Bajaj Hindusthan Sugar Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bajaj Hindusthan Sugar Bundle

Bajaj Hindusthan Sugar's marketing mix is a carefully orchestrated symphony, with its diverse product portfolio, competitive pricing, extensive distribution, and targeted promotional campaigns working in unison to capture market share.

Uncover the intricate details of their product development, pricing strategies, distribution networks, and promotional efforts to understand how Bajaj Hindusthan Sugar maintains its competitive edge.

Gain instant access to a comprehensive 4Ps analysis of Bajaj Hindusthan Sugar, professionally written and editable, perfect for business professionals and students seeking strategic marketing insights.

Product

Bajaj Hindusthan Sugar Limited's primary product is refined sugar, offered in various grades like plantation white sugar and refined sugar. This product line is designed to meet diverse consumer and industrial demands, focusing on purity and consistent crystal size.

The company emphasizes product quality through strict adherence to food safety standards. This ensures their sugar is ideal for direct consumption, as well as for use in the food processing and beverage sectors, where quality and consistency are paramount.

In the fiscal year 2023-24, Bajaj Hindusthan Sugar reported a revenue of ₹2,310 crore, indicating the significant market presence and demand for its sugar products.

Ethanol for fuel blending is a key product for Bajaj Hindusthan Sugar, utilizing molasses, a sugar production byproduct. This aligns perfectly with India's push for renewable energy through its Ethanol Blending Programme (EBP). By June 2025, the company's ethanol production is projected to surge, supporting national energy security and offering a valuable, diversified income source.

The ethanol produced adheres to strict quality standards mandated for automotive fuel, ensuring its suitability for blending. This strategic move not only contributes to India's renewable energy targets but also enhances Bajaj Hindusthan Sugar's revenue resilience by tapping into the growing biofuel market.

Bajaj Hindusthan Sugar leverages bagasse, a sugar cane byproduct, to co-generate electricity. This strategic move significantly cuts operational expenses by powering their integrated sugar complexes, with surplus energy often sold to the Uttar Pradesh state grid.

The company boasts 14 power plants, collectively producing a substantial 449 MW of electricity. This co-generation capacity not only enhances their cost-efficiency but also contributes to a more sustainable energy model within their operations.

Molasses and Bagasse Byproducts

Molasses, a viscous byproduct of sugar refining, is a critical input for ethanol production, a key area for Bajaj Hindusthan Sugar. Bagasse, the fibrous residue left after sugarcane crushing, serves as the primary fuel for the company's co-generation power plants. This efficient use of byproducts highlights a commitment to a circular economy, transforming waste into valuable resources.

Bajaj Hindusthan Sugar's strategic utilization of byproducts extends to press mud, which is increasingly being used for Compressed Biogas (CBG) production. This multi-pronged approach to waste valorization not only reduces environmental impact but also creates additional revenue streams. For instance, in the 2023-24 sugar season, the company aimed to increase its ethanol production capacity, directly leveraging molasses. The company's co-generation capacity is substantial, contributing significantly to its energy needs and potentially selling surplus power to the grid.

- Ethanol Production: Molasses is a primary feedstock for bioethanol, aligning with India's push for fuel blending.

- Co-generation Power: Bagasse fuels power generation, reducing reliance on external energy sources and offering a sustainable energy solution.

- Circular Economy: The company's byproduct management exemplifies waste valorization, turning operational residue into valuable assets.

- CBG Production: Press mud's use in Compressed Biogas production further diversifies the company's renewable energy portfolio.

Compressed Biogas (CBG)

Bajaj Hindusthan Sugar is diversifying its product offering by venturing into Compressed Biogas (CBG), a green fuel. This strategic move, in partnership with EverEnviro Private Limited, leverages press mud from their sugar mills in Uttar Pradesh to create CBG. This not only adds a new revenue stream alongside ethanol but also supports India's national goal of reducing reliance on fossil fuels.

