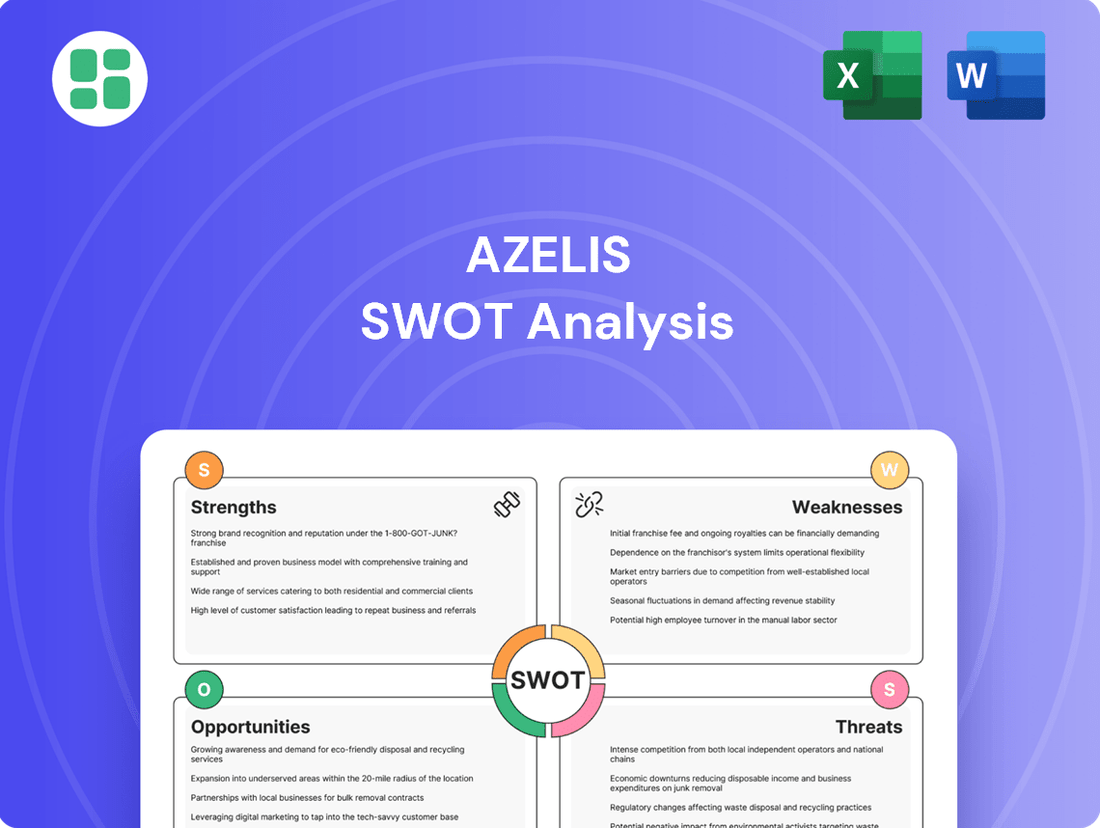

Azelis SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azelis Bundle

Azelis, a leading global innovation service provider in specialty chemicals and food ingredients, leverages its extensive distribution network and strong supplier relationships as key strengths. However, it faces potential threats from market volatility and increasing regulatory scrutiny within its operating regions.

Discover the complete picture behind Azelis' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Azelis stands as a prominent global leader in innovation services for specialty chemicals and food ingredients. Operating across 65 countries, the company boasts a workforce of over 4,300 professionals, underscoring its expansive reach and deep market penetration.

This extensive global network is a significant strength, enabling Azelis to effectively serve a wide array of customers and tap into valuable local market intelligence. The sheer scale of its operations provides a substantial competitive edge in the international arena.

Azelis's strength lies in its robust innovation and technical prowess, supported by a global network of over 70 application laboratories. This infrastructure empowers their award-winning teams to deliver exceptional technical guidance and create novel formulations, a core aspect of their 'Innovation through Formulation' strategy.

This dedication to developing cutting-edge solutions tailored to specific local market needs is a significant competitive advantage. The company's consistent receipt of industry awards underscores its sustained success and commitment to pushing the boundaries of chemical innovation.

