Ayvens PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayvens Bundle

Navigate the complex external forces shaping Ayvens's future with our comprehensive PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic direction. Gain a critical advantage by leveraging these expert insights to refine your own market approach. Download the full analysis now for actionable intelligence that drives informed decision-making.

Political factors

Governments worldwide are actively promoting electric vehicle (EV) adoption through substantial tax credits and subsidies, a trend that directly supports Ayvens' strategic shift towards greener fleet offerings. For instance, the United States federal EV tax credit, which can significantly lower the total cost of ownership for leased EVs, makes them a more compelling option for Ayvens' clients.

These financial incentives are crucial in making EVs more accessible and cost-effective, thereby boosting demand for Ayvens' sustainable fleet solutions. However, the dynamic nature of these policies, such as the potential expiration of the US federal EV tax credit in September 2025, introduces an element of uncertainty that requires careful consideration for long-term fleet management and investment strategies.

Governments worldwide are tightening vehicle emission standards, with new multi-pollutant regulations set for light-duty and medium-duty vehicles. For instance, the U.S. Environmental Protection Agency (EPA) and the California Air Resources Board (CARB) are implementing increasingly strict rules for model years starting in 2027.

These evolving regulations are a significant driver pushing fleet operators, including companies like Ayvens, to transition towards vehicles with lower or zero emissions. This regulatory push directly supports Ayvens' strategic objectives for decarbonizing its mobility offerings.

Global trade policies and geopolitical tensions significantly influence Ayvens' operations by affecting vehicle supply chains and manufacturing expenses. For instance, ongoing trade disputes and sanctions can disrupt the availability of essential components, particularly for electric vehicles (EVs), and consequently impact vehicle pricing strategies.

In 2024, the automotive industry continued to grapple with supply chain vulnerabilities exacerbated by geopolitical events. For example, the conflict in Eastern Europe led to shortages of key raw materials like palladium and neon, critical for semiconductor production, which in turn affected vehicle manufacturing output and availability for leasing companies like Ayvens.

To counter these risks, Ayvens must maintain agile procurement and diversify its sourcing channels. This strategy helps ensure a steady supply of vehicles and components, mitigating the impact of localized disruptions or sudden policy shifts.

Public Procurement and Fleet Requirements

Public sector tenders and large corporate contracts are increasingly mandating sustainable fleet operations and Environmental, Social, and Governance (ESG) disclosures. This shift directly benefits mobility providers like Ayvens that can showcase strong environmental performance and transparent ESG reporting. For instance, in the EU, public procurement rules are evolving to prioritize green vehicles and services, with many member states setting ambitious targets for zero-emission fleets by 2030.

Ayvens is strategically positioned to capitalize on this trend. Their commitment to sustainable mobility, including the expansion of their electric vehicle (EV) offering and investment in charging infrastructure, aligns perfectly with these evolving procurement criteria. As of early 2025, Ayvens reported a significant increase in demand for EV leasing solutions from both public and private sector clients, reflecting this growing market preference.

This focus on sustainability in procurement presents a clear opportunity for Ayvens to secure larger contracts and strengthen its market position. Key aspects include:

- Government Mandates: Many governments are setting targets for fleet electrification, influencing public procurement decisions. For example, the UK government aims for all new public sector vehicle procurements to be zero-emission by 2027.

- Corporate ESG Goals: Large corporations are integrating ESG criteria into their supply chain management, favoring leasing partners with strong sustainability credentials.

- Ayvens' EV Portfolio: Ayvens' expanding range of electric and hybrid vehicles, coupled with comprehensive charging and maintenance services, directly addresses these requirements.

- ESG Reporting: Ayvens' commitment to robust ESG reporting enhances its appeal to organizations that need to demonstrate compliance and responsible business practices to stakeholders.

Regulatory Stability Post-Merger

The regulatory landscape for Ayvens, formed from the merger of ALD Automotive and LeasePlan, is a key political factor. The ongoing IT and legal integration across numerous countries necessitates strict adherence to competition laws and financial regulations. For instance, in 2024, the European Commission's scrutiny of large mergers highlights the importance of clear compliance frameworks. Ayvens' success hinges on navigating these diverse regulatory environments smoothly.

Ensuring consistent compliance with local and international financial regulations is paramount for Ayvens. This includes adapting to evolving data privacy laws, such as GDPR, which impacts customer data management across its operations. By 2025, regulatory bodies are expected to further emphasize data security and cross-border data flow compliance, making this a critical area for Ayvens.

- Competition Law Compliance: Ayvens must ensure its operational scale post-merger does not create anti-competitive practices in key markets, a focus for regulators in 2024.

- Financial Services Regulation: Adherence to banking and financial services regulations in all operating jurisdictions is essential for Ayvens' stability and growth.

- Data Privacy and Security: Compliance with evolving data protection laws, like GDPR, is critical for Ayvens' customer trust and operational integrity.

