Trust is foundational to Bakkt's customer relationships, built on transparency, security, and regulatory compliance. The company emphasizes robust security measures, including advanced protocols and cold storage, to safeguard assets. This commitment to integrity is vital for retaining existing users and attracting new ones in the digital asset space, a sector where security concerns remain paramount.

| Customer Segment | Relationship Approach | Key Features/Initiatives (2024 Focus) | Data Point/Example |

|---|---|---|---|

| Individual Consumers | Self-Service Platform (Bakkt App) | Easy buy, sell, and hold of cryptocurrencies; user autonomy. | Significant portion of user base actively uses self-service features for direct crypto management. |

| Institutional Clients | Specialized Support & API/SaaS Integration | Tailored services, market entry guidance, liquidity solutions, seamless integration for loyalty programs. | Continued refinement of regulated digital asset solutions for institutional investors. |

| Key Partners/Large Institutions | Strategic Account Management | Proactive engagement, bespoke solutions, opportunity exploration, enhanced partner loyalty. | Focus on uncovering new avenues for collaboration and product integrations. |

| All Customers | Trust & Transparency | Robust security measures, clear operational information, regulatory adherence, responsive customer support. | Investment in advanced security protocols like cold storage and multi-signature wallets. |

Channels

The Bakkt mobile application acts as a crucial direct-to-consumer channel, enabling individuals to seamlessly buy, sell, and hold a variety of digital assets, including cryptocurrencies. This platform offers a user-friendly gateway for retail participation in the burgeoning digital economy.

As of early 2024, Bakkt reported over 1 million app downloads, highlighting its reach in the consumer market. The app's design prioritizes accessibility, making it easier for everyday users to engage with digital asset trading and management.

Bakkt’s direct sales and business development teams are instrumental in forging relationships with key institutional players. These teams actively target and onboard clients such as Bitcoin ETF providers, crypto-native firms, neobanks, and burgeoning fintech companies.

This proactive outreach is vital for Bakkt's strategy to broaden its business-to-business presence. By securing these strategic partnerships, Bakkt aims to solidify its position in the evolving digital asset ecosystem.

Bakkt leverages API and Software-as-a-Service (SaaS) offerings as key indirect channels, allowing other businesses to embed its cryptocurrency trading and loyalty program features into their existing platforms. This strategy significantly broadens Bakkt's market penetration by tapping into the established customer bases of its partners.

For instance, in 2024, the global API management market was projected to reach over $10 billion, highlighting the strong demand for such integration solutions. Bakkt's SaaS model further simplifies adoption, making its digital asset capabilities accessible to a wider array of financial and retail businesses seeking to innovate their offerings.

BakktX Institutional Trading Platform

BakktX serves as a crucial channel for institutional clients, offering a high-performance venue for digital asset trading and sophisticated liquidity solutions. It’s designed to meet the rigorous demands of professional traders and firms looking for robust infrastructure.

This specialized platform provides access to deep liquidity pools and advanced trading functionalities, enabling institutions to execute large orders efficiently and manage risk effectively. The focus is on delivering a secure and compliant trading environment tailored for the institutional segment.

- BakktX Target Audience: Primarily institutional investors, hedge funds, proprietary trading firms, and other sophisticated market participants.

- BakktX Value Proposition: Offers regulated, secure, and efficient trading of digital assets with deep liquidity and advanced tools for institutional-grade execution.

- BakktX Key Features: Includes robust trading technology, prime brokerage services, and access to a regulated derivatives market, ensuring compliance and security.

Strategic Investments and Acquired Entities

Bakkt's strategic investments are key channels for market expansion and business model diversification. For instance, their investment in Marusho Hotta (bitcoin.jp) allows them to tap into the Japanese market and explore new ventures like corporate Bitcoin treasury services. This approach leverages acquired entities to broaden their reach and service portfolio.

These strategic moves are designed to accelerate growth and unlock new revenue streams. By acquiring stakes in companies like Marusho Hotta, Bakkt can gain immediate access to established customer bases and regulatory frameworks in different regions. This is crucial for a company operating in the rapidly evolving digital asset space.

