Axos Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axos Financial Bundle

Navigate the complex external forces impacting Axos Financial with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the banking landscape, and position your strategy for success. Download the full report now for actionable intelligence.

Political factors

The regulatory environment for digital banks like Axos Financial is a dynamic area, with federal and state authorities continuously adapting rules. For instance, the Federal Reserve and the Office of the Comptroller of the Currency (OCC) are key players in shaping these regulations. Changes in areas like online lending standards or data privacy, such as those influenced by the Gramm-Leach-Bliley Act, directly affect how Axos operates and plans its future growth.

Stricter compliance requirements, particularly around cybersecurity and consumer protection, can lead to increased operational costs for Axos. In 2023, the banking sector saw heightened scrutiny on digital asset custody and AI in lending, potentially impacting Axos's technology investments. Conversely, a regulatory framework that encourages fintech innovation, perhaps through sandbox environments or streamlined approval processes for new digital products, could unlock significant expansion opportunities for the company.

Government fiscal policies, such as taxation and spending, alongside the Federal Reserve's monetary policies, including interest rate adjustments, profoundly influence the financial sector. Axos Financial's profitability, particularly its net interest margin, is highly sensitive to changes in benchmark interest rates. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, pushing the federal funds rate from near zero to over 5%, directly impacted Axos's net interest income. Economic stimulus packages or austerity measures can also alter consumer and business lending demand, affecting loan origination volumes.

Political stability in the U.S. remains a key consideration. While the U.S. political landscape has seen periods of division, the underlying institutional framework generally supports market stability. However, global geopolitical tensions, such as ongoing conflicts and shifting international alliances, can introduce volatility. For instance, the continued geopolitical complexities in Eastern Europe and the Middle East have contributed to fluctuations in global energy prices, which indirectly impact the broader economic environment influencing financial markets.

Consumer Protection Regulations

Political bodies and regulatory agencies, like the Consumer Financial Protection Bureau (CFPB), are intensifying their focus on consumer protection. This translates into new mandates for financial product disclosures, fair lending, and how customer complaints are handled. For Axos Financial, a digital bank serving consumers directly, staying ahead of these evolving rules is crucial for maintaining compliance and customer confidence.

In 2024, the CFPB continued to emphasize fair lending practices, with enforcement actions and guidance potentially impacting how Axos Financial underwrites loans and markets its products. For instance, the CFPB's focus on algorithmic bias in lending could necessitate adjustments to Axos's automated decision-making processes. The agency also remains vigilant on data privacy and security, requiring robust measures to protect customer information.

- Heightened Regulatory Scrutiny: Increased oversight from entities like the CFPB means Axos Financial must ensure its digital platforms and product offerings strictly adhere to evolving consumer protection standards.

- Fair Lending Compliance: Adherence to fair lending laws, including those addressing potential discrimination in credit underwriting, remains a critical area of focus for regulators in 2024 and 2025.

- Transparency in Disclosures: Regulations often require clearer and more comprehensive disclosures for financial products, impacting how Axos communicates terms and conditions to its customer base.

- Complaint Resolution Mechanisms: Robust and timely complaint resolution processes are mandated, underscoring the importance of effective customer service infrastructure for digital banks.

Government Initiatives in Digital Transformation

Government initiatives aimed at fostering digital transformation present a significant opportunity for Axos Financial. For instance, the U.S. government's continued investment in broadband infrastructure, with billions allocated in recent years, directly supports the expansion of digital banking services to underserved areas. Policies promoting secure online identities and open banking standards, such as those being explored by regulators, can streamline Axos's customer onboarding processes and facilitate data sharing, enhancing the efficiency and reach of its technology-driven banking solutions.

These efforts can directly benefit Axos Financial by creating a more favorable regulatory and technological landscape. For example, the Biden-Harris administration's focus on digital equity and financial inclusion, highlighted by the National Broadband Equity, Access, and Deployment (BEAD) program which aims to connect millions of households by 2026, could expand Axos's potential customer base. Furthermore, evolving regulations around data privacy and security, while requiring compliance, also build greater consumer trust in digital financial services, a core offering for Axos.

- Digital Infrastructure Investment: Continued government spending on broadband expansion, like the BEAD program, increases access to digital financial services.

- Open Banking Exploration: Regulatory discussions around open banking could lead to standardized data sharing, improving Axos's service integration.

