b1BANK PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

b1BANK Bundle

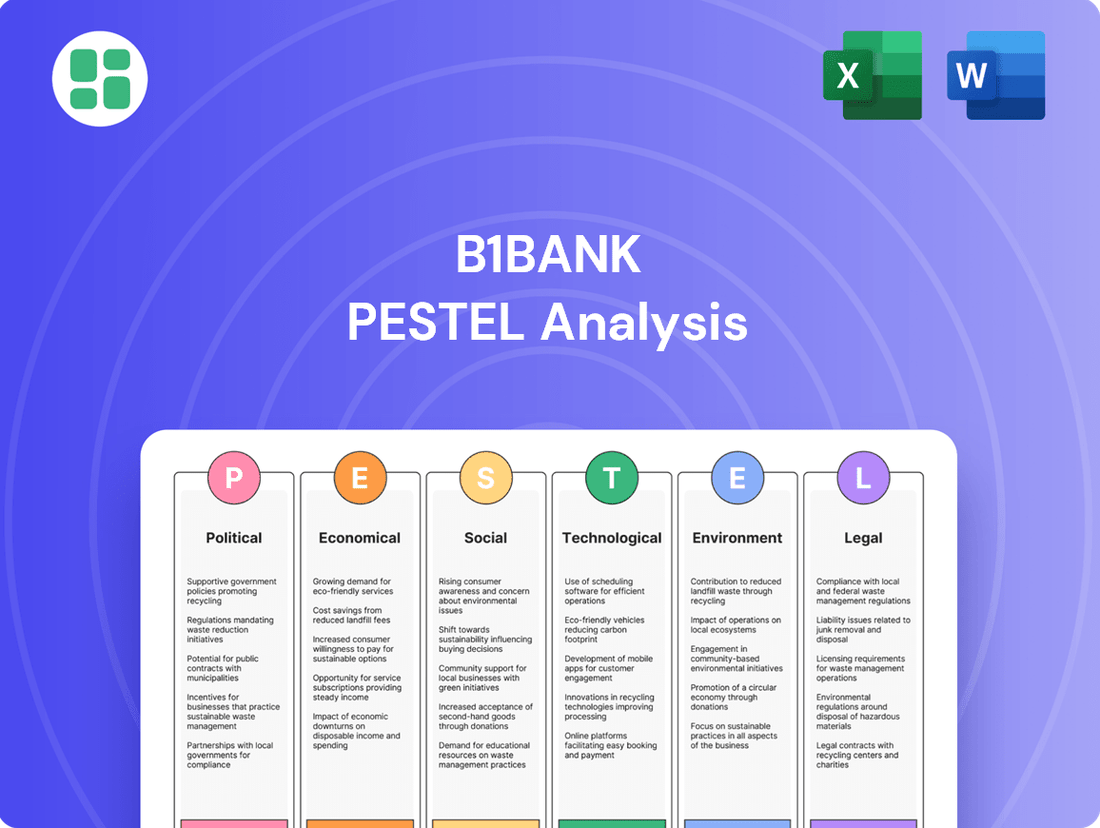

Uncover the intricate web of external forces shaping b1BANK's destiny with our comprehensive PESTLE analysis. From evolving political landscapes to technological disruptions, understand the critical factors driving change. Equip yourself with actionable intelligence to navigate these complexities and secure b1BANK's future success. Download the full analysis now and gain a decisive competitive advantage.

Political factors

The banking industry, including b1BANK, navigates a landscape of continuous regulatory shifts. For instance, the Federal Reserve's ongoing adjustments to capital requirements, like the proposed changes stemming from the Basel III endgame, directly impact how banks manage risk and allocate capital. These federal directives, alongside state-specific regulations in Louisiana and Texas, such as those concerning fair lending or data privacy, necessitate robust compliance frameworks.

Government fiscal policies, like changes in spending and taxation, directly impact the economic environment, influencing how much individuals and businesses borrow and save. For b1BANK, this means shifts in loan demand and the growth of its deposit base. For instance, increased government spending on infrastructure projects in 2024 could stimulate business borrowing.

Monetary policies, particularly interest rate adjustments by the Federal Reserve, are critical for banks. A higher federal funds rate, which has seen significant increases in 2023 and continued to be a focus in early 2024, directly affects b1BANK's net interest margin and the cost of acquiring funds. Banks must continuously adjust their strategies to navigate these interest rate fluctuations.

The political climate in Louisiana and Texas, crucial operating states for b1BANK, directly influences business confidence and investment decisions. A stable political environment, characterized by predictable policies and a business-friendly approach, fosters economic growth, which in turn drives demand for banking services. For instance, Texas consistently ranks high in business climate surveys, attracting significant investment, while Louisiana's economic development incentives aim to bolster its commercial sector.

