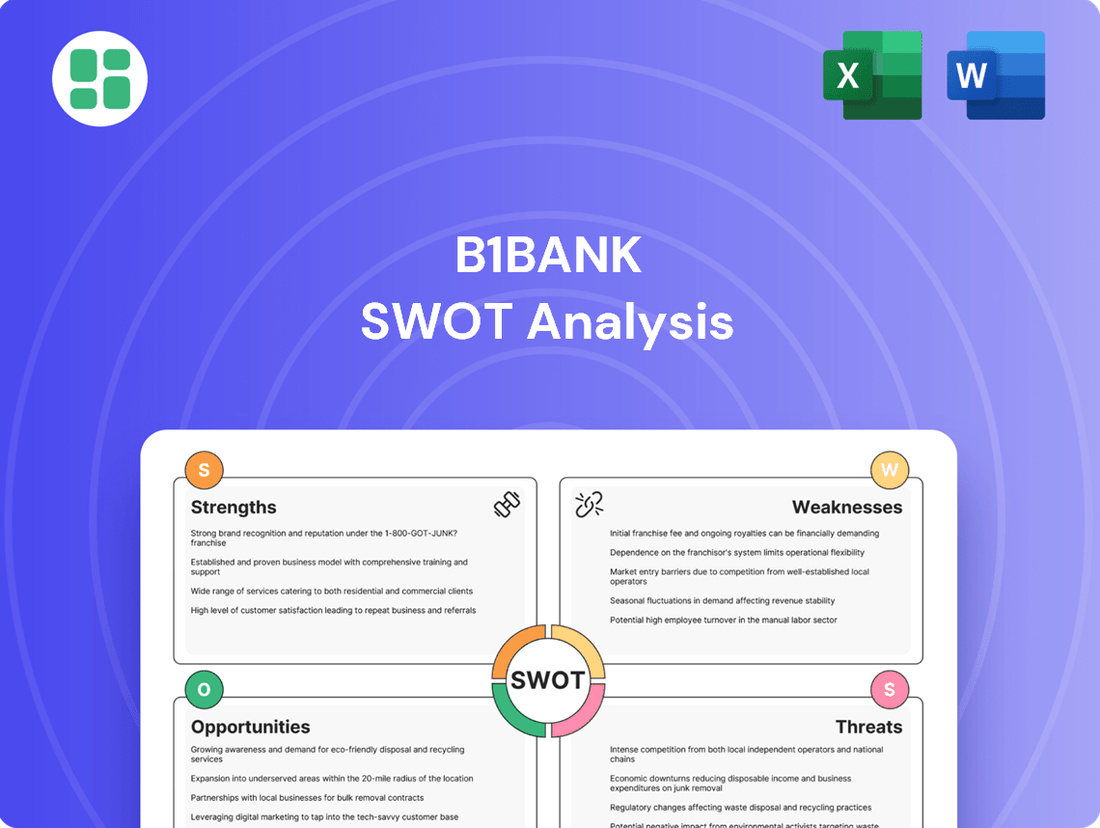

b1BANK SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

b1BANK Bundle

b1BANK's current market position shows promising strengths in its digital offerings and customer loyalty, but also highlights potential vulnerabilities in adapting to rapidly evolving fintech landscapes. Understanding these dynamics is crucial for any investor or strategist looking to navigate the banking sector.

Want the full story behind b1BANK's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

b1BANK boasts a robust regional market presence, particularly within Louisiana and Texas, with significant penetration in major hubs like Dallas/Fort Worth and Houston. This established footprint facilitates deep client relationships and localized market understanding.

The bank's market strength is further amplified by its strategic acquisitions. Following the acquisition of Progressive Bancorp, b1BANK is poised to solidify its leading position in deposit market share among Louisiana-based financial institutions, a testament to its growth strategy.

b1BANK's strength lies in its specialized focus on commercial banking, particularly serving small-to-mid-sized businesses, entrepreneurs, and professionals. This niche allows for a deep understanding of client needs, leading to tailored solutions in commercial lending, diverse deposit accounts, and treasury management. For instance, in Q1 2024, their commercial loan portfolio saw a 7% increase, demonstrating effective penetration within their target market.

b1BANK's robust acquisition strategy is a key strength, evident in its late 2024 acquisition of Oakwood Bancshares, which added $2.1 billion in assets. This strategic move significantly expanded b1BANK's presence in Texas.

