Avianca Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avianca Holdings Bundle

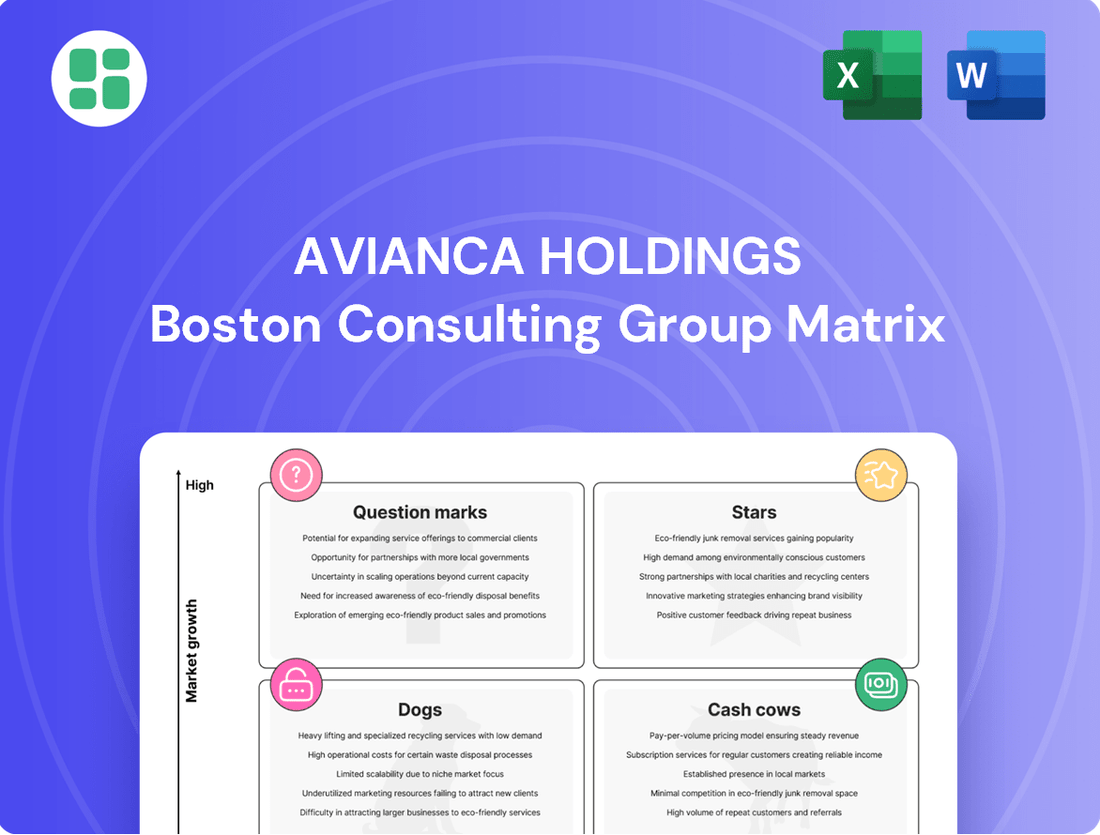

Curious about Avianca Holdings' strategic positioning? Our BCG Matrix analysis offers a glimpse into which of their operations are generating significant cash flow and which require careful consideration. Understand their current market standing and identify potential growth areas.

Unlock the full potential of this analysis by purchasing the complete Avianca Holdings BCG Matrix report. Gain detailed insights into each quadrant – Stars, Cash Cows, Dogs, and Question Marks – complete with data-backed recommendations to guide your investment and strategic decisions.

Don't miss out on the complete picture. The full BCG Matrix provides a clear roadmap for navigating Avianca Holdings' diverse portfolio, enabling you to make informed choices for future growth and resource allocation.

Stars

Avianca's strategic push into new international routes, especially those linking Latin America with key U.S. markets, highlights a strong growth trajectory. The upcoming Bogotá-Tampa route, set to launch in 2025 with no direct competition, is a prime example of this strategy, aiming to secure a significant market share in an expanding corridor.

This aggressive expansion is backed by concrete action; Avianca introduced 24 new routes throughout 2024. Further demonstrating this commitment, the first half of 2025 saw the addition of 10 more routes and destinations, underscoring a clear focus on penetrating and capitalizing on new and growing markets.

