Axos Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axos Financial Bundle

Axos Financial navigates a banking landscape shaped by moderate buyer power and intense rivalry among established players. Understanding these dynamics is crucial for any stakeholder.

The full analysis reveals the strength and intensity of each market force affecting Axos Financial, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Axos Financial, a digital-first bank, is significantly dependent on its technology infrastructure, encompassing cloud services and core banking software. The bargaining power of these specialized providers is often moderate to high, particularly when switching costs are substantial or when a limited number of major players dominate the market.

The ongoing trend of modernizing core banking systems underscores this reliance on specialized suppliers. For instance, in 2024, the global cloud computing market was projected to reach over $1 trillion, highlighting the scale and influence of these infrastructure providers.

Suppliers of advanced data analytics and AI tools are vital for Axos Financial's tech-centric model, powering personalized customer experiences and operational efficiency. As AI and machine learning become more sophisticated and embedded in banking, the bargaining power of these specialized providers is likely to grow, especially for those offering unique or proprietary solutions.

Payment network providers like Visa and Mastercard hold significant sway over banks such as Axos Financial. Their extensive reach and the critical nature of their services mean banks largely have to accept their terms. In 2023, Visa reported processing 237.7 billion transactions, highlighting their immense scale and indispensability.

This reliance grants these networks substantial bargaining power, as alternative payment infrastructures are still developing. While innovations like real-time payments and blockchain technology are on the horizon, their current impact on the established dominance of major payment networks is limited, leaving banks with few options.

Talent and Human Capital

The availability of skilled talent, particularly in areas like cybersecurity, AI development, and digital banking operations, significantly influences Axos Financial's operational costs. A scarcity of specialized fintech professionals or a surge in demand for these skills empowers employees, potentially driving up labor expenses for the company.

This dynamic is especially pertinent for Axos, a business deeply reliant on technological advancements. For instance, in 2024, the demand for cybersecurity experts remained exceptionally high, with reports indicating a global shortage of millions of skilled professionals in this domain, directly impacting recruitment costs and retention efforts for financial institutions.

- Talent as a Supplier: Skilled individuals in cybersecurity, AI, and digital banking function as critical suppliers to Axos Financial.

- Impact of Shortages: A deficit in specialized fintech talent or intense competition for these skills can escalate employee bargaining power and labor costs.

- Industry Relevance: This factor is paramount for Axos due to its inherently technology-driven business model.

Regulatory Compliance and Legal Services

Axos Financial, like all financial institutions, operates within a stringent and ever-changing regulatory framework. Suppliers offering essential regulatory compliance software, specialized legal advisory services, and critical audit functions wield considerable bargaining power. This stems from the non-negotiable nature of adhering to regulations and the substantial financial and reputational damage that non-compliance can inflict. For instance, the financial services sector faces ongoing scrutiny, with regulators like the SEC and CFPB imposing fines that can run into millions for violations. The complexity and cost associated with meeting these obligations, particularly through 2024 and projected into 2025, underscore the suppliers' leverage.

The bargaining power of these suppliers is further amplified by the specialized expertise required to navigate financial regulations.

- Specialized Knowledge: Suppliers possess deep understanding of complex financial laws and compliance requirements.

- High Switching Costs: Implementing new compliance systems or legal counsel can be time-consuming and expensive.

- Risk of Non-Compliance: Failure to meet regulatory standards can result in severe penalties, making reliable suppliers indispensable.

- Evolving Landscape: The continuous updates in financial regulations necessitate ongoing partnerships with expert service providers.

The bargaining power of suppliers for Axos Financial is a key consideration, particularly for its technology infrastructure. Providers of cloud services and core banking software often hold moderate to high power due to significant switching costs and market concentration. For example, in 2024, the global cloud market exceeded $1 trillion, indicating the substantial influence of major players.

Suppliers of advanced data analytics and AI tools are also crucial, with their power likely to increase as these technologies become more integral to banking operations. Payment network providers like Visa and Mastercard exhibit considerable leverage; in 2023, Visa processed 237.7 billion transactions, underscoring their indispensable role and ability to dictate terms.

