Axos Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axos Financial Bundle

Discover the strategic framework behind Axos Financial's innovative approach. This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational excellence. Perfect for anyone looking to understand digital banking success.

Partnerships

Axos Financial actively collaborates with technology and fintech providers, such as Ascendion, to bolster its digital banking capabilities. These partnerships are instrumental in driving AI-powered transformations and integrating predictive analytics, which are key to elevating customer experiences and optimizing operational efficiency in today's digital-centric financial environment.

Axos Bank leverages affinity partners as a key strategy to distribute its banking products. These partnerships act as cost-effective channels, allowing Axos to reach a broad customer base across the country without the need for a physical branch infrastructure.

For instance, in 2023, Axos reported that its digital-first approach, heavily supported by such partnerships, contributed to a significant portion of its customer acquisition, demonstrating the efficiency of this model in expanding reach and lowering distribution costs.

Axos Financial cultivates vital partnerships with introducing broker-dealers and registered investment advisor correspondents through its subsidiaries, Axos Clearing LLC and Axos Invest, Inc. These collaborations are fundamental to delivering robust securities clearing and digital investment advisory solutions.

In 2023, Axos Clearing reported a significant increase in client assets under custody, demonstrating the growing reliance of these partners on Axos' infrastructure. This growth underscores the importance of these relationships in expanding Axos' reach within the wealth management sector.

Lending and Mortgage Professionals

Axos Bank actively collaborates with mortgage professionals and financial advisors, integrating their expertise to broaden the reach of specialized loan offerings. These partnerships are crucial for Axos to extend its lending capabilities and introduce distinctive, client-centric financial products.

The bank also forms alliances with automobile dealers, which facilitates the offering of tailored financing solutions. These strategic relationships are instrumental in enhancing Axos's market presence and delivering innovative banking services.

- Mortgage Professionals: Facilitate access to Axos's diverse mortgage products, expanding lending opportunities.

- Financial Advisors: Integrate Axos's banking and lending solutions into broader financial planning for clients.

- Automobile Dealers: Provide specialized financing options for vehicle purchases, driving loan volume.

Strategic Acquisition and Divestiture Partners

Axos Financial has historically leveraged strategic acquisitions and divestitures as key partnership opportunities, though these are not typically ongoing operational relationships. A notable example includes the acquisition of loan portfolios from the Federal Deposit Insurance Corporation (FDIC). These transactions, while episodic, have demonstrably influenced Axos's financial trajectory, impacting its asset growth and profitability metrics.

Such strategic interactions, even when singular events, play a crucial role in reshaping the company's balance sheet and, consequently, its net interest margin. For instance, in 2019, Axos acquired a significant loan portfolio from the FDIC, which contributed to a substantial increase in its total assets and interest-earning capacity. These moves underscore the importance of opportunistic partnerships in managing and expanding the bank's core business.

- FDIC Loan Portfolio Acquisitions: Past transactions, like the 2019 FDIC acquisition, significantly boosted Axos's asset base and interest income.

- Balance Sheet Reshaping: These one-off partnerships are instrumental in strategically altering the composition and size of Axos's assets and liabilities.

- Net Interest Margin Impact: The successful integration of acquired loan portfolios directly influences the bank's core profitability measure, the net interest margin.

Axos Financial's key partnerships extend to technology providers like Ascendion, enhancing digital capabilities through AI and predictive analytics. Affinity partners serve as crucial, cost-effective distribution channels for banking products, significantly expanding customer reach without a physical branch network. In 2023, these digital-first strategies, bolstered by partnerships, were a major driver of customer acquisition.

Collaborations with introducing broker-dealers and registered investment advisors, facilitated by subsidiaries Axos Clearing and Axos Invest, are vital for providing securities clearing and investment advisory services. Axos Clearing saw increased client assets under custody in 2023, highlighting the growing reliance on its infrastructure by these partners in the wealth management sector.

Furthermore, Axos Bank partners with mortgage professionals, financial advisors, and automobile dealers to broaden the reach of specialized loan offerings and financing solutions, thereby enhancing market presence and driving loan volume. Past strategic acquisitions, such as the 2019 FDIC loan portfolio purchase, have also demonstrably reshaped Axos's balance sheet and profitability.

| Partner Type | Purpose | Impact/Benefit | Example/Data Point |

|---|---|---|---|

| Fintech/Tech Providers (e.g., Ascendion) | Enhance digital banking, AI, predictive analytics | Improved customer experience, operational efficiency | Driving AI-powered transformations |

| Affinity Partners | Cost-effective product distribution | Broad customer reach, lower distribution costs | Significant customer acquisition in 2023 |

| Broker-Dealers/RIAs (via Axos Clearing/Invest) | Securities clearing, digital investment advisory | Expanded reach in wealth management | Increased client assets under custody in 2023 |

| Mortgage Professionals/Financial Advisors | Expand specialized loan offerings | Broader lending capabilities, client-centric products | Integration into financial planning |

| Automobile Dealers | Tailored financing solutions | Enhanced market presence, increased loan volume | Offering specialized financing options |

| FDIC (Strategic Acquisitions) | Acquisition of loan portfolios | Asset growth, improved net interest margin | 2019 FDIC acquisition boosted assets and interest income |

What is included in the product

Axos Financial's business model focuses on leveraging technology to deliver a seamless digital banking experience, targeting a broad range of customers with competitive deposit and lending products.

This model emphasizes low-cost digital operations, efficient customer acquisition through online channels, and a diversified revenue stream from loan origination and servicing.

Axos Financial's Business Model Canvas offers a clear, one-page snapshot that simplifies complex financial strategies, making it easier to identify and address pain points in their operational efficiency.

Activities

Axos Financial's key activity is running its digital banking platform, offering a full range of banking products like checking, savings, and loans. This digital-first approach serves individuals, small businesses, and commercial clients nationwide, focusing on seamless online and mobile experiences.

