Ayvens Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayvens Bundle

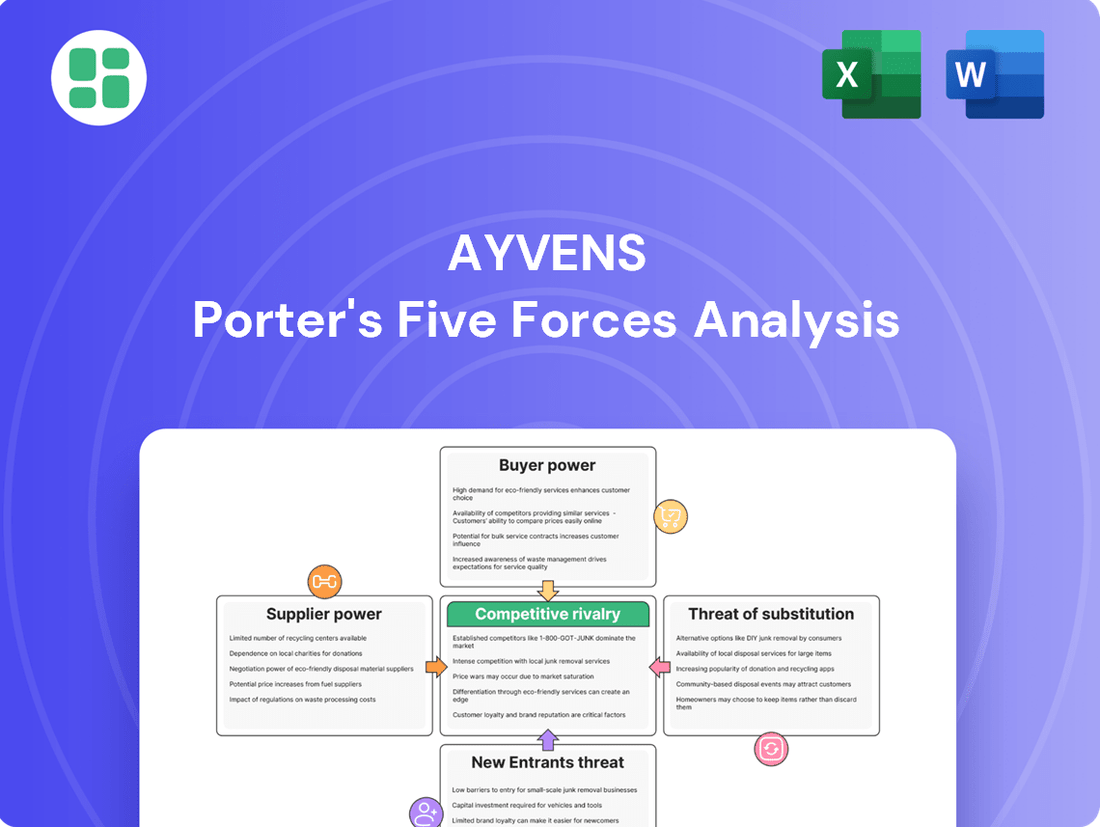

Ayvens's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ayvens’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of vehicle manufacturers, particularly major automotive groups, significantly impacts Ayvens. In 2024, the automotive industry saw continued consolidation, with a few large players like Volkswagen Group, Toyota, and Stellantis accounting for a substantial portion of global vehicle production. This concentration allows them to exert considerable influence over pricing and supply, especially for in-demand models and emerging technologies like electric vehicles, which are critical for Ayvens' fleet renewal and sustainability targets.

Ayvens' strategic approach involves securing long-term supply agreements and fostering close partnerships with Original Equipment Manufacturers (OEMs). These relationships are vital for negotiating favorable pricing, ensuring consistent access to a diverse range of vehicle models, and gaining early access to new technologies. For instance, Ayvens' 2024 fleet acquisition strategies often prioritize manufacturers with whom they have established, multi-year contracts, providing a degree of predictability in vehicle costs and availability.

