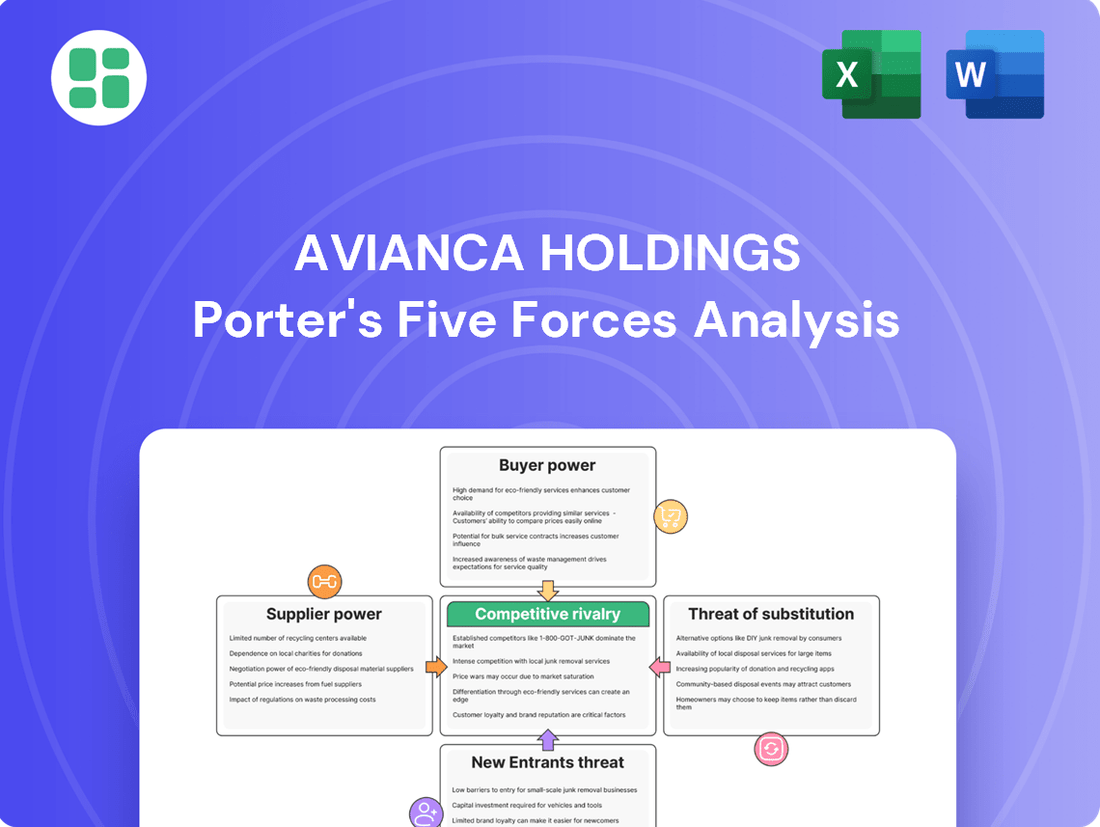

Avianca Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avianca Holdings Bundle

Avianca Holdings operates in a dynamic airline industry, facing significant pressures from intense rivalry and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Avianca Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Avianca Holdings, like many airlines, faces significant supplier bargaining power due to the highly concentrated nature of critical input markets. The airline industry relies heavily on a small number of aircraft manufacturers, primarily Boeing and Airbus, and major engine producers like General Electric and Rolls-Royce.

This limited supplier base means these companies hold substantial leverage. For instance, in 2023, Boeing and Airbus continued to dominate global aircraft deliveries, with each securing substantial order backlogs, giving them less incentive to offer favorable terms to individual buyers like Avianca. This lack of viable alternatives for new aircraft and essential components significantly strengthens their negotiating position.

Avianca's switching costs with its major aircraft and parts suppliers are substantial, significantly influencing supplier bargaining power. For example, changing from a Boeing fleet to an Airbus fleet, or vice versa, involves immense financial outlays for new aircraft acquisition, extensive retraining of pilots and maintenance crews, and the costly overhaul of existing maintenance infrastructure and spare parts inventory. These operational and financial hurdles make it difficult and expensive for Avianca to readily switch suppliers, thereby strengthening the leverage of its current partners.