Broader U.S. political trends also play a significant role. Shifts in federal regulations, fiscal policy, and geopolitical stances can introduce both opportunities and risks for financial institutions like b1BANK. For example, changes in interest rate policies by the Federal Reserve, influenced by political considerations, directly impact lending margins and investment strategies. In 2024, ongoing discussions around fiscal stimulus and potential regulatory adjustments continue to shape the economic outlook for the banking sector.

Trade Policies and Tariffs

While b1BANK is a regional institution, shifts in U.S. trade policies and tariffs can indirectly influence its clientele. For instance, the U.S. imposed tariffs on billions of dollars worth of goods from China in recent years, impacting supply chains for many American businesses, including those b1BANK might lend to. These tariffs can increase operating costs for companies reliant on imported components, potentially affecting their financial stability and loan repayment capacity.

Higher tariffs can lead to increased input costs for businesses, squeezing profit margins. This squeeze can reduce a company's ability to service debt, posing a risk to lenders like b1BANK. For example, a manufacturing client of b1BANK that imports raw materials subject to new tariffs might see its cost of goods sold rise significantly, impacting its cash flow and creditworthiness.

- Tariff Impact on Manufacturing: U.S. manufacturing sector faced an average tariff rate of 3.5% in 2023, a figure that can fluctuate based on trade disputes and policy changes, directly affecting input costs for businesses.

- Supply Chain Vulnerability: Businesses with complex international supply chains are particularly susceptible to trade policy shifts, potentially leading to disruptions and increased operational expenses.

- Regional Economic Sensitivity: Industries within b1BANK's operating region that have strong ties to international trade or rely on imported goods will be more directly exposed to the effects of U.S. trade policies.

Government Support and Lending Programs

Government support, particularly through lending programs, offers a substantial avenue for b1BANK's expansion. For instance, the U.S. Small Business Administration (SBA) loan programs, like the 7(a) and 504 loans, provide guarantees that reduce risk for lenders. In 2023, the SBA guaranteed over $28 billion in loans, demonstrating the significant volume of business activity facilitated by these programs.

b1BANK can strategically position itself to be a primary lender within these government-backed frameworks. This participation not only diversifies its loan portfolio but also opens doors to a broader client base, including small and medium-sized enterprises that might otherwise face funding challenges. By aligning with initiatives focused on economic development, b1BANK can foster community growth while enhancing its own market presence.

- SBA Loan Guarantees: The SBA's guarantee system lowers the risk profile for banks participating in its lending programs, encouraging them to lend to small businesses.

- Portfolio Expansion: Access to government-backed programs allows b1BANK to increase its loan origination volume and reach underserved market segments.

- Community Impact: Supporting small businesses through these channels directly contributes to local economic development and job creation.

- Strategic Alignment: Leveraging government initiatives aligns b1BANK's growth strategy with national economic priorities, potentially leading to further partnership opportunities.

Political stability within b1BANK's operating regions, Louisiana and Texas, significantly influences business confidence and investment. Texas's consistently favorable business climate, attracting substantial investment, contrasts with Louisiana's targeted economic development incentives aimed at commercial sector growth. Broader U.S. political trends, including federal regulatory adjustments and fiscal policies, directly shape the economic outlook for the banking sector, impacting lending and investment strategies.

Government support programs, such as the U.S. Small Business Administration (SBA) loan guarantees, offer b1BANK opportunities for portfolio expansion and client base diversification. In 2023 alone, the SBA facilitated over $28 billion in guaranteed loans, highlighting the significant role these programs play in fostering business activity and economic development.

Trade policies and tariffs, while indirect, can impact b1BANK's clientele by affecting operating costs and supply chains. For instance, U.S. tariffs can increase input costs for businesses reliant on imports, potentially impacting their financial health and loan repayment capacity, a risk b1BANK must monitor.

| Political Factor | Impact on b1BANK | 2024/2025 Data/Trend |

|---|---|---|

| Regulatory Environment | Compliance costs, capital requirements, risk management | Ongoing Basel III endgame proposals continue to shape capital adequacy. |

| Fiscal Policy | Loan demand, deposit growth, economic stimulus | Potential for increased infrastructure spending to boost business borrowing. |

| Monetary Policy | Net interest margins, cost of funds | Federal Reserve's stance on interest rates remains a key determinant of bank profitability. |

| Trade Policy | Client financial stability, supply chain impacts | Tariff adjustments can affect industries within b1BANK's service areas. |

| Government Support Programs | Loan origination, portfolio diversification | SBA loan programs remain a critical channel for supporting small businesses. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting b1BANK across Political, Economic, Social, Technological, Environmental, and Legal spheres.

