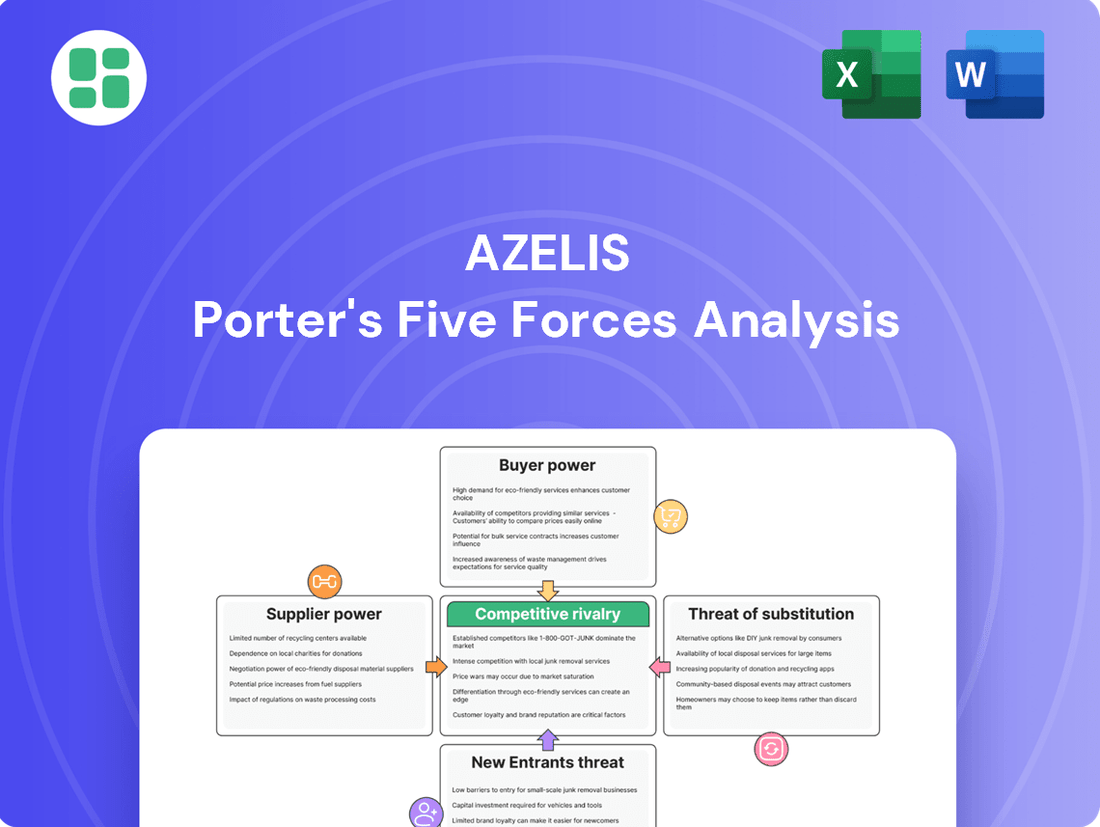

Azelis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azelis Bundle

Azelis operates in a dynamic market shaped by intense competition, significant supplier leverage, and the constant threat of substitutes. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping Azelis’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Azelis's bargaining power with suppliers hinges on the concentration of producers for specialized chemicals and ingredients. When a few dominant manufacturers supply critical inputs, these suppliers gain leverage, potentially increasing Azelis's costs and affecting supply chain reliability.

For instance, in 2024, the specialty chemicals market, a key area for Azelis, saw continued consolidation among key producers in specific niches. This trend means that for certain high-demand, low-supply materials, suppliers can command higher prices.

However, Azelis counters this by maintaining relationships with over 2,800 principals. This broad supplier network diversifies its sourcing options, reducing dependence on any single supplier and thereby strengthening its negotiating position, even in concentrated markets.

The uniqueness and proprietary nature of certain specialty chemicals and food ingredients significantly bolster supplier bargaining power. When Azelis relies on patented or complex-to-manufacture inputs, its options become restricted, allowing suppliers to dictate pricing and contract terms more effectively.