Avianca's premium business class offerings are a significant focus, particularly the expansion of this service onto narrowbody aircraft. This strategic move aims to tap into a broader segment of the premium travel market, not just on long-haul routes. By enhancing the onboard experience across more of their fleet, Avianca is positioning itself to capture higher yields from a wider customer base.

The introduction of the 'Insignia' brand for long-haul flights to Europe underscores Avianca's commitment to the high-yield premium segment. This brand is designed to offer a superior travel experience, directly competing for passengers willing to pay a premium for enhanced comfort and service. This focus aligns with industry trends showing a strong recovery and growth in premium cabin demand post-pandemic, with business class travel expected to continue its upward trajectory.

Avianca Cargo shines as a Star in the BCG matrix, holding a dominant position in flower transportation from Colombia and Ecuador to the United States. Its strategic use of the Miami hub facilitates this critical trade route.

The company's performance during peak seasons underscores its strength. For instance, the Mother's Day 2025 season was a record-breaker, with Avianca Cargo transporting over 20,100 tons of fresh flowers. This represents a significant 15% increase from the prior year, highlighting its substantial market share in this lucrative and expanding cargo segment.

Strategic Redeployment to International Markets

Avianca Holdings is strategically shifting its focus, moving resources away from the saturated domestic Colombian market towards international routes that offer better growth and profit potential. This move is about chasing higher-margin opportunities where demand is stronger.

This strategic redeployment is already showing positive results. By concentrating on international expansion and focusing on premium services, Avianca saw a significant boost in passenger revenue, particularly in the latter half of 2024. This demonstrates their agility in capturing international travel demand.

- International Route Expansion: Avianca has actively increased its presence on key international routes, recognizing them as primary growth engines.

- Premium Revenue Focus: Initiatives aimed at increasing revenue from premium cabins and services have been a core component of this international strategy.

- H2 2024 Performance: The latter half of 2024 saw a notable uplift in passenger revenue metrics, directly attributable to these strategic shifts.

- Capacity Redeployment: A deliberate reallocation of aircraft capacity from less dynamic domestic markets to more promising international corridors is central to this strategy.

Fleet Modernization with Fuel-Efficient Aircraft

Avianca's strategic fleet modernization, notably the integration of fuel-efficient narrowbody aircraft such as the A320neo, is a significant driver of operational efficiency. This focus on newer, more economical planes directly impacts cost structures, a critical factor in the airline industry. For instance, the A320neo family offers up to 15% fuel burn reduction compared to previous generations, translating into substantial savings on operating expenses.

Furthermore, the cabin reconfiguration of the Boeing 787 fleet enhances the passenger experience while optimizing seating capacity. This dual benefit allows Avianca to cater to a growing demand for comfortable and efficient air travel. By improving the economics of its long-haul operations, Avianca strengthens its competitive position in key international markets.

These investments in modern and reconfigured aircraft are crucial for securing market leadership, particularly in a segment prioritizing cost-effectiveness and passenger satisfaction. Avianca's commitment to fleet renewal positions it favorably to capture market share by offering superior value and a more sustainable travel option.

- Fleet Modernization: Avianca is actively incorporating fuel-efficient aircraft like the A320neo.

- Operational Efficiency: The A320neo offers up to 15% fuel burn reduction, lowering operating costs.

- Cabin Reconfiguration: Enhancements to the Boeing 787 fleet improve passenger experience and capacity.

- Market Position: These upgrades solidify Avianca's ability to serve growing demand and maintain cost leadership.

Avianca Cargo stands out as a Star in Avianca's BCG matrix, dominating the lucrative flower transport sector from Colombia and Ecuador to the United States. Its strategic utilization of the Miami hub is key to this success, facilitating vital trade flows. The company's consistent performance, especially during peak seasons, reinforces its strong market position.

The record-breaking Mother's Day 2025 season, where Avianca Cargo moved over 20,100 tons of flowers, a 15% increase from the previous year, exemplifies its Star status. This robust growth in a high-demand segment indicates continued investment and market leadership.

This strong performance in specialized cargo, particularly perishable goods, highlights Avianca Cargo's significant market share and its role as a high-growth, high-market-share business unit. Its ability to handle substantial volumes efficiently positions it as a leader in its niche.

