Baidu Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baidu Bundle

Baidu's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. From its dominant search engine to its expanding AI and cloud services, Baidu consistently innovates its product offerings. Discover how their pricing models and extensive distribution networks contribute to their market leadership.

Unlock the full story behind Baidu's success by delving into their comprehensive 4Ps marketing mix. This detailed analysis goes beyond the surface, revealing the intricate interplay of their product development, pricing strategies, market reach, and promotional campaigns. Gain actionable insights to inform your own marketing strategies.

Ready to understand what makes Baidu a digital giant? Our complete 4Ps Marketing Mix Analysis provides an in-depth look at their product innovation, competitive pricing, strategic distribution channels, and impactful promotional activities. Get the full, editable report to elevate your market understanding.

Product

Baidu's core product is its powerful search engine, now deeply infused with advanced AI. This AI integration, notably through its ERNIE large language model, delivers smarter search results, aids in content creation, and fosters more engaging user interactions. By the end of 2023, Baidu reported that its AI Cloud revenue grew by 36% year-over-year, showcasing the commercial impact of its AI advancements.

The Baidu App acts as a comprehensive digital ecosystem, consolidating services like news feeds and mini-programs. This creates a sticky user experience, further leveraging the AI-powered search capabilities. This AI-driven enhancement of search relevance and utility is a key differentiator against competitors, solidifying Baidu's position in the Chinese market.

Baidu AI Cloud offers a comprehensive suite of cloud services, distinguishing itself with a significant focus on artificial intelligence. This includes infrastructure, platform, and software solutions, notably the Qianfan Model-as-a-Service (MaaS) platform, which provides enterprises with access to a wide array of foundation models and development tools. This AI-centric approach positions Baidu AI Cloud as a crucial offering for businesses aiming to leverage scalable and intelligent capabilities for data processing and application development.

The product's strength lies in its AI capabilities, making it a compelling choice for companies looking to integrate advanced AI into their operations. For instance, Baidu AI Cloud's MaaS platform is designed to accelerate enterprise AI adoption by simplifying access to powerful AI models. This strategic emphasis on AI is a primary growth engine for Baidu, attracting a broad spectrum of industries seeking to enhance their digital transformation through intelligent cloud solutions.

Baidu's Apollo platform is a comprehensive, open-source autonomous driving ecosystem. Its product strategy focuses on providing a full suite of solutions, from the core autonomous driving software stack to hardware integration and cloud services. This extensive offering caters to a wide range of partners, including automakers and Tier 1 suppliers, aiming to accelerate the adoption of self-driving technology. By 2024, Apollo Go, Baidu's robotaxi service, was operating in over 60 cities across China, demonstrating significant market penetration and real-world application.

Content & Information Services

Baidu’s content and information services extend far beyond its search engine, creating a robust ecosystem. Platforms like Baidu Baike, an online encyclopedia, and Baidu Tieba, a popular discussion forum, foster user engagement and knowledge sharing. The company’s investment in iQIYI, a leading video streaming service, further diversifies its content offerings and user base.

These varied services are crucial for Baidu’s strategy to capture and retain users. By offering a wide spectrum of content, Baidu builds a sticky digital environment. For instance, iQIYI reported 100 million paying subscribers as of late 2023, demonstrating the significant user commitment to Baidu's content platforms.

AI integration is a key differentiator, enhancing user experience through personalized content recommendations and improved content creation tools across its information services. This focus on AI-driven personalization aims to boost user retention and deepen engagement within the Baidu ecosystem, solidifying its market position.

- Baidu Baike: A comprehensive online encyclopedia, contributing to Baidu's role as a primary information source in China.

- Baidu Tieba: A massive online community forum, facilitating discussions and user-generated content across millions of topics.

- iQIYI: A major video streaming platform, offering a vast library of movies, TV shows, and original content, with over 100 million paying subscribers reported in late 2023.

- AI Enhancement: Utilizes artificial intelligence for personalized content discovery and optimized user experiences across all information services.

Enterprise AI Solutions & Hardware

Baidu’s Product strategy in enterprise AI centers on a robust suite of AI-driven solutions and specialized hardware. This includes their proprietary Kunlun AI chips, advanced voice recognition systems, and sophisticated AI agent platforms designed to meet diverse business requirements. These offerings allow companies to integrate Baidu's advanced AI capabilities into their operations, enhancing everything from marketing effectiveness to customer support automation.

