Baidu Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baidu Bundle

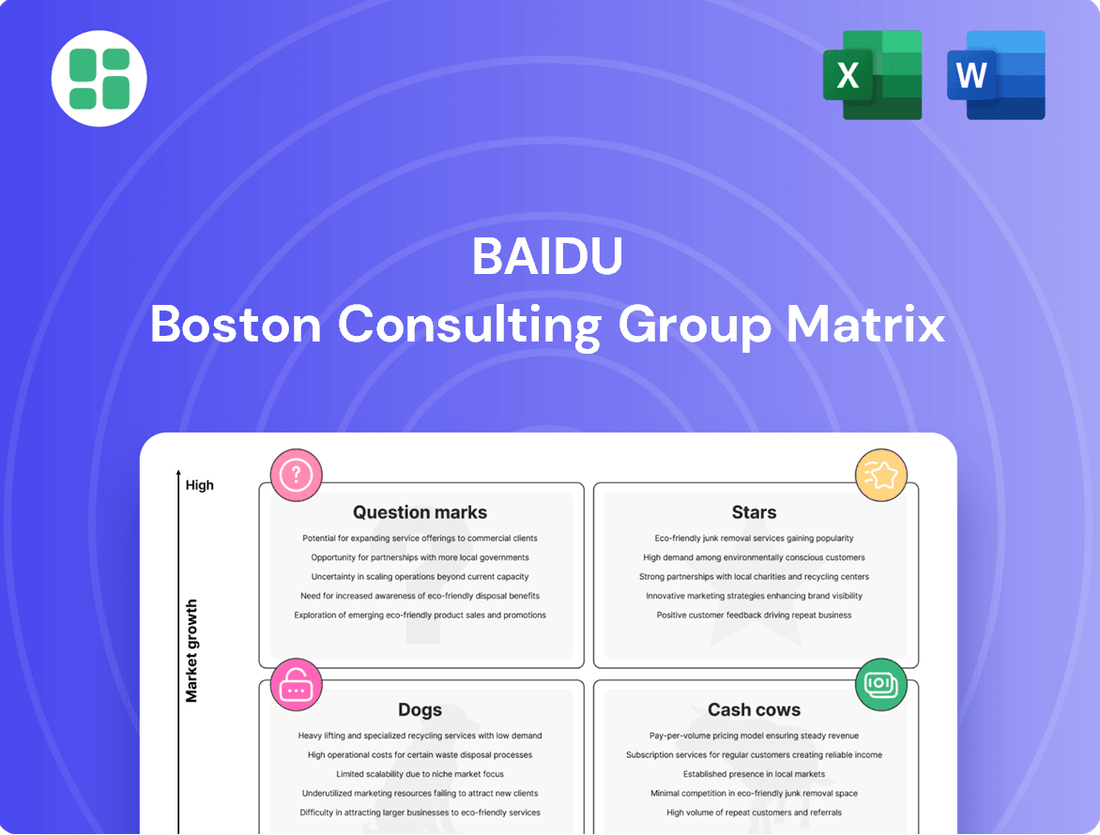

Curious about Baidu's strategic positioning? Our BCG Matrix analysis reveals which of their ventures are market leaders (Stars), reliable profit generators (Cash Cows), or potential underperformers (Dogs). Understand the dynamics driving Baidu's success and identify areas for future growth.

Don't miss out on the complete picture! Purchase the full Baidu BCG Matrix to unlock detailed quadrant placements, data-driven insights, and actionable strategies for optimizing your own portfolio. Gain a competitive edge by understanding where Baidu is investing and reaping rewards.

Stars

Baidu's AI Cloud business is a star performer, showing impressive revenue acceleration. In Q4 2024, it grew 26% year-over-year, and this momentum surged to a remarkable 42% year-over-year in Q1 2025. This growth is fueled by a strong demand for generative AI and core AI models across many sectors.