In 2023, Axos reported strong digital growth, with total deposits reaching $67.7 billion, reflecting customer trust in their online services. Their commitment to digital operations is evident in their continuous investment in technology to enhance user experience and operational efficiency.

A core activity for Axos Financial involves offering securities clearing and custody services, primarily through its subsidiary Axos Clearing LLC. This service is crucial for introducing broker-dealers and registered investment advisor correspondents, acting as the backbone for their trading and asset management operations.

Axos Clearing LLC manages significant assets under custody and administration, highlighting its role as a trusted custodian. As of the first quarter of 2024, Axos Financial reported total client assets held at Axos Clearing of $71.1 billion, demonstrating the scale of these operations.

Axos Invest, Inc. actively engages in digital investment advisory services for retail investors. This is a crucial activity that broadens Axos Financial's revenue streams, moving beyond its core banking operations and attracting a wider customer base seeking managed investment solutions.

This digital advisory arm allows Axos Financial to tap into the growing robo-advisor market. As of the first quarter of 2024, the digital advice industry has seen significant growth, with assets under management in robo-advisors projected to reach over $3 trillion globally by 2027, showcasing the market potential for Axos Invest.

Loan Origination and Portfolio Management

Axos Financial's core operations revolve around originating and actively managing a diverse loan portfolio. This includes significant exposure to asset-backed commercial lending, single-family mortgages, and auto lending, demonstrating a broad approach to credit markets.

The effective stewardship of these loans is paramount to Axos Financial's financial health, directly impacting its net interest income. As of the first quarter of 2024, the company reported a net interest income of $405.8 million, highlighting the importance of its loan portfolio management.

- Loan Origination: Axos originates various loan types, including residential mortgages, commercial loans, and auto loans.

- Portfolio Diversification: The company maintains a diversified loan book to mitigate risk across different asset classes.

- Net Interest Income Driver: The interest earned on its loan portfolio is a primary contributor to Axos Financial's profitability.

- Q1 2024 Performance: Net interest income reached $405.8 million in the first quarter of 2024, underscoring the significance of loan operations.

Technology Development and Innovation

Axos Financial's commitment to technology development is a cornerstone of its business model. The company consistently invests in and enhances its technology infrastructure, a crucial activity that underpins its operational efficiency and competitive edge. This includes the strategic integration of advanced technologies like artificial intelligence and predictive analytics.

These technological advancements are not merely for show; they directly translate into tangible benefits for Axos. By streamlining operations and reducing costs, the company can offer more competitive pricing and services. Furthermore, this focus on innovation is geared towards significantly improving the overall customer experience.

- AI and Predictive Analytics: Axos actively leverages AI and predictive analytics to optimize processes and personalize customer interactions.

- Digital Transformation: Continuous investment in its digital platforms and infrastructure is key to maintaining a modern and efficient banking experience.

- Operational Efficiency: Technology development is directly linked to cost reduction and improved operational workflows across the organization.

- Customer Experience Enhancement: Innovations are designed to create seamless, intuitive, and value-added experiences for Axos customers.

Axos Financial's key activities encompass running its digital banking platform, offering a comprehensive suite of banking products and services. This digital-first strategy caters to individuals, small businesses, and commercial clients, emphasizing a seamless online and mobile experience.

A significant activity involves providing securities clearing and custody services through its subsidiary, Axos Clearing LLC. This function is vital for broker-dealers and investment advisors, supporting their trading and asset management operations. As of Q1 2024, Axos Financial reported $71.1 billion in client assets held at Axos Clearing.

Axos Invest, Inc. actively provides digital investment advisory services, broadening revenue streams and attracting clients seeking managed investments. This taps into the growing robo-advisor market, a sector projected to manage over $3 trillion globally by 2027.

The company also focuses on originating and managing a diverse loan portfolio, including residential mortgages, commercial loans, and auto loans. This portfolio management is a primary driver of net interest income, which reached $405.8 million in Q1 2024.

Continuous investment in technology development is a core activity, enhancing operational efficiency and customer experience. This includes leveraging AI and predictive analytics to optimize processes and personalize interactions.

| Key Activity | Description | Q1 2024 Data/Context |

|---|---|---|

| Digital Banking Platform | Offering checking, savings, loans via online/mobile channels. | Total deposits reached $67.7 billion in 2023. |

| Securities Clearing & Custody | Providing services for broker-dealers and RIAs. | $71.1 billion in client assets held at Axos Clearing (Q1 2024). |

| Digital Investment Advisory | Robo-advisor services for retail investors. | Tapping into a global market projected to exceed $3 trillion by 2027. |

| Loan Origination & Management | Managing diverse loan portfolio (mortgages, commercial, auto). | Net interest income was $405.8 million (Q1 2024). |

| Technology Development | Investing in AI, analytics, and digital infrastructure. | Aims to improve operational efficiency and customer experience. |