It offers actionable insights and data-driven perspectives to identify strategic opportunities and mitigate potential threats for b1BANK's growth and stability.

The b1BANK PESTLE Analysis offers a clear, summarized version of complex external factors, acting as a pain point reliever by simplifying strategic planning and decision-making for all stakeholders.

Economic factors

Interest rate fluctuations, particularly those influenced by the Federal Reserve's monetary policy, significantly affect b1BANK's profitability. A key metric, the net interest margin (NIM), is directly tied to these changes. For instance, if the Fed continues its projected rate cuts into 2025, banks like b1BANK might experience a squeeze on their net interest income, necessitating careful management of deposit costs and loan pricing strategies.

Lower interest rates are generally anticipated to stimulate loan demand, especially in the crucial mortgage market. As borrowing becomes more affordable, more individuals and businesses are likely to seek financing, potentially boosting b1BANK's loan origination volumes. This shift could present an opportunity for the bank to expand its lending portfolio, provided it can effectively manage associated risks and maintain competitive pricing.

b1BANK's success is intrinsically linked to the economic vitality of Louisiana and Texas. For 2025, both states are projected to experience robust growth, with Texas anticipated to lead in job creation, building on its strong performance in 2024. This economic expansion directly impacts the financial capacity of b1BANK's core clientele: small and medium-sized businesses, entrepreneurs, and professionals.

The unemployment rate in both Louisiana and Texas is expected to remain historically low throughout 2025, a positive indicator for consumer spending and business investment. Texas's Gross State Product (GSP) growth is projected to outpace the national average, driven by sectors like technology and energy, which benefits b1BANK's diverse client base. Louisiana's economic trajectory, while perhaps more moderate, also shows consistent improvement, particularly in its burgeoning manufacturing and port-related industries.

Inflation significantly erodes consumer purchasing power, a critical factor for banks like b1BANK. For instance, the U.S. Consumer Price Index (CPI) saw a 3.3% annual increase as of June 2024, impacting how much discretionary income households have available for loans and other financial services. This can lead to a slowdown in consumer loan demand and potentially increase the risk of delinquencies as individuals struggle to manage rising costs.

The spending habits of consumers are a direct reflection of economic health and directly influence b1BANK's commercial clients. In 2024, retail sales in the U.S. have shown moderate growth, but persistent inflation could curb this momentum, affecting sectors from automotive to housing, which are key areas for business lending.

Credit Market Conditions and Loan Demand

The health of credit markets significantly impacts institutions like b1BANK. In 2025, we're seeing a projected uptick in loan demand, especially for mortgages, with some analysts forecasting a 5% increase year-over-year. However, growth in areas like credit card and auto loans is expected to be more subdued, perhaps in the 2-3% range, reflecting cautious consumer spending.

For b1BANK, a commercial lender, understanding these dynamics is key to managing risk and capitalizing on opportunities. Monitoring the credit quality of existing borrowers and gauging the evolving demand across both commercial and consumer loan segments will be crucial for strategic planning throughout 2025.

- Mortgage loan demand projected to rise by approximately 5% in 2025.

- Credit card and auto loan demand expected to see more modest growth, around 2-3% in 2025.

- Commercial lenders must assess credit quality and demand across diverse portfolios.

Competition from Non-Traditional Lenders

The banking sector is experiencing a significant shift with non-traditional lenders and fintech firms aggressively entering the commercial lending arena. This rise in alternative financing options is directly impacting traditional banks like b1BANK. For instance, by the end of 2024, fintech lenders were projected to capture an increasing share of the small business lending market, offering faster approvals and more flexible terms than many traditional institutions. This growing competition means b1BANK must continually adapt its strategies to retain its market position.

Businesses are actively exploring these alternative funding avenues, often citing dissatisfaction with the rigid credit policies and lengthy approval processes of established banks. This sentiment is a key driver for the growth of non-traditional lenders. As of early 2025, surveys indicate that over 30% of small and medium-sized enterprises (SMEs) are considering or actively using fintech platforms for their financing needs, a notable increase from previous years. b1BANK needs to address these client pain points directly.

To remain competitive, b1BANK must focus on enhancing its product offerings, optimizing pricing structures, and improving its responsiveness to client inquiries and needs. Key areas for improvement include streamlining loan application processes and offering more tailored financial solutions.

- Increased competition from fintech and alternative lenders is reshaping the commercial lending landscape.

- Businesses are seeking funding alternatives due to perceived shortcomings in traditional bank credit policies.

- By late 2024, fintech lenders were projected to increase their market share in small business lending.