Furthermore, the scarcity of specialized talent in areas like cybersecurity and AI empowers employees, driving up labor costs for Axos. The demand for these skills remained exceptionally high in 2024, with millions of skilled professionals needed globally. Finally, suppliers of regulatory compliance software and legal advisory services possess strong bargaining power due to the critical nature of compliance and the severe penalties for non-compliance, with fines often reaching millions.

What is included in the product

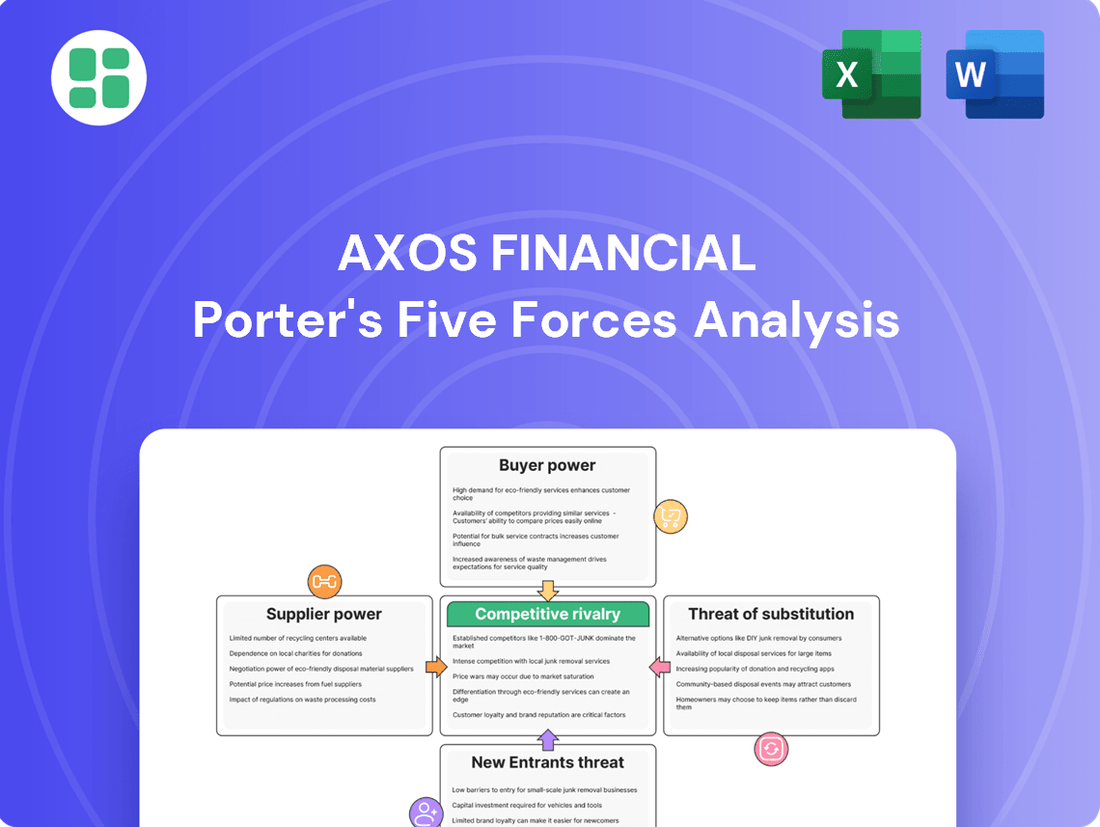

This analysis of Axos Financial dissects the five competitive forces impacting its banking and lending operations, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly assess competitive pressures with a visual breakdown of Axos Financial's Porter's Five Forces, simplifying complex strategic analysis.

Customers Bargaining Power

For fundamental banking products such as checking and savings accounts, customers generally experience low costs when switching between financial institutions. This is particularly true with the proliferation of digital banks and streamlined online account opening procedures, making it simple for consumers to move their money. In 2024, the ease of digital transfers means that a customer can open and fund a new account at a competitor, often within a single business day, directly impacting their ability to seek out better interest rates or improved service offerings.