Government incentives for electric vehicle (EV) adoption, such as tax credits and subsidies, directly benefit Ayvens by making greener fleet options more attractive to clients. For example, continued US federal EV tax credits, potentially extended beyond 2025, bolster the cost-effectiveness of leased EVs.

Stricter vehicle emission standards, like those being implemented by the EPA and CARB from model year 2027, compel fleet operators to transition to lower-emission vehicles, aligning with Ayvens' sustainability goals.

Public sector and corporate procurement increasingly mandate sustainable operations and ESG compliance, creating opportunities for Ayvens, particularly with its growing EV portfolio and transparent reporting, as seen in the EU's push for zero-emission fleets by 2030.

Navigating diverse regulatory environments, including competition and financial services laws, is critical for Ayvens post-merger, with a strong emphasis on data privacy like GDPR by 2025.

| Political Factor | Impact on Ayvens | Example/Data (2024-2025) |

|---|---|---|

| EV Subsidies & Tax Credits | Increases demand for green fleet solutions | US federal EV tax credit (potential extension beyond 2025) |

| Emission Standards | Drives transition to low/zero-emission vehicles | EPA/CARB regulations from MY2027 |

| Public Procurement Mandates | Opens doors for sustainable fleet contracts | EU targets for zero-emission fleets by 2030; UK public sector EV procurement by 2027 |

| Regulatory Integration & Compliance | Requires adherence to competition, financial, and data privacy laws | European Commission merger scrutiny (2024); GDPR compliance focus (2025) |

What is included in the product

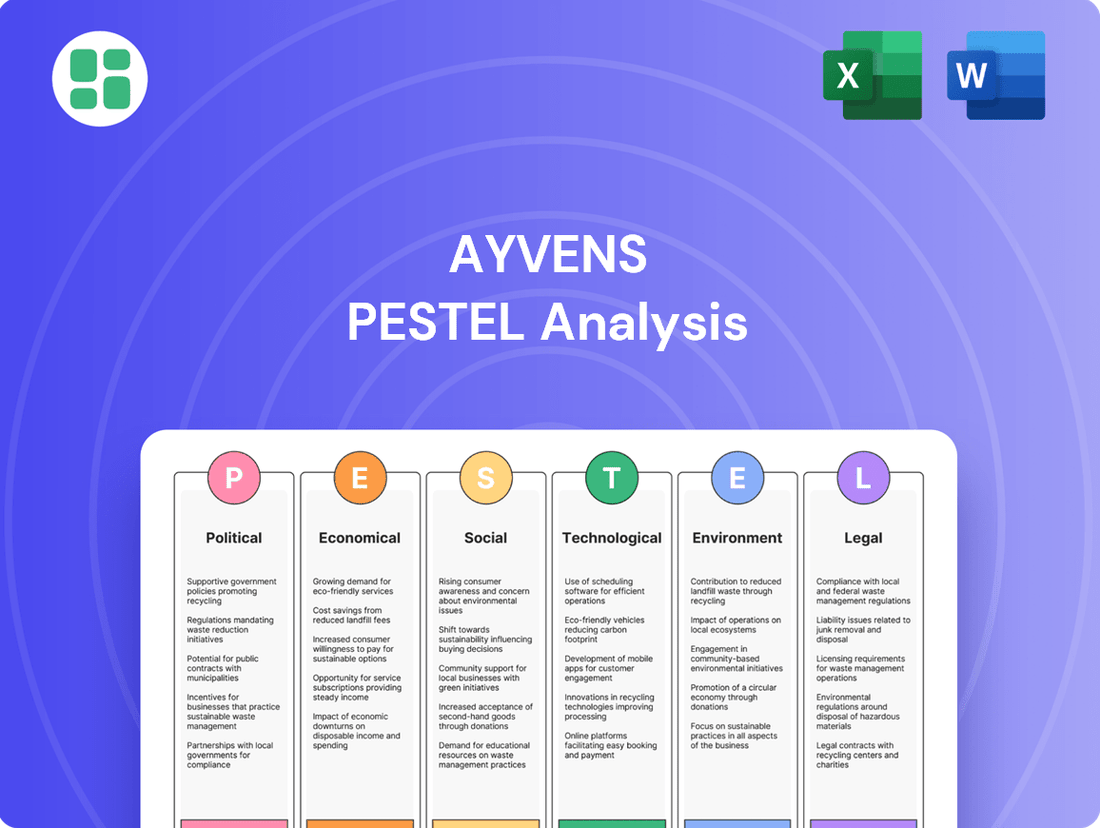

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ayvens, covering Political, Economic, Social, Technological, Environmental, and Legal aspects to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic application.

Economic factors

Changes in global interest rates directly affect Ayvens' financing costs for vehicle leases and overall business operations. Higher rates mean increased borrowing expenses for both Ayvens and its customers, which can dampen demand for leasing.

