Baidu SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baidu Bundle

Baidu, a titan of the Chinese internet, boasts significant strengths in its AI capabilities and dominant search engine, but faces intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Baidu’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Baidu commands a formidable presence in China's search engine landscape, consistently holding more than 50% of the market share across all platforms as of November 2024. This dominance is even more pronounced on mobile devices, where its user base is exceptionally strong.

This leading market share translates into a massive and engaged user base, forming a robust foundation for Baidu's lucrative online marketing services. The sheer volume of traffic and data generated is invaluable, particularly for the development and refinement of its advanced artificial intelligence initiatives.

Baidu's pioneering leadership in artificial intelligence is a significant strength. The company has made substantial investments in AI, establishing itself as a dominant player in China's AI landscape. This strategic focus is evident in the robust growth of its AI Cloud business, which experienced a 42% year-over-year acceleration in Q1 2025, fueled by the increasing demand for generative AI and foundation models.

Further solidifying its AI prowess, Baidu's ERNIE Bot handles billions of API calls daily, demonstrating widespread adoption and utility. The company also boasts China's largest portfolio of AI-related patents, a testament to its deep technological expertise and consistent innovation in the artificial intelligence sector.

Baidu's Apollo Go autonomous ride-hailing service stands as a major strength, demonstrating significant traction. In the first quarter of 2025, it facilitated over 1.4 million rides, marking a substantial 75% surge compared to the previous year. By May 2025, the cumulative number of rides exceeded 11 million, underscoring its rapid growth and market acceptance.

The expansion of Apollo Go into fully driverless operations across multiple Chinese cities highlights the maturity of Baidu's autonomous driving technology. With plans to enter European markets by 2026, Baidu is solidifying its position as a leader in intelligent driving solutions, paving the way for future revenue streams beyond its traditional search engine business.

Diversified Business Portfolio Beyond Search

Baidu's strategic move beyond its core search engine has yielded significant diversification, with substantial growth in areas like cloud computing and intelligent driving. This expansion is crucial for mitigating risks associated with its traditional online advertising segment.

The company's non-online marketing revenue, especially from its AI Cloud services, has shown robust expansion, underscoring the success of its pivot towards new, high-potential revenue streams. For instance, Baidu's AI Cloud revenue saw a notable increase in the first quarter of 2024.

- Diversification into AI-driven sectors like cloud and autonomous driving.

- Reduced reliance on online marketing revenue.

- Strong growth in non-search related segments, particularly AI Cloud.

Strong Investment in Research and Development

Baidu consistently allocates significant resources to research and development, with a strong focus on artificial intelligence. In 2023, Baidu reported R&D expenses of approximately RMB 20.9 billion (around $2.9 billion USD), underscoring its commitment to innovation.

This dedication has fueled the development of advanced technologies, including its ERNIE large language model and proprietary AI chips. For instance, ERNIE Bot, powered by ERNIE 4.0, has shown significant advancements in understanding and generating human-like text and code.

Continued investment in R&D is vital for Baidu to maintain its competitive edge:

- AI Leadership: Sustaining R&D investment is key to staying at the forefront of AI advancements, a critical differentiator in the tech industry.

- Technological Advancement: Developing in-house AI chips and sophisticated models like ERNIE allows for greater control and optimization of its services.

- Future Growth Drivers: Innovation stemming from R&D is essential for creating new products and services that will drive Baidu's future revenue and market share.

Baidu's strengths lie in its dominant position in China's search market, holding over 50% share as of November 2024, which fuels its online marketing services and AI development. Its pioneering leadership in AI, evidenced by a 42% year-over-year acceleration in AI Cloud in Q1 2025 and billions of daily ERNIE Bot API calls, is a significant asset. Furthermore, the rapid growth of its Apollo Go autonomous ride-hailing service, with over 1.4 million rides in Q1 2025 and cumulative rides exceeding 11 million by May 2025, showcases its diversification and technological advancement in intelligent driving.

