Avianca Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avianca Holdings Bundle

Navigate the complex external forces impacting Avianca Holdings with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, environmental concerns, and legal frameworks are shaping the airline's strategic landscape. Gain a competitive edge by leveraging these critical insights for your own market strategy. Download the full version now for actionable intelligence.

Political factors

Governments worldwide impose strict regulations on airlines, covering everything from route approvals and safety standards to operational licenses. For Avianca, this means navigating a complex web of national aviation authorities. In 2024, for instance, the International Civil Aviation Organization (ICAO) continued to emphasize enhanced safety oversight for all member states, directly impacting airline compliance protocols.

Bilateral Air Service Agreements (BASAs) are pivotal. These agreements dictate which airlines can fly between two countries and how often. Changes in BASAs, such as new open-skies agreements or restrictions, can significantly alter Avianca's ability to expand its network or maintain existing routes. For example, ongoing discussions in 2025 regarding expanded air travel between South American nations could present new opportunities for Avianca's regional connectivity.

Adherence to international standards set by bodies like the International Civil Aviation Organization (ICAO) and the International Air Transport Association (IATA) is non-negotiable for seamless cross-border operations. These organizations establish global benchmarks for safety, security, and efficiency, which Avianca must meet to operate internationally. In 2024, IATA's focus on sustainable aviation fuels (SAF) mandates also began to influence operational planning for carriers like Avianca.

Political stability across Latin America is a cornerstone for Avianca's operations, as disruptions like civil unrest or sudden policy changes can significantly impact travel demand and ensure operational continuity. For instance, in 2023, several Latin American nations experienced periods of political transition, which, while not directly halting operations, created an environment of heightened uncertainty for business travel.

Geopolitical tensions, whether regional disputes or shifts in international trade relations, can directly affect Avianca's passenger and cargo flows. For example, ongoing discussions around trade agreements in 2024 between key Latin American economies and global partners could reshape cargo routes, potentially requiring adjustments to Avianca's network or impacting demand on specific corridors.

Changes in trade policies, particularly the rise of protectionism in key markets such as the United States, Europe, and within Latin America, present a significant variable for Avianca. These shifts can directly impact the airline's cargo operations and the volume of passenger traffic it handles.

For instance, if the US were to implement stricter trade tariffs or if European Union nations were to introduce new bilateral air service agreements that favor national carriers, Avianca could see its market access curtailed. This could lead to reduced cargo revenue and fewer passenger opportunities on lucrative international routes. The International Air Transport Association (IATA) has consistently highlighted how trade liberalization fuels air cargo growth, with global trade volumes directly correlating to air freight demand.

Furthermore, any protectionist measures that lead to restrictions on international travel, or increased tariffs on essential components like aircraft parts and fuel, would inevitably drive up Avianca's operational costs. Higher fuel prices, for example, directly impact profitability, and increased import duties on spare parts could delay maintenance and affect fleet availability, thereby hindering the airline's ability to execute its growth strategies and maintain competitive pricing.

Government Support and Intervention

Government support, or its absence, proved critical for airlines during the COVID-19 pandemic. Avianca Holdings, for instance, underwent Chapter 11 restructuring in the United States, a process that often involves seeking financial aid or concessions. The airline industry globally received significant government backing, with many nations providing direct financial assistance, loan guarantees, or tax relief to prevent widespread bankruptcies. For example, the U.S. CARES Act provided over $50 billion in aid to passenger airlines.

Government intervention can also shape the competitive landscape. Policies regarding market access, bilateral air service agreements, and competition oversight directly influence an airline's operational freedom and profitability. In 2024 and 2025, continued scrutiny of airline mergers and alliances, alongside potential regulatory changes aimed at consumer protection or environmental standards, could impact Avianca's strategic options and market position.

- Government Aid: The global airline industry sought and received substantial government aid during the COVID-19 crisis, with figures reaching tens of billions of dollars in various countries.

- Regulatory Impact: Ongoing regulatory reviews of airline competition and consumer practices in 2024-2025 could lead to new operational constraints or opportunities for Avianca.

- Restructuring Support: Avianca's Chapter 11 filing in 2020 highlighted the need for government-friendly restructuring frameworks to navigate severe economic shocks.

Regulatory Environment for Alliances and Mergers

The regulatory landscape for airline alliances and mergers significantly shapes Avianca's strategic options. Antitrust scrutiny and competition laws in key operating regions, including Colombia and Brazil, directly influence the viability and design of partnerships. These collaborations are vital for Avianca, especially under the Abra Group umbrella, to enhance network connectivity and competitive positioning.