The uniqueness of supplier offerings significantly impacts Avianca Holdings' bargaining power. If suppliers provide highly specialized or proprietary products and services, such as unique aircraft engine maintenance or critical airline operating software with few viable alternatives, their power increases. For instance, a specialized MRO provider for a specific aircraft model, like the Airbus A320neo which forms a core part of Avianca's fleet, can command higher prices if Avianca lacks readily available substitutes for their expertise.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while less common for major aircraft manufacturers like Boeing or Airbus, can still influence Avianca's operational costs and strategic flexibility. Should a key supplier, perhaps in areas like IT services or specialized maintenance, decide to enter the airline industry directly, it could create a new competitive dynamic. This would significantly bolster their bargaining power, as they would no longer just be a supplier but a potential direct competitor, able to dictate terms or even capture market share.

For instance, a large aviation IT solutions provider could potentially launch its own charter or regional airline service, leveraging its existing technology and expertise. This would present Avianca with a dual challenge: higher costs from the supplier and direct competition from a new market entrant. While specific instances of this occurring in the airline sector are rare, the underlying principle remains a factor in supplier relationship management.

- Potential for IT or Maintenance Providers to Enter Airline Operations: This remains a latent threat, particularly as technology plays an increasingly crucial role in airline efficiency and customer experience.

- Impact on Bargaining Power: A supplier capable of forward integration gains significant leverage, potentially leading to increased costs for Avianca.

- Strategic Implications: Avianca must monitor supplier capabilities and market trends to anticipate and mitigate such competitive threats.

Importance of Avianca to Suppliers

Avianca's significance to its key suppliers plays a crucial role in determining supplier bargaining power. If Avianca represents a substantial portion of a supplier's revenue, that supplier may be more inclined to offer competitive pricing and favorable terms to secure Avianca's continued business. Conversely, if Avianca is a minor client for a supplier, the supplier holds greater leverage.

For instance, in 2024, major aircraft manufacturers like Boeing and Airbus, along with engine providers such as Rolls-Royce and GE Aviation, are critical suppliers. The airline's order volume for new aircraft and engine maintenance contracts directly impacts these suppliers' production schedules and profitability. A large order from Avianca would naturally increase the airline's sway in negotiations.

- Supplier Dependence: The bargaining power of suppliers is amplified if Avianca constitutes a significant percentage of their overall sales. For example, a specialized aviation parts supplier that relies heavily on Avianca's orders would have less power than a diversified supplier.

- Order Volume Impact: In 2024, Avianca's fleet size and its planned expansion or fleet renewal programs directly influence the volume of parts and services it procures. Larger orders generally translate to greater negotiation leverage for the airline.

- Switching Costs for Avianca: The ease or difficulty Avianca faces in switching to alternative suppliers also affects supplier power. If Avianca uses highly specialized or proprietary equipment, switching suppliers can be costly and time-consuming, giving the current supplier more leverage.

The bargaining power of suppliers for Avianca Holdings is considerable, primarily due to the concentrated nature of key input markets like aircraft manufacturing and engine production. This concentration limits Avianca's options, giving suppliers like Boeing and Airbus significant leverage in negotiations. For instance, in 2023, these manufacturers held substantial order backlogs, reducing their need to offer concessions to individual airlines.

Avianca faces high switching costs when dealing with major suppliers for aircraft and essential components. The expense and complexity involved in changing fleet types or maintenance providers reinforce the power of existing suppliers. This makes it difficult for Avianca to easily shift to alternatives, thereby strengthening the negotiating position of its current partners.

The uniqueness of certain supplier offerings, such as specialized maintenance for specific aircraft models or proprietary operating software, further enhances supplier bargaining power. If Avianca lacks readily available substitutes for these critical inputs, suppliers can command higher prices. This was evident in 2024 with specialized MRO providers for core fleet components.

| Supplier Category | Key Players | Impact on Avianca's Bargaining Power | 2024 Market Context |

|---|---|---|---|

| Aircraft Manufacturers | Boeing, Airbus | High (Limited competition, high switching costs) | Dominant duopoly with significant order backlogs. |

| Engine Manufacturers | General Electric, Rolls-Royce | High (Specialized technology, high switching costs) | Concentrated market with critical proprietary technologies. |

| Maintenance, Repair, and Overhaul (MRO) | Specialized providers for specific aircraft/engines | Moderate to High (Depends on specialization and alternatives) | Demand for specialized MRO services remains strong. |

| IT and Software Providers | Various | Moderate (Depends on proprietary nature and integration) | Increasing reliance on integrated software solutions. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Avianca Holdings' position in the Latin American airline industry.