| Area of Strength | Key Metric/Data Point | Impact |

|---|---|---|

| Search Market Dominance | >50% Market Share (Nov 2024) | Foundation for online marketing revenue & AI data |

| AI Leadership | 42% YoY AI Cloud Growth (Q1 2025) | Drives new high-potential revenue streams |

| Autonomous Driving | 1.4M+ Rides (Q1 2025) | Demonstrates traction in future mobility |

What is included in the product

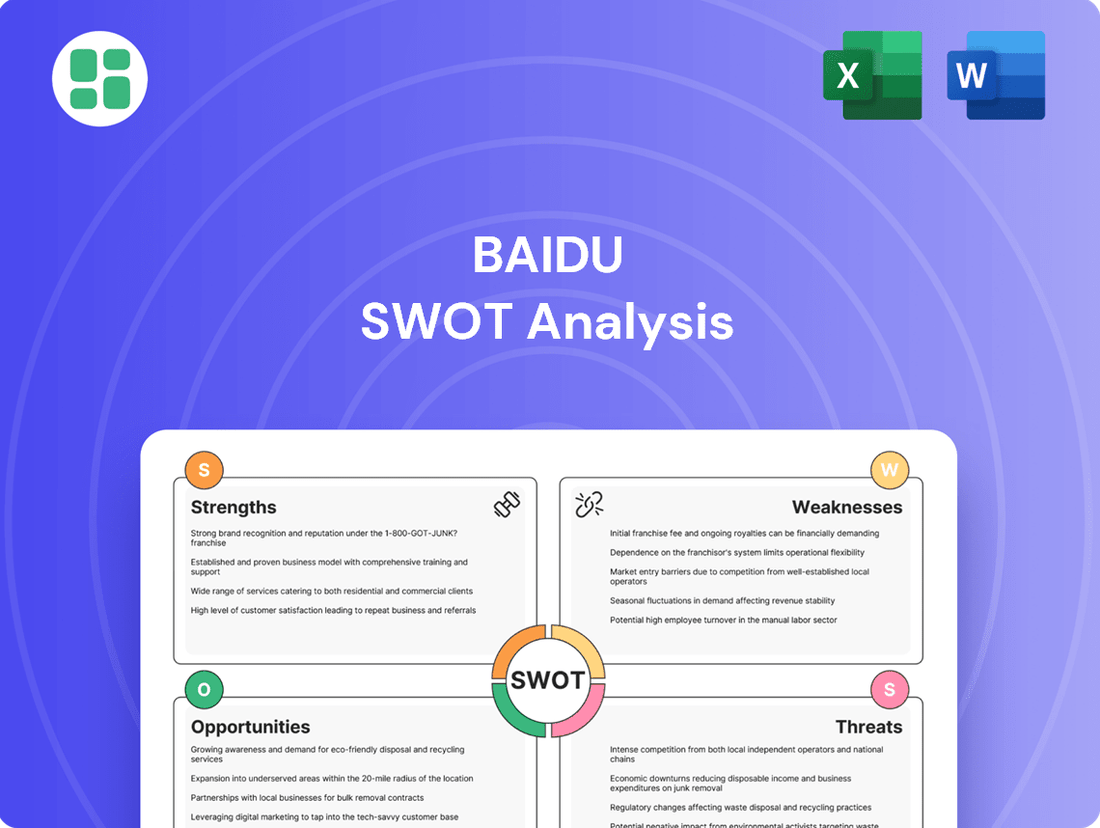

Analyzes Baidu’s competitive position through key internal and external factors, highlighting its strong brand recognition and AI capabilities while acknowledging reliance on search and competition in emerging markets.

Baidu's SWOT Analysis offers a clear roadmap to address competitive pressures and navigate regulatory challenges, providing actionable insights for strategic adjustments.

Weaknesses

Baidu's significant reliance on online marketing revenue presents a notable weakness. Despite attempts to diversify, this core advertising segment remains a substantial revenue driver, yet it has encountered persistent headwinds.

