Bajaj Hindusthan Sugar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Hindusthan Sugar Bundle

Bajaj Hindusthan Sugar faces a complex competitive landscape, with moderate bargaining power from suppliers and buyers influencing its profitability. The threat of new entrants is somewhat constrained by capital requirements, but substitutes pose a significant challenge.

The full Porter's Five Forces Analysis reveals the real forces shaping Bajaj Hindusthan Sugar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Government-mandated sugarcane prices significantly bolster supplier power for Bajaj Hindusthan Sugar. For the 2024-25 season, Uttar Pradesh, a key operating region, maintained its State Advised Price (SAP) at ₹370 per quintal for early varieties. This fixed pricing mechanism, alongside the national Fair and Remunerative Price (FRP), restricts Bajaj Hindusthan's ability to negotiate raw material costs downwards with sugarcane farmers.

The bargaining power of suppliers in the sugarcane industry, particularly for a company like Bajaj Hindusthan Sugar, is significantly influenced by the structure of its farmer base. While individual farmers are numerous and dispersed across Uttar Pradesh, their collective strength, often amplified by government policies and farmer unions, can exert considerable influence.

Although government-set minimum support prices (MSPs) for sugarcane offer a degree of protection to farmers, they also establish a floor price that mills must adhere to. For instance, in the 2023-24 season, the Fair and Remunerative Price (FRP) for sugarcane was set at ₹315 per quintal for a basic recovery rate of 10.25%, demonstrating a direct cost implication for sugar mills. This regulated pricing mechanism, while ensuring a supply, limits the mills' ability to negotiate lower input costs directly with a fragmented farmer base.

Sugarcane production is inherently tied to the whims of weather and farming techniques, creating natural volatility in supply. This variability can significantly shift power towards suppliers, especially when yields are unpredictable.

For instance, India's sugar output faced a downturn in the 2024-25 season, with Maharashtra and Karnataka experiencing reduced cane availability. This scarcity can empower farmers who manage to secure good yields, giving them more leverage over sugar mills like Bajaj Hindusthan Sugar.

Bajaj Hindusthan Sugar, with its integrated manufacturing facilities, has a critical need for a steady and high-quality supply of sugarcane. Disruptions in this supply chain, driven by agricultural factors, directly impact their operational efficiency and profitability, highlighting the suppliers' bargaining power.

Ethanol Diversion as an Alternative Market

The government's strong emphasis on ethanol blending has created a significant alternative market for sugarcane farmers. This initiative allows farmers to sell their sugarcane for ethanol production, reducing their dependence solely on sugar mills. This diversion has notably increased in the 2024-25 season, enhancing farmers' bargaining power.

The competition for sugarcane between sugar production and ethanol manufacturing directly impacts raw material costs for sugar companies like Bajaj Hindusthan Sugar. As more sugarcane is channeled into ethanol, sugar mills face increased pressure to secure their supply, potentially driving up the price they must pay for this crucial input.

- Ethanol Blending Target: India aims for 20% ethanol blending (E20) by 2025, increasing demand for sugarcane as feedstock.

- Farmer Leverage: The availability of the ethanol market provides farmers with an option to sell their sugarcane at potentially better prices, lessening their need to accept terms dictated by sugar mills.

- Cost Inflation: Increased demand from the ethanol sector can lead to higher sugarcane procurement prices for sugar mills, impacting their profitability.

Logistics and Transportation Costs

The geographical concentration of Bajaj Hindusthan Sugar's mills in Uttar Pradesh positions them to source sugarcane from nearby farming communities. This proximity, while beneficial, also means significant transportation costs are incurred to bring the raw material to the mills.

Escalating costs for sugarcane cutting and transportation are a direct concern. Reports indicate these expenses have risen by approximately Rs. 100-125 per tonne, directly impacting Bajaj Hindusthan's operational expenditures and bolstering the bargaining power of local suppliers and transporters.

