Bajaj Hindusthan Sugar PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Hindusthan Sugar Bundle

Unlock the strategic landscape of Bajaj Hindusthan Sugar with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its present and future. Gain a competitive edge by leveraging these insights to refine your own market approach.

Navigate the complexities of the sugar industry with confidence. Our PESTLE analysis of Bajaj Hindusthan Sugar provides actionable intelligence on everything from government policies to consumer trends. Download the full version now to equip yourself with the knowledge needed for smarter business decisions and robust investment strategies.

Political factors

The Indian government's control over sugarcane pricing, specifically the Fair and Remunerative Price (FRP), is a critical political factor for Bajaj Hindusthan Sugar. For the 2024-25 sugar season, the FRP for early maturing varieties was set at ₹345 per quintal and ₹355 per quintal for other varieties, a key input cost for the company.

Changes in FRP, or any disruptions in the payment system for farmers, can directly impact Bajaj Hindusthan Sugar's financial health and operational efficiency. For instance, if the FRP increases significantly without a corresponding rise in sugar prices, it squeezes profit margins.

Government policies on sugar buffer stocks and international trade, such as export subsidies or import duties, also shape the domestic market. In 2023-24, India's sugar production was estimated to be around 32 million tonnes, and government decisions on exports significantly influence the availability and pricing of sugar domestically.

The Indian government's strong emphasis on the Ethanol Blending Programme (EBP) is a significant political factor for Bajaj Hindusthan Sugar, leveraging its substantial ethanol production capacity. The ambitious target of achieving 20% ethanol blending with petrol (E20) by 2025 is a key driver, ensuring consistent demand and offering financial incentives that directly benefit the company's ethanol segment. For instance, in the fiscal year 2023-24, India's ethanol production capacity reached approximately 12.5 billion liters, with sugar mills and distilleries playing a crucial role.

Uttar Pradesh's agricultural policies, particularly those concerning sugarcane, directly impact Bajaj Hindusthan Sugar. The state government's focus on cane development, irrigation infrastructure, and farmer support schemes, such as subsidies for fertilizers and high-yield varieties, significantly influences the supply and quality of raw material for the company's mills. For instance, the Uttar Pradesh government's initiatives to increase sugarcane productivity, aiming for higher yields per hectare, are crucial for Bajaj Hindusthan's operational efficiency.

The political climate within Uttar Pradesh plays a pivotal role in shaping the sugar industry's landscape. Political stability and a supportive stance towards the agricultural sector, especially sugarcane cultivation, are essential for Bajaj Hindusthan Sugar. Policies related to Minimum Support Price (MSP) for sugarcane, timely payments to farmers, and regulations on inter-state movement of cane can create a favorable or challenging operating environment. The state's commitment to modernizing agricultural practices and ensuring fair pricing mechanisms for farmers directly correlates with the consistent availability of sugarcane for Bajaj Hindusthan's extensive operations.

Subsidies and Financial Support for Sugar Mills

Government subsidies and financial support play a crucial role in the sugar industry's stability. In 2023-24, the Indian government continued its focus on supporting farmers and the sugar sector, including measures to manage surplus sugar and promote ethanol production. For instance, the government has been actively encouraging sugar mills to increase their ethanol capacities, a move that directly benefits companies like Bajaj Hindusthan Sugar by providing an alternative revenue stream and helping manage sugar inventory.

These support mechanisms can significantly bolster the financial health of sugar mills. For example, the interest subvention schemes on loans for ethanol capacity expansion, which have been in place, reduce the borrowing costs for companies undertaking such projects. The government's stance on cane arrears also impacts the operational viability, as timely payments to farmers are critical for smooth operations. Bajaj Hindusthan Sugar, like its peers, benefits from these supportive policies.

- Government support aims to stabilize sugar prices and ensure timely payments to cane farmers, a key political objective.

- Financial assistance for ethanol production capacity expansion is a major driver for the sugar industry, aligning with India's biofuel targets.

- The continuation or modification of these subsidies directly influences the strategic investment decisions and profitability of sugar companies.

- In FY23, India's sugar production was around 32.7 million tonnes, with a significant portion diverted for ethanol, highlighting the impact of government policy on production allocation.

Trade Policies and Export Regulations

Government decisions on sugar exports significantly impact Bajaj Hindusthan Sugar. For instance, in the 2023-24 season, India imposed a 6.5 million tonne export cap to ensure domestic availability, a move that can limit opportunities for companies like Bajaj Hindusthan to sell excess sugar abroad.

These trade policies, including quotas and potential duties, directly influence Bajaj Hindusthan's ability to access international markets and manage its inventory. Favorable export conditions, such as those seen when India allowed duty-free exports for a period, can bolster prices and reduce domestic stock overhangs.

- Export Quotas: India's export quotas, like the 6.5 million tonne limit for 2023-24, directly restrict the volume Bajaj Hindusthan Sugar can sell internationally.

- Domestic Price Impact: Restrictive export policies can lead to a surplus in the domestic market, potentially depressing sugar prices for producers like Bajaj Hindusthan.

- Global Trade Dynamics: International tariffs and trade agreements can alter the competitiveness of Indian sugar exports, affecting Bajaj Hindusthan's global sales potential.