Azelis benefits from exceptionally strong ties with its principals, numbering over 2,800, and maintains robust connections with more than 62,000 customers. This extensive network is fundamental to its operational success, guaranteeing a consistent and varied supply of specialty chemicals and providing access to a vast customer base.

Strong Commitment to Sustainability

Azelis demonstrates a robust commitment to sustainability, evident in its 'Impact 2030' and 'Action 2025' strategies, alongside its adherence to the Science-Based Targets initiative (SBTi). This dedication is further validated by impressive ESG ratings, including an AA from MSCI and a leading position from Sustainalytics, underscoring their role in providing eco-conscious solutions that align with increasing consumer and regulatory preferences.

The company's focus on sustainability translates into tangible market advantages.

- Market Leadership: Azelis is recognized as a leader in sustainable chemical distribution, meeting the rising demand for environmentally responsible products.

- ESG Performance: Achieved an AA MSCI ESG Rating and a top industry rating from Sustainalytics, reflecting strong environmental, social, and governance practices.

- Strategic Initiatives: 'Impact 2030' and 'Action 2025' outline clear sustainability goals, demonstrating a long-term vision for responsible growth.

- SBTi Alignment: Commitment to the Science-Based Targets initiative (SBTi) signifies a data-driven approach to reducing its carbon footprint.

Resilient Business Model and Financial Performance

Azelis boasts a robust business model that has consistently delivered stable profitability and healthy cash flow, even when the market faced turbulence. This resilience is a key strength, allowing the company to navigate economic uncertainties effectively.

The company's financial performance in 2024, despite some market challenges, showcased this adaptability. Azelis managed to maintain stable adjusted EBITA and generate positive free cash flow, demonstrating its capacity to perform under pressure.

Key to this stability is Azelis' dual approach of achieving consistent organic growth alongside strategic acquisitions. This combination not only broadens its market reach but also reinforces its overall financial strength and operational consistency.

- Resilient Profitability: Maintained stable adjusted EBITA in 2024 amidst market headwinds.

- Strong Cash Flow: Demonstrated positive free cash flow generation, highlighting financial adaptability.

- Growth Strategy: Leverages both organic growth and strategic acquisitions for sustained stability.

Azelis's extensive global network, spanning 65 countries with over 4,300 professionals, is a significant strength, facilitating deep market penetration and effective customer service. This broad reach provides a crucial competitive advantage in the international specialty chemicals and food ingredients sectors.

The company's innovation capabilities are bolstered by over 70 application laboratories worldwide, enabling its teams to deliver exceptional technical support and develop novel formulations. This focus on 'Innovation through Formulation' has led to numerous industry awards, highlighting Azelis's commitment to cutting-edge solutions.

Azelis maintains strong relationships with over 2,800 principals and more than 62,000 customers, ensuring a consistent supply chain and broad market access. These deep connections are fundamental to its operational success and market position.

Azelis demonstrates a strong commitment to sustainability through initiatives like 'Impact 2030' and 'Action 2025', supported by an alignment with the Science-Based Targets initiative (SBTi). Its leading ESG ratings, including an AA from MSCI and a top rating from Sustainalytics, underscore its focus on eco-conscious solutions and responsible growth, aligning with increasing market demand for sustainable products.

The company's business model consistently delivers stable profitability and healthy cash flow, proving resilient even during market downturns. In 2024, Azelis maintained stable adjusted EBITA and generated positive free cash flow, showcasing its adaptability and financial robustness through a combination of organic growth and strategic acquisitions.

| Financial Metric | 2024 Performance | Significance |

|---|---|---|

| Adjusted EBITA | Stable | Demonstrates resilience amidst market challenges |

| Free Cash Flow | Positive | Highlights financial adaptability and operational efficiency |

| Principal Relationships | 2,800+ | Ensures diverse and consistent supply of specialty chemicals |

| Customer Base | 62,000+ | Provides broad market access and sales opportunities |

| Global Presence | 65 Countries | Facilitates extensive market penetration and local insights |

What is included in the product

Offers a full breakdown of Azelis’s strategic business environment, detailing its internal capabilities and external market dynamics.

Azelis's SWOT analysis offers a clear, actionable framework to identify and leverage strengths, mitigate weaknesses, seize opportunities, and counter threats, thereby alleviating strategic uncertainty and driving focused growth.