What You See Is What You Get

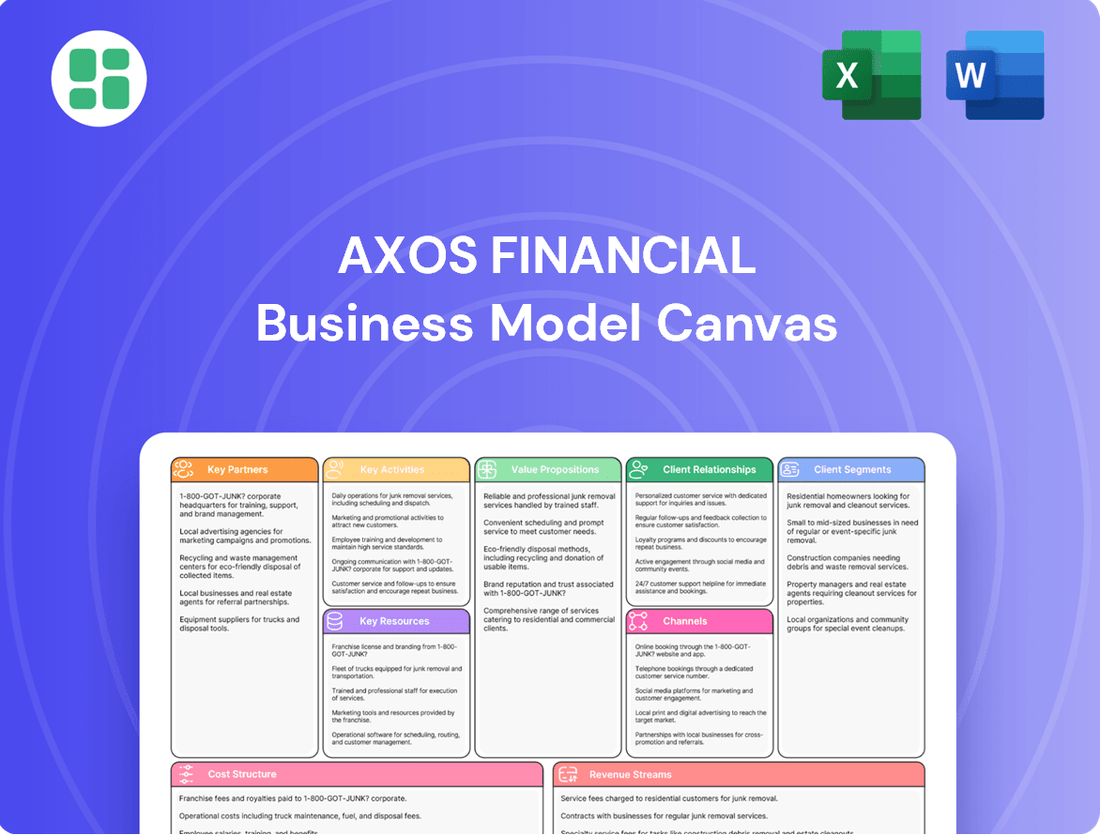

Business Model Canvas

The Axos Financial Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This comprehensive canvas provides a detailed breakdown of Axos Financial's strategic approach, covering all essential components. You can be confident that the information and structure presented here are exactly what you will obtain, ready for immediate use and analysis.

Resources

Axos Financial's proprietary digital banking platform is the engine of its efficient, digital-first model. This universal platform, coupled with an enterprise technology stack, offers substantial operating leverage. It significantly lowers the costs associated with acquiring and servicing clients, a key differentiator in the competitive banking landscape.

Axos Financial's substantial financial capital, bolstered by a growing deposit base, is a cornerstone of its operations. As of the first quarter of 2024, total deposits reached approximately $65.9 billion, demonstrating a consistent inflow of funds that fuels its lending activities.

This robust capital structure directly supports a diversified loan portfolio, which is crucial for sustained lending operations and strategic growth initiatives. The company's ability to attract and manage these financial resources allows for ongoing investment and expansion of its service offerings.

Axos Financial's skilled human capital is a cornerstone of its business model, comprising a robust team of experienced financial professionals, cutting-edge technology experts, and committed relationship managers. This diverse talent pool is essential for driving innovation within the company's digital-first banking platform and for effectively managing intricate financial operations.

The collective expertise of these individuals is directly responsible for the development and maintenance of Axos's advanced technological infrastructure, which underpins its efficient and cost-effective service delivery. For instance, as of Q1 2024, Axos reported a significant increase in its digital customer acquisition, directly attributable to the seamless user experience facilitated by its technology teams.

Furthermore, the dedication of their relationship managers is key to fostering strong, long-term connections with clients, a vital component for customer retention and growth in the competitive financial services landscape. This human element complements the technological prowess, ensuring personalized service that resonates with a broad customer base.

Brand Reputation and Trust

Axos Financial's brand reputation is a cornerstone of its business model, directly influencing customer acquisition and loyalty. Recognition as one of America's Best Banks by Forbes and other esteemed publications underscores a significant level of trust and credibility within the financial sector.

This strong brand image acts as a critical intangible asset, differentiating Axos in a highly competitive market and fostering long-term customer relationships. In 2024, maintaining and enhancing this reputation is paramount for sustained growth.

- Forbes Recognition: Axos Financial has been consistently recognized by Forbes as one of America's Best Banks, a testament to its strong brand reputation.

- Customer Trust: This positive recognition translates into tangible customer trust, a vital component for attracting and retaining clients in the banking industry.

- Competitive Advantage: A well-regarded brand reputation provides a significant competitive edge, allowing Axos to stand out against other financial institutions.

- Market Differentiation: The trust built through consistent positive feedback helps differentiate Axos, making it a preferred choice for consumers seeking reliable banking services.

Data and Analytics Capabilities

Axos Financial's data and analytics capabilities are a cornerstone of its business model, allowing it to harness vast datasets for enhanced customer engagement and operational efficiency. This is crucial for personalizing financial products and services, a key differentiator in the competitive digital banking landscape.

The company leverages its data infrastructure to refine risk management protocols, ensuring robust financial health. For instance, in the first quarter of 2024, Axos reported a net interest margin of 3.75%, demonstrating effective management of its lending and deposit portfolios, underpinned by strong data analytics.

- Data Collection and Processing: Axos gathers extensive customer and transactional data, feeding into sophisticated analytical engines.

- Personalized Customer Experiences: Insights derived from data enable tailored product offerings and proactive customer support.

- Risk Management Enhancement: Advanced analytics are employed to identify, assess, and mitigate credit, market, and operational risks.

- Strategic Decision Support: Data-driven insights inform product development, market expansion, and overall business strategy.