The company’s commitment to a full-stack AI approach is evident in its development of both in-house hardware and comprehensive AI toolkits. This integrated strategy positions Baidu as a key provider of end-to-end intelligent solutions across various sectors. For instance, Baidu's AI cloud services saw significant growth, with revenue increasing by 37% year-over-year in Q1 2024, highlighting strong market adoption of their AI technologies.

- Kunlun AI Chips: Baidu continues to iterate on its Kunlun AI chips, with Kunlun 3.0 announced in late 2023, aiming for enhanced performance in areas like large model training and inference.

- Voice Recognition & NLP: Baidu's speech recognition accuracy rates have consistently improved, reaching over 97% for Mandarin in many applications, powering numerous enterprise voice assistants and transcription services.

- AI Agent Platforms: The company offers platforms like ERNIE Bot for enterprise, enabling businesses to build custom AI agents for tasks such as content generation, data analysis, and customer interaction.

- Full-Stack AI Ecosystem: Baidu provides a complete AI ecosystem, from foundational AI models and chips to cloud infrastructure and application-level solutions, supporting businesses in their digital transformation journeys.

Baidu's product strategy is deeply rooted in its AI capabilities, extending from its core search engine to a broad ecosystem of services. The integration of its ERNIE large language model enhances search relevance and powers content creation tools. Baidu's commitment to AI is further demonstrated by the significant growth in its AI Cloud revenue, which increased by 36% year-over-year by the end of 2023.

The Baidu App acts as a central hub for diverse services, including news and mini-programs, creating a sticky user experience amplified by AI-driven personalization. This AI focus is a key differentiator, particularly within the competitive Chinese market, where Baidu's AI-powered search provides superior utility.

Baidu's product portfolio includes the Apollo autonomous driving platform, offering a complete suite of solutions for automakers and suppliers. By 2024, its robotaxi service, Apollo Go, was operational in over 60 Chinese cities, showcasing substantial real-world deployment.

The company also offers Baidu AI Cloud, featuring solutions like the Qianfan MaaS platform, which grants enterprises access to foundation models and development tools. This AI-centric approach supports businesses in their digital transformation, with Baidu AI Cloud revenue growing by 37% year-over-year in Q1 2024.

| Product Area | Key Offerings | Key Metrics/Developments |

|---|---|---|

| Search & Ecosystem | AI-powered Search, Baidu App, iQIYI | Baidu AI Cloud revenue up 36% YoY (end of 2023); iQIYI had over 100 million paying subscribers (late 2023) |

| Autonomous Driving | Apollo Platform, Apollo Go Robotaxi | Apollo Go operating in over 60 cities across China (2024) |

| Enterprise AI | Baidu AI Cloud, Kunlun AI Chips, ERNIE Bot | Baidu AI Cloud revenue up 37% YoY (Q1 2024); Kunlun 3.0 announced (late 2023) |