For instance, in 2024, the global specialty chemicals market, a key sector for Azelis, continued to see demand driven by innovation. Companies holding patents for novel ingredients or advanced formulations often command premium pricing due to the lack of readily available substitutes, directly impacting Azelis's cost of goods sold and its ability to offer competitive pricing to its own customers.

For Azelis, the costs of switching suppliers are significant. These include expenses for reformulating products, obtaining new regulatory approvals, and undergoing re-qualification processes with their own customers. These high switching costs empower suppliers, as Azelis faces considerable disruption and financial outlay to move away from an established supplier.

Threat of Forward Integration by Suppliers

Suppliers might integrate forward, directly selling to Azelis's customer base, thereby bypassing Azelis’s distribution services. This threat is particularly relevant if major chemical producers decide to establish their own sales channels and technical support, reducing the necessity for intermediaries like Azelis for specific product segments.

However, Azelis’s robust value proposition, which includes specialized technical expertise and state-of-the-art application laboratories, serves as a significant differentiator. These services go beyond mere logistics, offering customers tailored solutions and product development support that many raw material producers may not be equipped to provide directly.

For instance, in 2024, the specialty chemicals market, where Azelis primarily operates, continued to emphasize innovation and customized solutions. Companies that can offer deep technical understanding and application support, like Azelis, are better positioned to mitigate the threat of supplier forward integration. The global specialty chemicals market was valued at approximately $700 billion in 2024, with a significant portion driven by value-added services rather than commodity distribution.

- Supplier Forward Integration Threat: Suppliers could bypass distributors like Azelis by selling directly to end customers.

- Azelis's Competitive Advantage: Value-added services such as technical expertise and application labs differentiate Azelis.

- Market Context (2024): The specialty chemicals sector, valued around $700 billion, prioritizes innovation and tailored solutions, bolstering Azelis's position.

Importance of Azelis to Suppliers

Azelis's position as a global distributor is significant for its suppliers. By connecting producers with over 62,000 customers, Azelis offers a broad and efficient market reach. This extensive network is vital for many specialty chemical and food ingredient manufacturers seeking to expand their customer base.

For numerous specialty chemical and food ingredient producers, Azelis acts as a crucial gateway to markets. It provides not only sales but also essential technical expertise and streamlined logistics. This multifaceted support makes Azelis an indispensable partner, thereby mitigating the suppliers' bargaining power.

- Market Access: Azelis provides suppliers with access to a diverse customer base exceeding 62,000, a significant advantage for market penetration.

- Value-Added Services: Beyond distribution, Azelis offers technical sales support and logistical solutions, enhancing the value proposition for suppliers.

- Channel Criticality: For many producers, Azelis represents a critical distribution channel, reducing their reliance on direct sales and thus balancing their power.

The bargaining power of suppliers for Azelis is influenced by market concentration and product uniqueness. When few suppliers offer specialized inputs, their leverage increases, potentially raising Azelis's costs. Azelis mitigates this by maintaining a vast network of over 2,800 principals, diversifying its sourcing and strengthening its negotiation position.

The high switching costs for Azelis, including reformulation and re-qualification processes, empower suppliers. Furthermore, the threat of supplier forward integration, where producers might bypass Azelis by selling directly to customers, is a concern, though Azelis's technical expertise and application labs offer a strong counter-value proposition.

| Factor | Impact on Azelis | Mitigation Strategy |

|---|---|---|

| Supplier Concentration | Increased costs and supply risk | Diversified sourcing (2,800+ principals) |

| Product Uniqueness | Limited options, supplier pricing power | Value-added services, technical support |

| Switching Costs | Supplier leverage due to Azelis's high costs to change | Strong principal relationships, integrated services |

| Forward Integration Threat | Potential bypass of Azelis's distribution | Differentiated technical expertise and application labs |

What is included in the product

Azelis Porter's Five Forces Analysis provides a comprehensive examination of the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Azelis's operating markets.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Gain a strategic advantage by quickly assessing market dynamics and pinpointing areas for improved negotiation power.