- As of early 2025, over 30% of SMEs were considering or using fintech for financing.

Interest rate shifts, driven by Federal Reserve policy, directly impact b1BANK's net interest margin. If the Fed implements further rate cuts in 2025, b1BANK must strategically manage deposit costs and loan pricing to maintain profitability. Lower rates are expected to boost loan demand, particularly in mortgages, potentially increasing b1BANK's origination volumes.

| Economic Factor | 2024 Trend | 2025 Projection | Impact on b1BANK |

|---|---|---|---|

| Interest Rates | Moderate fluctuations, Fed signaling potential cuts | Projected cuts, potentially lowering net interest margins | Requires strategic management of NIM and loan pricing |

| Loan Demand | Steady, with mortgage growth | Mortgage demand up ~5%, other loans ~2-3% | Opportunity for loan portfolio expansion, risk management crucial |

| Regional Growth (TX/LA) | Robust job creation in Texas, moderate in Louisiana | Continued strong growth in Texas, steady improvement in Louisiana | Benefits b1BANK's core client base, potential for increased business activity |

| Unemployment Rate | Historically low | Expected to remain low | Supports consumer spending and business investment |

| Inflation | 3.3% annual increase (June 2024 CPI) | Moderating but still a concern | Erodes consumer purchasing power, may slow loan demand and increase delinquency risk |

What You See Is What You Get

b1BANK PESTLE Analysis

The preview you see here is the exact b1BANK PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting b1BANK, providing actionable insights for strategic planning.

What you’re previewing here is the actual file, offering a detailed breakdown of b1BANK's operational landscape, ensuring you get precisely the information you need.

Sociological factors

Louisiana and Texas are experiencing significant population growth, with Texas alone projected to add millions of residents by 2030. This influx, coupled with changing age demographics, directly fuels demand for a wider array of banking services, from mortgages for new homeowners to specialized financial products for an aging population. For instance, Texas's population grew by 1.5% in 2023, adding over 200,000 new residents, indicating a strong market for financial institutions.

Customer expectations are rapidly shifting, with younger demographics, like Gen Z and Millennials, demanding intuitive, mobile-centric digital banking. These groups, representing a significant portion of the future customer base, prioritize convenience and personalization, often expecting instant access and tailored financial advice through apps and online platforms.

For instance, a 2024 report indicated that over 70% of consumers under 35 prefer digital channels for most banking transactions, a figure expected to climb. B1BANK must invest in upgrading its digital infrastructure to meet this demand, ensuring its services are not only accessible but also offer a seamless and engaging user experience to stay competitive.

Public trust in financial institutions is a critical sociological factor. Recent events, such as the 2023 regional bank failures in the US, where Silicon Valley Bank and Signature Bank collapsed, have understandably shaken consumer confidence. Surveys from 2024 indicate that while trust is recovering, many individuals remain cautious about the security of their deposits and the overall stability of the financial system.

For b1BANK, cultivating and safeguarding its reputation for reliability and security is non-negotiable. A strong track record, exemplified by robust cybersecurity measures and transparent communication, is essential for fostering long-term client relationships. For instance, a 2024 study by Edelman found that 62% of consumers consider a company's ethical behavior when making purchasing decisions, directly impacting their choice of financial services.

Workforce Trends and Talent Acquisition

The banking sector faces a critical shortage of skilled talent, especially in technology, data analytics, and risk management. This scarcity directly impacts b1BANK's ability to innovate and compete. For instance, a 2024 report indicated a 15% year-over-year increase in demand for cybersecurity professionals within financial services, a trend expected to continue.

b1BANK must proactively address evolving workforce expectations. The rise of remote and hybrid work models is no longer a novelty but a core requirement for attracting top talent. A recent survey found that 70% of banking professionals prioritize flexible work options when considering new roles, making it a key differentiator for employers.

- Talent Gap: Significant demand for specialized skills in FinTech, AI, and cybersecurity within the banking industry.

- Digital Skills Imperative: Banks need employees proficient in data analysis, cloud computing, and digital customer engagement.

- Flexibility Demand: A strong preference among employees for hybrid and remote work arrangements, impacting recruitment and retention strategies.

- Employee Experience: Focus shifting towards creating a positive and engaging work environment to counter high turnover rates.

Financial Literacy and Advisory Needs

The financial literacy of small business owners and professionals directly impacts b1BANK's service offerings. For instance, a recent survey in late 2024 indicated that only 45% of small business owners felt confident in managing their business finances, highlighting a significant demand for accessible financial guidance. This gap presents an opportunity for b1BANK to tailor its services, moving beyond basic banking to include more sophisticated advisory solutions.