Customers, especially individuals and small businesses, are keenly aware of interest rates for both savings and borrowing. This means Axos Financial must offer attractive rates to win and keep business.

The digital banking landscape makes it simple for customers to shop around for the best deals. For example, in early 2024, the average interest rate on savings accounts from online banks hovered around 4.3%, significantly higher than many traditional brick-and-mortar institutions, highlighting the competitive pressure.

This high price sensitivity means Axos Financial faces considerable pressure to maintain competitive pricing on its deposit and loan products. Failing to do so can lead to customers easily switching to rivals, impacting both deposit growth and loan origination volumes.

The growing landscape of fintech and alternative finance platforms significantly amplifies customer bargaining power. Customers now have a wealth of options, from peer-to-peer lending to digital wallets and automated investment services, providing them with easy alternatives to traditional banking relationships.

This proliferation of choice directly empowers customers to seek better terms or switch providers if dissatisfied with Axos Financial's offerings. For instance, the global fintech market was valued at over $111 billion in 2023 and is projected to grow substantially, indicating a robust and expanding ecosystem of alternatives.

Digital-First Expectations and Demand for Personalization

Axos Financial's customer base, often characterized by a strong digital orientation, places a premium on personalized and convenient banking experiences. This demographic actively seeks out financial institutions that can deliver seamless mobile interactions and data-driven insights tailored to their individual needs.

The escalating demand for hyper-personalized services and intuitive digital platforms significantly amplifies customer bargaining power. Banks like Axos are compelled to continuously invest in technology and innovation to not only meet but anticipate these evolving digital expectations, lest they risk losing market share to more agile competitors.

- Digital Savvy Customers: A significant portion of Axos's clientele are digitally native, expecting sophisticated mobile banking features and personalized financial advice.

- Demand for Seamless Experience: Customers anticipate a frictionless journey across all digital touchpoints, from account opening to daily transactions.

- Personalization as a Differentiator: Tailored product offerings, customized alerts, and personalized financial planning tools are increasingly becoming a baseline expectation, not a luxury.

- Data-Driven Insights: Customers are more receptive to financial institutions that can leverage their data to provide actionable insights and proactive recommendations.

Information Transparency and Comparison Tools

The internet has dramatically shifted the bargaining power of customers in the financial sector. Information transparency, fueled by comparison websites, allows consumers to easily scrutinize banking products, fees, and interest rates. This accessibility empowers customers to make more informed choices, directly increasing their leverage when selecting financial institutions.

For instance, in 2024, numerous financial comparison platforms reported significant user engagement, indicating a strong consumer reliance on these tools for decision-making. This trend means that institutions like Axos Financial must remain competitive on pricing and service quality to attract and retain customers who can readily switch to a better offer.

- Increased Customer Awareness: Websites offering side-by-side comparisons of savings account APYs, checking account fees, and loan interest rates give customers a clear view of market offerings.

- Price Sensitivity: With easy access to competitive rates, customers are more likely to switch providers for even small percentage point differences, pressuring financial institutions to offer attractive terms.

- Demand for Fee Transparency: Customers can quickly identify and avoid institutions with hidden or excessive fees, forcing banks to be more upfront about their cost structures.

The bargaining power of customers for Axos Financial is significantly high, driven by the ease of switching, increased price sensitivity, and the proliferation of digital alternatives. Customers can readily compare rates and services online, demanding competitive pricing and seamless digital experiences. This forces Axos to continuously innovate and offer compelling value propositions to retain its customer base.

The digital banking environment, coupled with a growing fintech ecosystem, provides customers with numerous options. This empowers them to easily switch providers if they find better interest rates or more personalized services, directly impacting Axos Financial's ability to maintain market share and profitability.

In 2024, the accessibility of financial comparison tools means customers are highly informed about market offerings, from savings account APYs to loan interest rates. This transparency makes them less tolerant of higher fees or less competitive rates, intensifying the pressure on Axos to remain price-competitive and service-oriented.