Customers Bargaining Power

Azelis serves a vast network of over 62,000 customers spanning diverse sectors like personal care, food, CASE, and pharmaceuticals. This wide customer base generally dilutes the bargaining power of any individual customer, as no single client represents an overwhelming portion of Azelis's overall revenue.

While this fragmentation limits individual customer leverage, large global manufacturers, due to their substantial purchasing volumes, can still exert some influence. For instance, a major food ingredient buyer might negotiate slightly better terms, but it's unlikely to fundamentally alter Azelis's pricing structure across its broad portfolio.

Customers often face significant switching costs when moving from one specialty chemical or food ingredient supplier to another. These costs can include the time and resources required to re-qualify new ingredients, update existing product formulations, and potentially navigate new regulatory or registration processes. For instance, a food manufacturer switching a key ingredient might need extensive testing to ensure product consistency and safety, a process that can take months and incur substantial expense.

Azelis actively works to increase these switching costs, thereby diminishing customer bargaining power. Their extensive network of technical experts and state-of-the-art application laboratories play a crucial role. By assisting customers in developing and optimizing their formulations using Azelis's products, they become deeply integrated into the customer's product lifecycle. This technical partnership makes it more complex and costly for customers to simply swap out an Azelis ingredient for a competitor's, as it would likely require significant reformulation and revalidation efforts.

Customers can easily switch to competing distributors like IMCD or Brenntag, or even bypass distributors altogether by sourcing directly from manufacturers. This availability of alternatives significantly strengthens their negotiating position. For instance, in 2024, the specialty chemicals distribution market saw continued consolidation, with players like Brenntag making strategic acquisitions, potentially increasing customer options.

Customer Price Sensitivity

Azelis customers exhibit varying degrees of price sensitivity. For ingredients that are highly commoditized and represent a significant portion of a customer's final product cost, customers tend to be more sensitive to price changes. This heightened sensitivity directly translates into increased bargaining power for these customers.

Conversely, when Azelis supplies highly specialized or performance-enhancing ingredients, customer price sensitivity is generally lower. In these instances, the value derived from the ingredient's unique properties or its contribution to the final product's performance outweighs minor price differences, diminishing customer bargaining power.

- Price Sensitivity Drivers: Customer price sensitivity at Azelis is primarily influenced by the commoditization of ingredients and their proportion in the overall cost structure of the customer's end product.

- Impact on Bargaining Power: For commoditized, high-cost proportion ingredients, customers leverage their price sensitivity to negotiate better terms, thereby increasing their bargaining power.

- Specialty Ingredient Dynamics: For specialized or performance-driven ingredients, lower price sensitivity empowers Azelis, as customers prioritize functional benefits over minor cost variations.

- Market Segmentation: Azelis's strategy likely involves segmenting its customer base based on these price sensitivity factors to tailor its pricing and value propositions effectively.

Value-Added Services Provided by Azelis

Azelis significantly curtails customer bargaining power through its extensive value-added services. The company offers specialized technical expertise and formulation development across its network of over 70 laboratories. These capabilities transform Azelis from a simple distributor into a crucial innovation partner.

By deeply integrating into their customers' product development cycles, Azelis fosters a reliance that diminishes customers' ability to dictate terms. This partnership approach, exemplified by their commitment to innovation and problem-solving, strengthens Azelis's position in the market.

- Technical Expertise and Formulation Development: Azelis operates over 70 application laboratories globally, providing customers with formulation support and technical guidance. This deep technical engagement reduces the need for customers to possess all specialized knowledge internally.

- Innovation Partnership: Instead of just supplying chemicals, Azelis acts as an innovation partner, co-developing solutions with clients. This collaborative approach increases customer stickiness and reduces their leverage.

- Comprehensive Supply Chain Solutions: Azelis manages complex supply chains, offering logistical support and ensuring reliable delivery of specialty chemicals. This end-to-end service package further entrenches Azelis with its customer base.

The bargaining power of Azelis's customers is generally moderate, influenced by factors like customer size, price sensitivity, and the availability of alternatives. While Azelis's broad customer base of over 62,000 clients limits the power of any single buyer, large volume purchasers can still negotiate terms. The company's strategy of increasing switching costs through technical integration and value-added services, such as formulation support across its 70+ labs, effectively mitigates this power.