In the first quarter of 2025, Baidu's online marketing revenue saw a 6% decrease year-over-year. Projections for the remainder of 2025 indicate ongoing pressure, stemming from broader macroeconomic softness and evolving user engagement patterns.

This concentrated revenue stream leaves Baidu susceptible to economic downturns and heightened competition within the digital advertising landscape, impacting overall financial stability and growth prospects.

Baidu confronts formidable rivals in the burgeoning AI and cloud computing arenas, including domestic powerhouses like Alibaba Cloud and Tencent Cloud, alongside global competitors. Despite Baidu AI Cloud's increasing market presence, maintaining its competitive edge demands relentless innovation and substantial capital outlay, potentially impacting profitability.

The intense competition necessitates ongoing strategic adjustments and market positioning to prevent market share erosion. For instance, in 2023, the Chinese cloud market saw Alibaba Cloud leading with approximately 34% market share, followed by Huawei Cloud and Tencent Cloud, highlighting the challenging environment Baidu operates within.

Baidu's significant investments in AI, autonomous driving, and cloud infrastructure, while crucial for future expansion, are currently straining its short-term profitability and cash flow. These ongoing R&D expenditures are substantial, with projections indicating a potential decrease in earnings per share for 2025.

Regulatory Scrutiny and Compliance Costs

Baidu operates within China's dynamic and often stringent regulatory framework, facing continuous scrutiny over data privacy, content moderation, and advertising practices. This necessitates significant investment in compliance measures, potentially impacting profitability and operational flexibility. For instance, changes in advertising regulations can directly affect Baidu's core revenue streams, requiring swift adaptation and potentially leading to unforeseen costs.

The evolving regulatory landscape introduces inherent uncertainties that can hinder strategic initiatives, including mergers and acquisitions, and can slow down the pace of innovation. For example, in 2023, China continued to refine its regulations around algorithms and data usage, requiring companies like Baidu to invest heavily in compliance and adjust their product development cycles. These compliance costs, estimated to be in the hundreds of millions of dollars annually for major tech firms, directly impact the bottom line.

- Data Privacy Compliance: Baidu must adhere to regulations like the Personal Information Protection Law (PIPL), increasing operational complexity and costs associated with data handling and user consent.

- Content Moderation Demands: The company faces ongoing pressure to censor content deemed inappropriate by the government, requiring substantial resources for content review and moderation systems.

- Advertising Standards: Evolving rules on online advertising, including those related to misleading claims and data usage, necessitate continuous adjustments to Baidu's advertising platforms and sales processes.

Challenges in International Expansion

Baidu's international expansion, especially with its autonomous driving service Apollo Go, faces considerable hurdles. Navigating the patchwork of regulations across different countries is a major obstacle. For instance, differing data privacy laws and autonomous vehicle testing permits require tailored approaches for each new market.

The competitive landscape is fierce, with established global players like Waymo and Tesla already holding significant market share and brand recognition. Baidu must differentiate its offerings and build trust in unfamiliar territories. In 2024, Waymo continued to expand its fully driverless operations in cities like Phoenix and San Francisco, demonstrating the advanced stage of its global competitors.

Adapting services to diverse local preferences and legal frameworks is also critical. What works in China may not resonate or be legally permissible elsewhere. This necessitates significant investment in localization efforts, from user interface design to compliance with local employment and business laws, impacting the speed and cost of market entry.

- Regulatory Fragmentation: Inconsistent laws and licensing requirements across regions complicate market entry for autonomous driving services.

- Intense Global Competition: Established players like Waymo and Tesla present formidable competition, possessing advanced technology and brand loyalty.

- Localization Demands: Adapting services to varied local preferences, languages, and legal frameworks requires substantial resources and strategic planning.

Baidu's heavy dependence on online advertising revenue remains a core weakness. While efforts to diversify are underway, the advertising segment still accounts for a significant portion of its income, and it has faced considerable challenges.

This reliance makes Baidu vulnerable to economic downturns and increased competition in the digital ad space, impacting its financial stability and future growth. The company's first quarter 2025 earnings reflected this, with online marketing revenue declining by 6% year-over-year, a trend expected to continue due to economic pressures and changing user habits.