While interest rates saw a minor dip towards the end of 2024, projections suggest further reductions in 2025, potentially creating a more favorable market environment for leasing services.

Ongoing inflationary pressures significantly impact Ayvens' operational costs. For instance, new vehicle acquisition prices saw a notable increase in late 2023 and early 2024 due to supply chain issues and higher manufacturing input costs, directly affecting fleet leasing expenses. Maintenance and insurance premiums have also risen, with some insurance markets experiencing double-digit percentage increases by mid-2024.

Effective cost management is therefore paramount for Ayvens to maintain profitability and competitive pricing in the leasing sector. The company's strategic focus on cost control, including optimizing procurement and operational efficiencies, is crucial. Realizing synergies from the merger with LeasePlan, aiming for €300 million in cost savings by 2025, becomes even more vital in this challenging economic climate to offset these rising expenditures.

The used car market's performance is a critical factor for Ayvens, directly influencing residual value risk and the profitability of vehicle remarketing. A return to more normal market conditions in 2024 has helped stabilize margins.

However, ongoing fluctuations in used car prices, particularly across different powertrain types, necessitate continuous and proactive observation. For instance, while overall used car prices saw a slight dip in early 2024 compared to the previous year, the trend for electric vehicles (EVs) has been notably different.

EVs are demonstrating more robust residual values than internal combustion engine (ICE) vehicles, a trend that Ayvens must actively monitor as it impacts fleet management and remarketing strategies. Data from early 2024 indicated that while the average used car price might be softening, the depreciation rate for EVs was often less pronounced.

Global Economic Growth and Consumer Spending

Global economic growth and consumer spending are critical drivers for Ayvens, as they directly influence the demand for new vehicle leases and flexible mobility solutions. A sluggish economic climate, particularly in Europe where new car registrations have not yet recovered to pre-pandemic figures, poses a significant hurdle for expanding fleet sizes.

For instance, in 2023, new car registrations in the European Union saw a notable increase of 10.5% compared to 2022, reaching 10.5 million units, yet this figure remained 18.2% below 2019 levels. This underscores the ongoing challenge of returning to pre-COVID fleet expansion.

- Subdued Economic Environment: Continued economic uncertainty and inflation in key markets can dampen consumer and business confidence, impacting leasing demand.

- Vehicle Registration Trends: European new car registrations in 2024 are projected to continue their recovery, but the pace might be uneven across different countries, affecting fleet acquisition strategies.

- Consumer Spending Power: Inflationary pressures and interest rate hikes can reduce disposable income, potentially shifting consumer preferences towards more affordable mobility options or delaying new vehicle leases.

- Fleet Growth Ambitions: Ayvens is targeting a return to fleet growth in 2025, a goal contingent on a more stable economic outlook and successful execution of its partnership and market positioning strategies.

Investment in Sustainable Mobility

The global push towards sustainable mobility is significantly reshaping the automotive and financial sectors. Investment in electric vehicle (EV) infrastructure, charging networks, and green technologies is accelerating, creating both substantial capital demands and new revenue avenues.

Ayvens, as a major player in vehicle leasing and mobility services, faces this dynamic directly. The company's strategic expansion of its EV fleet and investment in supporting digital platforms are crucial for meeting evolving customer preferences and regulatory landscapes. This requires considerable upfront capital expenditure, which is a key consideration for financial planning and operational strategy.

However, these investments are not merely costs; they represent a strategic alignment with growing market demand. By embracing sustainable mobility, Ayvens is positioning itself to capture future revenue streams and enhance its competitive advantage in a rapidly transforming industry. For instance, the European Union's Fit for 55 package aims for a 100% reduction in CO2 emissions for new cars and vans by 2035, underscoring the long-term imperative for such investments.

- EV Market Growth: Global EV sales are projected to reach over 15 million units in 2024, a significant increase from previous years, indicating strong consumer adoption and the need for related infrastructure investment.

- Infrastructure Investment: Governments and private entities are pouring billions into charging infrastructure; for example, the US Bipartisan Infrastructure Law allocated $7.5 billion for EV charging stations.

- Fleet Electrification: Ayvens' commitment to electrifying its fleet is a direct response to corporate sustainability goals and increasing demand for green fleet solutions from businesses.

- Digital Solutions: Investment in digital tools for managing EV fleets, optimizing charging, and enhancing customer experience is becoming critical for operational efficiency and service differentiation.

Economic factors significantly influence Ayvens' operational costs and market demand. Rising inflation impacts everything from vehicle acquisition to maintenance, while fluctuating interest rates affect financing expenses. The used car market's stability, particularly for EVs, directly impacts residual value risk and remarketing profitability.

A subdued global economic environment and uneven recovery in new vehicle registrations, especially in Europe, present challenges for fleet growth. Consumer spending power, eroded by inflation and interest rates, can shift demand towards more affordable mobility solutions.

