Azelis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azelis Bundle

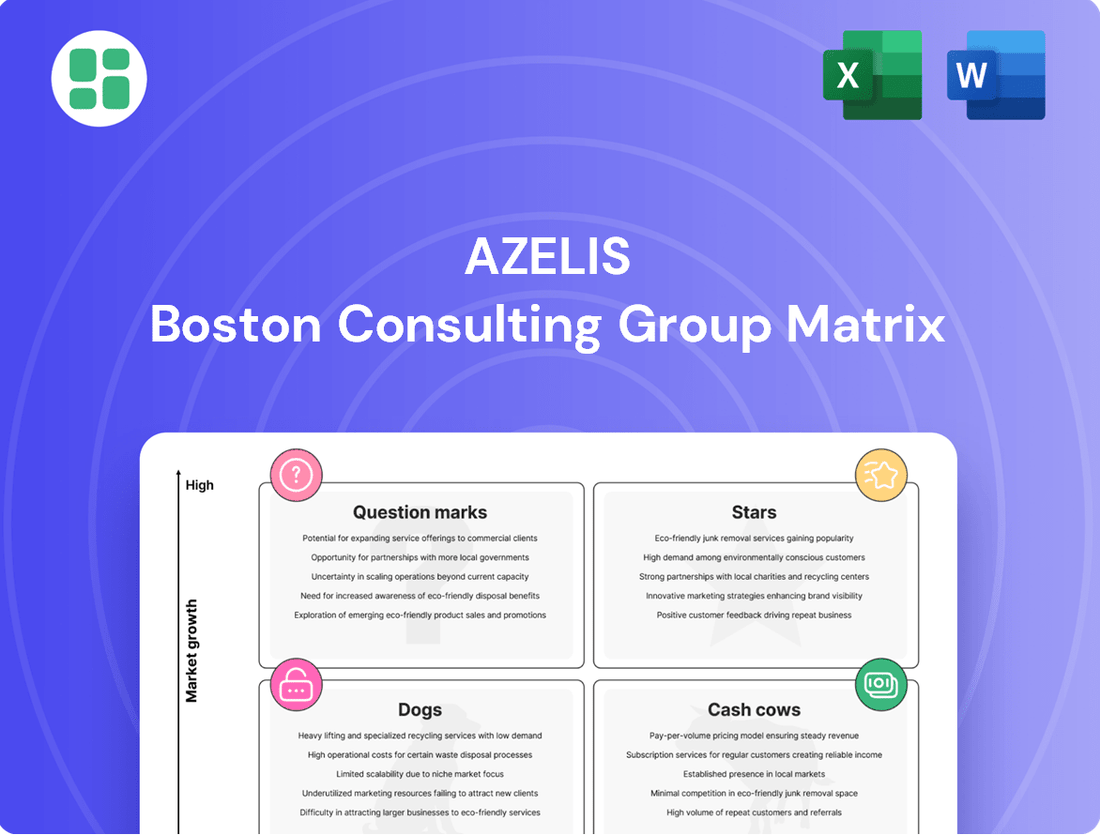

Curious about Azelis's strategic product positioning? Our BCG Matrix preview offers a glimpse into how their portfolio stacks up, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimizing Azelis's market performance.

Stars

Azelis' 'Impact 2030' program, a cornerstone of its strategy, is significantly driving growth and innovation, particularly within its Sustainable Solutions Portfolio. This initiative, aligned with Science Based Targets initiative (SBTi) for emission reductions, underscores Azelis' commitment to a greener future and positions it as a frontrunner in the burgeoning sustainable ingredients market.

The increasing global demand for eco-friendly products across various sectors directly benefits Azelis' Sustainable Solutions Portfolio. By offering these solutions, Azelis not only meets market needs but also strengthens its relationships with principals and customers who prioritize sustainability, thereby securing a competitive advantage in this critical and expanding market segment.

The Life Sciences segment, encompassing Personal Care, Food & Nutrition, and Pharma, demonstrated robust performance with a 3.7% year-on-year revenue increase in Q1 2025. This growth trajectory was further solidified by a 3.4% year-on-year rise in FY 2024, measured in constant currency, driven by a rebound in Pharmaceuticals & Healthcare and Flavours & Fragrances.

Azelis' strategic acquisitions consistently strengthen this segment, underscoring its solid market standing in these vital and expanding sectors. The global emphasis on health, wellness, and specialized nutrition fuels ongoing market expansion, presenting significant high-growth prospects.