Technology and software providers hold significant bargaining power over Ayvens, especially those offering specialized telematics and fleet management solutions. The uniqueness of their platforms and the integration required can lead to high switching costs for Ayvens, making it difficult to change providers without substantial disruption and expense. For instance, in 2024, the global fleet management software market was valued at approximately $30 billion, with a compound annual growth rate (CAGR) projected to be around 15% through 2030, indicating a dynamic and competitive yet consolidated supplier landscape in certain niche areas.

Financiers and capital providers hold significant sway over Ayvens, primarily due to its substantial vehicle acquisition requirements. The ability of banks and other lenders to dictate interest rates and loan terms directly influences Ayvens' cost of capital. For instance, in early 2024, global interest rates remained elevated, impacting the cost of financing for large fleet purchases. This power is further amplified by the overall liquidity in financial markets; tighter credit conditions can increase borrowing costs and limit access to necessary funds, thereby affecting Ayvens' profitability and expansion capabilities.

Maintenance and Repair Networks

The bargaining power of maintenance and repair networks for Ayvens' fleet is a significant consideration. Independent garages and authorized service centers can wield influence, particularly if specialized parts or expertise are required for Ayvens' diverse vehicle types. In 2024, the automotive repair industry continued to see consolidation, potentially increasing the leverage of larger service providers.

Factors influencing this power include the standardization of parts; if parts are highly specific to certain vehicle makes or models, it can limit the options and increase supplier power. The availability of skilled labor is also crucial; a shortage of certified technicians for particular vehicle systems can empower those who possess the necessary skills. Ayvens’ extensive fleet, encompassing various brands and models, means it relies on a broad spectrum of service providers.

- Standardization of Parts: The availability of generic versus proprietary parts directly impacts supplier power. For instance, common wear-and-tear items are less likely to grant suppliers significant leverage compared to specialized electronic components.

- Skilled Labor Availability: A 2024 report indicated a growing deficit in skilled automotive technicians, particularly those trained in electric vehicle (EV) maintenance, which could elevate the bargaining power of specialized service providers.

- Geographic Reach: The geographic distribution of authorized dealerships and independent repair shops across Ayvens' operational areas influences the ease with which the company can source services, thereby affecting supplier leverage.

- Parts Supplier Concentration: The market for certain automotive parts, especially those for newer technologies, might be dominated by a few key suppliers, giving them greater pricing and negotiation power.

Insurance Providers

Insurance providers can exert significant bargaining power over Ayvens, particularly as insurance is frequently integrated into their full-service leasing and subscription offerings. This integration means that fluctuations in insurance premiums directly impact Ayvens' operational costs and the attractiveness of their service packages to customers.

The competitive environment among insurance companies plays a crucial role. If the insurance market is consolidated with few major players, these insurers may have greater leverage to dictate terms and pricing. Conversely, a highly competitive insurance market could dilute their power, forcing them to offer more favorable rates to secure business from fleet management companies like Ayvens.

Ayvens' ability to negotiate with insurers is also influenced by their own risk profile and the overall market conditions. Insurers assess the risk associated with the vehicles and drivers managed by Ayvens. For instance, if Ayvens maintains a strong safety record and efficient fleet management, they might command better terms. In 2023, the global automotive insurance market was valued at over $700 billion, indicating the substantial financial weight of these providers.

- Influence on Costs: Insurance premiums are a significant component of Ayvens' bundled service costs, directly affecting profitability and customer pricing.

- Competitive Dynamics: The number and strength of insurance providers available to Ayvens influence their ability to negotiate favorable terms.

- Risk Assessment: Ayvens' operational safety record and fleet management efficiency impact how insurers price their policies, thereby affecting bargaining power.

- Market Size: The vast size of the global insurance market underscores the financial capacity of insurers to set terms.

The bargaining power of suppliers for Ayvens is substantial, impacting vehicle acquisition and operational costs. Key suppliers include vehicle manufacturers, technology providers, financiers, and maintenance networks.

Vehicle manufacturers, concentrated in large groups like Volkswagen and Toyota, dictate terms for new vehicles, especially EVs, crucial for Ayvens' fleet renewal. Similarly, specialized fleet management software providers, in a market valued around $30 billion in 2024, can command higher prices due to integration complexities and high switching costs.