Ayvens aims for fleet growth in 2025, contingent on a more stable economic outlook and strategic market positioning. The company's success hinges on managing costs effectively and adapting to evolving market dynamics.

| Economic Factor | 2024/2025 Trend/Projection | Impact on Ayvens |

|---|---|---|

| Interest Rates | Minor dip end of 2024, projected further reduction in 2025 | Lower financing costs, potentially increased leasing demand |

| Inflation | Ongoing pressure on operational costs (vehicles, maintenance, insurance) | Increased expenses, need for cost management and efficiency gains |

| Used Car Market | Stabilizing in 2024, EV residual values generally stronger | Impacts residual value risk and remarketing profitability; strategic monitoring needed |

| Economic Growth/Consumer Spending | Subdued in key markets, uneven recovery in new car registrations | Dampened demand for new leases, potential shift to affordable mobility |

Preview Before You Purchase

Ayvens PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ayvens PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate insight into the strategic landscape affecting Ayvens.

Sociological factors

Societal attitudes are evolving, with a noticeable move away from individual car ownership. Younger demographics, in particular, are embracing flexible, sustainable transportation, like car-sharing and subscription models. This shift prioritizes affordability and environmental consciousness over the traditional notion of owning a car.

In 2024, the global car subscription market is projected to reach over $10 billion, indicating a strong consumer interest in alternatives to outright purchase. This trend is fueled by concerns over urban congestion and the rising costs associated with vehicle maintenance and insurance, making flexible mobility solutions increasingly attractive.

Public awareness and concern regarding climate change are escalating, significantly shaping consumer and business decisions toward more environmentally friendly choices. Surveys in 2024 indicated that over 60% of consumers consider sustainability when making purchasing decisions, with a growing segment willing to pay more for eco-conscious products.

This heightened societal value placed on environmental responsibility directly fuels demand for Ayvens' sustainable mobility solutions, including electric vehicle leasing and the management of low-emission fleets. For instance, Ayvens reported a 45% year-over-year increase in demand for its EV leasing options in early 2025, reflecting this powerful trend.

Consumers and clients are increasingly scrutinizing the Environmental, Social, and Governance (ESG) performance of companies. A 2024 survey by Accenture found that 73% of consumers are more likely to buy from companies with strong sustainability practices. This growing demand means businesses like Ayvens must demonstrate clear commitments to social responsibility to maintain brand loyalty and attract new customers.

Companies that actively invest in ESG initiatives, such as robust employee well-being programs and equitable labor standards, are finding themselves more appealing across the board. This includes not only customers but also potential employees and investors. For instance, in 2024, companies with high ESG ratings saw their stock prices outperform those with lower ratings by an average of 5%, according to a study by Morgan Stanley.

Ayvens' comprehensive ESG strategy, which includes a strong focus on decarbonization, directly addresses this societal shift. This holistic approach not only bolsters its reputation but also positions it favorably in a market where ethical business practices are becoming a key differentiator, enhancing its overall brand appeal and competitive edge.

Urbanization and Congestion

Growing urbanization is a significant driver for Ayvens' business. As more people move into cities, traffic congestion becomes a major issue. This naturally increases the demand for transportation solutions that are efficient, space-saving, and kind to the environment. Ayvens' focus on shared mobility and smart fleet management directly addresses these urban challenges, offering alternatives to traditional car ownership.

Cities worldwide are actively seeking ways to manage this growth. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, according to the United Nations. This escalating urban density necessitates innovative approaches to mobility.

- Increased Urban Population: Global urbanization continues, with a higher percentage of people residing in cities, leading to greater demand for efficient transportation.

- Traffic Congestion: Densely populated urban centers experience significant traffic, prompting a need for space-saving and time-efficient mobility solutions.

- Demand for Eco-Friendly Options: Urban dwellers and city planners are prioritizing sustainable transport, boosting the appeal of electric and shared mobility services.

- Policy Support: Many cities are implementing policies to encourage shared mobility and reduce private vehicle use, creating a favorable environment for Ayvens' offerings.

Workforce Mobility and Employee Benefits

Companies are increasingly viewing mobility as a key employee benefit, especially for talent retention. In 2024, a significant portion of employees, particularly younger generations, prioritize flexible and sustainable commuting options. This trend is driving demand for services like those Ayvens offers, which provide access to modern, eco-friendly vehicles through leasing and subscription models. For instance, the demand for electric vehicles (EVs) within corporate fleets has surged, with many companies setting ambitious EV targets for the coming years.

These evolving corporate needs are directly addressed by comprehensive mobility providers. Offering a diverse fleet, including electric and hybrid vehicles, alongside flexible leasing or subscription plans, enhances employee satisfaction and reinforces a company's commitment to sustainability. This approach not only attracts top talent but also aligns with Environmental, Social, and Governance (ESG) objectives, a critical factor in today's business landscape. By integrating sustainable mobility into their benefits packages, businesses can expect to see improvements in employee morale and a stronger employer brand.