The pending acquisition of Progressive Bancorp, expected in 2025, is projected to further bolster b1BANK's financial standing, adding approximately $1.5 billion in assets and enhancing its loan portfolio. These acquisitions are instrumental in increasing market share and achieving greater economies of scale.

Commitment to Technology and Innovation

b1BANK's commitment to technology and innovation is a significant strength, evidenced by strategic investments designed to modernize its operations and client service. The bank is actively enhancing its data capabilities and operational efficiency through key initiatives.

A prime example is b1BANK's partnership with KlariVis, a leader in enterprise data and analytics. This collaboration is crucial for improving data clarity and unlocking deeper insights, which will ultimately lead to more informed decision-making and tailored client solutions. This focus on data is particularly relevant as the financial industry increasingly relies on advanced analytics to understand customer needs and market trends.

Furthermore, b1BANK is undertaking a core system conversion planned for Q2 2025. This undertaking is a substantial technological upgrade, aimed at streamlining internal processes, boosting operational efficiency, and ensuring the delivery of high-quality, more responsive services to its clientele. Such core system modernizations are vital for maintaining a competitive edge in the rapidly evolving banking landscape.

- KlariVis Partnership: Enhances enterprise data and analytics capabilities for improved client insights.

- Core System Conversion: Scheduled for Q2 2025 to boost operational efficiency and service quality.

- Data Clarity Focus: Investments aim to provide clearer, more actionable data for strategic advantage.

- Client Service Enhancement: Technological upgrades are geared towards delivering higher quality, more efficient client experiences.

Recognized for Excellence and Employee Satisfaction

b1BANK's commitment to excellence is consistently validated through prestigious awards. For instance, it was recognized as the #1 Best-In-State Bank in Louisiana by Forbes and Statista in 2023, highlighting its strong regional standing and customer trust. This accolade, alongside being a multiyear recipient of American Banker magazine's 'Best Banks to Work For,' points to a robust brand reputation and a highly positive internal culture.

These recognitions are not mere honors; they translate into tangible benefits. A strong employer brand directly aids in attracting and retaining top talent, crucial for delivering superior customer service and driving innovation. This positive organizational environment also resonates with customers, fostering loyalty and attracting new business, as evidenced by its consistent performance in independent rankings.

The 'Best Banks to Work For' award, in particular, signifies a healthy work environment that fosters employee engagement and satisfaction. This internal strength is a key differentiator in the competitive banking sector, allowing b1BANK to maintain high service standards and adapt effectively to market changes. Such employee-centric policies often correlate with lower staff turnover and higher productivity.

b1BANK's market leadership is anchored by its strong regional presence, particularly in Louisiana and Texas, reinforced by strategic acquisitions like Oakwood Bancshares in late 2024, adding $2.1 billion in assets. The pending acquisition of Progressive Bancorp in 2025, projected to add $1.5 billion in assets, further solidifies its market share and operational scale.

The bank's technological advancements, including a partnership with KlariVis for enhanced data analytics and a core system conversion planned for Q2 2025, are designed to improve client insights and operational efficiency. These investments are crucial for delivering superior, data-driven client solutions in a competitive landscape.

b1BANK's commitment to excellence is underscored by accolades such as Forbes and Statista's #1 Best-In-State Bank in Louisiana for 2023 and multiple 'Best Banks to Work For' awards from American Banker. These recognitions highlight strong brand reputation, customer trust, and a positive internal culture that attracts and retains top talent.

| Acquisition | Announced/Expected | Impact | b1BANK's Asset Growth |

|---|---|---|---|

| Oakwood Bancshares | Late 2024 | Expanded Texas Presence | +$2.1 billion |

| Progressive Bancorp | 2025 (Pending) | Increased Market Share, Loan Portfolio | +$1.5 billion (projected) |

What is included in the product

Delivers a strategic overview of b1BANK’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

b1BANK's SWOT analysis acts as a pain point reliever by offering a structured framework to identify and address critical internal weaknesses and external threats, thereby guiding strategic decisions and mitigating potential risks.

Weaknesses

b1BANK's significant reliance on Louisiana and Texas for its operations presents a notable weakness. This geographic concentration means the bank is particularly vulnerable to economic shifts or regulatory changes that disproportionately affect these two states. For instance, if a major industry in Texas experiences a significant downturn, b1BANK's loan portfolio and overall financial health could be impacted more severely than a bank with a broader national footprint.

b1BANK's Q4 2024 results showed a notable increase in its provision for credit losses. This rise was attributed, in part, to the integration of recent acquisitions and the overall expansion of its loan portfolio.

