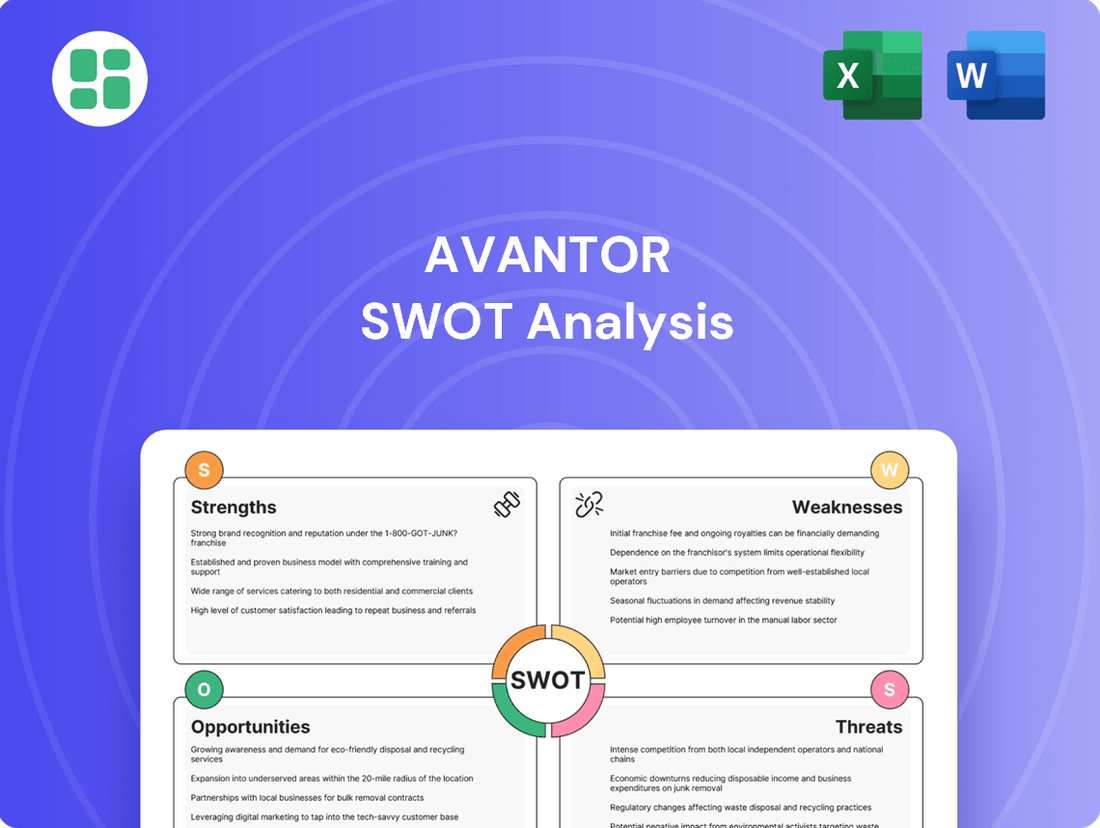

Avantor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avantor Bundle

Avantor's robust supply chain and strong customer relationships are key strengths, but the company faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for anyone looking to navigate the life sciences and advanced technologies sectors.

Want the full story behind Avantor’s competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Avantor's strength lies in its incredibly diverse portfolio, offering everything from performance materials and chemicals to essential lab equipment. This comprehensive suite of products and services supports customers across the entire scientific workflow, from initial research to full-scale production. This breadth makes them a vital partner for life sciences and advanced technology sectors.

In 2023, Avantor reported net revenues of $6.37 billion, underscoring the significant market penetration and demand for its wide array of offerings. This financial performance highlights the critical nature of their products in enabling scientific advancement and technological innovation.

Avantor's global reach is a formidable strength, evidenced by its presence in approximately 180 countries and its service to over 300,000 customer locations. This widespread network ensures deep penetration into critical scientific and industrial markets worldwide.

This expansive footprint allows Avantor to cultivate robust customer relationships and integrate seamlessly into global scientific processes, fostering consistent revenue generation and a resilient operational infrastructure.

Avantor commands a leading market share in the biopharma and healthcare industries, benefiting from the robust growth trajectory of these sectors. This strong positioning is a significant advantage, allowing the company to tap into expanding opportunities.