Government policies, particularly the Fair and Remunerative Price (FRP) for sugarcane, directly influence Bajaj Hindusthan Sugar's cost structure. For the 2024-25 season, the FRP was set at ₹345-₹355 per quintal, impacting raw material expenses. The government's Ethanol Blending Programme (EBP), aiming for 20% blending by 2025, provides a crucial revenue stream and financial incentives for the company's ethanol segment, with India's ethanol production capacity reaching approximately 12.5 billion liters in FY23-24.

Uttar Pradesh's agricultural policies, including cane development and irrigation initiatives, are vital for ensuring a consistent and quality supply of sugarcane for Bajaj Hindusthan Sugar. Government support through subsidies and financial assistance, such as interest subvention schemes for ethanol capacity expansion, helps stabilize the industry and improve profitability. For instance, in FY23, India's sugar production was around 32.7 million tonnes, with a significant portion allocated to ethanol production, underscoring the impact of government policy on production allocation.

Trade policies, such as export quotas, directly affect Bajaj Hindusthan Sugar's ability to manage inventory and access international markets. The 2023-24 export cap of 6.5 million tonnes limited overseas sales opportunities, potentially leading to domestic price pressure due to surplus stock. Global trade dynamics, including tariffs, also influence the competitiveness of Indian sugar exports.

| Political Factor | Impact on Bajaj Hindusthan Sugar | Relevant Data (2023-2025) |

| Sugarcane FRP | Directly affects raw material cost and profitability. | FRP for 2024-25: ₹345-₹355 per quintal. |

| Ethanol Blending Programme (EBP) | Provides alternative revenue stream and financial incentives. | Target E20 by 2025; India's ethanol capacity ~12.5 billion liters (FY23-24). |

| Export Policies | Influences inventory management and global sales potential. | 2023-24 export cap: 6.5 million tonnes. |

| State (UP) Agricultural Policies | Impacts raw material supply and quality. | Focus on cane development and irrigation infrastructure. |

What is included in the product

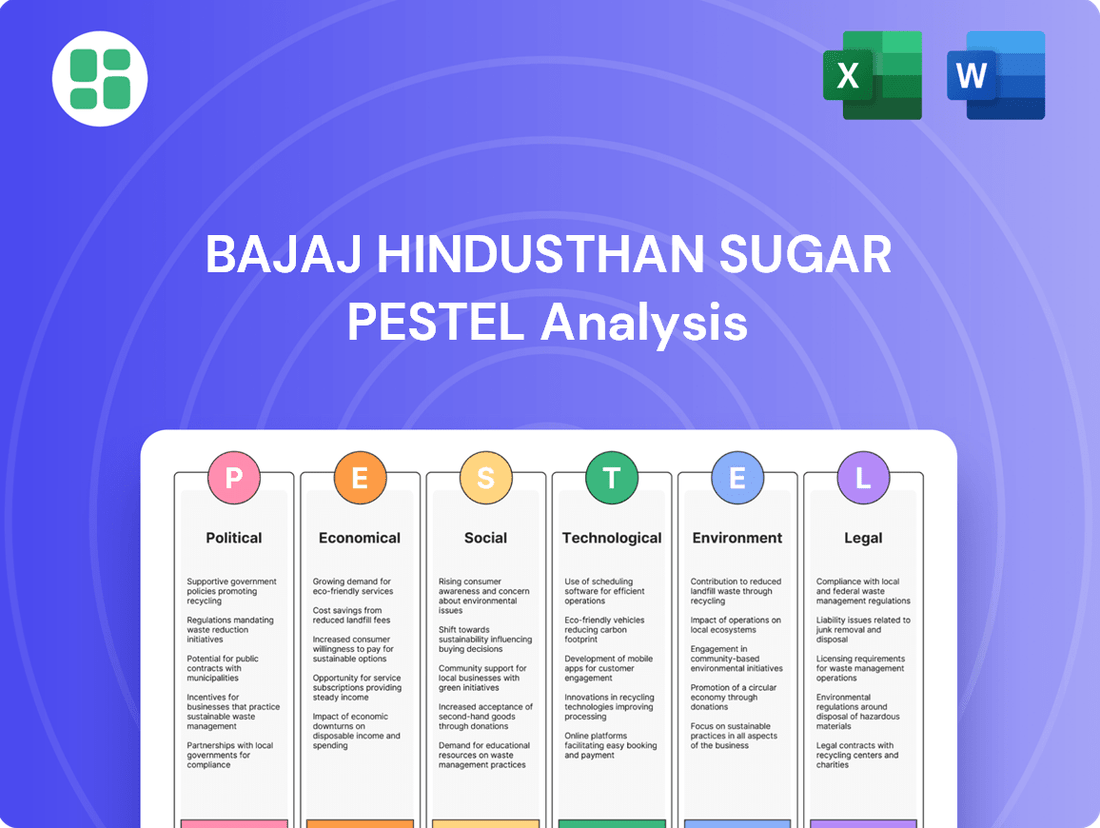

This PESTLE analysis offers a comprehensive examination of the external forces impacting Bajaj Hindusthan Sugar, covering political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides actionable insights for stakeholders to navigate the complex operating landscape and capitalize on emerging opportunities within the sugar industry.

A concise Bajaj Hindusthan Sugar PESTLE Analysis offers a clear overview of external factors, helping to preemptively address challenges and identify opportunities, thus alleviating strategic planning pain points.