- Market Entry: Acquisitions facilitate quicker entry into new geographical markets, such as Japan through the Marusho Hotta investment.

- Business Model Expansion: Strategic stakes allow Bakkt to pivot into new business areas, including corporate Bitcoin treasury solutions.

- Synergistic Growth: Acquired entities can offer complementary services, enhancing Bakkt's overall value proposition to customers.

- Risk Mitigation: Diversifying through acquisitions can help spread risk across different markets and business lines.

Bakkt's channels are diverse, ranging from direct consumer engagement via its mobile app to sophisticated institutional platforms like BakktX. Indirect channels, such as API and SaaS offerings, allow for broader market penetration by integrating Bakkt's capabilities into partner platforms.

Strategic investments, like the one in Marusho Hotta, serve as channels to enter new markets and diversify its business model, particularly in areas like corporate Bitcoin treasury services.

These channels collectively aim to capture a wide range of customers, from individual retail users to large financial institutions, by offering tailored digital asset solutions.

| Channel Type | Primary Offering | Target Audience | 2024 Relevance/Data Point |

|---|---|---|---|

| Direct-to-Consumer | Bakkt Mobile App | Individual Investors | Over 1 million app downloads (early 2024) |

| Business-to-Business | Direct Sales & Business Development | Institutions (ETF providers, neobanks, fintech) | Focus on onboarding institutional clients |

| Indirect (API/SaaS) | Embedded Trading & Loyalty Features | Businesses seeking to integrate digital assets | Global API management market projected over $10 billion (2024) |

| Institutional Trading | BakktX | Institutional Investors, Hedge Funds | Provides regulated, secure, efficient trading |

| Strategic Investments | Market Entry & Diversification | New Markets, Corporate Treasury Services | Investment in Marusho Hotta (bitcoin.jp) for Japanese market entry |

Customer Segments

Individual retail investors are a core customer segment for Bakkt, seeking a user-friendly platform to engage with digital assets. They are drawn to Bakkt for its ability to buy, sell, and hold cryptocurrencies and other digital collectibles, aiming for personal investment growth or everyday utility. For instance, in Q1 2024, Bakkt reported a significant increase in active users on its platform, indicating growing retail adoption.

Financial institutions, including banks and asset managers, are increasingly looking to offer digital asset services. These entities require robust, secure, and compliant platforms to trade, custody, and analyze digital assets, mirroring the security and regulatory standards they uphold in traditional finance.

In 2024, the digital asset market continued to mature, with traditional financial players showing significant interest. For instance, major financial institutions were exploring or actively launching crypto-related services, driven by client demand and the potential for new revenue streams.

Crypto-native companies and exchanges are key customers for Bakkt, seeking to bolster their existing operations. These entities, including other digital asset platforms and blockchain ventures, can integrate Bakkt's regulated infrastructure for improved trading capabilities, access to deeper liquidity pools, and secure custody of digital assets. For instance, as of early 2024, the global cryptocurrency market capitalization hovers around $1.6 trillion, indicating a substantial ecosystem where Bakkt can offer value-added services.

Neobanks and Fintech Innovators

Neobanks and fintech innovators are a key customer segment for Bakkt, actively seeking to embed cryptocurrency functionalities within their existing digital banking and financial service offerings. These forward-thinking companies, often characterized by their agile development and customer-centric approaches, recognize the growing demand for digital asset exposure among their user bases.

They leverage Bakkt's robust API and Software-as-a-Service (SaaS) solutions to streamline the integration of crypto trading, custody, and other digital asset services. This allows them to bypass the significant costs and complexities associated with building proprietary blockchain infrastructure from the ground up, accelerating their market entry and innovation cycles.

For instance, the digital asset market continued its upward trajectory through 2024, with a significant portion of this growth driven by increased institutional adoption and the expansion of crypto services into mainstream financial platforms. Bakkt's partners in this segment are well-positioned to capture a share of this expanding market.

- Target Audience: Digital banks and new-age financial technology firms.

- Value Proposition: Seamless integration of crypto capabilities via Bakkt's API and SaaS.

- Benefit: Avoids the need for in-house infrastructure development, reducing time-to-market and operational overhead.