The airline's strategic focus on international routes with higher growth potential, coupled with investments in premium services, directly fuels the success of its Star business units like Avianca Cargo. This strategic alignment ensures resources are directed towards the most promising segments of the aviation market.

What is included in the product

Avianca Holdings' BCG Matrix likely categorizes its diverse airline services, with established routes as Cash Cows and new, high-growth markets as Stars.

The analysis would identify potential Stars for investment and Question Marks needing strategic decisions, while also highlighting Dogs for divestment.

A one-page overview placing Avianca's business units in the BCG matrix quadrants clarifies strategic priorities, relieving the pain of resource allocation uncertainty.

Cash Cows

Avianca's core domestic routes in Colombia are clearly its Cash Cows. Despite facing more competition, the airline commanded a substantial 53.8% of the domestic capacity in 2024, flying 19.3 million passengers within the country. This strong position, particularly from its Bogota hub, signifies a mature market where Avianca has solidified its dominance.

These high-volume routes generate consistent and significant cash flow for Avianca, requiring relatively low promotional investment to maintain their market share. This financial strength allows Avianca to leverage these established routes to fund other parts of its business.

Avianca's established international routes to major North American hubs, like Miami and New York, are its core cash cows. These routes benefit from consistent, high passenger demand in mature markets where Avianca holds a significant share. In 2023, Avianca reported a substantial portion of its revenue came from its international network, underscoring the importance of these established corridors.

The LifeMiles loyalty program is a clear Cash Cow for Avianca Holdings. Its financial performance is exceptionally strong, evidenced by a Q1 2025 Cash EBITDA of $53 million, marking a significant 46.4% increase from the previous year.

This program boasts impressive member growth, with a 40% expansion in its member base since 2019, underscoring its sustained appeal and market position. LifeMiles operates as a highly profitable, low-growth asset that reliably generates substantial and stable cash flow for the Avianca Group.

The program effectively leverages its extensive member base and a wide network of commercial partners to maintain this consistent revenue stream. Its mature status within the loyalty program landscape contributes to its predictable and robust cash generation capabilities.

Overall Avianca Cargo Network Operations

Avianca Cargo’s extensive network, a vital component of Avianca Holdings’ BCG Matrix, functions as a robust cash cow. In 2024, this operation moved more than 500,000 tons of cargo, linking over 60 destinations. The fleet includes dedicated Airbus A330 freighters and significant belly capacity on passenger flights, ensuring consistent revenue streams from a wide array of goods.

This established operational strength underpins its cash cow status. Avianca Cargo benefits from its leading market positions throughout the Americas, generating reliable income that supports other ventures within the holding company.

- Network Reach: Connects over 60 destinations globally.

- Cargo Volume: Transported over 500,000 tons in 2024.

- Fleet Utilization: Leverages Airbus A330 freighters and passenger aircraft belly capacity.

- Market Position: Holds leadership in key Americas markets, ensuring stable revenue.

Maintenance, Repair, and Overhaul (MRO) Services

Avianca's Maintenance, Repair, and Overhaul (MRO) services, particularly if they possess in-house capabilities and certifications like LEED® MRO, can function as a cash cow. This segment likely exhibits low growth potential due to the mature nature of the MRO market in its operating regions, but it generates substantial cash flow.

Leveraging these facilities to serve external airlines in a stable regional market allows Avianca to capitalize on its existing infrastructure. This strategy can yield high-margin revenue streams, contributing significantly to the company's overall financial health.

- High Margins: MRO services typically command strong profit margins due to specialized expertise and equipment.

- Stable Demand: Aircraft maintenance is a necessity, ensuring consistent demand even in slower economic periods.

- Asset Utilization: In-house MRO facilities, if underutilized, can become a profitable revenue center by servicing third-party clients.

Avianca's established domestic routes in Colombia, particularly those originating from Bogota, represent significant cash cows. In 2024, the airline maintained a dominant 53.8% share of domestic capacity, transporting 19.3 million passengers within Colombia, a testament to the maturity and consistent demand in these markets.

These routes generate substantial and predictable cash flow with minimal need for increased investment to sustain their market leadership. This financial strength from its domestic operations provides a stable foundation for Avianca to allocate resources to other strategic areas.