- Employee Expectations: Surveys in late 2024 indicated that over 60% of employees in major European markets consider sustainable transportation options when evaluating job offers.

- Corporate Sustainability Goals: Many organizations are aiming for 30-50% of their fleet to be electric or plug-in hybrid by 2025, pushing demand for flexible fleet solutions.

- Talent Attraction & Retention: Companies offering advanced mobility benefits report a 15-20% higher success rate in attracting skilled professionals compared to those with traditional benefits.

- Cost Efficiency: While initial investment in EVs can be higher, total cost of ownership, including fuel and maintenance savings, is becoming increasingly attractive for businesses over the lease term.

Societal shifts are profoundly influencing mobility choices. A growing preference for flexible, subscription-based transportation over traditional ownership is evident, particularly among younger demographics. This trend is amplified by increasing environmental awareness and the desire for cost-effective solutions.

The global car subscription market is a testament to this, projected to exceed $10 billion in 2024. Concerns about urban congestion and the escalating costs of vehicle upkeep are making these flexible mobility models more appealing. Furthermore, over 60% of consumers consider sustainability in their purchasing decisions as of 2024, directly supporting Ayvens' eco-friendly offerings.

| Sociological Factor | Trend Description | Impact on Ayvens | Supporting Data (2024/2025) |

|---|---|---|---|

| Shift from Ownership to Usership | Preference for flexible, subscription-based mobility | Increased demand for Ayvens' leasing and subscription services | Car subscription market projected to exceed $10 billion in 2024 |

| Environmental Consciousness | Growing consumer concern for sustainability | Boosts demand for Ayvens' EV and low-emission fleet solutions | 60%+ consumers consider sustainability in purchases (2024) |

| Urbanization | Increasing urban populations and congestion | Drives need for efficient, shared mobility solutions like Ayvens offers | 68% global population to live in urban areas by 2050 (UN projection) |

| Employee Mobility Expectations | Demand for sustainable and flexible commuting benefits | Positions Ayvens as an attractive partner for corporate clients | 60%+ employees in Europe consider sustainable transport in job offers (late 2024) |

Technological factors

The digital fleet management landscape is rapidly evolving, with AI, machine learning, telematics, and IoT becoming integral. These technologies are revolutionizing how fleets operate by offering real-time tracking, predictive maintenance, and optimized routing. For instance, telematics data can reduce fuel consumption by up to 15% through better driving behavior monitoring.

These advancements translate into substantial operational efficiencies and cost reductions for businesses. Predictive maintenance alone can cut unscheduled downtime by as much as 30%, a critical factor for companies relying on consistent fleet availability. Ayvens is well-positioned to capitalize on these trends by offering sophisticated digital fleet solutions that enhance client operations and profitability.

Continuous advancements in battery technology, charging infrastructure, and EV performance are making electric vehicles more viable and attractive. For instance, by early 2024, average EV battery costs have fallen to approximately $150 per kWh, a significant drop from previous years, enabling more affordable EV models.

Increased battery range, faster charging times, and reduced costs are accelerating EV market growth. By the end of 2023, the global EV market share reached over 15%, a substantial increase from just 4% in 2020, demonstrating this trend.

Ayvens aims for 50% of its new car deliveries to be EVs by 2026, reflecting its strategic commitment to this evolving technological landscape and the broader transition to greener mobility solutions.

The increasing number of connected vehicles is a significant technological driver, creating massive datasets. This data, covering everything from driver habits to vehicle maintenance needs, is invaluable. For instance, in 2024, the global connected car market was valued at over $80 billion, with projections indicating substantial growth driven by these data capabilities.

Ayvens can leverage this influx of information to refine its service offerings. By analyzing telematics data, the company can provide more personalized fleet management solutions, predict maintenance needs before they become critical issues, and ultimately boost operational efficiency. This data-centric approach is key to unlocking new digital services and enhancing customer value.

Ultimately, harnessing data analytics is fundamental for maximizing fleet productivity and promoting sustainability. Insights derived from connected vehicle data allow for optimized routing, reduced fuel consumption, and better management of vehicle lifecycles, contributing to Ayvens' strategic goals in a data-driven environment.

Development of Autonomous Vehicle Technology

The evolution of autonomous vehicle technology, while still nascent for widespread commercial fleet deployment, presents a significant long-term technological factor for fleet management and vehicle leasing. As these systems become more sophisticated, they are projected to reshape operational efficiencies and business models within the sector.

The increasing capabilities of autonomous driving could unlock new service avenues and potentially decrease operational expenses by reducing reliance on human drivers. Furthermore, altered vehicle utilization patterns are anticipated as autonomous fleets could operate more consistently, impacting leasing agreements and fleet optimization strategies. Ayvens must proactively track these advancements to ensure its future service offerings remain competitive and relevant in a changing landscape.