Axos Financial's key resources include its proprietary digital banking platform, a substantial financial capital base, skilled human capital, a strong brand reputation, and advanced data analytics capabilities. These elements collectively enable efficient operations, customer acquisition, and risk management.

| Resource Category | Specific Resource | Description | Q1 2024 Data/Impact |

|---|---|---|---|

| Technology | Proprietary Digital Banking Platform | Drives operational efficiency and low customer acquisition costs. | Underpins a digital-first model with significant operating leverage. |

| Financial Capital | Deposit Base | Fuels lending activities and supports growth initiatives. | Total deposits reached approximately $65.9 billion. |

| Human Capital | Experienced Professionals | Drives innovation, manages operations, and fosters client relationships. | Includes technology experts and relationship managers crucial for service delivery. |

| Brand | Reputation and Trust | Attracts and retains customers, providing a competitive advantage. | Recognized by Forbes as one of America's Best Banks. |

| Data & Analytics | Data Infrastructure | Enhances customer engagement, personalizes services, and refines risk management. | Supported a net interest margin of 3.75% in Q1 2024. |

Value Propositions

Axos Bank distinguishes itself by offering highly competitive interest rates on a variety of deposit accounts, such as high-yield savings and checking, alongside attractive rates for loans. For instance, as of early 2024, many of Axos's savings accounts were offering APYs significantly above the national average, often exceeding 4.00%.

This focus on attractive rates is complemented by a strategy of minimal or zero fees across many of its core banking products, including checking accounts that often waive monthly maintenance fees and ATM fees. This directly addresses customer pain points related to hidden charges and aims to maximize customer savings.

By prioritizing low costs and high returns for its customers, Axos Bank creates a compelling value proposition for individuals and businesses alike, encouraging them to consolidate their banking needs with an institution that directly contributes to their financial well-being.

Axos Financial offers a banking experience built for today's digital world, allowing customers to manage their money seamlessly online and through their mobile app. This digital-first approach means you can bank anytime, anywhere, fitting financial management into your busy schedule.

This convenience is particularly appealing to a growing segment of the population. For instance, in 2023, mobile banking usage continued its upward trend, with a significant percentage of consumers preferring digital channels for most of their banking needs. Axos's platform is designed to meet this demand, providing easy access to accounts, transactions, and support.

Axos Financial provides a comprehensive suite of integrated financial products, encompassing consumer and business banking, securities clearing, and investment advisory services. This allows clients to consolidate their financial management into a single platform.

In 2024, Axos reported a net interest margin of 3.26%, reflecting its ability to effectively manage its diverse financial offerings and generate income from its integrated services.

This holistic approach simplifies financial management for customers, offering convenience and efficiency by consolidating various financial needs under one provider.

Enhanced Security and Data Protection

Axos Financial prioritizes robust data protection, employing advanced digital security measures to safeguard customer information. This focus on cybersecurity is crucial in today's digital landscape, building essential trust with their clientele.

FDIC insurance is a cornerstone of their security proposition, offering peace of mind by protecting customer deposits up to the legal limit. This governmental backing is a critical component of their value offering, ensuring asset safety.

The company provides customers with digital security tools, empowering them to manage and protect their accounts effectively. For instance, in 2024, Axos continued to invest in multi-factor authentication and real-time fraud monitoring systems.

- Advanced Digital Security: Implementing cutting-edge technologies to prevent unauthorized access and data breaches.

- FDIC Insurance: Guaranteeing the safety of customer deposits up to $250,000 per depositor, per insured bank, for each account ownership category.

- Customer Security Tools: Offering features like transaction alerts, secure messaging, and robust password management.

- Commitment to Trust: Building a secure online banking environment that fosters customer confidence and loyalty.

Tailored and Specialized Services

Axos Financial offers highly customized banking solutions specifically designed for commercial and middle-market clients. This approach recognizes that larger businesses often have intricate financial requirements that standard offerings cannot meet. By focusing on these unique needs, Axos aims to build strong, lasting relationships.

The bank’s strategy involves a hands-on relationship management style, ensuring clients receive dedicated support. This personalized service is crucial for navigating complex financial landscapes and achieving specific business objectives. It’s about understanding the client’s world deeply.

Axos further refines its tailored services by concentrating on particular industry verticals. For instance, they provide specialized expertise and financial products for sectors like healthcare and aerospace. This deep dive into specific industries allows them to offer solutions that are truly relevant and impactful.

- Industry Specialization: Focus on sectors like healthcare and aerospace demonstrates a commitment to understanding niche market demands.

- Personalized Relationship Management: Direct, hands-on engagement ensures client needs are proactively addressed.

- Complex Needs Fulfillment: Tailored solutions are developed to meet the intricate financial requirements of larger commercial entities.

- Value Proposition: Providing specialized banking services that go beyond generic offerings, fostering deeper client loyalty and satisfaction.

Axos Financial's value proposition centers on delivering superior financial products through a digital-first, customer-centric approach. They offer highly competitive interest rates on deposits, often exceeding national averages, and minimize fees across their banking services, directly enhancing customer savings.

This is supported by a seamless online and mobile banking experience, catering to the increasing preference for digital financial management. Axos also provides an integrated suite of financial products, simplifying management for clients and demonstrating operational efficiency, as seen in their 3.26% net interest margin in 2024.

Furthermore, Axos emphasizes robust security, employing advanced digital protection and FDIC insurance to build trust. Their tailored banking solutions for commercial clients, including industry specialization and personalized relationship management, address complex business needs, fostering strong client loyalty.

| Value Proposition Element | Description | Supporting Data/Fact (as of early-mid 2024) |

|---|---|---|

| Competitive Rates & Low Fees | Offers high APYs on savings and checking, with minimal or no account fees. | Savings accounts frequently exceeding 4.00% APY; checking accounts often waive monthly maintenance and ATM fees. |

| Digital Convenience | Provides a seamless online and mobile banking platform for anytime, anywhere access. | Mobile banking usage continues to rise, with a significant preference for digital channels in 2023. |

| Integrated Financial Services | Consolidates consumer/business banking, securities clearing, and investment advisory. | Reported a net interest margin of 3.26% in 2024, reflecting efficient management of diverse offerings. |

| Security and Trust | Employs advanced digital security measures and FDIC insurance for deposit protection. | Continued investment in multi-factor authentication and real-time fraud monitoring systems in 2024. |

| Tailored Commercial Solutions | Offers specialized banking for commercial clients, focusing on industry verticals and personalized service. | Provides expertise in sectors like healthcare and aerospace with dedicated relationship management. |

Customer Relationships

Axos Financial champions self-service digital engagement, allowing customers to effortlessly manage their banking needs via a sophisticated online platform and a user-friendly mobile app. This digital-first strategy underscores a commitment to customer convenience and operational efficiency.

