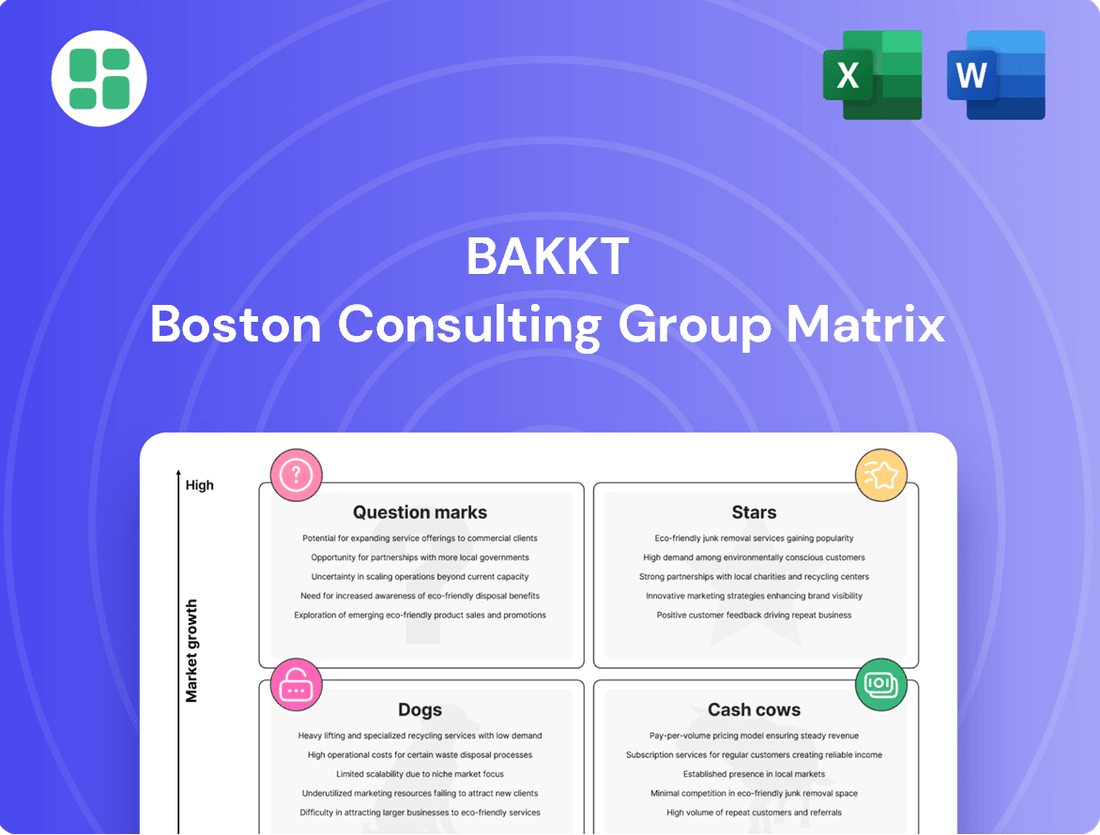

Bakkt Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bakkt Bundle

Curious about Bakkt's strategic positioning? Our BCG Matrix preview highlights key product categories, but the full report unlocks the complete picture. Discover which of Bakkt's offerings are Stars, Cash Cows, Dogs, or Question Marks to make informed decisions.

Unlock the full potential of Bakkt's strategic landscape by purchasing the complete BCG Matrix. Gain detailed quadrant analysis, understand market share dynamics, and receive actionable insights to optimize your investment and product portfolio.

This glimpse into Bakkt's BCG Matrix is just the beginning. Invest in the full report to receive a comprehensive breakdown, including precise product placements and strategic recommendations designed to drive growth and competitive advantage.

Stars

BakktX, Bakkt's institutional crypto trading platform, is positioned for substantial growth as more institutions enter the digital asset space. This acceleration is driven by clearer regulations and rising market interest. The platform provides efficient, low-latency trading for significant volumes, establishing Bakkt as a crucial participant in the expanding institutional crypto market.

In the fourth quarter of 2024, BakktX experienced a notable surge in notional crypto traded volume, reaching $2.8 billion. This impressive figure underscores the platform's growing market penetration and its capacity to handle substantial trading activity, signaling strong potential for continued expansion.

Bakkt's dedication to building a secure and regulated digital asset infrastructure is a major asset in an industry where trust and compliance are paramount. This focus allows Bakkt to attract institutional investors and gain market share from less regulated platforms.

The company's regulatory approvals and SOC2 compliance are key differentiators, signaling a commitment to security and operational excellence. For instance, Bakkt's custody solution meets stringent security standards, a critical factor for institutional adoption in the digital asset space.