By 2024, significant investments continue to pour into autonomous vehicle research and development, with major automotive manufacturers and tech companies dedicating billions. For instance, Waymo, a leader in autonomous driving, has been expanding its driverless ride-hailing services in select cities, demonstrating tangible progress. This ongoing innovation suggests that the disruption to traditional fleet management, including leasing, is not a question of if, but when.

- Increased Investment: Global spending on autonomous vehicle technology is projected to reach hundreds of billions by the end of the decade, fueling rapid innovation.

- Service Expansion: Autonomous capabilities could enable new fleet services like on-demand autonomous delivery or specialized logistics solutions.

- Cost Reduction Potential: Reduced labor costs associated with drivers could significantly alter the economics of fleet operations and leasing.

- Utilization Optimization: Autonomous vehicles may allow for higher vehicle uptime, leading to revised leasing structures based on mileage or operational hours rather than fixed terms.

Cybersecurity and Data Privacy in Digital Solutions

As fleet management increasingly relies on digital and data-driven solutions, cybersecurity and data privacy are critical concerns. Protecting sensitive client and vehicle information is essential for maintaining trust and avoiding significant legal penalties. For instance, the global cybersecurity market was projected to reach $270 billion in 2024, highlighting the significant investment in this area. Ayvens must prioritize secure platforms to safeguard its data assets.

The evolving landscape of data privacy regulations, such as GDPR and CCPA, necessitates strict adherence. Non-compliance can lead to substantial fines; in 2023, GDPR fines exceeded €200 million across the EU. Ayvens' commitment to robust data protection measures directly impacts its operational integrity and reputation. Investing in secure digital infrastructure is therefore not just a technical requirement but a strategic imperative for sustained business operations and client confidence.

- Cybersecurity Investment: Global cybersecurity spending is expected to exceed $270 billion in 2024, underscoring the industry's focus on digital protection.

- Data Privacy Compliance: GDPR fines alone surpassed €200 million in 2023, emphasizing the financial risks of data breaches and non-compliance.

- Trust and Reputation: Secure data handling is fundamental to maintaining client trust and Ayvens' corporate reputation in the digital fleet management space.

- Legal and Regulatory Risks: Adherence to evolving data privacy laws is crucial to mitigate legal challenges and financial penalties.

Technological advancements are reshaping fleet management, with AI, IoT, and telematics offering real-time insights for optimized routing and predictive maintenance, potentially cutting fuel costs by up to 15% and reducing downtime by 30%. The surge in connected vehicles, valued at over $80 billion in 2024, generates vast datasets that Ayvens can leverage for personalized services and enhanced efficiency.

The accelerating adoption of electric vehicles (EVs), supported by falling battery costs (around $150/kWh by early 2024) and increased market share (over 15% by end of 2023), aligns with Ayvens' goal of 50% EV deliveries by 2026, driving a greener mobility transition.

While still developing, autonomous vehicle technology promises long-term disruption, potentially lowering operational costs and altering utilization patterns, prompting proactive tracking by Ayvens amidst billions invested in R&D by major players.

Crucially, robust cybersecurity and data privacy are paramount, with global cybersecurity spending projected at $270 billion in 2024 and significant GDPR fines (over €200 million in 2023) underscoring the need for secure platforms to maintain client trust and regulatory compliance.

Legal factors

Governments globally are tightening rules on vehicle emissions and fuel economy. For instance, the US Environmental Protection Agency (EPA) is implementing multi-pollutant emission standards starting in 2027, and California's Air Resources Board (CARB) has similar stringent requirements. These regulations directly impact fleet operators, pushing them, and consequently leasing companies like Ayvens, towards a greater adoption of low and zero-emission vehicles.

Failure to comply with these evolving environmental mandates can result in significant financial penalties and harm a company's public image. Ayvens, as a major player in vehicle leasing, must proactively adapt its fleet offerings to meet these stricter standards, ensuring it remains competitive and compliant in a rapidly changing regulatory landscape.

New legal frameworks like the EU's CSRD and the UK SRS are making ESG reporting compulsory for more businesses. These rules demand thorough reporting on environmental impact, social factors, and governance, directly influencing how Ayvens must disclose its fleet's CO2 emissions and sustainability initiatives.

Vehicle safety and road transport regulations are a cornerstone for fleet management companies like Ayvens. Ongoing legal requirements concerning vehicle safety standards, driver working hours, and general road transport operations, such as tachograph regulations for commercial vehicles in Europe, directly influence how Ayvens manages its extensive fleet. For instance, the EU's General Safety Regulation (GSR) mandates advanced driver-assistance systems (ADAS) in new vehicles, impacting procurement and maintenance strategies.