Meeting this demand for advice can strengthen client loyalty and unlock new revenue streams. By offering workshops or personalized consultations, b1BANK can position itself as a trusted partner. This is particularly relevant as the complexity of financial regulations and investment options continues to grow, making expert advice invaluable. Consider that in 2024, small businesses utilizing financial advisors reported an average revenue growth of 12%, compared to 7% for those who did not.

- Low Financial Literacy: Many small business owners struggle with financial management, creating a need for educational resources and guidance.

- Demand for Advice: There's a clear market for financial advisory services among professionals seeking to optimize their business finances.

- Service Differentiation: b1BANK can differentiate itself by offering comprehensive advisory services alongside traditional banking products.

- Revenue Growth: Providing robust financial advice can lead to deeper client relationships and new income opportunities for the bank.

Sociological factors significantly shape the banking landscape by influencing customer behavior and expectations. Shifting demographics, particularly the rise of digital-native generations, demand intuitive online and mobile banking experiences. For instance, over 70% of consumers under 35 prefer digital channels for most banking transactions as of 2024, a trend b1BANK must cater to by enhancing its digital infrastructure.

Public trust, eroded by events like the 2023 regional bank failures, remains a paramount concern. A 2024 Edelman study found that 62% of consumers consider ethical behavior when choosing financial services, underscoring the need for b1BANK to prioritize security and transparency to build lasting client relationships.

The financial literacy of small business owners presents both a challenge and an opportunity. With only 45% of small business owners feeling confident in managing their finances in late 2024, b1BANK can differentiate itself by offering tailored advisory services, fostering deeper client loyalty and new revenue streams, as businesses utilizing advisors saw 12% average revenue growth in 2024.

Technological factors

Digital transformation remains a cornerstone of banking strategy, with a significant shift towards online operations and mobile-first customer experiences. Banks are investing heavily in digital platforms to cater to evolving customer expectations for personalized, on-demand services.

B1BANK needs to prioritize investments in advanced digital platforms and intuitive mobile applications. This includes streamlining critical processes such as account opening and loan applications, which are increasingly expected to be handled seamlessly online and via mobile channels to meet customer demands for convenience and speed. For instance, by the end of 2024, it's projected that over 80% of retail banking transactions will be conducted digitally, highlighting the urgency for B1BANK to enhance its digital offerings.

The financial services sector, including institutions like b1BANK, remains a significant target for cyber threats. Phishing, ransomware, and distributed denial-of-service (DDoS) attacks are becoming more frequent and complex, posing a constant challenge. In 2024, the average cost of a data breach in the financial sector reached an estimated $5.9 million, highlighting the financial implications of inadequate security.

To counter these escalating risks, b1BANK must maintain substantial and ongoing investments in advanced cybersecurity infrastructure and stringent data protection measures. This commitment is crucial not only for safeguarding sensitive customer data and ensuring operational continuity but also for preserving the essential trust placed in the bank by its clients and stakeholders.

Artificial intelligence and automation are fundamentally reshaping how banks operate. For instance, AI-powered chatbots handled an estimated 75% of customer interactions in the banking sector by late 2024, a significant jump from previous years, showcasing their efficiency in customer service. These technologies are also crucial for advanced fraud detection, with AI algorithms identifying suspicious transactions with over 95% accuracy in many institutions.

B1BANK can harness AI for predictive analytics, anticipating market shifts and customer needs. Imagine personalized financial advice delivered through AI, increasing customer engagement. Internally, automation can streamline back-office processes, reducing operational costs by an estimated 15-20% in 2024-2025, thereby boosting overall efficiency and allowing staff to focus on higher-value tasks.

Fintech Competition and Collaboration

The financial technology, or fintech, landscape is rapidly evolving, presenting both challenges and opportunities for established institutions like b1BANK. Fintech firms are increasingly offering specialized services that directly compete with traditional banking products, often with a more agile and customer-centric approach. For instance, the global fintech market size was valued at approximately $2.4 trillion in 2024 and is projected to grow significantly, indicating strong adoption of these new financial services.

b1BANK must navigate this competitive environment, which includes digital-only banks and payment providers that have captured market share by focusing on user experience and lower fees. However, this disruption also creates avenues for strategic partnerships. Collaboration with fintechs can allow b1BANK to integrate cutting-edge technologies, such as embedded finance solutions that seamlessly weave financial services into non-financial platforms, or Banking-as-a-Service (BaaS) models. BaaS, in particular, enables b1BANK to offer its infrastructure and regulatory compliance to fintechs, creating new revenue streams and expanding its reach without directly building every new service from scratch.