- Geographical Concentration: Mills primarily located in Uttar Pradesh, relying on local sugarcane supply.

- Transportation Costs: Significant expenses associated with moving sugarcane from farms to mills.

- Cost Increases: Sugarcane cutting and transportation costs have reportedly risen by Rs. 100-125 per tonne.

- Supplier Power: Logistical challenges and rising costs strengthen the bargaining power of local suppliers and transporters.

The bargaining power of sugarcane suppliers for Bajaj Hindusthan Sugar is substantial, driven by government regulations and the growing demand from the ethanol sector. For the 2024-25 season, Uttar Pradesh's State Advised Price (SAP) remained at ₹370 per quintal for early varieties, a fixed cost that limits negotiation. This, coupled with the national Fair and Remunerative Price (FRP), which was ₹315 per quintal for the 2023-24 season, establishes a price floor for farmers. The government's ethanol blending targets, aiming for E20 by 2025, have created a strong alternative market, increasing farmer leverage and potentially driving up raw material costs for sugar mills.

| Factor | Impact on Supplier Power | Relevant Data/Context |

|---|---|---|

| Government Pricing (SAP/FRP) | High | UP SAP for 2024-25: ₹370/quintal. FRP for 2023-24: ₹315/quintal. |

| Ethanol Demand | Increasing | India's E20 target by 2025 increases sugarcane demand for ethanol. |

| Geographical Concentration & Logistics | Moderate | Mills in UP rely on local supply; cutting/transport costs up by ₹100-125/tonne. |

| Weather & Yield Volatility | Variable | Reduced cane availability in key states like Maharashtra in 2024-25 season. |