- Market Trend: Growing demand for crypto services from retail users of digital financial platforms.

Corporations Pursuing Bitcoin Treasury Strategies

This segment represents a significant new focus for companies like Bakkt, encompassing traditional corporations now actively considering holding Bitcoin and other digital assets on their balance sheets as a treasury management strategy. This shift is driven by the potential for diversification and yield enhancement.

Bakkt's strategic pivot, underscored by its acquisition of Marusho Hotta, directly targets these businesses. This move aims to provide the necessary infrastructure and regulatory compliance for corporate treasury departments to securely manage digital assets.

The growing interest in Bitcoin as a treasury asset is evident. For instance, in 2024, several publicly traded companies continued to allocate portions of their treasury to Bitcoin, seeking an alternative to traditional cash reserves and exploring its potential as a hedge against inflation.

- Corporate Adoption: Traditional companies are increasingly viewing Bitcoin as a viable treasury asset, moving beyond speculative investment to strategic balance sheet management.

- Bakkt's Strategic Alignment: The acquisition of Marusho Hotta signifies Bakkt's commitment to serving this burgeoning corporate segment by offering secure custody and management solutions for digital assets.

- Market Trends: By mid-2024, a notable number of public companies had integrated Bitcoin into their treasury operations, reflecting a growing institutional acceptance and a desire for portfolio diversification.

Bakkt serves individual retail investors looking for an accessible platform to trade digital assets, aiming for investment growth or everyday use. Financial institutions, such as banks and asset managers, are also key customers, requiring secure and compliant infrastructure to offer digital asset services, mirroring traditional finance standards. Crypto-native companies and exchanges leverage Bakkt for enhanced trading, liquidity, and custody, operating within a maturing global digital asset market valued in the trillions as of early 2024. Neobanks and fintech innovators integrate Bakkt's solutions to embed crypto functionalities, reducing their need for costly in-house development and capitalizing on growing retail demand for digital asset exposure.

Traditional corporations are increasingly adopting digital assets for treasury management, viewing Bitcoin as a strategic asset for diversification and potential yield enhancement. Bakkt's strategic acquisitions, like Marusho Hotta, are designed to provide the necessary secure and compliant infrastructure for these businesses to manage digital assets on their balance sheets, a trend that saw notable public company adoption throughout 2024.

| Customer Segment | Needs/Goals | Bakkt's Offering | Market Context (2024) |

|---|---|---|---|

| Retail Investors | Buy, sell, hold crypto; investment growth | User-friendly platform | Growing retail adoption |

| Financial Institutions | Offer digital asset services; security & compliance | Robust, secure, compliant platform | Increased interest from traditional finance |

| Crypto-Native Firms | Bolster operations; deeper liquidity | Regulated infrastructure, custody | Substantial crypto ecosystem value |

| Neobanks/Fintech | Embed crypto; reduce development costs | API/SaaS solutions | Expanding crypto services into mainstream |

| Corporations (Treasury) | Balance sheet diversification; inflation hedge | Secure digital asset management | Growing Bitcoin treasury allocation |

Cost Structure

Crypto costs and execution, clearing, and brokerage fees represent Bakkt's primary variable expenses. These costs directly scale with the volume of cryptocurrency trading activity on its platform, meaning higher trading volumes translate into increased operational costs for Bakkt.

For instance, in Q1 2024, Bakkt reported total revenue of $16.5 million, with a significant portion attributable to trading-related services. While specific fee breakdowns aren't always public, these execution and clearing costs are essential for facilitating transactions and ensuring smooth market operations.

Bakkt's technology and infrastructure development is a major cost driver, necessitating significant upfront and ongoing investment. These expenditures cover the creation, upkeep, and advancement of its digital asset trading platform, crucial APIs for seamless integration, and the incorporation of cutting-edge technologies such as artificial intelligence for enhanced analytics and stablecoin capabilities to facilitate smoother transactions.

In 2024, companies in the digital asset space are allocating substantial resources to R&D and platform maintenance. For instance, while specific Bakkt figures for 2024 are not publicly detailed, the broader industry trend shows a continuous push for innovation. Major players are investing hundreds of millions annually in technology to stay competitive, covering everything from cybersecurity enhancements to the development of new trading functionalities and regulatory compliance tools.