Economic factors

Bajaj Hindusthan Sugar's financial health is directly tied to the unpredictable swings in both global and local sugar prices. These price movements are driven by a complex interplay of international supply and demand, the cost of crude oil which affects ethanol production—a key byproduct—and the ever-changing currency exchange rates. For instance, in early 2024, global sugar prices saw considerable volatility, with benchmarks like the ICE Sugar No. 11 contract experiencing significant intraday swings due to weather patterns in major producing regions like Brazil and India.

A prolonged downturn in sugar prices can severely squeeze Bajaj Hindusthan Sugar's profit margins, making it harder to cover operational costs. Conversely, periods of elevated sugar prices can dramatically improve the company's top-line revenue and overall profitability. The company's ability to effectively manage its inventory levels and adapt its sales strategies is crucial for navigating this inherent price volatility and protecting its financial performance.

Bajaj Hindusthan Sugar's ethanol business is significantly influenced by crude oil prices. When crude oil costs rise, ethanol becomes a more competitive fuel additive, boosting demand and potentially improving Bajaj Hindusthan Sugar's ethanol revenue. For instance, in early 2024, crude oil prices hovered around $80 per barrel, making ethanol blending more appealing.

Conversely, a sharp decline in crude oil prices, such as the dip seen in late 2023 when prices briefly fell below $70 per barrel, can diminish the economic advantage of ethanol. This dynamic directly impacts the pricing power and sales volume of Bajaj Hindusthan Sugar's ethanol output, a critical component of its diversified revenue streams.

Bajaj Hindusthan Sugar, as an agro-based company, is deeply tied to the monsoon's rhythm. Good, timely rains are crucial for healthy sugarcane growth, which directly translates to more raw material for the sugar mills and improved sugar extraction efficiency.

Conversely, unpredictable monsoon patterns, such as droughts or excessive flooding, can significantly disrupt sugarcane production. This can lead to shortages of the essential raw material, impacting the company's ability to operate at full capacity and potentially increasing the cost of obtaining sugarcane.

For instance, the 2023 monsoon season in India saw regional variations, with some areas experiencing below-average rainfall, which could affect sugarcane yields in those specific regions for the subsequent crushing season. This variability underscores the direct financial impact of weather patterns on companies like Bajaj Hindusthan Sugar.

Inflation and Input Costs

Rising inflation in India directly impacts Bajaj Hindusthan Sugar's operational expenses. The Fair and Remunerative Price (FRP) for sugarcane, a primary input, has seen upward revisions, alongside increased costs for labor, energy sources like coal, and essential chemicals. For instance, the FRP for the 2023-24 season was set at INR 315 per quintal for a basic recovery rate of 9.5%, a notable increase from previous years, directly affecting procurement costs.

These escalating input costs present a significant economic hurdle, especially if sugar prices do not keep pace with the inflation. This imbalance can lead to compressed profit margins for the company. For example, while raw material and energy costs might climb by 10-15% year-on-year, sugar realization might not offer a similar uplift, squeezing profitability.

- Sugarcane Procurement Costs: FRP increases directly raise the cost of the primary raw material.

- Energy and Fuel Expenses: Higher coal and power prices increase manufacturing costs.

- Labor and Transportation: Wage inflation and rising fuel prices impact operational overheads.

- Margin Pressure: The inability to pass on all cost increases to consumers can reduce profit margins.

Consumer Disposable Income and Demand

Consumer disposable income is a key driver for sugar demand in India. As the Indian economy grows, so does the purchasing power of its citizens, leading to increased consumption of sugar-sweetened products like confectionery and beverages. For instance, India's GDP grew by an estimated 7.7% in FY2023-24, indicating a healthy economic environment that supports higher consumer spending on such goods.

Conversely, any economic slowdown or inflationary pressures that erode disposable income can negatively impact sugar consumption. When consumers have less discretionary income, they tend to cut back on non-essential items, including many sugar-based products. This can directly affect sales volumes and the pricing power of sugar producers like Bajaj Hindusthan Sugar.

The trend in disposable income directly correlates with the demand for sugar and its derivatives:

- Rising Disposable Income: Fuels demand for processed foods, beverages, and confectionery, benefiting sugar companies.

- Economic Slowdowns/Inflation: Reduces consumer spending power, leading to lower demand for sugar-based products.

- Rural vs. Urban Demand: Discretionary spending patterns can vary, with urban consumers often driving demand for premium sugar products and processed foods.

Economic factors significantly shape Bajaj Hindusthan Sugar's performance, with global sugar prices and crude oil prices being critical determinants. Fluctuations in these commodities directly impact revenue and the profitability of its ethanol segment. For instance, in early 2024, global sugar prices experienced volatility, while crude oil prices remained elevated around $80 per barrel, influencing ethanol's attractiveness as a fuel additive.

Domestic economic conditions, particularly inflation and consumer disposable income, also play a vital role. Rising input costs, such as the Fair and Remunerative Price (FRP) for sugarcane, which was set at INR 315 per quintal for the 2023-24 season, put pressure on margins if not matched by sugar price increases. Conversely, a growing economy with increasing disposable income, like India's estimated 7.7% GDP growth in FY2023-24, typically boosts demand for sugar and related products.

| Economic Factor | Impact on Bajaj Hindusthan Sugar | Relevant Data (Early 2024) |

| Global Sugar Prices | Affects revenue and profit margins. | Volatile; ICE Sugar No. 11 experienced significant intraday swings. |

| Crude Oil Prices | Influences ethanol demand and pricing. | Around $80 per barrel, making ethanol blending more appealing. |

| Inflation & Input Costs | Increases operational expenses (e.g., sugarcane procurement). | FRP for 2023-24 set at INR 315/quintal; energy and labor costs rising. |

| Consumer Disposable Income | Drives demand for sugar and sugar-sweetened products. | India's GDP growth of ~7.7% in FY2023-24 supports consumer spending. |

Preview Before You Purchase

Bajaj Hindusthan Sugar PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Bajaj Hindusthan Sugar PESTLE analysis provides a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

Bajaj Hindusthan Sugar's presence in Uttar Pradesh is deeply intertwined with the local social fabric, providing employment for thousands and directly impacting the livelihoods of numerous sugarcane farmers. In 2023-24, the company's operations continued to be a significant source of income in these rural areas.