Financiers' power is evident in elevated 2024 interest rates, directly affecting Ayvens' capital costs. Even maintenance providers, especially those with specialized EV skills, gain leverage due to a growing technician deficit. Insurance providers, a market exceeding $700 billion globally, also hold significant power, influencing Ayvens' bundled service costs.

| Supplier Category | Key Factors Influencing Bargaining Power | 2024 Data/Trend Example |

|---|---|---|

| Vehicle Manufacturers | Market concentration, EV technology demand | Major OEMs control significant market share; EV demand drives pricing power. |

| Technology Providers | Platform uniqueness, integration complexity | Fleet management software market ~ $30B; high switching costs. |

| Financiers | Interest rate environment, market liquidity | Elevated global interest rates in early 2024 increased capital costs. |

| Maintenance Networks | Specialized skills (e.g., EV), parts availability | Shortage of skilled EV technicians increases service provider leverage. |

| Insurance Providers | Market competition, Ayvens' risk profile | Global insurance market > $700B; Ayvens' safety record impacts premiums. |

What is included in the product

Ayvens' Five Forces analysis dissects the competitive intensity of the leasing industry, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitutes and existing rivals.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of the five forces.

Customers Bargaining Power

Large corporate fleets wield considerable bargaining power in the vehicle leasing market. Their substantial order volumes enable them to negotiate highly competitive pricing and customized leasing agreements. For instance, a single large corporate fleet might represent a significant portion of a leasing company's annual business, giving them leverage to demand favorable terms and specialized services.

This consolidated demand allows these clients to push for tailored solutions, including specific vehicle types, maintenance packages, and reporting capabilities. Their ability to switch providers if terms are not met further amplifies their influence, forcing leasing companies to offer attractive value propositions. Ayvens, with its expanded scale post-ALD Automotive and LeasePlan merger, is strategically positioned to cater to this powerful segment by offering comprehensive fleet management solutions designed to meet these demanding requirements.

Small and Medium-sized Enterprises (SMEs) can exert significant bargaining power on Ayvens, especially when acting collectively. While a single SME might have limited influence, their combined demand represents a substantial portion of the market. For instance, in 2024, SMEs continued to be a vital segment for the European automotive leasing market, with many leasing providers actively tailoring offerings to this group.

The ease with which SMEs can compare pricing and the availability of standardized, flexible leasing solutions directly amplify their bargaining power. If Ayvens' pricing isn't competitive or its contract terms are rigid compared to alternatives, SMEs can readily switch providers, putting pressure on Ayvens to offer more attractive terms. This transparency is key; a 2023 report indicated that over 60% of SMEs prioritize clear, upfront pricing when selecting leasing partners.

Individual customers wield significant bargaining power in the mobility sector, especially as they increasingly demand flexible and sustainable options like subscriptions and short-term leases. This power is amplified by readily available online comparison tools, allowing them to easily assess pricing and service offerings from various providers. The growing trend of usership over ownership further empowers them, as they can switch providers more readily if their needs aren't met.

Switching Costs for Customers

Customers often face significant switching costs when moving between mobility providers. These can include early termination fees on existing contracts, the administrative effort required to set up new accounts and services, and the potential need to integrate new fleet management software or systems. For instance, a large fleet operator might incur substantial costs in retraining staff on a new telematics platform or in migrating historical vehicle data.

These costs directly influence customer bargaining power. When switching is expensive and time-consuming, customers are less likely to change providers, giving existing providers more leverage. Conversely, if switching is relatively easy and inexpensive, customers can more readily demand better terms or seek out competitor offerings.

- Contractual Obligations: Many mobility contracts, especially for fleet services, include penalties for early termination, which can range from a percentage of the remaining contract value to fixed fees, discouraging customers from switching mid-term.

- Administrative Burden: The process of switching providers involves considerable administrative work, such as updating billing information, reconfiguring service agreements, and potentially managing vehicle transfers or replacements.

- Integration Costs: For businesses relying on integrated fleet management software, switching providers may necessitate the integration of new systems or significant modifications to existing ones, adding both cost and complexity.

- Learning Curve: New systems and processes often require a learning period for users, impacting productivity and adding an indirect cost to the transition.