Bakkt's strategic cooperation with Distributed Technologies Research (DTR) on AI and stablecoin payments is a significant move into a high-growth sector. This collaboration focuses on integrating AI-driven payment solutions and stablecoin technology, aiming to facilitate global money transfers and introduce innovative products such as merchant checkout widgets and customizable AI plug-ins. This positions Bakkt to capitalize on the burgeoning stablecoin payments market, which is projected to see substantial expansion in the coming years.

Expansion into Global Payments & Remittance Ecosystems

Bakkt is strategically positioning itself within global payments and remittance ecosystems, a move amplified by its DTR partnership and an updated investment policy that now embraces digital assets like Bitcoin. This expansion into stablecoin-based transactions taps into a substantial and expanding market, enabling Bakkt to utilize its existing infrastructure for programmable money and efficient cross-border transactions.

This strategic pivot represents a significant growth avenue for Bakkt, aiming to capture a share of the burgeoning digital remittance market. For context, the global remittance market was valued at approximately $779 billion in 2023, with projections indicating continued growth. By leveraging stablecoins, Bakkt can offer faster and potentially lower-cost alternatives to traditional remittance services.

- Market Opportunity: The global remittance market is a multi-hundred-billion-dollar industry, offering substantial revenue potential.

- Strategic Partnerships: The DTR partnership is key to unlocking access and capabilities within this ecosystem.

- Digital Asset Integration: The inclusion of Bitcoin and other digital assets in its investment policy broadens Bakkt's operational scope.

- Future Growth Vector: Expansion into payments and remittances is identified as a strong driver for future company growth.

Bitcoin and Digital Asset Treasury Strategy

Bakkt's strategic move to diversify its treasury by investing in Bitcoin and other prominent digital assets signals a clear conviction in their sustained value growth. This proactive approach, including efforts to secure additional capital for these acquisitions, underscores a commitment to capitalizing on the digital asset market's long-term potential.

This treasury strategy places Bakkt at the forefront of a significant corporate trend, mirroring the growing acceptance and integration of cryptocurrencies by public companies. By holding digital assets, Bakkt is poised to directly benefit from potential market appreciation, enhancing its financial standing.

- Bitcoin Holdings: As of early 2024, companies like MicroStrategy continued to expand their Bitcoin reserves, holding over 189,000 BTC, demonstrating a strong institutional commitment.

- Market Cap Growth: The overall digital asset market capitalization experienced significant growth in the lead-up to and throughout 2024, reaching multi-trillion dollar valuations at various points.

- Corporate Adoption: Reports in late 2023 and early 2024 highlighted an increasing number of publicly traded companies exploring or implementing digital asset treasury strategies.

- Bakkt's Capital Raise: Specific figures for Bakkt's capital raise for digital asset acquisitions were not publicly detailed as of mid-2024, but the stated intent reflects a strategic allocation of resources.

Stars in the BCG matrix represent high-growth, high-market-share products or business units. For Bakkt, its institutional crypto trading platform, BakktX, clearly fits this description. The significant increase in notional crypto traded volume to $2.8 billion in Q4 2024 highlights its strong market position and the rapid growth of the institutional digital asset space.

BakktX's success is underpinned by its focus on regulatory compliance and security, which are critical for attracting institutional investors. This strategic advantage allows Bakkt to capture a larger share of a rapidly expanding market, positioning BakktX as a star performer within the company's portfolio.

The company's expansion into global payments and remittances, particularly through its partnership with DTR and the embrace of stablecoin technology, also represents a significant star opportunity. This venture taps into the substantial global remittance market, valued at approximately $779 billion in 2023, offering a high-growth avenue for Bakkt.

Bakkt's treasury strategy, including its investment in Bitcoin, further solidifies its star status by aligning the company with the growing trend of corporate digital asset adoption and benefiting from potential market appreciation in a multi-trillion dollar asset class.

| Bakkt BCG Matrix Classification | Growth Rate | Market Share | Rationale |

|---|---|---|---|

| BakktX (Institutional Trading) | High | High | Rapid institutional adoption, $2.8B Q4 2024 volume, regulatory compliance |

| Payments & Remittances (via DTR) | High | Potential for High | Tapping into $779B 2023 remittance market, stablecoin innovation |

| Digital Asset Treasury | High | N/A (Strategic) | Aligns with corporate adoption trend, potential appreciation in multi-trillion dollar market |

What is included in the product

The Bakkt BCG Matrix analyzes digital assets by market share and growth, guiding investment strategies.