Preview Before You Purchase

Baidu SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Baidu's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis awaits your purchase.

Opportunities

Baidu can deepen the integration of its AI technologies, like ERNIE Bot, into its search engine, content platforms, and enterprise services. This synergy is crucial as AI-generated content increasingly features in search results, promising to refine user engagement and open new revenue streams beyond conventional ads.

The burgeoning market for generative AI and large language models provides a significant boost for Baidu's AI Cloud. For instance, in the first quarter of 2024, Baidu reported that its cloud revenue grew by 11% year-over-year, highlighting the increasing demand for its AI-powered cloud solutions.

Baidu's Apollo Go is strategically positioned for global expansion, with ambitious plans to introduce robotaxi services in Europe by 2026 via key partnerships. This international push, alongside the ongoing expansion of its autonomous ride-hailing services within China, presents a significant chance to monetize its advanced autonomous driving technology and create fresh revenue streams.

The burgeoning robotaxi market offers Baidu a unique opportunity to gather vast amounts of real-world data, which is crucial for the continuous improvement and refinement of its sophisticated AI ecosystem. This data-driven approach is essential for maintaining its competitive edge in the rapidly evolving intelligent driving sector.

Baidu Intelligent Cloud is seizing a significant opportunity by leading China's Model-as-a-Service (MaaS) and AI big model solutions market in the first half of 2024. This leadership is driven by the escalating demand for generative AI and foundation models across various sectors.

The company is well-positioned to capitalize on this trend, expecting substantial growth in its subscription-based cloud revenue. By offering high-performance, cost-effective AI solutions, Baidu can attract enterprises eager to integrate AI into their operations.

Baidu's robust AI infrastructure further solidifies its appeal, making it a go-to provider for businesses seeking to adopt advanced AI technologies. This strategic advantage allows Baidu to deepen its market penetration and expand its cloud service offerings.

Leveraging Data and AI for Personalized Services

Baidu's immense user base, stemming from its leading search engine and mobile ecosystem, positions it to harness its substantial data and advanced AI for highly personalized services. This personalization can significantly boost user engagement and unlock new revenue streams.

By offering tailored content, advertising, and other services, Baidu can create a sticky user experience that competitors find challenging to match, thereby solidifying its competitive edge. For instance, Baidu's AI-powered recommendation engine for its video platform, iQIYI, has been instrumental in its growth. In 2023, iQIYI reported a substantial increase in average viewing time per user, directly attributable to its AI's ability to predict and serve engaging content.

- Enhanced User Engagement: Baidu's AI algorithms can analyze user behavior to deliver more relevant search results, news feeds, and entertainment options, leading to longer session times.

- New Revenue Streams: Personalized advertising, driven by deep user understanding, can command higher CPMs and CTRs, boosting Baidu's advertising revenue.

- Competitive Differentiation: Offering unique, data-driven personalized experiences makes it harder for rivals to attract and retain users, strengthening Baidu's market position.

Strategic Partnerships and Acquisitions in Emerging Technologies

Baidu can significantly boost its diversification and innovation by forming strategic partnerships and pursuing acquisitions in cutting-edge technology sectors. For instance, its collaboration with companies like Geely for its Jidu Auto venture, aiming to compete in the burgeoning electric vehicle market, highlights this strategy. Such moves are crucial for staying ahead in rapidly evolving fields.

These alliances can accelerate market penetration and technology adoption. Baidu's existing partnerships, like those for deploying autonomous vehicles, demonstrate how collaborations can open new avenues for its AI and mobility solutions. By integrating its technologies with established players, Baidu can gain wider reach and faster acceptance.

Acquisitions offer a direct route to acquiring new talent, intellectual property, and complementary business units. This approach allows Baidu to quickly integrate advanced capabilities, such as those in AI or cloud computing, into its existing ecosystem. For example, acquiring smaller AI startups could bolster its research and development in specialized areas.