The expectation for hyper-personalized digital experiences further amplifies customer leverage. Financial institutions like Axos must invest in technology to deliver tailored insights and frictionless interactions, as customers can easily migrate to competitors offering superior digital engagement.

| Factor | Impact on Axos Financial | 2024 Data/Trend |

|---|---|---|

| Ease of Switching | High | Digital account opening and transfers allow customers to switch in under a day. |

| Price Sensitivity | High | Average savings account rates from online banks reached ~4.3% in early 2024, pressuring traditional institutions. |

| Availability of Alternatives | High | Fintech market valued over $111 billion in 2023, offering diverse financial solutions. |

| Demand for Digital Experience | High | Customers expect seamless mobile interactions and data-driven insights. |

Same Document Delivered

Axos Financial Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Axos Financial, detailing the competitive landscape and strategic positioning within the banking sector. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering no surprises and full usability. It meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

Axos Financial faces formidable competition from digital-first banks and neobanks. These nimble players, often boasting lower overheads, are rapidly attracting customers with streamlined online services and appealing user interfaces. For instance, by the end of 2023, neobanks like Chime and Varo had amassed millions of customers, showcasing their ability to quickly gain traction in the market.

Traditional banks are pouring billions into digital upgrades, making their online and mobile experiences increasingly robust. For instance, in 2024, major banks continued to expand features like advanced budgeting tools and seamless account opening processes, directly challenging the digital-first model. This investment allows them to leverage their existing, massive customer bases and strong brand recognition to attract and retain customers who might otherwise opt for purely online banks.

Axos Financial faces a significant hurdle in differentiating its digital banking products. While they offer a broad range of services, the banking sector is highly commoditized, making it tough to create lasting distinctions. Many basic banking functions are easily copied by competitors.

This commoditization forces competition to shift towards other areas like pricing, customer service quality, and targeting specific customer segments. For instance, in 2023, the average interest rate on savings accounts across major banks hovered around 0.35%, while some online banks, including Axos, offered rates significantly higher, sometimes exceeding 4.00% APY, highlighting the price-based competition.

Industry Consolidation and Strategic Partnerships

The banking landscape is characterized by ongoing industry consolidation, with mergers and acquisitions reshaping the competitive environment. This trend, coupled with a rise in strategic partnerships between burgeoning fintech companies and established traditional banks, can significantly intensify rivalry. These collaborations often result in stronger, more diversified entities capable of offering a wider array of integrated services, thereby raising the bar for competitors.

Axos Financial actively participates in this trend, forging its own strategic partnerships. For instance, in early 2024, Axos announced a collaboration with a leading digital payments provider to enhance its customer onboarding process, demonstrating its commitment to leveraging external innovation to bolster its competitive standing.

The impact of these consolidations and partnerships is evident in market share shifts. For example, as of Q1 2024, the top 10 U.S. banks held approximately 55% of total industry assets, a slight increase from the previous year, underscoring the ongoing consolidation effect.

- Industry Consolidation: Mergers and acquisitions are actively reshaping the banking sector, creating larger, more formidable competitors.

- Fintech-Bank Partnerships: Collaborations between fintechs and traditional banks are increasing, leading to enhanced service offerings and intensified competition.

- Axos's Strategic Engagement: Axos Financial is involved in these partnerships, aiming to leverage them for competitive advantage.

- Market Share Concentration: The top U.S. banks' share of industry assets rose to around 55% by Q1 2024, reflecting the impact of consolidation.

High Customer Acquisition and Retention Costs

The banking industry, including Axos Financial, faces considerable competitive rivalry. This intense competition directly leads to higher customer acquisition costs (CAC) across the board. Banks are investing heavily in marketing campaigns and advanced digital platforms to attract new customers and keep existing ones engaged. For instance, in 2024, many traditional banks and newer fintech players significantly ramped up their digital advertising spend and offered attractive sign-up bonuses, pushing CAC higher.