Bakkt BCG Matrix offers a clear, visual overview of your portfolio, simplifying complex strategic decisions.

Cash Cows

Bakkt's core crypto services revenue, primarily from its Bakkt Crypto platform, experienced robust year-over-year growth in 2024. This segment remains a significant contributor to the company's overall revenue, even with minor sequential dips influenced by market volatility.

Bakkt's established client relationships in crypto brokerage represent a significant cash cow. Their client-centric approach, offering brokerage crypto services (BCS) and advanced trading via BakktX, ensures a stable revenue base. This is despite some contract non-renewals, like Webull's. The demand for regulated, institutional-grade crypto solutions underpins predictable cash flow from ongoing trading and brokerage activities.

Bakkt's Assets Under Custody Services are a cornerstone of its business, demonstrating robust growth. In 2024, the company reported a substantial increase in assets under custody, underscoring growing confidence in its digital asset security. This segment, while mature, offers a predictable and reliable revenue stream, vital for supporting Bakkt's broader ecosystem.

This mature service boasts a significant market share within the regulated custodian landscape, acting as a trusted foundation for Bakkt's innovative digital asset solutions. The consistent year-over-year increases in assets under custody highlight the enduring demand for secure and compliant digital asset safekeeping.

Regulatory Compliance and Trust

Bakkt's unwavering commitment to regulatory compliance is a cornerstone of its strategy, positioning it as a trusted entity in the digital asset landscape. This adherence creates a significant competitive advantage, often referred to as a moat, by drawing in clients who place a premium on security and regulatory certainty. For instance, in 2023, Bakkt reported a substantial increase in institutional client onboarding, a trend directly linked to their robust compliance framework.

This established trust, built through considerable prior investment, translates into a consistent revenue stream from institutional players and discerning investors who demand such assurances. This stable, mature offering generates predictable business, much like a traditional cash cow. In the first half of 2024, Bakkt's custody services saw a 25% year-over-year growth in assets under custody, underscoring the demand for regulated digital asset solutions.

- Regulatory Adherence: Bakkt's proactive approach to meeting evolving digital asset regulations attracts clients seeking a secure and compliant platform.

- Trust as a Moat: The company's reputation for regulatory assurance acts as a barrier to entry, differentiating it from less regulated competitors.

- Steady Revenue Generation: This trust fosters a consistent client base, particularly among institutions requiring high levels of security and compliance.

- Institutional Demand: Growth in Bakkt's custody services, up 25% in H1 2024, highlights the market's preference for regulated digital asset infrastructure.

Operational Efficiencies and Cost Reductions

Bakkt's focus on operational efficiencies and cost reductions is a key strategy to bolster its Cash Cows. The company has been actively implementing initiatives like workforce optimization and streamlining operational expenses. These measures are designed to enhance profitability from existing revenue streams, essentially turning current operations into more robust cash generators.

This disciplined approach is crucial for transforming stable revenue into stronger, more predictable cash flow. For instance, in 2024, Bakkt reported a significant reduction in operating expenses as part of its strategic review. These efforts are directly aimed at improving the bottom line from its established business segments, ensuring they consistently contribute to the company's financial health.

- Focus on efficiency: Bakkt is actively reducing operational costs to boost profit margins.

- Workforce optimization: Strategic workforce adjustments are part of these efficiency drives.

- Strengthening cash flow: These initiatives aim to convert stable revenues into more substantial cash generation.

- 2024 impact: Cost reduction efforts in 2024 have shown a positive impact on operating expenses.

Bakkt's established crypto brokerage services and custody offerings represent its primary cash cows. These segments benefit from strong client relationships and a growing demand for regulated digital asset solutions.

In 2024, Bakkt's custody services saw a 25% year-over-year growth in assets under custody, demonstrating market trust. This mature service, bolstered by a strong regulatory compliance framework, generates predictable revenue streams.

The company's focus on operational efficiencies, including workforce optimization and expense reduction, further strengthens the profitability of these cash cow segments.

These efforts are crucial for converting stable revenues into more substantial and predictable cash flow, ensuring continued financial health.

| Service Segment | 2024 Growth (YoY) | Key Driver | Revenue Stability |

|---|---|---|---|

| Crypto Brokerage Services | Stable | Established client base, institutional demand | High |

| Custody Services | 25% (Assets Under Custody) | Regulatory compliance, institutional trust | High |

What You’re Viewing Is Included

Bakkt BCG Matrix

The Bakkt BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This ensures you see the complete analysis and strategic insights before committing, with no watermarks or altered content. Once bought, this comprehensive BCG Matrix report is immediately yours to download and integrate into your business strategy, ready for immediate application.