This AI Cloud segment is crucial for Baidu's overall growth strategy. It's effectively balancing out slower performance in other business areas, highlighting its potential for consistent, long-term expansion as businesses continue to embrace AI technologies.

Apollo Autonomous Driving, also known as Apollo Go, represents Baidu's ambitious venture into the autonomous ride-hailing sector. This service has demonstrated a strong validation of its business model, evidenced by substantial growth in user adoption and operational scale.

In the fourth quarter of 2024, Apollo Go experienced a significant 36% year-over-year increase in rides, reaching over 1.1 million. This upward trajectory continued into the first quarter of 2025, with the service facilitating a remarkable 1.4 million rides, marking a 75% surge compared to the same period in the previous year. By early 2025, Apollo Go had surpassed the milestone of 11 million cumulative rides, positioning it ahead of many competitors in the burgeoning autonomous mobility market.

The strategic expansion of Apollo Go beyond China, with services launched in Dubai and Abu Dhabi, underscores its global aspirations and its clear trajectory towards achieving profitability by 2025. This international push signifies a robust confidence in the service's scalability and economic viability.

Baidu's ERNIE Large Language Model is a cornerstone of its artificial intelligence ambitions. By December 2024, ERNIE was handling an impressive 1.65 billion API calls daily, demonstrating a significant 178% surge in external API usage quarter-over-quarter.

The continuous development of ERNIE, including the rollout of ERNIE 4.5 and ERNIE X1, highlights Baidu's commitment to enhancing performance and cost-efficiency. These advancements are crucial for Baidu as it aims to secure a substantial share of the enterprise AI market, offering competitive advantages over global competitors.

AI-Powered Search Capabilities

Baidu's AI-powered search capabilities represent a significant investment in its Stars quadrant within the BCG Matrix. The company is aggressively integrating artificial intelligence, with major upgrades planned for July 2025 to handle natural language queries exceeding 1,000 words. This allows for direct, analytical responses, moving beyond simple link aggregation.

This strategic shift aims to bolster Baidu's market position against evolving search paradigms. By offering more sophisticated and user-friendly search experiences, Baidu seeks to reclaim market share lost to social media platforms and emerging AI-driven information sources. The company's commitment to AI innovation underscores its potential for continued growth and dominance in the search engine market.

- AI Integration: Baidu's search engine is being heavily infused with AI technology.

- Enhanced Query Handling: By July 2025, users can submit queries over 1,000 words.

- Direct Answers: The AI will provide analytical answers, not just links.

- Market Strategy: This aims to improve user experience and competitive standing.

PadddlePaddle Deep Learning Platform

PaddlePaddle, Baidu's open-source deep learning platform, is a significant asset within Baidu's business portfolio. Its robust ecosystem supports a vast developer community and enterprise adoption, indicating strong market presence and growth potential.

As of recent data, PaddlePaddle has attracted 21.85 million developers and serves 670,000 enterprises. This widespread adoption has led to the creation of an impressive 1.1 million AI models, highlighting the platform's versatility and impact.

PaddlePaddle is instrumental in Baidu's AI strategy, powering high-efficiency inference for foundation models and fostering the development of AI-native applications across diverse sectors. This positions it as a key driver for innovation and future revenue streams.

- Developer Community: 21.85 million developers

- Enterprise Adoption: 670,000 enterprises

- AI Model Creation: 1.1 million models

- Strategic Importance: Underpins Baidu's AI initiatives and AI-native application development

Baidu's AI Cloud and Apollo Go are positioned as Stars in the BCG matrix due to their high growth and market share. AI Cloud saw 42% year-over-year growth in Q1 2025, driven by generative AI demand, while Apollo Go facilitated 1.4 million rides in Q1 2025, a 75% increase. ERNIE LLM's 1.65 billion daily API calls and PaddlePaddle's 21.85 million developers further solidify these businesses as key growth drivers for Baidu.