These elevated acquisition costs can put pressure on profit margins, especially if banks struggle with customer retention. A substantial portion of a bank's budget is allocated to retaining customers through loyalty programs, personalized services, and competitive interest rates. Failing to manage these costs effectively can erode profitability, making it crucial for institutions like Axos Financial to optimize their customer engagement strategies.

- High CAC in 2024: Banks reported increased marketing and promotional expenditures to attract new accounts.

- Retention Investments: Significant spending on digital tools and customer service to maintain existing client relationships.

- Margin Squeeze: The combined effect of high acquisition and retention costs can impact overall profitability if not offset by efficient operations.

- Digital Competition: Fintech companies continue to challenge traditional banks, driving up the cost of acquiring digitally-savvy customers.

Competitive rivalry within the banking sector is intense, driven by both digital-first challengers and digitally enhanced traditional institutions. This dynamic environment forces significant investment in customer acquisition and retention, directly impacting profitability. For example, in 2024, many banks increased their digital marketing budgets and offered higher interest rates on savings accounts, with some online banks exceeding 4.00% APY to attract depositors.

Industry consolidation further exacerbates this rivalry, as mergers create larger, more competitive entities. Axos Financial actively engages in strategic partnerships, such as its early 2024 collaboration with a payment provider, to enhance its offerings and maintain a competitive edge. By Q1 2024, the top 10 U.S. banks controlled approximately 55% of industry assets, illustrating the impact of consolidation on market concentration.

| Metric | 2023 Average | Axos Financial (Example) | Competitor Type |

|---|---|---|---|

| Savings Account APY | ~0.35% (Traditional Banks) | >4.00% | Online Bank |

| Digital Ad Spend | Increased Significantly in 2024 | High | All |

| Customer Acquisition Cost (CAC) | Rising | Elevated | All |

SSubstitutes Threaten

Peer-to-peer (P2P) lending platforms present a significant threat of substitutes to traditional banking services, including those offered by Axos Financial. These platforms directly connect borrowers with individual investors, effectively disintermediating banks from the lending process. For instance, by mid-2024, the P2P lending market continued its growth trajectory, offering an alternative for consumers and small businesses seeking capital outside of conventional bank loans, often with more streamlined application processes.

Fintech payment and budgeting apps present a significant threat of substitution for traditional banking services. Applications like PayPal, Venmo, and personal finance managers such as Mint (though recently sunsetted, its user base migrated to Credit Karma) offer streamlined payment solutions and budgeting tools that bypass conventional bank channels, reducing customer reliance on their primary financial institutions for daily transactions and financial oversight.

Cryptocurrencies and Decentralized Finance (DeFi) present an emerging threat by offering alternative avenues for value storage, fund transfers, and lending, bypassing traditional financial institutions. This disintermediation potential is particularly relevant for technologically adept consumers seeking novel financial solutions.

While the cryptocurrency market experienced significant volatility in 2024, with Bitcoin’s price fluctuating and the total market capitalization seeing considerable swings, its underlying technology continues to evolve. For instance, the total value locked (TVL) in DeFi protocols, a key metric for assessing the adoption of decentralized financial services, reached hundreds of billions of dollars at various points in 2024, indicating growing user engagement with these alternatives.

Alternative Investment Platforms (Robo-Advisors)

Robo-advisors and other digital investment platforms present a significant threat of substitutes for Axos Financial. These platforms offer automated, low-cost investment management, directly competing with traditional wealth management services. They attract a wide investor base looking for efficient and accessible ways to manage their money.

The growth of these digital alternatives is substantial. For instance, the robo-advisor market managed approximately $1.5 trillion in assets globally by the end of 2023, a figure projected to reach $3.2 trillion by 2028. This indicates a strong and growing preference among consumers for these automated solutions.

Key factors driving this trend include:

- Lower Fees: Robo-advisors typically charge significantly lower management fees compared to traditional human advisors, often ranging from 0.25% to 0.50% annually, whereas traditional advisors might charge 1% or more.

- Accessibility: Many platforms have low or no minimum investment requirements, making them accessible to a broader demographic, including younger or less affluent investors.