What is included in the product

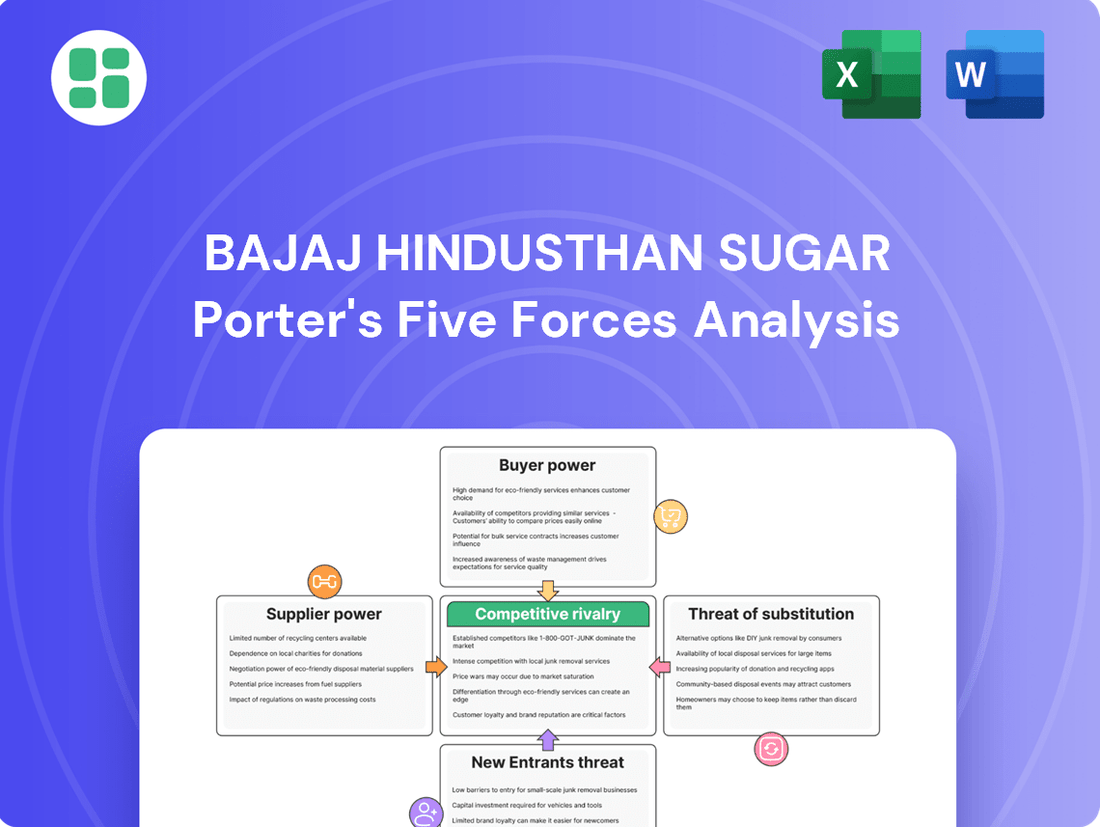

This analysis of Bajaj Hindusthan Sugar reveals intense industry rivalry, significant buyer power from large food manufacturers, and moderate supplier bargaining power, alongside low threat of new entrants and substitutes due to high capital requirements and established infrastructure.

Instantly visualize the competitive landscape of Bajaj Hindusthan Sugar with a clear, one-sheet summary of all five forces, perfect for quick strategic decision-making.

Customers Bargaining Power

The commoditized nature of sugar significantly empowers customers. Because sugar is largely undifferentiated across producers, buyers, especially large industrial consumers in the food and beverage industries, can readily switch suppliers if prices are more favorable elsewhere. This lack of product distinction means Bajaj Hindusthan Sugar must focus heavily on cost competitiveness to retain its customer base.

The Indian government significantly influences sugar pricing and distribution, directly impacting the bargaining power of customers. By setting a Minimum Support Price (MSP) for sugar, the central government limits the pricing flexibility of mills like Bajaj Hindusthan. This intervention essentially caps the potential price increases that a company could otherwise pass on to consumers, thereby strengthening the customer's position.

Furthermore, the allocation of domestic sugar quotas to mills by the central government plays a crucial role. For instance, the domestic sugar quota for May 2025 was reportedly lower than the previous year. This cautious supply management strategy, while aimed at stabilizing prices, also means that the available sugar supply is controlled, giving buyers more leverage within the regulated market framework.

Bajaj Hindusthan Sugar's diversified product portfolio, including co-generation of power and ethanol production, offers a buffer against the bargaining power of customers in the sugar market. By creating alternative revenue streams, the company is less susceptible to price pressures from sugar buyers.

The increasing demand for ethanol, fueled by government mandates for fuel blending, provides a more predictable and expanding market for a significant portion of Bajaj Hindusthan's molasses, a byproduct of sugar production. This strategic diversification lessens the company's dependence on the volatile sugar sales market.

Presence of Large Industrial Buyers

The presence of large industrial buyers significantly impacts Bajaj Hindusthan Sugar's bargaining power of customers. Major food and beverage manufacturers, who are substantial sugar consumers, wield considerable influence due to their bulk purchasing. These buyers often have advanced procurement strategies and can negotiate for competitive pricing, flexible credit terms, and stringent quality specifications.

For Bajaj Hindusthan Sugar, retaining these key accounts necessitates maintaining robust customer relationships and optimizing operational efficiency. The company's ability to meet the demands of these large industrial clients is crucial for its market position.

- Large industrial buyers, such as major food and beverage companies, represent a significant portion of sugar demand.

- These customers possess strong bargaining power due to their bulk purchasing volumes and sophisticated procurement processes.

- Negotiations often involve demands for competitive pricing, favorable credit terms, and adherence to specific quality standards.

- Bajaj Hindusthan Sugar must focus on building and maintaining strong relationships with these large industrial clients to ensure continued business.

Consumer Health Awareness and Substitutes

Consumer health awareness is a significant factor influencing the bargaining power of customers in the sugar industry. Growing concerns about obesity and diabetes are driving demand for sugar alternatives.