The company's commitment to farmers, including timely payments for sugarcane, is vital for community stability and ensures a consistent supply of raw materials. For instance, during the 2023-24 crushing season, prompt payments were a key factor in maintaining farmer trust and operational continuity.

Any disruption stemming from farmer dissatisfaction or social unrest poses a direct risk to Bajaj Hindusthan Sugar's operations. Past instances have shown that agricultural community sentiment can significantly influence the availability and cost of essential inputs like sugarcane.

Consumer health consciousness in India is on the rise, with a growing awareness of the impact of sugar on lifestyle diseases. This trend could significantly affect long-term demand for sugar products. For instance, a 2024 report indicated that over 65% of urban Indian consumers are actively seeking to reduce their sugar intake.

This societal shift towards healthier alternatives, including a reduced sugar content in processed foods, presents a challenge for companies like Bajaj Hindusthan Sugar. It may necessitate strategic adjustments such as product diversification into lower-sugar options or exploring alternative sweeteners to remain competitive.

Monitoring these evolving dietary habits is crucial. Bajaj Hindusthan Sugar will need to adapt its product portfolio and marketing strategies to align with the increasing consumer preference for healthier food choices to ensure sustained market relevance in the coming years.

Bajaj Hindusthan Sugar, as a major employer in rural Uttar Pradesh, faces significant societal expectations concerning its Corporate Social Responsibility (CSR). In fiscal year 2023-24, the company allocated ₹15.7 crore towards CSR activities, focusing on education and rural development projects. These investments are crucial for maintaining its social license to operate and fostering goodwill within the communities where it has a substantial presence.

The company's engagement in community development, including initiatives in healthcare and infrastructure, directly impacts its public image and operational sustainability. For instance, their recent partnership with a local NGO to improve sanitation facilities in 20 villages near their distillery plant in 2024 demonstrates a commitment to tangible community benefits. Such actions help mitigate social risks and cultivate a more supportive environment for business operations.

Labor Relations and Workforce Demographics

Bajaj Hindusthan Sugar's labor relations are a critical sociological element. The company must navigate its relationship with both skilled and unskilled labor, ensuring fair practices and safe environments to maintain smooth operations. For instance, in the 2023-24 fiscal year, the Indian sugar industry, including companies like Bajaj Hindusthan, faced ongoing discussions regarding minimum wage adjustments and worker welfare schemes, impacting overall labor costs and employee satisfaction.

Demographic shifts significantly influence the labor landscape. An aging workforce or shifts in migration patterns can affect the availability of skilled and unskilled labor for Bajaj Hindusthan Sugar. As of recent reports from 2024, India's agricultural sector, which provides a significant portion of the workforce for sugar production, is seeing a gradual shift with younger generations sometimes seeking opportunities outside traditional farming, necessitating proactive recruitment and training initiatives.

- Worker Welfare: Ensuring safe working conditions and fair labor practices is paramount for maintaining productivity and avoiding industrial disputes.

- Demographic Trends: The aging agricultural workforce and migration patterns present challenges and opportunities for labor availability and skill sets in the sugar industry.

- Skill Development: Adapting HR strategies to address changing workforce demographics, including upskilling and reskilling programs, is essential for future operational needs.

- Industrial Relations: Effective management of industrial relations is key to ensuring uninterrupted production cycles in the sugar manufacturing process.

Public Perception and Brand Image

Public perception of Bajaj Hindusthan Sugar, shaped by its operational practices, environmental footprint, and community involvement, is a key sociological element. A strong brand image helps attract skilled employees, build customer loyalty, and increase trust among investors and the wider community. For instance, in the fiscal year ending March 31, 2024, the company reported a net loss of INR 1,066.94 crore, a significant factor that can impact public sentiment regarding its financial stability and operational efficiency.

Negative press, such as issues with environmental regulations or unresolved farmer disputes, can severely harm its reputation. This can translate into societal pressure, potential consumer boycotts, and increased scrutiny from regulatory bodies. The company's efforts in corporate social responsibility (CSR) are crucial for mitigating these risks. In FY23, Bajaj Hindusthan Sugar reported CSR expenditure of INR 1.81 crore, contributing to rural development and education initiatives, which aims to foster a positive societal connection.

- Brand Image Impact: Positive public perception can lead to increased consumer preference and investor confidence, while negative publicity can result in boycotts and regulatory challenges.

- Environmental Concerns: Public awareness regarding the environmental impact of sugar production, including water usage and waste management, directly influences brand image.

- Community Relations: The company's relationship with local communities, particularly sugarcane farmers, is vital for maintaining social license to operate. Grievances from farmers can quickly escalate into public relations crises.

- Financial Performance and Perception: While not directly sociological, financial results like the net loss of INR 1,066.94 crore in FY24 can significantly influence public and stakeholder perception of the company's overall health and management.