- Fintech Market Growth: The global fintech market is expected to reach over $3.5 trillion by 2027, highlighting the increasing consumer and business adoption of digital financial solutions.

- Embedded Finance Expansion: By 2025, it's estimated that embedded finance transactions could reach $7 trillion globally, demonstrating a massive opportunity for banks to participate in non-banking ecosystems.

- BaaS Adoption: The Banking-as-a-Service market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years, signaling strong demand for banks to provide their services via APIs.

- Digital-Only Bank Impact: In 2024, neobanks and digital-only banks continue to attract millions of customers, particularly younger demographics, by offering streamlined mobile banking experiences.

Cloud Computing and Data Analytics

Cloud computing offers banks like b1BANK a flexible and scalable infrastructure, crucial for handling fluctuating transaction volumes and data storage needs. This allows for efficient deployment of new services and reduces the burden of managing physical servers. In 2024, the global cloud computing market in banking was projected to reach over $60 billion, highlighting its significant adoption.

Advanced data analytics, powered by cloud infrastructure, allows b1BANK to process and interpret massive datasets, unlocking valuable customer insights. This enables the bank to personalize product offerings, anticipate customer needs, and improve risk management by identifying patterns and potential fraud more effectively. By 2025, it's estimated that banks leveraging AI and analytics will see a 15-20% increase in customer retention.

- Scalability: Cloud platforms provide on-demand resources, allowing b1BANK to adjust computing power and storage as needed without significant upfront investment.

- Data-Driven Decisions: Analytics transforms raw data into actionable intelligence, enabling more precise marketing campaigns and product development.

- Personalization: Understanding customer behavior through data allows b1BANK to offer tailored financial products and services, enhancing customer satisfaction.

- Risk Management: Advanced analytics can identify fraudulent activities and assess credit risk with greater accuracy, contributing to a more secure banking environment.

Technological advancements are fundamentally altering the banking landscape, pushing institutions like b1BANK towards digital-first strategies and enhanced customer experiences. The rapid adoption of AI and automation is streamlining operations, with AI handling a significant portion of customer interactions and improving fraud detection accuracy to over 95% by late 2024.

The burgeoning fintech sector, valued at approximately $2.4 trillion in 2024, presents both competitive pressures and opportunities for collaboration, particularly through embedded finance and Banking-as-a-Service (BaaS) models. Cloud computing provides the scalable infrastructure necessary for these digital transformations, with the banking cloud market projected to exceed $60 billion in 2024, enabling advanced data analytics for personalization and risk management.

Cybersecurity remains a critical concern, with the average cost of a data breach in the financial sector reaching an estimated $5.9 million in 2024, necessitating continuous investment in robust security measures. b1BANK must adapt to these technological shifts by prioritizing digital platform enhancements and cybersecurity to remain competitive and trustworthy in an increasingly digital financial ecosystem.

Legal factors

b1BANK navigates a stringent regulatory landscape, adhering to directives from bodies like Louisiana's Office of Financial Institutions (OFI). This includes critical compliance with capital adequacy ratios, lending restrictions, and consumer protection mandates, which are fundamental to its operation.

Meeting these extensive requirements demands substantial financial and operational resources dedicated to legal and compliance departments. For instance, in 2024, the cost of regulatory compliance for U.S. banks continued to be a significant operational expense, with many institutions allocating over 10% of their operating budget to meet these obligations.

While b1BANK's core operations are in Louisiana and Texas, it must navigate a landscape increasingly shaped by data privacy regulations. Laws like the California Consumer Privacy Act (CCPA), which grants consumers significant control over their personal information, and the overarching principles of the European Union's General Data Protection Regulation (GDPR) often serve as benchmarks for evolving U.S. data protection standards. For instance, CCPA enforcement actions in 2023 and early 2024 have highlighted the importance of robust consent mechanisms and data access rights for consumers.

Financial institutions like b1BANK operate under rigorous Anti-Money Laundering (AML) and sanctions regulations. These laws mandate the implementation of strong systems and processes to identify and report any suspicious financial activities. For instance, in 2023, global AML fines reached billions of dollars, highlighting the significant financial and reputational risks of non-compliance.

Adherence to these legal frameworks is paramount for b1BANK to safeguard against financial crimes and avert substantial penalties. Failure to comply can result in severe sanctions, including hefty fines and operational restrictions, impacting the bank's stability and market standing.

Consumer Credit and Lending Laws

Consumer credit and lending laws significantly shape b1BANK's operations, particularly its retail and small business lending. These regulations, including fair lending statutes and usury limits, dictate how b1BANK can offer credit, ensuring fairness and preventing predatory practices. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces these rules, with significant penalties for violations. In 2023, the CFPB reported over $4 billion in consumer relief through its enforcement actions, highlighting the financial risks of non-compliance for institutions like b1BANK.