These substitutes include artificial sweeteners and natural low-calorie options like stevia and monk fruit. For instance, the global market for artificial sweeteners was valued at approximately $3.4 billion in 2023 and is projected to grow significantly. This increasing availability and acceptance of alternatives can reduce consumers' reliance on traditional sugar, thereby increasing their bargaining power.

While sugar remains a widely used ingredient, the long-term trend towards healthier lifestyles could potentially curb overall sugar consumption. This shift exerts a latent pressure on sugar prices and demand, as consumers become more discerning about their intake.

- Growing Health Consciousness: Consumers are increasingly seeking healthier options, leading to a demand for sugar substitutes.

- Rise of Alternatives: Products like stevia, erythritol, and monk fruit are gaining popularity as replacements for sugar.

- Impact on Sugar Demand: The increasing adoption of these alternatives could lead to a long-term reduction in overall sugar consumption.

- Price Pressure: This trend can put downward pressure on sugar prices as manufacturers and consumers explore lower-sugar formulations.

The bargaining power of customers for Bajaj Hindusthan Sugar is substantial, primarily driven by the commodity nature of sugar and the presence of large industrial buyers. These buyers, often from the food and beverage sector, leverage their significant purchase volumes to negotiate favorable pricing and terms. For instance, in 2023-24, India's sugar production reached a record 34.2 million tonnes, increasing supply and potentially strengthening buyer leverage.

| Factor | Impact on Bajaj Hindusthan Sugar | Supporting Data (2023-24) |

| Commoditization & Switching Costs | High customer power due to undifferentiated product; low switching costs. | India's sugar production exceeded 34 million tonnes, increasing market supply. |

| Large Industrial Buyers | Significant leverage from bulk purchases and demand for competitive terms. | Food & Beverage sector is a major consumer of sugar in India. |

| Government Regulations | Price controls (MSP) limit pricing flexibility, indirectly aiding customers. | Government often intervenes to manage sugar prices and availability. |

| Health Consciousness & Alternatives | Growing demand for sugar substitutes can reduce reliance on traditional sugar. | Global sugar substitute market shows consistent growth. |

Same Document Delivered

Bajaj Hindusthan Sugar Porter's Five Forces Analysis

This preview showcases the complete Bajaj Hindusthan Sugar Porter's Five Forces Analysis, detailing the competitive landscape, bargaining power of suppliers and buyers, threat of new entrants and substitutes. The document you see here is the exact, professionally written analysis you'll receive immediately after purchase, ready for your strategic planning needs.

Rivalry Among Competitors

The Indian sugar industry is characterized by intense rivalry due to its highly fragmented nature, featuring a large number of cooperative and private sugar mills. This fragmentation, coupled with government regulations such as cane area reservation and administered pricing mechanisms, fuels fierce competition among players for limited resources and market share. For instance, as of the 2023-24 sugar season, India had over 700 sugar mills in operation, highlighting the sheer number of competitors Bajaj Hindusthan faces.

Competitive rivalry in the sugar industry is intense, particularly when production outstrips demand or when sugar recovery rates are low, a situation that affected some regions during the 2024-25 season. Mills constantly work to maximize their crushing capacity and improve recovery rates to benefit from economies of scale and ensure profitability. Bajaj Hindusthan's success hinges on its ability to efficiently operate its integrated sugar complexes.

Ethanol blending has emerged as a significant competitive differentiator in the sugar industry. Mills are actively investing in distillation capabilities to redirect molasses or cane juice towards ethanol production, a move driven by government mandates and the potential for stable revenue streams. This strategic shift allows companies to mitigate the inherent volatility of sugar prices.

Companies possessing greater ethanol production capacity and more efficient conversion technologies are better positioned to gain a competitive advantage. Bajaj Hindusthan Sugar, for instance, has strategically leveraged its ethanol production as a key asset, diversifying its revenue sources and reducing its dependence on the fluctuating sugar market. This focus on ethanol is crucial for navigating the competitive landscape.