For instance, the ongoing integration and potential future consolidations within the Latin American aviation sector are subject to rigorous oversight. Regulators in 2024 and 2025 are likely to continue focusing on market concentration to prevent anti-competitive practices. Avianca's ability to leverage its alliance structure, including its membership in Star Alliance and its integration within Abra Group, is therefore heavily dependent on these regulatory frameworks.

- Antitrust Reviews: Jurisdictions like Colombia and Brazil maintain strict antitrust regulations that scrutinize airline mergers and alliances to protect consumer interests and fair competition.

- Competition Policies: Policies aimed at preventing monopolies and promoting a competitive market directly impact the scope and structure of Avianca's strategic partnerships, including those within the Abra Group.

- Network Expansion: Regulatory approvals for alliances and potential mergers are critical enablers for Avianca to expand its route network and increase its market share across Latin America.

- Abra Group Integration: The regulatory environment affects the operational and strategic integration of Avianca within the broader Abra Group, impacting its ability to achieve synergies and economies of scale.

Government regulations significantly impact Avianca's operations, from safety standards to route approvals, necessitating compliance with international bodies like ICAO and IATA. Changes in bilateral air service agreements in 2025 could reshape Avianca's network, while ongoing focus on sustainable aviation fuels in 2024 influences operational planning.

Political stability across Latin America is crucial for Avianca's consistent operations, as civil unrest or policy shifts can affect travel demand. Geopolitical tensions and trade policy shifts, such as potential protectionism in key markets in 2024, can directly alter cargo flows and passenger traffic, impacting revenue and operational costs.

Government aid played a vital role during the COVID-19 crisis, with airlines globally receiving substantial support; for instance, the U.S. CARES Act provided over $50 billion to passenger airlines. Regulatory scrutiny of airline mergers and alliances in 2024-2025 also influences Avianca's strategic options and market position.

Antitrust reviews and competition policies in regions like Colombia and Brazil are critical for Avianca's strategic partnerships, including those within the Abra Group. Regulatory approvals for alliances are essential for network expansion and market share growth, directly impacting Avianca's ability to achieve synergies.