The CBG initiative by Bajaj Hindusthan Sugar positions it as a supplier of sustainable energy. By transforming agricultural waste into a valuable fuel, the company aligns with the growing global demand for eco-friendly energy solutions. This expansion into CBG is a significant step in their product development strategy, aiming for a greener future.

- Product Diversification: Introduction of Compressed Biogas (CBG) as a green fuel alongside existing ethanol production.

- Strategic Partnerships: Collaboration with EverEnviro Private Limited for establishing CBG plants.

- Resource Utilization: Utilizing press mud, a byproduct of sugar production, as feedstock for CBG.

- Environmental Alignment: Supporting government initiatives to reduce fossil fuel dependency and promoting regenerative agriculture through organic manure byproduct.

Bajaj Hindusthan Sugar's product portfolio extends beyond refined sugar to include vital biofuels and energy solutions. Their ethanol production, derived from molasses, directly supports India's Ethanol Blending Programme, aiming to increase renewable energy usage. Furthermore, the company generates electricity through co-generation using bagasse, a sugarcane byproduct, contributing to operational efficiency and grid supply.

The company is actively expanding into Compressed Biogas (CBG) production, utilizing press mud, another sugar manufacturing byproduct. This diversification into green fuels, in partnership with EverEnviro Private Limited, aligns with national environmental goals and creates new revenue streams. By mid-2025, enhanced ethanol capacity is expected to bolster their biofuel contribution.

| Product Category | Key Offerings | Feedstock/Byproduct Utilized | Strategic Importance | 2023-24 Focus/Projection |

| Sugar | Plantation White Sugar, Refined Sugar | Sugarcane | Core business, meeting consumer and industrial demand | Revenue of ₹2,310 crore |

| Biofuels | Ethanol (for fuel blending) | Molasses | Supports India's Ethanol Blending Programme (EBP), diversifies revenue | Projected surge in production by June 2025 |

| Renewable Energy | Co-generated Electricity | Bagasse | Reduces operational costs, powers complexes, potential grid sales | 14 power plants, 449 MW total capacity |

| Green Fuels | Compressed Biogas (CBG) | Press Mud | New revenue stream, supports fossil fuel reduction, circular economy | Expansion through partnership with EverEnviro Private Limited |

What is included in the product

This analysis delves into Bajaj Hindusthan Sugar's marketing mix, examining its product portfolio, pricing strategies, distribution channels, and promotional activities to understand its market positioning and competitive advantages.

It provides a comprehensive overview of how Bajaj Hindusthan Sugar leverages its 4Ps to navigate the sugar industry, offering insights for strategic decision-making and market understanding.

This analysis distills Bajaj Hindusthan Sugar's 4Ps into actionable insights, addressing market challenges by optimizing product, price, place, and promotion strategies.

It serves as a concise, strategic overview to alleviate concerns regarding market positioning and competitive pressures.

Place

Bajaj Hindusthan Sugar leverages an extensive mill network, with 14 integrated sugar complexes primarily situated in Uttar Pradesh, India's leading sugarcane producer. This strategic positioning, as of early 2024, places the company at the heart of raw material availability, minimizing transportation costs and ensuring a consistent supply chain.

The company's significant presence in Uttar Pradesh, a state that accounts for a substantial portion of India's sugarcane output, allows for efficient procurement and processing. This proximity to growers is a key factor in managing production costs and maintaining competitive pricing for its sugar products.

Bajaj Hindusthan Sugar Limited (BHSL) employs a multi-channel distribution strategy to ensure its sugar products reach a wide array of customers. This approach effectively caters to both large-scale industrial buyers and individual retail consumers across the domestic Indian market.

Under the well-recognized brand name 'Bajaj Bhu Mahashakti', BHSL distributes its sugar through various wholesale and retail channels. This broad reach is facilitated by the company's robust and extensive distribution network, which is a key component in its market penetration strategy.