The LifeMiles loyalty program is a prime example of an Avianca cash cow, demonstrating robust financial performance with a Q1 2025 Cash EBITDA of $53 million, a 46.4% year-over-year increase. With a 40% member growth since 2019, LifeMiles is a mature, low-growth, high-profitability asset that reliably fuels the Avianca Group.

Avianca Cargo, with its extensive network connecting over 60 destinations and moving more than 500,000 tons in 2024, also operates as a key cash cow. Its leading market positions across the Americas ensure consistent revenue streams, leveraging both dedicated freighters and belly capacity.

| Segment | 2024 Domestic Capacity Share | 2024 Cargo Volume (tons) | Q1 2025 LifeMiles Cash EBITDA | Key Characteristic |

|---|---|---|---|---|

| Domestic Colombian Routes | 53.8% | N/A | N/A | Mature, high-volume, stable cash flow |

| LifeMiles Loyalty Program | N/A | N/A | $53 million | High profitability, low growth, consistent revenue |

| Avianca Cargo | N/A | >500,000 | N/A | Extensive network, leading market position, stable income |

What You See Is What You Get

Avianca Holdings BCG Matrix

The Avianca Holdings BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing Avianca's business units as Stars, Cash Cows, Question Marks, or Dogs, is ready for immediate strategic deployment. You can expect no watermarks or demo content, only the complete, professionally designed BCG Matrix ready for your business planning needs.

Dogs

Certain niche domestic routes within Colombia, such as those connecting smaller cities with limited passenger volume, are facing significant headwinds. These routes often contend with intense competition from new ultra-low-cost carriers like JetSMART, which can aggressively price fares, leading to oversupply and reduced profitability for Avianca.

While Avianca maintains a strong overall domestic market share, these specific underperforming routes might exhibit low growth prospects and a shrinking customer base. For instance, routes with passenger traffic below 10,000 annually and a negative growth rate in 2024 could become cash traps, draining resources that could be better allocated to more promising segments of the business.

Older, less efficient aircraft variants, such as earlier models of the Airbus A320ceo family that haven't been upgraded to the A320neo, are likely considered Dogs within Avianca Holdings' BCG Matrix. These planes typically have higher operating expenses due to increased fuel consumption and potentially higher maintenance costs compared to newer, more fuel-efficient models. For instance, the A320ceo typically burns around 1,500 kg of fuel per hour, whereas the A320neo can achieve savings of up to 15-20%, translating to significant operational cost differences.

Certain regional routes within Avianca Holdings' network may be classified as Dogs. These are routes that historically saw limited passenger traffic and currently exhibit low demand, failing to contribute meaningfully to profitable hub operations or international flight connections. In 2024, airlines globally faced challenges in optimizing such underperforming routes, often due to high operating costs relative to revenue generated.

Inefficient Legacy Ancillary Service Offerings

Inefficient legacy ancillary service offerings at Avianca, like older bundled fare options that haven't resonated with travelers, can be categorized as Dogs in the BCG matrix. These services often struggle to gain significant market share and generate minimal revenue. For instance, in 2023, Avianca reported that while ancillary revenue per passenger increased, certain older product bundles continued to underperform, contributing less than 1% to the total ancillary revenue stream.

These underperforming offerings demand considerable operational and marketing resources that could be better allocated to more profitable ventures. They might operate at a breakeven point or even incur small losses, effectively tying up capital and hindering overall growth potential.

- Low Revenue Contribution: Older bundled services may account for a negligible portion of Avianca's overall ancillary revenue.

- High Resource Drain: Continued investment in marketing and operational support for these underperformers diverts resources from growth areas.

- Limited Market Traction: Customer adoption rates for these legacy offerings have remained consistently low, indicating a lack of market demand.

- Potential for Divestment: Consideration should be given to phasing out or significantly revamping these services to improve resource allocation.