Price Sensitivity and Demand Elasticity

Customers' sensitivity to price significantly impacts their bargaining power, particularly when the total cost of ownership is a primary consideration. In 2024, with persistent inflation and the lingering effects of higher interest rates from 2023, many consumers and businesses are more keenly aware of every dollar spent. This heightened price sensitivity means that even modest price increases can lead to a noticeable drop in demand, giving customers more leverage to negotiate better terms or seek alternatives.

- Price Sensitivity: In 2024, consumer spending patterns reveal a heightened focus on value. For instance, the automotive sector, where total cost of ownership is crucial, saw a significant shift towards used vehicles and more fuel-efficient models as prices for new cars remained elevated.

- Demand Elasticity: If a company raises prices, and customers can easily switch to a competitor or a substitute product without incurring significant costs, demand is considered elastic. This elasticity amplifies customer bargaining power, forcing businesses to carefully consider pricing strategies to avoid alienating their customer base.

- Economic Conditions: During economic downturns, such as those experienced in various global markets throughout 2023 and continuing into 2024, customers tend to have less disposable income. This makes them more price-conscious and increases their willingness to exert pressure on suppliers for lower prices or more favorable payment terms.

- Total Cost of Ownership (TCO): For complex purchases like fleet vehicles or business equipment, TCO includes not just the initial purchase price but also maintenance, fuel, and financing costs. A thorough understanding of TCO allows customers to compare offerings more effectively and bargain from a position of informed power.

Customers’ ability to negotiate favorable terms is significantly influenced by the availability of substitute offerings and their own price sensitivity. In 2024, the automotive leasing market continued to see a proliferation of flexible mobility solutions, from subscription services to short-term rentals, providing ample alternatives for both corporate and individual clients. This increased choice directly empowers customers to demand competitive pricing and adaptable contract structures from providers like Ayvens.

The bargaining power of customers is also shaped by the switching costs involved in changing providers. High switching costs, such as early termination fees or the administrative burden of migrating data and systems, can lock customers into existing relationships, reducing their leverage. Conversely, lower switching costs enable customers to more readily explore and adopt alternative solutions, thereby increasing their ability to negotiate better terms.

Price sensitivity remains a critical factor in customer bargaining power. In 2024, ongoing economic pressures meant that many businesses and individuals were highly attuned to the total cost of ownership for their vehicles. This heightened awareness compels leasing companies to offer transparent and competitive pricing to retain clients, as customers are more inclined to switch if they perceive better value elsewhere.

| Factor | Impact on Bargaining Power | 2024 Relevance |

|---|---|---|

| Availability of Substitutes | High availability increases power | Growing number of flexible mobility options |

| Switching Costs | Low costs increase power | Administrative and contractual penalties can be significant |

| Price Sensitivity | High sensitivity increases power | Economic conditions in 2024 made customers more cost-conscious |

Preview the Actual Deliverable

Ayvens Porter's Five Forces Analysis

This preview showcases the complete Ayvens Porter's Five Forces Analysis, offering a deep dive into the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect this professionally formatted and ready-to-use analysis to be delivered instantly, empowering your strategic decision-making.

Rivalry Among Competitors

The global vehicle leasing and fleet management sector is characterized by intense competition. Ayvens, a significant player formed from the merger of ALD Automotive and LeasePlan, operates within a landscape populated by numerous large international competitors, agile regional specialists, and the captive finance divisions of major automotive manufacturers.

This competitive environment means Ayvens must constantly innovate and offer compelling value propositions. For instance, in 2023, the combined entity of ALD Automotive and LeasePlan reported a fleet of 3.4 million vehicles managed worldwide, highlighting the scale of operations and the significant market share they aim to defend against a diverse set of rivals.

The sustainable mobility and fleet management sectors are experiencing robust growth, which can temper competitive rivalry. For instance, the global fleet management market was valued at approximately $29.5 billion in 2023 and is projected to reach $66.9 billion by 2030, growing at a compound annual growth rate of 12.4% during this period. This expansion means there's ample opportunity for multiple companies to gain traction without necessarily engaging in cutthroat competition for a limited customer base.

However, as the market matures and growth rates potentially moderate, the intensity of competition is likely to increase. Companies will then focus more on differentiating their offerings, optimizing operational efficiencies, and potentially engaging in price-based competition to capture a larger share of the expanding market. This dynamic suggests that while current growth may soften direct clashes, future market conditions could see a more aggressive competitive landscape.