| Business Segment | Growth Rate (YoY) | Key Metrics | Baidu BCG Classification |

| AI Cloud | Q1 2025: 42% | Strong demand for generative AI | Star |

| Apollo Go (Autonomous Driving) | Q1 2025: 75% increase in rides | 1.4 million rides in Q1 2025; 11 million cumulative rides by early 2025 | Star |

| ERNIE Large Language Model | N/A (Usage Metric) | 1.65 billion daily API calls (Dec 2024) | Star |

| PaddlePaddle (Deep Learning Platform) | N/A (Adoption Metric) | 21.85 million developers, 670,000 enterprises | Star |

What is included in the product

This analysis categorizes Baidu's business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment and divestment decisions.

The Baidu BCG Matrix offers a clear, visual overview of business units, alleviating the pain of strategic uncertainty.

Cash Cows

Baidu’s core search engine remains a formidable cash cow, commanding a significant portion of the Chinese digital landscape. As of June 2025, it held a dominant 50.71% of the overall search engine market share, with an even stronger 67.41% on mobile devices, underscoring its continued relevance.

Despite facing increased competition, Baidu’s search engine consistently drives substantial user traffic and generates considerable advertising revenue. This consistent performance solidifies its position as a reliable income generator for the company, even as other business segments evolve.

Baidu's online marketing services, largely driven by its search engine, remain its dominant revenue generator. This segment represented 55% of Baidu's total revenue in 2024, underscoring its critical role.

While this core business experienced a 7% year-over-year decline in Q4 2024 and a 6% dip in Q1 2025, it still accounts for a significant 72% of Baidu's core revenue as of 2023. This enduring contribution solidifies its position as a cash cow, despite recent market pressures.

The Baidu App continues to be a cornerstone of Baidu's mobile strategy, boasting 679 million monthly active users (MAUs) by the end of 2024, a 2% increase from the previous year. This robust user base is crucial for distributing content and integrating new AI-powered applications.

By Q1 2025, the MAU count climbed further to 724 million, marking a significant 7% year-over-year growth. This expanding user engagement solidifies the Baidu App's position as a cash cow, enabling consistent monetization through its integrated marketing solutions and serving as a stable platform for Baidu's future ventures.

Baidu Wenku

Baidu Wenku, a key component of Baidu's content and information services, is demonstrating strong performance, positioning it as a potential cash cow. The platform's focus on AI-driven features has clearly resonated with users, leading to substantial growth.

The platform's user base has expanded dramatically, reaching 94 million monthly active users as of December 2024. This represents an impressive 216% increase compared to the previous year, highlighting its increasing relevance and adoption.

Baidu Wenku's AI capabilities, including smart slide generation, AI-powered search, and intelligent audio picture books, are driving this user engagement. These innovations contribute directly to Baidu's overall content and information services revenue streams.

- December 2024 Monthly Active Users: 94 million

- Year-over-Year User Growth: 216%

- Key AI Features: Smart slides generation, AI-powered search, intelligent audio picture books

Managed Page

Managed Page is a key component of Baidu's Core business, acting as a cash cow within its BCG Matrix. This service is crucial for businesses looking to establish and maintain their presence on Baidu's platform, offering tools for online marketing and presence management.

In the fourth quarter of 2024, Managed Page demonstrated its financial strength by contributing a substantial 48% to Baidu Core's online marketing revenue. This highlights its role as a reliable and significant revenue generator for the company.

The service's ability to provide a stable revenue stream stems from its focus on existing clients, ensuring consistent income from businesses that rely on Baidu for their digital marketing needs. This recurring revenue model solidifies its position as a cash cow.

- Revenue Contribution: Accounted for 48% of Baidu Core's online marketing revenue in Q4 2024.

- Business Function: Enables businesses to manage their online presence and marketing within Baidu's ecosystem.

- Revenue Stability: Generates a consistent income stream from its established client base.