Azelis is significantly bolstering its digital capabilities, with a notable 60% surge in active users across its customer portals in 2024 alone. This strategic digital investment is designed to create a more seamless and engaging experience for clients.

This digital push is a key driver for Azelis, aiming to enhance operational efficiency and customer relationships, ultimately capturing greater market share. The company's commitment to digital transformation positions it strongly in a rapidly evolving chemical distribution landscape.

Innovation through Formulation Services

Azelis champions innovation by focusing on formulation services, leveraging its extensive network of over 70 application laboratories worldwide. These labs are staffed by award-winning teams dedicated to developing approximately 5,000 unique formulations annually, offering crucial technical guidance to clients.

- Global Reach: Azelis operates over 70 application laboratories across the globe, fostering localized innovation and technical support.

- Formulation Prowess: Their teams develop nearly 5,000 formulations each year, showcasing a deep commitment to product development.

- Market Responsiveness: This robust R&D focus enables Azelis to adapt to changing customer needs and identify new market opportunities.

- Principal Attraction: Their technical leadership and innovative solutions attract high-growth principals, strengthening their market position.

Strategic Acquisitions in High-Growth Regions/Segments

Azelis actively pursues strategic acquisitions to bolster its presence in high-growth regions and specialized market segments. This approach is evident in its 2024 and early 2025 acquisition activity, which saw eight deals completed in 2024 and one in the first quarter of 2025. These moves are designed to strengthen its position in key end markets, such as nutraceuticals in Spain with the Solchem Nature acquisition, and performance chemicals in India through the S. Amit Group deal.

The company's focus on regions like the Americas and APAC, which exhibit robust revenue growth, underscores its aggressive strategy to gain market share. This proactive consolidation aims to capitalize on emerging opportunities and enhance its capabilities across the value chain.

- Strategic Expansion: Azelis completed eight acquisitions in 2024 and one in Q1 2025.

- Market Reinforcement: Acquisitions like Solchem Nature (Spain, nutraceuticals) and S. Amit Group (India, performance chemicals) strengthen focus end markets.

- Geographic Focus: The company targets high-growth regions such as the Americas and APAC.

- Growth Strategy: This active consolidation aims to increase market share and enhance the lateral value chain.

Stars in Azelis' portfolio represent high-growth, high-market-share segments. These are areas where Azelis is a clear leader and is experiencing significant expansion, often driven by innovation and strategic acquisitions. The company's focus on sustainability and digital transformation is a key enabler for these Star segments.

The Life Sciences sector, particularly Personal Care and Food & Nutrition, demonstrates Star-like characteristics due to consistent growth and Azelis' strong market position, supported by its extensive formulation expertise and acquisition strategy. These segments benefit from global trends in health and wellness.

Azelis' commitment to developing its Sustainable Solutions Portfolio, aligned with SBTi targets, positions it to capture growth in environmentally conscious markets. This focus, coupled with digital enhancements like customer portal engagement, fuels the growth of its Star performers.

| Segment | Growth Trajectory | Market Share | Key Drivers |

|---|---|---|---|

| Life Sciences (Personal Care, Food & Nutrition) | Robust (3.7% YoY Q1 2025 revenue growth) | Strong | Health & wellness trends, formulation expertise, acquisitions |

| Sustainable Solutions Portfolio | High Growth Potential | Increasing | Global demand for eco-friendly products, 'Impact 2030' program |

| Digital Channels | Rapid Expansion (60% surge in active users in 2024) | Growing | Enhanced customer experience, operational efficiency |

What is included in the product

Azelis BCG Matrix: Strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

A clear Azelis BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Azelis' Industrial Chemicals distribution, especially within the CASE sector in mature regions like EMEA and the Americas, functions as a classic Cash Cow. This segment benefits from long-standing principal relationships and a wide customer reach, leading to consistent, substantial cash generation.

The stability of this business means it requires less intensive investment in marketing and promotion compared to Azelis' higher-growth Life Sciences segments. For instance, in 2024, Azelis reported that its EMEA region, a significant hub for industrial chemicals, continued to demonstrate robust performance, contributing a substantial portion to the group's overall profitability.

Azelis' extensive portfolio of legacy products, particularly in commodity and semi-specialty chemicals, functions as a significant cash cow. These are foundational materials for numerous industries, enjoying broad market acceptance and a predictable demand profile.