What is included in the product

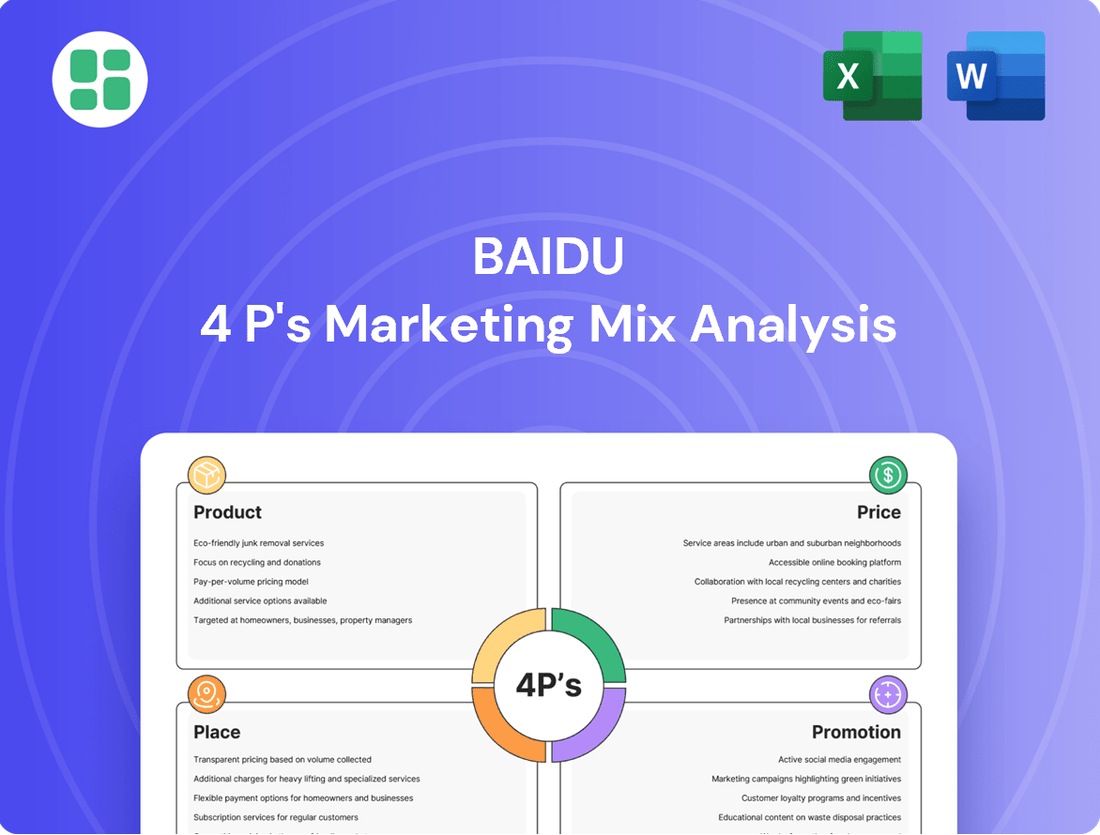

This analysis offers a comprehensive exploration of Baidu's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Baidu's market positioning and competitive landscape, providing actionable insights for strategy development.

Simplifies Baidu's complex marketing strategy into a clear, actionable 4Ps framework, alleviating the pain of understanding and implementing their approach.

Provides a concise overview of Baidu's product, price, place, and promotion, easing the burden of comprehensive market analysis for busy executives.

Place

Baidu's primary distribution strategy revolves around its robust online platform, accessible via web browsers and its highly popular Baidu App. This app acts as a central hub, connecting users to its vast ecosystem of services, including search, news, and a burgeoning mini-program environment.

The Baidu App is a critical distribution channel, boasting hundreds of millions of monthly active users, providing a direct gateway to its diverse product and service offerings across China. This massive user base ensures broad reach and engagement for Baidu's consumer-facing applications.

Beyond its own app, Baidu leverages mobile app stores as a significant distribution avenue for its suite of mobile applications, further expanding its digital footprint and user acquisition efforts.

Baidu's B2B strategy for offerings like Baidu AI Cloud and enterprise AI solutions centers on direct sales. These teams directly engage with corporate clients, fostering relationships essential for understanding and meeting complex business needs. This direct approach allows for tailored solutions and seamless integration of Baidu's advanced technologies into client operations.

Strategic partnerships are equally vital for Baidu's enterprise market penetration. By collaborating with businesses in sectors such as manufacturing, finance, and automotive, Baidu broadens the adoption of its AI and cloud services. For instance, in 2023, Baidu announced collaborations with several leading automotive manufacturers to integrate its autonomous driving technology, aiming to capture a significant share of the rapidly growing intelligent vehicle market.

Baidu actively cultivates a thriving developer ecosystem and open platforms, such as its Qianfan AI development platform and Apollo autonomous driving platform, to significantly broaden the adoption and application of its advanced AI technologies. These initiatives provide essential APIs, SDKs, and comprehensive development toolkits, empowering third-party developers and businesses to create innovative AI-native applications and seamlessly integrate Baidu's AI prowess into their existing products and services.

Autonomous Driving Deployment Zones

Baidu's Apollo Go autonomous ride-hailing service operates within carefully selected deployment zones across numerous Chinese cities, making its robotaxis accessible to the public in these specific areas. By mid-2024, Apollo Go had expanded its commercial operations to 60 cities in China, a significant increase from its earlier stages.

The 'place' strategy extends globally through key partnerships. Baidu has collaborated with international ride-hailing platforms, aiming to broaden Apollo Go's reach into markets in Europe, Asia, and the Middle East. This global expansion is crucial for establishing a wider operational footprint.

Establishing these zones involves significant logistical and regulatory groundwork. Baidu must set up operational hubs, manage fleets, and secure necessary approvals from local authorities in each new geographic region before launching services. This meticulous planning ensures safe and compliant operations.

- China Expansion: As of early 2024, Apollo Go was operational in 60 cities across China, with plans to reach 100 cities by the end of 2025.

- Global Partnerships: Collaborations with companies like Uber and Lyft are facilitating entry into select international markets, though specific city deployments are still in early stages.