What is included in the product

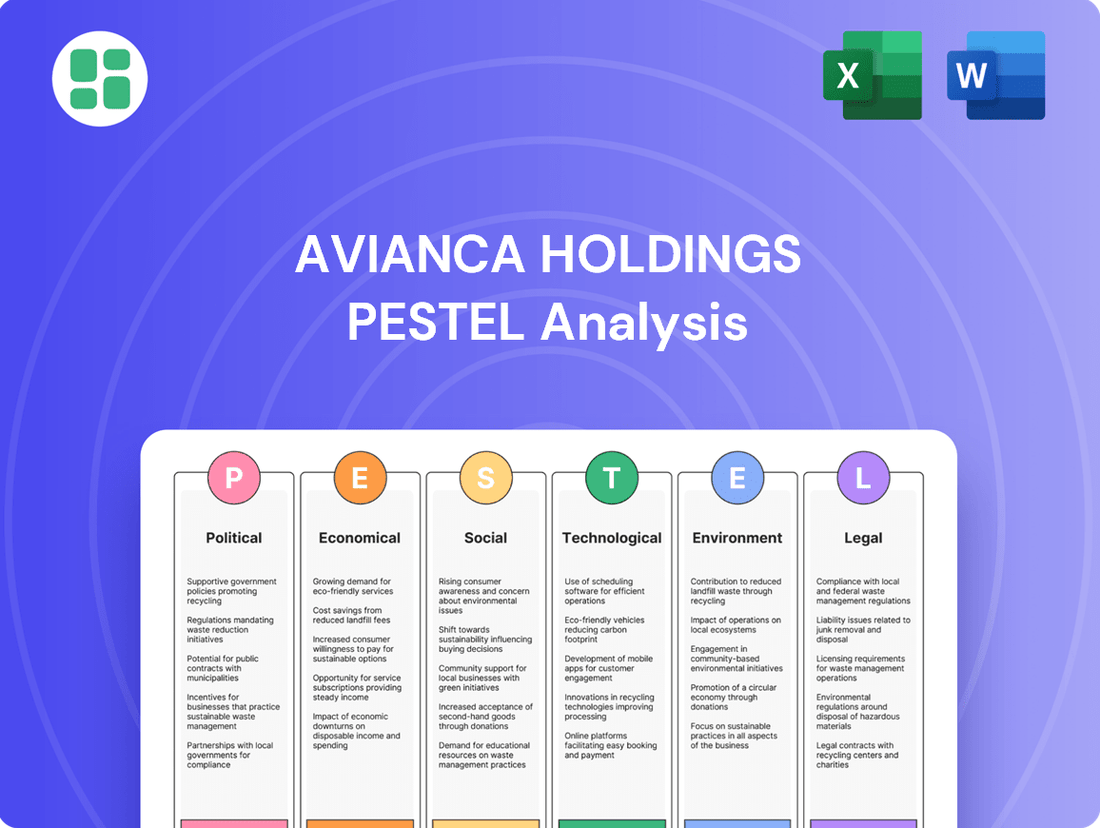

This PESTLE analysis dissects the external macro-environmental forces impacting Avianca Holdings, examining Political stability, Economic fluctuations, Social trends, Technological advancements, Environmental regulations, and Legal frameworks within its operating regions.

It offers a comprehensive overview of how these factors present both strategic challenges and opportunities for Avianca Holdings's future growth and operational planning.

A concise PESTLE analysis for Avianca Holdings, presented in a digestible format, alleviates the pain of sifting through lengthy reports, enabling faster strategic decision-making.

This PESTLE analysis offers a clear, segmented view of external factors impacting Avianca, simplifying complex market dynamics and reducing the time spent on understanding potential risks and opportunities.

Economic factors

Fuel price volatility is a major concern for airlines like Avianca Holdings, as jet fuel constitutes a substantial part of their operating expenses. Fluctuations in global oil prices directly impact profitability. For instance, during 2024, crude oil prices experienced significant swings, with Brent crude trading between $75 and $90 per barrel at various points, directly affecting Avianca's cost structure.

Sharp rises in jet fuel costs can severely compress profit margins, forcing airlines to reconsider fare strategies to remain competitive. Conversely, periods of stable or declining fuel prices offer a significant tailwind, potentially boosting financial performance and allowing for more aggressive pricing. This sensitivity means Avianca must closely monitor geopolitical events and supply/demand dynamics influencing the oil market.

Avianca's financial health is significantly influenced by currency exchange rate fluctuations. The airline generates revenue in multiple currencies across Latin America and Europe, but many of its core expenses, such as fuel purchases and aircraft leases, are pegged to the U.S. Dollar (USD).

A notable example of this impact can be seen in the performance of Latin American currencies against the USD. For instance, during 2024, several major Latin American currencies experienced depreciation. The Colombian Peso (COP), a key currency for Avianca, saw a weakening trend against the dollar, impacting the cost of USD-denominated obligations. This trend continued into early 2025, with the COP trading at levels around 3,900-4,000 per USD, compared to stronger historical rates.

Consequently, when local currencies weaken against the USD, Avianca's operating costs in dollar terms effectively increase when translated back into local currency. This directly squeezes profit margins and makes it more expensive to service its USD-denominated debt, posing a significant challenge to the company's profitability and financial stability.

Avianca's performance is closely tied to the economic growth in its key Latin American markets. For instance, in 2024, several of these economies are projected to experience moderate growth, which should support consumer disposable income. This increased spending power is crucial for demand in the airline industry.

Recessions or economic slowdowns directly impact disposable income, leading to reduced spending on non-essential services like air travel. A downturn in a major market like Colombia or Brazil could significantly dampen Avianca's passenger volumes and revenue per passenger.

Competition and Pricing Pressure

The airline industry in Latin America is fiercely competitive, with Avianca facing intense pressure from the growing presence of low-cost carriers. These budget airlines often operate with leaner cost structures, enabling them to offer significantly lower fares, which directly impacts Avianca's ability to maintain premium pricing. For instance, in 2024, the expansion of airlines like Viva Air and Sky Airline continued to challenge established players by capturing market share through aggressive pricing strategies.

To counter this, Avianca must continually refine its pricing strategies, balancing the need to offer competitive fares with the costs associated with its full-service model. This involves dynamic fare adjustments and promotional campaigns to attract price-sensitive travelers without eroding profitability. The airline's focus on cost discipline remains paramount, as demonstrated by ongoing efforts to optimize fleet utilization and operational efficiency throughout 2024 and into early 2025.

- Increased Low-Cost Carrier Penetration: Low-cost carriers have steadily increased their market share in key Latin American routes, intensifying competition.

- Price Sensitivity of Consumers: A significant portion of the Latin American traveler base is highly sensitive to price, making competitive fares a critical factor in purchasing decisions.

- Strategic Fare Adjustments: Avianca's response includes a mix of promotional fares, bundled offerings, and loyalty programs to appeal to a wider customer segment.

- Operational Efficiency as a Differentiator: Maintaining high operational efficiency is crucial for Avianca to offset the pricing advantages of its leaner competitors.