Price sensitivity varies; customers are more sensitive to commoditized ingredients that form a larger part of their costs, granting them more leverage. Conversely, for specialized, performance-enhancing ingredients, price sensitivity is lower, strengthening Azelis's position. The competitive landscape, with distributors like IMCD and Brenntag (which made strategic acquisitions in 2024), offers customers alternatives, thus moderating their overall bargaining strength.

| Factor | Impact on Azelis | Supporting Data/Context |

| Customer Base Size | Dilutes individual customer power | Over 62,000 customers across diverse sectors |

| Switching Costs | Reduces customer leverage | High costs for reformulation and revalidation of ingredients |

| Price Sensitivity | Increases power for commoditized goods | Lower for specialized, performance-enhancing ingredients |

| Availability of Alternatives | Increases customer bargaining power | Presence of major competitors like IMCD, Brenntag |

| Value-Added Services | Decreases customer bargaining power | 70+ application labs offering technical and formulation support |

Full Version Awaits

Azelis Porter's Five Forces Analysis

This preview showcases the comprehensive Azelis Porter's Five Forces Analysis, detailing the competitive landscape of the specialty chemicals and food ingredients distribution industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights into market dynamics. You're looking at the final, ready-to-use report, ensuring no surprises and immediate utility for your strategic planning.

Rivalry Among Competitors

The specialty chemical and food ingredient distribution sector is quite crowded. You have big global companies like IMCD and Brenntag, but also a lot of smaller, local distributors operating in specific regions.

Azelis, with its EUR 4.2 billion in revenue for 2024, is certainly a major force in this market. However, it has to contend with the significant competitive pressure from these large, well-established competitors who have a strong presence and deep market knowledge.

The specialty chemical distribution market is projected for robust expansion, with an anticipated compound annual growth rate (CAGR) of 8.2% between 2025 and 2029. Similarly, the food ingredients sector is expected to grow at a 6.6% CAGR during the same period. Generally, high growth rates tend to temper competitive rivalry as the market can accommodate more players.

However, Azelis's reports from 2024 and Q1 2025 highlight market volatility and the ongoing normalization of conditions. This dynamic environment can paradoxically increase competitive intensity, as companies may aggressively pursue market share during periods of adjustment and uncertainty.

Azelis sets itself apart by focusing on innovation services, a robust network of application laboratories, and deep technical expertise. This strategy elevates them beyond a simple product distributor, offering customers integrated solutions and formulation support. This emphasis on value-added services helps to lessen competition based purely on price, as clients increasingly prioritize comprehensive technical assistance.

Switching Costs for Customers Among Distributors

Switching between distributors offering similar services can be relatively low for customers, which naturally intensifies competition among them. This means that if Azelis's competitors offer comparable product portfolios and logistical support, customers might not face significant hurdles in moving their business elsewhere.

Azelis counters this by deeply integrating into its customers' research and development cycles through its network of application laboratories. This strategy aims to significantly increase switching costs by providing proprietary formulations and invaluable technical expertise that are difficult for rivals to replicate. For instance, Azelis reported that its innovation centers supported over 3,000 customer projects in 2023, demonstrating the depth of its technical engagement.

- Low Distributor Switching Costs: Customers can often switch between distributors of similar specialty chemicals and ingredients with minimal disruption or financial penalty, fostering a more competitive market.

- Azelis's R&D Integration: The company’s strategy of embedding itself in customer R&D via its laboratories creates unique value through tailored formulations and technical support.

- Increased Switching Barriers: This technical collaboration makes it harder and more costly for customers to switch to a competitor who doesn't offer the same level of specialized, integrated support.

Acquisition Strategy and Market Consolidation

Azelis is actively engaged in market consolidation, having completed eight acquisitions in 2024 and one in early 2025. This strategy aims to broaden its reach across the value chain, expand its geographical presence, and enhance its product offerings.

This aggressive acquisition approach is not unique to Azelis; competitors are also consolidating their positions. Such activity intensifies rivalry as larger entities strive to capture greater market share and achieve economies of scale, thereby reducing competitive pressures through expanded capabilities and market dominance.