Ayvens, a major player in the automotive leasing and fleet management sector, faces a competitive landscape where differentiation is key. Competitors are increasingly leveraging technology, such as advanced telematics and AI-driven fleet optimization tools, to offer more sophisticated services. For instance, many providers now offer integrated mobility solutions, combining traditional vehicle leasing with car-sharing and public transport options, aiming to cater to evolving customer needs for flexibility and sustainability.

Customer service remains a critical differentiator. Companies that provide proactive support, personalized account management, and seamless digital interfaces often retain clients more effectively. In 2024, the emphasis on Environmental, Social, and Governance (ESG) factors has also become a significant point of differentiation, with firms highlighting their commitment to electric vehicle (EV) fleets and sustainable operational practices. This focus on greener mobility solutions is resonating with corporate clients seeking to meet their own sustainability targets.

The ability to offer a truly integrated and multi-modal mobility experience, supported by robust technology platforms and exceptional customer service, directly impacts the intensity of rivalry. When competitors can effectively differentiate their full-service leasing, subscription, and fleet management offerings, it lessens the reliance on price alone, thereby reducing head-to-head price competition and fostering a more stable market environment.

High Fixed Costs and Exit Barriers

Companies in the automotive leasing and fleet management sector often face substantial fixed costs. These include the significant investments required for maintaining extensive vehicle fleets, robust IT systems for operations and customer management, and widespread service and maintenance networks. For instance, a large fleet operator might have billions invested in vehicles alone.

These high fixed costs create considerable exit barriers. When a company has invested so heavily, it becomes economically challenging to simply shut down operations and leave the market. Instead, firms are often incentivized to continue operating, even in less profitable conditions, to try and recoup their sunk costs.

This situation naturally intensifies competitive rivalry. With companies finding it difficult to exit, they are more likely to engage in aggressive competition to maintain or grow their market share. This can manifest as price wars, increased marketing spend, or a greater focus on customer retention to avoid losing revenue that would further strain their financial position.

- High Capital Investment: The automotive leasing industry demands immense capital for vehicle acquisition, often running into billions of dollars for major players, creating a significant barrier to entry and exit.

- Operational Infrastructure: Maintaining a broad network of service centers, repair facilities, and sophisticated IT platforms for fleet management represents substantial ongoing fixed costs.

- Market Share Imperative: Due to high exit barriers, companies feel compelled to fight aggressively for market share, leading to intensified price competition and service innovation to retain customers and revenue.

Strategic Alliances and Acquisitions

The automotive leasing and mobility sector is witnessing a flurry of activity through mergers, acquisitions, and strategic alliances. These moves are reshaping the competitive dynamics, often driven by the pursuit of greater scale, expanded service offerings, and enhanced technological capabilities. For instance, the very formation of Ayvens, through the merger of LeasePlan and ALD Automotive, exemplifies this trend. This consolidation aimed to create a powerhouse with a significant global footprint, projected to manage over 3.7 million vehicles worldwide by the end of 2024, thereby bolstering its competitive standing.

These strategic maneuvers directly impact competitive rivalry by consolidating market share and potentially leading to more integrated service platforms. Companies are actively seeking partnerships or acquisitions to gain access to new markets, customer segments, or innovative technologies, such as advanced telematics and electric vehicle fleet management solutions. The increased size and scope resulting from these combinations can create significant barriers to entry for smaller players and intensify pressure on existing competitors to adapt or consolidate themselves.

- Ayvens' formation: Merger of ALD Automotive and LeasePlan.

- Scale of operation: Targeting over 3.7 million vehicles managed globally by end of 2024.

- Industry trend: Increased M&A and strategic alliances to gain market share and capabilities.

- Impact on competition: Consolidation of market power and pressure on smaller players to adapt.

Competitive rivalry in the vehicle leasing and fleet management sector is fierce, driven by numerous global and regional players, including captive finance arms of automakers. Ayvens, formed from the merger of ALD Automotive and LeasePlan, manages a substantial fleet, with projections indicating over 3.7 million vehicles by the end of 2024, showcasing the scale of competition.