Inflationary Pressures and Cost Management

Broader inflationary pressures are a significant concern for airlines like Avianca. In 2024, global inflation, while showing signs of moderation, continued to impact key operational inputs. For instance, labor costs, a substantial component of airline expenses, saw upward adjustments in many regions. Airport fees, which are often regulated or subject to negotiation, also experienced increases, adding to the overall cost base.

Maintenance costs for aircraft fleets, encompassing parts, specialized labor, and outsourced services, have also been affected by inflationary trends. These rising expenses directly challenge Avianca's ability to manage its operating costs effectively. The airline industry, with its high fixed costs, is particularly sensitive to such pressures, as even small increases in input prices can have a material impact on profitability.

To counter these headwinds, Avianca is focused on robust cost management and operational efficiencies. Initiatives such as fleet modernization, aimed at introducing more fuel-efficient aircraft, are critical. For example, the introduction of newer generation aircraft can lead to significant savings in fuel consumption, which remains a major operating expense. Furthermore, ongoing fuel conservation initiatives, including optimized flight paths and improved ground operations, are essential to mitigate the impact of volatile fuel prices and broader inflationary pressures on the bottom line.

- Labor Cost Increases: In 2024, average wage growth for aviation sector employees in Latin America saw an estimated increase of 5-7%, driven by demand for skilled personnel and general inflation.

- Airport Fee Hikes: Several major Latin American airports reported increases in landing and handling fees by an average of 3-5% in late 2023 and early 2024 to fund infrastructure upgrades.

- Maintenance Cost Inflation: The cost of aircraft spare parts and specialized maintenance services saw an approximate 4-6% increase globally in 2024 due to supply chain issues and raw material costs.

- Fuel Efficiency Gains: Avianca's fleet modernization program, targeting a 15-20% improvement in fuel efficiency per seat kilometer with its new aircraft, is a key strategy to offset rising fuel costs and operational expenses.

Economic growth in Avianca's key markets directly influences passenger demand and revenue. For instance, in 2024, several Latin American economies were projected to see moderate GDP growth, supporting consumer spending on air travel. However, economic slowdowns or recessions in major markets like Colombia or Brazil could significantly reduce passenger volumes and average fares.

Fuel price volatility remains a critical economic factor for Avianca. In 2024, jet fuel costs, a substantial portion of operating expenses, fluctuated significantly, with Brent crude trading between $75 and $90 per barrel. This volatility directly impacts profitability and necessitates careful fare management.

Currency exchange rates also pose a significant economic challenge. Avianca's revenue is generated in various Latin American currencies, while many costs, like fuel and leases, are USD-denominated. The weakening of currencies like the Colombian Peso against the USD in 2024, trading around 3,900-4,000 per USD, increases operating costs and debt servicing expenses.

Inflationary pressures, particularly on labor, airport fees, and maintenance costs, continue to affect Avianca. In 2024, these costs saw increases, impacting the airline's overall expense base. Strategies like fleet modernization, aiming for improved fuel efficiency, are crucial for cost mitigation.

| Economic Factor | Impact on Avianca | 2024/2025 Data Point |

|---|---|---|

| GDP Growth (LatAm) | Influences passenger demand and spending power | Projected moderate growth in key markets |

| Fuel Prices (Jet Fuel) | Major operating expense, impacts profitability | Brent Crude trading $75-$90/barrel (2024) |

| Currency Exchange Rates (COP vs USD) | Affects cost of USD-denominated expenses | COP around 3,900-4,000/USD (early 2025) |

| Inflation (Labor, Fees, Maintenance) | Increases operational costs | Estimated 3-7% increase in key cost inputs |

Full Version Awaits

Avianca Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Avianca Holdings PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline. Understand the strategic landscape and potential challenges and opportunities facing Avianca.

Sociological factors

Consumer travel preferences are notably shifting, with a bifurcated demand emerging for both highly affordable options and more luxurious, premium experiences. This trend was evident in 2024, with reports indicating a significant uptick in bookings for budget carriers alongside a resurgence in demand for premium cabin classes on long-haul flights.

Avianca Holdings' strategic positioning reflects this evolving market. By maintaining a hybrid operational model, the company aims to leverage efficiencies for its lower-cost offerings while simultaneously investing in enhanced business class services. This approach is designed to appeal to a wider passenger demographic, capturing market share from both ends of the spectrum.

Latin America is experiencing significant demographic shifts, with a growing middle class and increasing urbanization. For instance, projections indicate that by 2030, over 80% of Latin America's population will reside in urban areas, a notable increase from current figures. This trend directly translates into a larger pool of potential air travelers, as urban dwellers typically have greater disposable income and a higher propensity to travel.