- BCG Matrix Classification: Positioned as a cash cow due to its high market share and low growth potential within Baidu's portfolio.

Baidu's core search engine and the Baidu App are prime examples of its cash cows, consistently generating substantial revenue and user engagement. The search engine, despite a slight revenue dip in late 2024 and early 2025, still commanded over 50% of the search market share as of June 2025, with its online marketing services accounting for a significant portion of Baidu's overall income. The Baidu App, with its growing user base reaching 724 million MAUs by Q1 2025, provides a stable platform for monetization and future growth initiatives.

Baidu Wenku and Managed Page also function as important cash cows within Baidu's portfolio. Wenku's user base surged by 216% to 94 million MAUs by December 2024, driven by AI innovations, contributing to content and information services revenue. Managed Page, a key part of Baidu Core, secured 48% of its online marketing revenue in Q4 2024 through its stable client base, solidifying its role as a reliable income generator.

| Business Segment | BCG Classification | Key Metrics (2024/Q1 2025) | Revenue Contribution (2024) |

|---|---|---|---|

| Search Engine | Cash Cow | 50.71% overall search market share (June 2025), 67.41% mobile search share | 55% of total revenue (Online Marketing Services) |

| Baidu App | Cash Cow | 724 million MAUs (Q1 2025), 7% YoY growth | Integral to monetization of core services |

| Baidu Wenku | Potential Cash Cow | 94 million MAUs (Dec 2024), 216% YoY user growth | Contributes to content and information services revenue |

| Managed Page | Cash Cow | 48% of Baidu Core's online marketing revenue (Q4 2024) | Stable revenue from existing client base |

Delivered as Shown

Baidu BCG Matrix

The preview of the Baidu BCG Matrix you're examining is the identical, fully-formatted document you will receive upon purchase. This ensures complete transparency; what you see is precisely what you get, ready for immediate strategic application without any alterations or hidden elements.

Dogs

iQIYI, Baidu's video streaming service, is currently positioned as a Question Mark in the BCG Matrix. Its revenue has seen a significant downturn, with a 14% year-over-year decrease in Q4 2024 and a further 9% drop in Q1 2025.

The platform's struggles to produce hit content and attract advertising revenue have fueled speculation about a potential spin-off. This move would allow Baidu to redirect resources towards its more promising AI and cloud computing ventures, aiming to improve overall business performance.

In the Baidu BCG Matrix, the legacy desktop search market is a clear question mark, or perhaps even a dog, given its declining dominance. While Baidu is a powerhouse in mobile search, its foothold in the desktop arena is considerably weaker. As of June 2025, Baidu's desktop search market share stood at a mere 26.57%.

This figure pales in comparison to competitors like Bing, which commanded a substantial 41.73% of the desktop search market during the same period. The trend of users migrating to mobile devices and newer digital platforms further erodes the growth potential and overall relevance of this desktop-centric business segment.

Traditional display advertising, a cornerstone of Baidu's online marketing services, is experiencing significant headwinds. This segment is feeling the heat from newer, more engaging platforms like short-form video apps and social media, which are capturing user attention and advertiser budgets. In 2023, Baidu's total online marketing services revenue saw a modest increase, but the growth was largely driven by other segments, highlighting the stagnation in traditional display.

Older Mobile Apps with Low Adoption

Within Baidu's extensive mobile portfolio, certain older applications may be classified as Dogs. These are apps that, despite Baidu's strong mobile presence, struggle to achieve significant user adoption or market share. This often stems from intense competition within the app landscape, where newer, more innovative offerings can quickly overshadow established but less dynamic products.

While specific examples of Baidu's "Dog" applications aren't publicly detailed, this category represents a common hurdle for large technology firms. Companies like Baidu constantly manage a diverse range of products, and inevitably, some will fail to gain the necessary traction to justify continued investment or development.

- Low User Engagement: Apps in this category typically exhibit low daily active users (DAU) and monthly active users (MAU) compared to their potential or Baidu's other successful applications.