Societal expectations around employment and community welfare significantly shape Bajaj Hindusthan Sugar's operational environment. As a major employer in Uttar Pradesh, the company's CSR initiatives, such as the ₹15.7 crore allocated in FY23-24 for education and rural development, are critical for maintaining its social license to operate and fostering goodwill.

Consumer health consciousness is a growing sociological factor, with a notable trend towards reduced sugar intake. Reports in 2024 indicated over 65% of urban Indian consumers are actively trying to cut down on sugar, prompting companies like Bajaj Hindusthan Sugar to consider product diversification and alternative sweeteners to align with evolving dietary preferences.

Labor relations and demographic shifts also play a crucial role. The company must manage fair labor practices amidst discussions on minimum wage adjustments, as seen in the 2023-24 fiscal year. Furthermore, changing workforce demographics, including an aging agricultural labor pool, necessitate adaptive HR strategies and skill development programs to ensure operational continuity.

| Sociological Factor | Impact on Bajaj Hindusthan Sugar | Relevant Data/Observation (2023-2024/2024-2025) |

|---|---|---|

| Community Dependence & CSR | Reliance on company for employment and development; need for positive social impact. | ₹15.7 crore CSR allocation in FY23-24 for education and rural development. |

| Health Consciousness & Dietary Shifts | Potential decrease in sugar demand; need for product adaptation. | Over 65% of urban Indian consumers seeking to reduce sugar intake (2024). |

| Labor Dynamics & Demographics | Availability and cost of labor; need for fair practices and skill development. | Ongoing discussions on minimum wage adjustments in the sugar industry (FY23-24); aging agricultural workforce trends. |

| Public Perception & Brand Image | Influence on consumer loyalty, investor confidence, and regulatory scrutiny. | Net loss of INR 1,066.94 crore in FY24 impacting public sentiment; INR 1.81 crore CSR expenditure in FY23. |

Technological factors

Technological advancements are significantly boosting efficiency in sugar processing and extraction for companies like Bajaj Hindusthan Sugar. Improved milling techniques, advanced clarification processes, and more efficient crystallization methods directly translate to higher sugar recovery rates from sugarcane. For instance, investments in modern machinery can increase sugar yields, thereby lowering per-unit production costs and improving overall profitability.

Bajaj Hindusthan Sugar's strategic move into power co-generation utilizes bagasse, a readily available byproduct from its sugar manufacturing operations. This integration allows the company to convert waste material into a valuable energy source.

Recent advancements in boiler technology, particularly supercritical steam generation, and more efficient turbine designs are enhancing the economic viability of co-generation. Improved grid synchronization and power evacuation infrastructure are also crucial for maximizing returns from selling surplus electricity.

In the fiscal year 2023-24, Bajaj Hindusthan Sugar reported a significant increase in its power generation capacity, contributing to its diversification strategy. The company aims to optimize its energy output, reducing operational costs and creating an additional revenue stream by supplying power to the national grid.

Technological advancements are reshaping ethanol production, and Bajaj Hindusthan Sugar needs to stay ahead. Innovations in fermentation efficiency, like using advanced yeast strains or optimizing conditions, can boost output. For instance, by 2024, India's ethanol blending program aims for 20% blending, driving demand for more efficient production methods.

Beyond traditional molasses, exploring feedstocks like sugarcane bagasse or agricultural waste for second-generation ethanol offers diversification. This not only reduces reliance on sugar cycles but also taps into a growing market for sustainable biofuels. Companies investing in these technologies are better positioned for long-term growth and environmental compliance.

Research and development are paramount. Bajaj Hindusthan Sugar's commitment to R&D in areas like reduced energy consumption during distillation or exploring new enzyme technologies can significantly improve cost-effectiveness. By 2025, the global biofuel market is projected to grow, making technological leadership a key competitive advantage.

Automation and Digitalization in Operations

Bajaj Hindusthan Sugar is increasingly leveraging automation and digital platforms to streamline its sugar manufacturing and power co-generation. This adoption of technologies like the Internet of Things (IoT) is aimed at boosting operational control, minimizing errors, and enabling more effective predictive maintenance. For instance, in 2023, many sugar mills globally reported a reduction in downtime by up to 15% through IoT-driven maintenance strategies.

The company is also focusing on digitalizing its entire supply chain, from sourcing sugarcane to delivering final products. This digital transformation is expected to unlock significant efficiencies, drive down costs, and sharpen decision-making capabilities. By 2024, the Indian sugar industry is seeing a trend where digitally integrated supply chains are contributing to an average of 8-10% cost reduction in logistics.

Embracing Industry 4.0 principles is crucial for Bajaj Hindusthan Sugar's future competitiveness. This includes integrating advanced analytics, artificial intelligence, and robotics into its operations. Companies that have successfully implemented Industry 4.0 initiatives have observed improvements in overall equipment effectiveness (OEE) by as much as 20-25%.

- Enhanced Operational Efficiency: Automation and IoT integration are key to improving real-time monitoring and control of sugar production processes.

- Supply Chain Optimization: Digitalization of logistics and procurement is vital for cost savings and better inventory management.

- Predictive Maintenance: Implementing IoT sensors allows for early detection of equipment issues, reducing unexpected breakdowns and maintenance costs.

- Industry 4.0 Adoption: A strategic move towards smart manufacturing principles is essential for staying competitive in the evolving industrial landscape.