Outdated Onboard Entertainment or Connectivity Systems

Outdated onboard entertainment or connectivity systems on certain Avianca Holdings aircraft could be classified as Dogs within the BCG Matrix. These systems, often found on older aircraft or less frequently serviced routes, represent past investments that now offer limited customer appeal and minimal revenue potential. For instance, while specific Avianca fleet data for outdated systems isn't publicly itemized, the general airline industry trend shows a significant push for enhanced passenger experience. In 2024, airlines are investing heavily in next-generation Wi-Fi and personalized entertainment, making older systems a clear disadvantage.

These underperforming assets drain resources through maintenance without contributing meaningfully to market share or future growth. Passengers increasingly expect seamless connectivity and engaging entertainment options, and systems failing to meet these standards can lead to lower customer satisfaction and potentially impact booking decisions. This can be seen across the industry, where airlines with superior onboard offerings often command higher passenger loyalty and yield.

Consider these points regarding outdated systems:

- Low Customer Satisfaction: Passengers in 2024 prioritize reliable Wi-Fi and modern entertainment, leading to dissatisfaction with older, slower systems.

- Limited Revenue Potential: Outdated systems often lack the capability for premium content or faster internet speeds, hindering ancillary revenue generation.

- High Maintenance Costs: Older technology can be more prone to breakdowns, increasing maintenance expenses without a corresponding increase in service quality.

- Competitive Disadvantage: Airlines investing in advanced onboard technology gain a competitive edge, making older systems a liability.

Certain niche domestic routes within Colombia, such as those connecting smaller cities with limited passenger volume, are facing significant headwinds. These routes often contend with intense competition from new ultra-low-cost carriers like JetSMART, which can aggressively price fares, leading to oversupply and reduced profitability for Avianca. While Avianca maintains a strong overall domestic market share, these specific underperforming routes might exhibit low growth prospects and a shrinking customer base. For instance, routes with passenger traffic below 10,000 annually and a negative growth rate in 2024 could become cash traps, draining resources that could be better allocated to more promising segments of the business.

Older, less efficient aircraft variants, such as earlier models of the Airbus A320ceo family that haven't been upgraded to the A320neo, are likely considered Dogs within Avianca Holdings' BCG Matrix. These planes typically have higher operating expenses due to increased fuel consumption and potentially higher maintenance costs compared to newer, more fuel-efficient models. For instance, the A320ceo typically burns around 1,500 kg of fuel per hour, whereas the A320neo can achieve savings of up to 15-20%, translating to significant operational cost differences.

Inefficient legacy ancillary service offerings at Avianca, like older bundled fare options that haven't resonated with travelers, can be categorized as Dogs in the BCG matrix. These services often struggle to gain significant market share and generate minimal revenue. In 2023, Avianca reported that while ancillary revenue per passenger increased, certain older product bundles continued to underperform, contributing less than 1% to the total ancillary revenue stream.

These underperforming offerings demand considerable operational and marketing resources that could be better allocated to more profitable ventures. They might operate at a breakeven point or even incur small losses, effectively tying up capital and hindering overall growth potential.

Question Marks

Newly launched international routes, such as Avianca's recent expansions into Florida with flights connecting Fort Lauderdale to Managua and Medellin, or Miami to Guatemala City and San Jose, exemplify the question marks in the BCG Matrix. These markets, while showing promising growth trajectories, currently represent areas where Avianca has a nascent presence and thus, a low initial market share.

Capturing the potential of these new international destinations requires substantial upfront investment. Avianca must allocate resources towards aggressive marketing campaigns and dedicated route development to build brand awareness and attract passengers. The goal is to cultivate demand and eventually achieve profitability in these emerging markets, transforming them from question marks into stars.

Avianca's dedication to sustainability, seen in its fuel-saving efforts and exploration of Sustainable Aviation Fuels (SAF), positions these investments as Question Marks in the BCG matrix. These ventures require significant capital outlay and hold promise for future growth and environmental advantages, though their current market share and direct revenue impact are minimal as the sector matures.

For instance, the global SAF market was valued at approximately $2.3 billion in 2023 and is projected to reach $17.7 billion by 2030, indicating substantial long-term potential. Avianca's early engagement in this burgeoning field, while not immediately generating high returns, aligns with a strategic vision for a more sustainable future in aviation.

Avianca Holdings' acquisition of Wamos Air, a widebody wet lease specialist, positions Wamos as a 'Question Mark' within the BCG Matrix. This strategic move is designed to bolster Avianca's widebody capabilities and enhance network flexibility, particularly for long-haul routes. The success of this integration hinges on Wamos' ability to contribute significantly to Avianca's market share and profitability in the competitive international aviation landscape.