Avianca Holdings' Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making on competitive pressures.

Customers Bargaining Power

Avianca's passengers and cargo clients exhibit significant price sensitivity, especially within the competitive Latin American aviation sector. Leisure travelers, in particular, frequently compare fares across various airlines, making them prone to switching for even minor cost savings. In 2024, the average airfare in Latin America saw fluctuations, with some routes experiencing a 5-10% increase due to fuel costs, further amplifying passenger price awareness.

The availability of alternative airlines significantly impacts Avianca's customer bargaining power. In 2024, the Latin American airline market is characterized by robust competition, with numerous carriers like LATAM Airlines Group, Copa Airlines, and Volaris serving many of Avianca's core routes. This abundance of choices means passengers can easily switch to a competitor if Avianca’s pricing or service levels are not perceived as optimal. For instance, on popular routes between major South American cities, customers often have a selection of five or more airlines, driving down fares and compelling Avianca to offer competitive pricing and loyalty programs to retain its customer base.

For typical airline passengers, switching costs to a competitor are quite low. This often boils down to the time it takes to re-book a flight, making price, schedule, and convenience the primary drivers of choice. In 2024, with numerous online travel agencies and direct airline booking platforms, comparing and selecting alternatives is a matter of minutes, significantly increasing customer power.

Customer Information and Transparency

The bargaining power of customers for Avianca Holdings is significantly influenced by the increasing transparency in the airline industry. Customers now have access to vast amounts of information regarding pricing, flight schedules, and service quality across various airlines. This readily available data empowers them to compare options effectively, putting upward pressure on Avianca to offer competitive fares and superior service to retain their business.

The rise of online travel agencies (OTAs) and sophisticated price comparison websites has been a major catalyst for this heightened customer transparency. These platforms allow consumers to easily view and contrast offerings from multiple carriers, making it simpler to identify the best value. For instance, in 2024, it's common for travelers to spend minutes, if not hours, comparing dozens of flight options before making a booking, directly impacting Avianca's pricing strategies and service level expectations.

- Increased Information Access: Customers can readily find detailed information on Avianca's pricing, routes, and past performance compared to competitors.

- Price Comparison Tools: Websites and apps allow for instant comparison of Avianca's fares against other airlines, highlighting any price discrepancies.

- Service Quality Benchmarking: Online reviews and ratings provide insights into Avianca's service quality, influencing customer choices and potentially increasing their willingness to switch for better experiences.

- Impact on Pricing: High transparency forces Avianca to maintain competitive pricing, as customers can easily identify and opt for cheaper alternatives.

Volume of Purchase by Key Customers

Avianca Holdings faces significant bargaining power from its large corporate clients and freight forwarders due to their substantial purchase volumes. These key customers, by consolidating their travel or cargo needs with Avianca, can demand more favorable pricing and terms. This leverage allows them to negotiate discounts, preferential service agreements, and even customized solutions that directly impact Avianca's revenue and profit margins.

- High-Volume Clients: Corporate accounts and major freight forwarders represent a concentrated segment of Avianca's customer base, giving them considerable influence in price negotiations.

- Negotiating Leverage: The ability of these clients to switch to competitors if their demands aren't met strengthens their bargaining position, potentially leading to reduced yields for Avianca.

- Customized Service Demands: Large clients may also request tailored services, such as dedicated support or specific cargo handling, which can increase operational complexity and costs for Avianca if not managed efficiently.

Avianca's customers possess considerable bargaining power, primarily driven by the ease of switching and the abundance of competitive options in the Latin American market. The airline industry's transparency, amplified by online travel agencies and comparison tools, allows passengers to readily assess fares and services, compelling Avianca to maintain competitive pricing and service levels to retain its customer base.