Geographical Concentration and Regional Rivalry

Bajaj Hindusthan Sugar's operations are heavily concentrated in Uttar Pradesh, a state that accounts for a significant portion of India's sugar production. This geographical focus intensifies regional rivalry, as numerous sugar mills, both large and small, compete directly for sugarcane procurement and market share within the same localized areas.

This intense regional competition can create significant pricing pressures. For instance, in the 2023-24 sugar season, Uttar Pradesh mills faced challenges in securing adequate sugarcane due to competition, impacting their operational efficiency and profitability. The proximity of competitors means that price negotiations for sugarcane and the subsequent sale of sugar are often conducted in a highly competitive environment.

- Geographical Concentration: Bajaj Hindusthan's primary operational base is Uttar Pradesh, a key sugar-producing region in India.

- Intensified Regional Rivalry: The concentration leads to direct competition with numerous other sugar mills within Uttar Pradesh for raw materials and market access.

- Localized Pricing Pressures: This intense local competition often results in downward pressure on sugar prices and increased costs for sugarcane procurement.

- 2023-24 Season Impact: Mills in Uttar Pradesh experienced challenges in sugarcane availability, a direct consequence of heightened competition during the 2023-24 season.

Financial Health and Consolidation Trends

The Indian sugar industry is experiencing significant consolidation. Projections indicate that roughly 20% of existing sugar mills could cease operations within the next five years. This trend will likely see the top five sugar producers expanding their market dominance.

Companies demonstrating robust financial health are better equipped to navigate this evolving landscape. Bajaj Hindusthan, with its financial stability, is positioned to benefit from these shifts. This stability enables strategic investments in technological upgrades and operational efficiencies, crucial for sustained competitiveness.

- Industry Consolidation: An estimated 20% decrease in sugar mills is anticipated over the next five years.

- Market Share Shift: The top 5 producers are expected to capture a larger portion of the market.

- Financial Strength Advantage: Companies like Bajaj Hindusthan, with strong financial health, can invest in technology and efficiency.

- Strategic Opportunities: Financial stability facilitates strategic acquisitions and modernization efforts, enhancing competitive positioning.

Competitive rivalry in the Indian sugar sector is intense due to a large number of mills, particularly in concentrated regions like Uttar Pradesh, leading to price pressures for both sugarcane procurement and sugar sales. For instance, during the 2023-24 season, Uttar Pradesh mills struggled with sugarcane availability due to this heightened competition. The industry is also undergoing consolidation, with an estimated 20% of mills expected to close in the next five years, allowing larger, financially stable players like Bajaj Hindusthan to potentially increase market share.

| Factor | Description | Impact on Bajaj Hindusthan |

|---|---|---|

| Fragmentation | Over 700 sugar mills in India, many in Uttar Pradesh. | Intensifies competition for sugarcane and market share. |

| Regional Concentration | Operations primarily in Uttar Pradesh. | Leads to direct rivalry with numerous local mills. |

| Ethanol Blending | Government push for ethanol production. | Provides a competitive edge for companies with distillation capacity. |

| Industry Consolidation | 20% mill closure projected in 5 years. | Favors financially strong companies for market share gains. |

SSubstitutes Threaten

The threat of substitutes for sugar is growing, primarily from artificial sweeteners such as aspartame, sucralose, and saccharin, alongside natural low-calorie options like stevia. These alternatives are gaining traction in India due to rising health consciousness, with consumers increasingly concerned about obesity and diabetes. This shift is particularly evident in the processed food and beverage sectors, indicating a long-term challenge to traditional sugar demand.

Industrial users of sugar, such as those in the confectionery and beverage sectors, face the threat of substitutes like high-fructose corn syrup (HFCS) and various sugar alcohols. While HFCS is a significant competitor globally, its adoption in India is influenced by local production capabilities and import policies. In 2023, India's HFCS production was still developing, making it less of a direct threat to bulk sugar compared to mature markets.