- Financial Inclusion Goals: Government pushes for financial inclusion align with Axos's digital-first model, potentially attracting new customer segments.

- Cybersecurity Enhancements: Government focus on cybersecurity can bolster consumer confidence in online banking platforms.

Political factors significantly shape Axos Financial's operational landscape through evolving regulations and government initiatives. Heightened scrutiny from agencies like the Consumer Financial Protection Bureau (CFPB) in 2024, particularly regarding fair lending and data privacy, necessitates continuous adaptation of Axos's digital platforms and customer interaction protocols.

Government investments in digital infrastructure, such as the BEAD program aiming to expand broadband access, create opportunities for Axos to reach new customer segments. Policies promoting financial inclusion and open banking standards, actively discussed by regulators, could streamline Axos's customer onboarding and service integration, fostering growth.

The Federal Reserve's monetary policy, including interest rate adjustments, directly impacts Axos's net interest margin, as seen with the rate hikes throughout 2022-2023. Political stability, while generally strong in the U.S., is indirectly influenced by global geopolitical events, creating a dynamic economic backdrop for financial institutions.

| Regulatory Focus Area | 2024/2025 Impact on Axos | Key Government Agency |

|---|---|---|

| Consumer Protection & Fair Lending | Increased compliance costs, potential need to adjust underwriting algorithms. | CFPB |

| Data Privacy & Cybersecurity | Mandatory robust security measures, enhanced consumer trust. | Federal Trade Commission (FTC), State Regulators |

| Digital Infrastructure & Inclusion | Expanded customer reach through broadband initiatives (e.g., BEAD program). | National Telecommunications and Information Administration (NTIA) |

| Monetary Policy & Interest Rates | Direct impact on net interest income and loan demand. | Federal Reserve |

What is included in the product

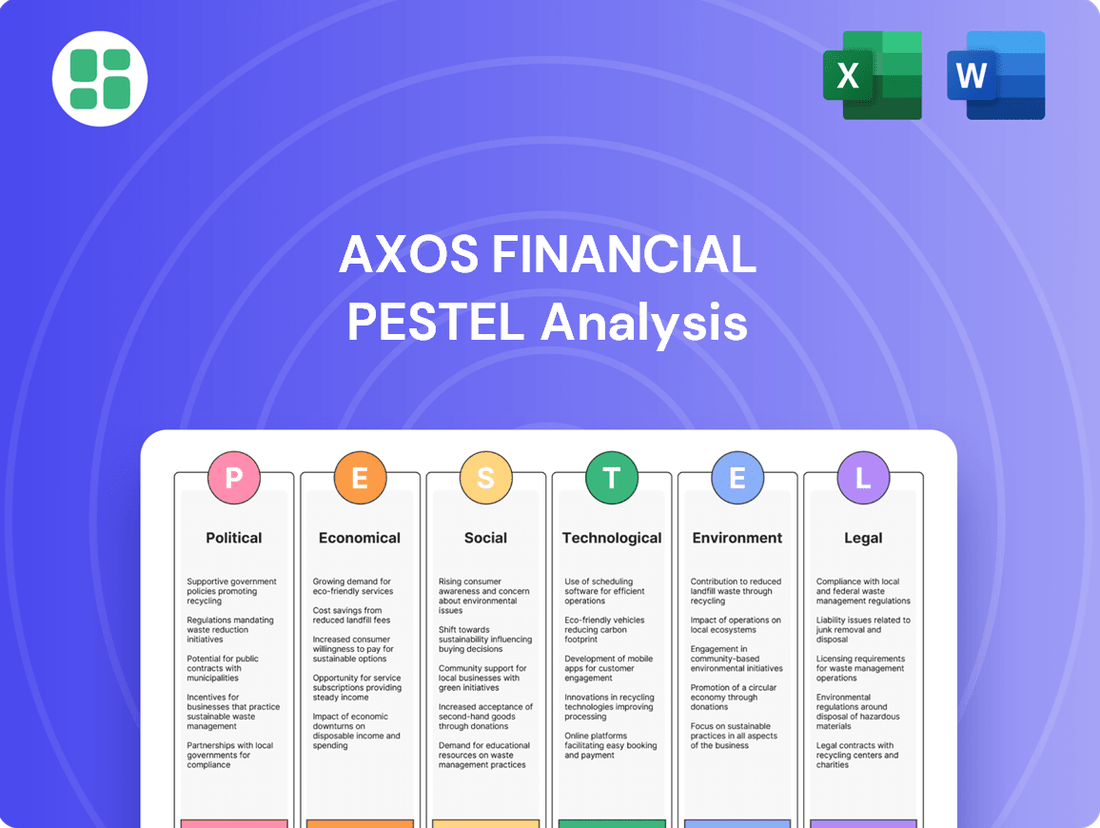

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal forces impacting Axos Financial, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making, helping stakeholders navigate external challenges and capitalize on emerging opportunities.