This power is further amplified by the low switching costs for individual travelers, who can easily re-book with alternative carriers for minor savings or schedule improvements. Large corporate clients and freight forwarders also wield significant influence due to their volume, enabling them to negotiate favorable terms and discounts, directly impacting Avianca's revenue streams.

| Factor | Impact on Avianca | 2024 Context |

|---|---|---|

| Price Sensitivity | High | Average airfares in Latin America saw 5-10% increases on some routes in 2024, heightening passenger price awareness. |

| Availability of Alternatives | High | Numerous competitors like LATAM and Copa Airlines serve Avianca's core routes, offering passengers ample choice. |

| Switching Costs | Low | Re-booking flights takes minimal time, making price and convenience key decision factors. |

| Information Transparency | High | OTAs and comparison sites provide easy access to fare and service data, empowering customers. |

| Corporate & Freight Clients | Significant | High-volume clients negotiate discounts and preferential terms due to their substantial purchasing power. |

Preview the Actual Deliverable

Avianca Holdings Porter's Five Forces Analysis

This preview displays the complete Avianca Holdings Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. You will receive this exact, professionally formatted document immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. This ensures you get the full, ready-to-use analysis without any surprises.

Rivalry Among Competitors

Avianca Holdings contends with a broad spectrum of competitors across its primary Latin American and international routes. These include established full-service carriers like LATAM Airlines Group and Copa Airlines, which command significant market share and brand loyalty. In 2024, LATAM, for instance, continued its recovery and expansion efforts, operating a substantial fleet and serving numerous destinations.

The competitive landscape also features a growing presence of low-cost carriers (LCCs) such as Volaris and Viva Aerobus in Mexico and other regional players, intensifying price competition. These LCCs often offer more agile cost structures, enabling them to undercut traditional carriers on fares, particularly for shorter, leisure-focused routes. Their strategic objective is typically rapid passenger acquisition and market penetration.

Furthermore, regional airlines, while smaller in scale, play a crucial role by connecting secondary cities and feeding passengers into larger hubs, thereby fragmenting the market further. The financial strength and strategic maneuvers of these diverse rivals, from fleet modernization to network adjustments, directly impact Avianca's market positioning and pricing power.

The Latin American airline industry is experiencing a robust growth trajectory, which generally tempers competitive rivalry. For instance, the International Air Transport Association (IATA) projected a significant rebound in passenger traffic for Latin America in 2024, with a forecast of 7.7% growth. This expansion allows new entrants and existing players to capture market share without necessarily engaging in destructive price wars, as the overall pie is getting larger.

Avianca competes in a market where product differentiation is crucial for standing out. While the airline offers loyalty programs and in-flight amenities, the intensity of competition, particularly from low-cost carriers, often pressures them to focus on price. For instance, in 2024, Avianca continued to invest in modernizing its fleet and enhancing its digital offerings to attract and retain customers, aiming to differentiate beyond just network reach.

Exit Barriers for Competitors

Avianca Holdings faces significant exit barriers in the Latin American market, making it challenging for airlines to withdraw. These barriers include substantial investments in aircraft, which are difficult to divest quickly, and long-term lease agreements that lock airlines into commitments. As of 2024, the airline industry globally continues to grapple with the capital-intensive nature of its operations, with new aircraft orders often spanning years and requiring substantial upfront or ongoing financial obligations.

Furthermore, existing labor contracts and the strategic imperative to maintain a presence in key routes contribute to these high exit barriers. Airlines often find it more economically viable to continue operating, even at reduced capacity, rather than incurring the costs associated with terminating contracts and abandoning routes. This situation can lead to persistent overcapacity within the region, fueling intense price competition as carriers fight for market share.

- High Capital Investment: Aircraft acquisition and maintenance represent massive fixed costs.

- Long-Term Leases: Many airlines operate under multi-year aircraft lease agreements, creating ongoing financial obligations.

- Labor Contracts: Binding agreements with pilots, cabin crew, and ground staff can be costly to break.

- Strategic Importance: Maintaining a network presence is crucial for long-term brand value and future market opportunities.

Cost Structure and Pricing Strategies

Avianca's cost structure, like most airlines, is heavily weighted towards high fixed costs, including aircraft acquisition, maintenance, and labor. This inherent cost structure compels airlines to prioritize filling seats, often leading to aggressive pricing tactics to cover these substantial overheads. In 2023, Avianca reported a total operating cost of US$4.0 billion, highlighting the significant fixed expenses involved in its operations.