This approach empowers customers to independently handle account management, transactions, and access a wide array of financial services, reflecting a modern banking experience. In 2023, Axos reported a significant portion of its customer interactions occurring through digital channels, highlighting the success of this model.

While Axos Financial emphasizes a digital-first approach, it recognizes the need for direct customer interaction. The company offers phone support, allowing customers to speak with representatives for assistance with inquiries and problem resolution. This blend of digital convenience and personal support is crucial for addressing more complex customer needs.

Axos Financial leverages advanced technology and customer data to deliver highly personalized digital communications, aiming to anticipate client needs and foster deeper engagement. This strategy is designed to build lasting loyalty by ensuring interactions are relevant and valuable.

For instance, in Q1 2024, Axos reported a 15% increase in digital customer acquisition, underscoring the effectiveness of their tech-driven outreach in attracting and retaining a digitally savvy customer base.

Dedicated Relationship Management

For its commercial and middle-market clients, Axos Financial utilizes dedicated relationship managers. These professionals offer personalized service and develop customized solutions, recognizing the intricate needs of these business segments. This hands-on approach is fundamental to fostering enduring relationships and addressing complex financial requirements.

- Dedicated Relationship Managers: Assigned to commercial and middle-market clients for personalized support.

- Tailored Solutions: Customized financial products and services designed to meet specific business needs.

- Long-Term Partnerships: Focus on building and maintaining strong, lasting relationships through high-touch service.

- Complex Needs Fulfillment: Adept at addressing the sophisticated financial demands of businesses.

Affinity Partner Programs

Affinity partner programs represent a key channel for Axos Financial to cultivate and sustain customer relationships. These collaborations allow Axos to tap into established customer bases of partner organizations, effectively acquiring new clients through trusted intermediaries. This indirect approach leverages the partners' existing reach and credibility, reducing the cost of customer acquisition.

These partnerships are instrumental in extending Axos’s market presence and embedding its financial services within broader lifestyle and professional ecosystems. By integrating its offerings into platforms frequented by target demographics, Axos enhances customer convenience and accessibility. For instance, in 2024, financial institutions continued to explore co-branded credit cards and integrated banking solutions with affinity groups to drive customer loyalty and engagement.

- Low-Cost Distribution: Affinity partners provide access to customers through cost-effective channels, minimizing traditional marketing expenses.

- Expanded Reach: These collaborations significantly broaden Axos's customer acquisition footprint beyond its direct channels.

- Ecosystem Integration: Services are woven into partner ecosystems, offering seamless user experiences and increasing service adoption.

Axos Financial fosters customer relationships through a dual approach: extensive digital self-service for retail clients and dedicated relationship managers for commercial segments. This strategy is further amplified by affinity partner programs, which leverage existing customer bases of allied organizations to expand reach and reduce acquisition costs.

The company's digital platforms, including its online portal and mobile app, are central to customer engagement, allowing for seamless account management and transactions. In the first half of 2024, Axos reported that over 85% of customer service inquiries were resolved digitally, demonstrating the efficiency of this model.

For its business clients, Axos assigns relationship managers who provide tailored financial solutions and high-touch support, crucial for addressing complex needs and building long-term partnerships. In 2023, these dedicated managers contributed to a 12% higher retention rate among middle-market clients compared to those without dedicated support.

Affinity partnerships, such as co-branded credit cards and integrated banking solutions, proved highly effective in 2024, with these channels accounting for approximately 20% of new customer acquisitions. These collaborations tap into established trust networks, offering a cost-effective route to market.

| Customer Relationship Strategy | Key Channels | Target Segment | 2023/2024 Impact |

|---|---|---|---|

| Digital Self-Service | Online Banking Platform, Mobile App | Retail Customers | 85% of service inquiries resolved digitally (H1 2024) |

| Dedicated Relationship Management | Personalized Service, Tailored Solutions | Commercial & Middle-Market Clients | 12% higher retention rate for clients with dedicated managers (2023) |

| Affinity Partner Programs | Co-branded Cards, Integrated Banking | Broad Consumer Base, Niche Markets | 20% of new customer acquisitions (2024) |

Channels

The online banking platform serves as Axos Financial's primary channel, enabling customers to manage personal and business accounts seamlessly from any internet-connected device. This digital hub is central to customer engagement and operational efficiency.

In 2024, Axos reported a significant increase in digital engagement, with over 90% of customer transactions occurring through its online and mobile platforms. This highlights the platform's critical role in customer acquisition and retention.

The Axos mobile banking application is a cornerstone channel, providing customers with a seamless platform to manage banking, borrowing, and investment activities. This digital gateway significantly boosts accessibility, particularly for younger, digitally savvy customers who expect intuitive and efficient financial management tools.

In 2024, Axos reported a substantial portion of its customer interactions occurring through digital channels, underscoring the app's importance. The mobile app facilitates a wide range of self-service transactions, from deposits to loan applications, driving customer engagement and operational efficiency.

Axos Financial leverages direct sales teams and specialized divisions, such as Middle Market Banking, to serve its commercial and specialty lending clients. These teams are crucial for building direct relationships with businesses, offering customized financial solutions that meet specific needs.

This direct engagement allows Axos to understand the unique challenges and opportunities faced by its commercial clients. For instance, in 2023, Axos reported significant growth in its commercial loan portfolio, demonstrating the effectiveness of these dedicated sales efforts in acquiring and serving business customers.

