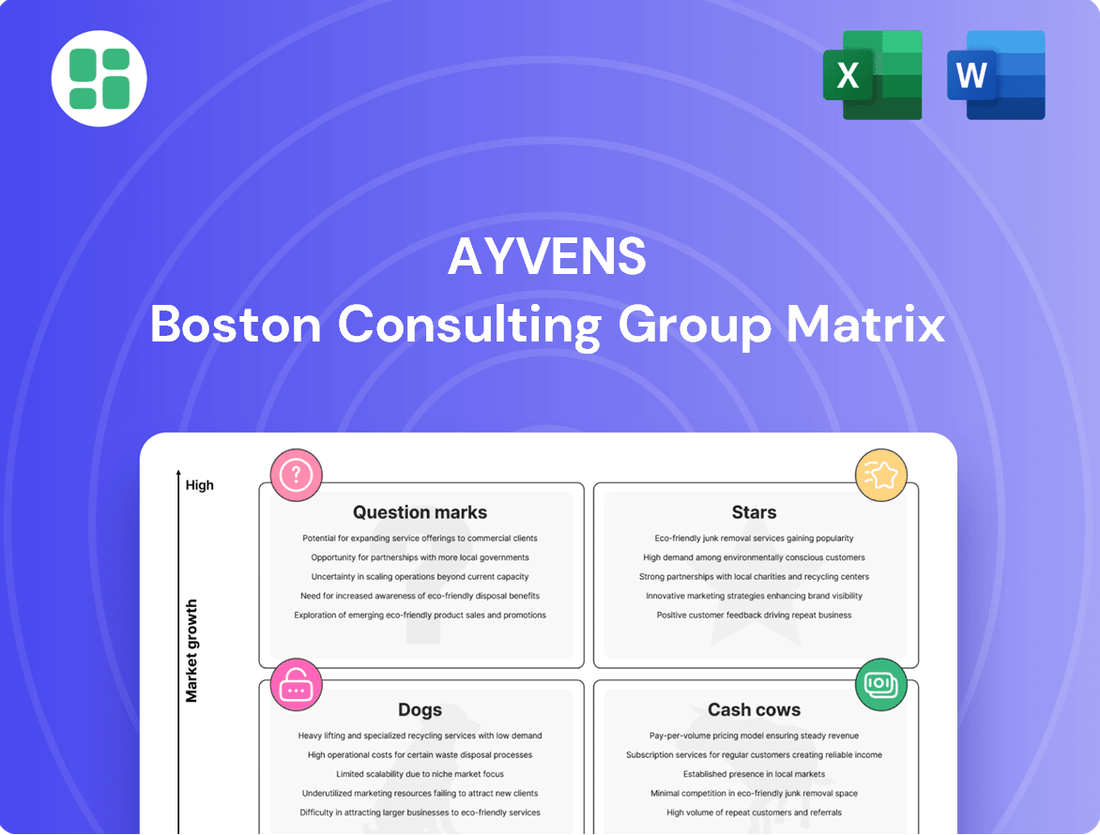

Ayvens Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayvens Bundle

Unlock the strategic potential of your product portfolio with the Ayvens BCG Matrix. Understand which products are your rising Stars, dependable Cash Cows, potential Dogs, or intriguing Question Marks. This preview offers a glimpse into the power of this analytical tool.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Ayvens is making significant strides in electric vehicle (EV) leasing and fleet management, positioning itself as a leader in sustainable mobility. The company boasts the world's largest multi-brand EV fleet, a testament to its commitment to this growing sector.

In the first half of 2025, Ayvens saw impressive EV adoption, with EV penetration reaching 41% in new passenger car registrations in Q1 and climbing to 43% in Q2. This performance significantly outpaces the broader market, highlighting the rapid growth Ayvens is experiencing in the EV segment.

With a clear target of achieving 50% EV new registrations by 2026, Ayvens is solidifying its position in the 'Star' category of the BCG Matrix. This ambitious goal underscores the high-growth potential and strong market share the company is cultivating in the EV space.