Axos Financial's PESTLE analysis provides a clear, summarized version of external factors, easing the burden of extensive research and allowing teams to focus on strategic responses during planning sessions.

Economic factors

Interest rate fluctuations are a cornerstone of Axos Financial's economic landscape, directly shaping its profitability. The bank's core business relies on the net interest margin, the difference between what it earns on loans and investments and what it pays for deposits. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25% to 5.50% by July 2023, significantly impacted this margin.

As of early 2024, the prevailing interest rate environment continues to be a key consideration. While higher rates generally benefit banks by increasing interest income, the speed and magnitude of these changes, coupled with potential economic slowdowns, can also lead to increased funding costs and a greater risk of loan defaults. Axos Financial's ability to manage its asset-liability mix in response to these shifts is crucial for maintaining healthy net interest income.

The U.S. economy's trajectory significantly impacts Axos Financial's operations. Strong economic expansion, as seen in the projected 2.3% GDP growth for 2024, typically boosts loan demand and improves credit quality, leading to more profitable lending and investment activities for the company.

Conversely, the risk of a recession, even a mild one, poses challenges. Should the economy contract, Axos could face increased loan defaults and a slowdown in new business origination, directly affecting its revenue streams and profitability. For instance, a 1% increase in unemployment, a common recessionary indicator, often correlates with higher non-performing loans across the financial sector.

Rising inflation presents a dual challenge for Axos Financial. Increased operational costs, from technology to personnel, can directly impact profitability. For instance, the US Consumer Price Index (CPI) saw a significant increase, reaching 3.4% year-over-year in April 2024, up from 3.5% in March, indicating persistent cost pressures.

While higher interest rates, often a response to inflation, can theoretically boost net interest margins for banks like Axos, the economic reality is more complex. Persistent inflation, as seen with the aforementioned CPI figures, can dampen consumer spending power. This reduced purchasing power may lead to slower loan growth and an increased risk of loan defaults, impacting asset quality.

Consumer Spending and Savings Behavior

Consumer spending is a major driver for Axos Financial. In late 2024 and into 2025, we're seeing a continued focus on essential goods and services, though discretionary spending is gradually recovering as inflation moderates. Savings rates have remained relatively robust, with many households having built up reserves during prior periods, which can translate into more deposits for banks like Axos.

Debt levels are also a key consideration. While consumer debt has been managed, rising interest rates in 2024 have made borrowing more expensive, potentially impacting demand for personal loans and mortgages. However, a strong employment market, with unemployment rates hovering around 3.7% in early 2024, provides a solid foundation for continued consumer activity.

- Consumer Spending Trends: Retail sales in the US saw a notable increase of 0.3% month-over-month in April 2024, indicating ongoing consumer demand.

- Savings Behavior: The personal saving rate in the US was around 3.9% in early 2024, a slight decrease from previous highs but still indicating a willingness to save.

- Debt Levels: Total household debt in the US reached approximately $17.7 trillion in Q1 2024, with credit card debt seeing a significant uptick.

- Employment Impact: The stable unemployment rate supports consumer confidence and their capacity to spend and save.

Competitive Landscape and Market Dynamics

The financial services sector is fiercely competitive, with Axos Financial navigating a landscape populated by traditional banks, credit unions, and rapidly growing fintech firms. This intense rivalry presents a constant economic challenge, demanding strategic agility and robust financial offerings.

To attract and retain customers, Axos Financial must consistently provide competitive interest rates and cutting-edge digital services. This necessitates ongoing investment in technology and a clear strategy for differentiation in a market that is constantly evolving. For instance, as of Q1 2024, the average interest rate on savings accounts from major banks remained below 1%, while Axos has actively sought to offer more attractive rates to capture market share.

- Market Share Competition: Axos competes with institutions holding significant assets, such as JPMorgan Chase with over $3.9 trillion in assets as of early 2024.