Advanced Digital Transformation Initiatives for Customer Experience

Avianca Holdings is exploring advanced digital transformation initiatives to elevate its customer experience, moving beyond standard online services. This includes deploying AI-powered customer support and creating highly personalized travel offers. The airline is also looking into seamless biometric airport processes to streamline passenger journeys.

These ambitious projects demand substantial technological investment and innovation. While the potential for increased customer loyalty and market share is significant, the full impact and widespread adoption of these advanced digital solutions are still in the developmental stages. For instance, in 2024, the airline industry saw a notable increase in customer expectations for digital convenience, with surveys indicating that over 60% of travelers prefer airlines offering advanced digital self-service options.

- AI-driven customer support: Aiming to resolve queries faster and more efficiently.

- Personalized travel offers: Leveraging data analytics to tailor promotions and services to individual passenger preferences.

- Biometric airport processes: Enhancing security and reducing wait times through facial recognition or fingerprint scanning.

Expansion of the Hybrid Business Model into New Segments

Avianca's strategic pivot towards a hybrid carrier model, blending cost-effectiveness with enhanced services, positions its expansion into new, competitive segments as a 'Question Mark' within the BCG Matrix. This approach aims to capture a broader customer base, but entering highly contested markets, such as the ultra-low-cost sector where rivals like JetSMART are established, presents significant challenges.

The success of this expansion hinges on Avianca's ability to continually adapt its offerings and secure substantial investment to compete effectively. For instance, in 2024, Avianca continued to refine its hybrid strategy, focusing on optimizing its network and fleet to better serve diverse passenger needs across its Latin American routes.

- Hybrid Model Evolution: Avianca is actively evolving its business model to cater to both price-sensitive and service-seeking travelers.

- New Segment Penetration: The company is exploring expansion into new, highly competitive market segments, including the ultra-low-cost carrier (ULCC) space.

- Growth Potential vs. Risk: This strategy offers high growth potential by attracting diverse customer segments but carries significant risk in gaining substantial market share against entrenched competitors.

- Adaptation and Investment Needs: Continuous adaptation and significant investment are crucial for Avianca to succeed in these new, competitive battlegrounds.

Avianca's new international routes, like those connecting Florida to Central America, are question marks. They represent areas with growth potential but currently low market share for Avianca. Significant investment in marketing and route development is needed to build demand and achieve profitability, aiming to transform these into stars.

The airline's investments in sustainability, such as exploring Sustainable Aviation Fuels (SAF), also fall into the question mark category. While the global SAF market is projected to grow significantly, reaching an estimated $17.7 billion by 2030 from $2.3 billion in 2023, these initiatives require substantial capital with currently minimal direct revenue impact.

Avianca's acquisition of Wamos Air and its push into digital transformation, including AI customer support and biometrics, are also question marks. These ventures demand considerable investment and innovation, with their ultimate success in boosting market share and customer loyalty still to be fully realized, despite growing passenger demand for digital convenience, with over 60% of travelers preferring advanced digital options in 2024.

The company's hybrid carrier model expansion into competitive segments, like the ultra-low-cost sector, is another question mark. This strategy offers high growth potential but faces significant risks in gaining market share against established competitors, requiring continuous adaptation and investment, as seen in Avianca's 2024 focus on optimizing its network and fleet.

| BCG Category | Avianca Holdings Examples | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks | New International Routes (e.g., Florida to Central America) | High | Low | Requires significant investment to gain share; potential to become Stars. |

| Question Marks | Sustainable Aviation Fuel (SAF) Initiatives | High (Projected $17.7B by 2030) | Low | Long-term investment for environmental and future market positioning. |

| Question Marks | Digital Transformation (AI Support, Biometrics) | High (Industry trend) | Low/Developing | Investment in customer experience and efficiency; outcome uncertain. |

| Question Marks | Hybrid Model Expansion (e.g., into ULCC segments) | High (Competitive) | Low | High risk, high reward; needs aggressive strategy and capital. |

BCG Matrix Data Sources

Our Avianca BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.