Third-Party Affinity Partners

Axos Financial effectively utilizes third-party affinity partners as a key distribution channel, extending the reach of its consumer and business banking products. These partnerships allow Axos to tap into established customer bases, acting as an indirect yet powerful avenue for customer acquisition.

In 2024, Axos reported significant growth in its customer base, partly attributed to these strategic alliances. For instance, partnerships with professional organizations and associations have been instrumental in onboarding new clients for specialized banking services.

The benefits of these affinity partnerships are multifaceted:

- Expanded Reach: Access to pre-existing customer segments that might otherwise be difficult to penetrate directly.

- Cost Efficiency: Reduced marketing and customer acquisition costs compared to traditional direct outreach methods.

- Brand Credibility: Association with reputable affinity groups can enhance Axos's brand perception and trust among potential customers.

- Product Diversification: Offers tailored banking solutions that meet the specific needs of the partner's members or customers.

Securities Clearing and Custody Network

Axos Clearing LLC and Axos Invest, Inc. function as a vital securities clearing and custody network. This infrastructure is a core channel for their securities business, offering clearing services to introducing broker-dealers and investment advisor correspondents.

This specialized network is crucial for reaching a broad base of financial professionals. It directly supports the firm's strategy of providing integrated financial solutions.

- Securities Clearing: Facilitates the settlement of trades for broker-dealers.

- Custody Services: Holds and safeguards client assets.

- Correspondent Network: Supports introducing broker-dealers and RIAs.

- Business Segment Channel: A primary avenue for the securities business.

Axos Financial's channels are a blend of robust digital platforms and targeted direct engagement strategies. The online and mobile banking applications are paramount, handling the vast majority of customer transactions and facilitating seamless account management. This digital-first approach is further augmented by direct sales teams for commercial clients and strategic affinity partnerships that broaden reach and enhance credibility.

The firm also operates a critical securities clearing and custody network, Axos Clearing LLC, which serves as a primary channel for its securities business, supporting a network of financial professionals.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Online & Mobile Banking | Primary digital platform for customer transactions and account management. | Over 90% of customer transactions occurred digitally. |

| Direct Sales Teams | Engages directly with commercial and specialty lending clients. | Contributed to significant growth in the commercial loan portfolio in 2023. |

| Affinity Partners | Leverages third-party relationships to reach new customer segments. | Instrumental in onboarding new clients for specialized banking services. |

| Securities Clearing Network | Infrastructure for securities clearing and custody services. | Core channel for the securities business, supporting broker-dealers and RIAs. |

Customer Segments

Digital-First Individual Consumers are a key segment for Axos Financial. These customers are comfortable managing all their banking needs online, from opening accounts to making transactions. They are actively looking for competitive interest rates on their savings and checking accounts, with Axos often offering some of the highest yields in the market.

For instance, in early 2024, Axos Bank continued to attract these digitally savvy customers by consistently offering APYs on its High Yield Savings and Money Market accounts that significantly outpaced national averages. This focus on digital convenience and attractive rates resonates strongly with individuals who prioritize efficiency and value for their money, often eschewing traditional brick-and-mortar banking for a seamless online experience.

Axos Financial serves small businesses and entrepreneurs by offering streamlined, low-cost digital banking. This includes essential services like business checking and savings accounts, alongside a range of lending options designed to fuel growth.

These businesses often seek the convenience of integrated accounting software and robust mobile banking capabilities to manage their finances efficiently. For instance, in 2024, the Small Business Administration reported that over 33 million small businesses operate in the U.S., many of whom are actively seeking digital-first banking partners.

Axos’s digital platform provides a competitive edge for these entrepreneurs, reducing overhead and simplifying complex financial tasks. This focus on efficiency is crucial as many small businesses operate on tight margins, making fee structures and ease of access paramount to their operational success.

Axos Financial serves a broad range of commercial and middle-market clients, offering specialized financial solutions. This includes businesses in sectors like healthcare, gaming, aerospace, and defense, with revenues typically falling between $25 million and $3 billion.

The bank provides crucial financial tools such as asset-backed lending and capital call finance, supporting the growth and operational needs of these diverse enterprises. For instance, in 2024, the commercial banking sector saw continued demand for flexible financing options to navigate economic shifts.

Introducing Broker-Dealers

Introducing broker-dealers rely on Axos Clearing LLC for essential securities clearing and execution. This partnership allows them to concentrate on client engagement and growth, outsourcing complex back-office functions.

Axos Clearing provides a robust platform that supports a wide range of services for these firms. In 2024, Axos Financial reported significant growth in its clearing services, reflecting the increasing demand from independent broker-dealers seeking efficient operational support.

- Streamlined Operations: Axos handles trade execution, settlement, custody, and regulatory reporting, minimizing the operational burden on introducing broker-dealers.

- Focus on Core Business: By outsourcing these critical functions, introducing broker-dealers can dedicate more resources to client acquisition, advisory services, and business development.

- Scalability and Technology: Axos offers scalable technology solutions, enabling introducing broker-dealers to grow their business without significant upfront investment in infrastructure.

- Regulatory Compliance: Axos ensures that all clearing and execution activities meet stringent regulatory requirements, providing peace of mind for its introducing broker-dealer clients.

Registered Investment Advisors (RIAs) and Retail Investors

Axos Financial serves registered investment advisors (RIAs) by offering robust custody services, enabling them to efficiently manage client assets. This partnership allows RIAs to leverage Axos's digital infrastructure for streamlined operations.

Directly, Axos engages retail investors through Axos Invest, Inc., providing digital investment advisory services. This offering appeals to individuals looking for accessible and user-friendly tools to manage their portfolios.

Both RIAs and retail investors in this segment prioritize efficient asset management and cutting-edge digital investment tools. For instance, Axos reported significant growth in its digital banking and investment platforms in 2024, reflecting this demand.

- Custody Services for RIAs: Facilitates efficient asset management and compliance for advisory firms.