Research and Development in Sugarcane Varieties

Bajaj Hindusthan Sugar's reliance on sugarcane as a primary input makes advancements in agricultural biotechnology and plant breeding crucial. Research into new sugarcane varieties with higher sugar content, enhanced disease resistance, and improved yields directly impacts the company's raw material quality and availability. For instance, the development of varieties that are more tolerant to drought conditions, a growing concern in many sugarcane-producing regions, could significantly mitigate production risks.

These technological improvements can lead to more efficient processing operations and ultimately better financial performance. In 2023-24, the Indian Council of Agricultural Research (ICAR) continued its efforts in developing improved sugarcane varieties, with some new strains showing potential for a 10-15% increase in sucrose content compared to existing ones.

- Higher Sugar Content: Varieties yielding more sucrose per tonne of cane reduce processing costs and increase sugar output.

- Disease Resistance: Reduced crop losses from pests and diseases improve overall yield stability.

- Yield per Acre: Maximizing output from available land is key to cost-effectiveness.

- Drought Tolerance: Crucial for regions facing water scarcity, ensuring consistent supply.

Technological advancements in agricultural biotechnology are critical for Bajaj Hindusthan Sugar, focusing on developing sugarcane varieties with higher sugar content and improved yields. For example, by 2024, new strains are showing potential for a 10-15% increase in sucrose content.

The company's strategic investment in power co-generation is enhanced by advancements in boiler and turbine technology, boosting efficiency and profitability. By fiscal year 2023-24, Bajaj Hindusthan Sugar saw increased power generation capacity, contributing to its revenue diversification.

Digitalization and Industry 4.0 adoption, including IoT and AI, are streamlining operations and supply chains, aiming to reduce costs by 8-10% in logistics by 2024 and improve overall equipment effectiveness by up to 25%.

Innovations in ethanol production, such as advanced fermentation techniques and the use of alternative feedstocks, are vital for meeting India's 20% blending target by 2025, positioning Bajaj Hindusthan Sugar for growth in the biofuel market.

| Key Technological Impact Area | Bajaj Hindusthan Sugar's Focus | 2024/2025 Data/Projections |

| Sugarcane Cultivation | Biotechnology for higher sucrose & yield | Potential 10-15% increase in sucrose content (ICAR 2023-24) |

| Sugar Processing | Advanced milling & extraction techniques | Increased sugar recovery rates & lower production costs |

| Power Co-generation | Supercritical steam & efficient turbines | Enhanced economic viability of waste-to-energy |

| Ethanol Production | Fermentation efficiency & new feedstocks | Support for India's 20% blending target by 2025 |

| Operational Efficiency | Automation, IoT, AI (Industry 4.0) | 8-10% logistics cost reduction (projected 2024), up to 25% OEE improvement |

Legal factors

Bajaj Hindusthan Sugar must adhere to strict environmental laws governing its sugar mills and distilleries. This includes regulations on air emissions, water pollution, and waste disposal, overseen by bodies like the Central Pollution Control Board (CPCB) and State Pollution Control Boards (SPCBs). Non-compliance can lead to significant fines, operational halts, and damage to the company's reputation.

The company is legally obligated to invest in advanced effluent treatment plants and emission control systems to meet these environmental standards. For instance, in 2023, the Indian government intensified scrutiny on industrial emissions, with sugar factories facing particular attention for their water usage and discharge. Bajaj Hindusthan Sugar's ongoing capital expenditure plans in 2024 and 2025 are expected to heavily feature upgrades to these environmental compliance technologies.

Bajaj Hindusthan Sugar operates under a stringent framework of labor laws. These include mandates on minimum wages, as set by state governments, which can impact the company's operational costs. For instance, the minimum wage for agricultural laborers in Uttar Pradesh, where many of Bajaj's operations are located, saw revisions in early 2024, influencing direct labor expenses.

Maintaining compliance with regulations concerning working hours, employee safety (like those under the Factories Act, 1948), and social security contributions is paramount. Failure to adhere to these can result in penalties, such as fines or even temporary closure of facilities, as seen in past instances with other industrial players facing labor law violations.

Healthy industrial relations are vital for Bajaj Hindusthan Sugar to avoid disruptive labor disputes and strikes. The company's engagement with trade unions and its approach to collective bargaining significantly influence its ability to maintain smooth operations and prevent costly work stoppages, which can derail production targets and financial performance.

As a major food producer, Bajaj Hindusthan Sugar is bound by stringent food safety and quality standards, primarily overseen by the Food Safety and Standards Authority of India (FSSAI). These regulations cover crucial aspects such as the purity and grading of sugar, appropriate packaging materials, clear and accurate labeling, and rigorous hygiene protocols throughout the manufacturing process.

Compliance with these FSSAI mandates is not merely a legal obligation; it's fundamental to ensuring consumer safety and building trust. For instance, FSSAI standards often specify permissible levels of impurities and contaminants in food products. Failure to meet these benchmarks can lead to severe penalties, including hefty fines and product recalls, which can significantly damage brand reputation and market share. In 2023, the FSSAI continued its drive to enhance food safety across the nation, with ongoing inspections and updates to existing regulations impacting the food processing industry.

Land Acquisition and Usage Laws

Bajaj Hindusthan Sugar's expansion and modernization efforts are significantly influenced by India's intricate land acquisition and usage laws. These regulations, which differ across states, dictate the procedures for acquiring land, compensating landowners, and obtaining necessary environmental approvals. Successfully navigating these legal requirements is paramount for the company's infrastructure development and future growth initiatives.