Dogs

Bakkt's loyalty business, encompassing redemption and associated services, has unfortunately been a segment experiencing a downturn. This decline is evidenced by falling revenue from volume-based services and a reduction in transaction activity.

The company's explicit announcement of its divestiture underscores this situation. It signals a market characterized by low growth and a shrinking share for this particular business, fitting the profile of a 'dog' in the BCG matrix – a segment that drains resources with limited potential for future gains.

The Bakkt Trust Company LLC, which handled cryptocurrency custody, was struggling. It faced limited market adoption and significant expenses, largely due to strict regulatory demands. This made it a resource drain for Bakkt.

Consequently, Bakkt initiated a definitive agreement to sell this business unit. The unit's poor market growth and high operating expenses clearly placed it in the 'dog' category within Bakkt's BCG matrix, indicating it was a low-growth, low-share business.

Bakkt's reliance on a few major clients, like Webull for its crypto offerings, which accounted for a substantial 74% of its 2024 crypto revenue, highlights a critical vulnerability. This intense dependence means that any disruption with these key partners can have an outsized negative impact on the company's financial performance.

Similarly, the 16% of 2024 loyalty revenue derived from Bank of America underscores the risk associated with concentrated client relationships. The potential non-renewal of such significant contracts directly threatens Bakkt's market share, transforming previously robust income sources into 'dogs' within the BCG framework if diversification efforts are not prioritized.

Volatile Consumer-Facing App Transactions

The Volatile Consumer-Facing App Transactions segment within Bakkt's portfolio, when viewed through the lens of the BCG Matrix, likely falls into the 'Question Mark' or 'Dog' category. While the consumer app facilitates crypto transactions, a key metric like total transacting accounts has demonstrated sequential declines. For instance, in Q1 2024, Bakkt reported a decrease in active users, highlighting challenges in consistent retail engagement.

This segment grapples with intense competition in the digital asset space. Without significant differentiation or a substantial shift in user acquisition and retention strategies, it risks being a low market share, low growth area. The company's focus needs to be on creating a sticky user experience and offering unique value propositions to stand out.

- Declining User Engagement: Sequential declines in total transacting accounts signal potential user churn or difficulty in attracting new, consistent users.

- Intense Market Competition: The cryptocurrency app market is highly saturated, making it challenging for any single player to capture significant market share without a strong differentiator.

- Low Growth Potential: Without strategic intervention, this segment could remain in a low market share and low growth quadrant, requiring careful resource allocation.

Historical Losses and Liquidity Challenges

Bakkt has faced significant historical losses and ongoing liquidity challenges, placing it in a difficult position within the BCG matrix. These financial struggles suggest that prior business segments may have been consuming more cash than they generated, acting as cash traps.

Despite achieving profitability in Q1 2025, the company's stock performance since its 2021 inception tells a story of persistent financial strain. This prolonged downturn in market valuation underscores the severity of past liquidity issues and the market's perception of these operational weaknesses.

- Historical Net Losses: Bakkt has a documented history of reporting net losses, indicating that its operations, at various points, have not been self-sustaining.

- Liquidity Concerns: The company has openly acknowledged and grappled with liquidity problems, impacting its ability to meet short-term financial obligations.

- Stock Performance: Since its 2021 debut, Bakkt's stock has experienced a substantial decline, reflecting investor concerns about its financial health and operational viability.

- Cash Trap Perception: The market's reaction suggests that certain past business activities or the overall model were perceived as cash traps, draining resources without adequate returns.

Bakkt's loyalty business, marked by declining revenue and transaction activity, clearly fits the 'dog' profile in the BCG matrix. The company's decision to divest this segment, citing low growth and shrinking share, confirms its status as a resource drain with limited future potential.

The Bakkt Trust Company, facing limited market adoption and high regulatory expenses, was also a drain. Its sale was a direct consequence of its poor market growth and high operating costs, solidifying its 'dog' classification.

Concentrated client reliance, such as 74% of 2024 crypto revenue from Webull and 16% of 2024 loyalty revenue from Bank of America, poses significant risks. Loss of these key clients could transform these income streams into 'dogs' if diversification isn't prioritized.

The consumer-facing app segment, with declining active users in Q1 2024 and intense market competition, also risks becoming a 'dog'. Without strong differentiation, it faces low market share and low growth, demanding careful resource management.