- Regulatory Hurdles: Securing permits and navigating diverse regulatory frameworks in new countries remains a primary focus for expanding deployment zones.

Physical Infrastructure for Cloud & AI

Baidu's physical infrastructure for cloud and AI is the bedrock of its digital offerings. This includes a vast network of data centers and high-speed connectivity, essential for supporting its AI Cloud, search engine, and other data-intensive operations. This robust foundation ensures the performance and scalability that users expect.

The company has been actively expanding its data center footprint to meet the growing demand for cloud and AI services. For instance, Baidu announced plans to invest heavily in AI infrastructure, aiming to build more advanced computing centers. These investments are crucial for processing the massive datasets required for AI model training and deployment.

- Data Center Expansion: Baidu continues to invest in building and upgrading data centers across China to support its AI and cloud services.

- Network Backbone: A sophisticated network infrastructure connects these data centers, ensuring low latency and high bandwidth for seamless service delivery.

- AI Computing Power: The physical infrastructure directly supports Baidu's AI capabilities, providing the necessary computing power for its advanced AI models and applications.

Baidu's 'Place' in its marketing mix is multifaceted, encompassing its digital platforms, physical infrastructure, and strategic geographic expansion for services like Apollo Go. Its primary digital presence is anchored by the Baidu App, a gateway to its extensive ecosystem, complemented by app store distribution for its mobile offerings. For enterprise solutions, direct sales and strategic partnerships are key to reaching clients and integrating AI technologies.

The physical infrastructure, including data centers and network connectivity, underpins Baidu's cloud and AI services, with ongoing investments in expanding this crucial computing power. Apollo Go's operational zones are meticulously selected, with significant expansion within China and strategic global partnerships to broaden its reach, though regulatory approvals remain a key consideration.

| Service/Offering | Primary Distribution Channel | Key Expansion/Deployment Focus | 2024/2025 Data Point |

|---|---|---|---|

| Baidu App & Ecosystem | Baidu App, Web Browsers | User engagement, Mini-program growth | Hundreds of millions of monthly active users |

| Enterprise AI Cloud/Solutions | Direct Sales, Strategic Partnerships | Manufacturing, Finance, Automotive sectors | Collaborations with leading auto manufacturers in 2023 |

| Apollo Go (Autonomous Ride-hailing) | Specific Deployment Zones | Expansion within China, Global Partnerships | Operational in 60 cities by mid-2024; aiming for 100 cities by end of 2025 |

| AI/Cloud Infrastructure | Data Centers, High-speed Connectivity | Data center expansion, AI computing power | Plans for significant investment in advanced computing centers |

Preview the Actual Deliverable

Baidu 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished Baidu 4P's Marketing Mix analysis you’ll own. You'll receive the complete document immediately after purchase, ready for immediate use. Gain a comprehensive understanding of Baidu's strategy without any hidden surprises.

Promotion

Baidu leverages its robust digital marketing platforms, including search advertising and in-feed ads, to promote its own vast array of products and services. This internal promotion strategy highlights the effectiveness of its advertising solutions, which are also offered to external businesses seeking to connect with the massive Chinese consumer base. Baidu's approach is heavily reliant on AI-driven precision targeting, aiming to deliver highly relevant advertisements by analyzing user behavior and search intent.

Baidu actively cultivates its AI ecosystem through major developer conferences like Baidu Create. These events highlight advancements in ERNIE models and the Apollo platform, offering developers new toolkits and insights. For instance, Baidu Create 2024 focused on generative AI and large models, attracting thousands of developers and partners.

Baidu's strategic partnerships are crucial for its intelligent driving and AI technologies. Collaborations with global players like Lyft and Uber are key for the international rollout of Apollo Go robotaxis, generating substantial media buzz and reinforcing Baidu's technological authority worldwide.

These alliances not only broaden Baidu's market presence but also solidify the credibility of its advanced AI solutions beyond China's borders. For instance, Baidu's investment in and partnership with Luminar, a lidar technology company, in 2021, aimed to integrate Luminar's sensors into Baidu's autonomous driving platforms, showcasing a commitment to leveraging external expertise.

Public Relations & Thought Leadership in AI

Baidu leverages public relations to showcase its AI prowess, regularly announcing advancements in foundational models and autonomous driving. In 2024, Baidu continued to emphasize its significant AI patent portfolio, a testament to its innovation. This strategic communication aims to solidify its image as a leading AI innovator on the global stage.