The cost-effectiveness and availability of these industrial substitutes directly influence bulk sugar demand. If alternative sweeteners become significantly cheaper or more readily available for large-scale industrial applications, it could force a shift in procurement patterns away from traditional sugar. This dynamic is particularly relevant as the Indian food processing industry continues to grow.

While molasses and sugarcane juice can be diverted for ethanol production, this is primarily a strategic diversification for sugar mills, not a direct substitute for consumer sugar demand. Ethanol acts as a biofuel, lessening reliance on imported crude oil, and thus complements the sugar business by creating an alternative revenue stream from the same core raw material.

This diversion strengthens the overall sugar industry's financial resilience. For instance, India's ethanol blending program aims for 20% blending by 2025, significantly increasing demand for ethanol derived from sugarcane byproducts. In the 2023-24 sugar season, India's ethanol production from molasses and sugarcane juice reached approximately 3.7 billion liters, showcasing the scale of this complementary activity.

Shift Towards Natural and Unrefined Sweeteners

The increasing consumer demand for natural and less processed sweeteners like jaggery and khand sari, alongside fruits and honey, poses a potential threat. These traditional options appeal to both rural and health-conscious urban consumers, offering a distinct value. Bajaj Hindusthan, being a major refined sugar producer, is particularly vulnerable to these evolving consumer tastes.

This shift impacts Bajaj Hindusthan's market share as consumers increasingly opt for alternatives perceived as healthier or more traditional. For instance, the jaggery market in India has seen steady growth, with reports indicating a significant increase in its consumption, especially in semi-urban and rural areas. This trend directly challenges the demand for refined sugar.

- Growing Consumer Preference: A notable segment of consumers, particularly in India, is moving towards natural sweeteners like jaggery (gur) and khand sari.

- Health and Traditional Appeal: These alternatives are often perceived as healthier due to less processing and retain more natural nutrients, aligning with traditional dietary practices.

- Market Impact on Refined Sugar: Bajaj Hindusthan Sugar, primarily a producer of refined sugar, faces a direct challenge as these substitutes gain traction, potentially reducing the demand for its core product.

- Rural and Urban Demand: The preference for these traditional sweeteners is evident across both rural demographics and a growing health-conscious urban population.

Regulatory and Health Body Warnings on Artificial Sweeteners

Warnings from organizations like the World Health Organization (WHO) regarding potential long-term health risks associated with artificial sweeteners, such as an increased likelihood of Type 2 diabetes and cardiovascular issues, could dampen their appeal. For instance, a 2023 WHO guideline advised against using non-sugar sweeteners for weight control, suggesting potential long-term undesirable effects. This development may indirectly bolster demand for traditional sugar, though it also highlights the imperative for the sugar industry to proactively manage its own health perceptions and advocate for responsible consumption patterns.

The potential health concerns surrounding artificial sweeteners, as highlighted by bodies like the WHO, present a nuanced threat. While this could lead consumers back to sugar, it also pressures the sugar industry to address its own health-related challenges and promote healthier consumption habits. For example, the ongoing debate about sugar's role in obesity and metabolic diseases remains a significant factor for the entire sweetener market.

- WHO's 2023 guidance on non-sugar sweeteners: Advised against their use for weight management, citing potential long-term adverse health effects.

- Potential impact on sugar demand: Health concerns surrounding artificial sweeteners could shift consumer preference back towards sugar.

- Industry's need for responsible consumption: The sugar industry must address its own health perceptions and promote moderation.

The threat of substitutes for sugar, particularly from artificial and natural low-calorie sweeteners like stevia, is a growing concern for Bajaj Hindusthan Sugar. Rising health consciousness in India, with increasing awareness of issues like obesity and diabetes, is driving consumers towards these alternatives. This trend is particularly noticeable in the beverage and processed food industries, signaling a potential long-term reduction in demand for traditional sugar.

Industrial users also face substitutes such as high-fructose corn syrup (HFCS), though its impact in India is less pronounced than in global markets due to local production and import policies. The cost and availability of these industrial alternatives are key factors influencing bulk sugar demand. In 2023, India's HFCS production was still developing, limiting its immediate threat to the established sugar market.