- Fintech Disruption: The rise of digital-only banks and payment platforms, like Chime and Square, introduces innovative business models and customer acquisition strategies that pressure traditional players.

- Interest Rate Sensitivity: Axos's profitability is directly tied to its ability to manage net interest margins in a fluctuating rate environment, a key dynamic in 2024.

- Digital Service Investment: The ongoing need to invest in user experience and digital capabilities, with the digital banking sector projected to grow significantly through 2025, is a critical factor.

Economic factors significantly shape Axos Financial's operational landscape, with interest rate movements being paramount. The Federal Reserve's monetary policy, including the federal funds rate range of 5.25% to 5.50% as of July 2023, directly influences Axos's net interest margin, a core profitability driver.

The broader U.S. economic health, projected to grow by 2.3% in 2024, generally supports loan demand and credit quality for Axos. However, persistent inflation, evidenced by a 3.4% year-over-year CPI increase in April 2024, raises operational costs and can temper consumer spending, impacting loan origination and asset quality.

Consumer behavior, including spending, saving, and debt management, is a critical economic input. While robust employment, with unemployment around 3.7% in early 2024, bolsters spending capacity, rising debt levels and borrowing costs in 2024 necessitate careful management by Axos.

| Economic Indicator | Value/Trend | Impact on Axos Financial |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (as of July 2023) | Influences Net Interest Margin |

| Projected GDP Growth (2024) | 2.3% | Supports Loan Demand and Credit Quality |

| CPI (Year-over-Year, April 2024) | 3.4% | Increases Operational Costs, May Dampen Spending |

| Unemployment Rate (Early 2024) | ~3.7% | Supports Consumer Spending Capacity |

| Total Household Debt (Q1 2024) | ~$17.7 trillion | Higher borrowing costs may impact loan demand |

Preview the Actual Deliverable

Axos Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Axos Financial delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain insights into regulatory changes, market trends, and consumer behavior relevant to Axos Financial.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed report provides a strategic overview for understanding Axos Financial's operating environment.

Sociological factors

Consumers are increasingly comfortable with digital platforms, with a significant portion of daily activities, including banking, now conducted online. This trend directly supports Axos Financial's digital-first strategy, as more people embrace online and mobile banking solutions.

As digital literacy improves across various age groups, the pool of potential customers for Axos Bank's services expands. For instance, in 2024, it's estimated that over 75% of US adults use online banking, a figure that continues to climb, indicating a strong market for digital banking platforms.

Consumers increasingly demand banking services that are quick, easy to use, and available anytime, anywhere. This societal shift strongly favors digital platforms over traditional bank branches. For instance, a 2024 survey indicated that 75% of banking customers prefer mobile banking apps for their daily transactions.

Axos Financial's digital-first strategy is well-positioned to capitalize on this trend. However, to maintain its competitive edge, the company must consistently invest in its technology to offer even more personalized and frictionless digital experiences. By 2025, it's projected that over 80% of new account openings will occur online.

Demographic shifts are significantly reshaping the banking landscape. The increasing financial influence of Millennials and Gen Z, who are now entering their prime earning years, presents a key opportunity. These generations, having grown up with technology, overwhelmingly favor digital banking solutions, with studies showing a strong preference for mobile-first experiences and seamless online account management.

Axos Financial's focus on digital platforms aligns well with these evolving consumer habits. As of early 2024, a substantial portion of banking transactions are conducted digitally, and this trend is only expected to accelerate. Institutions that can provide intuitive, user-friendly mobile apps and robust online tools are best positioned to attract and retain these younger, tech-savvy customers.

Trust and Security Concerns in Digital Finance

While many consumers embrace digital finance, a persistent sociological concern revolves around trust and security in online transactions. Axos Financial, like other digital banks, faces the challenge of allaying public anxieties regarding data breaches and digital fraud, which can significantly impact customer adoption and retention. Maintaining robust cybersecurity and transparent communication is paramount to fostering and sustaining customer confidence in the digital financial landscape.

Recent surveys highlight these ongoing concerns. For instance, a 2024 study indicated that over 60% of consumers still worry about the security of their personal financial information online. This societal sentiment directly influences how individuals interact with digital financial services, making trust a critical, albeit intangible, asset for institutions like Axos Financial.

- Societal Hesitation: Despite high digital adoption rates, a significant portion of the population remains wary of the security and privacy of their financial data online.