Ayvens must meticulously ensure its fleet and all associated services adhere to these stringent safety and operational regulations across every market it operates within. Non-compliance can lead to significant fines, operational disruptions, and reputational damage. In 2023, the European Transport Safety Council reported that while road fatalities in the EU decreased, specific areas still require enhanced safety measures, underscoring the critical nature of these regulations.

Strict adherence to these legal frameworks is not merely a matter of avoiding penalties; it is absolutely crucial for effective risk management and ensuring the uninterrupted continuity of Ayvens' operations. Maintaining a compliant fleet safeguards both the company and its customers, reinforcing trust and operational stability in a highly regulated industry.

Data Protection and Privacy Laws

The collection and utilization of vehicle telematics and driver data by Ayvens in its digital fleet management solutions are heavily regulated by data protection and privacy laws. Adherence to frameworks like the General Data Protection Regulation (GDPR) is paramount. Ayvens must ensure its data handling is transparent, secure, and fully compliant with all applicable legislation to safeguard client and driver information. Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Ayvens' commitment to data privacy is crucial for maintaining trust and operational integrity. This involves implementing robust security measures and clear consent protocols for data collection and processing. As of 2024, the global data privacy software market is projected to reach over $3 billion, indicating the growing importance and complexity of these regulations for businesses like Ayvens.

- GDPR Compliance: Ayvens must ensure all telematics data collection and processing activities align with GDPR principles, including lawful basis, purpose limitation, and data minimization.

- Data Security: Implementing advanced encryption and access controls is essential to protect sensitive driver and vehicle data from breaches.

- Transparency: Clear communication with clients and drivers regarding what data is collected, why, and how it is used is a legal and ethical requirement.

- Cross-border Data Transfers: Ayvens needs to manage international data transfers carefully, ensuring compliance with regulations governing the movement of personal data across different jurisdictions.

Anti-Trust and Competition Regulations Post-Merger

Following the significant merger that created Ayvens, the company is under the watchful eye of anti-trust and competition regulators across numerous jurisdictions. This scrutiny is standard procedure for large consolidations to prevent market dominance.

To gain approval for the merger, Ayvens was compelled to divest specific business units. For instance, in several European markets, the company had to sell off parts of its fleet leasing operations to satisfy competition authorities concerned about reduced choice for customers.

Maintaining robust compliance with existing and evolving competition laws is paramount for Ayvens. This involves actively monitoring market share and ensuring that business practices do not stifle fair competition or lead to monopolistic tendencies.

- Merger Impact: The integration of ALD Automotive and LeasePlan created a global leader in mobility, necessitating regulatory review.

- Divestitures: Ayvens completed divestitures in key markets, such as the sale of its fleet leasing activities in France and Luxembourg, to comply with competition mandates.

- Ongoing Compliance: Continuous adherence to anti-trust regulations is crucial to avoid penalties and maintain market access.

- Market Dynamics: Ayvens must navigate a competitive landscape where preventing anti-competitive behavior is a regulatory priority.

Legal frameworks surrounding vehicle emissions and safety are continually evolving, directly impacting fleet operations. For example, the European Union's General Safety Regulation (GSR) mandates advanced driver-assistance systems (ADAS) in new vehicles, influencing Ayvens' procurement strategies. Similarly, stricter emission standards, like those being implemented by the US EPA from 2027, are pushing leasing companies towards zero-emission vehicle fleets.

Data protection laws, such as the GDPR, significantly affect how Ayvens handles telematics and driver information, with potential fines up to 4% of global turnover for non-compliance. The company must ensure transparent data collection and robust security measures to maintain client trust. The global data privacy software market, projected to exceed $3 billion in 2024, highlights the increasing regulatory focus on this area.

Competition law is also a critical consideration, especially following Ayvens' formation through merger. Regulatory bodies scrutinize such consolidations to prevent market dominance, leading to necessary divestitures in certain markets to ensure fair competition.

| Regulation Area | Key Impact on Ayvens | Example/Data Point |

|---|---|---|

| Emissions Standards | Fleet composition shift towards EVs/low-emission vehicles | US EPA multi-pollutant standards from 2027 |

| Vehicle Safety | Mandatory inclusion of ADAS technology | EU General Safety Regulation (GSR) |

| Data Privacy | Strict protocols for telematics/driver data handling | GDPR fines up to 4% of global turnover |

| Competition Law | Divestitures to ensure market fairness | Sale of operations in France and Luxembourg post-merger |

Environmental factors

Ayvens is actively pursuing decarbonization, aiming for a 20% reduction in overall emissions by 2030 as part of its Net-Zero 2050 commitment. This focus shapes its strategy to promote low-emission vehicle options and assist clients in transitioning their fleets to more sustainable choices.

The company recognizes that achieving its decarbonization targets is fundamental to its ongoing business operations and market standing. This commitment is not just about environmental responsibility but also a critical element of its long-term business strategy and social license to operate.