The intense competition, particularly from low-cost carriers (LCCs) such as Wingo, a subsidiary of Copa Holdings, further intensifies pricing pressure. LCCs typically operate with leaner cost bases, allowing them to offer lower fares. For instance, Avianca's yield per passenger revenue in Q1 2024 was approximately US$0.07, while LCCs often achieve lower yields by maximizing aircraft utilization and minimizing ancillary services.

- High Fixed Costs: The airline industry is characterized by substantial fixed costs, such as aircraft leasing or ownership, maintenance, and personnel, which must be incurred regardless of passenger volume.

- Price Sensitivity: To cover these fixed costs, airlines often engage in price wars, especially when load factors are not optimal, making them susceptible to competitors' pricing strategies.

- Low-Cost Carrier Impact: The presence of efficient low-cost carriers forces legacy carriers like Avianca to match or come close to their pricing, impacting overall revenue per passenger.

- Ancillary Revenue Importance: Airlines are increasingly relying on ancillary revenues (baggage fees, seat selection, etc.) to offset lower base fares and improve profitability in a competitive market.

Competitive rivalry within Avianca Holdings' operating regions remains intense, driven by a mix of legacy carriers and agile low-cost carriers (LCCs). Established players like LATAM Airlines Group and Copa Airlines continue to exert significant influence through extensive networks and brand recognition. In 2024, these carriers actively pursued fleet modernization and route expansion, intensifying the competitive dynamic.

The proliferation of LCCs further escalates price competition, as these airlines leverage leaner cost structures to offer attractive fares. This dynamic forces traditional carriers, including Avianca, to remain highly competitive on pricing, impacting overall revenue yields. For instance, while Avianca's Q1 2024 yield was around US$0.07 per passenger, LCCs often achieve lower yields through optimized operations.

The Latin American airline market's growth, projected by IATA at 7.7% for 2024, offers some buffer against destructive rivalry by allowing for market expansion. However, high exit barriers, such as substantial capital investments in aircraft and long-term lease commitments, mean that underperforming carriers often remain in the market, contributing to persistent capacity and price pressures.

| Competitor | Key Characteristics | 2024 Activity Focus |

|---|---|---|

| LATAM Airlines Group | Extensive network, strong brand loyalty | Fleet modernization, route expansion |

| Copa Airlines | Hub-and-spoke model, strong intra-Latin American presence | Network optimization, passenger experience enhancement |

| Volaris / Viva Aerobus (LCCs) | Low-cost structure, price-focused strategy | Market share growth, operational efficiency |

SSubstitutes Threaten

The availability and appeal of ground transportation, particularly buses and trains, represent a significant threat to Avianca's short to medium-haul routes within Latin America. For instance, in 2024, the bus network across countries like Brazil and Colombia remains extensive and cost-effective, often serving as the primary mode of travel for many citizens.

While air travel offers speed, the price sensitivity of many passengers on these shorter routes means that cheaper bus tickets can easily sway demand. In 2023, the average cost per kilometer for intercity bus travel in several Latin American nations was substantially lower than comparable airfares, making it a compelling substitute, especially for budget-conscious travelers.

The increasing effectiveness of virtual communication technologies poses a significant threat of substitution for Avianca Holdings. Advancements in video conferencing and collaboration platforms, like Zoom and Microsoft Teams, are making remote meetings more viable and productive, directly impacting the need for business travel. For instance, a 2023 report indicated that 70% of businesses now offer hybrid work models, relying heavily on these virtual tools, which can reduce demand for Avianca's premium corporate travel services.

Customers considering alternatives to Avianca weigh factors like travel time, convenience, and comfort against direct financial costs. For instance, a high-speed rail option might offer greater city-center accessibility and a more relaxed journey than air travel, even if the flight itself is cheaper. In 2024, the increasing efficiency and network expansion of rail services in key Avianca operating regions could present a more compelling substitute for shorter to medium-haul routes.

Impact on Both Passenger and Cargo Segments

The threat of substitutes significantly impacts both Avianca's passenger and cargo operations. For passengers, alternatives like high-speed rail, particularly in dense regional markets, and even personal vehicles for shorter trips, present viable options. In 2024, for example, continued investment in high-speed rail networks in regions like Europe and parts of Asia offers a compelling alternative to air travel for certain routes, potentially drawing away passengers seeking more environmentally friendly or ground-based travel.