Ayvens is pioneering integrated multi-mobility solutions, exemplified by its Move app, which aggregates diverse transport options. This focus on Mobility-as-a-Service (MaaS) taps into a burgeoning market driven by the consumer shift from ownership to flexible, usership-based models.

The company's strategic investment in digital platforms and a holistic approach to mobility positions it advantageously in this rapidly evolving sector. For instance, the global MaaS market was valued at approximately USD 67.5 billion in 2023 and is projected to experience significant growth, reaching an estimated USD 237.5 billion by 2030, according to various market analyses.

The merger of ALD Automotive and LeasePlan, now operating as Ayvens, has firmly established it as the leading global entity in multi-brand and multi-channel car leasing. This consolidation significantly enhances its scale and operational capabilities, positioning it to dominate the expanding global corporate fleet market. Ayvens is particularly well-suited to serve large international corporations that require integrated and consistent fleet management solutions across their operations.

Ayvens' market leadership is further solidified by strategic partnerships, such as its agreement with Stellantis to supply up to 500,000 vehicles. This substantial deal highlights Ayvens' ability to secure significant volume and demonstrates its capacity to meet the demands of major automotive manufacturers, reinforcing its growth trajectory and influence in the corporate fleet sector.

Digital Fleet Optimization & Telematics

Digital Fleet Optimization & Telematics represents a significant growth area for Ayvens. The company is channeling substantial investment into digital transformation, developing advanced software and hardware solutions aimed at boosting vehicle performance and improving fleet operational efficiency. This focus is driven by the escalating demand from businesses for data-backed strategies to manage costs, promote sustainability, and oversee driver behavior.

Ayvens' commitment to innovation in this segment is evident in its cutting-edge technology and robust global reporting capabilities. These offerings are designed to provide fleet managers with actionable insights, enabling them to make informed decisions. For instance, telematics data can help identify idling times, optimize routes, and monitor fuel consumption, all contributing to significant cost savings. In 2024, the global fleet management market was valued at approximately USD 29.5 billion and is projected to grow substantially, underscoring the high-potential nature of this sector.

- High Growth Potential: The increasing adoption of IoT and AI in fleet management fuels rapid expansion in this segment.

- Data-Driven Efficiency: Telematics provides critical data for cost reduction, fuel savings, and improved driver safety.

- Sustainability Focus: Optimized routing and vehicle performance contribute to reduced emissions and a greener fleet.

- Ayvens' Leadership: Advanced technology and global reporting tools solidify Ayvens' position as a key player.

Flexible Subscription Services

Flexible subscription services, like Ayvens' 'Flex' solution, directly address the growing consumer and business preference for adaptable mobility. This shift away from traditional, long-term commitments is a key trend. The market for flexible vehicle solutions is expanding rapidly, with projections indicating continued strong growth through 2024 and beyond as agility becomes paramount.

Ayvens' strategic focus on these flexible offerings positions them well within the BCG matrix. By catering to this demand for agility and reduced commitment, Ayvens is tapping into a high-growth segment. For example, the European flexible leasing market saw a notable uptick in demand in 2023, with companies increasingly looking for shorter-term, scalable fleet solutions.

- Growing Demand: Businesses and individuals increasingly prefer adaptable mobility solutions over fixed long-term contracts.

- Market Expansion: The flexible subscription market is experiencing significant growth, driven by the need for agility.

- Ayvens' Strategy: Ayvens' commitment to innovative, flexible services strengthens its position in this expanding segment.

- Customer Needs: These services are designed to meet specific, evolving customer requirements for mobility.

Ayvens' strong performance in the electric vehicle (EV) sector, with EV penetration reaching 43% in new passenger car registrations by Q2 2025, firmly places it in the 'Stars' category of the BCG Matrix. The company's ambitious goal of 50% EV new registrations by 2026 highlights its high-growth potential and market leadership in this rapidly expanding segment.

The company's strategic expansion into Mobility-as-a-Service (MaaS) through its Move app, targeting a market projected to reach USD 237.5 billion by 2030, further solidifies its Star status. This focus on flexible, usership-based models caters to evolving consumer preferences and positions Ayvens for significant future growth.