For instance, Azelis reported a 10.7% like-for-like growth in its EMEA region for the first quarter of 2024, driven by strong performance in its specialty chemicals distribution, which includes many of these established product lines. This consistent revenue generation requires minimal incremental investment, primarily focusing on operational efficiency and robust supplier partnerships.

Azelis’ mature European market operations are a cornerstone of its business, acting as significant cash cows. This established region, characterized by deep customer relationships and extensive logistical networks, consistently generates robust profits for the company.

In 2024, Azelis continued to leverage its strong foothold in Europe, a market where it has a long history and well-developed infrastructure. These mature operations, while experiencing slower growth, offer predictable and substantial cash flows, underpinning the company's financial stability and enabling strategic investments elsewhere.

Centralized Supply Chain and Logistics Efficiency

Azelis' centralized supply chain and logistics efficiency are key drivers of its Cash Cow status. The company's extensive network, honed over years, ensures smooth product flow and cost-effective operations. This translates directly into robust profit margins for its established distribution channels.

By meticulously managing warehousing, transportation, and inventory, Azelis significantly lowers operational expenses. This focus on efficiency maximizes cash generation from its core business lines, even those experiencing slower growth. For instance, in 2024, Azelis reported continued strong performance in its established specialty chemical distribution segments, underscoring the reliability of its logistics infrastructure.

- High Profit Margins: Achieved through optimized distribution channels and reduced operational costs.

- Maximized Cash Flow: Generated by efficient warehousing, transportation, and inventory management.

- Sustained Profitability: Maintained even in mature or lower-growth market segments due to operational excellence.

Strong Principal Relationships

Azelis's extensive network of over 2,800 principal relationships is a cornerstone of its success, with many of these partnerships being both long-standing and exclusive. This deep integration with leading manufacturers, often spanning decades, ensures a consistent and reliable supply of high-margin specialty chemicals and food ingredients. For instance, in 2023, Azelis continued to strengthen its exclusive distribution agreements in key growth markets, securing access to innovative product portfolios.

These robust relationships translate directly into a stable source of high-margin products, a key characteristic of a Cash Cow in the Boston Consulting Group (BCG) matrix. The exclusivity often prevents competitors from accessing the same sought-after ingredients, thereby reducing competitive pressure and solidifying Azelis's market position. This strategic advantage allows Azelis to command premium pricing and maintain healthy profit margins on its distributed goods.

The consistent supply of in-demand ingredients, guaranteed by these deep principal partnerships, minimizes disruptions and ensures predictable revenue streams. This reliability is crucial for generating the consistent cash flow needed to support other ventures within a diversified portfolio. In 2024, Azelis reported that its core distribution business, bolstered by these strong principal ties, continued to be its primary cash generator, funding strategic acquisitions and innovation initiatives.

- Principal Relationships: Azelis maintains over 2,800 principal relationships.

- Exclusivity & Longevity: Many relationships are long-standing and exclusive, ensuring privileged access to products.

- High-Margin Products: These partnerships provide a stable source of high-margin specialty chemicals and ingredients.

- Revenue Stability: Deep relationships minimize competitive threats and guarantee reliable revenue streams, underpinning cash generation.

Azelis' established specialty chemicals distribution, particularly in mature markets like EMEA, acts as a prime Cash Cow. These segments benefit from deep customer penetration and long-term supplier agreements, ensuring steady revenue streams. In 2024, Azelis highlighted the continued strength of its European operations, which are characterized by these mature, high-generating businesses.

The predictable demand for its extensive portfolio of legacy and specialty chemical products allows for optimized operational efficiency, minimizing the need for substantial reinvestment. This focus on cost management, coupled with consistent sales, translates into robust and reliable cash flow generation for Azelis. For instance, the company’s performance in Q1 2024 showed continued resilience in its core specialty distribution business.