- Cybersecurity Imperative: Axos Financial must continually invest in and visibly demonstrate advanced cybersecurity measures to counter widespread concerns about digital fraud and breaches.

- Transparency Builds Confidence: Open communication regarding data protection policies and incident response is crucial for building and maintaining customer trust in the digital banking environment.

Demand for Socially Responsible Banking

A significant and growing segment of society, especially younger demographics, is increasingly factoring environmental, social, and governance (ESG) criteria into their banking choices. This societal shift directly impacts financial institutions like Axos Financial, creating both a challenge to adapt and an opportunity to attract a conscious customer base. For instance, a 2024 report indicated that over 70% of millennials consider ESG factors when making investment decisions, a trend that extends to their banking preferences.

This growing demand for socially responsible banking means Axos Financial faces pressure to clearly articulate and demonstrate its commitment to corporate social responsibility. Failure to do so could alienate a key consumer group, while a strong ESG stance can foster enhanced customer loyalty and attract new clients. This focus on ethical practices is becoming a competitive differentiator in the financial services sector.

Axos Financial can leverage this trend by:

- Highlighting sustainable lending practices and community investment initiatives.

- Increasing transparency around its governance structures and diversity metrics.

- Developing financial products that align with ESG principles, such as green bonds or impact investing options.

Consumer preferences are shifting towards digital-first banking, with a strong emphasis on convenience and accessibility. This aligns perfectly with Axos Financial's strategy, as more individuals, particularly younger demographics, embrace online and mobile platforms for their financial needs. By 2025, it's projected that over 80% of new account openings will occur online, underscoring the importance of a robust digital presence.

Trust and security remain paramount concerns for consumers engaging in digital transactions. Axos Financial must actively address anxieties surrounding data breaches and fraud through advanced cybersecurity measures and transparent communication. A 2024 study revealed that over 60% of consumers still worry about the security of their financial information online, making trust a critical factor for customer retention.

Societal expectations are increasingly incorporating Environmental, Social, and Governance (ESG) factors into consumer choices. This trend presents an opportunity for Axos Financial to attract a socially conscious customer base by highlighting sustainable practices and community involvement. In 2024, over 70% of millennials reported considering ESG factors in their financial decisions, indicating a growing market for ethical banking.

Technological factors

The rapid evolution of artificial intelligence and machine learning presents substantial opportunities for Axos Financial. These technologies can significantly boost operational efficiency, strengthen fraud detection, and create more personalized customer interactions. For instance, AI-powered credit scoring models can lead to faster approvals and better risk assessment.

By integrating AI, Axos Financial can gain a competitive advantage in the digital banking landscape. Applications like AI-driven chatbots for customer support and predictive analytics for identifying market trends and customer needs are key differentiators. In 2024, the global AI market is projected to reach over $200 billion, highlighting the widespread adoption and investment in these transformative technologies.

As a digital-first institution, Axos Financial is inherently exposed to evolving cybersecurity threats like data breaches, ransomware, and phishing. These risks necessitate significant and ongoing investment in advanced security measures to safeguard sensitive customer information.

Protecting customer data and maintaining trust requires robust cybersecurity infrastructure, including threat intelligence and comprehensive employee training. Failure to do so can lead to severe financial penalties and reputational damage, especially given increasingly stringent regulatory requirements.

The financial services sector saw a significant rise in cyberattacks in 2023, with the average cost of a data breach reaching $4.45 million globally, according to IBM's 2023 Cost of a Data Breach Report. This highlights the critical need for institutions like Axos to prioritize cybersecurity spending to mitigate these substantial risks.

Axos Financial heavily relies on cloud computing infrastructure for its operational agility, enabling scalability and cost efficiencies crucial for its digital-first banking model. This technological foundation allows for rapid adaptation to market demands and seamless expansion of services.

The ongoing evolution of cloud technologies, particularly in areas like enhanced security protocols and sophisticated hybrid cloud solutions, is poised to further refine Axos's digital backbone. This will be instrumental in accelerating new product launches and improving the overall customer experience throughout 2024 and into 2025.

Mobile Banking and User Experience Innovation

Smartphones are now the go-to for many banking needs, making mobile platforms crucial for Axos Financial. The company must keep its apps fresh with easy-to-use designs and smooth transaction processes. This includes adding helpful financial management tools to stand out from competitors who are also focused on digital experiences.