Consumer preference is also shifting towards traditional, less processed sweeteners like jaggery and khand sari, which are perceived as healthier. This preference is seen across both rural and health-conscious urban populations, directly challenging the market share of refined sugar producers like Bajaj Hindusthan. The jaggery market, for instance, has experienced steady growth in India.

While the WHO's 2023 advisory against non-sugar sweeteners for weight management might offer some respite, the sugar industry must still address its own health perceptions. The ongoing debate surrounding sugar's link to obesity and metabolic diseases remains a significant factor impacting the entire sweetener market.

| Sweetener Type | Key Examples | Indian Market Trend (as of 2023-2024) | Impact on Bajaj Hindusthan Sugar |

|---|---|---|---|

| Artificial Sweeteners | Aspartame, Sucralose, Saccharin | Growing consumer adoption driven by health consciousness. | Potential reduction in demand for refined sugar, especially in processed foods and beverages. |

| Natural Low-Calorie Sweeteners | Stevia | Increasing popularity as a perceived healthier alternative. | Further pressure on refined sugar demand, particularly in health-focused product segments. |

| Traditional Sweeteners | Jaggery, Khand Sari | Steady growth in consumption, appealing to both rural and urban health-conscious consumers. | Direct competition for refined sugar, potentially eroding market share in certain consumer segments. |

| Industrial Substitutes | High-Fructose Corn Syrup (HFCS) | Limited impact in India due to developing local production and import policies. | Currently a minor threat compared to global markets, but could evolve with policy changes. |

Entrants Threaten

The sugar manufacturing industry demands massive upfront capital for land acquisition, advanced machinery, and integrated processing facilities. For instance, establishing a new sugar mill with a crushing capacity of, say, 5,000 tonnes per day, can easily cost hundreds of millions of dollars. This high entry cost creates a formidable barrier, especially when competing against established giants like Bajaj Hindusthan Sugar, which operates multiple large-scale sugar complexes.

Bajaj Hindusthan Sugar, with its extensive network of sugar mills, already enjoys significant economies of scale. This means they can produce sugar at a lower per-unit cost due to their sheer production volume and optimized operations. New entrants would struggle to match these cost efficiencies initially, making it difficult to compete on price and deterring many potential investors from entering the market.

Government regulations and licensing requirements significantly deter new entrants in the Indian sugar industry. For instance, the specific requirements for obtaining licenses, allocating cane areas, and adhering to pricing policies, as mandated by bodies like the Directorate of Sugar, present a formidable hurdle. These stringent controls, which were particularly active in 2024 with ongoing policy reviews, demand substantial time and resources to navigate, effectively favoring companies like Bajaj Hindusthan Sugar that possess established expertise and relationships within the regulatory framework.

The threat of new entrants in the sugar industry, specifically concerning access to raw materials and farmer relationships, is significantly mitigated by the established networks of companies like Bajaj Hindusthan Sugar. Securing a consistent and adequate supply of sugarcane is absolutely vital for any sugar mill's operation. New players would face considerable hurdles in replicating the deep-rooted relationships Bajaj Hindusthan has cultivated with farmers in key sugarcane-producing regions, particularly in Uttar Pradesh.

Bajaj Hindusthan Sugar benefits from decades of experience in building trust and reliable procurement networks. This allows them to secure a substantial portion of the available sugarcane, making it difficult for newcomers to compete for this essential input. For instance, in the 2023-24 sugar season, Uttar Pradesh, a major operational area for Bajaj Hindusthan, produced approximately 12.5 million metric tons of sugar, highlighting the scale of competition for raw materials.

Established Distribution Channels and Brand Recognition

Established sugar companies like Bajaj Hindusthan Sugar possess deeply entrenched distribution networks, crucial for reaching diverse markets from industrial buyers to retail consumers across India. Newcomers face a significant hurdle in replicating these extensive supply chains, which have been built over years of operation and investment.