For instance, the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, sets a national standard, but state-specific rules add layers of complexity. Bajaj Hindusthan Sugar must ensure compliance with these varying state land laws when planning new sugar mills or expanding existing facilities.

- State-Specific Land Laws: Adherence to diverse land acquisition acts across different Indian states is crucial for operational expansion.

- Compensation and Resettlement: Ensuring fair compensation and proper resettlement for landowners is a legal mandate during land acquisition.

- Environmental Clearances: Obtaining environmental permits and clearances is a prerequisite for any new facility or expansion project.

- Regulatory Compliance Costs: The company incurs costs associated with legal consultation, documentation, and compliance with land acquisition procedures.

Corporate Governance and SEBI Regulations

Bajaj Hindusthan Sugar, as a publicly traded entity, operates under stringent corporate governance frameworks mandated by the Securities and Exchange Board of India (SEBI) and the Companies Act. These regulations cover critical areas such as financial reporting accuracy, timely and comprehensive disclosures, the structure and independence of its board of directors, and the protection of shareholder rights. For instance, SEBI's LODR (Listing Obligations and Disclosure Requirements) Regulations, particularly those updated in 2023-2024, dictate specific timelines for financial results dissemination and corporate actions, impacting how Bajaj Hindusthan Sugar communicates its performance and strategic decisions to the market.

Adherence to these legal and regulatory requirements is paramount for maintaining transparency and fostering investor confidence. Failure to comply can result in significant penalties, legal challenges, and damage to the company's reputation. In 2024, SEBI continued its focus on enhancing corporate governance, with new guidelines often emphasizing greater board accountability and improved risk management practices, directly influencing Bajaj Hindusthan Sugar's internal controls and operational oversight.

The company's commitment to these norms is reflected in its compliance reports and annual filings, which detail its adherence to SEBI's directives on matters like insider trading prevention and related-party transactions. For example, the company's latest annual report would detail its board diversity and the composition of its audit committee, key indicators of its governance strength as per SEBI's evolving expectations.

- SEBI LODR Regulations: Bajaj Hindusthan Sugar must comply with updated disclosure timelines and content requirements for quarterly and annual financial results, impacting market communication strategies.

- Board Composition and Independence: SEBI mandates specific ratios of independent directors on the board, influencing Bajaj Hindusthan Sugar's governance structure and decision-making processes.

- Shareholder Rights Protection: Compliance with regulations safeguarding minority shareholder interests, including fair treatment in corporate actions and access to information, is crucial for maintaining investor trust.

- Financial Reporting Standards: Adherence to Indian Accounting Standards (Ind AS) and SEBI's accounting norms ensures the accuracy and comparability of Bajaj Hindusthan Sugar's financial statements.

Bajaj Hindusthan Sugar is subject to various governmental policies and regulations impacting the sugar industry, including pricing controls, export/import duties, and ethanol blending mandates. For instance, the Indian government's focus on increasing ethanol production from molasses, a byproduct of sugar manufacturing, directly influences demand and pricing for Bajaj's sugar and related products. The company's strategic decisions in 2024 and 2025 are heavily shaped by these evolving government policies aimed at boosting agricultural income and energy security.

The company must also navigate complex tax structures, including Goods and Services Tax (GST) on sugar and its derivatives, and excise duties on specific products. Changes in tax rates or the introduction of new levies can significantly affect profitability and pricing strategies. For example, any shifts in GST rates for sugar or ethanol in the 2024-2025 fiscal year would require immediate adjustments to Bajaj Hindusthan Sugar's financial planning and operational costs.

Furthermore, government support schemes for the agricultural sector, such as subsidies for sugarcane farmers or incentives for modernizing sugar mills, can provide a competitive advantage. Bajaj Hindusthan Sugar's ability to leverage these policy benefits, such as those related to renewable energy generation from bagasse, will be a key factor in its operational efficiency and financial performance in the coming years.

Environmental factors

Sugarcane cultivation, the backbone of Bajaj Hindusthan Sugar's operations, is inherently water-intensive. This dependency makes water availability a paramount environmental concern, particularly in regions like Uttar Pradesh, which has experienced increasing water stress in recent years. For instance, reports from the Central Ground Water Board (CGWB) indicate a declining groundwater table in several districts of Uttar Pradesh, directly impacting irrigation potential.

Effective water management is therefore crucial for both sustainability and operational resilience. Bajaj Hindusthan Sugar must focus on implementing efficient irrigation techniques at the farm level and optimizing water usage within its sugar mills, including process water recycling and rainwater harvesting initiatives. Such measures not only reduce environmental impact but also ensure compliance with evolving water usage regulations.

The company's performance can be significantly affected by climatic events like droughts, which directly reduce sugarcane yields, or by changes in government water allocation policies. For example, a severe drought in 2023-2024 could have led to a substantial drop in cane availability for mills, impacting production volumes and profitability. Similarly, stricter regulations on water abstraction could necessitate costly upgrades to mill infrastructure.

Bajaj Hindusthan Sugar's operations are deeply tied to managing byproducts from sugar production. Bagasse, a fibrous residue, is primarily used for co-generation of power, with the company often selling surplus electricity. In the 2023-24 crushing season, Bajaj Hindusthan Sugar reported significant bagasse utilization for its captive power needs, contributing to energy cost savings.