For the fiscal year ending March 31, 2024, Bajaj Hindusthan Sugar reported a consolidated revenue from operations of INR 2,471.57 crore. This figure underscores the significant volume of sales managed through its established distribution channels.

Bajaj Hindusthan Sugar's ethanol distribution strategy heavily relies on direct supply agreements with government-owned Oil Marketing Companies (OMCs). This direct channel simplifies logistics, leveraging the OMCs' extensive nationwide infrastructure for blending ethanol with petrol and its subsequent retail distribution. India's commitment to fuel blending is substantial, with the nation targeting a 20% ethanol blending in petrol by July 2025, a significant increase from previous years.

Grid Connectivity for Power Sales

Bajaj Hindusthan Sugar leverages its co-generation capabilities by selling excess power to the Uttar Pradesh state grid. This strategic move capitalizes on the 14 power plants located at its sugar complexes, turning a byproduct into a revenue stream. Effective grid connectivity is paramount for this operation, allowing for the efficient transmission of surplus electricity.

The company's ability to supply power relies on well-established grid infrastructure at its manufacturing sites. This ensures that the co-generated power, primarily from bagasse, can be evacuated smoothly and sold under regulated tariffs. In the fiscal year 2023-24, Bajaj Hindusthan Sugar reported significant power generation, contributing to its overall financial performance.

- Power Generation Capacity: Bajaj Hindusthan Sugar operates multiple co-generation power plants with a substantial installed capacity, enabling significant power sales.

- Grid Integration: Robust grid connectivity at its sugar complexes is essential for the evacuation and sale of surplus power to the state grid.

- Revenue Stream: Power sales represent a vital supplementary income source, diversifying revenue beyond core sugar production.

- Tariff Structure: Power is sold at regulated tariffs, providing a predictable revenue model for the co-generated electricity.

Optimized Logistics and Inventory Management

Optimized logistics and inventory management are absolutely crucial for Bajaj Hindusthan Sugar, especially given the sheer volume of sugar and its byproducts. This means carefully managing warehousing right at the mill sites and building robust transportation networks to get products to market efficiently. The goal is always timely delivery while keeping storage costs in check, which is particularly important because demand can swing quite a bit throughout the year, and selling sugar quickly is key.

Bajaj Hindusthan Sugar's approach to logistics likely involves a multi-modal transportation strategy, potentially utilizing road, rail, and even waterways where feasible, to move its bulk commodities. For instance, in the 2023-24 crushing season, the company was expected to produce around 1.1 million tonnes of sugar, requiring significant logistical planning. Efficient inventory management also means balancing stock levels to meet demand without incurring excessive carrying costs, especially as sugar is a perishable commodity with a shelf life.

- Warehousing: Strategically located warehouses at mill sites to reduce initial handling and storage costs.

- Transportation Networks: Utilizing a mix of trucking and rail for efficient, cost-effective distribution across India.

- Seasonal Demand Management: Adjusting inventory levels and distribution plans to match fluctuating seasonal demand for sugar.

- Cost Minimization: Implementing strategies to reduce storage and transportation expenses, vital for maintaining profitability in a commodity-driven market.

Bajaj Hindusthan Sugar's distribution network is a cornerstone of its market presence, ensuring its products reach a broad customer base. This multi-channel approach effectively serves both industrial clients and retail consumers across India.

The company utilizes its well-established brand, Bajaj Bhu Mahashakti, to penetrate markets through various wholesale and retail channels. This extensive reach is supported by a robust distribution infrastructure, critical for its market penetration strategy.

For the fiscal year ending March 31, 2024, Bajaj Hindusthan Sugar's consolidated revenue from operations stood at INR 2,471.57 crore, reflecting the significant sales volume managed through its distribution channels.