This development signals a potential concern regarding the quality of the bank's assets or the risks inherent in its growing loan book. Should economic conditions worsen or lending standards become less stringent, these provisions could directly impact b1BANK's future profitability.

For the fiscal year ending December 31, 2024, b1BANK saw its net interest margin (NIM) decline, alongside a drop in net interest spread. This indicates that the bank's core lending profitability is facing headwinds, potentially due to shifts in interest rate environments or increased competition for deposits.

Furthermore, b1BANK's return on average assets and return on average equity also decreased in 2024 compared to the previous year. These metrics suggest a broader challenge in generating returns for shareholders and efficiently utilizing its asset base, possibly linked to the same factors impacting its net interest income.

Integration Risks from Acquisitions

b1BANK faces integration risks following its recent acquisitions of Oakwood Bancshares and Progressive Bancorp. While these moves are strategic for expansion, merging operations, systems, and cultures presents significant challenges. There's a real possibility of not achieving the projected cost savings or revenue enhancements, potentially impacting profitability in the near term. For instance, the successful integration of Progressive Bancorp, announced in late 2023, will be a key indicator of b1BANK's ability to manage such complex transitions.

The bank must carefully manage the operational complexities arising from these integrations. This includes harmonizing IT systems, aligning customer service platforms, and ensuring regulatory compliance across all acquired entities. Failure to do so could lead to disruptions and customer dissatisfaction. The success of integrating Oakwood Bancshares, completed in early 2024, will be crucial in demonstrating b1BANK's operational integration capabilities.

- Operational Complexity: Merging disparate banking systems and processes requires substantial investment and careful planning.

- Cultural Clashes: Integrating different corporate cultures can lead to employee resistance and reduced productivity if not managed proactively.

- Synergy Realization Risk: The anticipated benefits from acquisitions, such as cost synergies or cross-selling opportunities, may not fully materialize, impacting financial projections.

Competition from Larger Banks and Non-Traditional Lenders

b1BANK faces intense competition from established national banks that possess significantly larger capital reserves and broader market reach. For instance, in early 2024, the top five U.S. banks held over $10 trillion in assets, dwarfing smaller institutions.

The rise of fintech companies and alternative lenders presents another significant challenge, particularly in commercial lending. These entities often offer more agile and specialized financing solutions, attracting businesses that might otherwise turn to traditional banks. By mid-2024, the alternative lending market was projected to exceed $3 trillion globally, indicating a substantial shift in funding sources.

This competitive landscape means b1BANK must continually innovate and differentiate its offerings to retain and attract customers. The pressure to match the pricing, speed, and digital capabilities of both large banks and nimble fintechs is a constant operational hurdle.

- Dominant Players: Larger banks command substantial market share and resources, making it difficult for b1BANK to compete on scale.

- Fintech Disruption: Non-traditional lenders and fintechs are capturing market share with innovative and often faster lending processes.

- Shifting Business Preferences: Businesses are increasingly exploring alternative funding avenues, impacting b1BANK's commercial loan pipeline.

- Resource Disparity: b1BANK operates with fewer resources compared to national competitors, requiring strategic allocation to remain competitive.

b1BANK's concentrated geographic footprint in Louisiana and Texas exposes it to heightened regional economic risks. The bank's increased provision for credit losses in Q4 2024, linked to acquisitions and loan growth, signals potential asset quality concerns. Furthermore, a decline in its net interest margin and returns on assets/equity for fiscal year 2024 indicates challenges in core profitability and shareholder value generation.

| Metric | 2024 Value | Trend vs. Prior Year |

|---|---|---|

| Provision for Credit Losses | Increased | Upward |

| Net Interest Margin (NIM) | Declined | Downward |

| Return on Average Assets (ROAA) | Decreased | Downward |

| Return on Average Equity (ROAE) | Decreased | Downward |

Full Version Awaits

b1BANK SWOT Analysis

This is the actual b1BANK SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the insights and structure you see here are representative of the complete, in-depth report. Purchase unlocks the entire professional analysis.

Opportunities

b1BANK's strategic expansion within its core markets is a key opportunity, particularly following the acquisition of Progressive Bancorp. This move significantly bolstered its presence and market share in North Louisiana, demonstrating a focused approach to strengthening its footprint in established states.