Adherence to these legal frameworks is crucial for maintaining consumer trust and ensuring equitable access to financial products. b1BANK must navigate a complex web of federal and state regulations designed to protect borrowers. Failure to comply can result in substantial fines, legal challenges, and severe damage to the bank's reputation, directly impacting its ability to attract and retain customers.

- Fair Lending Laws: Regulations like the Equal Credit Opportunity Act (ECOA) prohibit discrimination in lending based on race, color, religion, national origin, sex, marital status, or age, ensuring all consumers have a fair chance at credit.

- Usury Limits: State-specific usury laws cap the maximum interest rate a lender can charge, influencing the pricing strategies for loans and impacting profitability. For example, some states have interest rate caps as low as 10%.

- Truth in Lending Act (TILA): TILA requires lenders to disclose the terms and costs of credit to consumers in a clear and standardized way, promoting transparency and informed decision-making.

- Consumer Protection Bureau (CFPB): The CFPB plays a vital role in enforcing consumer protection laws in the financial sector, issuing guidance and taking enforcement actions against non-compliant institutions.

Mergers & Acquisitions Regulatory Approval

b1BANK's acquisition strategy, exemplified by its purchase of Progressive Bancorp, Inc., necessitates navigating a complex web of legal requirements. Federal and state authorities scrutinize these mergers, demanding thorough due diligence to ensure compliance with anti-trust laws and banking concentration limits. For instance, the Federal Reserve and the Office of the Comptroller of the Currency (OCC) play pivotal roles in approving such transactions, often assessing potential impacts on market competition and financial stability.

These regulatory approvals are not mere formalities; they involve rigorous examination of financial health, operational integration plans, and adherence to consumer protection statutes. Failure to meet these legal benchmarks can lead to significant delays, costly divestitures, or outright rejection of proposed mergers. In 2024, regulators continued to emphasize robust compliance frameworks, particularly for institutions engaging in significant M&A activity, underscoring the critical nature of legal due diligence for b1BANK's growth trajectory.

- Anti-trust Review: Ensuring acquisitions do not create undue market concentration.

- Banking Concentration Rules: Adhering to legal limits on the number or size of institutions a single entity can control.

- Federal Reserve and OCC Oversight: Navigating approval processes from key banking regulators.

- State-Specific Regulations: Complying with individual state banking laws where acquisitions occur.

b1BANK operates within a heavily regulated financial sector, requiring strict adherence to federal and state laws. Compliance with capital adequacy, lending, and consumer protection mandates, overseen by bodies like Louisiana's OFI, is critical and demands significant resource allocation, with U.S. banks often dedicating over 10% of operating budgets to compliance in 2024.

The bank must also navigate evolving data privacy laws, with frameworks like CCPA setting benchmarks for consumer data control, as evidenced by enforcement actions in early 2024. Furthermore, robust Anti-Money Laundering (AML) and sanctions compliance are essential to prevent substantial fines, which globally reached billions in 2023, and to avoid reputational damage.

Consumer credit laws, including fair lending statutes and usury limits, directly influence b1BANK's lending practices, with the CFPB actively enforcing these rules and providing billions in consumer relief through actions in 2023. Adherence to these regulations is vital for maintaining consumer trust and avoiding penalties that could impact market standing.

Mergers and acquisitions, like the one involving Progressive Bancorp, are subject to rigorous anti-trust and banking concentration reviews by regulators such as the Federal Reserve and OCC, impacting growth strategies and requiring thorough legal due diligence in 2024.

Environmental factors

Given b1BANK's significant presence in Louisiana and Texas, the bank faces considerable exposure to physical climate risks. These regions are highly susceptible to hurricanes and flooding, events that can directly impact the value of properties held as collateral in the bank's loan portfolio. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that the US experienced 28 separate billion-dollar weather and climate disasters in 2023, with Texas and Louisiana frequently featuring among the most affected states.

Such extreme weather events can severely impair borrowers' ability to repay loans, leading to increased non-performing assets for b1BANK. Furthermore, the operational continuity of the bank's branches and infrastructure in these vulnerable areas could be disrupted, affecting service delivery and potentially incurring significant repair costs. The economic impact of these disasters, as seen with Hurricane Ida in 2021 which caused billions in damage across Louisiana, directly translates to financial risk for lending institutions like b1BANK.

Investor demand for ESG-aligned investments is surging, with global sustainable fund assets projected to reach $50 trillion by 2025, creating significant pressure on banks like b1BANK to integrate environmental, social, and governance considerations into their core strategies. This means demonstrating tangible progress in areas like reducing financed emissions and supporting green lending initiatives.