In 2024, a significant portion of banking interactions are expected to occur via mobile devices. For instance, industry reports from late 2023 indicated that over 70% of consumers prefer mobile banking for routine transactions. Axos Financial's ability to offer a superior user experience directly impacts customer acquisition and retention in this competitive landscape.

- Mobile Adoption: Continued growth in smartphone penetration globally fuels the demand for robust mobile banking solutions.

- User Interface (UI) and User Experience (UX): Investment in intuitive app design and seamless functionality is paramount for customer satisfaction and engagement.

- Feature Integration: Incorporating budgeting tools, personalized financial insights, and easy payment options within the mobile app enhances its value proposition.

- Competitive Differentiation: Digital-first banks and fintech companies are setting high user experience standards, pushing traditional institutions to innovate rapidly.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are still finding their footing in broad banking adoption, but they hold significant long-term potential for revolutionizing payment processing, securities settlement, and digital identity verification. Axos Financial actively tracks these developing technologies, seeking avenues to boost operational efficiency, trim expenses, and bolster security. For instance, by 2024, the global blockchain market was projected to reach over $13.5 billion, indicating substantial investment and ongoing development in this space.

The potential benefits for financial institutions like Axos are considerable:

- Enhanced Security: DLT's inherent cryptographic nature can offer superior data integrity and fraud prevention.

- Increased Efficiency: Streamlining processes like cross-border payments could significantly reduce transaction times and associated costs.

- New Service Offerings: Exploration into tokenized assets and digital currencies could open new revenue streams.

Technological advancements, particularly in AI and cloud computing, are central to Axos Financial's strategy, driving efficiency and customer experience. The company's reliance on mobile platforms is critical, with over 70% of consumers preferring mobile banking for routine transactions as of late 2023. Emerging technologies like blockchain also offer future potential for streamlining operations and security.

| Technology Area | Impact on Axos Financial | Market Data/Projections (2024/2025) |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhanced operational efficiency, fraud detection, personalized customer interactions, faster credit approvals. | Global AI market projected to exceed $200 billion in 2024. |

| Cybersecurity | Mitigation of data breaches, ransomware, phishing; protection of sensitive customer data; maintaining trust. | Average cost of a data breach reached $4.45 million globally in 2023. |

| Cloud Computing | Operational agility, scalability, cost efficiencies, rapid adaptation to market demands, seamless service expansion. | Continued evolution of cloud security and hybrid solutions expected to refine digital backbone. |

| Mobile Platforms | Crucial for customer acquisition and retention; need for intuitive design and smooth transactions. | Over 70% of consumers prefer mobile banking for routine transactions (late 2023 data). |

| Blockchain & Distributed Ledger Technology (DLT) | Potential for revolutionizing payment processing, securities settlement, digital identity; boosting efficiency and security. | Global blockchain market projected to exceed $13.5 billion by 2024. |

Legal factors

Axos Financial, operating as a federally regulated bank holding company, navigates a dense regulatory landscape dictated by bodies like the Federal Reserve, OCC, and FDIC. These regulations, covering capital adequacy, lending practices, and operational integrity, directly shape its business strategy and financial performance. For instance, as of Q1 2024, Axos reported a Common Equity Tier 1 (CET1) capital ratio of 13.5%, well above the regulatory minimums, demonstrating its robust compliance posture.

The increasing number of data privacy laws, like the California Consumer Privacy Act (CCPA) and other state-level regulations, directly affects how Axos Financial handles customer information. This includes how they gather, keep, and utilize data.

Staying compliant with these regulations is vital. Failure to do so can lead to significant financial penalties, damage customer confidence, and create legal hurdles for Axos Financial's online activities.

Axos Financial operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, necessitating comprehensive customer identification and transaction monitoring protocols to combat financial crime. These legal requirements are dynamic, demanding ongoing investment in compliance technology and personnel training to effectively manage legal and reputational risks.

In 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize the importance of robust AML/KYC programs, with financial institutions facing significant penalties for non-compliance. For instance, several major banks incurred multi-million dollar fines for AML deficiencies in recent years, underscoring the financial and operational impact of failing to meet these legal standards.

Digital Accessibility Laws and Standards

Axos Financial, as a digital-first institution, faces significant legal obligations under digital accessibility laws like the Americans with Disabilities Act (ADA). These regulations mandate that its online banking platforms and mobile applications must be usable by individuals with disabilities, including those with visual, auditory, or motor impairments. Failure to comply can result in substantial financial penalties and legal actions.