Differentiation through technology, such as AI-driven optimization, and a focus on ESG factors, particularly electric vehicle fleets, are crucial for retaining customers. The market's growth, with the global fleet management market valued at approximately $29.5 billion in 2023 and expected to reach $66.9 billion by 2030, offers opportunities but also intensifies the need for companies to stand out.

High fixed costs associated with vehicle fleets and operational infrastructure create significant exit barriers, compelling companies to compete aggressively for market share. This often leads to price-based competition and a strong emphasis on customer retention to manage profitability.

| Key Competitor Attributes | Ayvens (ALD/LeasePlan) | Other Major Competitors | Captive Finance Arms |

| Fleet Size (Est. 2024) | > 3.7 million vehicles | Varies significantly | Varies significantly |

| Differentiation Focus | Integrated mobility, ESG, Technology | Service quality, Niche offerings, Technology | Vehicle brand loyalty, Integrated sales |

| Competitive Intensity Driver | Scale, Innovation, Customer Retention | Agility, Specialization, Pricing | Product bundling, Brand strength |

SSubstitutes Threaten

Direct vehicle ownership, whether through outright purchase or financing, presents a significant substitute for leasing and fleet management. In 2024, the average new car price in the US hovered around $47,000, a figure that can be a substantial barrier for many, making leasing a more accessible option. Fluctuations in interest rates directly impact the cost of financing, further influencing the attractiveness of ownership versus leasing.

Consumer sentiment also plays a crucial role. While some consumers still value the idea of owning an asset outright, a growing segment prioritizes flexibility and predictable monthly costs, which leasing models often provide. This shift in preference directly challenges traditional ownership models by offering an alternative that aligns with evolving lifestyle and financial priorities.

The increasing adoption of car-sharing and ride-hailing services presents a significant threat of substitutes for traditional long-term vehicle access. These platforms, particularly prevalent in urban centers, provide users with flexible, on-demand transportation without the commitment of ownership, including maintenance and depreciation costs.

In 2024, the global ride-hailing market was projected to reach over $250 billion, demonstrating substantial consumer preference for these alternatives. Car-sharing services also saw considerable growth, with many cities reporting a doubling of shared vehicle fleets in recent years, directly impacting the demand for new vehicle leases or purchases.

Public transportation, including buses, trains, and trams, acts as a significant substitute for private and leased vehicles, especially in urban environments. For instance, in 2024, cities like London and Tokyo continue to see high public transit usage, with millions of daily commuters relying on these systems, thereby reducing demand for car leasing and ownership in those areas.

Investments in improving public transit infrastructure and operational efficiency can further diminish the need for personal transportation. Many metropolitan areas are actively expanding their rail networks and bus rapid transit systems, aiming to offer competitive and convenient alternatives to driving, which directly impacts the market for vehicle leasing services.

Micro-mobility Solutions

The rise of micro-mobility solutions like electric scooters and bikes presents a growing threat of substitutes for traditional car usage, especially in urban settings for short trips. These options address increasing demand for sustainable and convenient personal transport, impacting sectors reliant on short-distance logistics.

For instance, in 2024, cities globally saw significant growth in shared e-scooter fleets, with some reporting millions of rides annually, directly competing with car rentals or short-term car sharing for last-mile connectivity. This trend is amplified by a growing consumer preference for eco-friendly transportation, pushing companies to re-evaluate their fleet strategies.

- Growing Adoption: Global e-scooter market size was valued at approximately $40 billion in 2023 and is projected to expand significantly by 2030, indicating a substantial shift in consumer preference.

- Cost-Effectiveness: For short urban commutes, micro-mobility can be considerably cheaper than owning or renting a car, offering a compelling alternative for budget-conscious individuals.

- Environmental Concerns: Increasing awareness of carbon footprints and urban pollution drives adoption of zero-emission micro-mobility, making it an attractive substitute for internal combustion engine vehicles.

- Urban Congestion: As cities grapple with traffic, micro-mobility offers a nimble solution for navigating congested areas, further reducing the appeal of cars for certain journeys.

Alternative Flexible Mobility Models

The threat of substitutes for traditional long-term vehicle leasing is growing as flexible mobility models gain traction. Short-term rentals, month-to-month leasing, and vehicle subscription services offer alternatives that cater to customers seeking greater adaptability.