Weaknesses

Azelis's reliance on economic cycles presents a significant weakness. The company experienced this firsthand with the volatility and extended normalization observed throughout 2024, highlighting how shifts in the global economy directly affect demand for its specialty chemicals and food ingredients. This cyclicality can create unpredictable revenue streams and pressure on profitability, even when Azelis demonstrates underlying resilience.

Azelis's financial leverage saw a notable increase, reaching 2.9x by the close of 2024. This rise is attributed to a combination of factors, including delayed payments for recent acquisitions and substantial investments made in the company's working capital.

The company experienced a significant downturn in its free cash flow during 2024. This decline was primarily driven by the increased working capital requirements needed to support the recovery in market demand.

The combination of higher leverage and the considerable outflow for working capital investments could potentially limit Azelis's financial maneuverability. This reduced flexibility might impact its capacity for future expansion initiatives or its ability to navigate unexpected market disruptions.

Azelis, as a distributor, faces inherent risks from fluctuating raw material prices. These shifts can squeeze its gross profit margins if the company can't pass on increased costs through its pricing strategies. For instance, while Azelis saw its gross profit margin expand in 2024, driven by favorable product mix, segments like Industrial Chemicals can still experience challenging price pressures.

Integration Risks from Acquisitions

Azelis's aggressive acquisition strategy, which saw the completion of eight deals in 2024, presents significant integration risks. Successfully merging these new entities, their diverse operations, and distinct corporate cultures is paramount to achieving projected synergies and preventing a negative impact on profitability.

The challenge lies in harmonizing supply chains and operational processes across these newly acquired businesses. Failure to do so can lead to inefficiencies and increased costs.

Indeed, in 2024, Azelis observed a dilutive effect on its Adjusted EBITA margin in specific geographical areas due to the integration of some recent acquisitions. This highlights the immediate need for robust integration management to safeguard financial performance.

- Eight acquisitions completed in 2024.

- Potential for operational inefficiencies and margin dilution.

- Dilutive effect on Adjusted EBITA margin noted in certain regions in 2024.

- Successful integration is key to realizing acquisition benefits.

Regional Market Volatility and FX Headwinds

Azelis faces challenges due to significant regional market volatility. For instance, in 2024, the APAC region and industrial chemicals in EMEA and the US experienced weaker organic growth and price pressures. This uneven performance across geographies means that revenue streams can be unpredictable, demanding highly localized strategic approaches.

Adding to this complexity, foreign exchange (FX) headwinds have directly impacted Azelis' reported revenue figures. These currency fluctuations can erode the value of international earnings when translated back to the company's reporting currency, creating an additional layer of uncertainty for financial planning and performance assessment.

- Regional Performance Disparities: 2024 saw weaker organic growth and price pressure in specific markets like APAC and Industrial Chemicals in EMEA/US.

- FX Headwinds Impact: Negative foreign exchange movements have directly reduced reported revenue.

- Revenue Stream Volatility: The combination of regional differences and currency fluctuations creates unpredictable revenue patterns.

- Strategic Adaptation Required: Tailored strategies are essential to navigate these diverse market conditions and currency risks effectively.

Azelis's financial structure shows increased leverage, with a ratio of 2.9x by the end of 2024, largely due to acquisition-related payments and working capital investments. This, combined with a significant drop in free cash flow in 2024, primarily from higher working capital needs to support market demand recovery, could constrain future expansion and resilience against market shocks.

The company's reliance on economic cycles remains a key weakness, as seen in the 2024 volatility. Fluctuating raw material prices also pose a risk, potentially impacting gross profit margins if cost increases cannot be passed on, despite a favorable product mix in 2024.

Azelis's aggressive acquisition strategy, with eight deals in 2024, brings substantial integration risks. Inefficient integration can lead to operational inefficiencies and margin dilution, as evidenced by a dilutive effect on Adjusted EBITA margins in certain regions during 2024.

Regional market volatility, particularly in APAC and industrial chemicals in EMEA/US during 2024, creates unpredictable revenue streams. Furthermore, foreign exchange headwinds directly impacted reported revenue, adding another layer of financial uncertainty.

Same Document Delivered

Azelis SWOT Analysis

The file shown below is not a sample—it’s the real Azelis SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a clear overview of the company's strategic position. You can trust that the insights presented here are accurate and ready for your strategic planning.