These demographic changes are fueling demand for air travel, both domestically and internationally. As more people move to and concentrate in major cities, the need for efficient connectivity grows. This is particularly evident in routes linking key urban centers across the Americas and extending to Europe, supporting Avianca's network strategy.

Public health crises, such as the COVID-19 pandemic, significantly reshaped passenger behavior, causing a sharp decline in air travel demand and necessitating the implementation of stringent health and safety measures. Avianca, like other airlines, faced the challenge of rebuilding passenger trust by demonstrating a commitment to rigorous health protocols.

Adapting operations to evolving public health guidelines became paramount for Avianca's survival and recovery. For instance, in 2023, the International Air Transport Association (IATA) reported that while air travel demand was recovering, passenger confidence remained sensitive to health concerns, influencing booking patterns and the willingness to travel internationally.

Cultural and Social Connectivity

Avianca's strategic positioning to link Latin America with global destinations directly leverages the deep-seated cultural and social connections prevalent in the region. These ties fuel demand for travel driven by family reunions, burgeoning tourism, and essential business interactions.

By closely monitoring regional travel trends and passenger preferences, Avianca can more effectively tailor its route networks and service portfolios. This granular understanding ensures that offerings resonate with the specific travel needs and desires of its customer base.

- Family Reunions: Latin America's strong emphasis on family often drives significant intergenerational travel, particularly during holidays and significant life events.

- Tourism Growth: In 2023, Latin America saw a notable increase in international tourist arrivals, with projections for continued growth into 2024 and 2025, indicating a robust market for leisure travel.

- Business Connectivity: The increasing economic integration within Latin America and its expanding trade relationships globally necessitate reliable air transport for business professionals.

Labor Relations and Employee Welfare

Avianca's operational stability hinges on robust labor relations and a commitment to employee welfare, impacting service quality. A workforce exceeding 14,000 individuals requires careful management to ensure consistent daily operations and positive customer experiences.

Key considerations for Avianca's labor relations include:

- Employee Engagement: Initiatives to foster a motivated workforce contribute directly to service excellence.

- Union Negotiations: Successful collaboration with labor unions is vital for avoiding disruptions and ensuring fair practices.

- Training and Development: Investing in employee skills enhances operational efficiency and safety standards.

- Compensation and Benefits: Competitive packages are essential for attracting and retaining skilled aviation professionals.

Societal shifts in Latin America, like a growing middle class and increasing urbanization, are expanding the potential customer base for air travel. For example, projections suggest over 80% of the region's population will be urban by 2030, boosting demand for connectivity. Furthermore, strong cultural ties drive travel for family events and tourism, with Latin America experiencing a notable increase in international tourist arrivals in 2023, expected to continue into 2024 and 2025.

Technological factors

Avianca is actively investing in fleet modernization, with a significant focus on fuel-efficient aircraft such as the Airbus A320neo family and the Boeing 787 Dreamliner. This strategic move is crucial for reducing operational expenses, as fuel costs represent a substantial portion of an airline’s budget. For instance, the A320neo offers up to 15% fuel burn reduction compared to its predecessor, directly impacting Avianca's bottom line.

Beyond cost savings, this technological upgrade aligns Avianca with growing environmental sustainability demands and enhances the passenger experience through quieter cabins and improved comfort. These modern aircraft are designed with advanced aerodynamics and more efficient engines, contributing to a lower carbon footprint, a key consideration for both regulators and increasingly environmentally conscious travelers in 2024 and 2025.

Avianca Holdings is increasingly leveraging technology to transform its customer experience. This includes sophisticated online booking platforms and user-friendly mobile applications, which saw significant adoption. For instance, by the end of 2023, Avianca reported that over 70% of its bookings were made through digital channels, a testament to the growing reliance on these tools.

The airline is also focusing on efficient self-service check-in options, both online and via their app. This digital shift not only enhances passenger convenience by reducing wait times but also contributes to operational efficiency by lowering the need for manual check-in processes. In 2024, Avianca aims to increase its self-service check-in rate to 85%.

Avianca is increasingly leveraging data analytics and AI to refine its operations. For instance, AI-powered tools are being used to optimize flight schedules and crew assignments, aiming to reduce delays and improve efficiency. This focus on data-driven decision-making is expected to enhance Avianca's ability to manage costs and boost revenue streams through more targeted customer engagement.

Cybersecurity and Data Privacy

Avianca's increasing reliance on digital platforms for operations and customer interactions makes robust cybersecurity crucial. Protecting sensitive passenger and financial data is paramount to maintaining trust. In 2023, the global average cost of a data breach reached $4.45 million, a figure Avianca must actively mitigate.