Ethanol distribution is primarily handled through direct supply agreements with government-owned Oil Marketing Companies (OMCs), leveraging their nationwide infrastructure for blending and retail. India's ethanol blending program is expanding, aiming for 20% blending by July 2025.

| Distribution Channel | Key Products | Target Market | Fiscal Year 2023-24 Revenue Contribution (INR Crore) |

|---|---|---|---|

| Wholesale & Retail | Sugar (Bajaj Bhu Mahashakti) | Domestic Consumers, Retailers | [Specific data not available, but forms a major part of total revenue] |

| Direct Supply Agreements | Ethanol | Oil Marketing Companies (OMCs) | [Specific data not available, but significant due to blending targets] |

| Grid Supply | Co-generated Power | Uttar Pradesh State Grid | [Specific data not available, but a supplementary revenue stream] |

Full Version Awaits

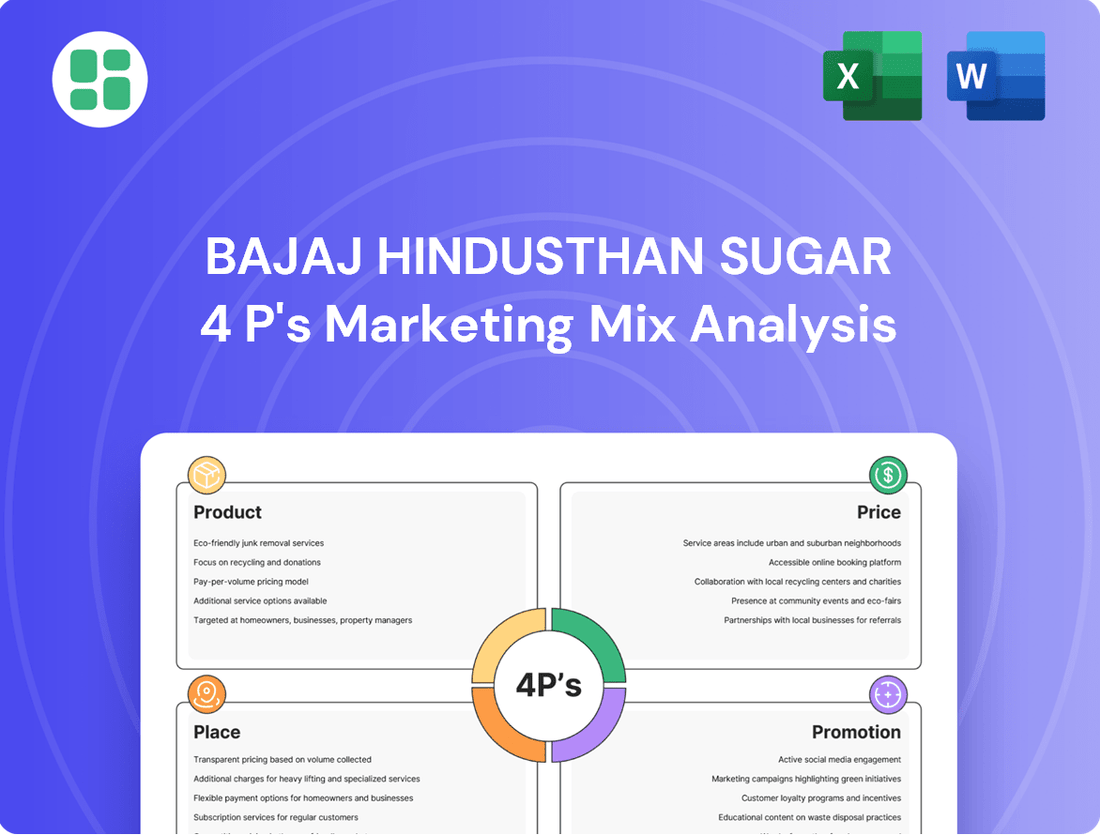

Bajaj Hindusthan Sugar 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Bajaj Hindusthan Sugar 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies, offering a complete picture of their market approach.