Regulatory bodies are also tightening ESG disclosure requirements, pushing b1BANK to enhance transparency in its reporting on climate-related risks and opportunities, as seen in the growing adoption of frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

Public and consumer expectations are shifting, with a growing preference for financial institutions that exhibit strong environmental stewardship and social responsibility, influencing b1BANK's brand reputation and customer loyalty.

The global sustainable finance market is experiencing robust growth, with green bond issuance projected to reach over $1 trillion in 2024, according to various market analyses. This trend offers b1BANK a significant opportunity to develop and promote green lending products, such as financing for solar farm developments or energy efficiency upgrades for commercial properties. By catering to this increasing demand for environmentally responsible financial solutions, b1BANK can attract a growing segment of environmentally conscious clientele and enhance its corporate social responsibility profile.

Environmental Regulations for Businesses

Environmental regulations significantly shape the operating landscape for b1BANK's commercial clients, particularly in sectors like energy, agriculture, and manufacturing. For instance, stricter emissions standards or waste disposal mandates can directly increase operational costs for these businesses. In 2024, many industries faced heightened scrutiny under evolving climate policies, with compliance costs potentially rising by 5-10% for some sectors.

These increased regulatory burdens can compress profit margins for b1BANK's borrowers. When companies experience reduced profitability due to compliance expenses, their ability to service debt can be impaired. This directly influences their creditworthiness and, by extension, the risk profile for b1BANK's loan portfolio.

The financial health of b1BANK is thus indirectly linked to the effectiveness of environmental policy implementation. For example, a surge in carbon pricing mechanisms, as seen in some European markets in late 2023 and continuing into 2024, can create substantial financial pressures on carbon-intensive industries.

- Increased Compliance Costs: Businesses in regulated sectors may see operating expenses rise due to new environmental standards.

- Impact on Profitability: Higher compliance costs can lead to reduced profits, affecting a company's ability to repay loans.

- Creditworthiness Concerns: Diminished profitability and increased financial strain can negatively impact a borrower's credit rating.

- Sector-Specific Risks: Industries like energy and manufacturing often face more stringent environmental regulations, posing unique challenges.

Reputational Risk from Environmental Incidents

Banks like B1BANK face significant reputational risk if they are seen as financing companies with poor environmental performance or if their own activities cause ecological damage. This perception can erode customer trust and investor confidence. For instance, in 2024, several major financial institutions faced public backlash and protests for their continued investment in fossil fuel projects, impacting their stock prices and brand image.

To counter this, B1BANK must actively manage its environmental impact and rigorously evaluate the sustainability practices of its clients. This proactive approach is crucial for maintaining a positive public image and ensuring long-term financial stability. A 2025 report by the Global Sustainability Initiative highlighted that 65% of consumers consider a company's environmental record when making purchasing decisions, a figure that directly influences banking relationships.

Managing these environmental factors effectively can lead to tangible benefits:

- Enhanced Brand Image: Demonstrating commitment to environmental responsibility can attract environmentally conscious customers and investors.

- Reduced Regulatory Scrutiny: Proactive environmental management can preempt stricter regulations and associated compliance costs.

- Improved Risk Management: Identifying and mitigating environmental risks within client portfolios reduces potential loan defaults and reputational damage.

- Access to Green Finance: A strong environmental record can open doors to specialized green bonds and sustainable investment funds, potentially lowering the cost of capital.

b1BANK's exposure to physical climate risks is significant, especially in Louisiana and Texas, areas prone to hurricanes and flooding. The US saw 28 billion-dollar weather events in 2023, with these states frequently impacted, directly affecting collateral values and borrower repayment capacity.

Investor demand for ESG investments is projected to reach $50 trillion by 2025, pressuring b1BANK to show progress in areas like financed emissions. Simultaneously, tightening ESG disclosure requirements, such as TCFD adoption, mandate greater transparency in climate risk reporting.

Public and consumer preferences are shifting towards environmentally responsible financial institutions, impacting b1BANK's brand and customer loyalty. The growing green finance market, with over $1 trillion in green bond issuance expected in 2024, presents an opportunity for b1BANK to offer green lending products.

Environmental regulations increase operational costs for b1BANK's commercial clients, potentially impacting their profitability and ability to service debt. For example, stricter emissions standards in 2024 could raise compliance costs by 5-10% in some industries, affecting creditworthiness.

PESTLE Analysis Data Sources

Our PESTLE analysis for b1BANK is built on a robust foundation of data from official financial regulatory bodies, leading economic research institutions, and reputable industry-specific publications. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, verifiable information.