These mature business lines, while exhibiting lower growth rates, are highly profitable due to established market positions and efficient supply chains. Azelis effectively leverages its logistical expertise and extensive principal relationships to maximize cash generation from these foundational segments. The company’s 2024 financial reports consistently pointed to these areas as key contributors to its overall profitability and cash flow.

| Segment | Market Maturity | Key Characteristics | Cash Flow Generation |

| Industrial Chemicals (EMEA/Americas) | Mature | Long-standing principal relationships, wide customer reach, stable demand | High and consistent |

| Legacy & Semi-Specialty Chemicals | Mature | Broad market acceptance, predictable demand profile, foundational materials | Substantial and reliable |

| European Market Operations | Mature | Deep customer relationships, extensive logistical networks, established infrastructure | Robust and predictable |

Preview = Final Product

Azelis BCG Matrix

The Azelis BCG Matrix preview you are currently viewing is the identical, fully comprehensive document you will receive upon purchase. This means no watermarks or placeholder content; you'll get the complete, professionally formatted strategic analysis ready for immediate application.

Dogs

Azelis might identify certain highly specialized industrial chemical product lines as Dogs within its portfolio. These are likely segments serving stagnant or declining niche markets where Azelis has a minimal market share. For instance, a product line focused on a specific type of industrial dye used in a shrinking textile sector could fall into this category.

These underperforming lines might be characterized by low profitability, potentially breaking even or even incurring losses. In 2024, Azelis reported that while its specialty chemicals segment saw robust growth, certain legacy industrial chemical offerings continued to face margin pressures due to oversupply and weak demand in their specific end-markets. These segments may consume valuable capital and management focus that could be redirected to more promising growth areas.

Geographical overlap from suboptimal acquisitions can be a significant concern for companies like Azelis. If past acquisitions haven't resulted in clear synergies or substantial market share gains, they might represent areas for divestiture or restructuring. For instance, if Azelis acquired two companies that both had strong presences in the same European region without a clear strategic advantage, it could lead to inefficiencies.

Such overlaps can manifest as duplicated sales forces, marketing efforts, and distribution networks, ultimately diluting profitability. In 2024, Azelis's focus on integrating its numerous acquisitions means scrutinizing these overlaps is crucial. For example, if a 2023 acquisition in the Benelux region significantly overlaps with an existing Azelis operation there, and the combined market share hasn't improved demonstrably, that segment might be a candidate for streamlining.

Outdated or less specialized formulations within Azelis' portfolio, particularly those not aligning with the growing demand for sustainable solutions, represent a classic 'Dog' category. For instance, if Azelis still heavily relies on traditional chemical ingredients for personal care products while the market increasingly seeks biodegradable or plant-based alternatives, these older formulations would fall into this quadrant. This is especially true if Azelis holds a weak market position in these specific niche segments.

These types of products often experience shrinking sales volumes and minimal revenue growth. In 2024, the specialty chemicals market saw a significant push towards eco-friendly ingredients, with reports indicating that over 60% of consumers are willing to pay more for sustainable products. Formulations that don't meet this demand are at a distinct disadvantage, facing intense competition from innovative, greener alternatives that are gaining market share rapidly.

Segments with High Competition and Low Differentiation

Azelis might encounter "Dog" segments in areas where its specialty chemicals and food ingredients are highly commoditized. Intense price competition and limited opportunities to stand out mean that maintaining a significant market share is difficult, and profitability is often squeezed. For instance, if Azelis operates in a market for basic industrial solvents where numerous suppliers offer very similar products, this would represent a Dog segment. In 2023, the global specialty chemicals market experienced growth, but certain sub-segments, particularly those with lower R&D intensity, faced margin pressures due to increased competition.

These highly competitive, low-differentiation markets are characterized by thin profit margins, making sustained investment a challenge for Azelis. The company's strategy in such areas would likely focus on managing costs efficiently or potentially reducing its exposure. For example, a market for widely available food additives where Azelis' primary competitive lever is price, rather than unique product performance or technical service, would fit this description. The average gross profit margin for distributors in less specialized chemical segments can be significantly lower than in niche markets.

Segments falling into the Dog category for Azelis could include:

- Commoditized industrial chemicals: Markets where Azelis distributes basic chemicals with little to no product innovation or unique service offerings, leading to intense price wars.

- Generic food ingredients: Distribution of common ingredients like standard starches or basic emulsifiers where Azelis faces numerous competitors offering identical products.

- Low-margin personal care bases: Supplying foundational ingredients for personal care products that are widely available from multiple distributors, with differentiation primarily based on price and delivery speed.