Molasses, another key byproduct, is a vital input for ethanol production. The company's ethanol manufacturing capacity plays a role in India's biofuel targets. For instance, during the 2023-24 fiscal year, Bajaj Hindusthan Sugar's distilleries processed a substantial volume of molasses, aligning with the government's push for increased ethanol blending in petrol.

The environmental impact of waste, such as press mud and distillery spent wash, is a significant concern. Improper handling can lead to water and soil contamination, inviting regulatory attention. Bajaj Hindusthan Sugar has been investing in effluent treatment plants and exploring methods for the safe disposal or valorization of these waste streams to mitigate environmental risks and comply with stricter pollution control norms, especially in regions like Uttar Pradesh where its major facilities are located.

Sugar mills, including those operated by Bajaj Hindusthan Sugar, release pollutants like particulate matter and greenhouse gases into the atmosphere. This necessitates ongoing monitoring and control of emissions to meet stringent air quality regulations. For instance, in 2023, India's Central Pollution Control Board reported that industrial emissions contributed significantly to air pollution in many regions, highlighting the importance of compliance for companies like Bajaj Hindusthan Sugar.

To address this, Bajaj Hindusthan Sugar needs to invest in advanced pollution control technologies. Implementing equipment such as electrostatic precipitators and scrubbers is crucial for reducing their environmental footprint and avoiding potential fines from regulatory bodies. These investments are vital for sustainable operations and maintaining a positive environmental record.

Climate Change Impacts on Sugarcane Cultivation

Climate change presents significant environmental challenges for Bajaj Hindusthan Sugar. Altered rainfall patterns, more frequent extreme weather like droughts and floods, and rising temperatures directly threaten sugarcane cultivation, the company's primary raw material source. For instance, India, where Bajaj Hindusthan operates, has experienced erratic monsoons in recent years, impacting agricultural output.

These climatic shifts can lead to reduced sugarcane yields and lower sugar recovery rates, directly affecting the company's operational efficiency and profitability. Furthermore, warmer and wetter conditions can foster increased pest and disease outbreaks, necessitating higher input costs for crop protection.

In response, adopting climate-resilient farming practices is becoming crucial for long-term sustainability. This includes developing drought-tolerant sugarcane varieties and implementing efficient water management techniques.

- Reduced Yields: Climate change can decrease sugarcane output per hectare.

- Lower Sugar Recovery: Higher temperatures and water stress can impact the sugar content in the cane.

- Increased Pest & Disease Risk: Favorable conditions for pests and diseases can damage crops and increase management costs.

Sustainable Farming Practices and Soil Health

Bajaj Hindusthan Sugar's reliance on sugarcane means sustainable farming is paramount. Promoting practices like reduced fertilizer and pesticide use, alongside crop rotation, directly supports soil health. For instance, in the 2023-24 crushing season, India's sugarcane production was estimated to be around 43 million tonnes, highlighting the scale of agricultural input. Degraded soil can significantly reduce yields, posing a risk to the company's raw material supply and its long-term environmental footprint.

The company's commitment to sustainability is crucial for mitigating these risks. Encouraging farmers to adopt methods that preserve soil fertility, such as organic manure application and conservation tillage, can lead to more resilient crops. This focus is particularly relevant given the increasing global emphasis on climate-smart agriculture, which aims to increase productivity while reducing greenhouse gas emissions and improving soil carbon sequestration.

- Promoting sustainable sugarcane farming practices among farmers supplying Bajaj Hindusthan Sugar is essential for long-term environmental health and raw material security.

- Encouraging judicious use of fertilizers and pesticides, crop rotation, and maintaining soil health are key components of these practices.

- Degraded soil and unsustainable farming methods can lead to lower yields over time, impacting the company's future raw material availability.

- India's agricultural sector, a significant contributor to its GDP, is increasingly focusing on sustainable methods to ensure food security and environmental protection.

Water scarcity is a critical environmental factor for Bajaj Hindusthan Sugar, given sugarcane's high water demand. Declining groundwater levels in key cultivation areas like Uttar Pradesh, as noted by the Central Ground Water Board, necessitate efficient water management. The company's operational resilience hinges on adopting advanced irrigation and recycling technologies, especially as water allocation policies become stricter.

Climate change poses a significant threat through erratic rainfall, droughts, and temperature fluctuations, directly impacting sugarcane yields and sugar recovery rates. For instance, India has witnessed unpredictable monsoon patterns in recent years, affecting agricultural output. These shifts can also increase pest infestations, raising crop protection costs.

Bajaj Hindusthan Sugar must address air pollution from its mills, which release particulate matter and greenhouse gases. Compliance with India's stringent air quality regulations, overseen by bodies like the Central Pollution Control Board, requires investment in technologies such as electrostatic precipitators and scrubbers to minimize emissions.

Sustainable farming practices are vital for maintaining soil health and ensuring a steady supply of sugarcane, the company's primary raw material. Promoting practices like reduced fertilizer and pesticide use, crop rotation, and organic manure application among farmers is crucial for long-term environmental health and raw material security, especially considering India's focus on climate-smart agriculture.

PESTLE Analysis Data Sources

Our Bajaj Hindusthan Sugar PESTLE Analysis is built on a robust foundation of data from government reports, agricultural statistics, and economic indicators. We incorporate insights from industry associations, market research firms, and relevant policy updates to ensure a comprehensive understanding of the operating environment.