These evolving options, often provided by original equipment manufacturers (OEMs) or specialized third-party providers, present varying degrees of flexibility. For instance, car subscription services, which bundle insurance, maintenance, and mileage into a single monthly fee, are becoming increasingly popular, especially among younger demographics who value convenience and the ability to switch vehicles frequently.

The market for these alternatives is expanding rapidly. By the end of 2024, the global car subscription market was projected to reach over $10 billion, indicating a significant shift in consumer preferences. This trend directly impacts traditional leasing by offering a compelling alternative for those who may not require a vehicle for an extended period or who prefer to avoid long-term commitments.

- Short-term Rentals: Offer maximum flexibility for occasional use, often booked via apps.

- Month-to-Month Leasing: Provides a middle ground, allowing for shorter commitments than traditional leases.

- Vehicle Subscription Services: Bundle all costs into a single monthly payment, often with options to swap vehicles.

- OEM-Provided Services: Major car manufacturers are increasingly launching their own subscription or flexible leasing programs.

The threat of substitutes for traditional vehicle leasing and ownership is multifaceted, encompassing various transportation modes and ownership models. These alternatives directly challenge the established market by offering different value propositions, such as flexibility, cost-effectiveness, or convenience.

The increasing popularity of car-sharing and ride-hailing services, coupled with the growth of public transportation and micro-mobility options, significantly erodes the demand for long-term vehicle commitments. By 2024, the global ride-hailing market was projected to exceed $250 billion, highlighting a substantial consumer shift towards on-demand mobility solutions.

Furthermore, flexible mobility models like vehicle subscription services are gaining traction, offering consumers the ability to switch vehicles or alter their usage patterns without the constraints of traditional leases. The global car subscription market was expected to surpass $10 billion by the end of 2024, indicating a growing preference for adaptable transportation solutions.

| Substitute Type | 2024 Market Projection/Data | Impact on Leasing/Ownership |

|---|---|---|

| Ride-Hailing Services | Global market projected >$250 billion | Reduces need for personal vehicle ownership/leasing, especially in urban areas. |

| Car-Sharing Services | Significant growth in shared vehicle fleets | Offers flexible access to vehicles without long-term commitment. |

| Public Transportation | Millions of daily commuters in major cities | Directly competes with private vehicle use, reducing demand in well-connected areas. |

| Micro-mobility (e-scooters/bikes) | Global e-scooter market valued ~$40 billion (2023) | Addresses short-distance travel needs, substituting for car use in specific urban scenarios. |

| Vehicle Subscription Services | Global market projected >$10 billion (end of 2024) | Provides a flexible, all-inclusive alternative to traditional leasing and ownership. |

Entrants Threaten

The capital requirements for entering the vehicle leasing and mobility services market are substantial, presenting a significant barrier. Building and maintaining a large fleet of vehicles, which is essential for competitive pricing and service breadth, demands immense upfront investment. For instance, a large fleet could easily run into hundreds of millions of dollars.

Beyond the fleet itself, establishing a robust operational infrastructure, including maintenance facilities, administrative offices, and a skilled workforce, adds to the financial burden. Furthermore, developing and maintaining advanced digital platforms for booking, fleet management, and customer service requires continuous technological investment. In 2024, companies are investing heavily in AI-driven analytics and user-friendly apps, further escalating these capital needs.

Established players like Ayvens leverage significant economies of scale, allowing them to negotiate better terms with vehicle manufacturers due to high purchasing volumes. In 2024, the global automotive market saw continued consolidation, meaning larger leasing companies could secure more favorable pricing and fleet management efficiencies than newcomers. This scale translates directly into lower operating costs, a hurdle for any new entrant aiming to compete on price.

Established brand loyalty and trust are formidable barriers in the vehicle leasing and fleet management sector. Companies like Ayvens (formerly ALD Automotive and LeasePlan) have cultivated deep customer relationships over years, making it difficult for new entrants to replicate this level of confidence and preference. For instance, in 2023, Ayvens reported a significant proportion of its new business coming from existing clients, highlighting the power of these established connections.