The landscape of digital accessibility litigation is evolving, with a notable increase in ADA-related lawsuits filed against businesses, including financial institutions. For instance, in 2023, the number of ADA Title III lawsuits filed in federal court continued its upward trend, with many targeting websites and digital services. Axos must proactively ensure its digital offerings meet current and emerging accessibility standards to mitigate these risks.

- ADA Compliance: Ensuring websites and mobile apps meet WCAG 2.1 AA standards is crucial for accessibility.

- Litigation Risk: Unaddressed accessibility gaps can lead to costly lawsuits, impacting financial performance and brand reputation.

- Regulatory Scrutiny: Financial regulators increasingly focus on digital inclusion, potentially leading to stricter oversight and compliance requirements.

Intellectual Property Law and Fintech Innovation

Axos Financial's reliance on technology makes robust intellectual property (IP) protection paramount. This includes securing patents for its proprietary software and registering trademarks for its brand identity, safeguarding its innovative fintech solutions. In 2024, the global fintech market saw significant investment in IP, with companies actively seeking patent protection for AI-driven financial tools and blockchain applications, reflecting the critical role of IP in maintaining a competitive edge.

Legal frameworks governing IP, such as patent enforcement and the protection of trade secrets, are essential for Axos Financial. These legal structures are vital for defending its unique technological advancements and preserving its competitive advantage within the rapidly evolving fintech landscape. The United States Patent and Trademark Office (USPTO) reported a notable increase in fintech patent filings in the first half of 2024, underscoring the legal importance of IP for growth in this sector.

- Patents: Protecting unique software algorithms and platform functionalities.

- Trademarks: Safeguarding brand names and logos associated with Axos Financial's services.

- Trade Secrets: Maintaining confidentiality of proprietary processes and customer data.

- Enforcement: Legal recourse against infringement to protect market position.

Axos Financial's operations are heavily influenced by evolving consumer protection laws, which mandate transparency in lending, fair advertising, and data security. Compliance with these regulations, such as those enforced by the Consumer Financial Protection Bureau (CFPB), is critical to maintaining customer trust and avoiding legal repercussions. For instance, the CFPB's ongoing focus on fair lending practices in 2024 means Axos must continually review its underwriting and marketing to ensure no discriminatory patterns emerge.

The legal framework surrounding digital banking, including cybersecurity mandates and electronic fund transfer regulations, directly impacts Axos Financial's service delivery and risk management. Adherence to standards set by agencies like the National Credit Union Administration (NCUA) and state banking departments ensures the integrity and security of its online platforms. As of early 2024, regulatory bodies have increased their scrutiny on cybersecurity resilience, with many financial institutions investing heavily in advanced threat detection systems.

| Legal Factor | Description | Impact on Axos Financial | 2024/2025 Relevance |

|---|---|---|---|

| Consumer Protection Laws | Regulations ensuring fair treatment, transparency, and data privacy for customers. | Requires robust disclosure policies, fair lending practices, and secure data handling. | CFPB's continued focus on fair lending and data privacy necessitates ongoing compliance audits. |

| Digital Banking Regulations | Rules governing cybersecurity, electronic transactions, and online platform integrity. | Demands investment in secure IT infrastructure, fraud prevention, and compliance with e-signature laws. | Heightened regulatory expectations for cybersecurity resilience and data breach notification protocols. |

| Anti-Money Laundering (AML) & KYC | Laws to prevent financial crimes through customer identification and transaction monitoring. | Mandates strict onboarding processes and continuous monitoring of financial activities. | FinCEN's emphasis on proactive AML programs means increased investment in compliance technology and training. |

Environmental factors

Societal and investor demand for sustainable and ESG-compliant financial products is a growing environmental factor. Axos Financial, like many institutions, may see pressure to incorporate ESG principles into its lending and investment strategies. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2024, indicating a substantial shift in investor preferences.

This trend means Axos could be motivated to offer green financial products and services to attract environmentally conscious customers and investors. Failing to adapt could mean missing out on a significant and expanding segment of the market, as evidenced by the increasing number of funds focused on environmental, social, and governance criteria.