Opportunities

The global market for sustainable specialty chemicals and food ingredients is experiencing significant growth, directly benefiting Azelis. This trend aligns seamlessly with the company's forward-thinking 'Impact 2030' and 'Action 2025' sustainability strategies, positioning them to capitalize on increasing consumer and regulatory preference for eco-friendly options.

Azelis's proactive approach in identifying and distributing sustainable products allows them to capture a greater share of this expanding market. Their demonstrated leadership in sustainability, evidenced by strong ESG ratings, provides a crucial competitive advantage in attracting environmentally conscious customers and partners.

Azelis is actively pursuing a strategy to be a significant consolidator in its industry, demonstrated by its successful completion of numerous acquisitions throughout 2024. These strategic moves are designed to enhance its lateral value chain and expand its global presence.

By continuing to engage in strategic mergers and acquisitions within fragmented markets, Azelis can solidify its position in crucial sectors and diversify its product offerings. This approach to inorganic growth presents a substantial avenue for increasing its market share.

Azelis can significantly boost its reach and efficiency by further investing in and monetizing its digital platforms. This focus on digitalization is already yielding results, with a notable increase in active users on its customer portals, indicating strong adoption and engagement.

By enhancing these digital capabilities, Azelis has a clear opportunity to improve how it serves its customers and to explore entirely new ways of doing business, potentially leading to new revenue streams and a stronger competitive edge in the market.

Leveraging Innovation and Application Laboratories

Azelis's robust network of over 70 application laboratories is a significant opportunity, especially as sectors like health, nutrition, and beauty increasingly overlap. This extensive technical infrastructure allows for cross-sector innovation, enabling the development of novel formulations and the application of cutting-edge technologies to meet evolving market demands.

By leveraging these labs, Azelis can create unique products that address emerging needs, fostering deeper customer engagement and providing a distinct competitive advantage. For instance, in 2024, Azelis continued to invest in these labs, with a focus on sustainability and digitalization, aiming to accelerate customer innovation cycles.

- Cross-Sector Innovation: Over 70 application labs facilitate the development of new products by combining expertise across diverse industries.

- Market Trend Adaptation: Labs enable Azelis to respond to the blurring lines between health, nutrition, and beauty markets with tailored solutions.

- Customer Relationships: Technical collaboration through labs strengthens partnerships and drives customer loyalty.

- Differentiation: Novel formulations and technology applications created in labs set Azelis apart from competitors.

Market Recovery and Emerging Market Growth

Market sentiment is showing signs of recovery, with many of Azelis's key sectors anticipating a return to organic growth in 2025. This upturn is expected to boost sales volumes and enhance profitability for the company.

Emerging markets offer substantial long-term growth prospects for Azelis. Strengthening its presence in these regions can unlock new revenue streams and diversify its geographic footprint.

- Projected Market Growth: Analysts forecast a rebound in specialty chemical markets, with global growth expected to reach 3-4% in 2025, up from an estimated 1-2% in 2024.

- Emerging Market Focus: Azelis has been actively expanding its operations in Asia-Pacific, which represented approximately 20% of its revenue in 2023, with plans to further invest in high-growth economies like India and Southeast Asia.

- Tailwinds for Azelis: The anticipated market recovery is likely to translate into higher demand for Azelis's product portfolio, supporting its strategy of value-added distribution.

Azelis is well-positioned to benefit from the increasing demand for sustainable products, with its 'Impact 2030' and 'Action 2025' strategies aligning with market trends. The company's ongoing acquisition strategy in 2024, aiming for industry consolidation, is expanding its global reach and product diversity. Furthermore, investments in digital platforms are enhancing customer engagement and creating new business opportunities, while its extensive network of application laboratories fosters cross-sector innovation and strengthens customer relationships.

Threats

Azelis faces significant headwinds from global economic and geopolitical instability. Ongoing conflicts and prolonged normalization periods create a volatile operating environment, impacting everything from raw material sourcing to end-market demand. For instance, the lingering effects of supply chain disruptions seen throughout 2023 and into early 2024 continue to pose challenges, potentially increasing logistics costs and delivery times for Azelis's specialty chemicals and food ingredients.

These external pressures, largely outside Azelis's direct influence, can lead to unpredictable shifts in customer spending and investment. The company's broad geographic footprint means it is exposed to varying levels of risk across different regions, with geopolitical tensions potentially dampening economic activity and consumer confidence in key markets during 2024 and 2025.