Legacy Infrastructure or Operations in Declining Markets

Legacy infrastructure or operations in declining markets, often found in sectors like traditional manufacturing or areas heavily reliant on industries facing structural shifts, can be categorized as dogs within the Azelis BCG Matrix context. These might include older chemical plants or distribution hubs situated in regions experiencing sustained economic downturns or a move away from chemical-dependent economies. For instance, a chemical distribution center in a formerly industrial heartland that has seen significant factory closures might struggle to achieve profitability.

These aging assets can become significant financial burdens. High ongoing maintenance costs, coupled with declining demand and potentially outdated technology, lead to low or negative returns on investment. In 2024, companies are increasingly scrutinizing such assets. For example, a report from S&P Global indicated that capital expenditures on maintaining legacy infrastructure in mature chemical markets remained a significant, yet often underperforming, portion of overall spending for many chemical distributors.

The strategic imperative for these dog assets is clear: a thorough review is essential. Options typically include divestment, selling the underperforming unit to a more specialized or cost-efficient operator, or undertaking a substantial restructuring. Restructuring might involve significant capital investment to modernize the facility or a complete pivot in its operational focus, though the latter is often challenging in declining markets.

- Cost Drain: Legacy sites in shrinking markets may face escalating maintenance expenses without commensurate revenue growth.

- Low Returns: These operations often yield minimal profits, acting as a drag on overall company performance.

- Strategic Imperative: A critical assessment for potential divestment or major operational overhaul is typically required.

- Market Realities: By 2024, many chemical industry segments are seeing a consolidation of older, less efficient facilities in economically challenged regions.

Dogs in Azelis' portfolio represent product lines with low market share in slow-growing or declining industries. These segments often struggle with profitability due to intense competition and lack of differentiation. For example, Azelis might have legacy industrial chemicals serving niche, shrinking markets where its competitive edge is minimal.

These underperforming areas can be a drain on resources. In 2024, Azelis, like many in the specialty chemicals sector, faced margin pressures on less innovative product lines. Such segments consume capital and management attention that could be better allocated to high-growth opportunities, impacting overall financial performance.

Azelis may also identify "Dogs" in areas where its specialty chemicals and food ingredients are highly commoditized, leading to intense price competition and thin profit margins. For instance, distributing basic industrial solvents where differentiation is minimal would fit this description. In 2023, the specialty chemicals market saw growth, but sub-segments with low R&D intensity experienced margin erosion due to increased competition.

The strategic approach for these "Dog" segments typically involves cost management, potential divestment, or restructuring. For Azelis, this means critically evaluating legacy infrastructure or operations in declining markets, such as distribution hubs in economically challenged regions. By 2024, many chemical distributors were scrutinizing such assets due to high maintenance costs and low returns.

| Category | Description | 2024 Market Insight | Potential Azelis Strategy |

|---|---|---|---|

| Commoditized Chemicals | Low market share in basic chemicals with little innovation. | Intense price competition in segments like industrial solvents. | Cost efficiency, potential divestment. |

| Declining Industries | Serving sectors with structural shifts and reduced demand. | Legacy infrastructure in former industrial heartlands faces low returns. | Divestment or significant operational overhaul. |

| Low Differentiation | Products with minimal unique selling propositions. | Market share erosion due to readily available alternatives. | Focus on niche specialization or exit strategy. |

Question Marks

Azelis actively invests in emerging technologies and sustainable innovations, particularly within nascent markets. These forward-thinking initiatives, such as those under the 'Impact 2030' program, are positioned in high-growth sectors but currently hold a small market share.

Significant investment is needed to foster their commercial viability and market penetration. These ventures, while promising for future growth, are currently cash-intensive, reflecting their early-stage development and the inherent risks associated with pioneering new solutions.

Azelis' strategy of frequent, smaller acquisitions, particularly those entering nascent markets or product segments, often positions them to build future strength. For example, their acquisition of Solchem in the nutraceuticals sector and S. Amit Group in India, while strategically sound for geographic and product diversification, likely represent businesses with smaller initial market shares within their specific niches compared to Azelis' more established segments.

These tuck-in acquisitions, though potentially low on the BCG matrix initially due to their niche focus and smaller scale, are crucial for Azelis' long-term growth. They require focused integration and investment to scale up, aiming to transform these smaller players into significant contributors within their respective growing markets.

Azelis' strategic push into untapped geographic regions, particularly in Asia-Pacific and Latin America, signifies its Stars quadrant initiative. These emerging markets, characterized by robust economic growth and increasing demand for specialty chemicals and food ingredients, present significant opportunities. For instance, Azelis reported strong growth in its Asia Pacific segment in 2023, driven by new business wins and market penetration efforts.