Compliance with evolving data privacy regulations, such as GDPR and similar frameworks in Latin America, is essential. Failure to comply can lead to significant fines and reputational damage. For instance, fines under GDPR can reach up to 4% of global annual turnover or €20 million, whichever is higher.

- Cybersecurity Investment: Avianca must continue to invest in advanced threat detection and prevention systems to safeguard its digital infrastructure.

- Data Privacy Compliance: Adherence to stringent data privacy laws across its operating regions is non-negotiable to avoid penalties.

- Customer Trust: Demonstrating a strong commitment to data security is vital for retaining customer confidence in an increasingly digital travel landscape.

- Incident Response: Developing and regularly testing comprehensive incident response plans is key to minimizing the impact of any potential cyber threats.

Air Traffic Management and Navigation Technologies

Advancements in air traffic management and navigation technologies are significantly reshaping the aviation landscape, directly influencing flight efficiency, safety, and overall capacity. The ongoing implementation of systems like the Single European Sky (SES) initiative aims to modernize air traffic control, promising more direct routes and reduced flight times. For Avianca Holdings, embracing these technological shifts means a tangible benefit to their operational performance.

The adoption of next-generation navigation systems, such as Performance-Based Navigation (PBN) and satellite-based augmentation systems (SBAS), allows for more precise flight paths. This precision translates into fewer holding patterns and more optimized airspace utilization, which can lead to substantial fuel savings and improved on-time performance metrics for Avianca. In 2024, airlines globally are seeing the impact of these technologies, with some reporting reductions in flight delays by up to 10% due to more efficient air traffic flow management.

Key technological factors impacting Avianca include:

- NextGen and SESAR Implementation: Continued rollout of advanced air traffic control systems in the Americas and Europe, improving airspace efficiency.

- Satellite Navigation Enhancements: Increased reliance on GPS and other satellite systems for more accurate and direct routing, reducing flight times and fuel burn.

- Data-Driven Air Traffic Management: Integration of real-time data analytics to predict and manage air traffic flow, minimizing congestion and delays.

- Automation in Air Traffic Control: Introduction of AI and machine learning tools to assist air traffic controllers, enhancing safety and capacity.

Avianca's commitment to fleet modernization, including the integration of fuel-efficient aircraft like the Airbus A320neo, directly addresses operational costs and environmental concerns prevalent in 2024 and 2025. This technological investment is projected to yield significant fuel savings, with the A320neo alone offering up to a 15% reduction in fuel burn compared to older models.

The airline is enhancing customer experience through advanced digital platforms, with over 70% of bookings made online by the end of 2023. This digital push extends to self-service check-in options, aiming for an 85% adoption rate in 2024, thereby improving passenger convenience and operational efficiency.

Leveraging data analytics and AI is central to Avianca's strategy, with applications in optimizing flight schedules and crew assignments to minimize delays and boost revenue through targeted customer engagement.

The airline must prioritize robust cybersecurity measures and compliance with evolving data privacy regulations, such as GDPR, to protect sensitive information and avoid substantial penalties, with global data breach costs averaging $4.45 million in 2023.

Legal factors

Avianca Holdings, like all airlines, must meticulously follow stringent aviation safety regulations. This includes compliance with standards from national bodies such as Colombia's Aeronautica Civil and international organizations like the International Civil Aviation Organization (ICAO). Failure to adhere to these rules can lead to significant fines, grounding of aircraft, and severe reputational damage, impacting Avianca's ability to fly and its passenger trust.

Consumer protection laws significantly shape Avianca's operations, particularly concerning passenger rights. Regulations around flight delays, cancellations, and refund policies are constantly evolving, requiring Avianca to stay agile. For instance, in 2024, many jurisdictions strengthened passenger compensation mandates for significant disruptions, potentially increasing Avianca's liabilities and necessitating robust customer service protocols.

Avianca navigates a complex web of labor and employment laws across its operational countries, each with unique regulations on unionization, working hours, and employment conditions. For instance, in Colombia, a key market, labor unions have historically played a significant role in the aviation sector, impacting negotiations and operational flexibility.

Effective management of these diverse labor relations is paramount to prevent disruptions like strikes, which can severely impact Avianca's operational continuity and financial performance. The airline must remain vigilant in complying with local labor statutes, ensuring fair working conditions and adhering to collective bargaining agreements to maintain a stable workforce.