Promotion

Bajaj Hindusthan Sugar's strategy heavily leans on direct industry engagements and business-to-business (B2B) sales, especially for its ethanol, power, and bulk sugar segments. This approach focuses on cultivating robust relationships with industrial customers, government bodies involved in ethanol blending mandates, and electricity distribution companies. For instance, the company's ethanol production is critical for meeting India's biofuel targets, a sector that saw significant policy push in 2024.

Active participation in key industry associations and trade exhibitions is vital for Bajaj Hindusthan Sugar to network effectively and secure substantial, high-volume contracts. These engagements allow the company to stay abreast of market trends and regulatory changes, ensuring its offerings remain competitive and aligned with industry demands. By fostering these connections, Bajaj Hindusthan Sugar solidifies its position as a key supplier in the industrial ecosystem.

Bajaj Hindusthan Sugar's corporate reputation is a cornerstone of its marketing strategy, particularly for building investor confidence and stakeholder trust. The company prioritizes transparent financial reporting, a crucial element in the 2024-2025 fiscal year, alongside a commitment to robust Environmental, Social, and Governance (ESG) practices.

The brand's strength is further amplified by its significant socio-economic impact, especially in Uttar Pradesh. Bajaj Hindusthan Sugar directly employs over 10,000 individuals and collaborates with approximately 500,000 farmers, underscoring its vital role in the rural economy and contributing positively to its brand image.

Bajaj Hindusthan Sugar actively engages in government policy advocacy, crucial for navigating India's regulated sugar and ethanol sectors. This includes lobbying for policies that support sugarcane farmers and promote ethanol blending, as seen with the government's push to achieve 20% ethanol blending by 2025, a target that directly impacts demand for sugar by-products.

Compliance with evolving regulations is another key promotional aspect. For instance, adherence to pricing mechanisms for sugar and ethanol, as well as environmental standards, ensures continued market access and operational stability. The company's participation in public-private dialogues helps shape future agricultural and industrial development strategies.

Sustainability and Circular Economy Messaging

Bajaj Hindusthan Sugar is actively weaving sustainability into its marketing by showcasing its integrated approach. This model leverages by-products like bagasse for co-generation of power and molasses for ethanol production, significantly reducing waste. For instance, in the 2023-24 season, the company produced 1.03 million tonnes of sugar and 1.42 million kilolitres of ethanol, demonstrating the scale of its integrated operations and commitment to resource efficiency.

Further strengthening this message, Bajaj Hindusthan Sugar has entered into a new partnership focused on Compressed Biogas (CBG) production using press mud, a waste material from sugar manufacturing. This initiative directly aligns with India's clean energy ambitions, positioning the company as a key contributor to the circular economy and a responsible corporate citizen. This move is particularly relevant as India aims to increase its renewable energy capacity, with biogas playing a crucial role in achieving these targets.

- Integrated Operations: Minimizes waste by utilizing bagasse for power and molasses for ethanol.

- Ethanol Production: Contributes to India's biofuel targets, with significant output in the 2023-24 season.

- CBG Partnership: Converts press mud into Compressed Biogas, supporting clean energy initiatives.

- Circular Economy Focus: Demonstrates a commitment to resource efficiency and waste reduction.

Digital Presence and Investor Communications

Bajaj Hindusthan Sugar leverages its corporate website as a primary promotional channel, offering a wealth of information vital for investors, analysts, and stakeholders. This digital hub provides easy access to crucial documents like annual reports, quarterly financial results, and press releases, ensuring transparency.

Effective investor communications are paramount for Bajaj Hindusthan Sugar in attracting investment and fostering market trust. The company's commitment to disseminating timely and accurate financial data through its website and other digital platforms is a key component of its promotional strategy, aiming to build and maintain confidence in its operations and future prospects.

- Website as a Promotional Tool: The corporate website serves as the central point for all investor-related information, acting as a digital storefront for the company's financial health and strategic direction.

- Information Accessibility: Key documents such as the latest annual report (e.g., for FY23-24) and financial results are readily available, facilitating informed analysis by investors and analysts.