- Convenience: The digital-first nature of these services allows for easy account setup, management, and monitoring through intuitive online interfaces and mobile apps.

Embedded Finance Solutions

The increasing prevalence of embedded finance solutions poses a notable threat of substitutes for traditional banking services. By integrating financial products directly into non-financial platforms, such as e-commerce checkouts offering 'buy now, pay later' options, these solutions streamline the customer experience. This seamless integration can divert transactions and customer relationships away from Axos Financial.

For instance, the global embedded finance market was projected to reach over $7 trillion by 2026, indicating a substantial shift in how consumers access financial services. This growth means more customers might bypass traditional banking channels entirely for everyday transactions.

Key substitute threats include:

- Buy Now, Pay Later (BNPL) services integrated into retail platforms

- Payment processing solutions offering instant credit at point-of-sale

- Digital wallets with built-in lending or investment features

- Neobanks and fintech companies focusing on niche, embedded financial experiences

The threat of substitutes for Axos Financial is amplified by the growing adoption of digital-first financial solutions. These alternatives often provide greater convenience, lower costs, and more specialized services, directly challenging traditional banking models. For example, the global robo-advisor market, managing significant assets, highlights a consumer shift towards automated investment management.

Embedded finance, where financial services are integrated into non-banking platforms, further erodes traditional banking’s direct customer interaction. This trend is supported by substantial market growth projections for embedded finance, indicating a future where financial transactions are increasingly seamless and integrated into everyday digital experiences, potentially bypassing conventional banks.

Peer-to-peer lending and decentralized finance (DeFi) also present viable substitutes by offering direct access to capital and alternative financial ecosystems, bypassing intermediaries. The continued evolution and adoption of these technologies, despite market volatility in 2024, signify a persistent challenge to established financial institutions like Axos Financial.

| Substitute Category | Key Characteristics | Impact on Axos Financial | 2024 Market Trend/Data Point |

|---|---|---|---|

| Digital Investment Platforms (Robo-Advisors) | Low fees, accessibility, convenience | Competition for wealth management services | Global robo-advisor market managed approx. $1.5 trillion in assets by end of 2023; projected to reach $3.2 trillion by 2028. |

| Embedded Finance | Seamless integration into non-financial platforms | Diversion of transactions and customer relationships | Global embedded finance market projected to exceed $7 trillion by 2026. |

| P2P Lending & DeFi | Disintermediation, direct borrower-investor connection, alternative financial ecosystems | Alternative sources for capital and financial services | Total Value Locked (TVL) in DeFi protocols reached hundreds of billions of dollars at points in 2024. |

Entrants Threaten

The financial services sector, including banking, is notoriously complex to enter due to extensive regulatory oversight. New companies must secure various licenses, meet significant capital reserve requirements, and adhere to a labyrinth of compliance rules. For instance, in 2024, the Federal Reserve’s capital requirements for large banks, such as those exceeding $700 billion in assets, demand robust financial health and operational readiness, making it a substantial hurdle for newcomers.

Establishing a bank, even a digital-first operation like Axos Financial, demands significant capital. This includes substantial investments in robust technology infrastructure, extensive marketing campaigns to build brand awareness, and the crucial maintenance of liquidity reserves to ensure operational stability. For instance, in 2023, the average capital required to start a new bank in the US could easily run into hundreds of millions of dollars, a formidable barrier.

This high capital outlay acts as a powerful deterrent, effectively discouraging many potential new entrants from challenging established players like Axos. The sheer financial commitment needed to launch and sustain a banking operation means only well-funded entities can realistically consider entering the market, thereby limiting direct competition.

Establishing trust and brand recognition in financial services is a significant hurdle for new entrants. It requires substantial time and capital investment to cultivate a reputation that reassures customers, especially when competing against established players like Axos Financial, which has spent years building its credibility.

Consumers often gravitate towards known entities in banking due to the sensitive nature of their money. Even digital-first banks, despite offering competitive rates or innovative platforms, face an uphill battle in convincing customers to switch from institutions they have long relied upon. This inherent customer loyalty to established brands significantly raises the barrier to entry.