- Limited Market Share: They hold a negligible share of their respective app market segments, often overshadowed by dominant competitors.

- Stagnant Growth: User acquisition and retention rates are minimal, indicating a lack of appeal or perceived value to the target audience.

- Potential for Divestment: Baidu might consider phasing out or divesting these applications if they do not show signs of improvement or strategic alignment.

Less Competitive Niche Internet Services

Within Baidu's diverse internet service portfolio, certain niche offerings may be positioned in the "Dogs" quadrant of the BCG Matrix. These are services that likely exhibit low growth and hold a small market share. For instance, older, less popular forums or specialized content platforms that haven't integrated advanced AI or attracted substantial user bases could fall into this category.

These "Dogs" might be self-sustaining, perhaps breaking even, but they consume valuable resources like development time and marketing spend without offering significant potential for future expansion or profitability. In 2024, Baidu's strategic focus on AI-driven initiatives, such as Ernie Bot and its autonomous driving segments, suggests a deliberate shift away from or a divestment strategy for such underperforming assets.

Consider the implications for resource allocation. If a niche service, for example, a legacy community platform, is seeing declining user engagement, it might represent a drain on engineering talent that could otherwise be deployed on more promising AI ventures. Baidu's reported investments in AI research and development, reaching billions of dollars annually, underscore the company's commitment to high-growth areas, implicitly leaving less room for legacy services that don't align with this forward-looking strategy.

- Low Market Share: Niche services often struggle to gain traction against larger, more established competitors or newer, AI-powered alternatives.

- Low Growth Potential: Without significant innovation or market demand, these services are unlikely to see substantial user or revenue increases.

- Resource Drain: Maintaining these services can tie up capital and human resources that could be better utilized in more strategic growth areas.

- Potential for Divestment: Companies often consider divesting or shutting down "Dog" assets to streamline operations and focus on core competencies.

Within Baidu's diverse internet service portfolio, certain niche offerings may be positioned in the "Dogs" quadrant of the BCG Matrix. These are services that likely exhibit low growth and hold a small market share, such as older, less popular forums or specialized content platforms that haven't integrated advanced AI or attracted substantial user bases.

These "Dogs" might be self-sustaining, perhaps breaking even, but they consume valuable resources like development time and marketing spend without offering significant potential for future expansion or profitability. Baidu's strategic focus on AI-driven initiatives, such as Ernie Bot and its autonomous driving segments, suggests a deliberate shift away from or a divestment strategy for such underperforming assets.

Consider the implications for resource allocation. If a niche service, for example, a legacy community platform, is seeing declining user engagement, it might represent a drain on engineering talent that could otherwise be deployed on more promising AI ventures. Baidu's reported investments in AI research and development, reaching billions of dollars annually, underscore the company's commitment to high-growth areas, implicitly leaving less room for legacy services that don't align with this forward-looking strategy.

| Baidu Business Segment | BCG Matrix Quadrant | Rationale | Key Data Point (as of mid-2025) |

|---|---|---|---|

| Legacy Desktop Search | Dog | Declining market share and user migration to mobile. | Desktop search market share: 26.57% (vs. Bing's 41.73%) |

| Traditional Display Advertising | Dog | Facing headwinds from newer, more engaging platforms. | Growth in this segment is outpaced by other Baidu revenue drivers. |

| Underperforming Mobile Apps | Dog | Low user adoption and market share due to intense competition. | Specific app data not publicly available, but represents a common challenge for tech giants. |

| Niche Internet Services (e.g., legacy forums) | Dog | Low growth, small market share, and potential resource drain. | Strategic focus on AI implies potential divestment of such assets. |

Question Marks

Baidu's Smart Transportation AI Expert Systems, encompassing traffic congestion management, vehicle-road collaboration via ZhiLu OS, and smart public transport, represent a significant investment in a high-growth market. These solutions tackle pressing urban mobility issues, a crucial area for development. While the market potential is substantial, Baidu's current global market share in this emerging sector is still being established, necessitating continued investment to capture a larger footprint.