- Azelis's 2024 Acquisitions: Eight completed, signaling a robust M&A strategy.

- 2025 Momentum: One acquisition already finalized, continuing the trend.

- Industry Consolidation: Competitors are also pursuing similar strategies, intensifying rivalry.

- Strategic Goals: Expansion of lateral value chain, geographic footprint, and product portfolio.

The competitive rivalry within the specialty chemical and food ingredient distribution sector is significant, fueled by a fragmented market with both global giants and smaller regional players. Azelis, a major entity with EUR 4.2 billion in revenue for 2024, faces intense pressure from established competitors possessing extensive market knowledge and reach.

While market growth rates are generally favorable, Azelis's strategy of focusing on innovation services, application laboratories, and deep technical expertise helps differentiate it from competitors focused solely on price. This value-added approach aims to increase switching costs for customers, making it harder for rivals to capture business based on product alone.

The company's aggressive acquisition strategy, with eight acquisitions in 2024 and one in early 2025, is a direct response to industry consolidation. This pursuit of scale and expanded capabilities intensifies rivalry as both Azelis and its competitors strive for greater market share and operational efficiencies.

| Competitor Type | Key Characteristics | Impact on Azelis |

| Global Distributors (e.g., IMCD, Brenntag) | Strong global presence, extensive product portfolios, deep market penetration | High competitive pressure, need for differentiation through specialized services |

| Regional/Local Distributors | Niche market focus, strong local relationships, potentially lower overhead | Can compete effectively in specific geographies, may offer price advantages |

| Companies Pursuing Consolidation | Aggressive M&A activity, aim for economies of scale, expanded reach | Increased rivalry as market share is contested, pressure to maintain competitive M&A pace |

SSubstitutes Threaten

The threat of substitutes for Azelis is significant, stemming from alternative chemicals and ingredients that can perform similar functions for their customers. These substitutes might offer cost advantages or unique performance characteristics. For instance, the growing demand for bio-based alternatives in the specialty chemicals sector, or innovative functional ingredients in the food industry, could directly challenge Azelis' traditional product lines.

Customers will naturally gravitate towards substitutes if they present a more attractive price-performance ratio. For instance, if a competitor's chemical formulation offers comparable efficacy at a 15% lower cost, Azelis faces increased pressure. This is particularly relevant as a growing number of industries, such as the coatings sector, are demanding more sustainable alternatives, and a substitute that better meets these evolving environmental standards could gain significant traction even at a slightly higher price point.

Customer willingness to adopt substitute ingredients for Azelis is a key factor in assessing the threat of substitutes. This willingness is significantly influenced by how easily a substitute can be integrated into existing formulations and manufacturing processes. For instance, in the highly regulated personal care and pharmaceutical sectors, where product stability and safety are paramount, the adoption of new ingredients can be a slow and rigorous process, thereby reducing the immediate threat of substitutes.

Regulatory hurdles play a crucial role; stringent approval processes can deter quick switching to alternatives. Consumer acceptance is another vital element. If consumers have strong preferences for established ingredients or brands, it makes it harder for substitutes to gain traction. For example, in the food industry, consumer demand for natural or organic ingredients might drive the adoption of certain substitutes, while in other segments, established performance and familiarity might outweigh the appeal of alternatives.

The threat of substitutes for Azelis is moderated by the complexity and regulatory environment of its key end markets. In 2024, industries like specialty chemicals and life sciences, which are significant for Azelis, often face long lead times for new ingredient approvals. This can extend from 18 months to several years, depending on the specific application and region, making rapid substitution less likely and providing a degree of insulation for established suppliers and distributors like Azelis.

Innovation in Raw Material Production

Advances in raw material production, like the upcycling of lignin into high-performance specialty chemicals, represent a significant threat of substitutes for Azelis. These innovations can create entirely new ingredients that may outperform or offer cost advantages over existing offerings.

Such disruptive substitutes could bypass traditional supply chains, directly impacting the demand for Azelis's current product portfolio and potentially fragmenting market share.

- Lignin-based chemicals: Research highlights the potential for lignin, a byproduct of the paper industry, to be transformed into valuable chemicals, offering a sustainable alternative to petroleum-based products.