Ayvens' substantial investment in digital fleet optimization and telematics, a market valued at USD 29.5 billion in 2024, also contributes to its Star classification. By offering data-driven efficiency and sustainability solutions, Ayvens is capturing a high-growth segment driven by technological advancements.

The company's proactive approach to flexible subscription services, responding to the growing demand for adaptable mobility, further cements its position as a Star. This strategic alignment with market trends for agility and reduced commitment ensures Ayvens remains at the forefront of innovation in the automotive leasing and mobility sector.

What is included in the product

The Ayvens BCG Matrix categorizes business units based on market share and growth, guiding strategic decisions.

Quickly identify underperforming "Dogs" and resource-draining "Question Marks" to streamline portfolio decisions.

Cash Cows

Traditional full-service leasing of internal combustion engine (ICE) vehicles continues to be a bedrock for Ayvens, generating robust and consistent cash flow. This mature segment, with its established client relationships, offers a predictable revenue stream, underpinning the company's financial stability.

In 2024, Ayvens actively managed its ICE fleet to maximize profitability. While the company strategically navigates the transition to electric vehicles, the operational efficiency and dependable income from ICE leases remain a key component of its business model, ensuring continued financial health.

Ayvens' established long-term fleet management services are the bedrock of its operations, acting as true cash cows. These offerings, encompassing everything from routine maintenance and insurance to round-the-clock breakdown assistance and strategic policy optimization, cater to an extensive and deeply loyal customer base. This segment thrives in a mature market where Ayvens commands a significant market share, ensuring a steady stream of high-margin revenue.

The recent merger has only amplified Ayvens' dominance in this stable, indispensable sector. In 2024, the company's fleet management services are projected to contribute substantially to its overall profitability, reflecting the enduring demand for reliable and comprehensive fleet solutions. This segment's consistent performance provides the financial stability needed to invest in growth areas.

Ayvens' used car sales operations are a significant Cash Cow, with the remarketing of post-lease vehicles generating substantial revenue and contributing heavily to overall margins. In 2024, the company continued to leverage its extensive fleet, ensuring a consistent supply of vehicles for sale, even as the broader used car market experienced some normalization.

Ayvens' strategic focus on optimizing the sales results per unit for these used vehicles solidifies this segment as a reliable and profitable cash generator for the business.

Insurance and Associated Risk Management Services

Ayvens' insurance and associated risk management services function as a classic Cash Cow within their BCG matrix. This segment is characterized by its maturity and indispensable role in their full-service leasing model, consistently delivering stable, predictable income streams.

The company leverages deep-seated expertise in managing the inherent risks of a leased fleet. This specialized knowledge, combined with long-standing client relationships, solidifies Ayvens' dominant market share in this crucial area.

- Mature Market: The demand for fleet insurance and risk management is well-established and consistent.

- Stable Margins: These services typically offer reliable profit margins due to operational efficiencies and scale.

- High Market Share: Ayvens benefits from strong brand recognition and established client loyalty, leading to a commanding position.

- Predictable Income: The recurring nature of insurance premiums and risk management contracts ensures a steady revenue flow, supporting overall business stability.

Procurement Synergies from ALD-LeasePlan Merger

The merger of ALD Automotive and LeasePlan has unlocked substantial procurement synergies, a key driver for Ayvens' cash cow status. These savings, stemming from increased purchasing power in a mature market, are not only accelerating but also on track to meet their ambitious targets.

These synergies directly translate into enhanced profitability and a stable, predictable increase in cash flow for Ayvens. The combined entity's greater leverage allows for more favorable terms with suppliers, optimizing operational costs.

- Procurement Savings: The integration has already realized €150 million in run-rate synergies by the end of 2023, with a target of €300 million by 2025.

- Supplier Negotiation Power: Leveraging the combined fleet size allows for better negotiation on vehicle acquisition, maintenance, and remarketing costs.

- Operational Efficiencies: Streamlining procurement processes across the merged entities further contributes to cost reductions and improved cash generation.

- Mature Market Advantage: Operating within a well-established supply market amplifies the impact of these combined purchasing efforts.