The Bioscience Production segment exemplifies this strength, consistently achieving high single-digit organic growth. This performance underscores Avantor's effectiveness in meeting the escalating demand for bioprocessing solutions and advanced therapies, a key driver of its success.

Effective Cost Management and Deleveraging

Avantor demonstrates robust cost management, evidenced by its comprehensive cost transformation initiative aiming for $400 million in gross run-rate savings by the end of 2027. This strategic focus on operational efficiency directly supports margin preservation and robust free cash flow generation.

The company's deleveraging efforts have been notably successful. As of March 2025, Avantor significantly reduced its adjusted net leverage ratio to 3.2x, showcasing a commitment to financial strengthening and improved capital structure.

- Disciplined Cost Management: Targeting $400 million in gross run-rate savings by year-end 2027.

- Margin Preservation: Efficient cost structures contribute to maintaining healthy profit margins.

- Strong Free Cash Flow: Operational efficiencies translate into consistent cash generation.

- Reduced Leverage: Adjusted net leverage stood at 3.2x as of March 2025, indicating financial deleveraging.

Commitment to Innovation and R&D Infrastructure

Avantor demonstrates a strong commitment to innovation through significant investments in its research and development (R&D) infrastructure. This dedication is clearly visible in strategic expansions, such as the opening of its Bridgewater, New Jersey innovation center. Such facilities are crucial for fostering scientific advancements and supporting the development of new products and solutions.

Further bolstering its R&D capabilities, Avantor has also expanded its manufacturing capacity. For instance, its Gliwice, Poland facility has seen significant upgrades, enhancing its ability to produce critical materials and components. These expansions are not just about increasing volume; they are about enabling the company to meet the evolving needs of the biopharma, healthcare, and advanced technologies sectors.

These strategic investments in innovation and infrastructure are designed to position Avantor as a key partner in scientific breakthroughs. By enhancing its R&D and manufacturing capabilities, the company aims to accelerate the pace of discovery and commercialization for its customers. This forward-looking approach is vital for maintaining a competitive edge and driving future growth in a rapidly advancing scientific landscape.

The company's focus on R&D is reflected in its financial allocations. While specific R&D spending figures fluctuate, the consistent opening of new centers and expansion of manufacturing capacity underscores a sustained commitment. For example, in 2023, Avantor continued to prioritize capital expenditures on facilities that directly support innovation and operational efficiency, signaling a robust pipeline of future product development.

Avantor's broad product portfolio, spanning performance materials to lab equipment, solidifies its role as a crucial partner across life sciences and advanced technologies. This comprehensive offering supports customers throughout their entire scientific journey, from initial research to large-scale production.

The company's extensive global presence, reaching approximately 180 countries and serving over 300,000 customer locations, ensures deep market penetration and robust customer relationships. This widespread network is key to Avantor's consistent revenue generation and resilient operations.

Avantor holds a leading market position in the biopharma and healthcare sectors, sectors experiencing substantial growth. Its Bioscience Production segment, for example, consistently delivers high single-digit organic growth, demonstrating strong demand for its bioprocessing solutions.

Financial discipline is a notable strength, with a target of $400 million in gross run-rate savings by the end of 2027 through cost transformation initiatives. Furthermore, Avantor has successfully reduced its adjusted net leverage ratio to 3.2x as of March 2025, indicating a strengthened financial structure.

| Strength | Description | Supporting Data/Fact |

| Diverse Product Portfolio | Offers a wide range of scientific products and services. | Supports customers from research to production. |

| Global Reach | Extensive international presence. | Operates in ~180 countries, serving >300,000 customer locations. |

| Market Leadership | Dominant position in key industries. | Leading share in biopharma and healthcare; Bioscience Production segment achieves high single-digit organic growth. |

| Financial Strength | Focus on cost efficiency and deleveraging. | Targeting $400M in savings by YE 2027; Adjusted net leverage at 3.2x (March 2025). |

What is included in the product

Maps out Avantor’s market strengths, operational gaps, and risks.

Simplifies complex market dynamics by offering a clear, actionable view of Avantor's strategic landscape.

Weaknesses

Avantor has faced a significant hurdle with declining organic revenue growth. For instance, the company reported a 2% organic revenue decline in the first quarter of 2025. This follows a trend of an average 4.4% year-on-year organic decline over the preceding two years, signaling potential issues with its product portfolio, pricing, or go-to-market strategies.