Antitrust and Competition Legislation

Antitrust and competition legislation critically shape Avianca's strategic options within the airline sector. These regulations scrutinize market concentration, preventing monopolistic practices and ensuring fair competition. For Avianca, this means any proposed alliances, joint ventures, or mergers and acquisitions, particularly those involving entities like the Abra Group, require rigorous review and approval from competition authorities to ensure they do not unduly restrict market access or harm consumers.

The regulatory landscape directly impacts Avianca's growth trajectory and its ability to consolidate its market position. For instance, the formation of the Abra Group, which brought together Avianca and Gol Linhas Aéreas Inteligentes, was subject to extensive antitrust reviews in multiple jurisdictions. These reviews assess potential impacts on ticket prices, route availability, and overall passenger choice.

- Regulatory Hurdles: Avianca's expansion plans, including its integration into the Abra Group, necessitate navigating complex antitrust approvals across various Latin American markets.

- Market Concentration Concerns: Authorities monitor the airline industry for excessive market share, which could lead to higher fares and reduced service quality for passengers.

- Alliance Scrutiny: Strategic partnerships and code-sharing agreements are also subject to antitrust oversight to prevent anti-competitive behavior.

Data Privacy and Security Regulations

Avianca Holdings, like all airlines, manages substantial passenger data, necessitating strict adherence to data privacy and security regulations. This includes compliance with global standards such as the General Data Protection Regulation (GDPR) and specific data protection laws across the Latin American countries where it operates.

Non-compliance can lead to severe financial penalties and significant damage to Avianca's reputation. For instance, GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher. Recent data breaches in the travel industry, though not specific to Avianca, highlight the ongoing risks and the critical need for robust data protection measures.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- Latin American Data Laws: Varying but increasingly stringent requirements for data handling.

- Reputational Risk: Data breaches erode customer trust and brand image.

- Operational Impact: Compliance requires ongoing investment in technology and training.

Avianca's operations are heavily influenced by aviation safety regulations, requiring strict adherence to standards from bodies like Colombia's Aeronautica Civil and the ICAO. Consumer protection laws, especially concerning passenger rights for delays and cancellations, are also critical, with increased compensation mandates noted in 2024. Labor laws across its operating regions, including union relations in Colombia, significantly impact workforce management and operational stability.

Antitrust legislation scrutinizes Avianca's strategic moves, such as its integration into the Abra Group with Gol, to prevent market monopolization and ensure fair competition. Data privacy laws, including GDPR and regional equivalents, are paramount due to the substantial passenger data Avianca handles, with non-compliance carrying substantial financial and reputational risks.

| Legal Area | Key Regulations/Concerns | Potential Impact on Avianca | 2024/2025 Data/Trends |

|---|---|---|---|

| Aviation Safety | ICAO Standards, National Aviation Authorities | Fines, aircraft grounding, reputational damage | Ongoing ICAO audits and national safety oversight enhancements. |

| Consumer Protection | Passenger rights (delays, cancellations, refunds) | Increased liabilities, customer service costs | Strengthening of passenger compensation rules in various Latin American markets. |

| Labor Law | Unionization, working hours, employment conditions | Operational disruptions (strikes), negotiation costs | Continued emphasis on collective bargaining agreements and fair labor practices. |

| Antitrust/Competition | Market concentration, alliances, mergers | Approval delays, potential divestitures, restricted growth | Intensified scrutiny of airline consolidations, including the Abra Group formation. |

| Data Privacy | GDPR, regional data protection laws | Fines (up to 4% global revenue), reputational damage | Increased focus on cybersecurity and data breach prevention protocols. |

Environmental factors

The airline sector is under growing scrutiny regarding its environmental impact, with stricter regulations and ambitious carbon emission reduction targets being implemented globally. These targets are often driven by international agreements and national policies aimed at combating climate change. For instance, the International Civil Aviation Organization (ICAO) has set a goal for net-zero carbon emissions from international aviation by 2050, a commitment many countries are aligning with.

Avianca is proactively addressing these environmental pressures by investing in fleet modernization and implementing fuel-efficient operational practices. This includes the introduction of newer, more fuel-efficient aircraft, such as the Airbus A320neo family, which can reduce fuel burn by up to 15%. In 2023, Avianca reported a reduction in its CO2 emissions intensity, a key metric for sustainability in the industry, demonstrating a commitment to long-term environmental responsibility.

The growing emphasis on Sustainable Aviation Fuel (SAF) presents a significant environmental consideration for airlines like Avianca. SAF offers a tangible way to cut aviation's substantial carbon emissions, a critical goal for the industry. For instance, by 2023, SAF production globally reached approximately 1.5 million tons, a notable increase from previous years, though still a small fraction of total jet fuel consumption.