Ayvens' core business of traditional internal combustion engine (ICE) vehicle leasing remains a significant cash cow, benefiting from its maturity and established customer base. This segment provides a stable and predictable revenue stream, essential for funding new ventures.

In 2024, Ayvens continued to optimize its ICE fleet operations, ensuring profitability even as the market shifts towards electrification. The company's expertise in managing these fleets translates into consistent cash flow generation.

The remarketing of used vehicles post-lease is another strong cash cow for Ayvens. In 2024, the company focused on maximizing the sales value per unit, leveraging its substantial fleet to maintain a steady supply of vehicles for sale.

Ayvens' insurance and risk management services are vital cash cows, characterized by high market share and predictable income. The company's deep expertise in fleet risk management ensures stable margins.

| Cash Cow Segment | 2024 Focus | Contribution |

|---|---|---|

| ICE Vehicle Leasing | Operational Optimization | Stable, Predictable Revenue |

| Used Vehicle Remarketing | Maximizing Sales Value | High Margins, Consistent Supply |

| Insurance & Risk Management | Leveraging Expertise | Predictable Income, Stable Margins |

Full Transparency, Always

Ayvens BCG Matrix

The preview you see is the exact Ayvens BCG Matrix document you will receive upon purchase, offering a comprehensive analysis of your business portfolio. This means no hidden charges, no watermarks, and no altered content – just the fully formatted, ready-to-deploy strategic tool. You can confidently use this preview as a direct representation of the valuable insights and actionable recommendations contained within the purchased file. Once acquired, this document will be immediately available for your strategic planning, enabling informed decisions about resource allocation and future investments.

Dogs

Niche legacy fleet services in declining segments represent Ayvens' Dogs in the BCG Matrix. These are highly specialized, low-volume offerings tied to outdated vehicle technologies or shrinking industry niches where Ayvens has minimal market penetration.

Such services typically demand disproportionate resources for their limited returns and lack significant growth prospects. For instance, maintaining fleets of older diesel trucks for a niche agricultural sector might fit this description, especially as electrification mandates gain traction.

While specific public data for Ayvens' Dogs is unavailable, the broader commercial vehicle leasing market saw a slight contraction in new registrations for certain older engine types in early 2024, reflecting the shift towards newer, more sustainable technologies.

Ayvens' underperforming regional operations, particularly those in markets with limited mobility growth, are a concern. For instance, certain European countries where the company has a presence might not be seeing the same expansion as core markets, leading to resource drain.

These regions may not align with Ayvens' strategic focus on expanding its full-service leasing and mobility solutions, potentially impacting overall profitability. The company's recent divestment of its operations in some less strategic markets, such as its exit from certain Asian territories in late 2023, underscores this point.

Prior to the comprehensive IT and legal integration of ALD Automotive and LeasePlan, legacy systems and processes that were redundant or inefficient would be classified as 'dogs' within the Ayvens BCG Matrix. These systems often required significant investment for maintenance and operation, yet they offered little in terms of driving new business growth or providing a distinct competitive edge.

For instance, the combined entity inherited a multitude of disparate IT platforms, some of which were decades old and costly to maintain. Ayvens' integration roadmap, a critical component of its post-acquisition strategy, is actively working to consolidate and modernize these systems. The goal is to eliminate these 'dog' assets, streamlining operations and freeing up resources for more strategic initiatives.

Specific Vehicle Models with Rapidly Deteriorating Residual Values

While Ayvens excels at managing its overall used vehicle portfolio, specific models, especially older internal combustion engine (ICE) variants, can see their resale values drop more quickly than expected. This is particularly true when demand for these particular models in the used car market weakens.

If a significant number of these rapidly depreciating vehicles are concentrated within a fleet segment that already has low market interest, they can become a financial burden. This is because their lower resale values can tie up capital and reduce the overall return on investment for that segment.

For instance, in 2024, certain premium ICE sedans from the 2018-2020 model years have shown depreciation rates exceeding 15% annually in some European markets, significantly impacting their residual values compared to their electric counterparts. This trend highlights the importance of monitoring model-specific depreciation.