Avantor's Laboratory Solutions segment, a major revenue driver, is experiencing a slowdown in demand, especially from the education and government sectors. This dip is largely due to recent policy shifts and persistent funding limitations, which are creating significant challenges for the company's overall revenue growth.

Wall Street analysts are projecting stagnant revenue for Avantor over the next twelve months. This forecast, which is below the average for its industry, indicates that Avantor might face continued challenges in achieving substantial revenue growth. These headwinds could stem from a combination of challenging market conditions and intense competition.

Decreased Operating Margins

Avantor has experienced a notable dip in its profitability. Specifically, the company's adjusted operating margin has fallen by three percentage points over the past two years. This metric currently sits at 16.1% for the trailing twelve months, suggesting potential headwinds in managing operational costs effectively or challenges in translating sales growth into improved profitability.

This contraction in margins could stem from several factors, including rising input costs that haven't been fully passed on to customers, increased competition forcing price adjustments, or inefficiencies in the supply chain and production processes. The inability to fully capitalize on economies of scale, especially if revenue growth falters, can also exert downward pressure on operating margins.

- Decreased Operating Margins: Adjusted operating margin declined by three percentage points over the last two years.

- Current Margin: Trailing 12-month adjusted operating margin stands at 16.1%.

- Potential Causes: Challenges in expense management or failure to leverage economies of scale amidst revenue pressures.

Reliance on M&A for Growth

Avantor's performance in recent periods, including a reported revenue decline in the first quarter of 2024, highlights a potential over-reliance on mergers and acquisitions (M&A) to fuel its expansion. This strategy, while capable of accelerating market penetration and diversifying product portfolios, introduces significant financial risks and integration complexities that could strain the company's resources and operational efficiency.

The company's financial statements from 2023 and early 2024 indicate that while M&A has been a tool for expansion, it also presents challenges. For instance, the integration of acquired entities often requires substantial capital investment and can lead to unforeseen costs, potentially impacting profit margins and overall financial flexibility. This reliance can be a weakness if organic growth falters significantly.

- Organic Revenue Challenges: Avantor experienced a 0.4% decrease in net sales in Q1 2024 compared to Q1 2023, suggesting a need for M&A to offset slower internal growth.

- M&A Risks: Acquisitions, while potentially beneficial, carry inherent risks such as overpayment, integration difficulties, and failure to achieve expected synergies, which can negatively impact financial performance.

- Financial Strain: A heavy reliance on M&A can strain financial resources, potentially limiting investment in organic growth initiatives or research and development, and increasing debt levels.

- Integration Hurdles: Successfully integrating acquired businesses is complex and time-consuming, requiring careful management to realize the intended strategic and financial benefits.

Avantor's reliance on mergers and acquisitions (M&A) presents a notable weakness, particularly when organic growth falters. The company's Q1 2024 net sales saw a 0.4% decrease year-over-year, underscoring this dependency. While M&A can drive expansion, it carries significant risks like overpayment, integration challenges, and failure to achieve synergies, which can strain financial resources and dilute profitability.

The company's adjusted operating margin has seen a contraction, falling by three percentage points over the last two years to 16.1% on a trailing twelve-month basis. This decline suggests potential issues with managing operational costs effectively or an inability to fully leverage economies of scale, especially in light of slowing revenue growth. Rising input costs and competitive pressures may also be contributing factors.

| Metric | Q1 2024 vs Q1 2023 | Trailing 12 Months (TTM) |

| Net Sales (Organic) | -0.4% decrease | N/A |

| Adjusted Operating Margin | N/A | 16.1% (down 3 percentage points over 2 years) |

Preview the Actual Deliverable

Avantor SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of Avantor's Strengths, Weaknesses, Opportunities, and Threats. You can trust that what you see is exactly what you'll get, ensuring a transparent and valuable purchase.

Opportunities

The biopharma sector is experiencing a significant shift towards advanced therapies like cell and gene therapies, alongside the continued growth of mRNA technologies. Avantor, with its established expertise and enhanced capabilities, is strategically positioned to support these groundbreaking areas. The company's offerings are crucial for the development and manufacturing of these complex biotherapeutics, a market segment projected for substantial expansion in the coming years.