The company actively cultivates thought leadership through various channels. In 2024 and early 2025, Baidu published numerous whitepapers detailing its AI research and participated extensively in key industry forums, reinforcing its expertise. Securing high rankings on prestigious innovation indexes further bolsters its reputation.

This robust thought leadership strategy directly contributes to Baidu's brand equity. It serves to attract top-tier AI talent, secure vital investments, and win over enterprise clients seeking cutting-edge AI solutions. Baidu's commitment to sharing its AI advancements positions it as a trusted partner in the rapidly evolving AI landscape.

Content Marketing & Brand Building via Ecosystem

Baidu leverages its extensive content ecosystem, featuring platforms like Baidu Baike (an encyclopedia) and Baijiahao (a content publishing platform), for robust content marketing and brand building. Businesses can establish an authoritative brand presence on Baidu Baike, enhancing credibility with users. Baidu's content innovation strategy actively fosters immersive and participatory brand experiences, moving beyond traditional advertising to cultivate trust and enduring user relationships.

This strategy is crucial in the evolving digital landscape. For instance, in 2023, Baidu's revenue from its core search business, which benefits from its content ecosystem, reached approximately ¥80.7 billion RMB. This highlights how valuable content and brand building contribute to its primary revenue streams, demonstrating the effectiveness of this approach for businesses operating on the platform.

- Baidu Baike: Provides a platform for brands to build authoritative and trustworthy profiles, akin to a digital encyclopedia entry.

- Baijiahao: Empowers content creators and businesses to publish and distribute a wide range of engaging content directly to Baidu's massive user base.

- Content Innovation: Focuses on creating interactive and immersive brand experiences that encourage user participation and deeper engagement.

- Long-Term Relationships: Prioritizes building user trust and loyalty through the consistent delivery of valuable and relevant information, rather than relying solely on direct sales pitches.

Baidu's promotion strategy is multifaceted, encompassing direct advertising on its platforms, developer engagement, strategic partnerships, and thought leadership. The company actively showcases its AI capabilities through events and public relations, aiming to build its brand equity and attract talent and investment.

Baidu's content ecosystem, including Baidu Baike and Baijiahao, serves as a key promotional tool, enabling businesses to build credibility and engage users. This content-driven approach enhances brand building and fosters long-term user relationships, as evidenced by the significant revenue generated from its core search business.

The company's promotional efforts extend to fostering an AI ecosystem through events like Baidu Create, highlighting advancements in generative AI and large models. Strategic partnerships, such as with Luminar for lidar technology, further bolster its image as a leading AI innovator.

| Promotional Tactic | Description | Key Focus Area | Example/Data Point |

|---|---|---|---|

| Digital Advertising | Utilizing search and in-feed ads on Baidu platforms. | Precision targeting via AI analysis of user behavior. | Baidu's core search business generated approximately ¥80.7 billion RMB in 2023. |

| Developer Engagement | Hosting events like Baidu Create. | Showcasing AI advancements (e.g., ERNIE models, Apollo platform). | Baidu Create 2024 focused on generative AI and large models. |

| Strategic Partnerships | Collaborating with industry players. | Enhancing intelligent driving and AI technologies. | Partnerships with Luminar (lidar) and global ride-sharing companies. |

| Public Relations & Thought Leadership | Announcing AI advancements, patent portfolio, publishing whitepapers. | Establishing image as a leading global AI innovator. | Emphasis on significant AI patent portfolio in 2024. |

| Content Ecosystem | Leveraging Baidu Baike and Baijiahao. | Brand building, content marketing, user engagement. | Enabling authoritative brand presence on Baidu Baike. |

Price

Baidu's core revenue driver is its pay-per-click (PPC) advertising model, a performance-based pricing strategy where advertisers pay each time a user clicks on their ad displayed in search results or content feeds. This model is central to Baidu's online marketing services, allowing businesses to directly tie their advertising expenditure to tangible user engagement and potential customer acquisition.

In 2023, Baidu's advertising revenue, largely fueled by its PPC model, accounted for a significant portion of its total revenue. For instance, Baidu's total revenue for Q4 2023 was RMB 32.4 billion, with online marketing services remaining a key contributor. This structure offers advertisers flexibility and control over their budget, ensuring they only pay for actual interactions with their ads.

Baidu AI Cloud services typically employ a subscription or tiered pricing structure. Costs are determined by factors such as usage volume, computational power, data storage requirements, and the specific AI functionalities utilized, such as those available on their Qianfan platform.