Entering these less-penetrated territories demands considerable upfront capital for establishing local infrastructure, hiring specialized talent, and building brand awareness. This investment phase, typical for Stars, carries inherent risks but promises substantial long-term rewards. The company's focus on these markets aligns with its strategy to diversify revenue streams and capture early market share in high-potential areas.

Digitalization of Customer Experience & Supply Chain

Digitalization of customer experience and supply chain initiatives within Azelis, while generally a Star, can also contain elements that resemble a Question Mark. These are typically newer, cutting-edge digital projects focused on enhancing customer engagement or optimizing supply chain operations that are in their nascent stages. For example, advanced AI-driven personalization for customer interactions or blockchain-based supply chain transparency might be in early testing phases.

These nascent digital ventures require significant upfront investment in research and development, as well as the complex process of implementation. While they hold the potential for substantial future market leadership and increased efficiency, they currently lack widespread adoption and, consequently, immediate, substantial market share gains. Their success hinges on effectively scaling these innovative solutions.

- Emerging AI for Customer Personalization: Azelis might be exploring AI tools to offer highly tailored product recommendations and support, a strategy still in its early adoption phase.

- Blockchain for Supply Chain Traceability: Implementing blockchain technology to provide end-to-end visibility and traceability in its complex supply chain is a promising but nascent digital endeavor.

- Investment in Digital Transformation: In 2024, Azelis continued to invest heavily in digital infrastructure and talent, with a significant portion allocated to these developing customer and supply chain technologies.

Specialized Ingredients for Future-Oriented Industries

Azelis is actively developing and distributing highly specialized ingredients crucial for emerging sectors like advanced materials and bio-based chemicals. These future-oriented industries represent significant growth potential, though Azelis' current market share in these specific niches remains relatively low. For instance, in the rapidly expanding field of sustainable packaging, which saw global market value reach an estimated USD 275.8 billion in 2023 and is projected to grow substantially, Azelis is focusing on innovative bio-polymers and compostable additives.

These ventures are inherently high-risk, high-reward, demanding substantial investment to secure a competitive edge. Azelis' strategy involves targeted R&D and strategic partnerships to build a strong market position before competitors solidify their dominance. The company's investment in areas like biodegradable surfactants for eco-friendly cleaning products, a market segment experiencing double-digit annual growth, exemplifies this approach.

- Focus on Advanced Materials: Azelis is increasing its portfolio of specialized additives for high-performance polymers used in electric vehicles and aerospace, industries with projected compound annual growth rates exceeding 15% through 2030.

- Bio-Based Chemicals for Niche Applications: The company is expanding its offerings of bio-derived solvents and specialty ingredients for the pharmaceutical and cosmetic sectors, where demand for sustainable and natural components is soaring.

- Market Share Growth Strategy: Azelis is prioritizing market penetration in these nascent sectors through dedicated sales teams and technical support, aiming to capture a significant portion of the projected multi-billion dollar market growth by 2028.

- Investment in Innovation: Significant capital is being allocated to research and development for novel ingredients that address future regulatory requirements and consumer preferences for sustainability and performance.

Azelis' Question Marks represent their investments in new, high-potential markets or technologies where their current market share is minimal. These ventures, like their exploration into advanced bio-based chemicals for niche applications, require substantial investment to gain traction. In 2024, Azelis continued to allocate significant capital towards these emerging areas, aiming to build future market leadership.

These initiatives, while promising, are cash-intensive and carry inherent risks due to their early stage. For example, their focus on sustainable packaging additives, a market projected for substantial growth, is a prime example of a Question Mark. Azelis is strategically investing in R&D and partnerships to establish a strong foothold before competitors dominate.

The company's digital transformation efforts, particularly in AI for customer personalization and blockchain for supply chain transparency, also fall into this category. These nascent digital projects are undergoing early testing and implementation, demanding upfront investment without immediate, widespread adoption. Their success hinges on Azelis' ability to scale these innovative solutions effectively.

Azelis' strategic acquisitions of smaller companies in nascent sectors, such as nutraceuticals or specific geographic regions like India, also initially position them as Question Marks. While these tuck-in acquisitions are crucial for diversification, they require focused integration and investment to grow their market share within their respective niches.

BCG Matrix Data Sources

Our Azelis BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.