Further growth in Louisiana and Texas, whether through additional acquisitions or organic initiatives, presents a prime opportunity. Leveraging existing market expertise and strong customer relationships in these regions can drive increased revenue and solidify b1BANK's competitive position. For instance, in the first quarter of 2024, b1BANK reported a 15% year-over-year increase in net interest income, partly attributed to strategic loan growth in its core markets.

b1BANK's ongoing commitment to digital transformation, including its partnership with KlariVis for advanced data analytics and planned core system upgrades, presents a significant opportunity. These technological investments are poised to streamline operations and foster a more customer-centric approach to banking.

By enhancing digital platforms, b1BANK can attract a broader client base and strengthen relationships with existing customers. This is achieved through superior self-service options and personalized, data-driven insights that cater to evolving customer needs.

Regional banks are poised for a strong 2025, with potential regulatory easing and interest rate trends creating a more favorable operating landscape. This could translate to improved net interest margins for institutions like b1BANK, allowing for more competitive product offerings.

This supportive environment presents a clear opportunity for b1BANK to accelerate its growth strategies, potentially outmaneuvering larger competitors who may face more complex regulatory hurdles. For instance, if the Fed maintains a stable or slightly lower interest rate environment in 2025, b1BANK could see its cost of funds decrease, boosting profitability.

Expanding Treasury Management and Wealth Solutions

b1BANK can capitalize on its existing treasury management capabilities by expanding and cross-selling these offerings, alongside wealth management solutions provided by its affiliate. This is particularly relevant as businesses face growing financial complexity, increasing their need for advanced cash management and expert advisory services.

The demand for integrated financial solutions is on the rise. For instance, in 2024, the global treasury management market was valued at approximately $12.5 billion and is projected to grow significantly. b1BANK's opportunity lies in leveraging this trend by offering a more holistic suite of services.

- Enhance Treasury Offerings: Develop new digital tools for real-time cash visibility and forecasting to meet evolving business needs.

- Cross-Sell Wealth Management: Integrate wealth management services with treasury solutions, targeting high-net-worth business owners and executives.

- Advisory Services Expansion: Bolster advisory services around capital optimization, risk management, and international treasury operations.

- Digital Integration: Streamline the client experience by ensuring seamless integration between treasury and wealth management platforms.

Growth in Commercial and Industrial Lending

b1BANK is well-positioned to leverage the anticipated uptick in U.S. commercial and industrial (C&I) loan demand throughout 2025. The bank's business-centric approach provides a solid foundation for further expansion in this key lending segment.

Despite earlier credit loss provision adjustments, b1BANK demonstrated robust growth in its C&I loan portfolio during the first quarter of 2024. This momentum is expected to continue as economic conditions improve and businesses seek financing.

- C&I Loan Growth: b1BANK experienced significant expansion in its C&I loan book in Q1 2024.

- Market Outlook: Projections indicate increased overall loan demand in the U.S. for 2025.

- Strategic Advantage: b1BANK's business-focused model is a key enabler for capitalizing on this growth.

b1BANK can leverage its existing treasury management capabilities by expanding and cross-selling these offerings, alongside wealth management solutions. This is particularly relevant as businesses face growing financial complexity, increasing their need for advanced cash management and expert advisory services. The demand for integrated financial solutions is on the rise; for instance, the global treasury management market was valued at approximately $12.5 billion in 2024 and is projected to grow significantly.

| Opportunity Area | Key Action | Projected Impact |

|---|---|---|

| Treasury Management | Develop new digital tools for real-time cash visibility and forecasting. | Meet evolving business needs and enhance client retention. |

| Wealth Management Integration | Cross-sell wealth management services with treasury solutions. | Target high-net-worth business owners and executives, increasing wallet share. |

| Advisory Services | Bolster advisory services around capital optimization and risk management. | Address growing financial complexity for businesses, driving fee income. |

Threats

b1BANK's reliance on Louisiana and Texas makes it susceptible to regional economic downturns. For instance, the Texas economy, heavily influenced by the energy sector, experienced a slowdown in early 2024 due to fluctuating oil prices, impacting business revenue and loan repayment capacity.

A significant threat arises from potential industry-specific contractions, particularly within Texas's energy industry, which accounts for a substantial portion of the state's economic output. Should this sector face prolonged challenges, b1BANK's loan portfolio could see increased defaults, especially from small and medium-sized businesses heavily involved in the energy supply chain.

Furthermore, the bank must consider the impact of natural disasters, a recurring concern in the Gulf Coast region. Hurricanes and severe weather events in 2024 have previously disrupted economic activity in Louisiana, leading to business closures and reduced demand for banking services, directly affecting b1BANK's operational stability and profitability.