Apollo Go's international expansion, including its presence in Dubai and Abu Dhabi, and its planned 2026 entry into Europe through a Lyft partnership, signifies a high-potential growth avenue. This strategic move aims to capture new user bases and diversify revenue streams beyond its strong Chinese market.

While Apollo Go boasts impressive cumulative ride numbers in China, its market share in these newly entered international regions is currently modest. This necessitates substantial financial commitment and strategic marketing efforts to gain traction and achieve significant scale in these competitive landscapes.

Baidu is actively cultivating new AI-native applications like Wenxiaoyan App and Chengpian, signaling a strategic pivot within its mobile ecosystem. These ventures are positioned in nascent, high-potential sectors fueled by advancements in large language models.

While these applications tap into significant growth potential driven by generative AI, their current market penetration is likely modest. As relatively new entrants, Wenxiaoyan App and Chengpian are in the crucial phase of building user bases and solidifying their market positions.

In-house AI Chips (e.g., Kunlun 800)

Baidu's Kunlun 800 AI chips are a prime example of a company investing heavily in proprietary technology to fuel its AI ambitions. These chips are essential for Baidu's extensive AI infrastructure, powering everything from its search engine to its autonomous driving initiatives and large language models like ERNIE Bot.

While the overall AI chip market is experiencing explosive growth, with projections indicating a market size of over $200 billion by 2030, Baidu's direct market share in chip manufacturing or sales is likely modest. This is because the Kunlun chips are primarily designed for internal use and specific cloud service customers, rather than broad market distribution. This positions them in a high-growth segment but with a currently limited external market footprint.

- Strategic Importance: Kunlun chips are foundational to Baidu's AI ecosystem, enabling advanced model training and inference for its core businesses.

- Market Dynamics: The AI chip market is rapidly expanding, driven by demand from cloud providers, automotive, and enterprise sectors.

- Baidu's Position: While Baidu is a significant player in AI services, its direct share in the global AI chip manufacturing market is nascent, as Kunlun primarily serves internal and select external cloud needs.

- Growth Potential: The internal development of such specialized hardware signifies Baidu's commitment to innovation and its potential to capture value in the high-growth AI infrastructure segment.

Generative Foundation Model-Based Agent Technology

Baidu is actively developing generative foundation model-based agent technology, notably through its ERNIE Agent Platform and Business Agent. This initiative aims to significantly lower the costs associated with building AI-powered applications and improve their overall capabilities.

This area of AI technology is experiencing rapid expansion and holds considerable promise for future growth. However, the actual commercial uptake and market penetration of Baidu's specific agent technologies are still in their nascent stages.

- ERNIE Agent Platform: Baidu's platform for building generative AI agents.

- Business Agent: A specific application of generative AI agents for business use cases.

- Cost Reduction: A primary goal is to make AI development more affordable.

- Market Stage: Commercial adoption is currently in the early phases.

Baidu's AI-native applications, such as Wenxiaoyan App and Chengpian, are positioned in emerging sectors driven by advancements in large language models. These ventures represent Baidu's strategic pivot within its mobile ecosystem, aiming to capitalize on high-growth potential.

While these applications tap into significant growth potential fueled by generative AI, their current market penetration is likely modest. As relatively new entrants, Wenxiaoyan App and Chengpian are in the crucial phase of building user bases and solidifying their market positions.

The question marks in Baidu's BCG Matrix likely represent these new, high-potential AI applications. They require substantial investment to grow market share in rapidly evolving, competitive landscapes. Their success hinges on continued development and effective market adoption strategies.

BCG Matrix Data Sources

Our Baidu BCG Matrix leverages comprehensive data from Baidu's financial reports, internal performance metrics, and extensive market research to accurately assess business unit standing.