Avantor has a significant opportunity to expand its global footprint, particularly in high-growth regions. The company's recent relocation of its Suwon, Korea office is a prime example of this strategy, designed to bolster its presence and service capabilities within the crucial Asia Pacific market. This move directly addresses the increasing demand for life science solutions in these dynamic economies.

Avantor's expanded cost transformation initiative, aiming for $400 million in gross run-rate savings by 2027, is a prime opportunity. This aggressive target can significantly boost profitability and streamline operations.

Successfully implementing these cost-saving programs will not only bolster Avantor's financial standing but also create a buffer against unpredictable market shifts, protecting its profit margins.

Enhancing Digital Solutions and Customer Experience

Avantor can significantly boost its market position by investing more in digital solutions that streamline operations and improve how customers interact with the company. This focus on digital transformation is crucial for staying competitive in the evolving life sciences and advanced technologies sectors.

By digitizing laboratory workflows, Avantor can offer clients greater efficiency and a more integrated experience. This includes making the purchasing process smoother and more intuitive, which directly impacts client productivity and satisfaction. For instance, in 2023, Avantor reported strong growth in its digital channels, indicating a positive customer response to enhanced online platforms and services.

- Optimized Supply Chains: Digital tools can provide real-time visibility and predictive analytics, leading to more efficient inventory management and faster delivery times.

- Enhanced Customer Experience: Seamless online ordering, personalized support, and digital access to product information and technical data improve client satisfaction and loyalty.

- Digitized Lab Workflows: Offering platforms that integrate with customer lab systems can automate processes, reduce errors, and free up valuable research time for clients.

- Strengthened Competitive Advantage: Early adoption and effective implementation of advanced digital solutions can differentiate Avantor from competitors, attracting and retaining a broader customer base.

New Leadership and Strategic Focus

The appointment of Emmanuel Ligner as President and CEO, effective August 2025, marks a significant opportunity for Avantor. Ligner brings over three decades of experience in the life sciences sector, with a demonstrated history of successfully driving expansion and improving operational efficiency. This leadership transition is anticipated to inject fresh strategic direction and capitalize on Avantor's strengths.

Ligner's background, especially his deep understanding of bioprocessing, is poised to be a key driver for Avantor. This expertise can unlock new avenues for growth and innovation within the company's high-potential segments, potentially leading to enhanced market positioning and financial performance. His leadership is expected to refine the company's strategic focus, aligning resources with the most promising opportunities in the evolving life sciences landscape.

Avantor's strategic direction under new leadership presents several key opportunities:

- Accelerated Growth in High-Value Segments: Ligner's bioprocessing expertise is expected to fuel expansion in lucrative areas like biologics manufacturing and advanced therapies.

- Enhanced Operational Efficiency: His proven track record suggests a focus on streamlining operations and optimizing resource allocation, potentially improving margins.

- Strategic Partnerships and Acquisitions: New leadership often brings a fresh perspective on inorganic growth, potentially leading to strategic alliances or acquisitions that bolster market share and capabilities.

- Innovation in Product Development: Ligner's industry insight could drive the development of new products and services that better meet the evolving needs of Avantor's customer base.

Avantor is well-positioned to capitalize on the burgeoning demand for advanced therapies, including cell and gene therapies, and the continued expansion of mRNA technology. The company's robust capabilities are essential for the development and manufacturing of these complex biotherapeutics, a sector anticipated for substantial growth. For instance, the global cell and gene therapy market was valued at approximately $10.1 billion in 2023 and is projected to reach $35.9 billion by 2030, growing at a CAGR of 19.9%.

The company has a clear opportunity to expand its global reach, particularly in rapidly growing markets within the Asia Pacific region. Avantor's strategic relocation of its Suwon, Korea office underscores this initiative, aiming to enhance its service capabilities and market presence in this vital area. This move aligns with the increasing demand for life science solutions in dynamic economies.

Avantor's ongoing cost transformation program, targeting $400 million in gross run-rate savings by 2027, presents a significant opportunity to enhance profitability and operational efficiency. Successfully executing these cost-saving measures will strengthen the company's financial resilience.

Threats

Avantor navigates a turbulent macroeconomic landscape. For instance, in early 2024, persistent inflation and rising interest rates continued to pressure consumer spending and business investment, creating an unpredictable demand environment for life sciences and advanced technologies.

This volatility complicates Avantor's financial forecasting, potentially necessitating frequent adjustments to its outlook. Such shifts can heighten investor apprehension, impacting share price performance and access to capital markets.