In the cargo segment, substitutes such as ocean freight for bulk or non-time-sensitive goods remain a persistent threat. Overland transport, including trucking and rail, also provides competitive alternatives for regional and domestic shipments, especially when cost efficiency is paramount. For instance, the cost per ton-mile for ocean freight is substantially lower than air cargo, making it the preferred choice for many industries moving goods internationally.

- Passenger Substitutes: High-speed rail and private vehicles offer alternatives, particularly for shorter distances and in regions with developed ground infrastructure.

- Cargo Substitutes: Ocean freight and overland transport (trucking, rail) are key substitutes for air cargo, especially for non-urgent or bulk shipments where cost is a primary driver.

- Cost Sensitivity: The relative cost of substitutes plays a crucial role; for example, ocean freight can be up to 10 times cheaper than air freight for certain types of goods.

- Environmental Concerns: Growing environmental awareness may also push some travelers and shippers towards lower-emission alternatives like rail or sea transport.

Customer Perceptions of Substitute Quality and Convenience

Customers increasingly view high-speed rail and advanced bus services as viable, and sometimes superior, alternatives to air travel for shorter to medium distances. The perception of quality hinges on factors like punctuality, comfort, and the overall travel experience. For instance, in Europe, the expansion of high-speed rail networks has directly impacted short-haul flight demand, with many travelers opting for the convenience of city-center to city-center travel offered by trains.

The convenience factor is particularly strong when considering the entire journey. While a flight might be quicker in the air, the time spent on airport transfers, security checks, and boarding can make train or bus travel more appealing, especially for trips under 500 miles. In 2024, many rail operators reported significant increases in passenger numbers, underscoring this shift in customer preference driven by perceived convenience and often comparable or lower overall travel times when factoring in airport procedures.

- Perceived Quality: Customers increasingly value punctuality and comfort in substitutes like high-speed rail, often seeing them as more reliable than air travel for certain routes.

- Convenience: City-center to city-center accessibility offered by rail and bus services bypasses airport hassles, making them a more attractive option for many travelers.

- Impact on Air Travel: This growing perception of quality and convenience among substitutes directly challenges airlines like Avianca, particularly on shorter domestic and regional routes.

- Market Trends: In 2024, several European rail networks saw substantial passenger growth, indicating a tangible customer shift away from short-haul flights due to these perceived advantages.

For Avianca, substitutes like high-speed rail and advanced bus services present a significant challenge, especially on shorter routes where the total travel time and convenience of ground transport can outweigh air travel. The increasing efficiency and network expansion of rail services in key Latin American markets during 2024 offer a compelling alternative for many passengers.

The threat of substitutes extends to Avianca's cargo operations as well. Ocean freight remains a cost-effective alternative for bulk and non-time-sensitive goods, while trucking and rail offer competitive options for regional and domestic shipments. For example, the cost per ton-mile for ocean freight can be significantly lower than air cargo, making it the preferred choice for many industries moving goods internationally.

| Substitute Type | Avianca Segment | Key Advantage | 2024 Trend Example |

|---|---|---|---|

| High-Speed Rail | Passenger | City-center accessibility, reduced airport hassle | Expansion of networks in key regional markets |

| Buses | Passenger | Cost-effectiveness, extensive networks | Continued reliance for budget travelers on shorter routes |

| Ocean Freight | Cargo | Lower cost per ton-mile for bulk goods | Dominant for non-urgent international shipments |

| Trucking/Rail Freight | Cargo | Cost efficiency for regional/domestic | Competitive for time-sensitive but not express cargo |

Entrants Threaten

Launching a new airline demands immense capital, a significant barrier for potential competitors. For instance, acquiring a single new narrow-body aircraft can easily cost upwards of $100 million, with larger planes costing considerably more. Beyond aircraft, new entrants must also invest heavily in maintenance facilities, ground operations, technology systems, and obtaining necessary regulatory approvals, all of which require substantial upfront financial commitment.

The airline industry faces a complex web of regulations, including stringent safety certifications from bodies like the FAA and EASA, and approvals for specific flight routes. These requirements demand significant investment in compliance and infrastructure, acting as a substantial barrier for new airlines aiming to enter the market.