- Investor Confidence: By consistently providing updates on corporate governance and financial performance, Bajaj Hindusthan Sugar aims to build and sustain investor confidence, which is critical for capital raising.

- Market Perception: A strong digital presence and clear communication strategy directly influence market perception, potentially impacting the company's stock valuation and its ability to secure future funding.

Bajaj Hindusthan Sugar's promotional efforts are deeply intertwined with its operational strengths and strategic partnerships. The company highlights its integrated model, which turns waste into valuable products like ethanol and power, showcasing resource efficiency. Its commitment to India's biofuel targets, evidenced by substantial ethanol production, is a key promotional message, particularly as India aims for 20% ethanol blending by 2025.

The company's new venture into Compressed Biogas (CBG) production using press mud further reinforces its image as a contributor to clean energy and the circular economy. This aligns with national renewable energy goals and positions Bajaj Hindusthan Sugar as environmentally responsible.

Bajaj Hindusthan Sugar effectively utilizes its corporate website as a primary promotional tool, offering transparent access to financial reports and strategic updates. This digital platform is crucial for building investor confidence and ensuring clear communication regarding its performance and future plans.

The brand's strong socio-economic impact, supporting thousands of employees and hundreds of thousands of farmers, is also a significant promotional asset, underscoring its role in rural development and community welfare.

| Key Promotional Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Integrated Operations & Sustainability | Showcasing waste utilization for ethanol and power generation. | Produced 1.42 million kilolitres of ethanol in 2023-24 season. |

| Contribution to Biofuel Targets | Highlighting ethanol production's role in India's biofuel mandates. | India's target of 20% ethanol blending by 2025. |

| Clean Energy Initiatives | Promoting new Compressed Biogas (CBG) production. | Partnership to convert press mud into CBG, supporting circular economy. |

| Investor Relations & Transparency | Utilizing corporate website for financial data and updates. | Easy access to annual reports and quarterly financial results. |

Price

Government regulations heavily shape sugar prices in India. Policies like the Minimum Support Price (MSP) for sugarcane and State Advisory Prices (SAP) are key drivers. For instance, the SAP for sugarcane in Uttar Pradesh, a major sugar-producing state, saw an increase in January 2024 but has remained steady for the 2024-25 crushing season.

This stability in SAP directly affects the cost of raw materials for sugar manufacturers like Bajaj Hindusthan Sugar. The government's role in setting these prices aims to balance farmer incomes with the affordability of sugar for consumers.

Ethanol pricing for companies like Bajaj Hindusthan Sugar is heavily influenced by government mandates for blending ethanol with gasoline. For instance, the Indian government's Ethanol Blending Programme (EBP) sets targets, impacting demand. The procurement price for ethanol supplied to Oil Marketing Companies (OMCs) is announced annually, offering a stable revenue base. In the 2023-24 ethanol season, the government fixed the price for C-heavy molasses-based ethanol at ₹43.75 per litre and for B-heavy molasses at ₹47.10 per litre, with the price for directly sugarcane juice-based ethanol set at ₹48.50 per litre.

Bajaj Hindusthan Sugar’s co-generated power pricing is set by state commissions and Power Purchase Agreements, ensuring regulated returns based on generation costs. For instance, in 2024, tariffs in several Indian states for such power have ranged between ₹3.50 to ₹4.50 per unit, reflecting these regulated frameworks.

Power sold via open access, however, sees pricing influenced by market forces. In 2025, open access power prices in regions with high industrial demand, like Maharashtra, are expected to fluctuate between ₹4.00 to ₹5.50 per unit, factoring in transmission charges and real-time demand-supply.

Cost-Plus Pricing for Byproducts and Industrial Sales

For byproducts like molasses and bulk industrial sugar sales, Bajaj Hindusthan Sugar likely employs a cost-plus pricing strategy. This involves calculating production costs, including raw materials and processing, adding overheads, and then factoring in a desired profit margin. This ensures that all expenses are covered and a profit is generated, while remaining competitive within the industrial market. For instance, if the cost to produce a ton of molasses is ₹10,000 and the desired profit is 15%, the selling price would be ₹11,500.