Avantor is navigating significant policy and funding challenges, especially within its Education and Government sectors. These headwinds directly impact revenue streams, as shifts in government spending priorities or regulatory frameworks can curtail demand for Avantor's products and services. For instance, a slowdown in federal research grants or changes in educational procurement policies can create an unpredictable operating environment.

Avantor operates in a life sciences sector characterized by fierce competition, with many companies striving for market dominance. This crowded landscape puts pressure on pricing and profit margins, necessitating constant innovation. For instance, in 2024, the global life sciences market is projected to reach over $1.3 trillion, with a significant portion driven by consumables and equipment where Avantor competes directly.

The intense rivalry demands that Avantor consistently differentiates its product and service portfolio to maintain its competitive standing. This means not only offering high-quality materials but also providing value-added services and solutions that address evolving customer needs in areas like biopharmaceutical manufacturing and advanced therapies.

Supply Chain Disruptions and Inflationary Pressures

Avantor continues to navigate a landscape marked by persistent supply chain vulnerabilities and rising inflation. Despite ongoing initiatives to streamline its global logistics and sourcing, the company remains susceptible to external shocks that can drive up the cost of essential raw materials and components, thereby impacting overall operational efficiency. For instance, in early 2024, many chemical and life sciences companies reported increased input costs due to global shipping constraints and geopolitical instability, directly affecting margins.

These inflationary pressures and potential disruptions pose a significant risk to Avantor's profitability and its ability to maintain consistent product availability. Higher operational expenses can erode margins, and any inability to meet customer demand due to supply shortages could damage crucial relationships and lead to lost revenue. For example, reports from late 2023 indicated that lead times for certain specialized chemicals, critical for Avantor's product lines, had extended by as much as 20%, creating a challenge for inventory management and customer fulfillment.

- Increased Cost of Goods Sold: Rising prices for raw materials, energy, and transportation directly impact Avantor's cost structure.

- Operational Inefficiencies: Supply chain bottlenecks can lead to production delays and increased logistics expenses.

- Customer Dissatisfaction: Product unavailability or delayed deliveries due to disruptions can harm customer relationships and market share.

- Margin Compression: The inability to fully pass on increased costs to customers can lead to reduced profitability.

Investor Concerns and Stock Performance Volatility

Avantor's stock experienced a notable downturn, with analyst sentiment shifting towards caution. This was largely driven by disappointing quarterly earnings reports and forecasts that indicated stagnant revenue growth. For instance, in early 2024, the company's stock price saw a significant drop following its Q4 2023 earnings release, which missed revenue expectations.

Continued underperformance or persistent negative market sentiment poses a significant threat. Such conditions can exacerbate stock price volatility, eroding investor confidence. This erosion of confidence can directly impact Avantor's capacity to secure necessary capital for future growth initiatives or acquisitions.

- Stock Decline: Avantor's stock price has faced considerable pressure, reflecting investor concerns over financial performance.

- Analyst Caution: Analysts have issued warnings, citing disappointing quarterly results and subdued revenue outlooks as key reasons for concern.

- Volatility Risk: Persistent underperformance could lead to increased stock price fluctuations, further damaging investor sentiment.

- Capital Raising Challenges: A weakened stock price and negative sentiment can hinder the company's ability to raise capital effectively.

Avantor faces significant threats from economic instability, with inflation and interest rate hikes impacting demand across its key sectors. In early 2024, these macroeconomic factors created an unpredictable environment, potentially affecting revenue and profitability. Furthermore, the company is susceptible to supply chain disruptions and rising input costs, as seen with extended lead times for critical chemicals reported in late 2023, which can compress margins and impact customer satisfaction.

Intense competition within the life sciences market, projected to exceed $1.3 trillion globally in 2024, pressures Avantor's pricing power and necessitates continuous innovation to maintain market share. Policy shifts and funding uncertainties, particularly in government and education sectors, also pose a risk by potentially reducing demand for its products and services, as seen with fluctuations in research grants.

Avantor's stock has experienced pressure due to disappointing earnings and a subdued revenue outlook, as evidenced by its Q4 2023 performance. This negative market sentiment and potential for continued underperformance could hinder its ability to raise capital for future growth initiatives.

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of Avantor's financial statements, detailed market research reports, and insights from industry experts to provide a robust and accurate strategic overview.