Technological Infrastructure and Cybersecurity Demands

The threat of new entrants into the digital banking space, particularly concerning technological infrastructure and cybersecurity, is significant but requires substantial capital. While Axos Financial operates with a sophisticated digital platform, any new competitor must replicate this, necessitating massive upfront investment in secure, scalable, and user-friendly technology. This includes not only the core banking systems but also advanced fraud detection, data encryption, and continuous security monitoring to comply with stringent financial regulations. For instance, the global cybersecurity market was projected to reach over $232 billion in 2024, highlighting the immense expenditure required to establish a secure foundation.

New entrants face a high barrier to entry due to the sheer cost and complexity of building and maintaining a robust technological backbone. This involves not just initial development but ongoing upgrades to stay ahead of evolving threats and customer expectations.

- Significant Capital Outlay: New digital banks must invest billions in developing and securing their technological infrastructure, including core banking platforms and advanced cybersecurity measures.

- Regulatory Compliance: Meeting the rigorous cybersecurity and data protection standards mandated by financial regulators is a complex and costly endeavor for any new entrant.

- Talent Acquisition: Attracting and retaining top-tier cybersecurity and IT talent is crucial, adding to operational expenses and the challenge of building a secure digital environment.

- Scalability and Resilience: New entrants need to build systems that can scale rapidly with user growth while remaining resilient against cyberattacks and technical failures, a non-trivial engineering feat.

Economies of Scale and Network Effects

Established financial institutions, like Axos Financial, often leverage significant economies of scale. This means their larger operational footprint allows for lower per-unit costs in areas like technology infrastructure, compliance, and marketing. For instance, in 2023, major banks continued to invest billions in digital transformation, a cost that can be prohibitive for smaller, newer players. This scale advantage enables them to offer more attractive pricing on loans and deposits, a key competitive hurdle for new entrants.

Network effects also present a substantial barrier. As more customers join a platform, its value increases for everyone. This is particularly true for digital banking services where a large user base can facilitate faster innovation and a wider array of integrated services. For example, a bank with millions of active users can more easily negotiate partnerships or develop new features that appeal to a broad audience, something a startup would find difficult to replicate initially.

- Economies of Scale: Large banks can spread fixed costs over a greater volume of business, reducing average costs.

- Network Effects: A larger customer base attracts more services and enhances the platform's utility, creating a virtuous cycle.

- Customer Acquisition Cost: Established players often have lower customer acquisition costs due to brand recognition and existing relationships.

- Capital Requirements: The significant capital needed to build a robust banking infrastructure acts as a deterrent to new entrants.

The threat of new entrants for Axos Financial is generally low, primarily due to the substantial barriers to entry in the banking sector. These include significant capital requirements, stringent regulatory hurdles, and the need to build brand trust. For instance, in 2024, the cost to establish and maintain compliance with evolving financial regulations remains a considerable investment, often running into millions of dollars annually.

New entrants must also overcome the established network effects and economies of scale enjoyed by incumbents like Axos. Building a comparable technological infrastructure and customer base requires immense time and financial resources, making it difficult for newcomers to compete on price or service offerings effectively.

The sheer capital needed to launch a bank, coupled with the ongoing costs of technology, compliance, and customer acquisition, deters many potential competitors. This high cost of entry ensures that only well-capitalized and strategically positioned entities can realistically challenge established players.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant upfront investment in technology, licenses, and reserves. | High; requires hundreds of millions to start. |

| Regulatory Hurdles | Extensive compliance with federal and state banking laws. | High; complex and costly to navigate. |

| Brand Recognition & Trust | Building customer loyalty in a sensitive industry. | High; takes years and substantial marketing. |

| Economies of Scale | Lower per-unit costs for established players. | High; makes it hard for new entrants to match pricing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Axos Financial is built upon a foundation of comprehensive data, including SEC filings, investor relations reports, and industry-specific market research. We also incorporate insights from financial news outlets and analyst reports to capture current market dynamics.