- Strategic Partnerships: Baidu's collaboration with Geely for Jidu Auto is a key example, targeting the rapidly expanding EV market.

- Autonomous Vehicle Deployment: Agreements to deploy autonomous vehicles on ride-sharing platforms outside China facilitate market entry and technology validation.

- AI and Cloud Integration: Acquisitions of AI startups can rapidly enhance Baidu's capabilities in critical growth areas.

Baidu's AI Cloud is poised for significant growth, especially with its leadership in China's Model-as-a-Service (MaaS) market during the first half of 2024. This positions the company to capitalize on the increasing demand for generative AI and foundation models across various industries, expecting substantial growth in its subscription-based cloud revenue.

The company's extensive user base, powered by its dominant search engine and mobile ecosystem, provides a rich foundation for leveraging AI to deliver highly personalized services. This deep user understanding can translate into enhanced engagement and new revenue opportunities through tailored content and advertising, as seen with iQIYI's increased user viewing time in 2023.

Baidu's Apollo Go is strategically expanding globally, with plans for European robotaxi services by 2026, complementing its ongoing expansion within China. This international push offers a substantial opportunity to monetize its advanced autonomous driving technology and generate new revenue streams.

Strategic partnerships and acquisitions are key opportunities for Baidu to diversify and innovate. Collaborations like the one with Geely for Jidu Auto in the electric vehicle market, and potential acquisitions of AI startups, can accelerate market penetration and enhance its technological capabilities.

Threats

Baidu is up against formidable rivals. Domestically, companies like Alibaba and Tencent are fierce competitors, especially in burgeoning fields like cloud computing and artificial intelligence. Internationally, global tech titans pose a significant challenge, particularly in the critical area of autonomous driving technology.

This heightened rivalry often translates into aggressive pricing strategies and substantial increases in marketing and research and development expenditures. Such pressures can erode Baidu's market share and impact its profitability, particularly within its established online advertising services, a segment that has historically been a core revenue driver.

Baidu faces considerable threats from China's evolving regulatory landscape and escalating geopolitical tensions. New data privacy regulations, like the Personal Information Protection Law (PIPL) enacted in 2021, and ongoing content censorship can restrict Baidu's ability to innovate and monetize its services.

Increased antitrust scrutiny, a trend seen across major tech players globally, could lead to forced divestitures or operational limitations. Geopolitical friction, particularly between the US and China, introduces risks such as potential restrictions on accessing critical technologies, including advanced semiconductors essential for AI development, which directly impacts Baidu's long-term competitiveness.

China's ongoing economic slowdown presents a significant threat to Baidu, as its advertising revenue, a crucial part of its business, is directly tied to the nation's economic health. A sluggish economy often means businesses cut back on marketing spend, impacting Baidu's top line.

Key sectors such as automotive and real estate, historically significant advertisers, have faced challenges, contributing to a downturn in Baidu's online marketing revenue. This, coupled with shifts in user attention towards short-video platforms, further exacerbates these headwinds.

For instance, Baidu's advertising revenue saw a decline in recent quarters, reflecting these macroeconomic pressures. A prolonged economic slump could severely impact Baidu's profitability and growth prospects, especially given its reliance on advertising income.

AI Cannibalization of Traditional Revenue Streams

Baidu faces the threat of its own AI advancements potentially undermining its core search advertising business. As AI-driven features offer more direct answers and integrate advertising in novel ways, users may bypass traditional ad clicks, impacting revenue. For instance, if Baidu's AI chatbot provides comprehensive solutions without directing users to advertiser websites, it could diminish the value proposition of standard pay-per-click models. This shift could accelerate a decline in online marketing revenue, a significant portion of Baidu's income, as user interaction patterns evolve.

The increasing sophistication of AI in search could lead to a direct displacement of traditional advertising slots. Baidu's reliance on search advertising, which historically formed a substantial part of its revenue, is vulnerable to this technological evolution. As AI becomes more adept at summarizing information and providing immediate answers, the necessity for users to navigate through multiple search result pages, and consequently click on ads, may decrease. This presents a significant challenge to maintaining current advertising revenue streams.