Employee salaries, wages, and benefits represent a significant operational cost for Bakkt. These expenses are crucial for attracting and retaining the talent needed to develop and maintain its digital asset marketplace and custody solutions.

In 2024, Bakkt implemented restructuring and headcount reductions aimed at optimizing these compensation and benefits expenses. This strategic move was intended to streamline operations and improve cost efficiency as the company navigates the evolving digital asset landscape.

Regulatory, Compliance, and Legal Expenses

Bakkt's business model incurs substantial costs related to regulatory, compliance, and legal matters. Operating within the digital asset and financial services sectors demands adherence to a complex web of regulations, leading to significant outlays for licensing, legal counsel, and ongoing compliance programs. For instance, in 2024, companies in similar fintech spaces have reported compliance costs ranging from 5% to 15% of their operating revenue, reflecting the intensive oversight required.

These expenditures are critical for maintaining Bakkt's operational integrity and building trust with users and partners. Key cost drivers include:

- Licensing Fees: Obtaining and maintaining necessary licenses in various jurisdictions where Bakkt operates.

- Legal and Compliance Staff: Hiring and retaining specialized legal and compliance professionals to navigate evolving regulatory landscapes.

- Audits and Reporting: Costs associated with internal and external audits, as well as fulfilling regulatory reporting obligations.

- Risk Management: Implementing robust systems and processes to manage legal and compliance risks, including potential litigation.

In 2023, the global spending on financial compliance was estimated to be over $100 billion, highlighting the industry-wide trend of increasing regulatory burdens that directly impact cost structures for platforms like Bakkt.

Marketing, Sales, and General & Administrative (SG&A)

Bakkt's Marketing, Sales, and General & Administrative (SG&A) expenses are crucial for client acquisition, retention, and overall brand presence. These costs encompass advertising campaigns, promotional efforts, and the essential functions of running the business, such as executive leadership and support staff.

In 2023, Bakkt reported a significant decrease in SG&A expenses, reflecting strategic restructuring and a focus on operational efficiency. This reduction, amounting to $170.4 million in Q4 2023 compared to $249.3 million in Q4 2022, demonstrates a commitment to streamlining operations and improving profitability.

- Client Acquisition and Retention: Costs include marketing campaigns, sales team salaries, and customer support infrastructure aimed at attracting new users and keeping existing ones engaged.

- Brand Building: Investments in advertising, public relations, and content creation to enhance Bakkt's visibility and reputation in the competitive digital asset market.

- General Corporate Overhead: Expenses related to management, legal, finance, and other administrative functions necessary for the company's operation.

- Cost Reduction Initiatives: Bakkt has actively worked to lower SG&A, with reported savings contributing to a more sustainable cost structure.

Bakkt's cost structure is heavily influenced by variable expenses tied to crypto trading volume, such as execution and clearing fees. The company also invests significantly in technology and infrastructure development to maintain and enhance its digital asset platform.

Employee compensation, regulatory compliance, and SG&A expenses are also substantial cost drivers. Bakkt has undertaken initiatives in 2024 to optimize these costs, including restructuring and headcount reductions, to improve operational efficiency.

In 2024, the digital asset industry continues to see high spending on technology and compliance, with companies investing heavily to stay competitive and meet regulatory demands.

Bakkt's strategic focus in 2023 and 2024 has included reducing SG&A expenses, as seen in the significant decrease reported in Q4 2023 compared to the previous year, aiming for greater profitability.

| Cost Category | Key Components | 2024 Focus/Trend |

| Variable Costs | Crypto execution, clearing, brokerage fees | Directly scales with trading volume |

| Technology & Infrastructure | Platform development, maintenance, APIs, AI, stablecoins | Significant ongoing investment for innovation and competitiveness |

| Personnel Costs | Salaries, wages, benefits | Optimization through restructuring and headcount adjustments in 2024 |

| Regulatory & Compliance | Licensing, legal counsel, audits, risk management | High outlays due to complex regulations; industry-wide increase in compliance spending |

| SG&A | Marketing, sales, general corporate overhead | Reduced in 2023 through strategic restructuring, focus on efficiency |

Revenue Streams

Gross Crypto Services Revenues represent Bakkt's most significant and rapidly expanding income source. This revenue is predominantly generated from the trading activity occurring on Bakkt's platform, directly correlating with the overall surge in cryptocurrency market engagement and the increasing adoption of Bakkt's trading services.