- Bio-based materials: The growing market for bio-based polymers and composites, projected to reach billions in value by 2025, signifies a shift towards materials that can substitute traditional chemical inputs.

- Circular economy initiatives: Increased focus on upcycling and recycling processes can generate novel materials that compete with virgin chemical production, a trend observed across various industrial sectors in 2024.

Sustainability Trends Driving Substitution

The increasing consumer and regulatory focus on sustainability is a major force driving substitution across various sectors. For instance, in the food and nutrition industry, there's a pronounced shift towards clean-label and plant-based ingredients, directly impacting traditional offerings. By 2024, the global plant-based food market was valued at over $40 billion, demonstrating a clear preference for alternatives that align with environmental and health consciousness.

This trend extends to personal care and cosmetics, where demand for eco-friendly packaging and biodegradable formulations is surging. Companies are actively reformulating products to reduce their environmental footprint, making it easier for consumers to switch to brands that prioritize these values. This substitution pressure compels ingredient suppliers and manufacturers to innovate and adapt to meet evolving market expectations.

Key substitution drivers include:

- Growing consumer demand for sustainable and eco-friendly products: This is evident in sectors like food and personal care, where consumers actively seek out brands with a lower environmental impact.

- Regulatory pressures favoring greener alternatives: Governments worldwide are implementing policies that encourage or mandate the use of sustainable materials and processes, accelerating substitution.

- Innovation in bio-based and recycled materials: Advances in material science are creating viable and often superior alternatives to traditional petroleum-based or less sustainable options.

The threat of substitutes for Azelis is influenced by the cost-effectiveness and performance of alternative materials. For example, the development of advanced bio-polymers in 2024 offers a compelling substitute for traditional plastics in packaging, potentially impacting Azelis's offerings in that segment. Customers will switch if substitutes offer a better price-performance ratio, with studies indicating that a 10-20% cost advantage for a comparable substitute can trigger significant market shifts.

The ease with which customers can integrate substitutes into their existing processes is a critical factor. In sectors like automotive coatings, where reformulation can be costly and time-consuming, the threat of substitutes is lower. However, in fast-moving consumer goods, where product cycles are shorter, adoption of new ingredients can be more rapid. For instance, in 2024, the personal care industry saw a quicker uptake of novel natural preservatives compared to the pharmaceutical sector's more cautious approach.

Key substitution threats for Azelis in 2024 include:

| Industry Segment | Potential Substitute | Key Driver | Example Data (2024) |

|---|---|---|---|

| Food & Nutrition | Plant-based proteins, natural sweeteners | Consumer health trends, sustainability | Global plant-based food market projected to exceed $70 billion by 2025. |

| Personal Care | Biodegradable ingredients, natural extracts | Eco-consciousness, regulatory push for 'clean beauty' | Demand for natural and organic cosmetics grew by approximately 12% in 2024. |

| Coatings | Water-based or bio-based resins | Environmental regulations, VOC reduction | Waterborne coatings accounted for over 60% of the architectural coatings market in 2024. |

Entrants Threaten

Entering the global specialty chemical and food ingredients distribution arena demands substantial upfront investment. Think about the costs for warehouses, a robust logistics network, and specialized laboratories for quality control and formulation support. For instance, establishing a comprehensive distribution network across multiple continents, as Azelis does, involves hundreds of millions in capital expenditure.

Established companies like Azelis leverage significant economies of scale. This means they can negotiate better prices for bulk purchases of chemicals and ingredients, spread their fixed costs over a larger volume of sales, and operate more efficiently in warehousing and transportation. In 2024, major distributors often manage inventory worth hundreds of millions of dollars, a scale difficult for newcomers to match, impacting their ability to compete on price and service levels.

The chemical and food sectors are subject to stringent regulations concerning health, safety, and environmental impact. For instance, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe requires extensive data submission and can cost millions for new chemical registrations, presenting a significant barrier to entry.

New companies must navigate complex product registration processes, obtain various certifications, and comply with intricate international trade laws. These regulatory requirements demand substantial investment in time and resources, effectively deterring many potential new entrants.