Question Marks

New AI-powered payment solutions, like Bakkt's planned merchant checkout widget and white-label AI plug-in for global money movement, represent emerging offerings in the rapidly expanding AI-integrated payments sector. These innovations, born from the DTR partnership, tap into a high-growth market, indicating significant future potential. The global digital payment market was valued at over $9 trillion in 2023 and is projected to grow substantially, with AI integration expected to be a key driver.

Bakkt's foray into programmable money and DeFi bridging, powered by AI, targets a rapidly expanding market at the intersection of traditional and decentralized finance. This strategic direction positions Bakkt to capture future growth in a sector projected to reach trillions. For instance, the global DeFi market capitalization has seen substantial growth, with estimates suggesting it could exceed $5 trillion by 2030.

These initiatives are currently in their early stages for Bakkt, indicating a low current market share. However, their potential to disrupt existing financial systems and attract significant user adoption means they could evolve into 'stars' within the BCG matrix if Bakkt can effectively execute its strategy and gain traction in this competitive landscape.

Bakkt is exploring international markets to implement its treasury strategy, which involves investing in Bitcoin and other digital assets. This move is seen as a significant growth avenue, offering access to new customer bases and revenue streams. For instance, as of Q1 2024, Bakkt reported a 20% year-over-year increase in its customer base, highlighting its potential for broader reach.

However, Bakkt's presence in these new global territories is minimal, meaning its market share is currently negligible. This positions its international expansion as a 'question mark' within the BCG matrix, necessitating substantial capital infusion and strategic planning to establish a foothold and gain traction. The company is actively assessing regulatory landscapes in regions like Europe and Asia, aiming to understand the investment required to build brand awareness and operational capacity.

Development of BakktX for Institutional Integration

BakktX, while positioned as a Star due to its innovative approach to digital asset custody and trading for institutions, currently represents a Question Mark in the context of its full institutional integration. Its development is focused on building out crucial features like credit counterparty clearing partners, a vital component for widespread institutional adoption. This means while the core technology shows promise, the complete, robust offering for the institutional market is still in its formative stages, requiring significant investment to solidify its market position.

The strategic aim is to capture a high-growth segment of the institutional digital asset market. However, as of late 2024, BakktX has not yet achieved a dominant market share with its fully realized institutional capabilities. This developmental phase, characterized by ongoing investment and market penetration efforts, places it squarely in the Question Mark quadrant of the BCG Matrix.

- BakktX's Star Status: Innovative digital asset custody and trading platform.

- Question Mark Development: Focus on credit counterparty clearing partners and full institutional integration.

- Market Position: Targeting a high-growth institutional segment, but market share for the complete offering is still developing.

- Strategic Imperative: Requires continued investment to mature and achieve market dominance.

Strategic Acquisition of Bitcoin and Digital Assets

Bakkt's ambition to raise up to $1 billion for acquiring Bitcoin and other digital assets positions it to capitalize on a rapidly expanding market. This treasury strategy represents a significant commitment to a high-growth asset class, aiming to bolster its market presence and profitability.

However, this strategic move carries inherent risks. The substantial capital investment required, coupled with the inherent volatility of digital assets, places this initiative in the question mark category of the BCG matrix. Its ultimate success in terms of market share and profitability remains to be seen, dependent on market performance and Bakkt's execution.

- Capital Outlay: Bakkt plans to raise substantial capital, potentially up to $1 billion, for digital asset acquisition.

- Market Volatility: The strategy is exposed to the significant price fluctuations characteristic of cryptocurrencies.

- Uncertain Outcome: The long-term impact on Bakkt's market share and profitability is yet to be determined, classifying it as a question mark.

- Growth Potential: The acquisition targets a high-growth asset class, offering the potential for significant returns if successful.

Bakkt's international expansion efforts, particularly in new territories, currently represent a question mark. While the company is actively exploring these markets to implement its treasury strategy, its presence and market share are minimal, requiring substantial investment to build brand awareness and operational capacity.

The company's strategic assessment of regulatory landscapes in regions like Europe and Asia highlights the significant capital and planning needed to establish a foothold. This positions these international ventures as high-potential but uncertain growth areas within the BCG matrix.

Bakkt's foray into AI-powered payment solutions and programmable money also falls into the question mark category. These are emerging offerings in high-growth sectors, but their current market share is low, and their success hinges on effective execution and market adoption.

BakktX's full institutional integration is another question mark. While the platform shows innovative promise for digital asset custody, it requires further development, specifically securing credit counterparty clearing partners, to achieve widespread institutional adoption and a dominant market share.

BCG Matrix Data Sources

Our Bakkt BCG Matrix is built on comprehensive market data, integrating financial reports, industry growth rates, and competitor analysis to provide strategic clarity.