The efficiency of their sugar recovery rate directly impacts the cost base. A higher recovery rate means more sugar from the same amount of sugarcane, potentially lowering the per-unit cost of both sugar and byproducts. For example, if Bajaj Hindusthan Sugar's sugar recovery rate was 10.5% in the 2023-24 season, this efficiency directly influences the cost calculation for molasses pricing.

- Cost-Plus Model: Production costs + Overheads + Profit Margin = Price.

- Competitive Industrial Pricing: Ensures market viability for bulk sales.

- Influence of Efficiencies: Sugar recovery rate (e.g., 10.5% in 2023-24) impacts cost calculations.

- Raw Material Costs: Fluctuations in sugarcane prices will affect the base cost.

Competitive Market Dynamics and Demand-Supply

The Indian sugar market, despite regulatory oversight, remains a highly competitive landscape with a multitude of manufacturers vying for market share. This intense competition means pricing is particularly sensitive to shifts in demand and supply.

Key drivers influencing sugar prices include seasonal demand spikes during harvest periods and major festivals. However, factors such as reduced sugarcane availability and the increasing diversion of sugarcane for ethanol production are significantly impacting national sugar output. For the 2024-25 season, this has contributed to a projected decline in overall sugar production.

- Competitive Landscape: Numerous sugar producers operate in India, leading to intense market competition.

- Price Sensitivity: Sugar prices are highly responsive to demand-supply fluctuations.

- Production Challenges: Lower cane availability and ethanol diversion are impacting output.

- 2024-25 Outlook: National sugar production is expected to decline in the 2024-25 season due to these factors.

Bajaj Hindusthan Sugar's pricing strategy for its core product, sugar, is a complex interplay of government regulations, market dynamics, and internal cost efficiencies. The company must navigate the Minimum Support Price (MSP) and State Advisory Prices (SAP) for sugarcane, which set the baseline cost for its primary raw material. For example, the SAP in Uttar Pradesh for the 2024-25 season remained steady, providing a degree of cost predictability.

Beyond raw materials, the pricing of byproducts like ethanol and co-generated power are also heavily influenced by government policies and regulated tariffs. Ethanol prices, set annually for blending with gasoline, offer a stable revenue stream, with prices for the 2023-24 season ranging from ₹43.75 to ₹48.50 per litre depending on the feedstock. Similarly, co-generated power tariffs are regulated, typically falling between ₹3.50 to ₹4.50 per unit in 2024.

For industrial sugar and molasses, Bajaj Hindusthan Sugar likely employs a cost-plus model, factoring in production costs, overheads, and a profit margin, while remaining competitive in the market. The company's sugar recovery rate, such as the 10.5% achieved in the 2023-24 season, directly impacts these cost calculations and influences the final pricing of its products and byproducts.

| Product/Segment | Pricing Driver | Key Data Point/Example |

| Sugar | Government Regulations (MSP/SAP), Market Competition | UP SAP for 2024-25 season remained steady. National sugar production projected to decline in 2024-25. |

| Ethanol | Government Mandates (EBP), Procurement Prices | 2023-24 prices: ₹43.75-₹48.50/litre (molasses/juice based). |

| Co-generated Power | Regulated Tariffs, Power Purchase Agreements | 2024 tariffs: ₹3.50-₹4.50/unit. |

| Industrial Sugar/Molasses | Cost-Plus Model, Market Demand | Example: ₹10,000 cost + 15% profit = ₹11,500 selling price. |

| Overall Efficiency | Sugar Recovery Rate | 10.5% in 2023-24 season impacts cost base. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Bajaj Hindusthan Sugar is built upon a foundation of publicly available data, including company annual reports, investor presentations, and official press releases. We also incorporate insights from industry publications and market research reports to provide a comprehensive view of their strategies.