In the first quarter of 2024, Bakkt reported total revenue of $18.1 million, with a substantial portion attributed to its crypto-related services. This growth underscores the platform's success in capturing a share of the burgeoning digital asset market.

Bakkt generates revenue by charging transaction fees on the buying, selling, and exchanging of digital assets like Bitcoin on its platform. This fee structure directly captures value from the trading volume of both individual users and institutional clients.

Bakkt generates revenue by providing its digital asset platform and API solutions as a service to other businesses. This allows companies to easily integrate cryptocurrency functionalities into their own products and services. This model is designed to create a predictable, recurring income stream, particularly from institutional clients who rely on these services.

Custody Fees (from retained or partnered services)

While Bakkt has transitioned away from its direct Trust custody operations, it continues to generate revenue through custody services, often via partnerships. This means Bakkt may earn fees for facilitating custody solutions for its clients, leveraging its infrastructure or relationships with other custodians. Historically, these custody fees were a significant part of Bakkt's revenue model.

For instance, in the first quarter of 2024, Bakkt reported total revenue of $16.7 million, a decrease from the previous year. While specific breakdowns for custody fees aren't always granularly disclosed post-divestiture, the ongoing provision of these services, even through partners, indicates a continued, albeit potentially smaller, revenue stream.

- Partnership Revenue: Bakkt earns fees from collaborating with other entities to provide custody solutions.

- Facilitation Fees: Revenue is generated by enabling clients to access custody services through Bakkt's platform or network.

- Historical Context: Custody fees were a foundational revenue component for Bakkt in its earlier stages.

Potential Future Stablecoin Payment Network Fees

Bakkt anticipates new revenue streams through its planned stablecoin payment network, a development bolstered by its strategic partnership with DTR. This initiative is poised to capitalize on the growing demand for efficient global financial transactions.

The network is expected to generate fees from various sources, including the facilitation of global money movement. This represents a significant opportunity as cross-border payments continue to expand, reaching an estimated $156 trillion in 2023 according to SWIFT data.

Additional revenue will likely stem from merchant checkout widgets, simplifying digital asset payments for businesses. Bakkt also plans to integrate AI-powered payment solutions, offering enhanced functionality and potentially attracting a wider user base.

- Global Money Movement Fees: Transaction charges for international currency transfers.

- Merchant Checkout Widgets: Fees associated with integrating payment solutions for e-commerce.

- AI-Powered Payment Solutions: Revenue from advanced payment processing and analytics services.

Bakkt's revenue streams are diverse, primarily driven by its cryptocurrency services, which include transaction fees from trading activities. The company also generates income by offering its digital asset platform and API solutions to other businesses, creating recurring revenue, especially from institutional clients. While custody services have evolved, Bakkt continues to earn fees through partnerships and by facilitating these solutions.

Looking ahead, Bakkt is set to introduce new revenue streams with its stablecoin payment network, targeting fees from global money movement and merchant payment integrations, including AI-powered solutions.

| Revenue Stream | Description | 2024 Data/Projections |

| Gross Crypto Services Revenues | Transaction fees from trading digital assets. | Significant contributor to total revenue, growing with market engagement. |

| Platform & API Solutions | Licensing its digital asset platform and APIs to businesses. | Aims for predictable, recurring income, particularly from institutional clients. |

| Custody Services (Partnerships) | Fees earned through facilitating custody solutions via partnerships. | Continued, though potentially smaller, revenue stream post-divestiture. |

| Stablecoin Payment Network | Fees from global money movement and merchant payment solutions. | Projected to capitalize on growing demand for efficient financial transactions. |

Business Model Canvas Data Sources

The Bakkt Business Model Canvas is built upon a foundation of robust market research, competitive analysis, and regulatory insights. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the digital asset industry.