Furthermore, Bajaj Hindusthan benefits from considerable brand recognition, a valuable asset in the competitive Indian sugar market. A new entrant would need to allocate substantial capital and time to build a comparable brand presence and cultivate customer trust, making market entry a costly and protracted endeavor.

- Distribution Network: Bajaj Hindusthan's established channels are a major barrier, requiring significant investment for new entrants to replicate.

- Brand Recognition: Years of operation have built brand equity, which new competitors must painstakingly develop.

- Market Entry Costs: The combined cost of building distribution and brand awareness presents a substantial financial challenge for potential new players.

Technological Advancements and Diversification Needs

The sugar industry is seeing significant technological upgrades, pushing for greater efficiency and a move towards value-added products like ethanol and co-generated power. For example, India's ethanol blending program, aiming for 20% blending by 2025-26, incentivizes sugar mills to invest in this area.

New companies entering this evolving landscape must commit substantial capital not just to sugar refining but also to advanced technologies for ethanol production and power generation. This diversification is crucial for resilience against volatile sugar prices, making the barrier to entry higher.

Companies like Bajaj Hindusthan Sugar are already navigating this shift. In the fiscal year 2023-24, the company reported increased sugar production alongside its efforts in ethanol manufacturing.

- Technological Investment: New entrants require significant capital for advanced sugar processing, ethanol distillation, and co-generation power plants.

- Diversification Imperative: To compete, new players must offer integrated solutions beyond basic sugar, aligning with government mandates like ethanol blending targets.

- Capability Building: Success hinges on developing expertise in by-product utilization and energy production, adding complexity and cost to market entry.

The threat of new entrants in the sugar industry, particularly for a player like Bajaj Hindusthan Sugar, is generally considered low. Significant capital investment is required for land, machinery, and integrated facilities, with new mills costing hundreds of millions of dollars. Established players benefit from economies of scale, making it hard for newcomers to compete on price.

Stringent government regulations and licensing processes in India, which were actively reviewed in 2024, further erect barriers. Companies like Bajaj Hindusthan leverage their decades of experience in navigating these complexities and building farmer relationships for raw material procurement. For instance, securing sugarcane supply in key regions like Uttar Pradesh, which produced about 12.5 million metric tons of sugar in the 2023-24 season, is a major challenge for new entrants.

Furthermore, established distribution networks and brand recognition represent substantial hurdles. New entrants must invest heavily to build comparable market reach and customer trust. The industry's shift towards value-added products like ethanol, driven by government programs such as the 20% ethanol blending target by 2025-26, necessitates additional technological investment, increasing the cost and complexity of market entry.

| Barrier Type | Description | Impact on New Entrants | Bajaj Hindusthan's Advantage |

|---|---|---|---|

| Capital Requirements | High upfront costs for land, machinery, and facilities. | Formidable financial hurdle. | Established operational scale and infrastructure. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Difficulty in matching price competitiveness. | Significant cost efficiencies from multiple large-scale mills. |

| Government Regulations | Complex licensing, cane area allocation, and pricing policies. | Time-consuming and resource-intensive to navigate. | Existing expertise and established relationships with regulatory bodies. |

| Raw Material Access | Securing consistent sugarcane supply through farmer relationships. | Challenging to replicate deep-rooted procurement networks. | Decades of trust-building and reliable sourcing in key growing regions. |

| Distribution & Brand | Extensive supply chains and established brand recognition. | Requires substantial investment in market reach and customer trust. | Deeply entrenched distribution channels and significant brand equity. |

| Technological Investment | Need for advanced processing, ethanol production, and co-generation. | Increased costs and complexity for integrated operations. | Already investing in and navigating industry shifts towards ethanol. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bajaj Hindusthan Sugar is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and regulatory filings with SEBI. We also incorporate insights from reputable industry research firms and government reports on the Indian sugar sector.