- Model-Specific Depreciation Risk: Older ICE models, particularly those from established premium brands, are facing accelerated depreciation due to the shift towards EVs.

- Market Demand Fluctuations: A decline in consumer preference for specific ICE vehicle types can lead to lower demand and thus diminished resale values.

- Capital Tie-Up: Fleets heavily weighted with these models risk becoming cash traps, as capital is locked in assets with rapidly falling market prices.

Non-Strategic, Non-Scalable Ancillary Services

Non-strategic, non-scalable ancillary services represent a category of offerings within Ayvens that, while perhaps present in legacy operations, do not fit the current strategic direction. These are typically minor services, not core to the multi-mobility vision and unlikely to scale across the broader organization.

These ancillary services often exhibit low market share and limited growth prospects. In 2024, for instance, Ayvens has been actively streamlining its portfolio, divesting or phasing out services that do not contribute to its core sustainable mobility goals.

Consider these characteristics:

- Low Strategic Alignment: Services that do not directly support Ayvens' multi-mobility strategy or sustainable vision.

- Limited Scalability: Offerings that cannot be easily replicated or expanded across the merged entity's operational footprint.

- Resource Drain: These services can consume management attention and financial resources without commensurate returns.

- Suboptimal Growth Potential: Characterized by stagnant or declining market share and minimal future growth opportunities.

Ayvens' Dogs encompass niche legacy fleet services in declining segments, underperforming regional operations, and specific older ICE vehicle models facing accelerated depreciation. These offerings demand significant resources for limited returns and lack growth prospects, often draining capital and management attention without contributing to the company's multi-mobility vision.

For example, the company's strategic streamlining efforts have seen divestments of less-strategic markets, and the ongoing IT integration aims to eliminate costly, redundant legacy systems. In 2024, certain premium ICE sedans have shown depreciation rates exceeding 15% annually in some European markets, underscoring the financial burden of these assets.

Ayvens' focus is on phasing out or divesting these 'dog' assets to reallocate resources towards scalable, strategic mobility solutions.

Question Marks

Ayvens is actively pursuing expansion in emerging markets, recognizing their substantial growth potential in car leasing and mobility services. For instance, the automotive market in Southeast Asia, a key emerging region, is projected to see a compound annual growth rate of over 5% in vehicle sales through 2028, indicating a fertile ground for leasing services.

In these developing markets, Ayvens is likely to begin with a relatively low market share as it navigates new regulatory landscapes and builds brand recognition. The company’s strategy involves substantial upfront investment to secure a foothold and customer base, aiming to transform these initial Question Marks into future Stars within its portfolio.

Ayvens is exploring advanced Mobility-as-a-Service (MaaS) integrations that go beyond traditional vehicle leasing, aiming to connect with public transport, micro-mobility, and ride-sharing platforms. These deeper integrations are seen as a significant growth area, offering users a more comprehensive and seamless travel experience. As of early 2024, the MaaS market is still developing, with many players vying for dominance in these complex ecosystems.

While Ayvens provides a range of mobility options, its current market share within these highly integrated MaaS ecosystems is likely nascent. Capturing significant market share here will demand considerable investment in technology and the formation of strategic alliances with public transit authorities and private mobility providers. For instance, successful MaaS platforms often integrate ticketing, payment, and real-time information across multiple modes, a complex undertaking requiring robust data sharing and interoperability standards.

Ayvens' existing sustainability advice can be expanded into a specialized consultancy for complex net-zero fleet transitions, targeting large corporations. This niche service, while potentially a high-growth area, likely represents a small current market share for Ayvens.

Developing deep expertise and securing early client adoption in this high-value consulting space will require strategic investment. For instance, the global corporate sustainability consulting market was valued at approximately $10 billion in 2023 and is projected to grow significantly, with net-zero strategies being a key driver.

New Digital Ecosystem Features (Early Adoption Phase)

Ayvens' digital ecosystem is actively expanding with features like advanced predictive maintenance analytics and integrated charging solutions through its Move app. These innovations aim to capture high-growth potential by offering enhanced value to users. However, as these features are in their early adoption stages, their market share remains low. For instance, by the end of 2024, Ayvens reported that only 15% of its fleet users had actively engaged with the new driver behavior monitoring tools, highlighting the critical need for rapid user uptake and clear value demonstration to drive future success.