Despite SAF's current premium pricing compared to conventional jet fuel, its adoption is expected to accelerate. This is driven by increasing availability and a growing number of regulatory mandates and incentives aimed at decarbonizing air travel. For example, the European Union's ReFuelEU Aviation initiative aims to increase SAF uptake to 6% by 2030, which will undoubtedly shape fuel procurement strategies for carriers operating in and to Europe.

Noise pollution around airports is a major environmental issue, often resulting in strict local regulations and community resistance to airport growth or more flights. This can directly impact airline operations and expansion plans.

Avianca's ongoing fleet modernization, which includes introducing newer, quieter aircraft, is a key strategy to address these concerns. For instance, their acquisition of Airbus A320neo family aircraft, known for their reduced noise footprint compared to older models, demonstrates a commitment to environmental responsibility and improved community relations.

Waste Management and Recycling Initiatives

Airlines like Avianca face significant environmental challenges due to the substantial waste generated from both in-flight services and ground operations. This includes everything from food packaging and service items to maintenance materials.

Avianca's commitment to robust waste management and recycling initiatives is crucial for reducing its ecological footprint. This involves actively implementing programs to sort, recycle, and properly dispose of waste generated across its operations.

Key areas of focus for Avianca's environmental responsibility include:

- Reducing single-use plastics: Exploring alternatives and phasing out non-recyclable materials used in cabin service.

- Onboard recycling programs: Implementing systems for separating recyclable materials like paper, plastic, and aluminum during flights.

- Biodegradable materials: Investigating and adopting biodegradable or compostable alternatives for service items and packaging.

- Ground operations waste: Managing waste from maintenance, catering, and administrative facilities through recycling and responsible disposal.

For instance, in 2023, the aviation industry globally was estimated to generate over 1.5 million tons of cabin waste, highlighting the scale of the challenge. Airlines are increasingly investing in sustainable practices, with many setting targets to significantly reduce their waste-to-landfill ratios by 2025.

Climate Change Impacts on Operations

Climate change poses significant operational challenges for Avianca Holdings. Increased frequency and intensity of extreme weather events, such as hurricanes and heavy rainfall, directly impact flight schedules and safety. For instance, in 2024, the airline, like many others in Latin America, experienced numerous flight delays and cancellations due to severe storms affecting key hubs.

These physical impacts translate into higher operational costs and a need for enhanced resilience. Avianca must invest in advanced weather forecasting and adaptive flight planning strategies to mitigate disruptions. The airline's long-term strategic planning must incorporate the growing risks associated with climate change, including potential impacts on airport infrastructure and fuel efficiency due to altered wind patterns.

- Increased Turbulence: Climate change is linked to more unpredictable atmospheric conditions, leading to a rise in severe turbulence events, impacting passenger comfort and aircraft wear.

- Operational Disruptions: Extreme weather events in 2024, such as prolonged periods of heavy fog and intense thunderstorms in South America, led to significant flight cancellations and diversions for Avianca.

- Adaptation Costs: Avianca may face increased costs for route adjustments, fuel management, and potentially new aircraft technologies to cope with changing climate patterns.

Avianca faces increasing pressure to reduce its carbon footprint, with global targets like net-zero emissions from international aviation by 2050 driving industry change. The airline is investing in modern, fuel-efficient aircraft, such as the Airbus A320neo family, aiming to cut fuel consumption by up to 15%. In 2023, Avianca reported a reduction in its CO2 emissions intensity, reflecting its commitment to sustainability.

The growing adoption of Sustainable Aviation Fuel (SAF) is a key environmental strategy, though its current higher cost remains a hurdle. By 2023, global SAF production reached approximately 1.5 million tons, a step forward, but still a small portion of total jet fuel demand. Initiatives like the EU's ReFuelEU Aviation, targeting 6% SAF use by 2030, will significantly influence airline fuel strategies.

Waste management is another critical environmental focus for Avianca, with the aviation industry generating over 1.5 million tons of cabin waste annually as of 2023. The airline is implementing onboard recycling and exploring biodegradable materials to minimize its waste impact.

Climate change presents operational risks, including increased extreme weather events that caused flight disruptions for Avianca in 2024. The airline must invest in advanced weather forecasting and adaptive strategies to manage these growing climate-related challenges.

PESTLE Analysis Data Sources

Our Avianca Holdings PESTLE Analysis is built on a robust foundation of data from official aviation authorities, economic forecasting agencies, and international financial institutions. We incorporate insights from government policy updates, industry-specific market research, and reputable news outlets to ensure comprehensive coverage.