Regulatory Hurdles and Compliance

The automotive leasing and mobility sector, including companies like Ayvens (formerly ALD Automotive | LeasePlan), faces significant regulatory complexity. New entrants must navigate a labyrinth of licensing requirements, varying by jurisdiction, which can be time-consuming and expensive to obtain. For instance, in 2024, the European Union continued to refine its framework for vehicle emissions and safety standards, directly impacting fleet management and acquisition costs for any new player.

Compliance with environmental regulations, such as those mandating a certain percentage of electric vehicle (EV) fleets or adherence to stricter emissions controls, presents another substantial hurdle. Furthermore, data privacy laws, like GDPR, impose stringent requirements on how customer information is collected, stored, and processed, adding to operational overhead and potential legal risks for newcomers. These compliance costs and legal intricacies act as powerful deterrents, effectively raising the barrier to entry.

Key regulatory areas impacting new entrants include:

- Licensing and Permits: Obtaining necessary operational licenses in each target market.

- Environmental Standards: Meeting evolving emissions regulations and promoting sustainable fleet options.

- Data Privacy: Adhering to stringent data protection laws like GDPR for customer and vehicle data.

- Financial Regulations: Complying with financial services regulations if offering financing or related products.

Access to Distribution Channels and Technology

New entrants face significant hurdles in building extensive distribution networks and acquiring advanced telematics and digital fleet management technologies. Established companies often possess deeply integrated solutions and strategic partnerships that are challenging for newcomers to quickly replicate.

For instance, in the European fleet management sector, companies like Ayvens (formerly ALD Automotive and LeasePlan) have spent years developing proprietary digital platforms and securing partnerships with vehicle manufacturers and maintenance providers. This creates a substantial barrier to entry, as new players must invest heavily to achieve comparable reach and technological sophistication. By the end of 2024, the digital transformation of fleet operations is expected to be even more entrenched, with a greater reliance on data analytics and AI for predictive maintenance and route optimization, further raising the technological bar.

- Distribution Network Barriers: New entrants struggle to establish the widespread physical presence and service agreements that established players have cultivated over decades.

- Technological Investment: Acquiring or developing sophisticated telematics, AI-driven analytics, and digital fleet management software requires substantial capital and expertise.

- Integrated Solutions: Existing companies offer comprehensive, end-to-end solutions that are difficult for new entrants to match without significant time and investment.

- Partnership Ecosystem: Established relationships with OEMs, repair shops, and technology providers create a formidable competitive advantage that is hard to penetrate.

The threat of new entrants in the vehicle leasing and mobility services market is moderate, largely due to high capital requirements and established brand loyalty. Building a substantial vehicle fleet and the necessary operational infrastructure demands significant upfront investment, easily reaching hundreds of millions of dollars. Furthermore, companies like Ayvens benefit from economies of scale, securing better pricing through high purchasing volumes, a crucial advantage in 2024’s consolidating automotive market.

Navigating complex regulations, including licensing, environmental standards, and data privacy laws like GDPR, adds considerable cost and time for newcomers. The need for advanced digital platforms and integrated solutions, coupled with established distribution networks and partnerships, creates further barriers. For instance, Ayvens’ investment in AI-driven analytics and user-friendly apps in 2024 highlights the escalating technological demands that new players must meet.

| Barrier Type | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | High investment for fleet acquisition, infrastructure, and technology. | Fleet costs can exceed hundreds of millions; digital platform investment is continuous. |

| Economies of Scale | Lower operating costs due to high purchasing volumes. | Automotive market consolidation in 2024 favors larger players for better pricing. |

| Brand Loyalty & Trust | Established customer relationships are difficult to replicate. | Ayvens sees significant repeat business from existing clients, showing strong loyalty. |

| Regulatory Complexity | Navigating licensing, environmental, and data privacy laws. | Evolving EU emissions standards and GDPR compliance add to newcomer costs. |

| Technology & Distribution | Need for advanced digital platforms and extensive networks. | AI analytics and integrated solutions are key differentiators, requiring substantial investment. |

Porter's Five Forces Analysis Data Sources

Our Ayvens Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from Ayvens' official annual reports, investor presentations, and financial statements. We also leverage industry-specific market research reports and analyses from reputable automotive and leasing sector publications to provide a comprehensive view of the competitive landscape.