- AI-driven search may reduce click-through rates on traditional ads.

- Baidu's core advertising revenue is at risk from its own AI innovations.

- Shifts in user behavior towards direct AI answers can impact online marketing revenue.

Challenges in Monetizing New AI and Autonomous Driving Ventures

Baidu faces significant hurdles in turning its advanced AI and autonomous driving technologies, like Apollo Go, into profitable ventures. Despite substantial investment, the monetization strategy remains a challenge, with ongoing capital requirements for development and operations. For instance, in the first quarter of 2024, Baidu reported that its intelligent driving segment, which includes Apollo, saw revenue growth but continued to incur significant operating costs as the company scaled its services and expanded its fleet.

There's a tangible risk that these cutting-edge initiatives might not achieve substantial revenue generation within projected timelines. This could strain Baidu's overall financial performance if the high development and operational expenditures don't yield commensurate returns. The company's commitment to expanding its robotaxi services across multiple cities in 2024 and 2025 underscores the substantial, long-term investment needed before these ventures can become self-sustaining profit centers.

- Monetization Lag: The time required for AI and autonomous driving ventures to become profitable is uncertain, potentially delaying positive cash flow.

- High Operational Costs: Maintaining and expanding autonomous fleets and AI infrastructure demands continuous, significant capital outlay.

- Return on Investment Risk: Ventures may not generate sufficient revenue to offset the substantial research, development, and operational expenses incurred.

Baidu confronts intense competition from both domestic giants like Alibaba and Tencent, and global tech leaders, particularly in AI and autonomous driving. This rivalry forces increased spending on R&D and marketing, potentially squeezing profit margins, especially in its core online advertising business.

Regulatory shifts in China, including data privacy laws and content restrictions, pose a threat to Baidu's operational flexibility and revenue generation. Furthermore, geopolitical tensions, especially between the US and China, could limit access to crucial technologies like advanced semiconductors needed for AI development, impacting long-term competitiveness.

China's economic slowdown directly impacts Baidu's advertising revenue, as businesses reduce marketing spend during downturns. Sectors like automotive and real estate, key advertising sources, have faced difficulties, contributing to revenue declines for Baidu. User attention shifting to short-video platforms also presents a challenge.

Baidu's own AI advancements, while innovative, risk cannibalizing its traditional search advertising revenue. As AI provides direct answers, users may bypass traditional ad clicks, reducing the effectiveness of pay-per-click models. This evolution in user behavior could significantly affect Baidu's income streams.

The monetization of Baidu's AI and autonomous driving technologies, such as Apollo Go, remains a significant challenge. Despite substantial investments, these ventures require ongoing capital for development and operations, with uncertain timelines for profitability. For example, Baidu's intelligent driving segment incurred significant operating costs in Q1 2024 while scaling services.

| Threat Category | Specific Threat | Impact on Baidu | 2024/2025 Data/Context |

| Competition | Intensified rivalry in AI and autonomous driving | Erodes market share, increases R&D/marketing costs | Continued global investment in AI and autonomous tech by major players. |

| Regulatory & Geopolitical | Evolving Chinese regulations (e.g., PIPL) and US-China tensions | Limits innovation, monetization, and access to critical tech (semiconductors) | Ongoing scrutiny of tech companies and supply chain diversification efforts. |

| Economic Conditions | China's economic slowdown | Reduces advertising revenue, impacting core business | Projected GDP growth rates for China in 2024-2025 will be a key indicator. |

| Technological Disruption | AI-driven search displacing traditional ads | Cannibalizes search advertising revenue | Increasing adoption of AI chatbots and generative AI in search interfaces. |

| Monetization Challenges | Difficulty in profitable monetization of AI/autonomous driving | High operational costs, uncertain ROI, delayed profitability | Significant capital expenditure required for autonomous vehicle fleet expansion and AI infrastructure development. |

SWOT Analysis Data Sources

This Baidu SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded and accurate strategic overview.