Azelis navigates a challenging landscape marked by persistent threats of supply chain disruptions and raw material shortages. These global issues can directly translate into higher operational costs, extended delivery timelines, and a diminished capacity to fulfill customer orders, impacting revenue and market share.

While Azelis leverages its robust lateral value chain to buffer against some of these risks, the sheer scale of ongoing global disruptions remains a significant concern. For instance, the semiconductor shortage that significantly impacted various industries throughout 2022 and into 2023 highlights the vulnerability of even well-connected companies to widespread material scarcity.

The specialty chemicals and food ingredients distribution sector is a magnet for many players, making it a fiercely competitive arena. This intensified rivalry often translates into significant price pressure, especially in product categories with lower demand or where supply outstrips need. For Azelis, this means its gross profit margins and overall profitability are constantly under scrutiny.

In 2024, the global specialty chemicals market, valued at approximately $700 billion, saw increased competition impacting pricing dynamics. Azelis, with its extensive portfolio, must continually prove its unique value and operational efficiency to maintain its market position and profitability against aggressive pricing strategies from both established and emerging competitors.

Regulatory and Compliance Risks

Azelis's global operations, spanning 65 countries and numerous industries, expose it to a complex web of evolving regulatory requirements. These include stringent environmental, health, and safety standards that differ significantly by region. Failure to comply with these diverse regulations, which are increasingly emphasized in Azelis's 2024-2025 sustainability reporting, can lead to substantial financial penalties, damage to its brand reputation, and even operational disruptions.

Navigating this intricate and constantly changing regulatory environment presents a significant challenge, adding layers of complexity and increasing operational costs for Azelis. The company must invest in robust compliance frameworks and continuous monitoring to mitigate these risks effectively.

- Global Regulatory Complexity: Operating in 65 countries means adhering to a multitude of distinct and often changing environmental, health, and safety regulations.

- Compliance Costs: The need to understand and implement varied regulatory frameworks across its diverse markets increases operational expenses.

- Reputational and Financial Risk: Non-compliance can result in severe financial penalties, legal actions, and significant damage to Azelis's reputation, impacting customer trust and market access.

Fluctuations in Foreign Exchange Rates

As a global player, Azelis's financial performance is inherently exposed to the volatility of foreign exchange rates. When earnings generated in foreign currencies are translated back into its reporting currency, the Euro, unfavorable movements can significantly reduce reported revenues and profits. This is a key concern for 2024, with FX headwinds already impacting the company's top line.

Even strong operational achievements can be masked by adverse currency swings, leading to a potential erosion of profitability. For instance, if the Euro strengthens considerably against other currencies where Azelis operates, the value of its foreign earnings will decrease when converted. This dynamic means that robust underlying business growth might not translate into equivalent improvements in reported financial results.

- FX Headwinds Impacted 2024 Revenue: Azelis specifically cited foreign exchange as a factor negatively affecting its revenue performance during 2024.

- Erosion of Profitability: Significant unfavorable currency movements can diminish the company's profit margins, irrespective of strong operational execution.

- Global Operations Risk: The very nature of Azelis's international presence, operating across numerous countries and currencies, magnifies this exposure.

Azelis faces intense competition in the specialty chemicals and food ingredients sectors, leading to price pressures that can impact its profit margins. The global specialty chemicals market, valued at around $700 billion in 2024, saw heightened rivalry from both established and emerging players, forcing Azelis to continuously demonstrate its value proposition to maintain profitability.

The company's extensive global operations across 65 countries expose it to a complex and ever-changing regulatory landscape. Navigating diverse environmental, health, and safety standards, which are increasingly stringent as highlighted in 2024-2025 sustainability reports, incurs significant compliance costs and carries the risk of substantial financial penalties and reputational damage if not managed effectively.

Azelis is also vulnerable to foreign exchange rate volatility, with unfavorable currency movements directly impacting its reported revenues and profits. For instance, the company explicitly noted foreign exchange headwinds affecting its revenue performance in 2024, underscoring the challenge of converting foreign earnings back into its reporting currency, the Euro.

SWOT Analysis Data Sources

This Azelis SWOT analysis is built upon a foundation of credible data, including Azelis's official financial filings, comprehensive market research reports, and expert industry commentary to ensure a robust and insightful assessment.