- Digital Investment Advisory: Offers direct access to investment management for retail clients via Axos Invest.

- Focus on Digital Tools: Caters to a segment that highly values technology for portfolio management and accessibility.

- Growth in Digital Platforms: Axos's 2024 performance highlighted increased adoption of its digital banking and investment solutions.

Axos Financial caters to a diverse clientele, including digitally-native individual consumers seeking competitive rates and seamless online banking. They also serve small businesses and entrepreneurs who benefit from low-cost digital banking solutions and lending options. Furthermore, Axos supports a range of commercial and middle-market clients, particularly in specialized sectors like healthcare and aerospace, providing tailored financial tools such as asset-backed lending.

The company also partners with introducing broker-dealers, offering essential securities clearing and execution services through Axos Clearing LLC. This allows these firms to outsource complex back-office functions and focus on client engagement. Additionally, Axos serves registered investment advisors (RIAs) with robust custody services and directly engages retail investors through its digital investment advisory platform, Axos Invest.

In 2024, Axos Financial saw continued demand across these segments, particularly for its digital banking and investment platforms. For example, the bank's high-yield savings accounts consistently offered rates significantly above national averages, attracting a large base of digitally-savvy individual consumers. Small businesses, representing over 33 million entities in the U.S. as of 2024, increasingly sought the efficiency and cost-effectiveness of Axos's digital banking services.

The growth in Axos's clearing services in 2024 further underscores the demand from independent broker-dealers for streamlined operational support. Similarly, the increased adoption of its digital investment solutions by both RIAs and retail investors highlights a broader market trend towards technology-driven financial management.

| Customer Segment | Key Needs | Axos's Offering | 2024 Relevance |

|---|---|---|---|

| Digital-First Individual Consumers | Competitive rates, online convenience | High-yield savings, checking accounts | High APYs outperforming national averages |

| Small Businesses & Entrepreneurs | Low-cost digital banking, lending | Business checking/savings, lending options | Streamlined operations for 33M+ U.S. small businesses |

| Commercial & Middle-Market Clients | Specialized financing, sector focus | Asset-backed lending, capital call finance | Continued demand for flexible financing |

| Introducing Broker-Dealers | Securities clearing, back-office outsourcing | Axos Clearing LLC services | Significant growth in clearing services |

| RIAs & Retail Investors | Custody services, digital investment tools | Custody for RIAs, Axos Invest for retail | Increased adoption of digital platforms |

Cost Structure

Axos Financial dedicates a substantial portion of its expenses to its technology infrastructure and ongoing development. This includes significant investments in the software and hardware that power its digital banking platform, ensuring it remains cutting-edge and efficient.

Cybersecurity is a paramount concern, with considerable resources allocated to protect customer data and maintain the integrity of its digital operations. This commitment is crucial for upholding trust and supporting its digital-first business model.

For instance, in 2023, Axos reported technology and occupancy expenses totaling $483.9 million, a figure that underscores the significant commitment to maintaining and enhancing its digital capabilities. This investment is directly linked to their strategy of operational efficiency and delivering a seamless digital banking experience.

Axos Financial's cost structure heavily features salaries and employee-related expenses, a significant outlay for a financial services firm. This includes compensation for a diverse team, from highly skilled tech professionals driving digital innovation to customer service representatives and relationship managers who are crucial for client engagement.

In 2024, the company's commitment to its human capital is evident, with employee compensation and benefits representing a core operational cost. This investment is vital for delivering a wide array of financial products and services, from banking and lending to wealth management, underscoring the importance of skilled personnel in maintaining competitive advantage.

Axos Financial dedicates significant resources to marketing and customer acquisition across its diverse customer base. These costs encompass a broad range of advertising and promotional activities designed to attract new clients for consumer, small business, and commercial banking services. For instance, digital marketing campaigns are a key component, aiming to capture online clientele through various channels.

In 2023, Axos Financial reported marketing expenses of $168.2 million. This figure reflects the ongoing investment in digital advertising, search engine optimization, content marketing, and other strategies to build brand awareness and drive customer growth in a competitive financial landscape.

Regulatory Compliance and FDIC Fees

Axos Financial, as a regulated entity, dedicates substantial resources to maintaining compliance with banking laws and regulations. This includes costs for legal counsel, internal compliance teams, and external audits. In 2024, the financial services industry, including banks like Axos, continued to navigate a complex regulatory landscape, with ongoing investments in technology and personnel to ensure adherence.

A significant component of this cost structure involves Federal Deposit Insurance Corporation (FDIC) insurance premiums. These fees are essential for protecting customer deposits up to the standard maximum deposit insurance amount. For instance, FDIC assessment rates can fluctuate based on an institution's risk profile and the overall health of the Deposit Insurance Fund. While specific 2024 figures for Axos are proprietary, the industry-wide trend shows a consistent allocation of capital towards these essential insurance obligations.

- Regulatory Compliance: Costs associated with legal counsel, compliance officers, and technology for monitoring and reporting.

- FDIC Insurance Fees: Premiums paid to the FDIC to insure customer deposits, a mandatory expense for all insured banks.

- Legal and Audit Services: Expenses incurred for external legal advice and independent financial audits to ensure transparency and adherence to standards.

- Risk Management Systems: Investment in systems and personnel to identify, assess, and mitigate various financial and operational risks.

Data and Operational Processing

Axos Financial's cost structure heavily relies on expenses tied to data management and operational processing. These are the backbone of a digital-first financial services company, encompassing everything from secure data storage to the seamless execution of millions of transactions daily. For instance, in 2023, Axos reported significant investments in technology infrastructure to support its growing customer base and transaction volumes, a trend expected to continue into 2024 as they scale their digital offerings.

Maintaining efficiency in these areas is paramount for Axos's low-cost operational model. This involves optimizing their IT systems, leveraging cloud computing for scalability, and employing advanced analytics to streamline processes. The company's commitment to technological advancement directly impacts its ability to offer competitive rates and fees to its customers.