This flexible model enables businesses to select plans that align with their evolving needs, ranging from fundamental cloud infrastructure to sophisticated AI model deployment. For instance, Baidu has been actively participating in price competition for its AI models, aiming to secure enterprise clients and expand its market presence in the rapidly growing AI sector.

Baidu strategically licenses its cutting-edge AI technologies, including ERNIE large language models and Apollo autonomous driving, utilizing value-based pricing. This approach aligns costs with substantial R&D expenditures, unique functionalities, and the tangible benefits clients gain, such as improved efficiency and novel revenue opportunities.

In a move to bolster market competitiveness, Baidu recently implemented price reductions for its ERNIE Turbo models, demonstrating a dynamic pricing strategy responsive to market conditions and client accessibility needs.

Service Fees & Transaction-Based Pricing

Baidu's pricing strategy extends beyond core advertising and cloud services to include fees for specialized solutions. For example, its local promotion and lead generation services may implement transaction-based pricing, where fees are linked to the number of successful customer leads or specific promotional packages purchased. This approach aligns costs with tangible outcomes for businesses utilizing these features.

The Apollo Go robotaxi service exemplifies Baidu's application of per-ride transaction-based pricing. Fares are determined by factors such as the city of operation and the distance traveled, mirroring the common pricing models of conventional ride-hailing platforms. This direct correlation between service usage and cost ensures a clear value proposition for users.

- Local Promotion Fees: Baidu's local services may charge based on lead generation success.

- Apollo Go Pricing: Robotaxi rides are priced per trip, varying by city and distance.

- Specialized Solutions: Fees can apply to unique platform functionalities beyond core offerings.

Competitive & Market-Driven Pricing

Baidu's pricing for its AI models and cloud services is deeply intertwined with the competitive currents of China's tech sector. The company frequently revises its pricing to stay sharp against major players like Alibaba Cloud and Tencent Cloud, often implementing price cuts to capture market share.

This dynamic pricing strategy is designed to accelerate the adoption of Baidu's AI-first products, even if it means a temporary impact on profitability. For instance, in the fiercely competitive cloud market, Baidu's pricing adjustments are a key tactic to attract and retain customers, mirroring trends seen across the industry where aggressive pricing is common to gain a foothold.

Baidu's approach reflects a broader market trend where cloud service providers, particularly in AI-intensive areas, engage in price wars to expand their user base. This can be seen in the ongoing competition for AI model deployment and cloud infrastructure, where cost-effectiveness is a significant factor for businesses making adoption decisions.

- Market Responsiveness: Baidu's pricing directly reacts to competitive actions from rivals like Alibaba Cloud and Tencent Cloud.

- Price Adjustments: The company has a history of implementing price reductions to boost market penetration for its AI and cloud offerings.

- Strategic Goal: The primary aim is to maximize the adoption of its AI-first solutions, prioritizing growth over immediate margin gains.

- Industry Trend: This agile pricing mirrors a wider trend in China's tech market, characterized by aggressive competition and price sensitivity.

Baidu's pricing strategy is multifaceted, reflecting its diverse product and service offerings. For its core search advertising, the pay-per-click (PPC) model remains dominant, allowing advertisers to control costs based on user engagement. Baidu's AI Cloud services utilize tiered and subscription-based pricing, influenced by usage, computational power, and specific AI features, with recent price reductions on ERNIE Turbo models to boost adoption.

| Service Category | Pricing Model | Key Determinants | Example/Notes |

|---|---|---|---|

| Search Advertising | Pay-Per-Click (PPC) | Ad clicks, advertiser budget | Core revenue driver |

| AI Cloud Services | Subscription/Tiered | Usage volume, compute power, data storage, AI functionalities | ERNIE Turbo models saw price cuts in 2024 |

| AI Technology Licensing | Value-Based Pricing | R&D costs, unique functionalities, client benefits | ERNIE LLMs, Apollo autonomous driving |

| Specialized Solutions (e.g., Local Promotion) | Transaction-Based | Lead generation success, promotional packages | Fees linked to tangible outcomes |

| Apollo Go Robotaxi | Per-Ride Transactional | City of operation, distance traveled | Similar to conventional ride-hailing |

4P's Marketing Mix Analysis Data Sources

Our Baidu 4P's Marketing Mix Analysis is built upon a comprehensive review of Baidu's official financial reports, investor relations materials, and public announcements. We also leverage data from industry-specific reports and reputable technology news outlets to capture their product strategy, pricing models, distribution channels, and promotional activities.