Ayvens is heavily influenced by the accelerating global adoption of electric vehicles (EVs), a trend driven by environmental concerns and government policies. The company has set an ambitious target: 50% of its new car deliveries are expected to be EVs by 2026. This strategic shift involves a significant expansion of its multi-brand EV offerings and a concerted effort to promote battery electric vehicles (BEVs) to customers.

This focus on EVs directly supports Ayvens' environmental objectives by reducing the overall carbon dioxide (CO2) emissions of its fleet. For instance, in 2023, the company reported that its fleet CO2 emissions averaged 109.5 g/km, a figure that is expected to decrease substantially as EV penetration grows. This commitment aligns with broader European Union targets, which aim for an average CO2 emission reduction for new cars.

Ayvens is increasingly focused on embedding circular economy principles throughout its vehicle lifecycle. This involves responsible sourcing of vehicles, extending their useful life through proactive maintenance and repair, and ensuring efficient recycling at end-of-life. For instance, in 2024, Ayvens reported a 15% increase in the utilization of recycled materials in their vehicle repair processes, aiming to reduce their environmental footprint.

The company's sustainability strategy specifically targets enhanced circularity within its maintenance and repair operations. By prioritizing repair over replacement and optimizing parts management, Ayvens aims to significantly minimize waste generation and conserve valuable resources. Their 2025 projections indicate a further 10% reduction in waste per vehicle serviced, directly contributing to resource efficiency.

Carbon Footprint Reduction Across Value Chain

Ayvens is actively working to shrink its carbon footprint across its entire value chain, addressing Scope 1, 2, and 3 emissions. This commitment involves tackling direct emissions from its vehicle fleet, indirect emissions tied to energy usage, and those originating from its supply chain. The company emphasizes precise emissions reporting and has a defined strategy for decarbonizing its operations.

Key initiatives include:

- Fleet Electrification: Ayvens aims to significantly increase the proportion of electric vehicles (EVs) in its fleet. For instance, by the end of 2024, they targeted having 30% of their new vehicle registrations be electric or plug-in hybrid, a figure they plan to grow substantially by 2025.

- Energy Efficiency: Investments in energy-efficient technologies for their offices and operational sites are ongoing to reduce Scope 2 emissions.

- Supply Chain Engagement: Ayvens is collaborating with its suppliers to encourage sustainable practices and reduce Scope 3 emissions, focusing on areas like vehicle manufacturing and end-of-life management.

Sustainable Infrastructure Development

The expansion of sustainable infrastructure, especially electric vehicle (EV) charging networks, is a fundamental driver for Ayvens' growth in sustainable mobility. As of early 2024, the global EV charging infrastructure market is experiencing rapid growth, with projections indicating continued strong expansion through 2030. Ayvens' strategic investments and partnerships in developing and expanding these charging solutions are paramount to facilitating the widespread adoption of electric fleets.

This necessary infrastructure underpins the seamless operation of EVs, directly impacting Ayvens' ability to offer reliable and efficient leasing services. For instance, the European Union has set ambitious targets for charging point deployment, aiming for a significant increase in public charging stations by 2025 and beyond, which directly benefits Ayvens' operational capabilities in key markets.

- EV Charging Network Growth: The global EV charging infrastructure market was valued at approximately $25 billion in 2023 and is expected to reach over $100 billion by 2030, demonstrating significant investment and expansion.

- Government Initiatives: Many governments worldwide, including those in Europe, are providing substantial subsidies and incentives for the installation of public and private EV charging infrastructure, creating a more favorable environment for fleet electrification.

- Partnership Importance: Ayvens' collaborations with energy providers and infrastructure developers are crucial for building out a robust charging ecosystem, ensuring vehicle uptime and customer satisfaction for their electric fleet offerings.

Environmental regulations are increasingly shaping Ayvens' operational strategy, pushing for a significant reduction in fleet emissions. The company's commitment to decarbonization is evident in its target of a 20% overall emissions reduction by 2030, aligning with its Net-Zero 2050 ambition.

Ayvens is actively promoting electric vehicles (EVs), aiming for 50% of new car deliveries to be EVs by 2026, a move directly influenced by growing environmental awareness and supportive government policies. This strategic pivot is supported by substantial investments in expanding its multi-brand EV offerings and promoting battery electric vehicles.

The company is also integrating circular economy principles, focusing on extending vehicle life through maintenance and recycling, aiming to minimize waste. In 2024, Ayvens reported a 15% increase in recycled material use in repairs, underscoring its commitment to resource efficiency.

The expansion of EV charging infrastructure is critical for Ayvens' sustainable mobility goals, with the global market projected to exceed $100 billion by 2030, reflecting significant growth and investment opportunities. Ayvens' strategic partnerships in this area are vital for supporting its growing electric fleet services.

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable economic databases like the World Bank and IMF, and leading industry-specific market research reports. This comprehensive approach ensures that every political, economic, social, technological, legal, and environmental factor is grounded in accurate and current data.