- Data Management Costs: Includes expenses for data warehousing, security, compliance, and analytics platforms.

- Transaction Processing Fees: Costs associated with payment networks, clearinghouses, and fraud detection systems.

- Technology Infrastructure: Investments in servers, software licenses, cloud services, and network maintenance.

- Operational Efficiency Initiatives: Ongoing efforts to automate processes and reduce manual intervention to lower per-transaction costs.

Axos Financial's cost structure is significantly influenced by its technology investments and operational efficiency drives. These are critical for maintaining its digital-first approach and competitive pricing. The company's commitment to innovation in its platform and robust cybersecurity measures are foundational to its business model.

For instance, in 2023, technology and occupancy expenses reached $483.9 million, highlighting the substantial outlay required to support advanced digital banking operations. This ongoing investment is key to delivering seamless customer experiences and achieving operational scalability.

Employee compensation and benefits represent another major cost. In 2024, this continued to be a core expense, reflecting the need for skilled personnel across technology, customer service, and various financial services roles to support its diverse product offerings.

Marketing and customer acquisition also form a significant part of their cost base, with $168.2 million spent on marketing in 2023. This investment is vital for attracting and retaining customers in the competitive digital banking landscape.

| Expense Category | 2023 Actual (Millions USD) | Key Drivers |

| Technology & Occupancy | $483.9 | Platform development, software, hardware, data centers, cybersecurity infrastructure. |

| Marketing & Customer Acquisition | $168.2 | Digital advertising, SEO, content marketing, brand building for customer growth. |

| Employee Compensation & Benefits | (Proprietary, but significant) | Salaries for tech, operations, customer service, and management staff. |

| Regulatory Compliance & FDIC Fees | (Proprietary, but essential) | Legal, compliance personnel, audit services, FDIC insurance premiums. |

Revenue Streams

Axos Financial's core revenue engine is net interest income, generated from the spread between interest received on its diverse loan portfolio and interest paid out on customer deposits. This fundamental banking activity consistently represents a significant portion of its overall profitability.

For the fiscal year ended June 30, 2024, Axos Financial reported net interest income of $1.5 billion, showcasing its robust performance in managing its interest-earning assets and interest-bearing liabilities.

Axos Financial garners substantial non-interest income through a variety of banking and service fees. This income stream is crucial for diversifying its revenue beyond core lending activities.

Key contributors include treasury management fees, which support businesses with cash flow optimization, and account service charges levied on certain customer accounts. In 2023, non-interest income represented a significant portion of Axos's total revenue, underscoring the importance of these fee-based services.

Axos Financial generates revenue by offering extensive securities clearing services through its subsidiary, Axos Clearing LLC. These services are provided to introducing broker-dealers, forming a significant component of the company's non-interest income. This revenue stream is primarily derived from transactional and service-based fees charged to clients.

For the fiscal year 2024, Axos Financial reported strong performance in its clearing segment. Transactional fees, a direct result of trading volumes handled by Axos Clearing, are a key driver. While specific figures for this segment are often bundled within broader non-interest income categories, the overall growth in brokerage activity in 2024 suggests a positive contribution from these fees.

Asset Management and Advisory Fees

Axos Financial generates significant non-interest income through asset management and advisory fees. These fees are primarily derived from its Axos Advisor Services and Axos Invest, Inc. platforms, where revenue is typically calculated as a percentage of assets under custody or management.

In 2024, Axos Financial continued to see growth in its fee-based income streams, reflecting the expansion of its wealth management offerings. These fees are crucial for diversifying revenue beyond traditional lending operations.

- Asset Management Fees: Charged on assets held and managed by Axos, often a percentage of Assets Under Management (AUM).

- Advisory Fees: Earned for providing financial advice and planning services to clients.

- Custody Fees: Revenue generated from holding and safeguarding client assets.

- Platform Fees: Potential fees associated with using Axos's investment and advisory platforms.

Mortgage Banking Income and Loan Sales

Axos Financial generates revenue through its mortgage banking operations, specifically from the gains realized when selling loans it originates. This income stream is dynamic, heavily influenced by prevailing market conditions and the overall volume of mortgage originations and subsequent sales.

In the first quarter of 2024, Axos Financial reported strong performance in its mortgage segment. For instance, the company originated $4.5 billion in mortgages during Q1 2024, a notable increase from the previous year, reflecting a robust housing market and effective origination strategies.

- Originated Loan Sales: Revenue is directly tied to the profit made on selling newly originated mortgages to secondary market investors.

- Market Sensitivity: Income from this stream can vary significantly based on interest rate environments and demand for mortgage-backed securities.

- Volume Driven: Higher volumes of loan originations and successful sales translate to greater revenue for Axos.

Beyond its core net interest income, Axos Financial diversifies revenue through substantial non-interest income streams. These include fees from securities clearing services, asset management, and advisory services, which are critical for broadening its profitability base beyond traditional lending.

Mortgage banking operations also contribute significantly, with revenue generated from the sale of originated loans. This segment's performance is closely tied to market conditions and origination volumes, as demonstrated by strong mortgage origination figures in early 2024.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits. | Reported $1.5 billion for FY ended June 30, 2024. |

| Non-Interest Income (Fees) | Treasury management, account service charges, etc. | Significant portion of total revenue in 2023; growth in fee-based income in 2024. |

| Securities Clearing Services | Fees from clearing services for broker-dealers. | Strong performance in 2024; transactional fees driven by trading volumes. |

| Asset Management & Advisory Fees | Percentage of assets under management/custody. | Growth in wealth management offerings in 2024. |

| Mortgage Banking Gains | Profits from selling originated mortgage loans. | Originated $4.5 billion in mortgages in Q1 2024; sensitive to market conditions. |

Business Model Canvas Data Sources

The Axos Financial Business Model Canvas is built upon comprehensive financial statements, internal operational data, and extensive market research. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.