New airlines face significant hurdles in securing coveted airport slots at major hubs, a critical component for competitive operations. Avianca, like other established carriers, often benefits from long-standing relationships and historical rights, giving them preferential access that is difficult for newcomers to replicate. This scarcity directly impacts a new entrant's ability to establish a robust network and reach a broad customer base.

Furthermore, building effective distribution channels, encompassing travel agents, online travel agencies, and direct booking systems, requires substantial investment and time. In 2024, the reliance on these established networks remains high, meaning new airlines must overcome significant inertia to gain visibility and customer acquisition. For instance, securing prime advertising space or favorable placement on popular booking platforms can be prohibitively expensive for nascent carriers.

Brand Loyalty and Established Customer Relationships

Brand loyalty is a significant barrier for new entrants in the airline industry. Avianca Holdings, with its long-standing presence, particularly in Latin America, has cultivated strong brand recognition and trust among its passengers. This established equity makes it challenging for newcomers to quickly gain traction and replicate the deep-seated customer relationships Avianca enjoys.

Existing customer loyalty programs further solidify Avianca's position. These programs incentivize repeat business and create switching costs for travelers who have accumulated benefits. For instance, as of early 2024, Avianca's LifeMiles program boasts millions of active members, representing a substantial base of loyal customers that new airlines would struggle to attract away.

- Brand Recognition: Avianca's established name and reputation in key markets are difficult for new airlines to overcome.

- Customer Trust: Years of service have built a foundation of trust, making passengers more inclined to choose Avianca.

- Loyalty Programs: Programs like LifeMiles create stickiness, encouraging repeat bookings and making it harder for new entrants to poach customers.

- Switching Costs: Passengers invested in loyalty programs face tangible costs if they switch to a new airline.

Economies of Scale Enjoyed by Incumbents

Established airlines like Avianca Holdings benefit significantly from economies of scale, which create a formidable barrier to entry. These incumbents leverage their size to secure more favorable terms on crucial operational aspects such as bulk fuel purchases, aircraft maintenance contracts, and large-scale marketing campaigns.

For instance, in 2024, major airlines often negotiate fuel prices that are substantially lower per gallon compared to what a new, smaller airline could achieve. This cost advantage translates directly into more competitive pricing strategies, making it difficult for newcomers to match the operational efficiency and profitability of established players.

- Fuel Purchasing: Large airlines can lock in lower fuel prices through forward contracts and bulk purchasing agreements, reducing a significant variable cost.

- Maintenance and Parts: Incumbents benefit from economies of scale in maintenance, repair, and overhaul (MRO) operations and spare parts inventory.

- Marketing and Brand Recognition: Established brands can spread marketing costs over a larger customer base, achieving higher brand awareness at a lower per-customer acquisition cost.

The threat of new entrants for Avianca Holdings is generally low, primarily due to the substantial capital requirements and regulatory hurdles inherent in the airline industry. These barriers effectively deter most potential new competitors.

New airlines must contend with immense upfront costs for aircraft, infrastructure, and regulatory compliance, often running into hundreds of millions of dollars. For example, a single new narrow-body aircraft can cost over $100 million in 2024.

Furthermore, securing vital airport slots and establishing strong brand recognition and customer loyalty, bolstered by programs like Avianca's LifeMiles, present significant challenges for newcomers aiming to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Acquiring aircraft, facilities, and technology requires billions of dollars. | Very High - Deters most potential entrants. |

| Regulatory Hurdles | Strict safety certifications and route approvals are complex and costly. | High - Demands significant investment in compliance. |

| Airport Slots | Limited availability at prime airports favors established carriers. | High - Restricts network development and customer reach. |

| Brand Loyalty & Programs | Cultivated trust and loyalty programs create switching costs. | High - Difficult for new airlines to attract existing customers. |

| Economies of Scale | Incumbents benefit from lower costs in fuel, maintenance, and marketing. | High - Creates a significant cost disadvantage for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Avianca Holdings is built upon a foundation of robust data, including Avianca's annual reports, investor presentations, and filings with regulatory bodies like the SEC. We supplement this with industry-specific data from aviation consulting firms and market research reports to capture the competitive landscape.