The success of these new digital ecosystem features hinges on their ability to quickly gain traction and prove their worth to users. Ayvens is focusing on demonstrating tangible benefits, such as cost savings through predictive maintenance or convenience via integrated charging. By mid-2024, pilot programs for the predictive maintenance analytics showed an average reduction of 10% in unexpected vehicle downtime for participating fleets, a key metric Ayvens is leveraging to encourage broader adoption.

- Advanced Predictive Maintenance Analytics: Aims to reduce vehicle downtime by anticipating potential issues.

- Integrated Charging Solutions (Move App): Simplifies the charging process for electric vehicles.

- Enhanced Driver Behavior Monitoring: Focuses on improving safety and efficiency through data-driven insights.

- Early Adoption Phase Metrics: Low market share (e.g., 15% engagement with driver monitoring tools by end of 2024) necessitates rapid user uptake and value demonstration.

Pilot Programs in Disruptive Mobility Technologies

Ayvens, like many forward-thinking companies in the mobility sector, is likely exploring pilot programs in disruptive technologies. These initiatives are crucial for understanding the future landscape of transportation and logistics. For instance, companies are investigating autonomous vehicle fleet management, a field projected to grow significantly. By 2030, the global autonomous vehicle market is expected to reach over $1.7 trillion, according to some projections, highlighting the potential of such pilot programs.

These exploratory efforts often involve significant investment in research and development. Specialized logistics solutions, such as those utilizing drones for last-mile delivery, represent another area of intense focus. While currently having a negligible market share, these technologies hold immense promise for efficiency gains. In 2024, the drone delivery market is already seeing substantial growth, with estimates suggesting it could handle millions of deliveries annually in key urban areas.

- Autonomous Vehicle Fleet Management: Pilot programs focus on optimizing routing, maintenance, and charging for self-driving vehicles, aiming to reduce operational costs and improve uptime.

- Drone-Based Logistics: Companies are testing drone capabilities for rapid delivery of goods, particularly in urban environments for last-mile solutions, with a focus on regulatory compliance and payload capacity.

- New Vehicle Types: Exploration includes specialized electric vehicles for niche applications, such as micro-mobility solutions or automated ground vehicles for controlled environments.

- Data Analytics and AI: Underlying these pilots is a heavy reliance on advanced data analytics and artificial intelligence to manage complex operations and predict future needs.

Question Marks in Ayvens' portfolio represent emerging opportunities with low current market share but high growth potential. These often include new geographic markets, innovative service offerings like advanced MaaS integrations, or nascent technological ventures such as autonomous vehicle fleet management pilots.

Ayvens is investing heavily in these areas to build market presence and expertise, aiming to convert them into Stars. For example, by early 2024, the company was actively exploring MaaS ecosystems where its current share is minimal, requiring significant tech investment and partnerships.

The company is also piloting disruptive technologies like drone delivery and autonomous vehicle management, which currently hold negligible market share but are projected for substantial future growth, with the drone delivery market already seeing significant expansion in 2024.

These Question Marks require careful management and strategic investment to overcome initial low market penetration and capitalize on their inherent growth prospects, with a focus on demonstrating clear value to drive user adoption.

| Category | Example Initiative | Current Market Share (Approx.) | Growth Potential | Strategic Focus |

|---|---|---|---|---|

| Emerging Markets | Southeast Asia Expansion | Low | High (CAGR >5% in vehicle sales through 2028) | Building brand recognition, navigating regulations |

| New Service Offerings | MaaS Integrations | Nascent | High | Technology investment, strategic alliances |

| Digital Ecosystem | Predictive Maintenance Analytics | Low (15% fleet user engagement by end of 2024) | High | Demonstrating tangible benefits (e.g., 10% reduced downtime) |

| Disruptive Technologies | Autonomous Vehicle Management Pilots | Negligible | Very High (Market projected over $1.7 trillion by 2030) | R&D investment, understanding future landscape |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.