Axos Financial, like other financial institutions, faces growing pressure to disclose its climate-related risks. This includes both physical risks, like extreme weather events impacting assets, and transitional risks, such as policy changes affecting carbon-intensive industries. For instance, by the end of 2024, many banks are expected to align their reporting with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

This evolving landscape means Axos may need to bolster its reporting mechanisms. Such enhancements could influence operational strategies, perhaps by re-evaluating lending portfolios or investment decisions to better manage climate exposure. By 2025, regulators in key markets are anticipated to mandate more stringent climate risk assessments, potentially impacting capital requirements for institutions with significant climate-related exposures.

Axos Financial, despite its digital nature, maintains an operational carbon footprint through its data centers and corporate offices. In 2023, the financial services sector globally faced increasing scrutiny regarding its environmental impact, with a focus on energy consumption in digital infrastructure. This trend is projected to intensify through 2025, pushing companies like Axos to invest in energy-efficient technologies and potentially renewable energy sources to mitigate these costs and meet stakeholder expectations.

Reputational Risks from Environmental Impact

Public perception of environmental responsibility significantly shapes a company's brand and customer loyalty. Axos Financial, like many in the financial sector, is susceptible to reputational damage if it is seen as neglecting environmental concerns. This can directly affect its capacity to attract and retain clients, especially among younger demographics and those who actively seek out businesses with strong corporate social responsibility (CSR) credentials.

For instance, a growing number of consumers are making purchasing decisions based on a company's environmental footprint. A 2024 survey indicated that over 60% of millennials consider a company's sustainability practices when choosing financial services. If Axos Financial fails to demonstrate robust environmental stewardship, it risks alienating this key demographic and suffering a decline in market share.

- Customer Retention: Negative environmental perceptions can lead to customer attrition, impacting recurring revenue streams.

- Brand Image: A tarnished environmental reputation can be challenging and costly to repair, affecting overall brand value.

- Investor Confidence: Environmental, Social, and Governance (ESG) factors are increasingly important to investors; poor performance can deter capital.

Investment in Green Technologies and Renewable Energy

Axos Financial can capitalize on the growing demand for green technologies and renewable energy by offering specialized financing solutions. This aligns with global sustainability trends, potentially opening new revenue streams.

The environmental shift towards sustainability presents significant opportunities for Axos Financial to finance renewable energy projects and green infrastructure. For instance, the U.S. Department of Energy projected that renewable energy sources could account for 45% of the nation's electricity generation by 2050, a substantial increase from the 22% recorded in 2022. This growth trajectory signals a robust market for green financing.

- Financing Opportunities: Axos can develop loan products and investment vehicles for solar, wind, and other renewable energy installations.

- Sustainable Infrastructure: The bank can fund projects related to electric vehicle charging networks, energy-efficient buildings, and sustainable transportation.

- Market Positioning: By actively participating in green finance, Axos can enhance its reputation as a socially responsible institution, attracting environmentally conscious customers and investors.

- Revenue Growth: The expanding renewable energy sector, projected to see continued investment, offers a pathway for Axos to diversify its loan portfolio and generate new income.

Axos Financial, like all institutions, must navigate increasing regulatory scrutiny regarding climate risk disclosure, with frameworks like TCFD becoming standard by the end of 2024. This necessitates robust reporting and potential adjustments to lending and investment strategies to manage climate exposure, especially as regulators in key markets prepare to mandate stricter assessments by 2025, which could impact capital requirements.

The company's digital operations, including data centers, contribute to its carbon footprint, an area facing heightened scrutiny in the financial services sector through 2025. Investment in energy-efficient technologies and renewable energy sources is becoming crucial for mitigating operational costs and meeting stakeholder expectations for environmental responsibility.

Public perception of environmental responsibility directly impacts Axos's brand and customer loyalty, particularly with younger demographics who prioritize sustainability. A 2024 survey revealed over 60% of millennials consider a company's sustainability practices when choosing financial services, highlighting the risk of alienating this key market segment.

The growing demand for green technologies and renewable energy presents a significant opportunity for Axos to develop specialized financing solutions, aligning with global sustainability trends and potentially opening new revenue streams. The U.S. Department of Energy projects renewable energy to constitute 45% of electricity generation by 2050, up from 22% in 2022, indicating a robust market for green financing.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Axos Financial is built on data from official U.S. government agencies, financial regulatory bodies, and reputable economic forecasting firms. We incorporate insights from legislative updates, market performance reports, and technological adoption trends.