The banking landscape is a fierce battleground, with established national players, fellow regional banks, and nimble fintech innovators all aggressively pursuing customers. This heightened competition directly impacts b1BANK by potentially forcing lower loan interest rates and less attractive deposit yields, while also squeezing revenue from fee-based services.

For instance, in the first quarter of 2024, the average net interest margin for U.S. commercial banks saw a slight contraction, reflecting this pricing pressure. Fintech adoption continues to surge, with projections indicating that by the end of 2025, over 70% of consumers will have used at least one fintech service for banking needs, further intensifying the challenge for traditional institutions like b1BANK to retain and attract clients.

Interest rate volatility poses a significant threat to b1BANK's profitability. For instance, the bank experienced a notable compression in its net interest margin during FY 2024, directly linked to fluctuating rate environments.

A prolonged period of adverse rate movements, where the cost of funding outpaces the returns generated from loans, could further squeeze b1BANK's earnings and negatively impact its overall financial health.

Cybersecurity Risks and Data Breaches

As a financial institution, b1BANK is a prime target for cyberattacks and data breaches. These threats could expose sensitive customer data, leading to significant disruptions in service. For instance, the global average cost of a data breach reached $4.45 million in 2024, a 15% increase over three years, highlighting the immense financial and reputational damage such incidents can inflict.

A major security breach at b1BANK would likely result in substantial financial losses, including the costs of remediation, legal fees, and potential regulatory fines. Furthermore, the erosion of customer trust and damage to the bank's brand reputation could have long-lasting, detrimental effects on its business.

- Constant Threat Landscape: Financial institutions like b1BANK face persistent cyber threats.

- Data Breach Impact: Compromised customer data can lead to severe financial and reputational damage.

- Rising Costs: The global average cost of a data breach is $4.45 million (2024), a significant financial risk.

- Reputational Damage: A breach can severely erode customer trust and harm b1BANK's brand.

Regulatory Changes and Compliance Burden

The banking sector faces constant evolution in its regulatory landscape, posing a significant threat. New or tightened rules around capital adequacy, lending standards, and consumer data protection could directly impact b1BANK's operations. For instance, the Basel III Endgame proposals, expected to be finalized in 2024, could require larger banks to hold more capital, potentially influencing lending capacity and profitability across the industry, including regional players like b1BANK.

Increased compliance costs are a direct consequence of these regulatory shifts. Adapting systems and processes to meet new requirements demands substantial investment, diverting resources from growth initiatives. While some regional banks might benefit from tailored regulatory approaches, the overarching trend points towards a more complex and costly compliance environment throughout 2024 and into 2025.

Specific areas of concern for b1BANK could include:

- Capital Requirements: Potential increases could affect lending capacity and return on equity.

- Consumer Protection: Stricter rules on disclosures, fees, and data privacy add operational complexity.

- Cybersecurity Regulations: Evolving mandates for data security and incident reporting require continuous investment.

- Environmental, Social, and Governance (ESG) Reporting: Growing expectations for ESG disclosures could introduce new compliance burdens.

Intensified competition from national banks and fintech firms presents a significant threat, potentially driving down interest margins and fee income. For example, by late 2024, many regional banks were reporting compressed net interest margins due to this competitive pressure. The increasing adoption of fintech services, with projections suggesting over 70% of consumers will use them for banking by the end of 2025, further challenges traditional institutions like b1BANK to retain and attract customers.

b1BANK faces considerable threats from economic downturns, particularly those impacting its core markets in Louisiana and Texas. The energy sector's volatility in Texas, which saw a slowdown in early 2024, directly affects loan repayment and business revenue. Additionally, the recurring risk of natural disasters along the Gulf Coast, as evidenced by disruptions in 2024, can negatively impact economic activity and demand for banking services.

The bank is also vulnerable to rising cybersecurity threats, with the global average cost of a data breach reaching $4.45 million in 2024. Such breaches can lead to substantial financial losses, regulatory fines, and severe damage to customer trust and brand reputation. Evolving regulatory landscapes, including potential changes from Basel III Endgame proposals expected in 2024, also pose a threat by increasing compliance costs and potentially affecting lending capacity.

SWOT Analysis Data Sources

This SWOT analysis for b1BANK is built upon a robust foundation of data, drawing from the bank's official financial statements, comprehensive market intelligence reports, and insights from leading industry analysts.