A significant barrier for new entrants in the specialty chemicals and food ingredients distribution sector, like Azelis, is gaining access to established supply and distribution networks. Azelis has cultivated over 2,800 principal relationships with reputable producers, a testament to years of trust-building and a substantial hurdle for newcomers.

Replicating Azelis's extensive global distribution infrastructure, complete with robust logistics and warehousing capabilities, requires immense capital investment and considerable time. This operational complexity and scale are difficult for nascent competitors to overcome quickly.

Technical Expertise and Application Laboratories

Azelis's extensive network of over 70 application laboratories and a dedicated team of technical experts presents a formidable barrier to new entrants. These labs offer crucial formulation support and drive innovation, requiring substantial investment in research and development, as well as specialized talent. This deep technical expertise and intellectual property are not easily replicated.

The significant capital outlay and time needed to establish a comparable technical infrastructure and knowledge base deter potential competitors. For instance, building out such a comprehensive suite of laboratories and cultivating the necessary scientific acumen would likely cost tens of millions of dollars and take years to achieve. This makes it exceptionally difficult for newcomers to compete on a level playing field with Azelis's established technical capabilities.

- High Investment: Establishing a network of 70+ application labs and hiring specialized technical experts requires substantial upfront capital.

- Intellectual Property: Azelis's proprietary formulations and technical knowledge are difficult for new entrants to acquire or replicate.

- Time to Market: New entrants would face a significant time lag in developing comparable technical expertise and service offerings.

- R&D Intensity: The chemical distribution sector demands continuous innovation, making the R&D investment a perpetual challenge for new players.

Brand Reputation and Customer Loyalty

Established distributors like Azelis have cultivated robust brand reputations, fostering deep customer loyalty. This loyalty is built on a foundation of consistent reliability, high-quality product offerings, and dedicated technical support, evidenced by Azelis's relationships with over 62,000 customers. For any new entrant, overcoming this ingrained trust and loyalty presents a significant hurdle, requiring substantial time and investment to replicate the established service and product integrity.

The chemical distribution industry places a premium on product integrity and dependable service, making it challenging for newcomers to break into established relationships. Azelis, for instance, reported a revenue of €4.7 billion in 2023, underscoring the scale of operations and customer base that new entrants must contend with. Building a comparable level of trust and market presence would necessitate a considerable financial outlay and a proven track record.

- Brand Strength: Azelis's established reputation for quality and reliability is a significant barrier.

- Customer Loyalty: Over 62,000 customers rely on Azelis, making switching costly and time-consuming for them.

- Trust Factor: New entrants must invest heavily to build the trust that Azelis already commands in the market.

- Industry Demands: The sector's focus on product integrity and service makes it difficult for unproven companies to gain traction.

The threat of new entrants into Azelis's market is relatively low due to significant capital requirements for infrastructure, regulatory compliance, and establishing supplier and customer relationships. The extensive investment needed for logistics, laboratories, and navigating complex regulations like REACH, which can cost millions for new chemical registrations, creates a substantial barrier.

Economies of scale enjoyed by established players like Azelis, managing inventory worth hundreds of millions in 2024, further deter newcomers. Replicating Azelis's global distribution network and its over 2,800 principal relationships requires immense capital and time, making it difficult to compete on price and service.

| Barrier Type | Description | Impact on New Entrants |

| Capital Investment | Establishing global logistics, warehousing, and 70+ application labs requires hundreds of millions. | High barrier; significant financial resources needed. |

| Regulatory Hurdles | Compliance with stringent regulations (e.g., REACH) involves high costs and extensive data submission. | Deters entry due to complexity and expense. |

| Supplier Relationships | Accessing Azelis's 2,800+ principal relationships requires years of trust-building. | Difficult for new players to secure reliable supply chains. |

| Technical Expertise | Replicating Azelis's formulation support and R&D capabilities demands substantial investment in labs and talent. | Creates a competitive disadvantage for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Azelis Porter's Five Forces analysis is built on a foundation of robust data, incorporating annual reports, industry-specific market research from firms like IHS Markit, and financial data from Bloomberg terminals.